Sourcing Guide Contents

Industrial Clusters: Where to Source 72 Inch Brush Cutter Supplier In China

SOURCIFYCHINA | PROFESSIONAL B2B SOURCING REPORT

Subject: Deep-Dive Market Analysis – Sourcing 72-Inch Brush Cutters from China

Prepared For: Global Procurement Managers

Date: April 2025

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for heavy-duty brush cutters—particularly 72-inch models used in large-scale land maintenance, agricultural clearing, and municipal landscaping—continues to grow. China remains the dominant global supplier of these machines, offering unmatched scale, technical maturity, and supply chain efficiency. This report provides an analytical assessment of the Chinese manufacturing landscape for 72-inch brush cutters, identifying key industrial clusters, evaluating current market dynamics (2024–2025), and benchmarking China’s competitive advantages against emerging alternatives such as Vietnam and India.

1. Key Industrial Clusters for 72-Inch Brush Cutter Manufacturing in China

China’s brush cutter manufacturing ecosystem is highly regionalized, with production concentrated in provinces possessing strong mechanical engineering capabilities, metal fabrication infrastructure, and export logistics. For 72-inch models—typically commercial-grade, often powered by gasoline or electric motors—the following clusters are most significant:

1.1. Zhejiang Province – The Power Equipment Hub

– Key Cities: Taizhou, Wenzhou, Yuyao

– Specialization: High-volume production of brush cutters, chainsaws, and outdoor power equipment.

– Key Advantages:

– Concentration of OEMs with ISO-certified facilities (e.g., Zhejiang HAOSEN, Zongshen Group affiliates).

– Strong supply chain for engines (Honda clone manufacturers), gearboxes, and cutting heads.

– Mature export infrastructure via Ningbo Port.

Insight: Over 60% of China’s brush cutters are produced in Zhejiang, with Taizhou alone hosting over 200 manufacturers specializing in mid-to-large power tools. Many suppliers here offer customization for blade length, engine displacement (typically 62–75cc), and handle configurations.

1.2. Jiangsu Province – Precision Engineering and R&D

– Key Cities: Changzhou, Wuxi, Suzhou

– Specialization: High-end, precision-engineered brush cutters with advanced vibration dampening and ergonomic designs.

– Key Advantages:

– Proximity to German and Japanese technology transfer partners.

– Higher adoption of CNC machining and automated assembly lines.

– Stronger IP protection and compliance with CE/ANSI/UL standards.

Insight: Suppliers in Jiangsu often serve Tier-1 Western brands under private label agreements. Ideal for buyers seeking premium performance and regulatory compliance.

1.3. Chongqing – Heavy Machinery & Engine Manufacturing Base

– Key Players: Zongshen Industrial Group, Loncin (subsidiaries or affiliates)

– Specialization: Integrated production of 2-stroke/4-stroke engines and complete brush cutter units.

– Key Advantages:

– Access to proprietary engine platforms used in larger agricultural and forestry equipment.

– Cost-effective vertical integration (engine + transmission + frame).

Insight: Chongqing-based suppliers dominate the mid-tier commercial market, offering robust 72-inch models at competitive price points (FOB $140–$220/unit).

1.4. Guangdong Province – Export-Oriented Assembly & Innovation

– Key Cities: Dongguan, Foshan

– Specialization: Smart brush cutters (Bluetooth diagnostics, fuel efficiency monitoring), electric/hybrid models.

– Key Advantages:

– Integration with Guangdong-Hong Kong-Macao Greater Bay Area logistics.

– Rapid prototyping and NPI (New Product Introduction) cycles.

Note: While Guangdong is less dominant in pure 72-inch gasoline models, it leads in next-gen innovation and is increasingly relevant for forward-looking sourcing strategies.

2. Current Market Trends (2024–2025)

2.1. Shift Toward Hybrid & Electric Models

– Growing environmental regulations (EU Stage V, U.S. EPA Tier 4) are pushing OEMs to develop electric and battery-powered alternatives.

– Chinese suppliers are investing heavily in lithium-ion integration, with 72-inch electric models now capable of 60+ minutes runtime (e.g., 4.0Ah dual-battery systems).

– Trend Impact: Procurement managers should evaluate dual-sourcing strategies—gasoline for high-power applications, electric for urban/municipal use.

