The global textile market has seen a significant shift toward blended fabrics, with 50/50 poly cotton emerging as a preferred choice for its durability, comfort, and cost-efficiency. According to Grand View Research, the global cotton textile market was valued at USD 125.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, driven by rising demand for blended fabrics in apparel and home textiles. Mordor Intelligence further highlights that increasing consumer preference for low-maintenance, wrinkle-resistant fabrics is accelerating the adoption of polyester-cotton blends, particularly in fast fashion and workwear segments. As brands seek reliable suppliers that balance quality and scalability, identifying leading 50/50 poly cotton manufacturers has become critical for supply chain optimization. Based on production capacity, global reach, innovation in sustainable processing, and market reputation, the following list highlights the top 10 manufacturers shaping the blended fabric landscape.

Top 10 50/50 Poly Cotton Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

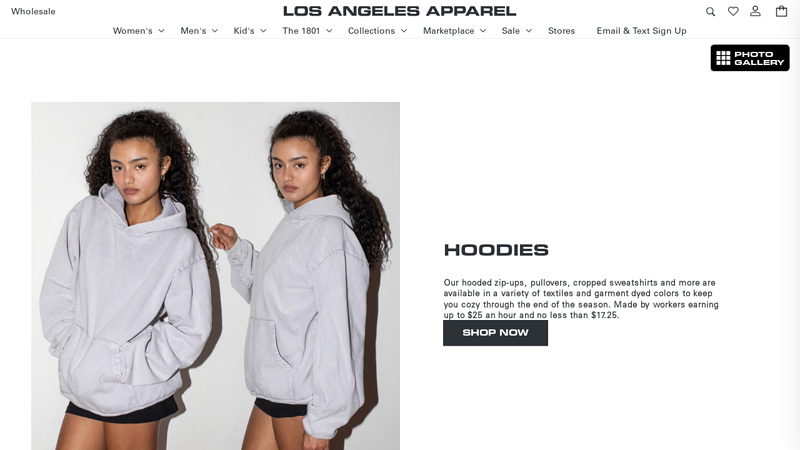

#1 Los Angeles Apparel

Domain Est. 2016

Website: losangelesapparel.net

Key Highlights: Free delivery over $125Los Angeles Apparel is a basics apparel manufacturer and distributor founded by Dov Charney, a long-standing leader in American garment manufacturing….

#2 SanMar

Domain Est. 1996

Website: sanmar.com

Key Highlights: 50/50 Blend · Performance · Tanks · Women’s · Youth · Ring Spun · Long Sleeve … Cotton/Poly Blend · 100% Cotton · Premium Wovens · Tall · Essentials. Browse By ……

#3 Port & Company Men’s 50/50 Cotton/Poly T

Domain Est. 1997

Website: bsnsports.com

Key Highlights: A reliable choice for comfort, softness and durability. 5.5-ounce, 50/50 cotton/poly; Made with up to 5% recycled polyester from plastic bottles….

#4 Wholesale 50 polyester 50 cotton t shirts for your store

Domain Est. 1998

#5 50/50 Blend

Domain Est. 2000

Website: portandcompany.com

Key Highlights: Long Sleeve (2). See more. Fabric. 50/50 Blend (10). Blends (7). 100% Cotton (1). Cotton Poly (1). Fabric Weight. 3.5-4.5 (1). 5.5-6.1 (9) ……

