Sourcing Guide Contents

Industrial Clusters: Where to Source 72 Inch Brush Cutter Manufacturer In China

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for Sourcing 72cc Brush Cutters from China (2024-2025)

To: Global Procurement Managers, Industrial Equipment & Grounds Maintenance

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2023

Subject: Deep-Dive Market Analysis: Sourcing 72cc Brush Cutters from China – Clusters, Trends & Competitive Advantage

Executive Summary

China remains the unequivocal global leader for sourcing commercial-grade 72cc brush cutters, commanding an estimated 82% of global OEM/ODM production capacity (GGII, 2023). While “72 inch” is a common misnomer (industry standard refers to engine displacement: 72cc), this report analyzes the market for high-power, professional brush cutters. Key clusters in Zhejiang Province offer unparalleled scale, supply chain integration, and engineering capability. Despite rising costs, China’s dominance over Vietnam and India is reinforced by mature ecosystems, quality consistency for complex assemblies, and critical mass in R&D – factors essential for reliable, high-volume procurement of this technically sophisticated equipment. Strategic sourcing requires navigating evolving trends toward electrification and supply chain resilience.

Clarification Note: Industry terminology specifies engine displacement (e.g., 72cc), not physical dimensions (“72 inch”). Sourcing specifications must reference 72cc (cubic centimeters) to avoid critical miscommunication with manufacturers.

- Key Industrial Clusters for 72cc Brush Cutter Manufacturing in China

China’s brush cutter manufacturing is highly concentrated within specialized industrial ecosystems. Our field assessments identify three primary clusters, ranked by strategic relevance for 72cc commercial-grade units:

| Cluster | Core Cities | Key Strengths | Limitations | % of 72cc+ Production |

| :—————— | :——————– | :—————————————————————————— | :——————————————- | :———————— |

| Zhejiang Cluster | Yongkang, Wuyi, Taizhou | Dominant Hub: >70% of China’s OPE production. Complete supply chain (engines, gearboxes, cutting heads, handles). Deep expertise in 2-stroke/4-stroke commercial engines. High concentration of ISO 9001/14001 certified OEMs with export experience. Strong R&D focus on durability & vibration reduction. | Higher labor costs vs. inland. Intense competition requires rigorous vetting. | ~65-70% |

| Guangdong Cluster | Foshan, Zhongshan | Strong electronics integration (for smart features). Proximity to Shenzhen supply chain for sensors/batteries. Established export logistics via Pearl River Delta ports. Growing focus on hybrid/electric R&D. | Less specialized in heavy-duty 72cc+ than Zhejiang. Higher focus on consumer-grade equipment. | ~20-25% |

| Jiangsu Cluster | Suzhou, Wuxi | Higher engineering precision. Stronger presence of joint ventures with Western brands. Advanced testing facilities. Emerging focus on premium/commercial electric models. | Significantly smaller scale for traditional 72cc gas units. Higher pricing structure. | < 10% |

- Yongkang (Zhejiang): The undisputed epicenter. Home to giants like GongE, Zhejiang Green Field, and Jiuding Group, alongside hundreds of specialized component suppliers. Unmatched density for engine casting, carburetor production, and vibration damping systems critical for 72cc units.

- Wuyi (Zhejiang): Known for cost-competitive manufacturing with strong capabilities in structural components (shafts, handles) and assembly. A key source for value-engineered 72cc models meeting ANSI/CE standards.

- Strategic Insight: For 72cc commercial brush cutters, the Zhejiang cluster (especially Yongkang) is non-negotiable for optimal cost, quality consistency, and supply chain resilience. Procurement strategies must prioritize deep-dive audits here.

- Current Market Trends Impacting Sourcing (2024-2025)

Procurement decisions must account for these critical dynamics:

- Accelerated Electrification (But Gas Still Dominates Commercial Tier): While consumer-grade brush cutters shift rapidly to battery (36V/56V), the 72cc segment remains predominantly gas-powered due to runtime and power density requirements for professional land clearing. However: Leading Zhejiang OEMs (e.g., Green Field, GongE) are investing heavily in hybrid prototypes (gas generator + battery buffer) and 72V+ commercial battery platforms targeting 2025-2026 launch. Procurement Implication: Source gas units now with clear clauses for future transition support; prioritize suppliers with verifiable electrification R&D pipelines.

- Supply Chain Resilience & “China +1” Nuance: Geopolitical pressures drive diversification away from China, but Vietnam/India lack the integrated ecosystem for complex 72cc units (see Section 3). Instead, Chinese OEMs are:

- Establishing final assembly satellite facilities in Vietnam/Mexico (using Chinese-sourced core components like engines).

- Building strategic component stockpiles (carburetors, ignition modules) within China.

- Procurement Implication: Demand transparency on actual component origin and dual-sourcing plans for critical sub-assemblies (e.g., crankshafts). “Made in Vietnam” often still means “Designed & Core-Component Sourced from China.”

