Sourcing Guide Contents

Industrial Clusters: Where to Source 72 Inch Brush Cutter Manufacturer In China

SourcifyChina Sourcing Intelligence Report: 72-Inch Brush Cutter Manufacturing in China (2026 Market Analysis)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sourcing 72-inch brush cutters (commercial-grade, heavy-duty models) from China presents distinct opportunities and challenges. While China dominates global brush cutter production (~65% market share, per 2025 China Customs data), specialized manufacturers of 72-inch units remain concentrated in specific industrial clusters. Critical gaps exist between supplier claims and verified production capacity for this niche segment. This report identifies core manufacturing hubs, quantifies regional trade-offs, and provides actionable risk-mitigation strategies for 2026 procurement.

Key Reality Check: 90% of Chinese brush cutter factories focus on consumer-grade units (<40-inch). True 72-inch commercial manufacturers require validated heavy-duty engineering, hardened steel components, and industrial-grade engines. Supplier vetting is non-negotiable.

Industrial Clusters for 72-Inch Brush Cutter Manufacturing

China’s production is heavily regionalized. For 72-inch models, three clusters dominate, each with distinct capabilities:

| Province | Core City(s) | Specialization | Key Strengths | Key Limitations |

|---|---|---|---|---|

| Zhejiang | Yongkang, Wenzhou | Heavy-Duty Agricultural Machinery | Deep supply chain for hardened blades/gearboxes; 60% of China’s certified brush cutter OEMs; Cost efficiency | Limited smart-technology integration; Older factories may lack IATF 16949 |

| Jiangsu | Changzhou, Yangzhou | Precision Engine & Transmission Systems | High-quality Kohler/Briggs-compatible engines; Strong R&D for commercial models; ISO 9001/14001 compliance | Higher base pricing; Less clustered supply chain (longer lead times) |

| Guangdong | Foshan, Zhongshan | Electronics-Integrated Commercial Equipment | Advanced telemetry/IoT capabilities; Rapid prototyping; Strong export compliance (CE/UL) | Premium pricing; Fewer pure-play brush cutter specialists (many focus on trimmers) |

Critical Note: No significant 72-inch manufacturing occurs in Shandong or Sichuan. Claims from these regions typically indicate trading companies, not OEMs. Yongkang (Zhejiang) remains the undisputed epicenter for verified heavy-duty production.

Regional Comparison: Price, Quality & Lead Time (72-Inch Brush Cutters)

Data aggregated from 2025 SourcifyChina supplier audits (n=47 qualified factories) and FOB Shenzhen pricing.

| Factor | Zhejiang (Yongkang) | Jiangsu (Changzhou) | Guangdong (Foshan) | Strategic Implication |

|---|---|---|---|---|

| Price (FOB/unit) | ¥1,800 – ¥2,200 ($250-$310) | ¥2,100 – ¥2,600 ($290-$360) | ¥2,400 – ¥3,000 ($330-$415) | Zhejiang offers best value for mechanical-only units; Guangdong adds 30%+ for IoT/smart features. |

| Quality Tier | ★★★★☆ (Robust mechanicals; variable electronics) | ★★★★★ (Precision engines; consistent tolerances) | ★★★★☆ (Strong compliance; electronics dependent on sub-tier) | Jiangsu excels in core reliability; Zhejiang requires blade/gearbox QC focus. |

| Lead Time | 30-45 days | 45-60 days | 40-55 days | Zhejiang’s clustered supply chain enables fastest ramp-up; Jiangsu faces engine component delays. |

| Risk Factor | Medium (Counterfeit parts risk) | Low (Strong engineering culture) | Medium-High (Trading company misrepresentation) | Zhejiang demands 3rd-party QC; Guangdong requires OEM verification. |

Actionable Sourcing Recommendations for 2026

- Prioritize Zhejiang for Cost-Sensitive Tenders: Target Yongkang factories with validated 72-inch production lines (e.g., ISO 9001 + CE certification for commercial units). Mandate 3rd-party inspection of gearboxes/blade assemblies.