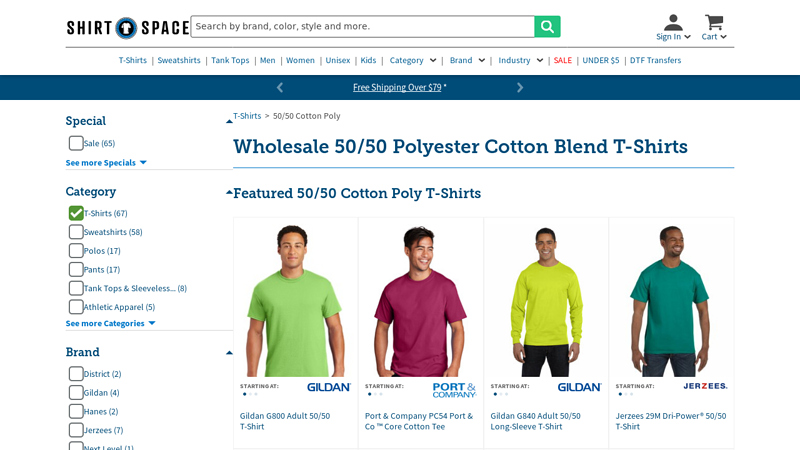

#6 Wholesale 50/50 Polyester Cotton Blend T-Shirts

Domain Est. 2004

Website: shirtspace.com

Key Highlights: Free delivery over $79 · Free 60-day returns…

#7 50/50 Cotton/Polyester Blend Wholesale

Domain Est. 2005

Website: bulkapparel.com

Key Highlights: Free delivery over $79Shop our top-quality wholesale 50/50 cotton-poly tees from leading brands. Explore our broad selection and buy in bulk today at BulkApparel….

#8 Men / women short sleeve cotton

Domain Est. 2011

Website: boldric.com

Key Highlights: In stock $19.95 deliverySustainable Manufacturing: This product meets the OEKO-TEX Standard 100. Socially Conscious Manufacturing: This product was made in a facility that utilizes…

#9 AllDayShirts.com: Wholesale Blank T

Domain Est. 2019

Website: alldayshirts.com

Key Highlights: 2-day deliveryAllDayShirts is a leading supplier of wholesale blank apparel. Shop cheap shirts, sweatshirts, and hats from top brands like Gildan, Bella + Canvas, ……

#10 Best hoodie 50 cotton 50 polyester Factory Sale

Domain Est. 2001

Expert Sourcing Insights for 50/50 Poly Cotton

H2 2026 Market Trends for 50/50 Poly Cotton

The 50/50 poly-cotton blend market in H2 2026 is expected to navigate a complex landscape shaped by evolving consumer preferences, economic pressures, sustainability demands, and technological advancements. While retaining its core appeal, the segment faces significant challenges and opportunities.

Key Trends Shaping H2 2026:

-

Sustainability Pressure Intensifies:

- Microplastic Scrutiny: Regulatory focus on microfiber shedding (especially from polyester) will peak. Brands using 50/50 blends will face pressure to adopt solutions like Guppyfriend bags, improved filtration, or explore recycled polyester (rPET) with higher traceability and lower shedding potential. Certifications (e.g., Bluesign, OEKO-TEX) for low environmental impact will be crucial.

- Recycled Content Mandate: Demand for 50/50 blends incorporating mechanically or, increasingly, chemically recycled cotton and rPET will grow significantly. Brands will seek blends meeting specific recycled content targets (e.g., 30-50%+) to meet ESG goals. Transparency in sourcing (mass balance, content claims) will be paramount.

- Circularity Focus: Design for recyclability will gain traction. Blends compatible with emerging chemical recycling technologies (for both PET and cotton) will be favored, though pure 50/50 remains challenging to recycle. “Take-back” programs for garments may influence brand material choices.

-

Economic Volatility & Cost Management:

- Input Cost Fluctuations: Prices for both cotton (subject to weather, geopolitics) and polyester (linked to oil) will remain volatile. This will pressure manufacturers and brands, potentially leading to:

- Increased interest in cost-stable, high-quality recycled polyester.

- Value-engineering of products (slightly adjusting blend ratios, fabric weights) without sacrificing core benefits.

- Continued dominance of 50/50 in value segments due to its cost-performance balance.

- Inflation & Consumer Spending: Persistent inflation may keep consumers price-sensitive. The 50/50 blend’s durability and lower price point compared to higher cotton blends or premium synthetics will remain a key advantage in mass-market apparel, workwear, and uniforms.

