The global glass packaging market is experiencing steady growth, driven by rising demand for sustainable, inert, and premium packaging solutions across the cosmetics, pharmaceutical, and beverage industries. According to Grand View Research, the global glass packaging market size was valued at USD 70.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is further amplified by consumer preference for recyclable materials and the resurgence of glass as a premium container choice—particularly in niche segments like essential oils, perfumery, and high-end skincare, where 50ml glass bottles are a standard size.

Mordor Intelligence projects similar momentum, noting that increasing environmental regulations and brand sustainability commitments are shifting packaging preferences toward glass, especially in Europe and North America. With this expanding demand, manufacturers specializing in 50ml glass bottles are scaling production, enhancing design capabilities, and investing in automation to meet quality and volume requirements. In this evolving landscape, identifying reliable, innovative, and compliant manufacturers is critical for brands aiming to balance aesthetics, functionality, and environmental responsibility. Below are nine leading 50ml glass bottle manufacturers shaping the industry through technological advancement, sustainable practices, and global reach.

Top 9 50Ml Glass Bottle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PGP Glass Bottle and Glass Container Manufacturers

Domain Est. 2021

Website: pgpfirst.com

Key Highlights: PGP Glass is a trusted name among glass bottle manufacturers and glass container manufacturers, delivering premium quality packaging solutions. Explore now!…

#2 50 ml Clear Glass Mini Bottles (Black Phenolic Cap)

Domain Est. 1997

Website: berlinpackaging.com

Key Highlights: In stock Free delivery over $300Buy 1.6 oz (50 ml) Clear Glass Mini Bottles. Ideal for individual servings, product samples, wedding favors, and more. Includes black 18-400 Phenoli…

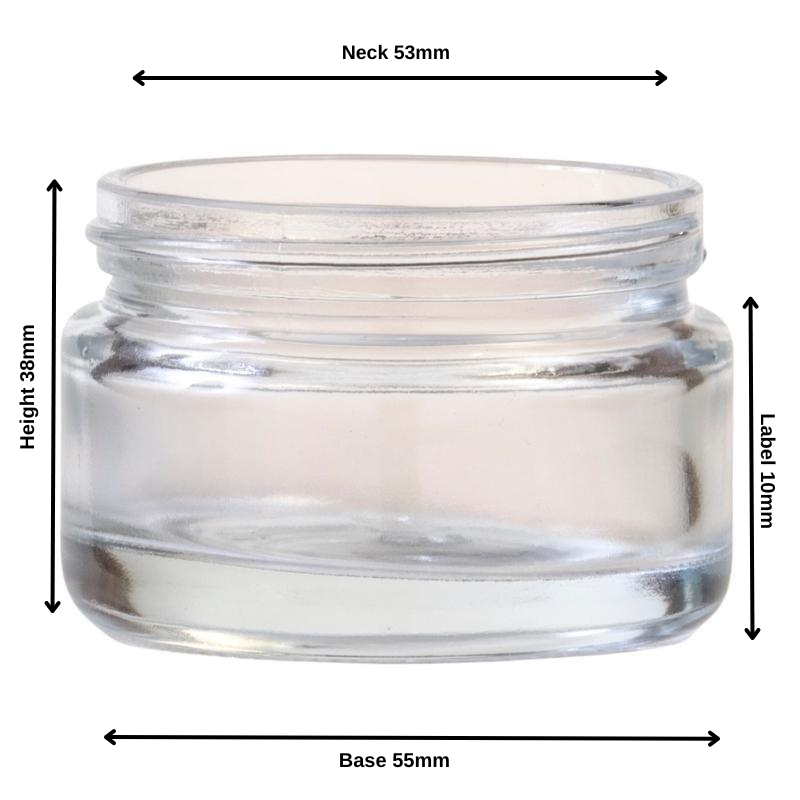

#3 Glass Jars Supplier & Distributor

Domain Est. 1997

Website: oberk.com

Key Highlights: O.Berk’s glass jar inventory includes ideal packaging solutions for pharmaceutical, personal care products and food-safe glass jars for food & beverage….