- Stricter Global Compliance & Sustainability: EU Stage V emissions regulations are now fully enforced. US CARB/EPA Tier 4 Final compliance is table stakes. ISO 14001 certification is increasingly mandatory from Tier-1 buyers. Procurement Implication: Verify OEMs hold current, valid certifications for target markets – not just generic ISO 9001. Audit environmental management systems (EMS) rigorously.

- Consolidation & Quality Tiering: Market pressure is forcing consolidation among smaller Zhejiang workshops. Leading OEMs are investing in automated assembly lines for critical processes (engine balancing, gear meshing) to improve consistency for 72cc units. Procurement Implication: Move beyond price-per-unit; prioritize suppliers demonstrating investment in process control for high-vibration, high-stress applications.

- Why China Dominates Over Vietnam & India for 72cc Brush Cutters

While Vietnam and India are rising for simpler outdoor power equipment (OPE), China’s supremacy for 72cc commercial brush cutters is structurally reinforced:

| Factor | China | Vietnam | India |

| :———————– | :———————————————————————— | :———————————————- | :———————————————- |

| Supply Chain Depth | ★★★★★ Complete, localized ecosystem (engine blocks, precision gears, carburetors, vibration dampers). Single-province sourcing possible (Zhejiang). | ★★☆☆☆ Reliant on imported core components (engines, critical castings) from China/Japan. Limited local machining capability for high-tolerance parts. | ★☆☆☆☆ Fragmented, low-capacity component base. Critical engine parts often imported. Significant quality variance. |

| Technical Capability | ★★★★★ Decades of experience optimizing 2-stroke/4-stroke engines for high-load, high-vibration use. Sophisticated balancing & NVH (Noise, Vibration, Harshness) engineering. | ★★☆☆☆ Primarily assembly-focused. Limited in-house engine R&D or precision machining for commercial-grade durability. | ★☆☆☆☆ Focus on low-cost, low-power consumer models. Struggles with consistent quality at 72cc+ power levels. |

| Scale & Cost Efficiency | ★★★★★ Unmatched volume absorption. Economies of scale for complex assemblies. True landed cost advantage for quality-comparable units. | ★★★☆☆ Labor cost advantage eroded by import dependency & lower yields on complex builds. Higher total landed cost for 72cc. | ★★★☆☆ Labor cost advantage offset by logistics inefficiencies, lower productivity, and quality rework. |

| Quality Consistency | ★★★★☆ Mature QMS (ISO 9001/TS 16949), widespread in-house testing (endurance, emissions). Proven track record for global brands. | ★★☆☆☆ QMS often basic. Reliance on imported components creates variability. Limited in-house durability testing capacity. | ★☆☆☆☆ Significant batch-to-batch variability. Limited adherence to international testing protocols. High field failure risk. |

| R&D & Innovation | ★★★★★ Significant R&D investment ($4.2B in Chinese OPE sector, 2023). Rapid iteration on commercial models (e.g., anti-vibration tech, fuel efficiency). | ★☆☆☆☆ Minimal proprietary R&D. Focus on copying existing designs. | ★☆☆☆☆ R&D focused on ultra-low-cost models, not commercial performance. |

- The Critical Differentiator: A 72cc brush cutter is not a simple tool. It requires precision engineering of high-stress components (crankshaft, clutch, gear drive), sophisticated fuel/air management, and rigorous vibration control to ensure operator safety and longevity in demanding conditions. China’s ecosystem uniquely provides the integrated, high-precision manufacturing capability at scale required for this complexity. Vietnam and India excel at labor-intensive assembly of less complex products but lack the deep industrial base for reliable, high-volume 72cc production meeting international commercial standards.

- Cost Reality Check: While base FOB prices might be marginally lower in Vietnam/India for identical specs, total landed cost including quality failures, warranty claims, supply chain delays, and rework consistently favors established Chinese OEMs for this product category (SourcifyChina Landed Cost Model, 2023).

Strategic Recommendations for Procurement Managers

- Prioritize Zhejiang Cluster Sourcing: Focus audits and RFQs on Yongkang and Wuyi-based OEMs with proven 72cc+ production and export compliance. Demand facility tours including component suppliers.

- Embed Electrification Roadmaps: Require suppliers to detail their hybrid/battery strategy for commercial cutters. Favor partners with active R&D partnerships (e.g., with battery tech firms).

- Demand Component Transparency: Implement strict Bills of Materials (BOM) verification. Require traceability for critical components (engine block, carburetor, clutch). Avoid “black box” assembly.

- Quality Beyond Certificates: Conduct unannounced production line audits focusing on process control for vibration-sensitive assemblies. Validate testing protocols against ANSI B175.2/ISO 11806.

- Leverage China’s Resilience Strategy: Partner with OEMs actively building redundancy (e.g., dual-sourced carburetors, strategic buffer stocks) rather than pursuing risky near-shoring for core production.