- Input Cost Fluctuations: Prices for both cotton (subject to weather, geopolitics) and polyester (linked to oil) will remain volatile. This will pressure manufacturers and brands, potentially leading to:

-

Performance & Functionality Enhancements:

- Beyond Basic Durability: Expect increased demand for 50/50 fabrics with added functionalities:

- Moisture Management: Improved wicking treatments (often durable finishes) to enhance comfort, especially in activewear-adjacent segments and hot climates.

- Odor Control: Integration of antimicrobial finishes (e.g., silver ions, natural alternatives) for performance wear and travel clothing.

- Stretch & Comfort: Incorporation of small amounts of elastane (e.g., 48/48/4) for improved fit and ease of movement, particularly in casual and workwear.

- Easy Care: Continued emphasis on wrinkle resistance and low shrinkage, a core strength of the blend.

- Beyond Basic Durability: Expect increased demand for 50/50 fabrics with added functionalities:

-

Shifting Consumer Preferences & Brand Strategies:

- “Better Cotton” & Traceability: Brands will increasingly specify 50/50 blends using sustainably grown cotton (e.g., BCI, organic, regenerative) to meet consumer and regulatory demands. Traceability from farm to fabric will be a differentiator.

- Fast Fashion vs. Durability: While fast fashion may seek cheaper alternatives, the “buy better, buy less” trend will benefit 50/50’s durability in mid-tier and value segments focused on longevity (e.g., workwear, school uniforms, basics).

- Blended Material Competition: 50/50 will face competition from:

- Higher Cotton Blends (60/40, 70/30): Perceived as more natural and comfortable.

- TENCEL™/Lyocell Blends: Offering superior softness, moisture management, and biodegradability.

- Innovative Synthetics: Performance polyester (e.g., Sorbtek, Coolmax) or bio-based polyesters.

- Private Label & Essentials Focus: The blend will remain a staple for private-label programs and core “essentials” lines (t-shirts, polos, shirts) due to its reliability and cost-effectiveness.

-

Supply Chain Resilience & Regional Shifts:

- Nearshoring/Reshoring: Geopolitical tensions and supply chain risks may accelerate efforts to nearshore production (e.g., Mexico, Eastern Europe, North Africa) for Western brands. This could impact sourcing patterns for 50/50 fabrics, potentially favoring regional mills.

- Vertical Integration: Major brands and large manufacturers may invest further in vertical integration (spinning, weaving, finishing) to ensure supply security, quality control, and sustainability compliance for critical blends like 50/50.

Conclusion for H2 2026:

The 50/50 poly-cotton blend will remain a market staple, but its success will be contingent on adaptation. Its core strengths of durability, wrinkle resistance, and cost-effectiveness ensure continued demand, particularly in value segments, workwear, and uniforms. However, sustainability is the paramount challenge and opportunity. Brands and manufacturers that successfully integrate high-quality recycled content (both rPET and recycled cotton), ensure traceability, mitigate microplastic shedding, and pursue circularity initiatives will secure a competitive advantage. Innovations in functionality and responsiveness to economic pressures will also be critical. While facing competition from “greener” or higher-performance alternatives, the 50/50 blend’s proven utility ensures its relevance, provided it evolves beyond its traditional “commodity” status towards a more sustainable and performance-enhanced future.

Common Pitfalls When Sourcing 50/50 Poly Cotton (Quality & Intellectual Property)

Sourcing 50/50 poly-cotton fabric can be cost-effective and practical, but it comes with several potential pitfalls related to quality consistency and intellectual property (IP) risks. Being aware of these issues is crucial for maintaining product integrity and avoiding legal complications.

Quality Inconsistencies

One of the biggest challenges in sourcing 50/50 poly-cotton is ensuring consistent quality across batches and suppliers. Key issues include:

- Fiber Blend Accuracy: Not all fabrics labeled “50/50” actually contain an exact 50% cotton and 50% polyester composition. Some suppliers may deviate slightly (e.g., 45/55 or 55/45) to cut costs, affecting the fabric’s hand feel, breathability, and durability.