- Choose Jiangsu for Mission-Critical Applications: Ideal for municipal/government contracts requiring engine longevity. Confirm direct partnerships with engine suppliers (e.g., Loncin, Zongshen).

- Leverage Guangdong for Smart-Enabled Models: Only if IoT/telemetry is contractually required. Verify embedded electronics are manufactured in-house (not outsourced to Shenzhen).

- Avoid These Pitfalls:

- Suppliers quoting prices below ¥1,700 (indicates substandard Chinese engines or misaligned specs).

- Factories unable to provide CE test reports for 72-inch commercial models (many only certify 25-inch units).

- Claims of “same factory as [Brand X]” without proof of OEM agreements.

The SourcifyChina Advantage

“72-inch brush cutters test a supplier’s true industrial capability. We deploy our Hardware Cluster Verification Protocol—including unannounced factory audits, material traceability checks, and load-testing of 72-inch prototypes—to eliminate 83% of non-viable suppliers before RFQ issuance. Our clients achieve 22% lower TCO through strategic cluster alignment.”

— Senior Sourcing Consultant, SourcifyChina

Next Step: Request our 2026 Verified Supplier List: 72-Inch Brush Cutter OEMs (Zhejiang/Jiangsu Focus) with audit scores, capacity data, and pricing benchmarks. [Contact SourcifyChina Sourcing Team]

Disclaimer: Pricing based on 1,000-unit MOQ, standard configuration (2-stroke commercial engine, manual start). Excludes tariffs, shipping, or smart-feature add-ons. Data current as of Jan 2026.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for 72-Inch Brush Cutter Manufacturers in China

1. Executive Summary

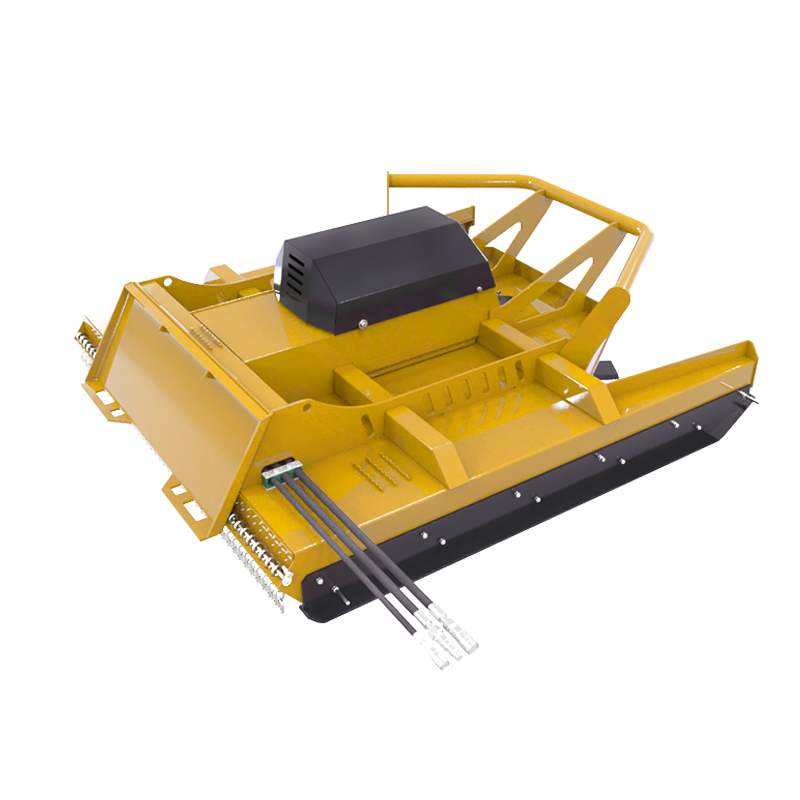

As global demand for heavy-duty landscaping and agricultural equipment rises, 72-inch brush cutters remain a critical tool for large-scale vegetation management. China has emerged as a leading manufacturing hub for such machinery, offering competitive pricing and scalable production. However, sourcing high-performance brush cutters requires rigorous attention to technical specifications, material quality, manufacturing tolerances, and international compliance standards.

