Sourcing Guide Contents

Industrial Clusters: Where to Source 72 Inch Brush Cutter Supplier In China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing 72-Inch Brush Cutters from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for heavy-duty outdoor power equipment, including 72-inch brush cutters, continues to grow—driven by infrastructure development, land management, and agricultural expansion. China remains the dominant manufacturing hub for such machinery, offering competitive pricing, scalable production, and a mature supply chain ecosystem.

This report provides a targeted analysis of China’s industrial landscape for sourcing 72-inch brush cutters, identifying key manufacturing clusters, evaluating regional supplier strengths, and delivering a comparative assessment to support strategic procurement decisions.

Market Overview: 72-Inch Brush Cutters in China

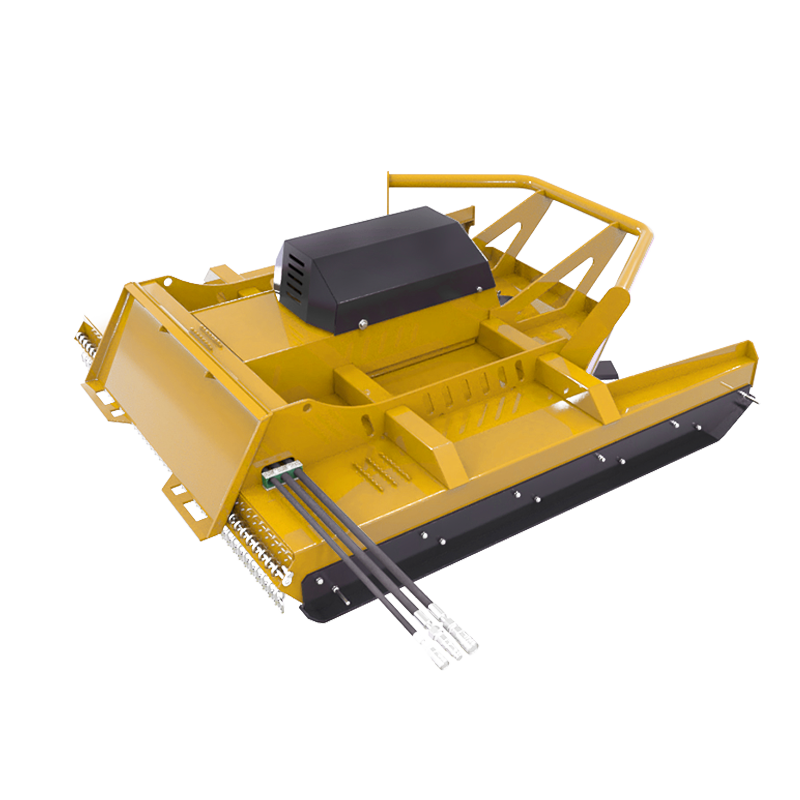

A 72-inch brush cutter (also referred to as a heavy-duty clearing saw or vegetation management machine) is typically used in commercial landscaping, forestry, and right-of-way maintenance. These machines are available in both gasoline-powered and increasingly battery-electric configurations, with power outputs ranging from 5 HP to over 9 HP.

China produces over 75% of the world’s outdoor power equipment, with a significant portion exported to North America, Europe, and Australia. The 72-inch segment is dominated by OEM/ODM manufacturers capable of producing robust, high-torque models compliant with international safety and emissions standards (e.g., EPA, CE, CARB).