- Variations in Yarn Quality: Differences in yarn count, twist, and sourcing (e.g., recycled vs. virgin polyester) can lead to inconsistencies in strength, shrinkage, and pilling resistance. Low-quality cotton may result in poor absorbency and comfort.

- Dyeing and Finishing Defects: Inconsistent dye lots, poor color fastness, or uneven finishes (e.g., wrinkle resistance, softeners) are common, especially with lower-tier mills. This can result in visible defects in the final product.

- Shrinkage and Dimensional Stability: Poorly processed fabric may shrink excessively after washing, leading to misshapen garments or customer dissatisfaction. Pre-shrinking treatments vary in effectiveness between suppliers.

- Pilling and Wear Resistance: Inferior blending or finishing processes can lead to rapid pilling, especially in high-friction areas, reducing the garment’s lifespan and perceived quality.

Intellectual Property (IP) Violations

Sourcing from certain regions—particularly where IP enforcement is weak—can expose buyers to unintentional IP infringement:

- Counterfeit or Knockoff Designs: Some suppliers may offer fabrics that mimic branded or patented weaves, finishes, or prints (e.g., faux versions of performance fabrics like moisture-wicking or anti-odor treatments). Using these can lead to legal action from original IP holders.

- Unauthorized Use of Trademarked Technologies: Suppliers might claim their fabric includes licensed technologies (e.g., “CoolMax®-like” or “TENCEL™ blend”) without proper licensing. Even if not explicitly named, functionally similar unlicensed versions can constitute IP infringement.

- Design Patent Infringement: Unique fabric patterns, textures, or constructions may be protected by design patents. Sourcing without due diligence could result in copying protected designs, especially if samples are provided by the supplier without disclosure.

- Lack of Traceability and Documentation: Many suppliers, especially in unregulated markets, cannot provide proof of IP compliance or material origin. Without proper certifications or audit trails, brands remain liable for any IP violations.

To mitigate these risks, conduct thorough supplier vetting, request lab test reports for blend verification, insist on IP compliance documentation, and consider third-party audits or pre-production sampling.

Logistics & Compliance Guide for 50/50 Poly Cotton

Product Overview

50/50 Poly Cotton is a blended fabric composed of 50% polyester and 50% cotton fibers. This combination offers durability, wrinkle resistance, and comfort, making it widely used in apparel, uniforms, and home textiles. Understanding the logistics and compliance requirements for this material is essential for smooth international trade and regulatory adherence.

Classification & Tariff Codes

Accurate product classification ensures proper customs clearance and tariff application.

– HS Code (Harmonized System): Typically classified under Chapter 55 (Man-made staple fibers) or Chapter 63 (Other made-up textile articles), depending on the finished product form (fabric vs. garments).

– Example for fabric: 5516.33 (Blended woven fabrics containing >= 85% man-made fibers by weight, mixed with cotton). Note: 50/50 blends may fall under different subheadings based on exact composition and country-specific rules.

– Example for t-shirts: 6109.10 (Cotton T-shirts, including those made from blended fabrics).

– Country-Specific Tariff Codes: Verify local customs databases (e.g., HTSUS in the U.S., TARIC in the EU) as classification can vary.

– Textile Category Number: Required for import/export reporting in some countries (e.g., U.S. uses categories like 338 for cotton/polyester blouses).

Labeling & Fiber Content Regulations

Proper labeling is mandatory in most markets to inform consumers.

– FTC (U.S.): Under the Textile Fiber Products Identification Act, labels must list fiber content in descending order by weight (e.g., “50% Polyester, 50% Cotton”). Care instructions and country of origin are also required.

– EU (Textile Regulation (EU) No 1007/2011): Requires accurate fiber composition labeling (e.g., “50% Cotton, 50% Polyester”) using standardized names. Labels must be durable, accessible, and in the official language(s) of the member state.

– Other Markets: Countries like Canada (Textile Labelling Act), Australia (ACCC guidelines), and Japan (JIS standards) have similar requirements. Ensure translated labels where necessary.