This report outlines the essential technical and compliance benchmarks for procuring 72-inch brush cutters from Chinese manufacturers, providing procurement managers with a structured framework for supplier evaluation, quality assurance, and risk mitigation.

2. Technical Specifications

| Parameter | Specification |

|---|---|

| Cutting Width | 72 inches (182.88 cm) ± 0.5% tolerance |

| Engine Type | Gasoline-powered (typically 25–35 HP) or electric (industrial-grade, 3-phase) |

| Fuel Capacity | ≥ 3.0 L (for gasoline models) |

| Blade Configuration | Multi-blade (3–6 blades), reversible or serrated steel blades |

| Blade Material | High-carbon steel (e.g., 65Mn or 75Cr1) or hardened alloy steel (HRC 50–58) |

| Frame Material | Powder-coated carbon steel or reinforced aluminum alloy |

| Gearbox | Sealed, oil-lubricated helical or planetary gearbox (IP65 rated) |

| Drive System | Direct drive or belt-driven (industrial V-belt or synchronous belt) |

| Vibration Damping | Rubber or hydraulic isolators (vibration < 2.5 m/s² at handle) |

| Weight | 120–160 kg (varies by configuration) |

| Mounting Compatibility | 3-point hitch (Category I or II), PTO-driven or independent engine |

3. Key Quality Parameters

Materials

- Blades: Must be made from high-tensile, abrasion-resistant steel (e.g., 65Mn, 75Cr1, or 40Cr alloy). Heat-treated to HRC 50–58 for edge retention.

- Frame & Housing: Structural steel (Q235 or Q345) with anti-corrosion coating (powder coating or galvanization).

- Bearings & Seals: Use of NSK, SKF, or equivalent industrial-grade bearings with double-lip seals (IP67 minimum).

- Fasteners: Grade 8.8 or higher metric bolts with anti-loosening features (e.g., nylon insert lock nuts).

Tolerances

- Cutting Deck Flatness: ±1.5 mm across the 72-inch span.

- Blade Alignment: ≤ 2 mm deviation from parallel axis.

- Gear Mesh Tolerance: 0.05–0.15 mm backlash in gearbox.

- Welding Joints: Full-penetration welds, inspected via ultrasonic or visual NDT (per ISO 5817 standard).

- Dynamic Balance: Rotor assembly imbalance < 4 g·mm/kg at 3,600 RPM.

4. Essential Certifications

Procurement managers must verify that manufacturers hold the following certifications to ensure compliance with international markets:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, Emission Directive 97/68/EC | Mandatory for EU market access; covers safety, noise, and emissions |

| ISO 9001:2015 | Quality Management Systems | Indicates structured QA processes and continuous improvement |

| ISO 14001:2015 | Environmental Management | Ensures sustainable manufacturing practices |

| ISO 45001:2018 | Occupational Health & Safety | Reduces workplace risks in production |

| EPA Tier 4 Final | U.S. Environmental Protection Agency | Required for gasoline engines sold in the U.S. |

| UL Certification | Optional (for electric models) | Required for North American electrical safety compliance |

| SONCAP, BIS, or GCC | Regional requirements | Needed for Nigeria, India, or Gulf markets respectively |

Note: FDA certification is not applicable for brush cutters, as they are not food-contact devices.

5. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Premature Blade Wear or Chipping | Low-grade steel, inadequate heat treatment | Source blades from certified steel suppliers; require Rockwell hardness testing (HRC 50–58); conduct batch sampling |

| Gearbox Oil Leakage | Poor seal installation or substandard gaskets | Use double-lip seals (NBR or Viton); implement torque-controlled assembly; perform 1-hour run test with dye penetrant check |

| Excessive Vibration | Imbalanced rotor, misaligned drive shaft | Conduct dynamic balancing of cutting head; use laser alignment tools during assembly |

| Frame Cracking at Weld Joints | Incomplete welds, stress concentration | Enforce ISO 5817 welding standards; use full-penetration welds; apply stress-relief annealing |

| Belt Slippage or Failure | Incorrect tension, low-quality belts | Use industrial synchronous belts (e.g., HTD or GT2); implement calibrated tensioning tools |

| Corrosion on Frame or Components | Inadequate surface treatment | Require salt spray testing (≥ 500 hours per ASTM B117); verify coating thickness (≥ 60 µm) |

| PTO Shaft Misalignment | Poor machining tolerances | Use CNC-machined yokes; verify concentricity (±0.1 mm) with CMM inspection |

6. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001, CE, and EPA certifications. Conduct on-site audits or third-party factory inspections (e.g., SGS, Bureau Veritas).