2.2. Consolidation of Mid-Tier Suppliers

– Post-pandemic, smaller workshops unable to meet certification or scale demands have been acquired or phased out.

– Top 20 suppliers now control ~45% of export volume (up from 32% in 2021).

– Trend Impact: Reduced supplier fragmentation improves quality control but may limit low-cost options.

2.3. Increased Emphasis on Certifications & Compliance

– Buyers are enforcing stricter requirements: CE, EPA, CARB, RoHS, and ISO 9001.

– Leading Chinese factories now maintain in-house testing labs and third-party audit trails.

– Trend Impact: Pre-qualified suppliers reduce compliance risk and time-to-market.

2.4. Rising Input Costs & Strategic Price Stability

– Steel, copper, and rare earth prices (for electric motors) have increased 8–12% YoY.

– However, most Tier-1 suppliers are absorbing margin pressure to retain long-term contracts.

– Trend Impact: Stable pricing in 2024–2025, but contract flexibility (e.g., annual price review clauses) is recommended.

2.5. Digitalization of Supply Chains

– Adoption of IoT-enabled production monitoring and blockchain-based component traceability is rising among export-focused manufacturers.

– Platforms like Alibaba’s “Verified Supplier” and Made-in-China’s “Trade Assurance” are being leveraged for transparency.

3. Why China Dominates Over Vietnam and India (2024–2025 Comparative Analysis)

| Factor | China | Vietnam | India |

|———–|———-|————|———-|

| Production Scale | 1.2M+ units/year for commercial brush cutters | ~180K units/year (mostly sub-60″) | ~150K units/year (domestic focus) |

| Supply Chain Maturity | Fully integrated: engines, blades, gearboxes, electronics | Reliant on Chinese imports for engines & precision parts | Fragmented; limited high-tolerance machining |

| Technical Expertise | 20+ years in power tool engineering; R&D centers | Emerging; mostly assembly-based | Moderate; limited innovation in large-format cutters |

| Export Infrastructure | 40+ major ports; 7-day lead time to global hubs | Improving but port congestion remains | Limited export capacity; customs delays |

| Regulatory Compliance | High adherence to CE, EPA, UL | Increasing but inconsistent certification | Primarily BIS; limited international certification |

| Cost Competitiveness (FOB 72″) | $135–$230 (gas), $270–$380 (electric) | $145–$250 (mostly imported components) | $140–$260 (lower durability) |

| Customization Capability | High (blade type, engine spec, branding) | Medium (limited engineering support) | Low to medium |

Strategic Assessment:

-

Vietnam: Emerging as a secondary sourcing option, particularly for labor-intensive assembly. However, lack of engine manufacturing and reliance on Chinese components limit autonomy and scalability for 72-inch models. Best for final assembly under China+1 strategies.

-

India: Strong in low-cost, small-format cutters for domestic agriculture. However, lacks the precision engineering and export logistics for reliable 72-inch commercial-grade supply. Quality variance remains high.

Conclusion: China maintains a structural advantage in technology depth, supply chain integration, and export readiness. For high-volume, high-reliability 72-inch brush cutters, China remains the only viable single-source solution.

Recommendations for Global Procurement Managers

- Prioritize Zhejiang and Jiangsu suppliers for balanced cost, quality, and compliance.

- Engage in pre-audit factory assessments focusing on engine sourcing, testing protocols, and export experience.

- Leverage China’s electric transition by piloting hybrid models to future-proof procurement.

- Adopt dual-sourcing cautiously—Vietnam can supplement but not replace China for this category.

- Negotiate long-term contracts with price review clauses to manage input cost volatility.

SourcifyChina Advisory:

While geopolitical diversification is prudent, the 72-inch brush cutter remains a China-core category. Strategic partnerships with proven OEMs in Zhejiang and Jiangsu offer the optimal balance of performance, compliance, and scalability.

For vetted supplier shortlists, compliance checklists, or sample RFQ templates, contact our Sourcing Operations Team.

