The global copper wire market is experiencing robust growth, driven by rising demand across electrical, construction, automotive, and renewable energy sectors. According to a report by Mordor Intelligence, the copper wire market was valued at approximately USD 98.5 billion in 2023 and is projected to grow at a CAGR of over 4.6% through 2029. Similarly, Grand View Research estimates the market to expand at a CAGR of 4.3% from 2023 to 2030, citing increased infrastructure investments and the global shift toward electrification as key drivers. Amid this growth, 6/3 copper wire—known for its high conductivity and load-bearing capacity—has become a standard in residential and commercial wiring, particularly for large appliances and service entrances. With demand on the rise, sourcing high-quality 6/3 copper wire from reliable manufacturers is more critical than ever. Here are the top five manufacturers leading the industry in quality, innovation, and market presence.

Top 5 6/3 Copper Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Non

Domain Est. 1996

Website: stateelectric.com

Key Highlights: In stock $12 deliveryNon-Metallic Cable, Stranded, 6 AWG, 3 conductors with ground, Copper. SKU: WCURX6/3GR. Manufacturer Part Number: RX6/3GR. $3.47/foot. Login for your price….

#2 Copperweld

Domain Est. 1998

Website: copperweld.com

Key Highlights: Copperweld is a bimetallic manufacturer specializing in power and grounding conductors for building construction, power grid, utilities, communications, ……

#3 6

Domain Est. 1994

Website: southwire.com

Key Highlights: Southwire Romex® Brand SIMpull® Type NM-B (nonmetallic-sheathed) cable may be used for both exposed and concealed work in dry locations as specified in the ……

#4 63NMBGX500 :: NM

Domain Est. 1995

#5 6/3 NM

Domain Est. 2006

Website: marselectric.com

Key Highlights: Free delivery over $25 90-day returnsNonmetallic-Sheathed Cable. 600 Volt. Copper Conductors. Color-Coded Jacket. SIMpull Jacket Designed for Easier Pulling….

Expert Sourcing Insights for 6/3 Copper Wire

H2: 2026 Market Trends for 6/3 Copper Wire

As the global economy continues to evolve through technological innovation, infrastructure development, and shifting energy policies, the market for 6/3 copper wire—a standard gauge cable widely used in electrical installations such as residential service entrances, subpanels, and electric vehicle (EV) charging stations—is expected to experience notable shifts by 2026. This analysis outlines the key trends shaping the demand, supply, pricing, and application landscape for 6/3 copper wire under a H2 (second half) 2026 outlook.

1. Increased Demand from Residential and EV Infrastructure

By H2 2026, the rollout of next-generation EV charging networks—particularly Level 2 and fast-charging stations—will significantly drive demand for 6/3 copper wire. As governments in North America and Europe push for broader EV adoption, residential and commercial installations requiring 6/3 wire for 240V circuits will grow. Additionally, new housing construction and renovation projects, especially in the U.S. Sun Belt and expanding urban corridors, will sustain strong demand for this gauge in main power feeders.

