The global market for small-format packaging, particularly 50ml bottles, has experienced robust growth driven by rising demand in the cosmetics, pharmaceuticals, and personal care industries. According to Grand View Research, the global packaging market was valued at USD 1.08 trillion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030, with compact and portable packaging formats like 50ml bottles gaining prominence due to consumer preference for travel-sized and sample products. Similarly, Mordor Intelligence projects that the packaging market will grow at a CAGR of over 5% during the forecast period 2024–2029, citing increased e-commerce penetration and brand focus on sustainable, lightweight solutions. As demand surges, manufacturers specializing in 50ml bottle production are scaling innovation in materials, automation, and design. Here are the top 7 manufacturers leading this space with advanced capabilities, global reach, and data-backed production excellence.

Top 7 50Ml Bottle Size Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PGP Glass Bottle and Glass Container Manufacturers

Domain Est. 2021

Website: pgpfirst.com

Key Highlights: PGP Glass is a trusted name among glass bottle manufacturers and glass container manufacturers, delivering premium quality packaging solutions. Explore now!…

#2 50 mL, Polypropylene Bottle with Cap Assembly, 29 x 104mm

Domain Est. 1990

Website: beckman.com

Key Highlights: 50 mL Polypropylene Bottle with Cap Assembly, 29 x 104mm – 24Pk. Product No:361694. Polypropylene Bottles with Cap Assemblies for use in High Performance and ……

#3 50 ml Clear PET Plastic Mini Liquor Bottles (Cap Not Included)

Domain Est. 1997

Website: berlinpackaging.com

Key Highlights: In stock Rating 4.8 (18) Our 1.6 oz (50 ml) Liquor Plastic Bottles are lightweight and durability, two compelling reasons to choose over their glass counterparts. (Bottle Only)…

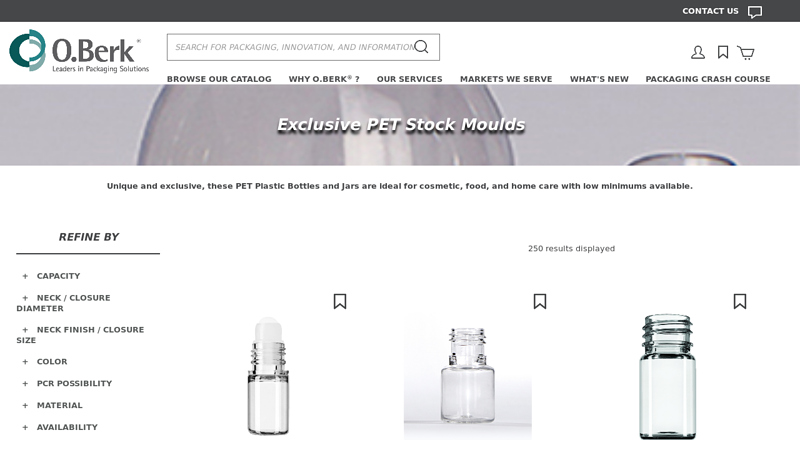

#4 Exclusive PET Plastic Bottles and Jars

Domain Est. 1997

Website: oberk.com

Key Highlights: Unique and exclusive, these PET Plastic Bottles and Jars are ideal for cosmetic, food, and home care with low minimums available. Processing, Please Wait….

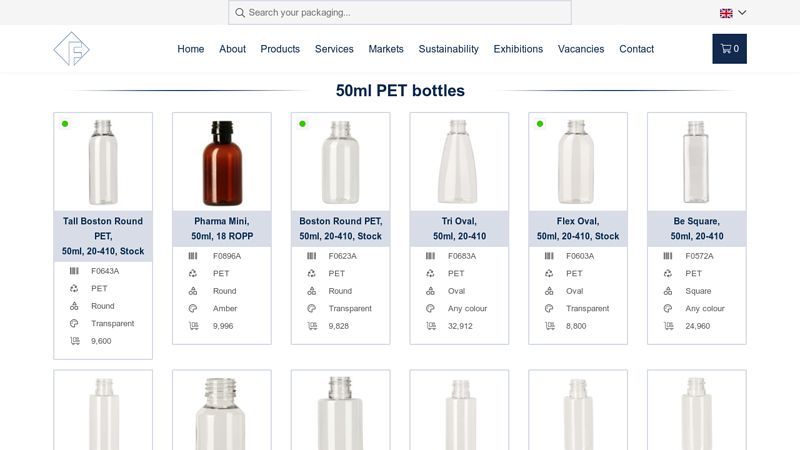

#5 The supplier of 50ml PET bottles

Domain Est. 2000

Website: frapak.com

Key Highlights: We have created a lot of different 50ml PET bottles. Our 50ml PET bottles are made in different neck sizes; 18 ROPP, 20-410, 20-415 and 28ROPP….