#4 Bottles & Jars

Domain Est. 1998

Website: lumson.com

Key Highlights: GLASS BOTTLES & JARS | Your product takes on a new identity. … 50ml), available in different shapes, from rounded lines to special silhouettes….

#5 Custom Glass Bottles

Domain Est. 2003

Website: saxco.com

Key Highlights: From supplying standard glass bottles and closures, to completely customized packaging … All size bottles, including 50 ml bottle, 100 ml bottle, 200 ml ……

#6 Glass Bottles

Domain Est. 2005

Website: generalbottle.com

Key Highlights: 6-day delivery 21-day returnsPremium-quality glass containers tailored for industries like food, beverage, cosmetics, and pharmaceuticals. Available in diverse sizes and styles….

#7 Glass Packaging Solutions

Domain Est. 2013

Website: calaso.com

Key Highlights: At Calaso, we offer an extensive range of glass packaging solutions tailored for industries from food to pharmaceuticals. With capacities from 5ml to 500ml, our ……

#8 Glass Bottles

Domain Est. 2017

Website: ucan-packaging.com

Key Highlights: Small glass bottles with droppers, pipettes, roll-on, sprayers, pump caps and more. Wholesale packaging for food and beverages, cosmetics, and perfume….

#9 Glass bottles

Domain Est. 2018

Website: bpsglass.com

Key Highlights: We specialize in providing glass bottles for the beverage, liquor, and food industries. Glass bottles. Show filters….

Expert Sourcing Insights for 50Ml Glass Bottle

H2: Analysis of 2026 Market Trends for 50ml Glass Bottles

The global market for 50ml glass bottles is poised for significant evolution by 2026, driven by shifts in consumer preferences, sustainability mandates, and innovation across end-use industries. This analysis explores key trends shaping the demand, production, and application of 50ml glass containers over the coming years.

-

Sustainability and Circular Economy Initiatives

Environmental concerns are increasingly influencing packaging decisions. By 2026, the 50ml glass bottle market will see heightened demand due to glass’s recyclability and inert nature. Governments and brands are tightening regulations on single-use plastics, favoring glass as a premium, eco-friendly alternative. Closed-loop recycling systems and lightweighting technologies will be adopted to reduce carbon footprints, enhancing the appeal of small-format glass bottles in cosmetics, pharmaceuticals, and premium beverages. -

Growth in Premium and Niche Product Segments

The 50ml size is ideal for sample sizes, travel-friendly packaging, and luxury goods. By 2026, the rise of premium skincare, essential oils, and craft spirits will drive demand. Brands are leveraging the aesthetic and tactile qualities of glass to convey quality and authenticity. Customization—such as embossing, colored glass, and unique shapes—will become more prevalent to support brand differentiation in competitive markets. -

Expansion in the Cosmetics and Personal Care Industry

The cosmetics sector remains a key driver for 50ml glass bottles, particularly for serums, toners, and perfumes. With the global skincare market projected to exceed $200 billion by 2026, demand for small, elegant, and preservative-safe packaging will increase. Glass offers superior barrier properties that preserve product integrity, making it ideal for sensitive formulations. -

Pharmaceutical and Diagnostic Applications

The healthcare industry’s need for sterile, chemically inert containers will boost 50ml glass vial usage. Advances in biologics, vaccines, and personalized medicine will require reliable storage solutions. Type I borosilicate glass bottles—resistant to thermal and chemical stress—will see rising adoption, especially in emerging markets investing in healthcare infrastructure. -

