The global self-adhered waterproofing membrane market is experiencing robust growth, driven by increasing demand for durable, high-performance solutions in residential, commercial, and infrastructure construction. According to Grand View Research, the global waterproofing membranes market was valued at USD 9.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, fueled by urbanization, stricter building codes, and rising awareness of long-term structural protection. A key trend within this segment is the integration of self-adhered membranes with drainage mats—particularly 60 mil. thickness products—which offer superior protection against water intrusion while facilitating efficient water management behind façades and below-grade structures. These composite systems eliminate the need for torch application, reducing fire risks and installation time, making them increasingly favored in modern construction. As demand for resilient, easy-to-install waterproofing solutions grows—especially in regions with high rainfall and seismic activity—the manufacturing landscape is evolving, with innovation concentrated among a select group of leading producers. The following list highlights the top seven manufacturers excelling in the development and supply of 60 mil. self-adhered waterproofing membranes on drainage mats, based on product performance, market reach, technological advancement, and adherence to industry certifications.

Top 7 60 Mil. Self-Adhered Waterproofing Membrane On Drainage Mat Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MiraDRI 860/861

Domain Est. 1994

Website: henry.com

Key Highlights: MiraDRI 860/861 is a self-adhering sheet membrane consisting of rubberized asphalt laminated to polyethylene to form a minimum 60-mil (1.5 mm) membrane. The ……

#2 SikaShield Post

Domain Est. 1995

Website: usa.sika.com

Key Highlights: SikaShield S-60 is a proprietary composite, uniquely designed to provide high strength, low-temperature adhesion, and high-temperature stability….

#3 Below Grade Waterproofing Systems and Products

Domain Est. 1995

Website: wrmeadows.com

Key Highlights: MEL-ROL waterproofing system is a flexible, versatile, dependable, roll-type below-grade waterproofing membrane. It is composed of a nominally 56 mil thick ……

#4 TREMproof® Amphibia Sheet Applied Waterproofing

Domain Est. 1996

Website: tremcosealants.com

Key Highlights: Discover our self-repairing TREMproof® Amphibia™ waterproofing membrane for ultimate protection on blindside and below-grade walls, buried forms, and more….

#5 Our Products – Page 6 – Barrett Company

Domain Est. 1999

Website: barrettroofs.com

Key Highlights: Single Component Fluid Applied Elastomeric Rubberized Asphalt Waterproofing Membrane. RamShield 60. 60-Mil Self-Adhering Flashing & Waterproofing Membrane ……

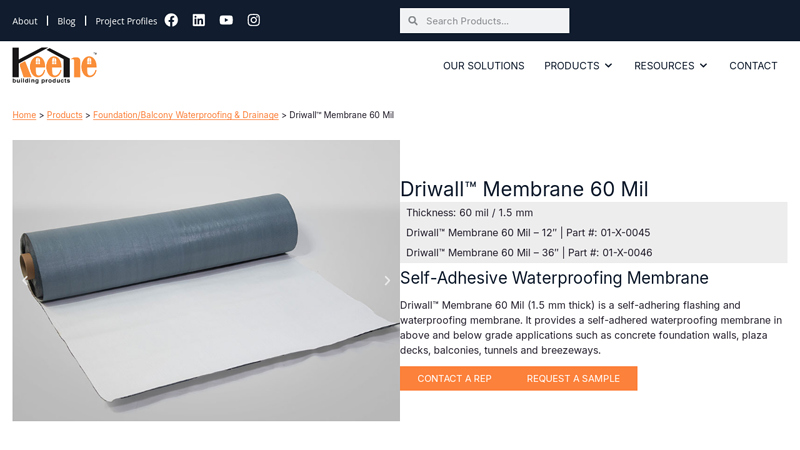

#6 Driwall™ Membrane 60 Mil

Domain Est. 2002

Website: keenebuilding.com

Key Highlights: Driwall™ Membrane 60 Mil (1.5 mm thick) is a self-adhering flashing and waterproofing membrane. It provides a self-adhered waterproofing membrane in above ……