#6 50ml Plastic Bottles With Lids (1.7 oz)

Domain Est. 2017

#7 Wholesale & Bulk Plastic Bottles

Domain Est. 1998

Expert Sourcing Insights for 50Ml Bottle Size

H2: Projected 2026 Market Trends for 50ml Bottle Size

The 50ml bottle size is poised to play a pivotal role across multiple consumer sectors by 2026, driven by evolving consumer preferences, sustainability imperatives, and shifts in global distribution models. This analysis explores key trends expected to shape the demand, production, and innovation landscape for 50ml bottles in the coming years.

-

Growth in Premium and Niche Fragrance Markets

By 2026, the fragrance industry is expected to see continued expansion in the premium and niche segments, where 50ml bottles remain a standard offering. Consumers are increasingly favoring mid-size formats that balance portability, value, and luxury appeal. The 50ml size offers an accessible entry point for high-end perfumes without the commitment of larger, more expensive bottles—making it ideal for gifting and trial purchases. Brands are responding with enhanced packaging, limited editions, and refillable designs to capture this demand. -

Rise of Travel-Friendly and On-the-Go Consumption

With global travel rebounding and consumers adopting more mobile lifestyles, demand for travel-compliant sizes is rising. The 50ml format fits perfectly within airline liquid restrictions (under 100ml), positioning it as a top choice for perfumes, skincare, and personal care products. By 2026, expect increased innovation in leak-proof caps, compact sprayers, and multi-chamber bottles to enhance functionality and user experience. -

Sustainability and Refillable Solutions

Environmental concerns are driving a shift toward sustainable packaging. The 50ml bottle is becoming a focal point for refillable and reusable models, particularly in the beauty and cosmetics sectors. Major brands are investing in closed-loop systems where consumers return empty 50ml bottles for refills or discounts. Lighter-weight glass, PCR (post-consumer recycled) plastic, and bio-based materials are expected to dominate material choices by 2026, reducing carbon footprints and meeting ESG goals. -

E-Commerce and Sampling Strategies

The growth of online retail continues to influence packaging decisions. The 50ml size strikes a balance between perceived product value and shipping efficiency. Brands are also leveraging 50ml bottles in subscription boxes, sample kits, and trial programs to boost customer acquisition. By 2026, digital-first brands may adopt customizable 50ml packaging to enhance personalization and brand loyalty. -

Expansion in Skincare and Cosmeceuticals

The skincare market, especially in anti-aging and targeted treatments, is embracing the 50ml format for serums, moisturizers, and specialty lotions. Consumers perceive 50ml as a “serious” dosage size—large enough for effective use, yet small enough to encourage product rotation and minimize waste from expired items. Innovations in airless pumps and UV-protective bottles will further boost adoption in this category. -

Regional Market Variations

Asia-Pacific markets, particularly South Korea and China, are expected to drive demand for aesthetically refined 50ml bottles, emphasizing minimalist design and cultural symbolism. In contrast, North American and European markets will prioritize sustainability certifications and refill infrastructure. Emerging markets may see increased local production of 50ml bottles to reduce import costs and support regional supply chains. -

Regulatory and Material Innovations

By 2026, stricter global regulations on single-use plastics will accelerate the adoption of alternative materials like aluminum, bioplastics, and mono-material recyclable resins in 50ml bottles. Regulatory bodies may also enforce labeling requirements for recyclability and carbon footprint, pushing manufacturers toward transparency and innovation.

Conclusion

The 50ml bottle size is set to remain a strategic format across beauty, fragrance, and personal care industries in 2026. Its versatility, consumer appeal, and alignment with sustainability goals make it a cornerstone of future packaging strategies. Companies that invest in smart design, circular systems, and digital integration will be best positioned to capitalize on this enduring trend.

Common Pitfalls When Sourcing 50ml Bottles (Quality & Intellectual Property)

Sourcing 50ml bottles, while seemingly straightforward, involves significant risks related to quality consistency and intellectual property (IP) protection. Overlooking these pitfalls can lead to product failures, customer dissatisfaction, legal disputes, and reputational damage. Here are key challenges to avoid:

Quality-Related Pitfalls

- Inconsistent Material Quality and Purity: Suppliers may use recycled or lower-grade resins (e.g., PCR plastic with inconsistent properties) or glass with impurities, leading to variations in clarity, strength, color, or chemical resistance. This affects product stability, shelf life, and consumer perception.