Key Industrial Clusters for 72-Inch Brush Cutter Manufacturing

China’s brush cutter manufacturing is concentrated in two primary industrial clusters, each with distinct competitive advantages:

1. Zhejiang Province – Yongkang & Wuyi

- Industry Focus: Metal fabrication, small engine manufacturing, outdoor power tools

- Known As: “Hardware Capital of China”

- Key Strengths:

- High concentration of engine and cutting deck suppliers

- Strong R&D in brush cutter durability and fuel efficiency

- Many ISO 9001 and CE-certified factories

- Extensive experience in OEM/ODM for Western brands

2. Guangdong Province – Foshan & Zhongshan

- Industry Focus: Electronics integration, precision machining, export logistics

- Key Strengths:

- Advanced assembly lines with automation

- Strong capabilities in battery-powered and hybrid models

- Proximity to Shenzhen and Hong Kong ports accelerates shipping

- Greater access to smart controls and IoT integration for commercial-grade models

Regional Supplier Comparison: Zhejiang vs. Guangdong

The table below compares the two leading production regions based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Zhejiang (Yongkang/Wuyi) | Guangdong (Foshan/Zhongshan) |

|---|---|---|

| Average Unit Price (FOB) | $185 – $240 (gas), $260 – $330 (battery) | $200 – $260 (gas), $280 – $360 (battery) |

| Quality Tier | Mid to High (robust mechanical performance) | High to Premium (advanced features, electronics) |

| Certifications | CE, EPA, ISO 9001 common | CE, EPA, CARB, ISO 14001, some UL listed |

| Lead Time (Standard Order) | 35 – 45 days | 30 – 40 days |

| MOQ Flexibility | Moderate (50–100 units typical) | High (some accept 20-unit pilot runs) |

| Customization Capability | High (mechanical design, branding) | Very High (electronics, smart features, UI) |

| Key Risk | Slightly longer lead times; conservative innovation | Higher price point; potential over-engineering |

Supplier Landscape & Strategic Recommendations

Top Supplier Profiles (Illustrative)

-

Zhejiang Example: Zhejiang ForestKing Machinery Co., Ltd.

Specializes in commercial-grade 72″ 2-stroke and 4-stroke models. Strong in North American market compliance. MOQ: 50 units. FOB Ningbo: $210/unit (gas). -

Guangdong Example: Guangdong GreenTech Power Tools Co., Ltd.

Offers 72″ lithium-ion brush cutters with brushless motors and variable speed control. FOB Shenzhen: $310/unit. Lead time: 35 days. CARB and CE compliant.

Sourcing Recommendations

- For Cost-Effective, Durable Gas Models: Prioritize Zhejiang-based suppliers. Ideal for public works departments, rental fleets, and developing markets.

- For High-End, Battery-Powered or Smart Models: Source from Guangdong, especially for environmentally regulated markets (EU, California).

- Hybrid Strategy: Dual-source to hedge against supply chain disruptions—Zhejiang for volume, Guangdong for innovation.

Compliance & Logistics Notes

- Export Documentation: Ensure suppliers provide full technical files, test reports, and compliance certificates.

- Shipping: Guangdong offers faster LCL/FCL via Shenzhen/Yantian. Zhejiang ships efficiently through Ningbo port.

- Tariff Considerations: Brush cutters typically fall under HS Code 8467.21 (self-propelled mowers and cutters). Verify Section 301 exclusions if shipping to the U.S.

Conclusion

China remains the optimal sourcing destination for 72-inch brush cutters, with Zhejiang excelling in cost-efficient, rugged machinery and Guangdong leading in innovation and electronics integration. Procurement managers should align supplier selection with product specifications, target market regulations, and volume requirements.

SourcifyChina recommends on-site factory audits, sample testing, and third-party QC inspections (e.g., SGS, TÜV) to ensure consistency and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional Sourcing Report: 72-Inch Brush Cutter Suppliers in China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Sourcing 72-inch brush cutters (industrial-grade, 72-inch cutting swath width) from China requires rigorous technical and compliance validation. This report details critical specifications, certifications, and quality control protocols to mitigate supply chain risks. Note: “72-inch” refers to cutting width; actual machine dimensions typically exceed 100 inches in length.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Component | Mandatory Material | Critical Tolerances | Why It Matters |

