The global industrial drums and containers market, which includes 55-gallon steel and plastic oil drums, is experiencing steady growth driven by rising demand across the chemical, petroleum, pharmaceutical, and manufacturing sectors. According to a report by Grand View Research, the global steel drums market size was valued at USD 10.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. This growth is fueled by increasing transportation and storage needs for hazardous and non-hazardous liquids, particularly in emerging economies. Additionally, stringent regulations on container safety and sustainability are prompting manufacturers to innovate in materials and design. Amid this evolving landscape, a select group of manufacturers has emerged as leaders in producing high-quality, compliant 55-gallon oil drums. These companies combine engineering precision, large-scale production capabilities, and global distribution networks to meet rigorous industry standards. Based on market presence, production volume, and innovation, the following eight manufacturers represent the top players shaping the 55-gallon oil drum industry today.

Top 8 55 Gal Oil Drum Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Apex Drum

Domain Est. 2002

Website: apexdrum.com

Key Highlights: Apex Drum Company, Inc. has been a leader in environmentally sound reconditioning and disposal of industrial containers for over half a century. We pride ……

#2 Skolnik Industries

Domain Est. 1996

Website: skolnik.com

Key Highlights: Skolnik Industries manufactures standard and custom steel drums and barrels from high-quality steels to meet strict industry requirements for many ……

#3 McManus Drum Company

Domain Est. 2005

Website: mcmanusdrum.com

Key Highlights: At McManus Drum Co. Inc., we offer heavy-duty 55-gallon plastic drums that are suitable for a variety of applications, including the storage of liquids ……

#4 55 Gallon Drum Manufacturers

Website: 55gallondrumcompanies.com

Key Highlights: For over 60 years, Rahway Steel Drum Company has been a reliable supplier of 55 gallon drums and drum services. We supply containers from 1 quart to 330 gallons ……

#5 55 Gallon Steel Drums

Domain Est. 1997

Website: bascousa.com

Key Highlights: 5-day delivery 30-day returns55 Gallon Steel Drums Available Now with no Minimum Order Size. Order now on phone or online!…

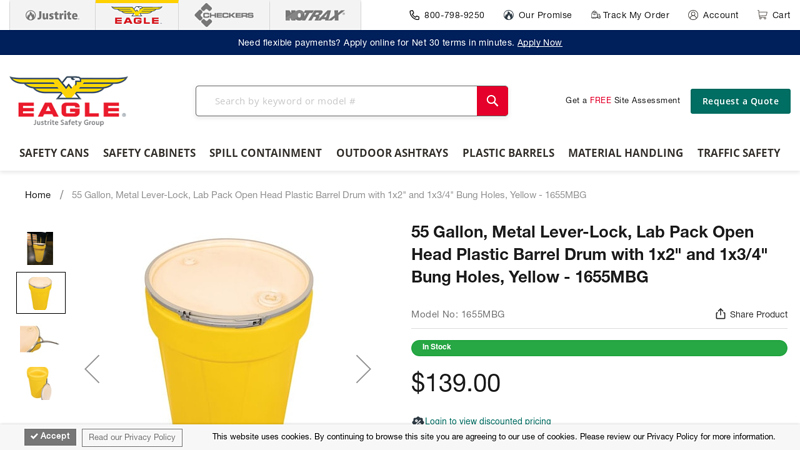

#6 Yellow 55 Gal Poly Drum Metal Lever-Lock

Domain Est. 1997

Website: eagle.justrite.com

Key Highlights: In stock $56.51 deliveryEagle 55 Gallon Lab Pack / Open Head Drum is constructed of yellow blow-molded high-density polyethylene (HDPE) with UV inhibitors, is durable and lightweig…

#7 Drums & Barrels

Domain Est. 1999

Website: thecarycompany.com

Key Highlights: 30-day returnsThe most popular drum and barrel size is 55 gallons. This size is considered to be the most convenient size for handling and transporting both solid and liquid ……

#8 Dallas Steel Drums

Domain Est. 2003

Website: dallassteeldrums.com

Key Highlights: We carry a large assortment of New and Reconditioned Plastic Drums in 15/55 gallon sizes. Learn More. PAILS. We offer plastic pails ……

Expert Sourcing Insights for 55 Gal Oil Drum

H2: 2026 Market Trends for 55-Gallon Oil Drums

The global market for 55-gallon oil drums is expected to undergo notable shifts leading into 2026, driven by evolving industrial demand, sustainability regulations, material innovation, and supply chain dynamics. As a critical component in the storage and transportation of liquids—ranging from crude oil and refined petroleum to chemicals and food-grade products—55-gallon steel and plastic drums remain essential across sectors such as energy, manufacturing, agriculture, and logistics.