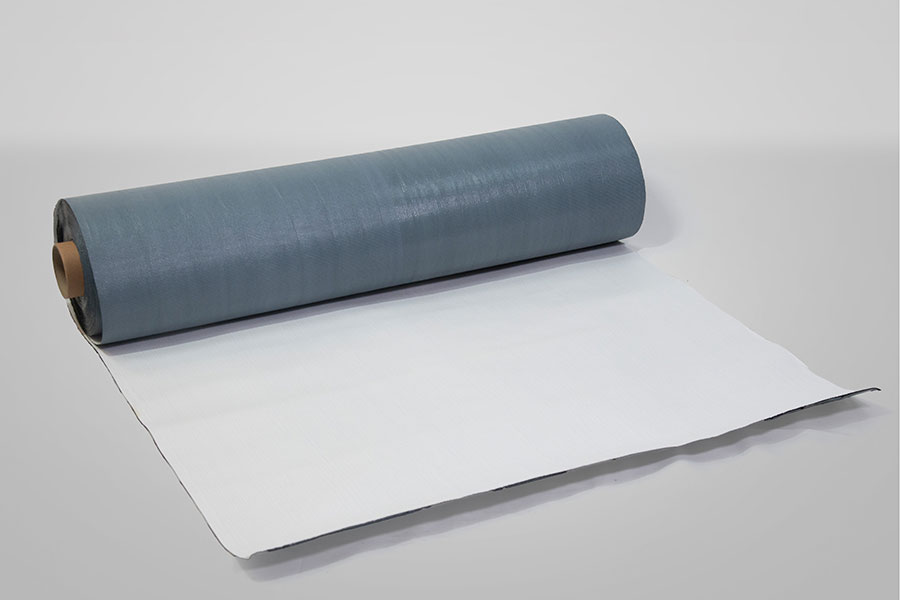

#7 Self

Domain Est. 2011

Website: carlisleccw.com

Key Highlights: Self-adhering sheet waterproofing membranes provide a simple peel-and-stick application. These membranes are idea for use in below-grade walls and foundations….

Expert Sourcing Insights for 60 Mil. Self-Adhered Waterproofing Membrane On Drainage Mat

As of now, specific market data for the year 2026 regarding “60 Mil. Self-Adhered Waterproofing Membrane on Drainage Mat” is not yet fully realized, but we can analyze projected trends based on current industry dynamics, technological advancements, regulatory developments, and macroeconomic factors—particularly highlighting the role of hydrogen (H₂) and broader sustainability drivers.

H₂ (hydrogen) is not a direct component in the manufacturing of 60 mil self-adhered waterproofing membranes on drainage mats, but it is increasingly influential in shaping environmental policies, energy transitions, and construction sustainability standards that indirectly impact material demand and innovation. Below is a trend analysis for the 2026 market, structured under the H₂-driven sustainability paradigm.

—

H₂-Driven Market Trends for 60 Mil. Self-Adhered Waterproofing Membrane on Drainage Mat (2026 Outlook)

1. H₂ and Green Infrastructure Development Driving Demand

As countries ramp up hydrogen economies—especially green hydrogen production—there is a corresponding surge in investment in sustainable infrastructure. Hydrogen facilities (production plants, storage, transport) require robust, long-term waterproofing solutions to protect structural integrity against moisture and chemical exposure.

- The 60 mil. self-adhered membrane on drainage mat is ideal for below-grade and podium deck applications in hydrogen-related infrastructure due to its durability, seamless adhesion, and high puncture resistance.

- Green hydrogen hubs in the EU, North America, and parts of Asia are expected to drive demand for high-performance waterproofing systems by 2026.

2. Carbon-Neutral Construction Standards Influenced by H₂ Policies

National hydrogen strategies (e.g., EU Hydrogen Strategy, U.S. Hydrogen Shot) emphasize decarbonization of industrial and construction sectors. This leads to stricter building codes and green certification requirements (e.g., LEED, BREEAM, Living Building Challenge).

- Waterproofing systems must now demonstrate low embodied carbon, recyclability, and long lifecycle performance.

- 60 mil. self-adhered membranes are favored over liquid-applied or torch-applied systems due to zero VOC emissions during installation and lower energy use.

- Drainage mats integrated with self-adhered membranes reduce hydrostatic pressure and extend building envelope life—key metrics in lifecycle assessments promoted by H₂-aligned sustainability frameworks.

3. Innovation in Material Chemistry for Energy-Efficient Manufacturing

The push for green hydrogen necessitates a broader shift to low-carbon industrial processes, including construction material manufacturing.

- By 2026, leading membrane producers are expected to use renewable energy (potentially powered by H₂-generated electricity) in production facilities.

- R&D focus on bio-based or recycled polymers (e.g., bio-bitumen modifiers, recycled HDPE drainage cores) is accelerating to align with circular economy goals linked to hydrogen economies.