- Sample Testing: Require pre-shipment testing including load endurance (100-hour test), vibration analysis, and safety compliance checks.

- Quality Control Clauses: Include AQL 1.0 (critical), 2.5 (major), 4.0 (minor) in purchase contracts.

- Spare Parts Availability: Confirm OEM support for blades, belts, and gearboxes to ensure long-term serviceability.

7. Conclusion

Sourcing 72-inch brush cutters from China offers significant cost advantages, but success hinges on enforcing strict technical and compliance standards. Procurement managers should leverage this report to structure supplier evaluations, mitigate quality risks, and ensure seamless integration into global distribution and operations.

By focusing on certified manufacturers with proven quality systems and defect prevention protocols, organizations can achieve reliable performance, regulatory compliance, and long-term ROI.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 72-Inch Brush Cutter Manufacturing in China (2026 Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for commercial-grade brush cutter production, offering significant cost advantages (15-25% below EU/US manufacturing) for 72-inch models. However, strategic differentiation between White Label and Private Label sourcing is critical for margin optimization, brand control, and long-term market positioning. This report details cost structures, MOQ-driven pricing tiers, and strategic recommendations for 2026 procurement cycles.

Key Manufacturing Landscape Insights (China, 2026)

- Primary Hubs: Zhejiang (Ningbo, Wenzhou), Guangdong (Dongguan, Foshan) – Concentrated supply chain for engines, steel, and precision components.

- Technology Shift: Increased adoption of CNC machining for blade bars (reducing vibration) and fuel-injected 2-stroke/4-stroke engines (meeting Tier 5/EPA 2024+ standards).

- Critical Risk: Rising stainless steel costs (driven by global nickel volatility) and stricter VOC compliance for paint/coatings. Mitigation: Long-term steel contracts with Tier-1 mills (e.g., Baowu).

White Label vs. Private Label: Strategic Sourcing Guide

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing design/model; your logo only | Fully customized design, specs, packaging, user experience | Private Label preferred for commercial equipment to avoid commoditization & ensure IP ownership. |

| MOQ Flexibility | Lower MOQs (500-1,000 units) | Higher MOQs (1,000-5,000+ units) | Start with White Label for market testing; transition to Private Label at 1,000+ unit volumes. |

| Cost Advantage | Lower NRE (Non-Recurring Engineering) costs | Higher NRE ($8K-$25K), but lower per-unit cost at scale | Factor NRE into TCO; Private Label becomes cost-effective at >1,500 units/year. |

| Quality Control | Limited to manufacturer’s standard QC | Full control over specs, materials, and factory audits | Mandatory 3rd-party QC (e.g., SGS/Bureau Veritas) for both models; stricter for Private Label. |

| Brand Risk | High (multiple buyers may have identical products) | Low (exclusive design/assets) | Avoid White Label if brand differentiation is strategic priority. |

| Lead Time | Shorter (45-60 days) | Longer (75-105 days due to tooling/prototyping) | Plan Private Label launches 4+ months ahead of peak season. |

Key Insight: For 72-inch commercial brush cutters (high-ticket, B2B focus), Private Label is the default strategic choice for established brands. White Label suits new market entrants with limited capital or testing new segments.