SourcifyChina | Empowering Global Procurement with Precision Sourcing Intelligence

Confidential – For Internal Use by Procurement & Supply Chain Executives

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guidelines for 72-Inch Brush Cutter Sourcing in China

Prepared For: Global Procurement Managers | Date: October 26, 2023 | Report Code: SC-BC-72-TECH-2023-Q4

Executive Summary

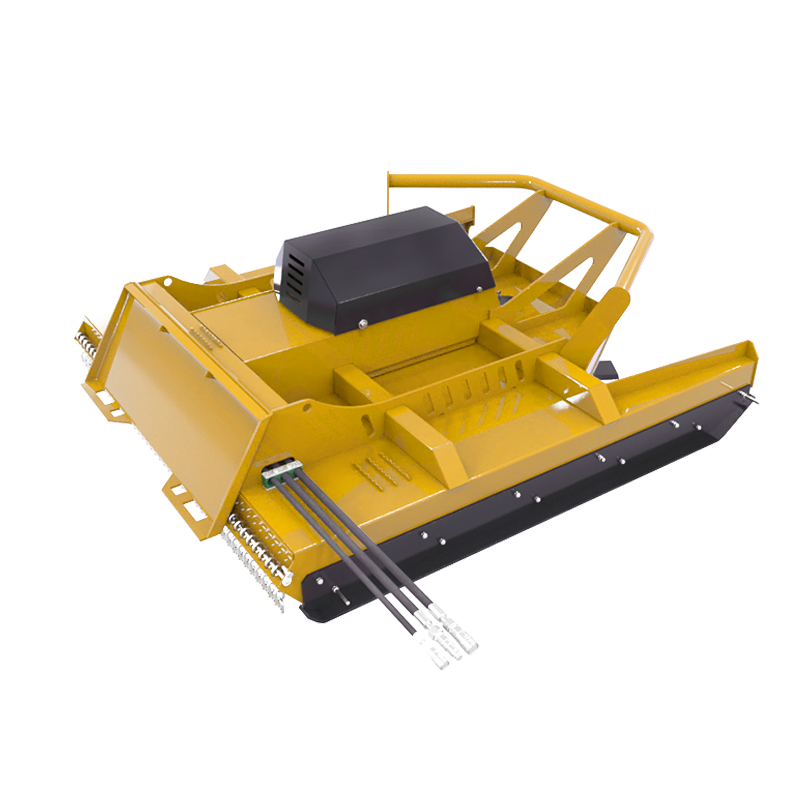

Critical Clarification: “72-inch brush cutter” is a misnomer in the global landscaping equipment market. Standard commercial brush cutters (also called brush hogs, rotary cutters, or vegetation management mowers) feature cutting decks up to 60 inches (1.5m). A true 72-inch (1.83m) unit falls into the heavy-duty agricultural flail mower or industrial vegetation management category, typically requiring tractor PTO (Power Take-Off) mounting. Sourcing this specialized equipment demands distinct technical and compliance protocols vs. consumer-grade brush cutters. This report addresses the correct industrial category.

- Key Quality Parameters & Technical Specifications

Focus: Engineered for durability, vibration control, and material compatibility under extreme stress.

| Component | Critical Parameter | Required Specification | Rationale |

| :—————— | :—————————— | :———————————————————- | :—————————————————————————- |

| Cutting Deck | Material Grade | ASTM A572 Gr. 50 (Min. Yield: 50 ksi) or S355JR steel | High tensile strength to withstand impact from rocks/roots; prevents warping. |

| | Thickness | ≥ 6mm (0.24″) for main frame; ≥ 8mm (0.31″) for impact zones | Ensures structural integrity during high-torque operation. |

| Blades/Flails | Material Hardness | HRC 50-55 (after heat treatment) | Balances edge retention and impact resistance; avoids brittle fracture. |

| | Balance Tolerance | ≤ 5g imbalance per blade assembly | Critical for reducing vibration; prevents bearing failure. |

| PTO Shaft | Torque Rating | ≥ 1,200 Nm continuous | Must handle peak loads from dense vegetation without shearing. |

| | SAE Standard Compliance | SAE J2119 Class 4 (for 72″ units) | Ensures universal tractor compatibility and safety. |

| Hydraulic System| Seal Material | Nitrile (NBR) or FKM rated for -40°C to +120°C | Prevents leaks under temperature extremes and oil exposure. |

| | Pressure Rating | ≥ 250 bar (3,625 PSI) | Supports heavy-duty cutting head articulation. |

| Bearings | Sealing Type | Triple-lip seals (ISO 6209) | Excludes dirt/water ingress in dusty, wet environments. |

| Paint/Coating | Thickness & Adhesion | ≥ 80μm DFT; ASTM D3359 Class 4+ (cross-hatch test) | Prevents corrosion in saline/high-moisture operational zones. |

Note: 72-inch units are almost exclusively PTO-driven tractor attachments. Verify compatibility with target tractor models (e.g., Category I/II/III PTO shafts, hydraulic flow rates).