-

Sustainability and Recyclability Driving Demand for Reconditioned Drums

Environmental regulations and corporate sustainability goals are expected to boost the reconditioned and reusable drum market. In 2026, reconditioned steel drums are projected to capture a larger market share, especially in North America and Europe, where circular economy principles are being enforced. Companies are increasingly opting for reconditioned drums to reduce waste and lower carbon footprints, supported by standards such as those from the Reusable Industrial Packaging Association (RIPA). -

Shift Toward Lightweight and Composite Materials

While steel remains the dominant material, demand for high-density polyethylene (HDPE) plastic drums is growing due to their corrosion resistance and lighter weight—reducing transportation costs. Innovations in composite materials may emerge by 2026, offering hybrid solutions that combine the durability of steel with the weight savings of polymers, particularly for specialty chemical and pharmaceutical applications. -

Energy Sector Volatility Influences Drum Demand

Fluctuations in global oil production and refining activities—impacted by geopolitical factors and the transition to renewable energy—will affect drum demand. In 2026, traditional oil drum usage may plateau or slightly decline in regions aggressively adopting green energy. However, emerging markets with expanding industrial bases (e.g., India, Southeast Asia, and parts of Africa) are likely to sustain demand for new and reconditioned drums in both oil and alternative energy sectors (e.g., biofuels and lubricants). -

Regulatory Compliance and Safety Standards

Stringent international shipping regulations (e.g., UN certification, DOT, and ADR standards) will continue to shape drum design and manufacturing. By 2026, manufacturers will increasingly adopt smart labeling and tamper-evident seals to meet traceability and safety requirements, particularly for hazardous materials. Digital integration, such as QR codes for lifecycle tracking, may become standard. -

Supply Chain Resilience and Regional Production

Post-pandemic supply chain disruptions have prompted companies to regionalize production and inventory. In 2026, localized drum manufacturing hubs are expected to rise, reducing dependence on global supply chains. This trend supports faster delivery times and responsiveness to regional industrial needs, particularly in Latin America and Eastern Europe. -

Digitalization and Smart Drums

While still in early stages, the integration of IoT-enabled sensors in drums for real-time monitoring of content levels, temperature, and location is anticipated to gain traction by 2026, especially in high-value or hazardous cargo logistics. This innovation will enhance supply chain visibility and reduce losses.

Conclusion:

The 55-gallon oil drum market in 2026 will be shaped by a balancing act between traditional industrial needs and modern sustainability and technology trends. While demand in mature markets may stabilize or modestly decline due to energy transitions, growth in emerging economies, coupled with innovations in reusability, materials, and digital tracking, will sustain the relevance and evolution of the 55-gallon drum across global industries.

Common Pitfalls Sourcing 55 Gallon Oil Drums (Quality & IP)

Sourcing 55-gallon oil drums, whether for storage, transport, or repurposing, involves significant risks related to both product quality and intellectual property (IP). Overlooking these pitfalls can lead to safety hazards, regulatory non-compliance, financial loss, and legal exposure.

Quality-Related Pitfalls

1. Inadequate Material Specifications

Many suppliers offer drums made from substandard steel or plastic that does not meet industry specifications (e.g., UN/DOT ratings for hazardous materials). Drums may lack proper wall thickness, leading to deformation, leaks, or failure under pressure. Always verify material grade (e.g., ASTM A512 for steel, HDPE resin type for plastic) and compliance with UN 1A2/Y or similar standards.

2. Poor Welding or Seaming

For steel drums, weak or inconsistent welds—especially on the body seam or head seams—compromise structural integrity. Poor welding can result in leaks during transport or storage, particularly with volatile or corrosive contents. Inspect sample drums for smooth, continuous welds and absence of pinholes.

3. Residual Contamination from Prior Contents

Used or reconditioned drums often retain chemical residues from previous loads (e.g., solvents, pesticides, or toxic oils). Improper cleaning leaves behind hazardous materials, posing health risks and contaminating new contents. Confirm the drum’s previous contents and insist on documentation of cleaning processes (e.g., steam cleaning, chemical neutralization, and testing).