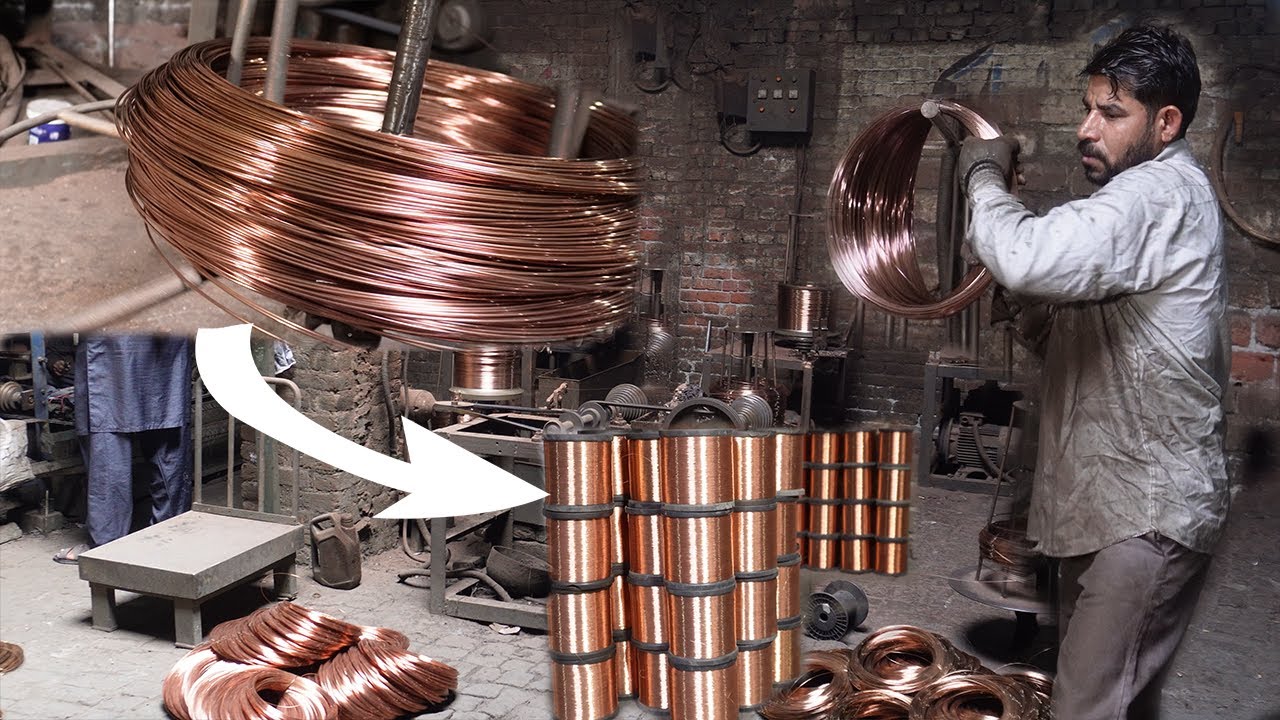

2. Copper Price Volatility and Supply Chain Adjustments

Copper prices are expected to remain elevated in H2 2026 due to constrained supply from key mining regions (e.g., Chile, Peru) affected by political instability and environmental regulations. Recycled copper supply will rise, partially offsetting primary production shortfalls. However, price volatility may lead to strategic stockpiling by distributors and contractors in Q3 2026 in anticipation of seasonal construction peaks, impacting short-term availability and pricing of 6/3 wire bundles.

3. Energy Efficiency and Building Code Revisions

Updated national and regional electrical codes, including the 2026 National Electrical Code (NEC) revisions in the U.S., will emphasize energy efficiency and safety. These updates may increase specifications for conductor sizing and insulation types, favoring high-quality 6/3 copper wire over aluminum alternatives in critical applications. This regulatory tailwind supports premium pricing for compliant, UL-listed 6/3 cables.

4. Competition from Aluminum Alternatives

Despite copper’s superior conductivity and reliability, cost-sensitive projects may increasingly consider aluminum 4/0 or 2/0 cables as alternatives to 6/3 copper for feeder lines. However, due to safety concerns and higher installation complexity with aluminum, the market for 6/3 copper wire will retain dominance in residential and high-reliability applications. OEMs and contractors will continue to prefer copper where longevity and code compliance are priorities.

5. Geographic Demand Shifts

North America, particularly the U.S., will remain the largest market for 6/3 copper wire in H2 2026, driven by infrastructure investment under the IIJA (Infrastructure Investment and Jobs Act) and Inflation Reduction Act (IRA) incentives. Emerging markets in Southeast Asia and the Middle East will also show rising demand due to urbanization and industrialization, though adoption of 6/3 gauge specifically will be slower due to differing regional standards.

6. Sustainability and ESG Pressures

Environmental, Social, and Governance (ESG) considerations will influence procurement decisions. Wire manufacturers will emphasize sustainable sourcing, recyclability, and lower carbon footprints in production. By H2 2026, leading brands offering traceable, responsibly mined copper in their 6/3 wire products may gain market share among green-certified construction projects (e.g., LEED, BREEAM).