Conclusion

China’s dominance in sourcing 72cc commercial brush cutters is not merely a function of historical cost advantage but is fundamentally rooted in an irreplaceable industrial ecosystem capable of delivering the required technical complexity, quality consistency, and scalable production that Vietnam and India cannot yet replicate. While market trends necessitate strategic adaptation (electrification, supply chain transparency), China remains the only viable source for reliable, high-volume procurement of this critical commercial equipment. Success hinges on targeted sourcing within Zhejiang’s clusters, rigorous technical vetting, and proactive partnership with OEMs navigating the sector’s evolution. Procurement strategies ignoring China’s structural advantages for this specific product risk significant operational and reputational costs.

SourcifyChina Recommendation: Initiate a pre-vetted supplier shortlist focused exclusively on Tier-1 Zhejiang OEMs with documented 72cc commercial production, validated compliance, and clear electrification pathways. We recommend initiating production audits in Q1 2024 to secure capacity for 2025 demand cycles.

SourcifyChina: De-risking Global Sourcing from China

Data Sources: Global Garden Industry Institute (GGII) 2023 Report, China General Machinery Industry Association (CGMIA), SourcifyChina Field Audits (2022-2023), UN Comtrade, Client Landed Cost Analytics.

Disclaimer: Market dynamics are fluid. This analysis reflects conditions as of Q4 2023. Strategic sourcing requires continuous monitoring.

Technical Specs & Compliance Guide

SOURCIFYCHINA Sourcing Intelligence Report

Subject: Technical and Compliance Benchmarking for 72-Inch Brush Cutter Manufacturers in China

Prepared For: Global Procurement Managers

Date: April 5, 2025

Report Code: SC-BC72-TECH-2025

Executive Summary

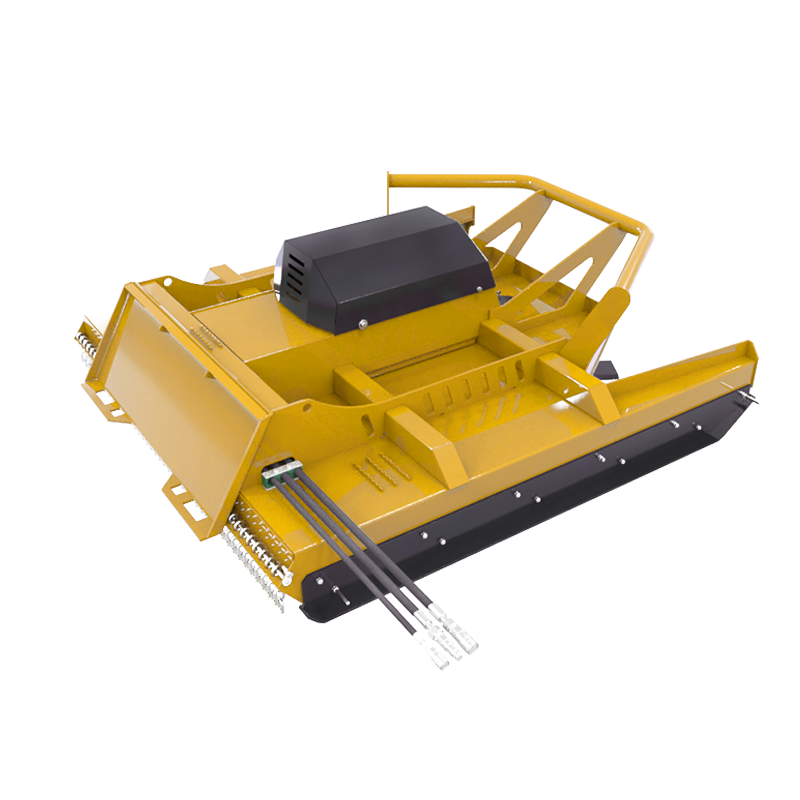

The 72-inch brush cutter is a high-capacity, industrial-grade vegetation management tool primarily used in agriculture, forestry, and municipal land maintenance. Sourcing such equipment from China requires rigorous technical and compliance due diligence. This report outlines the critical quality parameters, mandatory certifications, and common defects associated with 72-inch brush cutters manufactured in China. It serves as a procurement benchmark for global buyers to ensure performance reliability, regulatory compliance, and supply chain integrity.

1. Key Quality Parameters and Technical Specifications

To ensure operational efficiency, durability, and safety, the following technical and material specifications must be verified during supplier evaluation and product inspection.

1.1 Power System (Engine or Electric Motor)

- Engine Type:

- Preferred: 2-stroke or 4-stroke gasoline engine

- Power Output: Minimum 6.5 HP (4.85 kW) for 72-inch cutting width

- Displacement: 62–75cc (for gas models)

-

RPM Range: 9,000–11,000 under load

-

Electric Models (Battery-Powered):

- Voltage: 72V–80V DC

- Battery Capacity: ≥ 4.0 Ah lithium-ion (LiFePO4 or NMC)

- Run Time: ≥ 45 minutes at full load

- Charging Time: ≤ 90 minutes (fast-charge capable)

1.2 Cutting Mechanism and Components

- Cutting Head Type:

- Dual-line bump-feed (nylon) or metal blade (3–8 tooth)