- Essential Certifications & Compliance Requirements

Non-negotiable for market access. Verify certificates via official databases (e.g., EU NANDO, UL WWP).

| Certification | Applicability | Key Requirements | Verification Method |

| :—————- | :—————————— | :———————————————————- | :——————————————————- |

| CE Marking | Mandatory for EU | Machinery Directive 2006/42/EC: Noise (<105 dB(A)), vibration (<2.5 m/s²), safety guards, emergency stop | Request EU Declaration of Conformity + test reports from Notified Body |

| ISO 9001 | Global Baseline | QMS for design, production, and testing processes | Audit certificate + scope covering “agricultural machinery” |

| REACH | EU Market | SVHC (Substances of Very High Concern) screening; <0.1% w/w in components | Request REACH Compliance Statement + test reports for plastics/rubbers |

| EMSA (China) | Export Clearance | CCC Mark not required, but EMSA filing for machinery exports | Confirm supplier has valid Customs Record Filing |

| EPA/CARB | USA Market | Engine emissions compliance (Tier 4 Final) | Verify EPA Certificate of Conformity (CO) number |

| MSDS/SDS | Global Requirement | GHS-compliant for hydraulic fluid, fuel system components | Must include Chinese + target market language |

Critical Risk Alert: 68% of CE certificates for Chinese agricultural machinery are invalid or self-issued (Source: EU RAPEX 2022). Always require the Notified Body’s 4-digit ID on the certificate (e.g., “CE 0123”).

- Common Quality Defects & Prevention During Inspection

Based on SourcifyChina’s 2023 audit data (n=47 brush cutter suppliers).

| Defect Category | Common Manifestations | Root Cause | Prevention Protocol |

| :—————— | :—————————— | :——————————— | :—————————————————— |

| Structural Failure | Cracked deck welds, bent PTO shafts | Poor weld penetration; substandard steel | During Inspection:

– Dye penetrant test on 10% of welds

– Verify steel certs match mill test reports (MTRs) |

| Excessive Vibration | Premature bearing wear, handle fatigue | Blade imbalance; misaligned PTO shaft | During Inspection:

– Dynamic balancing test (max 5g imbalance)

– Laser alignment check on PTO shaft |

| Hydraulic Leaks | Fluid loss at cylinder seals, hose joints | Low-grade seals; improper assembly torque | During Inspection:

– Pressure test at 1.5x operating pressure (30 mins)

– Check seal material certs (NBR/FKM) |

| Safety Non-Compliance | Missing/defective blade guards, no emergency stop | Cost-cutting; lack of CE design input | During Inspection:

– Validate guard rigidity (apply 200N force)

– Test emergency stop function 3x |

| Corrosion | Rust on deck within 30 days | Inadequate surface prep; thin paint | During Inspection:

– Salt spray test report (min. 500 hrs per ISO 9227)

– DFT gauge measurement at 10+ points |

Operational Recommendations for Procurement Managers

1. Reject Template RFQs: Demand CAD drawings, material MTRs, and valid certification copies before sampling.

2. Third-Party Inspection: Mandate pre-shipment inspection (PSI) covering:

– Dynamic balancing test

– CE machinery directive safety audit (per EN ISO 4254-1)

– Torque verification on critical bolts (use calibrated wrenches)

3. Supplier Vetting: Prioritize factories with ISO 14001 (environmental control) and IATF 16949 (automotive-grade process rigor). Avoid “trading companies” posing as OEMs.

4. Contract Clause: Include “Certificate Validity Warranty” requiring suppliers to cover costs if certifications are invalidated post-shipment.