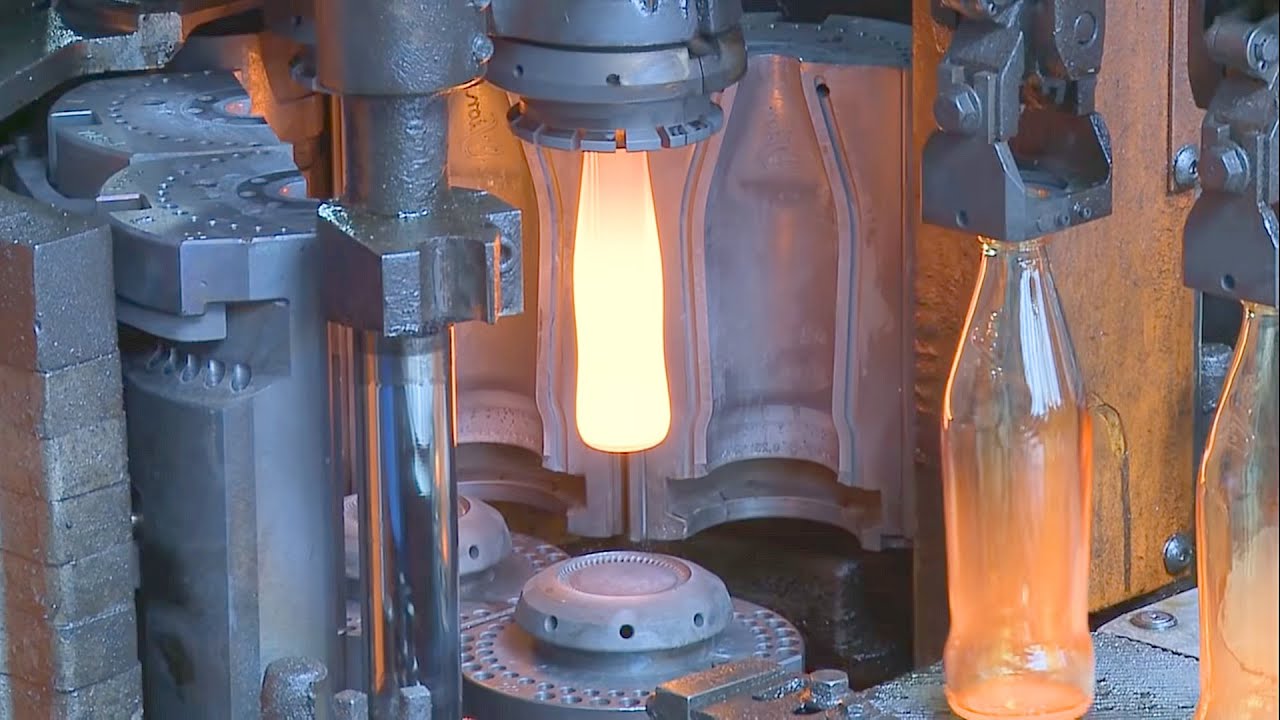

Technological Advancements in Manufacturing

Automation, AI-driven quality control, and energy-efficient production methods will redefine glass bottle manufacturing by 2026. Smart factories will enable faster turnaround, higher precision, and reduced waste. Innovations such as nano-coatings for improved barrier performance and shatter resistance will extend the functionality and safety of 50ml glass bottles. -

Regional Market Dynamics

Europe and North America will continue leading in sustainable packaging adoption, with strict ESG compliance pushing brands toward glass. Meanwhile, Asia-Pacific—particularly China, India, and South Korea—will emerge as high-growth regions due to rising disposable incomes, urbanization, and booming beauty and beverage industries. Localized production hubs will reduce logistics costs and support regional supply chains. -

Challenges: Cost and Logistics

Despite advantages, glass faces challenges related to weight, fragility, and higher production costs compared to plastic. By 2026, these issues will be mitigated through design optimization (e.g., thinner walls, shock-absorbing packaging), but transportation emissions remain a concern. The industry will increasingly adopt rail and sea freight over road transport to reduce environmental impact.

Conclusion

By 2026, the 50ml glass bottle market will be shaped by sustainability, premiumization, and technological innovation. As consumer trust in glass packaging grows and regulatory pressures mount against plastics, the 50ml format will solidify its role across cosmetics, pharmaceuticals, and specialty beverages. Companies investing in eco-design, regional manufacturing, and smart packaging integration will lead the market in this pivotal segment.

Common Pitfalls When Sourcing 50ml Glass Bottles (Quality & Intellectual Property)

Sourcing 50ml glass bottles, particularly for sensitive applications like cosmetics, pharmaceuticals, or premium beverages, involves navigating several critical quality and intellectual property (IP) risks. Overlooking these pitfalls can lead to product failure, brand damage, legal disputes, and supply chain disruptions.