7. Digitalization and Supply Chain Transparency

Advancements in supply chain tracking—using blockchain and IoT-enabled inventory systems—will improve transparency in copper wire distribution. Contractors and distributors will increasingly demand real-time visibility into 6/3 wire availability, lead times, and authenticity, reducing counterfeit risks and improving procurement efficiency.

Conclusion:

By H2 2026, the 6/3 copper wire market will be characterized by robust demand from EV and residential infrastructure, tempered by copper price fluctuations and regulatory dynamics. While alternative materials and sustainability pressures present challenges, copper’s performance advantages and code compliance will solidify its position as the preferred conductor for critical electrical applications. Stakeholders should prepare for heightened competition, supply chain agility, and growing emphasis on quality and sustainability to capture value in this evolving market.

Common Pitfalls When Sourcing 6/3 Copper Wire: Quality and Intellectual Property Concerns

Sourcing 6/3 copper wire—commonly used in residential and light commercial electrical installations for high-load circuits like electric ranges or dryers—requires careful attention to quality and potential intellectual property (IP) issues. Overlooking these factors can lead to safety hazards, code violations, financial losses, or legal complications.

Poor Material Quality and Non-Compliance

One of the most frequent pitfalls is receiving copper wire that does not meet required standards. Substandard wire may use impure copper (e.g., oxygen-free copper with insufficient purity), undersized conductors, or inadequate insulation thickness. This compromises electrical performance and increases fire risk. Always verify compliance with national standards such as the National Electrical Code (NEC) in the U.S. or IEC standards internationally. Request mill test reports and ensure the product bears legitimate certifications (e.g., UL, CSA, or ETL listed). Counterfeit certifications are common in low-cost supply chains, so confirm authenticity directly with the certifying body when in doubt.

Inadequate Insulation and Jacketing

The insulation on 6/3 cable (typically NM-B or UF-B) must withstand environmental stresses like moisture, heat, and physical abrasion. Low-quality insulation may crack, degrade prematurely, or lack proper flame-retardant properties. This is especially critical in damp or outdoor installations. Ensure the jacket material meets NEC ratings for the intended environment (e.g., Type NM-B for dry locations, UF-B for wet). Poor jacketing can lead to short circuits or ground faults, posing serious safety risks.

Misrepresentation of Conductor Gauge and Strand Count

Some suppliers may falsely advertise wire gauge or strand count. For example, selling 6.5 AWG wire as true 6 AWG, or reducing the number of strands per conductor to cut costs. This results in higher resistance and overheating under load. Always measure wire diameter and verify strand count upon receipt. Cross-check product specifications against industry standards such as ASTM B3 (soft round copper wire) and B8 (concentric-lay stranded copper conductors).

Intellectual Property and Brand Counterfeiting

Reputable brands like Southwire, General Cable (Prysmian), or Belden invest heavily in product development and hold trademarks and design patents. A major IP risk when sourcing is receiving counterfeit products bearing fake branding or misleading packaging. These fakes often mimic genuine product labels and packaging but deliver subpar performance. Purchasing counterfeit wire not only violates IP laws but may void insurance or fail inspection. To mitigate this, source exclusively from authorized distributors and verify batch numbers with the manufacturer.

Lack of Traceability and Documentation

Reliable suppliers provide full traceability, including lot numbers, manufacturing dates, and compliance documentation. Missing or falsified documentation is a red flag and can prevent you from proving compliance during electrical inspections or liability claims. Ensure all shipments include a certificate of conformance and retain records for audit purposes.

Conclusion

Avoiding these pitfalls requires due diligence in supplier vetting, insistence on verifiable certifications, and proactive quality checks upon delivery. Prioritize transparent supply chains and avoid deals that seem too good to be true—compromised quality or IP violations often explain the low price.