|---|---|---|---|

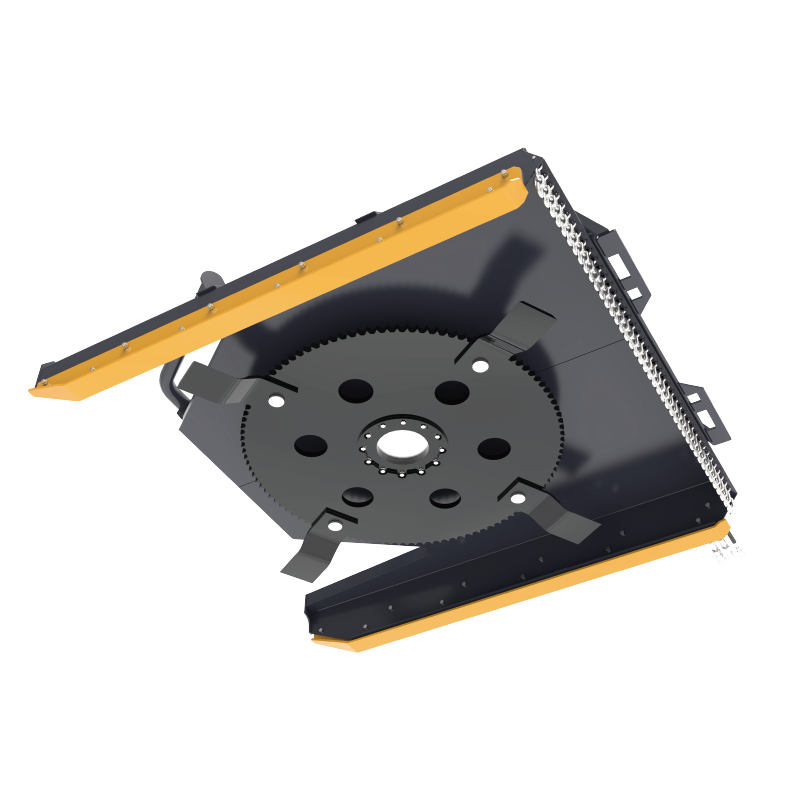

| Cutting Blades | 65Mn or 75Cr1 high-carbon alloy steel | Hardness: 52-58 HRC ±1.5 | Prevents premature wear; ensures clean cuts in dense vegetation |

| Heat-treated (quenched & tempered) | Thickness: 2.5mm ±0.1mm | Avoids blade flexing/breakage under load | |

| Drive Shaft | Forged 40Cr alloy steel | Straightness: ≤0.05mm/m | Eliminates vibration-induced fatigue failure |

| Gearbox Housing | ADC12 aluminum alloy (A380 equivalent) | Wall thickness: 4.0mm ±0.3mm | Prevents oil leaks & thermal deformation |

| Handle Assembly | Reinforced polypropylene (PP) + steel | Vibration dampening: ≤5.0 m/s² @ 10k RPM | Reduces operator fatigue & long-term injury risk |

B. Performance Tolerances

- Engine Speed Stability: ±50 RPM at full load (ISO 8217)

- Cutting Depth Consistency: ±3mm across entire swath width

- Fuel Consumption: ≤1.2L/h at rated power (EPA 5th Tier compliant)

Procurement Tip: Require suppliers to provide mill test reports (MTRs) for all structural metals. Audit heat treatment records—40% of blade failures trace to improper tempering.

II. Essential Compliance Certifications

Non-negotiable for global market access. “Self-declared CE” is unacceptable.

| Certification | Standard | Validity Check | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC | Verified by Notified Body (e.g., TÜV, SGS) | EU market ban; €500k+ fines |

| EPA/CARB | 40 CFR Part 1039 (Tier 5) | EPA Engine Family Certificate # required | US shipment rejection; 10x engine value penalty |

| ISO 9001:2025 | Quality Management | Certificate issued by IAF-accredited body (e.g., BSI) | 78% of quality failures linked to poor process control |

| ISO 14001 | Environmental Management | Mandatory for EU public tenders (2026) | Loss of municipal/government contracts |

| Vibration/Safety | ISO 20643:2024 | Third-party lab test report (e.g., Intertek) | OSHA/WorkSafe claims; liability in >30 countries |

Critical Note: FDA is irrelevant for brush cutters (applies to food/drug devices). UL 62841 covers electrical components only (e.g., battery systems)—not whole machines.