4. Lid and Closure Defects

Faulty or mismatched lids, missing gaskets, or damaged threads prevent proper sealing. This can lead to spills, vapor escape, or non-compliance with environmental regulations like EPA or OSHA standards. Ensure closures are compatible and certified for the intended use.

5. Lack of Certification and Traceability

Unverified drums may lack essential certifications (e.g., UN, NSF, FDA for food-grade use). Without traceability (batch numbers, manufacturer info), accountability is compromised in case of failure or contamination. Always source from suppliers who provide full documentation.

Intellectual Property (IP) Pitfalls

1. Counterfeit or Unauthorized Brand Replicas

Some suppliers sell drums bearing logos, trademarks, or embossing of major brands (e.g., SCHÜTZ, Myers, Mauser) without authorization. These replicas infringe on IP rights and often use inferior materials. Purchasing counterfeit drums exposes buyers to legal liability and supply chain risks.

2. Unauthorized Use of Patented Designs

Certain drum designs, closure systems, or handling features (e.g., proprietary lifting rings or venting mechanisms) may be protected by patents. Sourcing generic versions that replicate these features without licensing can result in patent infringement claims, especially in commercial or industrial applications.

3. Misrepresentation of Compliance Marks

Illegitimate use of certification marks (e.g., UL, CE, or UN symbols) on drums is a form of IP and regulatory fraud. These fake markings mislead buyers into believing the product meets safety or performance standards when it does not. Verify certification authenticity through official databases or third-party testing.

4. Grey Market Imports with IP Violations

Importing drums from unverified international sources may involve grey market goods that bypass authorized distributors. These products may infringe on regional IP rights or lack proper regulatory approval for use in specific markets (e.g., U.S. or EU).

Mitigation Strategy: To avoid these pitfalls, conduct thorough due diligence on suppliers, request material test reports and IP compliance documentation, audit manufacturing facilities when possible, and work only with reputable, certified vendors. For high-risk applications, consider third-party inspection and legal review of supply agreements.

Logistics & Compliance Guide for 55-Gallon Oil Drums

Proper handling, transportation, storage, and disposal of 55-gallon oil drums are essential for safety, regulatory compliance, and environmental protection. This guide outlines key considerations for managing both new and used oil drums containing lubricants, waste oil, or other petroleum-based products.

Regulatory Framework and Classification

The movement and management of 55-gallon oil drums are governed by multiple agencies depending on the drum’s contents and condition. Key regulations include:

- EPA (Environmental Protection Agency): Regulates used oil under 40 CFR Part 279. Used oil is defined as any oil that has been refined from crude oil and used, and as a result, is contaminated by physical or chemical impurities.

- DOT (Department of Transportation): Oversees transportation under 49 CFR, including proper packaging, labeling, marking, and documentation for hazardous materials.

- OSHA (Occupational Safety and Health Administration): Enforces workplace safety standards, including handling, storage, and exposure controls (29 CFR 1910).

Note: Whether a 55-gal oil drum is regulated as hazardous waste depends on:

– The type of oil (e.g., motor oil, hydraulic fluid)

– Contamination with listed hazardous substances

– Ignitability, corrosivity, reactivity, or toxicity (D001–D043 waste codes)

Used oil that is not mixed with listed solvents or exhibits hazardous characteristics may be managed under the less stringent used oil rules (40 CFR 279), not full RCRA hazardous waste regulations.

Drum Specifications and Integrity

- Material: Typically steel (mild or stainless), but plastic (HDPE) drums are also used for certain oils.

- UN Rating: Drums used for hazardous materials must be UN-rated (e.g., UN1A1/Y for steel drums) and marked accordingly.

- Condition: Drums must be in good condition—free of dents, rust, leaks, or bulges. Leaking drums may violate EPA and DOT regulations.

- Closure: Must be securely sealed with proper bungs (typically 2″ and 3/4″ NPT) to prevent spills.

Labeling and Marking Requirements

Proper labeling is critical for compliance and safety:

- Hazard Communication (HazCom): Per OSHA 29 CFR 1910.1200, containers must display:

- Product identifier

- Signal word (e.g., “Warning”)

- Hazard statements (e.g., “Flammable liquid and vapor”)

- Pictograms (e.g., flame for flammables)

- Precautionary statements

-

Supplier information

-

DOT Shipping Labels:

- If transporting a hazardous material, use appropriate hazard class labels (e.g., Class 3 for flammable liquids).