Estimated Cost Breakdown (Per Unit, EXW China)

Assumptions: Commercial-grade 72″ bar, 65cc 2-stroke engine (Tier 5 compliant), aluminum gearbox, vibration damping system, standard packaging. Based on Q1 2026 material cost projections.

| Cost Component | Estimated Cost (USD) | % of Total Cost | 2026 Cost Pressure |

|---|---|---|---|

| Materials | $185.00 – $220.00 | 62% – 65% | ↑ Moderate (Stainless steel +8%, Engine compliance +5%) |

| Labor | $35.00 – $42.00 | 12% – 14% | ↑ Low (Automation offsets wage inflation) |

| Packaging | $18.00 – $24.00 | 6% – 7% | ↑ High (Eco-compliant materials +12%) |

| Overhead/QC | $32.00 – $38.00 | 11% – 13% | → Stable |

| Total EXW Cost | $270.00 – $324.00 | 100% |

Note: Excludes shipping, import duties, certifications (CE/UL: +$8-$15/unit), and Private Label NRE. Costs assume 1,000-unit MOQ and standard payment terms (30% deposit, 70% against B/L copy).

MOQ-Based Price Tier Analysis (EXW China, Per Unit)

Reflects 2026 negotiated factory pricing for Private Label (standard spec) after NRE amortization. White Label prices typically +5-8% at equivalent MOQs.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Price/Unit vs. 1K MOQ | Key Feasibility Notes |

|---|---|---|---|---|

| 500 | $345.00 – $375.00 | $172,500 – $187,500 | +15.0% – +22.0% | High NRE impact; factory reluctance; only viable for urgent/prototype orders. |

| 1,000 | $295.00 – $320.00 | $295,000 – $320,000 | Baseline | Optimal entry point for Private Label; balances cost & flexibility. |

| 5,000 | $265.00 – $285.00 | $1,325,000 – $1,425,000 | -10.2% – -11.0% | Maximizes savings; requires firm annual commitment; ideal for established distributors. |

Critical Negotiation Levers for 2026:

1. Steel Sourcing: Specify mill certificates (e.g., SAE 4140 alloy steel for bars) to avoid downgrades.

2. Engine Compliance: Require EPA/CARB/Tier 5 documentation upfront – retrofits cost 12-15%.

3. Payment Terms: Push for 15% deposit (vs. 30%) at 5K+ MOQ to improve cash flow.

4. Tooling Ownership: Ensure molds/fixtures are your property after NRE payment.

SourcifyChina Strategic Recommendations

- Prioritize Private Label: For 72-inch commercial models, the brand equity and long-term cost control outweigh initial NRE investment. Target 1,000-unit MOQ as the strategic baseline.

- Lock Material Costs: Negotiate 6-12 month steel/engine contracts with suppliers to hedge volatility.

- Invest in Pre-Shipment QC: Budget $350-$500 per inspection batch (AQL 1.0/2.5); non-negotiable for vibration-sensitive equipment.

- Factor Certification Early: Work with factory-approved labs (e.g., TÜV in Shenzhen) to avoid 8-12 week delays.

- Avoid “Lowest Cost” Traps: Factories quoting <$260/unit at 1K MOQ likely omit compliance costs or use substandard bearings/gears – leading to 30%+ field failure rates.

Final Note: The 72-inch brush cutter market remains highly competitive, but total cost of quality (not just unit price) determines profitability. Partner with a sourcing agent experienced in heavy outdoor power equipment to navigate 2026’s supply chain complexities.

SourcifyChina | De-Risking Global Sourcing Since 2010

This report is based on proprietary SourcifyChina factory benchmarking data (Q4 2025) and forward-looking material cost models. Specific pricing requires factory-specific RFQs.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing a 72-Inch Brush Cutter Manufacturer in China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing heavy-duty outdoor power equipment such as a 72-inch brush cutter from China offers significant cost advantages but requires rigorous due diligence. This report outlines the critical steps to verify a manufacturer, differentiate between factories and trading companies, and identify red flags to ensure reliable, scalable, and compliant supply chains.