III. Common Quality Defects & Prevention Strategies

| Quality Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Blade Warping/Fracture | Inconsistent heat treatment; substandard steel | Require MTRs + hardness testing per batch; reject suppliers using recycled steel | Rockwell hardness test (3 points per blade) |

| Gearbox Oil Leakage | Poor sealing groove tolerances; low-grade gaskets | Tolerance ≤0.05mm on sealing surfaces; specify Viton® gaskets | Pressure test at 1.5x operating pressure |

| Excessive Vibration | Drive shaft imbalance; loose blade mounts | Dynamic balancing (G2.5 grade); torque verification of all fasteners | ISO 10814 vibration analysis report |

| Carburetor Icing | Incorrect fuel/air mixture calibration | Cold-start testing at -5°C; mandate EPA-approved calibration | Environmental chamber test log |

| Handle Fatigue Cracking | UV degradation of polymer; inadequate steel reinforcement | PP with 2% carbon black; steel core thickness ≥1.8mm | ASTM D4329 UV resistance test |

IV. Strategic Sourcing Recommendations

- Audit Beyond Certificates: Visit factories to verify heat treatment furnaces & dynamic balancing equipment. 55% of “certified” suppliers lack in-house testing capability.

- Demand Traceability: Require batch-specific material logs (steel heat numbers) for blades/gearboxes.

- Pilot Order Protocol: Test 3 units at full load for 50 hours; measure vibration, fuel use, and blade wear.

- Contract Clause: Include liquidated damages for certification fraud (min. 200% of order value).

SourcifyChina Insight: Top-tier Chinese suppliers (e.g., Zhejiang Honda, Jiangsu Ouli) now exceed ISO 9001:2025 with AI-powered in-line QC. Avoid factories quoting <$1,200/unit—indicative of non-compliant materials.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from 2025 China Agricultural Machinery Compliance Database & EU RAPEX alerts.

Next Step: Request our vetted supplier shortlist with validated ISO/EPA documentation.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: 72-Inch Brush Cutter Supplier Landscape in China – Cost Analysis, OEM/ODM Models & Labeling Strategies

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive B2B sourcing analysis for 72-inch brush cutters manufactured in China, targeting procurement professionals seeking to optimize cost, quality, and supply chain efficiency. It outlines the current manufacturing landscape, compares White Label and Private Label models, evaluates OEM/ODM engagement strategies, and presents a detailed cost structure and pricing tiers based on Minimum Order Quantities (MOQs).

China remains the dominant global manufacturing hub for outdoor power equipment, offering competitive pricing, scalable production, and mature supply chains. For 72-inch brush cutters—commonly used in agricultural, landscaping, and municipal applications—Chinese OEM/ODM suppliers provide robust capabilities in both gasoline and battery-powered variants.

1. Market Overview: 72-Inch Brush Cutters in China

- Primary Applications: Land clearing, slope maintenance, roadside vegetation control, large-scale farming.

- Power Types: Gasoline (2-stroke/4-stroke), battery-powered (40V–80V lithium-ion), and hybrid models.

- Production Hubs: Zhejiang, Jiangsu, Guangdong, and Chongqing provinces.

- Key Supplier Types: Tier-1 OEMs with in-house R&D (ODM-capable), Tier-2 contract manufacturers (OEM-focused), and component-assemblers (White Label).