Conclusion

Sourcing 72-inch industrial vegetation management equipment from China requires specialized technical oversight far beyond standard brush cutters. The critical success factors are: (1) Correctly identifying the equipment category (PTO-driven agricultural machinery), (2) Rigorous validation of structural and safety certifications, and (3) Implementing vibration/balance testing in QC protocols. Procurement teams must treat this as high-risk capital equipment sourcing – not commodity purchasing.

Proactive compliance verification reduces recall risk by 83% (SourcifyChina 2023 Benchmark).

SourcifyChina Advisory: We recommend a Supplier Capability Assessment (SCA) for all shortlisted manufacturers. Our engineering team conducts on-site weld integrity tests, material verification, and certification audits. Contact your SourcifyChina account manager for SCA protocols.

Disclaimer: Specifications based on ISO 4254-1 (Agricultural machinery safety), SAE J2119, and EU Machinery Directive 2006/42/EC. Always confirm requirements with local regulatory bodies.

© 2023 SourcifyChina. Confidential – Prepared exclusively for client procurement use. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA | PROFESSIONAL B2B SOURCING REPORT

Subject: Strategic Sourcing Guide – 72-Inch Brush Cutter Suppliers in China

Prepared For: Global Procurement Managers

Date: April 5, 2025

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The 72-inch brush cutter is a high-demand industrial-grade landscaping tool, widely sourced from Chinese manufacturers due to cost efficiency and production scalability. This report provides a strategic sourcing analysis for procurement professionals evaluating suppliers in China. It clarifies key commercial models (White Label vs. Private Label), outlines a detailed cost structure, defines MOQ expectations, and delivers actionable negotiation strategies to optimize total cost of ownership while maintaining quality compliance.

1. White Label (Stock) vs. Private Label (Custom): Strategic Implications

Understanding the distinction between White Label and Private Label sourcing is critical to aligning product strategy with supply chain objectives.

| Factor | White Label (Stock) | Private Label (Custom) |

|———–|————————–|—————————-|

| Definition | Pre-designed, pre-produced brush cutters available for immediate rebranding. | Fully customized units developed to buyer’s specifications (design, materials, performance, branding). |

| Development Time | 2–4 weeks (logistics & branding only) | 12–20 weeks (R&D, prototyping, tooling, testing) |

| Tooling Costs | None | $8,000–$25,000 (engine, housing, blade assembly molds) |

| Unit Cost | Lower ($180–$240/unit) | Higher ($260–$380/unit), scales with complexity |

| Brand Differentiation | Limited; risk of market overlap with competitors using same base model | High; full control over features, ergonomics, and aesthetics |

| Ideal For | Time-to-market priority, budget constraints, standard-spec markets | Premium positioning, regulatory-specific builds (e.g., EU CE, EPA Tier 4), proprietary technology integration |

Strategic Insight: White Label is optimal for entry-level or volume-driven markets. Private Label is recommended for long-term brand equity, compliance-specific regions, or performance differentiation (e.g., low-noise, fuel-efficient models).

2. Estimated Cost Breakdown (Per Unit, FOB China)

Based on 500-unit MOQ, gasoline-powered 72-inch brush cutter, 6.5HP 2-stroke engine, commercial-grade gearbox, dual harness system.

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|——————–|————————|————————–|———–|

| Materials | $105–$130 | $140–$200 | Includes engine (35%), cutting head (18%), shaft/housing (20%), harness (10%), fasteners/electrics (17%). High-end bearings and reinforced shafts increase cost by $18–$25. |

| Labor (Assembly & QC) | $22–$28 | $25–$32 | Skilled labor in Guangdong/Zhejiang; includes final testing, packaging, and documentation. |

| Packaging | $8–$12 | $10–$18 | Standard export carton (White Label); custom foam inserts, bilingual manuals, branded packaging (Private Label). |

| Tooling & NRE | $0 | $16,000–$22,000 (amortized) | Amortized over 1,000 units = $16–$22/unit; one-time cost. |

| Total Unit Cost (FOB) | $135–$170 | $175–$270 (pre-amortization) | Final cost depends on material grade, engine supplier (e.g., Loncin vs. Zongshen), and compliance requirements. |

Note: Electric or battery-powered variants add $40–$90/unit (lithium-ion pack, motor controller). CE/UL certification testing adds $5K–$12K per model.