- Dimensional Inaccuracy and Tolerance Issues: Poor mold precision or manufacturing control can result in bottles that don’t fit standard caps or pumps properly, causing leaks, dosing inaccuracies, or assembly line jams. Variations in neck finish (e.g., 18/410, 20/410) are a frequent problem.

- Defects in Finish and Surface: Cosmetic flaws like mold lines, sink marks, bubbles (in glass), haze, or surface scratches are common with lower-tier manufacturers. These defects diminish perceived product value, especially in premium markets like cosmetics or pharmaceuticals.

- Inadequate Barrier Properties: For sensitive contents (fragrances, essential oils, certain chemicals), bottles must provide effective barriers against oxygen, moisture, or UV light. Sourcing bottles with insufficient barrier layers (e.g., poor EVOH in plastic) can lead to product degradation.

- Lack of Batch-to-Batch Consistency: Failure to maintain rigorous process controls means each production run may yield bottles with slight differences in weight, color, or dimensions, complicating filling and packaging operations.

Intellectual Property (IP)-Related Pitfalls

- Unauthorized Use of Branded or Patented Designs: Sourcing generic bottles that closely mimic the distinctive shape, embossing, or closure system of a competitor’s patented or trademarked container can lead to infringement claims, resulting in costly legal battles, product seizures, and forced redesigns.

- Supplier’s Claim to Custom Tooling Ownership: When investing in custom molds for a unique 50ml bottle design, failing to secure clear contractual ownership of the tooling can be disastrous. Suppliers may retain ownership, charge exorbitant usage fees, or even sell the same design to competitors.

- Lack of Confidentiality Agreements: Discussing proprietary designs, formulations, or packaging concepts with suppliers without a robust Non-Disclosure Agreement (NDA) risks IP leakage, potentially enabling reverse engineering or unauthorized replication.

- Grey Market and Diversion Risks: Suppliers may produce excess units beyond the agreed order and sell them on the grey market, leading to unauthorized distribution, brand dilution, and loss of sales control.

- Inadequate Verification of Supplier’s IP Compliance: Assuming a supplier has the rights to produce a requested design (e.g., a specific pump mechanism or bottle shape) without due diligence can result in sourcing components that are themselves IP-infringing, making the buyer complicit.

Mitigation Strategy: To avoid these pitfalls, conduct thorough supplier vetting, demand detailed material specifications and quality certifications (e.g., ISO, USP), implement rigorous incoming inspection protocols, secure clear IP and tooling ownership agreements in writing, and consult legal counsel for high-risk or custom designs.

H2: Logistics & Compliance Guide for 50ml Bottle Size

The 50ml bottle size is widely used across industries such as cosmetics, pharmaceuticals, essential oils, food flavorings, and travel-sized products. While compact, this size requires careful attention to logistics and compliance to ensure safe, legal, and efficient distribution. Below is a comprehensive guide to help navigate key considerations for 50ml bottles.

H2: Regulatory Compliance

1. Product-Specific Regulations

– Cosmetics (EU & UK): Must comply with EU Regulation (EC) No 1223/2009 or UK Cosmetics Regulation. Ensure ingredient labeling (INCI names), responsible person registration, and Product Information File (PIF) are in place.

– Pharmaceuticals & Supplements: Subject to FDA (U.S.), EMA (EU), or MHRA (UK) regulations. Requires GMP compliance, accurate labeling, and batch traceability.

– Food & Beverages (e.g., flavorings): Must meet FDA 21 CFR (U.S.) or EU Food Information to Consumers Regulation (EU) No 1169/2011. May require GRAS (Generally Recognized As Safe) status for ingredients.

– Essential Oils & Chemicals: May fall under CLP (Classification, Labelling and Packaging) Regulation (EU) or OSHA HCS (U.S.). Requires SDS (Safety Data Sheet) and appropriate hazard labeling if applicable.

2. Labeling Requirements

– Mandatory Information:

– Product name

– Net quantity (50ml clearly stated)

– Name and address of manufacturer/distributor

– Batch number or lot code

– Expiry date or Period After Opening (PAO) symbol, if applicable

– Ingredient list (full disclosure as per region)

– Usage instructions and precautions

– Country of origin (required in some markets like U.S. and EU)

– Language: Labels must be in the official language(s) of the destination country.

– Barcode: Include a scannable GTIN (Global Trade Item Number), such as UPC (U.S.) or EAN-13 (EU).

3. Packaging Safety & Child Resistance

– If containing hazardous substances (e.g., certain pharmaceuticals or cleaning agents), child-resistant packaging may be required (e.g., U.S. Poison Prevention Packaging Act).