Logistics & Compliance Guide for 6/3 Copper Wire

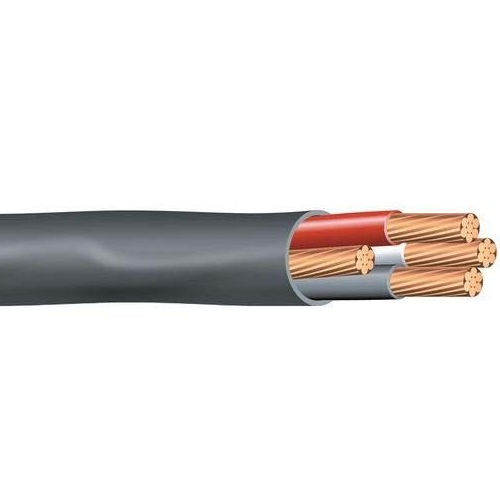

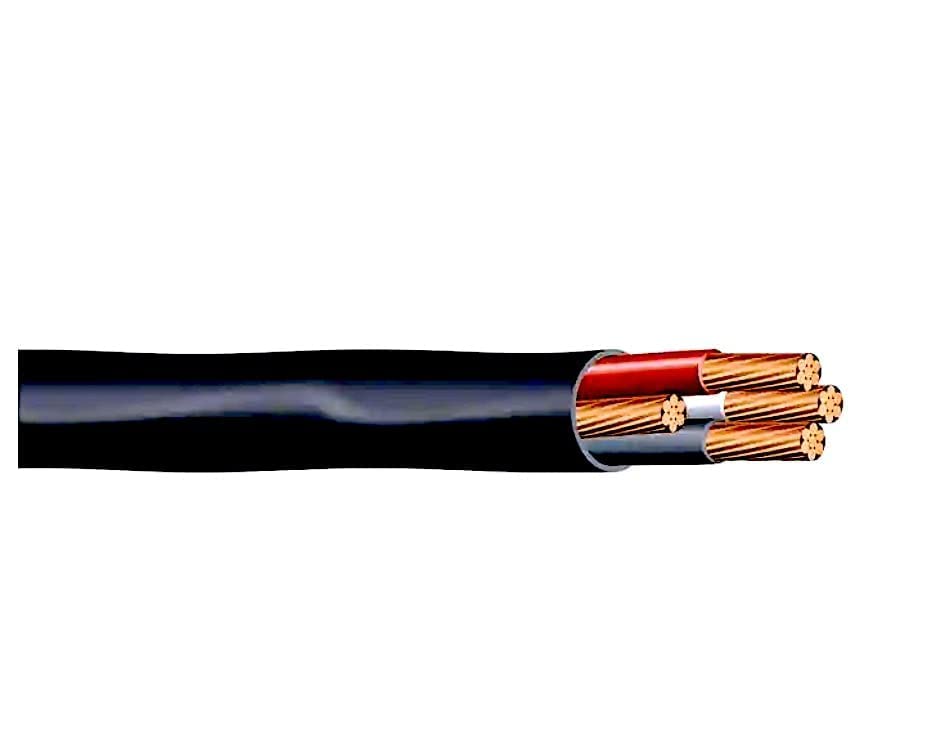

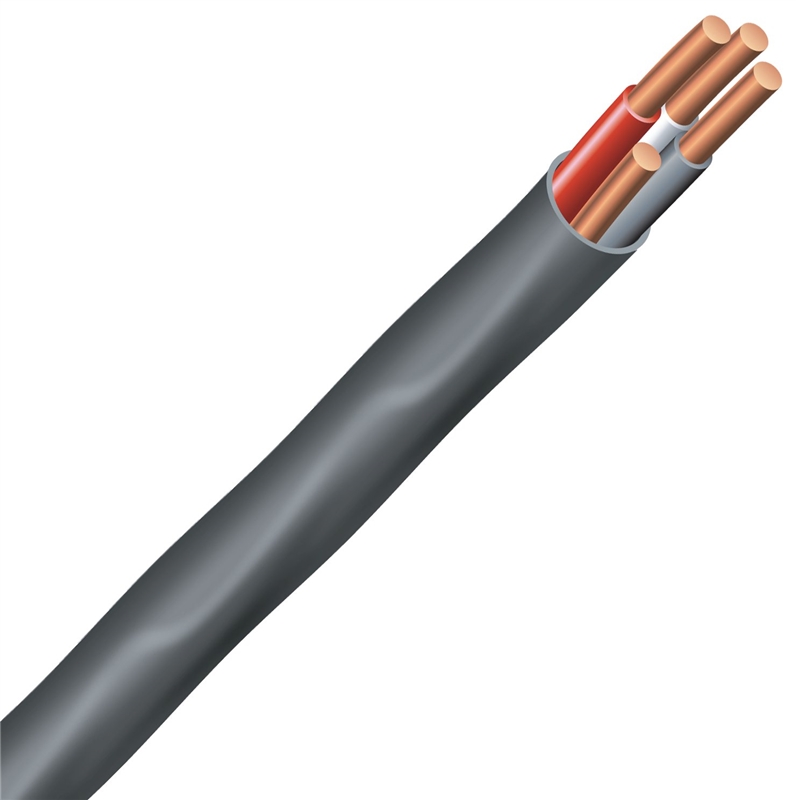

Overview of 6/3 Copper Wire

6/3 copper wire is a type of electrical cable commonly used in residential and commercial wiring for high-power applications such as electric ranges, dryers, subpanels, and HVAC systems. The designation “6/3” refers to three 6 AWG (American Wire Gauge) insulated conductors—typically two hot wires, one neutral—and often includes a bare copper ground wire. Due to its use in critical electrical systems, proper logistics handling and compliance with safety and regulatory standards are essential.

Regulatory Compliance Requirements

National Electrical Code (NEC) Compliance

6/3 copper wire must comply with the National Electrical Code (NEC), specifically Article 310 (Conductors for General Wiring) and Article 334 (Types NM, NMC, and NMS Cable). Key requirements include:

– Proper insulation type (e.g., THHN, XHHW, NM-B) for the intended application (dry, damp, or wet locations).

– Minimum ampacity of 55 amps for 6 AWG copper wire at 60°C (140°F), suitable for 50-amp circuits when properly installed.

– Use of NM-B cable for indoor residential branch circuits; use of UF-B or conduit-protected wire for outdoor or buried installations.

UL and CSA Certification

All 6/3 copper wire sold in the U.S. and Canada must carry certification marks from recognized testing laboratories such as:

– Underwriters Laboratories (UL)

– Canadian Standards Association (CSA)

These certifications confirm the wire meets safety, flame resistance, and performance standards.