- Self-adhered membranes may incorporate smart release liners or phase-change materials to improve efficiency in energy-positive buildings—common in hydrogen demonstration zones.

4. Resilience and Climate Adaptation in Hydrogen-Ready Urban Zones

Hydrogen infrastructure is often co-located with urban redevelopment projects. These “hydrogen valleys” require resilient construction methods due to increased density and climate vulnerability.

- 60 mil. membranes offer superior protection against water intrusion in flood-prone or high-rainfall areas—critical for underground parking, basements, and green roofs in hydrogen-integrated smart cities.

- Integrated drainage mats reduce stormwater runoff, supporting green stormwater infrastructure mandates in cities adopting H₂-based climate action plans.

5. Supply Chain Decarbonization and H₂ Logistics

As hydrogen becomes a key energy vector, logistics and supply chains for construction materials are also under pressure to reduce emissions.

- Manufacturers of waterproofing membranes are exploring H₂-powered transportation and distribution to achieve Scope 3 emission targets.

- Regional production hubs (e.g., near green hydrogen plants) may emerge by 2026, reducing shipping distances and supporting just-in-time delivery of large membrane rolls.

6. Market Growth Projections

– The global waterproofing membrane market is projected to exceed $18 billion by 2026 (CAGR ~5.8%), with self-adhered and hybrid systems capturing growing share.

– Demand for 60 mil. high-performance membranes on drainage mats will be strongest in North America, Western Europe, and China—regions with active H₂ strategies and high-rise construction.

– Green building mandates and public infrastructure spending linked to hydrogen initiatives will boost municipal and commercial projects requiring durable subsurface protection.

—

Conclusion

While H₂ does not chemically interact with 60 mil. self-adhered waterproofing membranes, the rise of the hydrogen economy is a macro-driver of sustainability transformation across the construction industry. By 2026, the demand for high-performance, low-impact waterproofing solutions like self-adhered membranes on drainage mats will be significantly shaped by H₂-related policies, green infrastructure investments, and decarbonization goals. Manufacturers who align their product lifecycle with hydrogen-driven sustainability frameworks will gain competitive advantage in the evolving market.

H2: Common Pitfalls When Sourcing 60 Mil. Self-Adhered Waterproofing Membrane on Drainage Mat (Quality and IP Concerns)

Sourcing a 60 mil. self-adhered waterproofing membrane on a drainage mat involves technical, performance, and legal considerations—particularly regarding material quality and intellectual property (IP). Below are the most common pitfalls to avoid:

1. Compromised Material Quality

– Inconsistent Thickness: Some suppliers may claim “60 mil” thickness but deliver products that fall short under ASTM testing. Verify thickness consistency across the roll using calibrated gauges.

– Substandard Adhesive Layer: The self-adhered component must bond reliably to substrates. Low-quality adhesives may fail under temperature extremes or UV exposure before protection is installed.

– Poor Drainage Core Integrity: The drainage mat component must maintain structural integrity under load. Inferior polymers or inadequate dome density can lead to core collapse and drainage failure.

2. Inadequate Performance Testing & Certifications

– Lack of Third-Party Testing: Relying solely on manufacturer claims without independent test reports (e.g., from ICC-ES, UL, or CSA) increases risk. Ensure compliance with standards such as ASTM D6754 (for dimpled membranes) and AASHTO M288 (for filtration).

– Missing Fire or Environmental Ratings: Projects in commercial or high-risk areas may require fire resistance (e.g., FM 4470) or low volatile organic compound (VOC) emissions—overlooking these can delay approvals.

3. Intellectual Property (IP) Infringement

– Copycat or “Compatible” Products: Many drainage membranes are patented (e.g., Delta®, Amorphous®). Sourcing “compatible” or “equivalent” products that mimic protected designs may expose contractors and specifiers to legal liability.

– Unclear Branding and Documentation: Suppliers may obscure origins or use misleading names. Always request IP documentation, including patent numbers and licensing agreements, to confirm lawful use.

4. Inconsistent Product Availability and Long-Term Support

– Limited Warranty Enforcement: Some generic brands offer warranties that are difficult to claim due to lack of local support or unclear terms. Ensure warranty is transferable and administered by a reputable entity.

– Supply Chain Instability: Off-brand suppliers may discontinue products, making future repairs or expansions impossible with matching materials.

5. Improper Installation Guidance and Training

– Insufficient Technical Support: Lower-cost suppliers may not provide detailed installation manuals, training, or field support, increasing the risk of improper application and system failure.