– For general consumer goods, tamper-evident seals are recommended.

H2: Shipping & Transportation

1. International Shipping Regulations

– Air Transport (IATA): 50ml bottles are generally permitted in carry-on luggage (under 100ml with 1L bag rule), but shipping via air freight may be restricted if contents are flammable, corrosive, or otherwise hazardous.

– Check IATA Dangerous Goods Regulations (DGR). Most non-hazardous liquids in 50ml containers are classified as “Not Restricted” for air transport.

– Ground & Sea (ADR/RID/IMDG): If classified as dangerous goods (e.g., alcohol-based perfumes), specific packaging, labeling, and documentation are required.

2. Packaging & Cushioning

– Use inner packaging (e.g., blister trays, cardboard dividers) to prevent movement.

– Secure bottles with bubble wrap, foam inserts, or molded pulp.

– Outer cartons should meet compression strength standards (ECT or Mullen) based on stack height and shipping method.

– Consider waterproof or moisture-resistant outer packaging for sea freight.

3. Temperature Control

– For temperature-sensitive products (e.g., serums, vaccines), use insulated packaging with gel packs or phase-change materials.

– Monitor with temperature data loggers if required by regulation.

H2: Import/Export Compliance

1. Customs Documentation

– Commercial Invoice: Include product description, HS code, value, origin, and buyer/seller details.

– Packing List: Itemize contents per shipment (e.g., 100 units x 50ml bottles per carton).

– Certificate of Origin: May be required for preferential tariffs under trade agreements.

– Import Permits: Required in some countries for pharmaceuticals, food, or cosmetics.

2. HS Code Classification

– Examples:

– Cosmetics: 3304.99 (EU), 3304.99.5000 (U.S.)

– Pharmaceuticals: 3004.90

– Essential Oils: 3301.29

– Food Flavorings: 2106.90

– Accurate HS codes ensure correct duty rates and avoid customs delays.

3. Country-Specific Requirements

– U.S.: FDA Prior Notice for food/cosmetics; EPA registration for disinfectants.

– EU: CPNP notification for cosmetics; EPR (Extended Producer Responsibility) fees for packaging.

– China: CFDA/NMPA approval for cosmetics and health products; GB labeling standards.

– Canada: Health Canada notification; bilingual (English/French) labeling.

H2: Sustainability & Environmental Compliance

1. Packaging Materials

– Use recyclable materials (e.g., PET, glass, aluminum).

– Avoid mixed materials that are hard to recycle.

– Label with appropriate recycling symbols (e.g., Resin Identification Code).

2. EPR & Packaging Waste Schemes

– Comply with national packaging waste regulations:

– EU: Member states require registration with packaging compliance schemes (e.g., FOST Plus in Belgium, EAR in Germany).

– UK: Producer Responsibility Obligations (Packaging Waste) Regulations.

– France/Spain/Italy: Must pay eco-contributions based on material type and weight.

3. Carbon Footprint & Eco-Labeling

– Consider carbon labeling or certifications like “Plastic Neutral” or “Recycled Content Verified.”

– Optimize packaging size to reduce material use and transport emissions.

H2: Best Practices Summary

- ✅ Label Accurately: Meet all regional requirements for language, content, and formatting.

- ✅ Classify Correctly: Determine product category and hazard status early.

- ✅ Use Certified Packaging: Ensure shipping containers meet ISTA or ASTM standards.

- ✅ Document Everything: Maintain SDS, certificates, and compliance records for audits.

- ✅ Partner with Experts: Use customs brokers, regulatory consultants, and 3PLs experienced in your product type.

By adhering to this logistics and compliance framework, businesses can ensure that their 50ml bottled products are safely and legally distributed across domestic and international markets.

Conclusion for Sourcing 50ml Bottle Size:

After a thorough evaluation of suppliers, materials, cost efficiency, and market demand, sourcing 50ml bottles is a strategic decision that aligns well with our product requirements and customer preferences. This size offers an optimal balance between portability, usability, and shelf appeal, making it ideal for target markets such as personal care, cosmetics, and premium liquids.

Available materials—such as glass and PET—provide flexibility in terms of durability, weight, and sustainability, allowing us to match packaging with brand values. Competitive pricing at scale, combined with widespread supplier availability, ensures reliable and cost-effective procurement.

Furthermore, the 50ml size complies with travel regulations and retail standards, enhancing customer convenience and market reach. In conclusion, sourcing 50ml bottles supports brand consistency, operational efficiency, and consumer satisfaction, making it a recommended and viable packaging solution.