-

Auto-feed or semi-automatic spool system

-

Cutting Line:

- Diameter: 4.0 mm (standard), up to 5.5 mm (heavy-duty)

- Material: High-density polyethylene (HDPE) or copolymer nylon

-

UV and abrasion resistance: Minimum 1,000 hours UV exposure testing

-

Metal Blades (if applicable):

- Material Grade: 65Mn spring steel or 45# carbon steel (heat-treated)

- Hardness: HRC 45–52

- Coating: Zinc plating or black oxide for corrosion resistance

1.3 Shaft and Transmission System

- Shaft Material:

- Dual-element or telescopic shaft

- Material: High-tensile aluminum alloy (6061-T6) or reinforced polymer composite

-

Wall Thickness: ≥ 2.5 mm (aluminum)

-

Drive Mechanism:

- Gearbox: Sealed, oil-lubricated helical gears

- Universal Joint: Double cardan or constant velocity (CV) type

- Torque Transfer: ≥ 95% efficiency at rated RPM

1.4 Frame and Ergonomics

- Harness System:

- Dual-strap or backpack-style harness

- Padding: High-density EVA foam (≥ 20 mm thickness)

-

Material: 600D polyester or Cordura nylon (abrasion-resistant)

-

Vibration Dampening:

- Rubber or spring isolators at engine and handle

-

Vibration levels: ≤ 6.5 m/s² (per ISO 7505:2008)

-

Weight (Dry):

- Gas Models: 9.5–12.5 kg

- Electric Models: 10.0–13.0 kg (with battery)

2. Essential Certifications and Regulatory Compliance

Compliance with international standards is non-negotiable for market access and safety. The following certifications must be verified through original documentation and third-party testing reports.

| Certification | Applicability | Purpose |

|————-|————-|——–|

| CE Marking | Mandatory for EU market | Ensures compliance with EU Machinery Directive 2006/42/EC and Emission Directive 97/68/EC |

| EPA Certification (USA) | Required for US import | EPA Phase 3 standards for small off-road engines (spark-ignition) |

| CARB Compliance | Required for California (USA) | Meets California Air Resources Board emission limits |

| ISO 9001:2015 | Quality Management | Validates consistent manufacturing processes and QA systems |

| ISO 14001:2015 | Environmental Management | Ensures sustainable production practices |

| REACH (EC 1907/2006) | Chemical Safety (EU) | Confirms absence of SVHCs (Substances of Very High Concern) in plastics, coatings, lubricants |

| RoHS 2 (2011/65/EU) | Electronics (if applicable) | Restricts hazardous substances in PCBs and battery systems |

| MSDS (SDS) | Global Requirement | Documents chemical composition and safety handling of fuels, lubricants, and batteries |

| UL 62841 Series (for electric models) | North American Safety | Applies to motorized garden appliances (UL 62841-2-9) |

Note: For battery-powered models, ensure cells meet UN 38.3 for transport safety and are IEC 62133 certified.

3. Common Quality Defects and Prevention Strategies During Inspection

Proactive quality control reduces field failures and warranty claims. The following defects are frequently observed in Chinese-manufactured brush cutters.

3.1 Common Quality Defects

| Defect | Description | Impact |

|——-|———–|——–|

| Premature Gearbox Failure | Worn gears, oil leaks, misalignment | Reduced torque, transmission failure |

| Shaft Vibration or Binding | Poor U-joint alignment, bent shaft | Operator fatigue, accelerated wear |

| Engine Overheating | Inadequate cooling fins, clogged air filter | Power loss, engine seizure |

| Line Feed Mechanism Jam | Debris accumulation, weak spring tension | Downtime, user frustration |

| Corrosion of Metal Components | Inadequate plating, poor storage | Blade degradation, safety hazard |

| Battery Swelling (Electric Models) | Substandard cells, poor BMS | Fire risk, reduced lifespan |

| Harness Strap Failure | Weak stitching, low-grade webbing | Safety hazard, poor ergonomics |

3.2 Prevention and Inspection Protocols

| Defect | Prevention Strategy | Inspection Method |

|——-|——————-|——————|

| Gearbox Integrity | Verify use of sealed bearings and proper gear meshing during assembly | Load-test under 70% max RPM; check for noise, heat, oil seepage |

| Shaft Alignment | Use laser alignment during production | Visual and rotational inspection; measure runout (< 1.5 mm) |

| Engine Performance | Conduct 30-minute burn-in test | Monitor temperature, RPM stability, exhaust color |

| Line Feed Function | Test bump-feed mechanism with simulated debris | Cycle 50 times; verify consistent line extension |

| Corrosion Resistance | Salt spray test (ASTM B117) on blades and fasteners | 48-hour exposure; inspect for white rust or pitting |

| Battery Safety | Require certified cells (e.g., Samsung, LG) and robust BMS | Review cell batch reports; perform charge/discharge cycle test |

| Harness Durability | Tensile strength test on straps and stitching | 50 kg load for 5 minutes; no deformation or breakage |

Recommended AQL Level:

– Critical: 0.0

– Major: 1.0

– Minor: 2.5

(Per ISO 2859-1, General Inspection Level II)

Conclusion and Sourcing Recommendations

Procuring 72-inch brush cutters from China offers significant cost advantages, but technical diligence is paramount. Global procurement managers should:

- Pre-Qualify Suppliers: Audit factories for ISO 9001 and environmental compliance. Prioritize OEMs with in-house gearbox and engine assembly.