Quality-Related Pitfalls

1. Inconsistent Glass Quality and Clarity

A major issue is variability in glass composition and manufacturing standards. Poor-quality glass may contain impurities, bubbles, or striations that affect appearance and structural integrity. Bottles with inconsistent wall thickness are prone to breakage during filling, transport, or handling. Always verify the supplier’s adherence to ISO standards (e.g., ISO 9001) and request sample testing for clarity, weight uniformity, and stress resistance using polarized light.

2. Dimensional Inaccuracy and Tolerance Issues

Even slight deviations in neck finish (e.g., 18/410, 24/410) or overall dimensions can cause filling line jams, improper sealing, or cap misalignment. Suppliers from regions with less stringent QC may not maintain tight tolerances. Require detailed dimensional drawings and conduct first-article inspections (FAI) before full production.

3. Poor Surface Finish and Defects

Chips, cracks, mold lines, or rough seams not only compromise aesthetics but can also harbor contaminants or weaken the bottle. Automated filling lines are especially sensitive to surface irregularities. Implement AQL (Acceptable Quality Level) inspections at the factory and include clauses for rejection of non-conforming batches.

4. Inadequate Chemical and Thermal Resistance

For products requiring sterilization or exposure to acidic/basic formulations, the glass must resist chemical leaching and thermal shock. Soda-lime glass may not suffice for certain applications; borosilicate might be required. Confirm the glass type and request compatibility testing with your formulation.

5. Weak or Non-Compliant Sealing Performance

A faulty seal leads to leakage, oxidation, or contamination. Ensure the supplier tests closure integrity (e.g., torque testing, leak testing) and complies with relevant standards such as USP <660> for pharmaceutical use or FDA 21 CFR for food contact. Verify compatibility with your chosen caps and liners.

Intellectual Property (IP) Pitfalls

1. Unlicensed Use of Protected Designs

Many 50ml bottle designs—especially in luxury cosmetics or perfumery—are trademarked or design-patented. Sourcing generic copies from suppliers who replicate branded shapes (e.g., resembling Chanel or Estée Lauder bottles) exposes you to infringement lawsuits. Always confirm that the design is either in the public domain or licensed for your use.

2. Lack of Design Ownership and Customization Rights

When commissioning custom molds, failing to secure full IP rights in the contract means the supplier may reuse or resell your design to competitors. Ensure the agreement explicitly transfers all rights to the mold and design to your company and includes confidentiality clauses.

3. Supplier Claims on Mold Investment

Suppliers may retain ownership of molds, charging high fees for exclusivity or threatening to produce for others. Clearly define mold ownership, usage rights, and costs in the contract. Paying a one-time NRE (Non-Recurring Engineering) fee should typically grant you full rights.

4. Counterfeit or Gray Market Goods

Some suppliers may offer “original design” bottles at suspiciously low prices, which could be diverted or counterfeit products. Conduct factory audits, verify certifications, and avoid third-party trading companies with no direct manufacturing control.

5. Inadequate Documentation for IP Protection

Without proper documentation—design files, mold registration, and legal agreements—it’s difficult to enforce IP rights. Maintain a complete audit trail and consider registering unique designs with intellectual property offices in key markets.

Mitigating these pitfalls requires due diligence, clear contracts, and proactive quality control. Engaging independent inspection services and legal counsel during sourcing can prevent costly oversights.

Logistics & Compliance Guide for 50ml Glass Bottles

Regulatory Classification & Documentation

Glass bottles themselves are not typically classified as hazardous goods for transport unless they contain a hazardous substance. However, their size, material, and intended use influence compliance requirements:

– UN Number: Not applicable (N/A) for empty bottles; if filled, classification depends on contents (e.g., UN1170 for ethanol solutions).

– Proper Shipping Name: “Empty Glass Bottles” or “Glass Articles, Not Otherwise Specified (N.O.S.)” when shipped empty.

– HS Code: 7010.90 (Glass bottles, jars, and other containers) – verify with local customs for precise classification.

– Safety Data Sheet (SDS): Not required for empty glass bottles under GHS, but may be needed if bottles are pre-cleaned with chemical agents.

– Certificate of Conformance (CoC): Recommended to validate compliance with ISO 90 or ISO 8317 (if child-resistant), especially for pharmaceutical use.

