The global off-the-road (OTR) tire market, which includes specialty segments such as 7.50-16 tire equivalents used in agricultural, industrial, and light utility vehicles, is experiencing steady expansion driven by rising demand from construction, farming, and material handling industries. According to Grand View Research, the global OTR tire market was valued at USD 26.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is bolstered by increased mechanization in agriculture, infrastructure development in emerging economies, and growing fleet modernization efforts across industrial sectors. As demand for durable, cost-effective 7.50-16 tire alternatives rises, manufacturers are focusing on enhanced tread design, load capacity, and puncture resistance to meet rigorous operational demands. In this competitive landscape, eight manufacturers have emerged as leading suppliers of high-performance 7.50-16 tire equivalents, combining innovation, scalability, and global distribution to capture significant market share.

Top 8 7.50 16 Tire Equivalent Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BKT Tires

Domain Est. 1997

Website: bkt-tires.com

Key Highlights: BKT Tires is a leading manufacturer in the off-highway tire market. Specializing in the manufacture of tires for agricultural, industrial and OTR vehicles….

#2 Firestone

Domain Est. 1999

Website: cokertire.com

Key Highlights: In stock $50.65 delivery750-16 Firestone Tire features authentic design and construction. These tires are Officially Licensed by Firestone and Made in the USA!Missing: equivalent …

#3 7.50/0R16 – Car tire size

Domain Est. 1997

Website: bfgoodrichtires.com

Key Highlights: Browse BFGoodrich car tires by size 7.50/0R16. Find high-performance options designed for your vehicle, offering exceptional safety, durability, ……

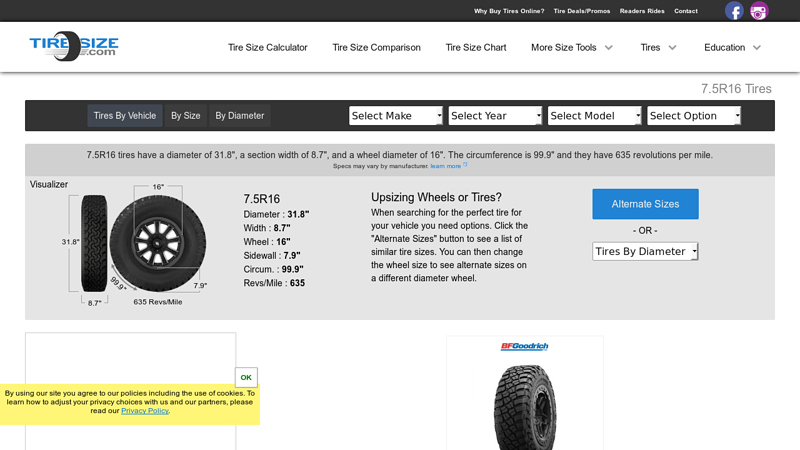

#4 7.5R16 Tires

Domain Est. 2000

Website: tiresize.com

Key Highlights: 7.5R16 tires have a diameter of 31.8″, a section width of 8.7″, and a wheel diameter of 16″. The circumference is 99.9″ and they have 635 revolutions per mile….

#5 Commercial Tires by Size

Domain Est. 2001

Website: business.michelinman.com

Key Highlights: We have listed all the tire sizes available to make it easy for you. To choose the right tire size, open your vehicle owner’s manual or your driver’s side door….

#6 TF

Domain Est. 2006

Website: mitas-tires.com

Key Highlights: Mitas TF-03 forklifts tires with multiple sizes (7.50-16 & 9.00-16) & properties Multi-rib tread pattern ✓strong lugs. Explore more features….

#7 7.50

Domain Est. 2009

#8 Americus LT2000 7.50R16 G/14PLY

Domain Est. 2021

Expert Sourcing Insights for 7.50 16 Tire Equivalent

H2: Market Trends for 7.50-16 Tire Equivalent by 2026

The 7.50-16 tire size, commonly used in light trucks, utility vehicles, agricultural machinery, and certain industrial applications, is undergoing a transformation as the market shifts toward standardized metric equivalents, improved durability, fuel efficiency, and sustainable manufacturing. By 2026, several key trends are expected to shape the market for tires equivalent to the 7.50-16 size (commonly replaced by metric sizes such as 205/75R16 or 215/75R16):

-

Shift Toward Metric Equivalents

The 7.50-16 designation is a legacy flotation tire size, increasingly being replaced by metric equivalents that offer better compatibility with modern vehicle systems and international standards. By 2026, demand is expected to consolidate around metric sizes like 205/75R16 and 215/75R16, which provide similar outer diameter and load capacity with enhanced performance metrics. Original Equipment Manufacturers (OEMs) are standardizing on metric sizing, accelerating this transition. -

Growth in Light Commercial and Utility Vehicles

The global expansion of e-commerce and last-mile delivery services is driving demand for light-duty trucks and vans that often use 7.50-16 or equivalent tires. Fleets operating delivery vans, utility service trucks, and agricultural support vehicles in emerging markets will continue to favor these tire sizes for their load-bearing capacity and ruggedness. This trend will sustain market relevance through 2026. -