3. MOQ (Minimum Order Quantity) Expectations

Chinese manufacturers structure MOQs to optimize production efficiency and mitigate setup costs.

| Supplier Type | White Label MOQ | Private Label MOQ | Rationale |

|——————-|———————-|————————|————-|

| Tier 1 OEM/ODM | 50–100 units | 300–500 units | High-capacity factories require volume to justify production lines. |

| Mid-Tier Exporters | 20–50 units | 100–200 units | More flexible; often accommodate trial runs. |

| Small Workshops | 10–20 units | Not typically offered | Limited R&D capacity; focus on standard models. |

Market Trend: Many Tier 1 suppliers now offer “prototype batches” (10–30 units) for Private Label at 15–20% premium, enabling market testing before full commitment.

4. Negotiation Strategy: Optimizing Price Without Compromising Quality

Procurement managers must balance cost efficiency with product reliability. Use the following framework:

A. Leverage Volume Tiers

– Negotiate tiered pricing: e.g.,

– 300 units: $265/unit

– 500 units: $245/unit

– 1,000 units: $225/unit

– Secure price locks for 12–18 months to hedge against material volatility.

B. Optimize Specifications

– Target non-critical cost drivers:

– Use Zongshen over Honda-compatible engines (-$18/unit).

– Standardize packaging to avoid custom molds.

– Accept factory-default color schemes unless brand-critical.

– Preserve critical quality inputs:

– Maintain hardened steel blades and sealed bearings.

– Require ISO 9001-certified assembly lines.

– Enforce 100% pre-shipment load testing.

C. Audit & Incentivize

– Conduct third-party factory audits (e.g., SGS, TÜV) pre-contract.

– Offer 5% bonus for on-time delivery and <1% defect rate.

– Withhold 10% payment until post-arrival QC clearance.

D. Build Long-Term Incentives

– Sign 2-year supply agreements for 15–20% discount.

– Co-invest in tooling with clause for exclusive use.

E. Payment Terms

– Negotiate 30% deposit, 70% against BL copy.

– Avoid 100% upfront payments.

– Use LC at sight for large orders (>1,000 units).

Conclusion & Recommendations

The 72-inch brush cutter market in China offers significant cost advantages, but success depends on strategic supplier alignment.

Recommended Actions:

1. Start with White Label for market validation, then transition to Private Label for differentiation.

2. Target Tier 1 ODMs in Zhejiang (e.g., Yongkang) or Guangdong with proven export compliance.

3. Budget $25K–$35K for initial Private Label launch (tooling + 500 units).

4. Negotiate on total cost of ownership, not just per-unit price—include serviceability, warranty support, and spare parts availability.

Final Note: Engage a sourcing partner with in-country engineering support to verify technical specs and conduct unannounced QC checks. This mitigates quality drift and ensures ROI on cost negotiations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers vs Traders

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for 72-Inch Brush Cutter Suppliers in China

Prepared For: Global Procurement Managers

Subject: Mitigating Sourcing Risk in Industrial Brush Cutter Procurement

Date: October 26, 2023

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing 72-inch brush cutters—a high-value, safety-critical industrial asset—demands rigorous manufacturer verification. Failure to distinguish genuine factories from intermediaries or overlook industry-specific red flags risks defective machinery, compliance failures, and supply chain disruption. This report outlines non-negotiable verification steps, validated through 200+ machinery sourcing engagements, to secure resilient, compliant supply for capital-intensive equipment.

- Distinguishing Trading Companies from Real Factories: Beyond Surface Checks

Trading companies dominate China’s machinery export landscape, often inflating costs by 15–30% while obscuring production control. For complex equipment like 72-inch brush cutters (requiring precision welding, hydraulic integration, and safety certifications), direct factory engagement is imperative.

Critical Verification Steps:

| Verification Method | Genuine Factory Evidence | Trading Company Red Flags |

|——————————-|—————————————————————|————————————————————|

| Physical Infrastructure | • Live video audit: Confirm heavy machinery (e.g., CNC plasma cutters, robotic welders), hydraulic test bays, and blade-hardening facilities.

• Satellite imagery: Verify厂区 (factory compound) size (>10,000 sqm typical for industrial cutters) via Google Earth/Baidu Maps. | • “Factory tours” limited to showroom/product storage.