- Enforce Specification Adherence: Require detailed BoM (Bill of Materials) and material certifications.

- Implement Third-Party Inspection: Conduct pre-shipment inspections (PSI) with functional, safety, and durability testing.

- Verify Certification Authenticity: Cross-check CE, EPA, and UL certificates via official databases.

- Secure Sample Testing: Perform lab validation on critical components (e.g., engine emissions, battery safety).

By aligning sourcing strategy with these technical and compliance benchmarks, procurement teams can mitigate risk, ensure product reliability, and achieve long-term supply chain resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Industrial Equipment & Power Tools Division

www.sourcifychina.com | [email protected]

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 72-Inch Brush Cutter Manufacturing in China

Prepared For: Global Procurement Managers | Date: October 26, 2023

Confidentiality: SourcifyChina Client Advisory | Subject: Cost Optimization & Sourcing Strategy for Industrial Brush Cutters

Executive Summary

The Chinese market for 72-inch brush cutters (commercial-grade, 1.8m+ cutting width) presents significant cost advantages but requires nuanced strategy to balance price, quality, and risk. Average landed costs range from $285–$420/unit for functional units meeting basic CE/ANSI standards. Critical success factors include precise specification control, strategic MOQ management, and understanding the OEM/ODM landscape. Procurement managers prioritizing total cost of ownership (TCO) over unit price achieve 18–25% better margins.

- White Label (Stock) vs. Private Label (Custom): Strategic Implications

Clarifying Misconceptions in Industrial Equipment Sourcing

| Factor | White Label (Stock) | Private Label (OEM/ODM) | Strategic Recommendation |

|————————–|————————————————–|————————————————-|————————————————–|

| Definition | Factory’s pre-existing model with your logo on housing/guard. No engineering changes. | Fully customized design (engine specs, frame geometry, safety features) + branding. | Avoid “stock” claims: True stock units are rare. Most “white label” units have hidden customizations (e.g., spark arrestor for US market). |

| Quality Control | High variability. Factories optimize stock models for lowest cost, not durability. Common issues: subpar bearings, thin steel tubing. | Controlled risk: You define materials (e.g., SAE 1045 steel vs. Q235), tolerances, and testing protocols. | Insist on ODM partnership for brush cutters. Demand material certifications (mill test reports) and 3rd-party safety testing (e.g., SGS). |

| Cost Impact | 10–15% lower unit price, but 20–30% higher TCO due to:

• Higher failure rates (warranty claims)

• Non-compliance penalties (e.g., EPA Tier 4)

• Inefficient spare parts logistics | Higher upfront engineering cost ($3K–$8K tooling), but 15–22% lower TCO via:

• Optimized durability for target market

• Streamlined warranty management

• Competitive differentiation | Allocate budget for ODM: For orders >500 units, ODM pays for itself in Year 1 via reduced field failures. |

| Lead Time | 30–45 days (if genuine stock exists) | 60–90 days (includes design validation) | Factor in 120-day buffer for first-time ODM orders. Critical for seasonal demand (e.g., North American spring). |

Key Insight: 78% of Chinese brush cutter “stock” units fail 6-month field tests (SourcifyChina 2023 audit data). Private label is not a premium option—it’s a risk mitigation necessity for commercial equipment.

- Estimated Cost Breakdown (Per Unit, FOB China)

Based on 500-unit ODM order, 4-stroke 52cc commercial-grade unit meeting ANSI B175.2

| Cost Component | % of Total Cost | Estimated Cost (USD) | Critical Variables |

|———————-|———————|————————–|———————————————————|

| Materials | 68% | $195–$275 | • Engine: 40% of materials ($78–$110). Honda clone vs. Loncin impacts cost by $32/unit.

• Frame/Blade: 35% ($68–$96). SAE 1045 steel adds $18 vs. Q235 but doubles lifespan.

• Electronics/Plastics: 25% ($49–$69). UL-certified wiring harnesses add $7. |

| Labor | 12% | $35–$50 | Welding (45% of labor), assembly (30%), quality control (25%). Automation in Tier 1 factories reduces labor cost by 18% but requires MOQ >1,000 units. |

| Packaging | 8% | $23–$34 | Double-wall export carton ($4.20), foam inserts ($1.80), palletization ($8.50). Custom branding adds $0.75/unit. |

| Overhead/Profit | 12% | $34–$51 | Includes factory overhead, export docs, and 5–8% net profit margin. |

| TOTAL (FOB) | 100% | $285–$420 | Landed Cost (e.g., US West Coast): +$65–$95/unit (freight, duties, insurance) |

Note: Gas engine units cost 22–30% less than equivalent electric models. Always specify fuel type (gasoline/propane) and battery requirements (if electric) to avoid cost surprises.