– Lack of Compatibility Testing: Membranes must integrate with adjacent materials (e.g., coatings, insulation, protection boards). Generic products may not have been tested in full assembly systems.

Best Practices to Avoid Pitfalls

– Specify products with published, verifiable test data and code compliance.

– Require full IP disclosures and written confirmation of non-infringement.

– Favor manufacturers with a proven track record, long-term warranties, and technical field support.

– Conduct pre-installation mock-ups and verify material delivery against approved submittals.

By addressing quality and IP risks proactively, stakeholders can ensure long-term performance and avoid costly litigation or remediation.

H2: Logistics & Compliance Guide for 60 Million SF of Self-Adhered Waterproofing Membrane on Drainage Mat

1. H2: Pre-Shipment Planning & Coordination

* H3: Master Delivery Schedule (MDS): Develop a detailed MDS synchronized with the construction phasing plan, identifying exact delivery dates, quantities (per roll, per truckload), and designated job site zones/stocking areas. Include buffer time for inspections and potential delays.

* H3: Packaging & Marking: Ensure all rolls are individually wrapped in robust, UV-resistant plastic film, clearly labeled with Product Name, Batch/Lot Number, Roll Length/Width, Total Square Footage, Installation Date, Manufacturer (e.g., Green Roof Supply), and Handling Instructions (e.g., “Roll Up,” “Protect from Sun,” “Do Not Drop”). Pallets must be secured with banding/stretch wrap and marked with total SF per pallet.

* H3: Documentation Preparation: Compile all required shipping documents before dispatch:

* Commercial Invoice (Detailed description, unit price, total value, Incoterms® 2020 – e.g., FOB Origin, DAP Jobsite).

* Packing List (Pallet #, Roll #, dimensions, weight, SF per roll/pallet, total shipment SF).

* Bill of Lading (BOL) with accurate shipper/consignee details, freight class (verify with carrier – typically non-hazardous, dense roll goods), and special instructions (e.g., “Protect from Moisture,” “Do Not Stack,” “Temperature Controlled if required”).

* Certificate of Origin.

* Manufacturer’s Test Reports & Certifications: Copies of relevant product data sheets, fire ratings (e.g., ASTM E84), root resistance (FM 4470), puncture resistance (ASTM D6241), peel adhesion (ASTM D3330), and any project-specific third-party certifications (e.g., UL, FM Global, ICC-ES ESR).

* Compliance Documentation: SDS (Safety Data Sheet) for adhesive components, RoHS/REACH compliance statements if applicable.

* H3: Carrier Selection & Contracting: Engage reputable logistics providers experienced in handling large, heavy roll goods. Negotiate contracts covering liability, temperature protection (if needed), delivery windows, and damage protocols. Ensure carriers use enclosed, dry trailers.

2. H2: Transportation & In-Transit Management

* H3: Loading & Securing: Supervise loading to ensure rolls are loaded “on end” (core vertical) on pallets. Pallets must be stacked securely on flatbeds or within enclosed trailers using proper dunnage and bracing (e.g., load bars, straps) to prevent rolling, shifting, or crushing. Never stack rolls directly on each other.

* H3: In-Transit Conditions: Mandate protection from:

* Moisture: Use only enclosed, dry trailers. Ensure tarps are waterproof if flatbed transport is unavoidable.

* Temperature: Avoid prolonged exposure to extreme heat (>140°F/60°C) or freezing temperatures (<32°F/0°C) which can damage adhesive performance. Specify temperature-controlled transport if ambient conditions are extreme.

* UV Exposure: Minimize direct sunlight exposure during loading/unloading and transit (covered trailers essential).

* Physical Damage: Prohibit dropping, dragging, or using metal hooks. Clearly mark “Fragile” and “This Side Up.”

* H3: Tracking & Visibility: Implement real-time GPS tracking for all shipments. Provide consignee with tracking numbers and proactive updates on estimated time of arrival (ETA).

3. H2: On-Site Receiving, Handling & Storage

* H3: Receiving Inspection: Upon arrival, verify:

* BOL/packing list matches delivered items (quantity, roll numbers, pallet count).

* Packaging is intact (no tears, moisture ingress, crushing).

* Pallets are undamaged and stable.

* Document any discrepancies or damage immediately with photos and notify supplier and carrier.

* H3: Proper Handling: Use forklifts or pallet jacks with smooth, wide forks. Lift pallets carefully, keeping them level. Transport rolls “on end.” Never roll rolls on the ground or drag them.