RoHS and REACH Compliance (International Shipments)

For international logistics, especially into the EU or other regions with strict environmental regulations:

– Ensure the wire and insulation materials comply with RoHS (Restriction of Hazardous Substances) directives.

– Confirm compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) for chemical content disclosure.

While copper itself is exempt, insulation and jacketing materials may contain restricted substances.

Packaging and Handling Standards

Protective Packaging

- 6/3 copper wire is typically shipped on reels or in coiled lengths within cardboard boxes or protective wraps.

- Reels must be secured to prevent unwinding during transit.

- Use edge protectors and moisture-resistant wrapping to prevent kinking, oxidation, and damage.

Weight and Dimension Considerations

- A 100-foot reel of 6/3 NM-B cable weighs approximately 25–30 lbs (11–14 kg).

- Standard reel diameter: 12–16 inches; palletized shipments require secure strapping and corner boards.

- Follow carrier guidelines for maximum load weight and dimensional restrictions to avoid surcharges.

Handling Precautions

- Avoid sharp bends or kinking which can compromise conductor integrity.

- Store wire in a dry, temperature-controlled environment to prevent moisture absorption and insulation degradation.

- Use proper lifting equipment for bulk pallets to prevent injury and damage.

Transportation and Shipping Logistics

Domestic (U.S.) Shipping

- Common carriers: FedEx Freight, UPS Freight, XPO Logistics, and regional LTL (Less-Than-Truckload) providers.