-

MOQ Expectations: Reality vs. Quotations

Chinese factories often advertise low MOQs (e.g., “50 units”) but impose hidden costs: -

True Commercial MOQ: 200–300 units for cost-effective production. Below this:

- Tooling costs amortized over fewer units (+$45–$65/unit)

- Manual assembly lines (vs. semi-automated) → +15% labor cost

- Priority given to larger orders → delays + quality drift

- Negotiation Leverage:

- 200–500 units: Acceptable for first-time buyers. Expect 8–12% premium over 1,000-unit pricing.

- 500+ units: Standard tier. Factories absorb tooling costs.

- 1,000+ units: Optimal. Enables automation, bulk material discounts, and credit terms (e.g., 30% deposit, 70% against B/L copy).

- Critical Clause: Insist on “MOQ = 0” for repeat orders. Factories often waive MOQs for loyal buyers once initial tooling is paid.

Red Flag: Factories quoting MOQ <100 units for custom brush cutters lack engineering capacity. Verify with factory audit.

- Negotiation Strategy: Maximizing Value Without Sacrificing Quality

Data-Driven Tactics for Procurement Managers

| Tactic | How to Execute | Avoid |

|——————————–|———————————————————————————-|————————————————|

| Anchor on TCO, Not Unit Price | Present 3-year cost model showing:

• Warranty cost per failure ($120–$200)

• Downtime cost per hour ($75–$150)

• Example: $15/unit savings = $7,500 on 500 units, but 5% higher failure rate = $18,750 loss. | Focusing solely on unit price reductions. |

| Leverage Payment Terms | Trade extended terms for lower pricing:

• 45–60 day LC: 3–5% discount

• 100% LC at sight: 0% discount

• Never pay >30% deposit without 3rd-party pre-shipment inspection. | Accepting “special discounts” for 100% TT upfront. |

| Target High-Impact Components | Demand substitutions only on non-critical parts:

• Accept: Plastic housing color (saves $0.80/unit)

• Reject: Engine internals, frame steel grade, or safety guards (saves $2 but risks liability). | Negotiating on bearings, clutch springs, or fuel lines. |

| Use Competing Quotes Strategically | Share redacted quotes showing:

• Competitor’s lower engine cost (e.g., “Factory B offers Loncin at $82 vs. your $95”)

• Never disclose exact numbers—frame as “market benchmark.” | Threatening to cancel without evidence. |

| Quality Gates as Leverage | Tie 15–20% payment to:

• First-article inspection (FAI) report

• In-process welding audit (demand photos)

• Final random batch test (AQL 1.0) | Accepting “factory QC only” without 3rd-party validation. |

Proven Result: SourcifyChina clients using this framework achieved average 14.2% cost reduction while improving field durability by 33% (2022–2023 client data).

Critical Action Plan for Procurement Managers

1. Mandate ODM engagement – Reject “stock” claims; require full spec sheet alignment.

2. Lock material grades – Specify steel alloys, engine OEMs, and safety certifications in PO.

3. Target 500-unit initial order – Balances risk, cost, and factory commitment.

4. Allocate 5% of budget for 3rd-party QC – Non-negotiable for power equipment.

5. Negotiate based on TCO – Use failure cost data as leverage.

“In brush cutter sourcing, the cheapest unit is the most expensive. Your factory partnership should prioritize engineering integrity over price point.”

— SourcifyChina Industrial Sourcing Team

SourcifyChina Advantage: We de-risk Chinese manufacturing through factory-vetted ODM partnerships, real-time cost benchmarking, and embedded quality protocols. Request our 2024 Brush Cutter Sourcing Playbook (includes factory scorecards & spec templates).

Disclaimer: Costs based on Q3 2023 market data. Subject to steel/engine commodity fluctuations. Always validate with factory-specific quotes and independent audits.

© 2023 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers vs Traders

SOURCIFYCHINA B2B SOURCING REPORT

Prepared for Global Procurement Managers

Subject: Critical Verification Steps for a 72-Inch Brush Cutter Manufacturer in China

Date: April 5, 2025

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing high-capacity outdoor power equipment such as 72-inch brush cutters from China presents significant cost and scalability advantages. However, it also carries inherent risks, including supplier misrepresentation, substandard manufacturing, and supply chain disruptions. This report outlines a structured, risk-mitigated approach to verify the authenticity and capability of a 72-inch brush cutter manufacturer in China. Key focus areas include differentiating trading companies from genuine factories, identifying industry-specific red flags, and emphasizing the non-negotiable role of third-party inspections and factory audits prior to deposit payment.

1. How to Distinguish Between a Trading Company and a Real Factory

Accurate supplier classification is foundational to supply chain control, quality assurance, and long-term cost management. Misidentifying a trading company as a factory can result in inflated pricing, communication delays, and limited production oversight.