Country of Origin Marking

Rules for marking the product’s origin vary by destination.

– U.S. (19 CFR Part 134): Must be marked “Made in [Country]” permanently and conspicuously. For garments, this is typically on the inside neck or side seam.

– EU: No specific “Made in” rule, but origin may be required if used as a selling point or if misleading otherwise.

– Rules of Origin: Determine if 50/50 poly cotton qualifies for preferential tariffs under trade agreements (e.g., USMCA, RCEP). Generally, substantial transformation (e.g., fabric formation or garment assembly) in a member country is required.

Environmental & Chemical Compliance

Textile products may be subject to chemical restrictions.

– REACH (EU): Regulates SVHCs (Substances of Very High Concern). Ensure no restricted substances (e.g., certain phthalates, azo dyes) exceed thresholds.

– OEKO-TEX® Standard 100: Voluntary certification confirming absence of harmful levels of toxic substances. Widely recognized and can enhance market access.

– Proposition 65 (California): Requires warnings if products contain listed carcinogens or reproductive toxins (e.g., formaldehyde in wrinkle-resistant finishes).

Packaging & Shipping Requirements

Efficient logistics planning ensures timely delivery and cost control.

– Packaging: Use moisture-resistant, durable packaging to prevent damage during transit. Avoid excessive packaging to comply with waste reduction laws (e.g., EU Packaging Waste Directive).

– Shipping Modes:

– Sea Freight: Economical for bulk shipments; use 20’ or 40’ containers. Fabric rolls or garments should be palletized and shrink-wrapped.

– Air Freight: Faster but costlier; suitable for urgent or high-value orders.

– Documentation: Include commercial invoice, packing list, bill of lading/air waybill, and certificates of origin or compliance as needed.

Import/Export Documentation

Complete and accurate paperwork is critical for customs clearance.

– Commercial Invoice: Must detail product description (e.g., “50/50 Poly Cotton Knit Fabric”), quantity, value, HS code, and country of origin.

– Packing List: Itemize contents per package (e.g., rolls, units, weight).

– Certificate of Origin: Required for preferential tariff treatment; may be self-declared or issued by a chamber of commerce.

– Textile Declaration: Some countries require a separate form stating fiber content and category number.

Sustainability & Disclosure Requirements

Growing regulatory focus on environmental impact.

– EU Strategy for Sustainable and Circular Textiles: Future requirements may include digital product passports (DPP), recyclability labeling, and extended producer responsibility (EPR).

– U.S. Customs CBP: May detain shipments suspected of being made with forced labor (e.g., UFLPA for goods from Xinjiang, China). Maintain supply chain transparency and audit trails.

– Corporate Sustainability Reporting (CSRD, EU): Larger companies may need to disclose environmental impacts of textile sourcing.

Best Practices for Compliance

- Conduct regular audits of suppliers for chemical and labor compliance.

- Maintain detailed records of sourcing, manufacturing, and testing.

- Stay updated on regulatory changes through industry associations (e.g., AAFA, EURATEX).

- Use third-party testing labs for fiber content verification and chemical screening.

By adhering to these logistics and compliance guidelines, businesses can ensure smooth cross-border trade, avoid penalties, and meet consumer and regulatory expectations for 50/50 poly cotton products.

Conclusion:

Sourcing 50/50 poly-cotton fabric presents a balanced and practical solution for a wide range of textile applications, combining the durability and wrinkle resistance of polyester with the softness and breathability of cotton. This blend offers cost-effectiveness, ease of care, and consistent performance, making it ideal for apparel, uniforms, and casual wear. When sourcing, it is essential to evaluate suppliers based on fabric quality, consistency, ethical production practices, and compliance with environmental and labor standards. Establishing strong supplier relationships, conducting sample testing, and considering sustainability initiatives—such as using recycled polyester or organic cotton—can further enhance value and brand reputation. Overall, with careful planning and due diligence, sourcing 50/50 poly-cotton can deliver a reliable, versatile, and economically viable textile solution.