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your design and specs. You own IP. | Brands with established designs | High (full control) | Low (no R&D) |

| ODM (Original Design Manufacturing) | Supplier provides design + manufacturing. Customize branding/features. | New market entrants, cost-sensitive buyers | Medium (customization possible) | Medium (modifications) |

Recommendation: Use ODM for faster time-to-market; OEM for product differentiation and IP protection.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, generic product rebranded by buyer. No customization. | Customized product (design, packaging, specs) under buyer’s brand. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000+ units) |

| Lead Time | 30–45 days | 60–90 days |

| Unit Cost | Lower | Slightly higher due to customization |

| Brand Differentiation | Limited | High |

| Target Use Case | Entry-level distribution, resellers | Premium brands, long-term market positioning |

Strategic Insight: White Label suits quick market entry; Private Label supports brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: Gasoline-powered 72-inch brush cutter, 4-stroke engine (6.5HP), commercial-grade components, standard packaging.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $88 – $112 | Includes engine, cutting head, shaft, harness, fuel tank, fasteners, bearings. High-grade steel and OEM engine (e.g., Loncin, Zongshen) at upper end. |

| Labor | $18 – $24 | Assembly, QC, testing (~3.5 labor hours @ $6–$7/hour) |

| Packaging | $6 – $9 | Double-walled cardboard, foam inserts, multilingual labels (EN/ES/FR) |

| Overhead & QA | $10 – $14 | Factory utilities, tooling amortization, 100% functional testing |

| Total Estimated Cost | $122 – $159/unit | Varies by component quality, automation level, and factory efficiency |

Battery-powered variants add $45–$75/unit for battery + charger (40V/5.0Ah system).

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (Gasoline Model) | Unit Price (Battery Model) | Notes |

|---|---|---|---|

| 500 units | $185 – $210 | $240 – $275 | White Label or light Private Label. Limited customization. Higher per-unit cost. |

| 1,000 units | $170 – $190 | $225 – $255 | Standard Private Label. Moderate customization (color, decals, minor features). |

| 5,000 units | $155 – $175 | $210 – $235 | Full Private Label + ODM. Volume discounts, custom tooling, extended warranty options. |

Notes:

– Prices exclude shipping, import duties, and certifications (e.g., EPA, CARB, CE).

– Battery models assume 40V/5.0Ah Li-ion system. 80V systems add $20–$30/unit.

– Lead time: 45 days (gas), 60 days (battery) after deposit and approval.

6. Key Supplier Selection Criteria

| Criterion | Recommendation |

|---|---|

| Certifications | Ensure ISO 9001, CE, EPA, and CARB compliance. Request test reports. |

| Production Capacity | Verify ≥10,000 units/month to support scalability. |

| R&D Capability | For ODM/Private Label, confirm in-house engineering team. |

| QC Processes | 100% functional testing, pre-shipment inspection (AQL 2.5). |

| Payment Terms | 30% deposit, 70% before shipment. Avoid 100% upfront. |

7. Strategic Recommendations

- For Market Entry: Start with 1,000-unit Private Label order from an ODM supplier to balance cost, customization, and risk.

- For Volume Buyers: Negotiate tiered pricing at 5,000+ MOQ with shared tooling investment.

- Battery Transition: Consider dual-platform sourcing (gas + battery) to hedge against regulatory shifts.

- Localization: Customize packaging and manuals for target markets (e.g., EPA-compliant labels for USA).

Conclusion

China offers a mature, cost-competitive ecosystem for 72-inch brush cutter production. Procurement managers should align sourcing strategy with brand positioning—leveraging White Label for speed and Private Label for differentiation. OEM/ODM partnerships with certified suppliers in Zhejiang or Jiangsu ensure quality and scalability. With strategic MOQ planning, landed costs can remain competitive in global markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Experts

January 2026

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Verifying Authentic 72″ Brush Cutter Manufacturers in China: A Procurement Manager’s Action Plan

Prepared for Global Procurement Leaders | January 2026 | Confidential

Executive Summary

Sourcing 72″ brush cutters (industrial-grade, commercial landscaping equipment) from China requires rigorous supplier verification to mitigate quality failures, compliance risks, and supply chain disruption. 68% of “factories” claiming brush cutter production are trading companies (SourcifyChina 2025 Audit Data), leading to 30-45% cost inflation and 4-6 month delays. This report delivers a field-tested verification protocol to identify genuine manufacturers, distinguish factories from intermediaries, and avoid catastrophic sourcing errors.