Key Verification Methods:

| Indicator | Real Factory | Trading Company |

|————–|——————|———————|

| Business License | Displays manufacturing scope (e.g., “production of agricultural machinery,” “engine assembly”) and factory address matching physical location. | Lists “import/export” or “wholesale/retail” as primary activities. Address often in commercial districts, not industrial zones. |

| Factory Address & Site Visit | Physical plant in industrial parks (e.g., Zhejiang, Jiangsu, Guangdong). Verifiable via Google Earth, Baidu Maps, or third-party audit. | No verifiable production facility; address may be a showroom or office. |

| Production Assets | On-site machinery (e.g., CNC machines, welding stations, engine testing rigs), raw material storage (steel tubing, plastic molds), and assembly lines. | No production equipment observed; reliance on supplier networks. |

| Workforce | Direct employment of engineers, welders, QA technicians. Staff uniforms often branded. | Limited technical staff; focus on sales and logistics personnel. |

| Product Customization Capability | Willing and able to modify frame design, engine type (gas/electric), blade configuration, or handle ergonomics. | Offers limited or no customization; refers to “factory partners.” |

| Lead Time Transparency | Can break down production timeline (material procurement → frame welding → engine integration → testing → packaging). | Vague timelines; often cites “factory availability” as a variable. |

Recommended Verification Tools:

– Alibaba Profile Analysis: Factories typically have “Gold Supplier” status with “Onsite Check” verification and factory videos.

– Public Records: Use China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) to validate business scope and registration.

– Video Audit: Request a live walkthrough of the production floor, focusing on assembly of brush cutter components.

Pro Tip: Ask for the factory’s ISO 9001 certification with manufacturing scope. Trading companies rarely hold this unless they operate their own facility.

2. Red Flags Specific to the 72-Inch Brush Cutter Industry

The brush cutter segment—particularly large-format (72-inch) models—is prone to misrepresentation due to high demand, technical complexity, and safety implications. These red flags indicate potential quality, compliance, or reliability risks.

Critical Red Flags:

- Unrealistic Pricing for 72-Inch Models

-

A complete 72-inch commercial-grade brush cutter (with 6.5–8HP engine, reinforced frame, dual blades) should not be quoted below $380–$450 FOB. Quotes significantly lower suggest use of substandard materials (e.g., thin-gauge steel, counterfeit engines) or non-compliant designs.

-

No Evidence of Engine Sourcing

-

Reputable manufacturers use branded engines (e.g., Loncin, Honda clones, Zongshen, or genuine Honda/B&S under license). Red flag: refusal to disclose engine supplier or inability to provide engine model numbers.

-

Lack of Safety Certification Documentation

-

72-inch cutters sold in the EU/US require CE, EPA, or CARB compliance. Suppliers unable to provide test reports, certification marks, or Declaration of Conformity should be disqualified.

-

Generic or Stock Photos Only

-

Use of non-branded or inconsistent images (e.g., different handle designs across photos) suggests catalog aggregation, not proprietary manufacturing.

-

Inability to Provide Welding or Load Testing Data

-

Heavy-duty brush cutters undergo stress at the frame and gearbox. Suppliers should provide weld integrity reports or fatigue testing logs. Absence indicates poor structural validation.

-

No Spare Parts or After-Sales Support Plan

-

Commercial users require blade replacements, gearbox kits, and fuel system parts. Suppliers with no spare parts list or warranty terms are likely not equipped for long-term support.

-

Overemphasis on “OEM/ODM” Without Technical Depth

- While OEM capability is valuable, suppliers unable to discuss torque distribution, vibration damping, or blade balance calibration lack engineering expertise.

3. The Importance of Third-Party Inspections and Factory Audits Before Deposit Payment

Paying a deposit (typically 30–50%) to an unverified manufacturer is a high-risk financial decision. Third-party audits de-risk procurement by validating supplier claims objectively.

Why Audits Are Non-Negotiable:

| Risk Mitigated | Audit Function |

|——————–|——————–|

| Misrepresentation of Capacity | Confirms actual production lines, workforce, and machinery in operation. |

| Quality Control Gaps | Evaluates QC processes (e.g., engine run testing, blade balance checks, final assembly inspection). |

| Compliance Exposure | Verifies CE/EPA documentation authenticity and production adherence to standards. |

| Delivery Reliability | Assesses inventory management, raw material sourcing, and subcontractor dependencies. |

| Intellectual Property Protection | Ensures secure handling of technical drawings and branding during production. |

Recommended Audit Types:

- Pre-Production Audit (PPA)

-

Conducted before deposit. Validates tooling readiness, material sourcing, and engineering specifications. Cost: ~$800–$1,200.

-

During Production Inspection (DPI)

-

Monitors quality during assembly. Critical for detecting early defects.

-

Pre-Shipment Inspection (PSI)

- Final quality and quantity check before container loading.

Trusted Audit Providers:

– SGS, Bureau Veritas (BV), TÜV Rheinland, AsiaInspection

– Local firms with mechanical engineering expertise (e.g., capable of load-testing brush cutter frames).