- Include proper shipping name (e.g., “Used Oil, N.O.S.”), UN number (e.g., UN3082), and shipper/consignee information.

-

Use ORM-D or “Residue Last Contained” markings if applicable.

-

Storage Area Signs:

- Label storage areas with “Used Oil” or “Flammable Storage” signs.

- Include “No Smoking” and “Fire Hazard” warnings where applicable.

Handling and Transportation

- On-Site Movement:

- Use drum handling equipment (drum dollies, forklifts with drum clamps).

- Never roll drums on their side; always use proper handling tools.

-

Inspect drums before moving for leaks or damage.

-

Transportation:

- Non-Hazardous Used Oil: May be transported without a hazardous waste manifest if managed under 40 CFR 279 and not exhibiting hazardous characteristics.

- Hazardous Waste: Requires a hazardous waste manifest (EPA Form 8700-22), proper packaging, and trained drivers with HAZMAT endorsement.

- Spill Prevention: Vehicles must have secondary containment or spill kits onboard.

- Documentation: Maintain records of waste oil shipments for at least 3 years (EPA requirement).

Storage Best Practices

- Location:

- Store on an impervious surface (concrete or sealed asphalt).

- Use spill containment (e.g., spill pallets or berms) capable of holding 110% of the largest drum.

-

Keep away from ignition sources, drainage systems, and incompatible materials.

-

Stacking:

- Steel drums may be stacked up to 3 high if structurally sound and on a level surface.

- Plastic drums should generally not be stacked.

-

Follow manufacturer recommendations.

-

Environmental Controls:

- Protect from weather (use covered storage or indoor facility).

- Prevent exposure to extreme heat or cold.

Spill Response and Contingency Planning

- Spill Kit: Maintain a spill kit nearby containing absorbents, gloves, goggles, and containment booms.

- Reporting:

- Report spills > 25 gallons of oil to the National Response Center (NRC) at 1-800-424-8802 (per CERCLA and Oil Pollution Act).

- Document all spills and corrective actions.

- SPCC Plan: Facilities storing > 1,320 gallons of oil aboveground (or > 42,000 gallons underground) must have a Spill Prevention, Control, and Countermeasure (SPCC) Plan (40 CFR 112).

Disposal and Recycling

- Used Oil Recycling:

- Recycle through licensed used oil processors or re-refiners.

- Ensure proper documentation (e.g., bill of lading, recycling certificate).

- Hazardous Waste Disposal:

- If oil is mixed with solvents or listed wastes, dispose of via a licensed hazardous waste facility.

- Complete a waste determination and maintain manifests.

- Drum Disposal:

- Empty drums with residues may still be regulated. “Triple-rinsing” or steam-cleaning may be required before recycling as scrap metal.

- Check state regulations—some states require drums to be crushed or punctured before disposal.

Recordkeeping and Compliance Audits

Maintain records for:

– Waste oil manifests or recycling receipts (3+ years)

– Spill reports and cleanup documentation

– Training records for personnel handling oil

– SPCC Plan and inspections

– Drum inspection logs

Conduct regular audits to ensure compliance with federal, state, and local regulations.

Disclaimer: Regulations vary by jurisdiction and change over time. Always consult the latest federal guidelines and state environmental agencies for specific compliance requirements. When in doubt, treat used oil and related waste as hazardous until proven otherwise.

Conclusion:

After evaluating various sourcing options for 55-gallon oil drums, it is clear that selecting the right supplier depends on specific needs such as cost, container condition (new vs. reconditioned), material type (steel, plastic, or fiber), and intended use (storage, transport, recycling, or repurposing). Local industrial suppliers, waste management companies, and specialized drum distributors offer reliable access to both new and reconditioned drums, often with the benefit of immediate availability and delivery options. Online marketplaces and classifieds can provide cost-effective solutions, though quality and consistency may vary. Direct contact with industrial manufacturers or refineries may yield surplus drums at low or no cost, particularly when establishing mutually beneficial recycling relationships.

To ensure safety, regulatory compliance, and suitability for the intended application—especially if storing hazardous materials or food-grade substances—drums should be properly certified (e.g., UN-rated) and cleaned. Ultimately, the most effective sourcing strategy combines cost-efficiency with reliability, quality assurance, and environmental responsibility. Conducting due diligence on suppliers and verifying drum specifications will help ensure a safe, sustainable, and economical solution for long-term needs.