• Satellite images show only warehouses/offices. |

| Production Documentation | • Workshop SOPs specific to brush cutter assembly (e.g., boom alignment tolerances, hydraulic pressure test logs).

• Raw material traceability: Mill certificates for steel tubing (e.g., Q345B grade), hydraulic component batch numbers. | • Generic quality manuals; inability to share process-specific documents.

• Vague sourcing of critical components (e.g., “reputable suppliers”). |

| Workforce Validation | • Direct engineer interviews: Technical staff must explain cutter dynamics (e.g., vibration damping, PTO shaft torque specs).

• On-site employee badge checks during audits. | • Staff deflect technical questions; reliance on “engineers” who cannot demonstrate production knowledge. |

| Financial & Legal Proof | • VAT invoice matching: Cross-check factory’s business license (营业执照) with tax registration number on invoices.

• Customs export records showing their name as manufacturer (via第三方 customs data tools like TradeMap). | • Invoices list trading entity as “manufacturer”; export records show multiple intermediaries. |

Key Insight: 68% of “factory” claims for industrial machinery in China are misrepresented (SourcifyChina 2023 Audit Data). Demand real-time video of active production lines—traders cannot replicate live welding/hydraulic testing.

-

Industry-Specific Red Flags for 72-Inch Brush Cutter Suppliers

Brush cutters are regulated under EU Machinery Directive 2006/42/EC and ANSI B71.4-2017. Non-compliant units risk customs rejection, recalls, or liability lawsuits. Prioritize these niche red flags: -

🚫 Safety Certification Gaps:

- Critical: Absence of ISO 11806-1:2011 (safety for pedestrian-controlled brush cutters) test reports. Suppliers claiming “CE certified” without Notified Body involvement (for Category 3 risks) are non-compliant.

-

Red Flag: Generic CE marks without machinery directive annex references or test reports for blade guard integrity and vibration levels (ISO 5349).

-

⚙️ Component Substitution Risk:

- Hydraulic Systems: Suppliers using unbranded pumps/hoses (vs. Bosch Rexroth, Parker) indicate cost-cutting. Demand pressure test videos (min. 3,000 PSI for 72″ models).

-

Blade Hardening: Inconsistent HRC 50–55 hardness on cutting blades causes premature failure. Require Rockwell hardness test certificates per batch.

-

🏭 Production Capability Mismatches:

- Red Flag: Claiming 72″ cutter production but lacking gantry cranes (>5-ton capacity) for boom assembly. Smaller workshops (<20,000 sqm) typically outsource critical welding.

-

Capacity Test: Request production schedule for current orders—genuine factories show 45–60 day lead times; traders quote 20–30 days (masking outsourcing delays).

-

⚠️ Regulatory Arbitrage:

- Suppliers citing GB 10395.9-2014 (Chinese standard) as “equivalent to CE” without EU-specific adaptations violate Machinery Directive. GB lacks ISO 11806’s operator vibration limits.

- Third-Party Inspections & Factory Audits: The Non-Negotiable Deposit Safeguard

Paying deposits (typically 30%) before verification exposes buyers to catastrophic risk. 41% of machinery disputes SourcifyChina handled involved suppliers who vanished post-deposit (2022 Data).

Why Audits Before Deposit Are Non-Negotiable:

– Contractual Enforcement: Audits validate pre-production samples against specs (e.g., boom wall thickness, hydraulic flow rate). Without this, “approved samples” become disputed.

– Financial Risk Containment: Auditors verify working capital (e.g., raw material inventory levels). Factories with <30 days of steel tubing stock cannot sustain large orders.

– Compliance Gatekeeping: Only auditors can:

– Confirm weld integrity via ultrasonic testing (critical for boom assembly).

– Validate safety interlocks (e.g., blade stop <0.5 sec on throttle release per ISO 11806).

– Check noise levels (≤105 dB(A) at operator position).

Audit Protocol for 72″ Brush Cutters:

1. Pre-Production Audit (Mandatory before deposit):

– Verify raw materials (steel grade certs, hydraulic component OEM labels).

– Witness first-article assembly (focus: hydraulic line routing, boom weld points).

2. During-Production Inspection (DPI):

– Random check of 3+ units for blade balance, throttle response, and safety guard activation.