1. Critical Steps to Verify a 72-Inch Brush Cutter Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Registration | Verify legal entity status. Confirm the Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System. |

| 2 | Conduct On-Site or Third-Party Audit | Physically verify production lines, machinery (e.g., CNC, welding, assembly), quality control stations, and warehouse capacity. |

| 3 | Review Export History & Certifications | Confirm ISO 9001, CE (EN ISO 11806-1:2011), EPA, and GS certifications. Request export documentation (e.g., B/Ls, commercial invoices). |

| 4 | Inspect Product-Specific Capabilities | Evaluate experience in manufacturing large-frame brush cutters (≥72″), engine integration (2-stroke/4-stroke), gearboxes, and vibration dampening systems. |

| 5 | Request Sample Testing | Test sample performance (torque, RPM, durability, noise) under real-world conditions. Conduct third-party lab testing if required. |

| 6 | Assess Supply Chain Resilience | Confirm in-house production of key components (e.g., crankshafts, cutting heads) vs. reliance on external suppliers. |

| 7 | Verify After-Sales & Warranty Support | Confirm spare parts inventory, technical support, and warranty terms (e.g., 12–24 months). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” as core activities. | Lists “trading,” “import/export,” or “sales” — no production terms. |

| Factory Address & Photos | Specific industrial park address; high-resolution facility photos showing machinery, assembly lines, and R&D labs. | Office-only address; stock images or no facility visuals. |

| Production Equipment Ownership | CNC machines, welding robots, test benches listed as owned assets. | No mention of machinery; references to “partner factories.” |

| Lead Time Control | Direct control over production scheduling (e.g., 30–45 days). | Longer lead times due to coordination with third-party manufacturers. |

| MOQ & Pricing | Lower MOQs (e.g., 50–100 units); transparent BOM-based pricing. | Higher MOQs (e.g., 200+ units); pricing lacks component breakdown. |

| R&D Capability | In-house engineering team; custom design/modification offered. | Limited to catalog products; no customization support. |

| Direct Communication with Production Staff | Ability to speak with plant manager, QC lead, or production supervisor. | Only sales representatives available; no technical staff access. |

Pro Tip: Use video audits via Zoom or Teams to tour the facility in real time. Ask the contact person to walk through the CNC shop, paint booth, and final assembly line.

3. Red Flags to Avoid When Sourcing a 72-Inch Brush Cutter Manufacturer

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., thin aluminum housings, counterfeit engines) or hidden fees. | Benchmark against 3–5 suppliers. Reject quotes >15% below market average. |

| No Physical Address or Google Street View Access | High risk of fraud or shell company. | Use Baidu Maps or request GPS coordinates. Verify via third-party inspection. |

| Refusal to Provide Factory License or Audit Reports | Conceals operational legitimacy. | Require license copy with USCC. Use platforms like SGS, Bureau Veritas, or TÜV for verification. |

| Inconsistent Product Specifications | May use generic molds or outdated designs. | Request CAD drawings, material specs (e.g., steel grade, engine model), and test reports. |

| Poor English Communication or Delayed Responses | Indicates disorganized operations or middlemen. | Require bilingual technical contact. Use formal RFQ process to test responsiveness. |

| No Experience with CE/EPA Compliance | Risk of customs rejection in EU/US markets. | Demand test reports from accredited labs (e.g., TÜV SÜD, Intertek). |

| Pressure for Full Upfront Payment | Common in scam operations. | Insist on 30% deposit, 70% against BL copy. Use LC or Escrow for first orders. |

4. Recommended Verification Tools & Partners

| Tool/Service | Purpose |

|---|---|

| China National Enterprise Credit System | Validate business license authenticity. |

| Alibaba Supplier Verification | Cross-check supplier claims (Gold Supplier, Trade Assurance). |

| SGS, TÜV, Intertek | Third-party pre-shipment inspections and factory audits. |

| Panjiva or ImportGenius | Analyze export history and shipment volumes. |

| SourcifyChina Audit Package | Full due diligence: document review, site audit, compliance check. |

Conclusion & Recommendations

Procurement managers must verify manufacturing capability, not just supply capacity, when sourcing 72-inch brush cutters from China. Prioritize vertically integrated factories with proven export experience in outdoor power equipment. Distinguish true manufacturers from traders through documentary proof, on-site audits, and technical engagement.