Packaging & Handling Requirements

Proper packaging minimizes breakage and ensures safe handling during transit:

– Cushioning & Segregation: Use dividers, foam inserts, or molded trays to prevent contact between bottles. Avoid stacking without intermediate layers.

– Outer Packaging: Use sturdy double-wall corrugated cardboard boxes rated for the load weight. Reinforce edges and seams.

– Palletization: Secure boxes on standard pallets (e.g., EUR/EPAL or GMA) using stretch wrap or banding. Limit stack height to 5–6 layers to prevent crushing.

– Labeling: Clearly mark “Fragile,” “This Side Up,” and “Do Not Stack” on all sides. Include handling pictograms per ISO 780.

– Weight Limits: Keep individual shipping units under 20 kg (44 lbs) for manual handling unless mechanical equipment is used.

Transportation & Storage

Ensure safe and compliant movement and storage conditions:

– Mode-Specific Rules:

– Air (IATA): Comply with IATA DGR Packing Instruction 904 for glass articles. Max gross weight per package: 30 kg.

– Sea (IMDG): Follow IMDG Code for non-hazardous general cargo. Secure against moisture and shifting.

– Road (ADR): No ADR requirements for empty bottles; secure loads per national regulations (e.g., EU Directive 2014/47/EU).

– Environmental Conditions: Store in dry, temperature-stable areas (15–25°C). Avoid humidity >60% to prevent label damage or mold.

– Shelf Life: Indefinite if stored properly, but inspect periodically for cracks or contamination.

Regulatory Compliance

Meet global and regional standards based on end-use:

– Food Contact: Comply with FDA 21 CFR 176.170 (US) and EU Regulation (EC) No 1935/2004. Certify that glass is lead-free and meets migration limits.

– Pharmaceutical Use: Adhere to USP <660> (Glass Containers) and Ph. Eur. 3.2.1. Include test reports for hydrolytic resistance (Type I, II, or III).

– Child-Resistant Closures: If applicable, meet ISO 8317 and US 16 CFR § 1700.20 testing standards.

– Labeling Requirements: Include manufacturer info, capacity (50ml), material (e.g., “Soda-Lime Glass”), and recycling code (e.g., “70” for glass).

Sustainability & Disposal

Address environmental responsibilities:

– Recyclability: 100% recyclable; label with universal glass recycling symbol (e.g., Mobius loop with “70”).

– Waste Handling: Broken glass must be disposed of as non-hazardous waste in puncture-resistant containers. Follow OSHA 29 CFR 1910.1450 for lab settings.

– Carbon Footprint: Optimize logistics to reduce transport emissions. Consider regional suppliers to minimize shipping distance.

Key Compliance Checklist

- [ ] Verify HS code with customs broker

- [ ] Use UN-certified packaging if bottles contain residues

- [ ] Apply correct handling labels

- [ ] Confirm food/pharma compliance documentation

- [ ] Train staff on fragile goods protocols

- [ ] Audit storage conditions quarterly

Note: Always consult local regulations and update documentation based on final product use (e.g., filled vs. empty, industry-specific standards).

Conclusion for Sourcing 50ml Glass Bottles

After thorough evaluation of suppliers, material quality, cost efficiency, and compliance standards, sourcing 50ml glass bottles is a viable and strategic decision for packaging small-volume liquids such as essential oils, perfumes, serums, or pharmaceuticals. Glass offers superior product preservation, UV protection (especially with amber or cobalt options), and a premium aesthetic that enhances brand perception. Additionally, its recyclability supports sustainability goals.

Key findings indicate that sourcing from experienced manufacturers—preferably those certified in ISO, FDA, or GMP standards—ensures consistent quality and regulatory compliance. Bulk ordering significantly reduces per-unit costs, while MOQ flexibility allows scalability for growing businesses. Packaging customization options, including dropper caps, sprayers, and labeling, further add value and functionality.

In conclusion, sourcing 50ml glass bottles aligns well with quality, environmental, and branding objectives. With the right supplier partnership and attention to logistics and packaging requirements, this solution offers a reliable and attractive packaging choice for premium liquid products.