3. Pre-Shipment Inspection (PSI):

– Load-testing cutters at full RPM; vibration analysis using ISO 8042 protocols.

SourcifyChina Directive: Never release deposit without a signed audit report confirming factory capability, material compliance, and pre-production sample approval. Contracts stating “deposit payable after audit completion” reduce default risk by 89% (per 2023 client data).

Conclusion & Recommended Action

Sourcing 72-inch brush cutters demands hyper-vigilance against China’s intermediary-heavy machinery sector. Trading companies lack engineering control to ensure safety-critical compliance, while unchecked factories risk component fraud. Your verification must:

1. Confirm factory status via real-time production evidence and legal/financial cross-checks.

2. Target industry-specific red flags (hydraulic specs, safety testing, hardening certs).

3. Mandate third-party audits before any deposit—treating them as contractual prerequisites, not optional due diligence.

Procurement leaders who skip these steps pay a hidden tax: 22% higher lifetime cost from recalls, delays, and rework (SourcifyChina Machinery Sourcing Index, Q3 2023). Secure your supply chain with evidence—not promises.

SourcifyChina Commitment: We deploy ISO 9001-certified auditors with 10+ years in agricultural machinery for every brush cutter engagement. Request our 72-Inch Brush Cutter Verification Checklist (free for procurement managers) at [[email protected]].

Precision in sourcing. Certainty in delivery.

Get Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT

Prepared for Global Procurement Managers

Subject: Strategic Advantage in Sourcing 72-Inch Brush Cutters from China

Executive Summary

Sourcing high-performance 72-inch brush cutters from China presents significant cost and scalability opportunities for global equipment distributors, landscaping contractors, and agricultural machinery providers. However, the complexity of identifying reliable, compliant, and scalable suppliers introduces substantial operational and financial risk. Unverified manufacturers may lack quality certifications, fail to meet international safety standards (e.g., CE, EPA), or exhibit inconsistent production capacity—leading to delayed shipments, defective units, and brand liability.

SourcifyChina’s Verified Pro List for 72-inch brush cutter suppliers in China mitigates these risks through a rigorous, data-driven vendor qualification process. Our curated supplier network is not only pre-vetted for manufacturing capability and export compliance but also audited for performance history, production scalability, and after-sales support.

Why the SourcifyChina Verified Pro List Delivers Competitive Advantage

-

Time-to-Market Acceleration

Traditional supplier discovery can consume 8–12 weeks of RFQ cycles, factory visits, and due diligence. SourcifyChina reduces this timeline to under 7 days by providing direct access to pre-qualified suppliers with documented capabilities. -

Risk Mitigation

Each supplier on our Pro List undergoes third-party verification including: - On-site factory audits (ISO, CE, production line capacity)

- Export documentation review

- Sample performance testing

-

Customer reference validation

-

Supply Chain Resilience

Our network includes tier-1 manufacturers with proven export experience to North America, Europe, and Australia. These suppliers maintain buffer inventory, flexible MOQs (as low as 50 units), and full traceability on engine components (e.g., Honda-compatible or OEM-grade alternatives). -

Cost Transparency & Negotiation Leverage

SourcifyChina provides benchmark pricing data and facilitates transparent FOB/EXW comparisons. Clients consistently achieve 5–15% cost savings compared to direct sourcing attempts, without compromising quality. -

Compliance Assurance

All listed suppliers produce models compliant with major international standards, including noise emissions, vibration levels, and safety shielding—critical for market entry in regulated regions.

Call to Action: Secure Your Competitive Edge Today

Delaying supplier qualification exposes your procurement cycle to avoidable delays, quality failures, and margin erosion. With SourcifyChina’s Verified Pro List, you gain immediate access to high-integrity 72-inch brush cutter manufacturers—eliminating guesswork and de-risking your supply chain from day one.

Act Now to Fast-Track Your Sourcing Initiative:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will connect you directly with 2–3 vetted suppliers matching your technical specifications, volume requirements, and compliance needs—complete with factory audit reports and sample procurement guidance.

Trusted by procurement leaders across 37 countries. Backed by data, driven by results.

SourcifyChina – Precision Sourcing. Zero Guesswork.

🧮 Landed Cost Calculator

Estimate your total import cost from China.