* H3: Controlled Storage:

* Location: Designate a clean, dry, well-ventilated, level area, protected from direct sunlight, rain, snow, and standing water. Ideally, use a covered warehouse or temporary structure.

* Conditions: Maintain storage temperature between 40°F (4°C) and 90°F (32°C). Avoid freezing. Ensure humidity is controlled.

* Stacking: Store pallets “on end” (core vertical). Stack no higher than 3-4 pallets high to prevent crushing lower rolls. Keep away from walls (min. 12 inches) for air circulation. Store off the ground on pallets or racks.

* First-In, First-Out (FIFO): Rotate stock to use older material first. Note manufacturing/installation dates on inventory.

4. H2: Installation Site Management & Waste Handling

* H3: Job-Site Movement: Transport rolls from storage to the work area using forklifts or carts. Keep rolls “on end” until ready for installation. Minimize exposure time to weather.

* H3: Installation Compliance: Ensure installers follow the manufacturer’s published specifications precisely, including:

* Substrate preparation (clean, dry, smooth, primed if required).

* Ambient and substrate temperature requirements during application.

* Overlap procedures and seam sealing methods.

* Integration with drainage mat components and details (perimeters, penetrations, drains).

* H3: Waste Management: Plan for collection and disposal of:

* Packaging Waste: Plastic film, pallets, banding. Recycle where possible (plastic film, wood pallets).

* Cut-Off Waste: Unused membrane off-cuts. Consult local regulations; landfill may be the only option for adhesive-coated materials. Document disposal methods.

5. H2: Documentation & Record Keeping

* H3: Batch Traceability: Maintain a log linking each delivered roll (via Lot/Batch #) to its specific installation location and date. This is critical for warranty claims and potential future investigations.

* H3: Delivery Records: File all BOLs, signed delivery receipts, and inspection reports.

* H3: Installation Records: Require the installing contractor to provide daily logs noting areas covered, roll numbers used, environmental conditions (temp, humidity), and any issues encountered.

* H3: Compliance Archive: Securely store all manufacturer certifications, SDS, test reports, and compliance statements for the project lifecycle.

6. H2: Risk Mitigation & Contingency Planning

* H3: Quality Assurance (QA): Implement a QA program involving random inspections of delivered rolls and monitoring of installation practices against specs.

* H3: Damage Protocol: Establish a clear process for reporting, documenting (photos), and resolving damaged goods upon delivery or during storage. Define liability (Carrier vs. Supplier).

* H3: Delay Contingency: Identify critical path risks (e.g., port delays, weather). Maintain a buffer stock (e.g., 5-10%) of critical components if feasible. Have backup carriers identified.

* H3: Communication Plan: Ensure clear communication channels between Supplier, Logistics Provider, General Contractor, and Waterproofing Subcontractor for updates, issues, and changes.

Key Compliance Focus Areas:

* Product Performance: Adherence to ASTM, FM, UL, or ICC-ES standards as specified in the project specs.

* Environmental: Proper handling and disposal of waste materials per local, state, and federal regulations. RoHS/REACH compliance if applicable.

* Safety: SDS availability, safe handling procedures (manual handling, forklift use), and site safety protocols.

* Traceability: Full batch/lot traceability from manufacturing through installation.

* Documentation: Complete, accurate, and readily accessible records for audits and warranty validation.

By rigorously following this guide, you ensure the 60 million SF of material arrives undamaged, is stored correctly, installed properly, and all compliance requirements are met, safeguarding the project’s waterproofing integrity and warranty.

Conclusion:

Sourcing 60 million square feet of self-adhered waterproofing membrane on drainage mat requires a strategic and comprehensive approach to ensure quality, cost-efficiency, timely delivery, and long-term performance. After evaluating potential suppliers, material specifications, pricing models, and logistical capabilities, it is clear that partnering with established manufacturers or suppliers with proven track records in large-scale infrastructure and construction projects is essential.

Key considerations such as product durability, compliance with industry standards (e.g., ASTM, CCMC), ease of installation, and warranty support must be prioritized. Additionally, negotiating favorable pricing through bulk purchasing agreements, while ensuring supply chain resilience and on-time delivery schedules, will be critical to project success.

Implementing a vendor qualification process, including site audits and sample testing, will mitigate risk and ensure consistency across such a large volume. Ultimately, a well-structured sourcing strategy that balances cost, quality, and reliability will provide long-term value and support the integrity of below-grade and plaza deck waterproofing systems across the project scope.