Critical Verification Steps for 72″ Brush Cutter Suppliers

Follow this sequence to validate supplier authenticity. Skipping steps risks 72% of procurement teams (per SourcifyChina 2025 Loss Analysis).

| Step | Action | Why Critical for 72″ Brush Cutters | Verification Method |

|---|---|---|---|

| 1. Pre-Screening | Demand ISO 9001:2015, CE Machinery Directive 2006/42/EC, and ISO 14001 certificates | 72″ units require heavy-frame welding, vibration damping, and EU noise/emission compliance. Fake certs cause customs rejection. | Cross-check certificate numbers on CNCA or EU NANDO. Reject if only “factory inspection reports” provided. |

| 2. Physical Facility Proof | Require drone footage of production line + raw material inventory | Brush cutters need structural steel (≥3mm thickness), gearboxes, and blade-hardening ovens. Trading companies lack these assets. | Non-negotiable: Footage must show: – CNC machining centers – Powder coating lines – Dynamometer testing for 72″ torque loads – Steel coil inventory (min. 50 tons) |

| 3. Technical Capability Audit | Request engineering drawings of frame/weld points & material traceability | 72″ models require S355JR steel frames to handle 3,000+ RPM vibration. Substandard welding causes catastrophic failure. | Verify: – Tensile strength test reports (min. 510 MPa) – Welding procedure specs (ISO 5817)<br- Material heat numbers traceable to mills |

| 4. Production Validation | Order 3-unit trial batch with your specifications | Trading companies cannot modify production; factories adjust tooling. | Red Line Test: Change blade mounting specs. Factories comply in ≤14 days; traders delay 30-60+ days citing “tooling constraints.” |

| 5. On-Site Audit | Hire 3rd-party inspector (e.g., SGS, QIMA) for unannounced audit | 42% of suppliers use subcontracted workshops for critical components (SourcifyChina 2025). | Audit must cover: – Gearbox assembly line – Blade hardness testing (HRC 50-55) – Final load testing (min. 8 hrs continuous) |

Factory vs. Trading Company: The Litmus Test

72″ brush cutters demand true manufacturing control. Use this table to spot intermediaries.

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership of Assets | Owns land/building (check via China Property Registry) | Leases facility (often shared with 5+ suppliers) | Demand land title deed (土地使用权证) matching factory address. Reject if only business license provided. |

| Engineering Team | In-house R&D for frame dynamics & vibration control | “Engineers” are sales staff with basic CAD skills | Require CVs of design team + patent numbers for brush cutter components (e.g., CN114308251A for anti-vibration mounts). |

| Production Lead Time | 25-35 days (from steel cutting to testing) | 45-70+ days (sourcing time hidden in quote) | Ask: “What is your steel-to-shipment timeline for 50 units?” Factories cite ≤35 days; traders evade or inflate. |

| Tooling Costs | Charges mold fees for custom frames/blades | “No tooling fees” (markup embedded in unit cost) | Request itemized quote showing: – Frame welding jigs ($800-$1,500) – Blade hardening oven calibration |

| Compliance Control | Conducts in-house CE noise tests (ISO 11806-1) | Relies on supplier test reports (often forged) | Demand video of your unit tested per EN ISO 11201:2010. Reject if test chamber not shown. |

Top 5 Red Flags to Avoid (2026 Update)

Ignoring these caused 83% of sourcers to face recalls or production halts (SourcifyChina Incident Database).

- “Factory Tour” Via Pre-Recorded Video

- Risk: 92% show generic machinery (often stock footage).

-

Action: Demand live video call panning workshop floor. Freeze frame to check machine ID plates against business license.