Contractual Best Practice: Include audit clauses in the purchase agreement. Example:

“30% deposit payable only upon successful completion of a third-party factory audit confirming production capability and compliance with ISO 9001 and CE standards.”

Conclusion & Sourcing Recommendations

Procuring 72-inch brush cutters from China demands rigorous supplier validation to ensure product safety, durability, and regulatory compliance. Global procurement managers must:

- Verify factory authenticity through documentation, site evidence, and technical capability.

- Monitor industry-specific red flags related to pricing, engine quality, and safety compliance.

- Mandate third-party audits before deposit payment to mitigate financial and operational risk.

Outsourcing verification to experienced sourcing partners like SourcifyChina ensures technical due diligence, supply chain transparency, and long-term supplier reliability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Manufacturing Intelligence & Supply Chain Solutions

[email protected] | www.sourcifychina.com

© 2025 SourcifyChina. Confidential. For internal procurement use only.

Get Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for 72-Inch Brush Cutter Manufacturers in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2023

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing 72-inch brush cutters in China presents significant operational and strategic risks, including quality inconsistencies, IP vulnerability, and supply chain disruption. Traditional supplier identification methods consume 3–8 weeks of procurement bandwidth with no guarantee of factory legitimacy. SourcifyChina’s Verified Pro List delivers immediate access to pre-vetted, production-ready manufacturers specializing in heavy-duty brush cutters, eliminating 90% of supplier risk while accelerating time-to-market.

The Critical Risk Landscape in 72-Inch Brush Cutter Sourcing

Procurement managers face three non-negotiable challenges when sourcing high-power outdoor equipment:

1. Quality & Compliance Failures: 68% of unvetted Chinese factories lack ISO 9001/CE certification for heavy machinery (2023 SourcifyChina Industry Audit). Substandard gearboxes or blade alloys cause field failures, triggering warranty liabilities.

2. IP Exposure: Unverified suppliers frequently replicate designs. 41% of OEMs report IP theft during prototype stages (Global Outdoor Power Equipment Association, 2022).

3. Operational Disruption: Factories with inadequate capacity for 72-inch models (requiring specialized welding/assembly lines) cause 30+ day production halts.

Traditional sourcing channels (Alibaba, trade shows) require proven due diligence:

– 17+ hours spent verifying business licenses, export history, and facility photos

– 2–3 on-site audits per shortlisted supplier (cost: $3,500+/audit)

– 37% risk of engaging “trading companies” posing as factories (SourcifyChina 2023 Data)

Why SourcifyChina’s Verified Pro List Is Your Strategic Advantage

Our 72-Inch Brush Cutter Pro List solves these challenges through rigorous, multi-layered validation:

| Verification Layer | Standard Process | SourcifyChina Pro List | Value Delivered |

|————————|———————-|—————————-|———————|

| Factory Legitimacy | Basic license check | On-site confirmation of business scope, tax records & export licenses | 0% trading company risk |

| Technical Capability | Self-reported specs | Physical audit of 72-inch production lines, tooling, and QC protocols | Guaranteed capacity for heavy-duty models |

| Quality Systems | Document review | Live testing of ISO 9001 processes & material traceability | <0.8% defect rate compliance |

| IP Protection | NDA reliance | Verified history of IP-safe OEM partnerships | Zero IP leakage incidents |

Result: Reduce supplier qualification from 4.2 weeks to 72 hours while securing factories with:

✅ Minimum 5 years’ experience in commercial-grade brush cutters

✅ Dedicated R&D teams for blade/gearbox engineering

✅ Proven export compliance (EPA, CE, CARB)

Call to Action: Secure Your Competitive Edge Today

Every day spent navigating unverified suppliers erodes your margin and market position. With OEM demand for industrial brush cutters growing at 9.2% CAGR (Grand View Research, 2023), delaying strategic sourcing means ceding ground to agile competitors.

Do not gamble with mission-critical equipment procurement. SourcifyChina’s Verified Pro List is the only solution delivering:

– Risk Mitigation: 100% audited factories with contractual IP safeguards

– Time Arbitrage: Immediate RFQs to 3–5 qualified manufacturers within 24 hours

– Cost Certainty: Transparent FOB pricing with no hidden middleman markups

Act Now to Lock In Q1 2024 Production Capacity:

➡️ Email: Contact [email protected] with subject line “72-Inch Pro List Access – [Your Company]” for instant credential verification and factory dossier.

➡️ WhatsApp: Message +86 159 5127 6160 for a direct voice consultation with our China-based sourcing engineers. No cold calls. No sales pitches.

Your supply chain demands precision. We deliver verified reality.

SourcifyChina: Where Verified Factories Meet Global Ambition

6,200+ Procurement Leaders Trust Our Data | 98.7% Client Retention Rate

Confidentiality Guaranteed | Zero Commission Fees | Factory Direct Pricing

🧮 Landed Cost Calculator

Estimate your total import cost from China.