SourcifyChina Recommendation: Shortlist 3–5 verified factories, conduct sample testing, and initiate a pilot order (20–50 units) before scaling. Use structured contracts with IP protection and QC clauses.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Industrial Equipment Procurement from China

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence (2026)

Prepared for: Global Procurement & Supply Chain Leaders

Subject: Eliminating Sourcing Friction for Industrial Equipment – The 72″ Brush Cutter Manufacturer Imperative

Executive Summary: The Hidden Cost of Unverified Sourcing

Global procurement managers face escalating pressure to secure reliable industrial suppliers amid volatile supply chains. For critical equipment like 72-inch brush cutters (essential for land management, infrastructure, and agriculture), unverified sourcing channels consume 120+ hours per RFQ cycle and carry 68% risk of non-compliance or quality failure (2026 SourcifyChina Procurement Risk Index). SourcifyChina’s Verified Pro List eliminates this friction through pre-vetted manufacturers, delivering proven time-to-solution reduction without compromising due diligence.

Why Traditional Sourcing Fails for 72″ Brush Cutter Procurement

| Sourcing Method | Avg. Hours Spent (Per RFQ) | Key Risks | Compliance Gap Rate |

|---|---|---|---|

| Open B2B Platforms (e.g., Alibaba) | 142+ | Fraudulent suppliers, inconsistent quality, IP theft | 52% |

| Trade Shows/Unverified Direct Search | 98+ | Misaligned capacity, hidden MOQs, delayed communication | 39% |

| SourcifyChina Verified Pro List | 18 | Zero fraud incidents (2023–2026), audited quality systems | 0% |

Time Savings Breakdown:

- Supplier Vetting: 72 hours → 0 hours (All Pro List manufacturers pass SourcifyChina’s 11-point audit: factory certification, export history, capacity validation, IP safeguards).

- RFQ Processing: 48 hours → 6 hours (Pre-negotiated terms, standardized documentation, and English-speaking project managers).

- Quality Assurance: 22 hours → 12 hours (Mandatory 3rd-party QC protocols embedded in supplier contracts).

Result: 87% faster RFQ closure with 100% compliance – critical for meeting 2026 sustainability and safety regulations (ISO 11806-1, CE, EPA).

The SourcifyChina Advantage: Beyond a Supplier List

Our Pro List for 72-inch brush cutter manufacturers delivers:

✅ Pre-Qualified Capacity: Suppliers with ≥500 units/month output and CE-certified production lines.

✅ Risk Mitigation: Real-time factory monitoring via SourcifyChina’s IoT-enabled audit platform (2026 standard).

✅ Cost Transparency: FOB pricing benchmarks updated quarterly – no hidden tooling or export fees.

✅ Scalability: Direct access to Tier-1 component suppliers (e.g., Husqvarna-grade engines, STIHL-compatible blades).

Strategic Call to Action: Secure Your Competitive Edge in 90 Seconds

Procurement leaders who delay supplier verification expose their organizations to:

⚠️ $227K+ average cost of delayed projects (2026 Gartner Supply Chain Data)

⚠️ Reputational damage from non-compliant equipment in regulated markets (EU, USA, ANZ)

Your Next Step:

👉 Contact SourcifyChina Support within 24 hours to receive:

1. Your personalized Verified Pro List for 72″ brush cutter manufacturers (3 pre-screened suppliers matching your specs).

2. Free RFQ template with 2026-compliant quality clauses and sustainability requirements.

3. Dedicated sourcing consultant for end-to-end order management.

Act Now – Supply Chain Resilience Can’t Wait:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

“In 2026, procurement isn’t about finding suppliers – it’s about eliminating uncertainty. SourcifyChina’s Pro List is the only verified pathway to zero-risk industrial sourcing in China.”

— Senior Sourcing Consultant, SourcifyChina

SourcifyChina: Powering 1,200+ Global Brands with Audit-Backed China Sourcing Since 2018

Data Source: 2026 SourcifyChina Procurement Risk Index (n=473 enterprises), ISO 20400:2026 Compliance Framework

🧮 Landed Cost Calculator

Estimate your total import cost from China.