- Classify NM-B 6/3 wire under NMFC (National Motor Freight Classification) code 145690-04, typically Class 70, due to density and handling characteristics.

- Proper freight documentation must include:

- Bill of Lading (BOL) with accurate weight and dimensions

- Hazard classification (non-hazardous for standard electrical wire)

- Compliance statements (UL, NEC) if required by customer

International Shipping

- Required documentation:

- Commercial Invoice (listing copper content and insulation materials)

- Packing List

- Certificate of Origin

- Safety Data Sheet (SDS) if requested

- Be aware of import regulations in destination countries—some may require additional certifications (e.g., CE marking in EU).

- Copper is a regulated material in some regions due to theft and recycling concerns; ensure proper export declarations.

Storage and Inventory Management

Optimal Storage Conditions

- Store in a dry, indoor environment with temperatures between 40°F and 100°F (4°C to 38°C).

- Keep away from direct sunlight and corrosive chemicals to prevent insulation degradation.

- Elevate reels off the floor using pallets to avoid moisture absorption.

Shelf Life and Inspection

- Copper wire has a long shelf life if stored properly; inspect for:

- Oxidation or green patina on exposed copper

- Cracking or brittleness in insulation

- Reel warping or physical damage

- Rotate stock using FIFO (First In, First Out) to ensure older inventory is used first.

Environmental and Safety Considerations

Recycling and Disposal

- Copper is highly recyclable—scrap wire should be collected and processed through certified recyclers.

- Insulation materials (PVC, PE) must be disposed of in accordance with local environmental regulations.

- Never burn insulation to extract copper—this releases toxic fumes and violates environmental laws.

Workplace Safety

- Use gloves and eye protection when handling wire to prevent cuts from sharp strands.

- Follow OSHA guidelines for manual handling to avoid back injuries during loading/unloading.

- Train personnel on proper use of wire cutters, strippers, and reel dispensers.

Documentation and Recordkeeping

Required Certifications and Records

- Maintain copies of:

- UL/CSA certification documents

- Mill test reports (if applicable)

- RoHS/REACH compliance statements

- Shipping manifests and BOLs

- Retain records for a minimum of 5 years for audit and traceability purposes.

Customer Compliance Support

- Provide spec sheets and compliance documentation upon request.

- Include labeling on packaging with:

- Wire type (e.g., 6/3 NM-B)

- AWG size and number of conductors

- Voltage rating (typically 600V)

- UL/CSA marks and compliance statements

Conclusion

Proper logistics and compliance management for 6/3 copper wire ensures safety, regulatory adherence, and customer satisfaction. From sourcing certified products to implementing correct handling, shipping, and storage protocols, each step in the supply chain must align with industry standards. Maintaining thorough documentation and staying updated on regulatory changes will mitigate risks and support smooth operations in both domestic and international markets.

Conclusion for Sourcing 6/3 Copper Wire:

After evaluating various factors such as cost, availability, quality, and supplier reliability, sourcing 6/3 copper wire requires a balanced approach that prioritizes both performance and value. 6/3 copper wire, commonly used in residential and commercial electrical installations for applications like service feeds, subpanels, and heavy appliances, must meet NEC standards and local code requirements to ensure safety and compliance.

The most effective sourcing strategy involves obtaining quotes from multiple reputable suppliers—both local electrical distributors and national online vendors—to compare pricing, lead times, and warranty options. Buying in bulk can offer significant cost savings, especially for large-scale projects, but should be weighed against storage needs and price volatility in the copper market.

Additionally, verifying that the wire is UL-listed, properly labeled, and complies with ASTM B3 and B8 standards ensures long-term reliability and code compliance. When possible, sourcing from suppliers with strong sustainability practices and transparent supply chains adds further value.

In summary, successful sourcing of 6/3 copper wire hinges on thorough supplier vetting, adherence to electrical codes, and strategic purchasing decisions that balance cost, quality, and project timelines. Establishing relationships with dependable suppliers can also streamline future procurement and support consistent project performance.