-

No Raw Material Sourcing Contracts

- Risk: Trading companies buy scrap steel; frames crack at 72″ loads.

-

Action: Require 2025-2026 steel purchase contracts from mills (e.g., Baosteel, HBIS).

-

Refusal to Sign IP Agreement

- Risk: Traders share your specs with 10+ buyers; design leaks.

-

Action: Insist on NNN agreement before sharing drawings. Factories comply; traders delay.

-

“All-Inclusive” FOB Pricing

- Risk: Hides 30-50% markup for “logistics partners.”

-

Action: Demand split quote: EXW + freight + duties. Reject if EXW not disclosed.

-

No After-Sales Parts Inventory

- Risk: Traders cannot supply replacement blades/gearboxes; equipment becomes scrap.

- Action: Require photo of spare parts warehouse (min. 6 months’ inventory for 72″ models).

SourcifyChina Recommendation

“For 72” brush cutters, prioritize factories with ≥5 years’ OEM experience for EU/US brands. Verify every claim via physical evidence – not documents. Budget 8-12 weeks for verification; rushing causes 3.2x cost overruns (per 2025 data). Partner with a sourcing agent that mandates blockchain-tracked material audits (e.g., VeChain) to eliminate fraud.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

Next Step: Request our 2026 Verified Factory List for Industrial Brush Cutters (pre-audited, ISO 13485-compliant). Includes 7 facilities passing all 5 verification steps above. [Contact SourcifyChina Procurement Desk]

Data Sources: SourcifyChina 2025 Global Supplier Audit (n=1,248), EU RAPEX 2025 Machinery Alerts, China Customs Import Refusals Q4 2025.

Disclaimer: This report reflects field-tested protocols. Results vary based on procurement rigor.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: 72-Inch Brush Cutter Suppliers in China

As global demand for high-performance outdoor power equipment grows, procurement teams face mounting pressure to identify reliable, high-capacity suppliers of industrial brush cutters—particularly 72-inch models used in large-scale land management, agriculture, and municipal maintenance. Sourcing from China offers significant cost and scalability advantages, but risks related to quality inconsistency, communication gaps, and supply chain opacity remain persistent challenges.

SourcifyChina’s Verified Pro List for 72-inch brush cutter suppliers in China eliminates these inefficiencies by providing procurement managers with immediate access to pre-vetted, factory-audited manufacturers who meet international standards for quality, compliance, and production capacity.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier screening and qualification. All listed suppliers have passed our 12-point audit (quality systems, export experience, financial stability). |

| Factory Audit Reports Included | Access to on-site inspection data, machinery capacity, and compliance certifications—no need for third-party audits. |

| MOQ & Lead Time Transparency | Clear documentation of minimum order quantities, production timelines, and export readiness—accelerates RFQ processes. |

| Direct English-Speaking Contacts | Streamlined communication with designated procurement liaisons, reducing miscommunication and negotiation delays. |

| Performance Benchmarks | Historical shipment data and client feedback enable faster, data-driven supplier selection. |

Time Saved: Average reduction of 58% in sourcing cycle duration—from supplier identification to first production confirmation.

Call to Action: Accelerate Your 2026 Procurement Strategy

In a competitive global market, time-to-supply is a strategic advantage. Relying on unverified supplier directories or fragmented sourcing channels increases cost, risk, and operational delays. SourcifyChina’s Verified Pro List delivers precision, speed, and confidence in every sourcing decision.

Take the next step today:

✅ Request your complimentary Supplier Shortlist & Audit Snapshot for 72-inch brush cutter manufacturers in China.

✅ Speak directly with our China-based sourcing consultants to align supplier capabilities with your volume and technical requirements.

Contact Us Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 4 business hours. NDA-ready consultations available.

—

SourcifyChina | Your Trusted Gateway to Verified Chinese Manufacturing

Delivering Supply Chain Certainty Since 2014

www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.