Emphasis on Fuel Efficiency and Low Rolling Resistance

As fuel economy regulations tighten globally, tire manufacturers are developing 7.50-16 equivalents with optimized tread compounds and casing designs to reduce rolling resistance. These tires are expected to gain traction in commercial fleets seeking to lower operational costs and carbon footprints. Innovations in silica-based tread compounds and lightweight construction will be key differentiators. -

Rise of All-Position and All-Season Tires

Versatility is becoming critical. By 2026, all-position tire designs—suitable for both drive and trailer axles—are expected to dominate the 7.50-16 equivalent segment. Additionally, all-season performance with improved wet and winter traction will be prioritized, especially in regions with variable climates. This reduces the need for seasonal tire changes and appeals to small business operators. -

Expansion in Emerging Markets

In regions such as Southeast Asia, Africa, and Latin America, rugged terrain and underdeveloped infrastructure sustain demand for flotation-type tires like the 7.50-16. Local manufacturers are producing cost-effective equivalents tailored to regional needs. As rural electrification and agricultural mechanization grow, so will the market for these tires. -

Sustainability and Retreadability

Environmental regulations and corporate sustainability goals are pushing demand for retreadable casings and tires made with recycled materials. The 7.50-16 equivalent segment is seeing increased development of durable, retread-friendly designs. By 2026, leading brands will likely offer circular economy solutions, including take-back programs and eco-labeling. -

Digital Integration and Smart Tire Technologies

While more common in larger commercial tires, early adoption of TPMS (Tire Pressure Monitoring Systems) compatibility and RFID tagging in 7.50-16 equivalents is expected by 2026, particularly in fleet-managed vehicles. This enables predictive maintenance, improves safety, and reduces downtime.

Conclusion

By 2026, the market for 7.50-16 tire equivalents will be defined by a transition to metric standards, increased focus on efficiency and durability, and growth in commercial and agricultural applications—especially in emerging economies. Manufacturers that innovate in sustainability, performance, and digital integration will lead the segment, ensuring continued relevance of this tire category despite the broader industry shift toward advanced tire technologies.

Common Pitfalls When Sourcing 7.50-16 Tire Equivalents (Quality & IP Concerns)

Sourcing 7.50-16 tire equivalents—especially for vintage, classic, or specialty vehicles—can be challenging. While modern radial tires with equivalent sizing (such as 225/70R16 or 235/70R16) offer improved performance and availability, buyers often encounter significant pitfalls related to quality and intellectual property (IP). Being aware of these issues helps ensure safety, value, and legal compliance.

Confusing Sizing and Load Ratings

One of the most common mistakes is assuming dimensional equivalence guarantees functional compatibility. The 7.50-16 is a bias-ply tire with specific load and inflation characteristics. Modern equivalents like 225/70R16 may have similar outer diameter and width, but differences in load range (e.g., Load Range C vs. D), ply rating, and recommended inflation pressure can affect vehicle handling, ride comfort, and safety. Choosing a tire with insufficient load capacity for the vehicle’s requirements can lead to premature failure or dangerous blowouts.

Prioritizing Price Over Quality

The market for vintage and classic vehicle tires includes many budget-friendly options, often from lesser-known manufacturers—especially those based in Asia. While cost-effective, these tires may use lower-grade rubber compounds, have reduced tread life, or lack rigorous quality control. Poor heat resistance, inferior wet traction, and shorter service life are common quality shortcomings. Buyers should verify compliance with safety standards (e.g., DOT, ECE) and seek brands with proven track records in classic vehicle applications.

Risk of Counterfeit or IP-Infringing Tires

A significant and often overlooked risk is purchasing counterfeit or IP-infringing tires. Some manufacturers produce tires that mimic the appearance, branding, or tread patterns of well-known premium brands (e.g., reproductions of Goodyear, Firestone, or BFGoodrich classic designs) without authorization. These knock-offs may:

– Use misleading branding that implies endorsement or affiliation.

– Replicate patented tread designs or logos, violating intellectual property rights.

– Lack the engineering, materials, and testing of authentic products.

Purchasing such tires not only supports IP violations but may also expose buyers (especially commercial restorers or dealers) to legal liability. Always source from authorized dealers and verify manufacturer authenticity.

Inadequate Weather and Performance Testing

Many equivalent tires marketed for classic vehicles are not tested to the same standards as modern passenger tires. They may lack severe weather ratings (e.g., no Three-Peak Mountain Snowflake symbol), have higher rolling resistance, or deliver subpar performance in rain or high temperatures. For vehicles driven regularly, especially in variable climates, this can compromise safety and driver confidence.

Conclusion

To avoid these pitfalls, buyers should:

– Confirm technical specifications match vehicle requirements.

– Prioritize reputable brands with documented quality control.

– Purchase from authorized distributors to avoid counterfeit products.

– Verify compliance with safety and environmental standards.

Careful sourcing ensures that the replacement tire not only fits but also performs safely and legally—preserving both the vehicle and the owner’s investment.

H2: Logistics & Compliance Guide for 7.50-16 Tire Equivalent

The 7.50-16 tire is a commonly used tire size in commercial trucks, trailers, and heavy-duty vehicles. Due to variations in tire designations across regions and manufacturers, identifying the correct metric or modern equivalent is essential for logistics, sourcing, and regulatory compliance. This guide outlines key logistics considerations and compliance requirements when handling or replacing 7.50-16 tires with their modern equivalents.

1. Understanding the 7.50-16 Tire and Its Equivalents

- Original Size: 7.50-16

- Section width: ~7.5 inches

- Rim diameter: 16 inches

-

Bias-ply construction (common in older models)

-

Common Metric Equivalent: 205/75R16C

- Section width: 205 mm (~8.07 inches)

- Aspect ratio: 75%

- Rim diameter: 16 inches

- “C” denotes commercial/load range (typically Load Range D or E)

-

Radial construction

-

Other Possible Replacements:

- 215/75R16C

- 195/80R16C (less common)

- Always verify load index, speed rating, and overall diameter compatibility.

✅ Key Tip: Confirm overall diameter and load capacity match to avoid speedometer inaccuracies or overloading.

2. Logistics Considerations

A. Sourcing & Procurement

- Ensure suppliers list tires with correct load range (e.g., C, D, E) and ply rating.

- Confirm availability of 205/75R16C or approved alternatives.

- Consider OEM specifications for fleet vehicles to maintain consistency.

B. Storage & Handling

- Store tires upright in a cool, dry environment, away from direct sunlight and ozone sources (e.g., motors, welding equipment).

- Max stack height: 6 tires if necessary; prefer vertical storage to prevent deformation.

C. Transportation

- Secure tires in transport vehicles to prevent rolling or shifting.

- Use pallets or racks for bulk shipments.

- Follow carrier guidelines for weight distribution and load securement (per FMCSA or local regulations).

D. Inventory Management

- Label stock clearly with size, load range, and DOT code.

- Rotate stock using FIFO (First In, First Out) to avoid aging.

- Track tread depth and age (DOT code indicates manufacture date—e.g., “2322” = 23rd week of 2022).

3. Compliance Requirements

A. DOT & FMCSA (U.S.)

- Tires must display a valid DOT identification number.

- Minimum tread depth: 2/32 inch for steering axle, 4/32 inch for drive/trailer axles (FMCSA §393.75).

- No exposed ply or cord; no bulges, cracks, or cuts deeper than 3/16 inch or extending to ply.

- Tires must be properly inflated per manufacturer specs—check monthly.

B. ECE Regulations (Europe/Global)

- If distributing internationally, ensure tires meet ECE Regulation No. 30 (passenger) or No. 54 (commercial).

- E-mark certification required for sale in ECE member countries.

- Speed and load ratings must match vehicle requirements.

C. Load & Inflation Compliance

- Match tire load range to vehicle GVWR (Gross Vehicle Weight Rating).

- Use load/inflation tables from tire manufacturer (e.g., Michelin, Goodyear).

- Example: 205/75R16C Load Range E = 3,195 lbs at 80 psi (dual), 3,415 lbs at 95 psi (single).

D. Environmental & Safety Compliance

- Used Tire Disposal: Follow EPA and local regulations for scrap tire management.

- REACH & RoHS (EU): Ensure no restricted substances in tire composition (applies to manufacturers).

- Tire Pressure Monitoring Systems (TPMS): Required on newer commercial vehicles; ensure compatibility with replacement tires.

4. Documentation & Record-Keeping

- Maintain records of:

- Tire purchase receipts

- Installation dates

- Inspection logs (pre-trip, post-trip)

- Maintenance and rotation history

- DOT inspection reports

⚠️ Non-compliance Risk: Failing to meet tire standards can result in fines, roadside out-of-service orders, or liability in case of accidents.

5. Best Practices Summary

| Action | Recommendation |

|——-|—————-|

| Replacement | Use 205/75R16C or approved equivalent with matching load/speed rating |

| Inspection | Monthly visual check + inflation check |

| Compliance | Meet FMCSA, DOT, and OEM standards |

| Training | Ensure drivers and mechanics understand tire safety protocols |

By aligning logistics operations with compliance standards and selecting the correct 7.50-16 tire equivalent (typically 205/75R16C), fleets and logistics managers can ensure safety, regulatory adherence, and operational efficiency.

In conclusion, sourcing an equivalent to a 7.50-16 tire involves careful consideration of modern metric tire sizes that match the overall diameter, load capacity, and width to ensure proper fitment, performance, and safety. The closest common equivalent is typically the 235/85R16 size, which offers a similar outer diameter and width while providing improved availability, enhanced performance, and better compliance with current vehicle standards. However, it is crucial to verify load index, speed rating, and clearance with the vehicle manufacturer or a trusted tire professional before making a final decision. Additionally, always ensure that any replacement tire meets or exceeds the original equipment specifications to maintain optimal handling, fuel efficiency, and safety. Confirming compatibility with your rims and intended use (e.g., load requirements, terrain) will ensure a successful and reliable tire replacement.