The global copper tubing market continues to expand, driven by rising demand in HVAC, plumbing, and refrigeration industries. According to Grand View Research, the global copper tubes market was valued at USD 58.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by increasing construction activities, especially in emerging economies, as well as the growing adoption of energy-efficient systems that rely heavily on high-performance copper tubing. Additionally, Mordor Intelligence forecasts steady market expansion, citing technological advancements and the metal’s superior thermal conductivity and corrosion resistance as key demand drivers. As industry demand rises, selecting reliable manufacturers becomes critical for quality and supply chain efficiency. Based on production capacity, global reach, innovation, and market presence, the following eight companies have emerged as leading copper tubing manufacturers shaping the future of the industry.

Top 8 5 8 Copper Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cerro Flow Products

Domain Est. 1996

Website: cerro.com

Key Highlights: Welcome to Cerro Flow Products LLC®. We manufacture world-class copper tube and supply fittings for the Plumbing, HVAC/Refrigeration, and Industrial markets.Missing: 5 8…

#2 Luvata

Domain Est. 2005

Website: luvata.com

Key Highlights: Luvata brings together people, innovation and technology to make the most of copper, specializing in technically demanding copper products….

#3 Great Lakes Copper Ltd.

Domain Est. 2010

Website: glcopper.com

Key Highlights: Great Lakes Copper Ltd serves the plumbing, refrigeration, OEM, medical, air conditioning and specialty markets with a wide range of products….

#4 Copper Tube Product

Domain Est. 1996

Website: unitedpipe.com

Key Highlights: We have a full line of copper tube and copper coils for plumbing, heating, air-conditioning, water works, refrigeration, medical, gas and other applications….

#5 5/8″ OD x 50′ Roll Tube Copper

Domain Est. 1997

Website: bakerdist.com

Key Highlights: Copper Tube – 5/8″ OD x 50′ Roll Tube Copper … Nearby stores: Contact your Baker Representative for product availability and current pricing….

#6 Mueller Industries D 10050 5/8 Inch Copper Refrigeration Tubing

Domain Est. 1997

Website: mecampbell.com

Key Highlights: 5/8 Inch Copper Refrigeration Tubing. Tubing; Applicable Standard UL; Outside Diameter 5/8 Inch; Wall Thickness 0.035 Inch; Length 50 FT; Material Copper….

#7 127058: 5/8 OD (1/2 Copper)

Domain Est. 1999

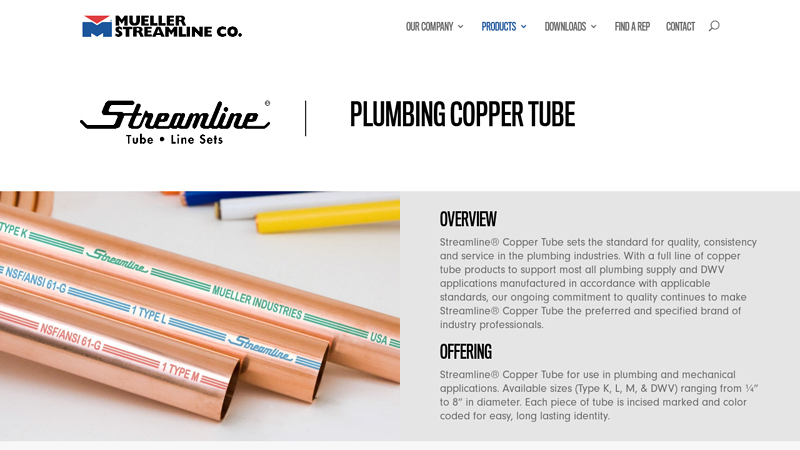

#8 Plumbing Copper Tube

Domain Est. 2013

Website: muellerstreamline.com

Key Highlights: Streamline® Copper Tube for use in plumbing and mechanical applications. Available sizes (Type K, L, M, & DWV) ranging from ¼” to 8” in diameter. Each piece ……

Expert Sourcing Insights for 5 8 Copper Tubing

H2: Projected 2026 Market Trends for 5/8″ Copper Tubing

The market for 5/8-inch copper tubing in 2026 is expected to be shaped by a confluence of macroeconomic, regulatory, and technological factors. As a standard diameter used extensively in residential and commercial HVAC (heating, ventilation, and air conditioning) and plumbing systems, 5/8″ copper tubing remains a critical component in construction and infrastructure. Below is an analysis of key trends expected to influence its market dynamics through 2026.

1. Steady Demand in HVAC and Refrigeration Sectors

The HVAC industry continues to be the largest consumer of 5/8″ copper tubing, particularly in air conditioning units and heat pumps. With global emphasis on energy efficiency and the transition to low-global-warming-potential (GWP) refrigerants, manufacturers are redesigning systems that maintain or increase the use of copper for its thermal conductivity and durability. The growing adoption of heat pumps—driven by decarbonization policies in North America, Europe, and parts of Asia—will sustain demand for 5/8″ tubing in refrigerant lines.

2. Impact of Construction Activity and Housing Markets

New residential construction and renovation activity directly influence copper tubing demand. In 2026, markets such as the United States, Canada, and parts of Southeast Asia are projected to see moderate growth in housing starts, supporting steady demand. However, high copper prices and supply chain volatility may prompt some builders to consider alternative materials like PEX in plumbing, though HVAC applications remain largely copper-dependent due to performance requirements.

3. Volatility in Copper Pricing and Supply Chain Resilience

Copper prices are expected to remain volatile in 2026 due to constrained mining output, geopolitical risks in key producing regions (e.g., Chile, Peru), and increasing competition from electrification projects (e.g., EVs, renewable energy infrastructure). This price uncertainty may lead to just-in-time inventory strategies among distributors and increased interest in copper recycling. Recycled copper is expected to supply over 35% of total copper demand by 2026, helping stabilize supply for tubing production.

4. Regulatory and Environmental Pressures

Environmental regulations are pushing for reduced lead content and increased recyclability in building materials. While copper tubing is inherently recyclable and lead-free, standards such as NSF/ANSI 61 continue to reinforce its preference in potable water systems. Additionally, green building certifications (e.g., LEED, BREEAM) favor materials with low environmental impact over their lifecycle, benefiting copper’s long-term use case despite higher initial costs.

5. Competition from Alternative Materials

Although copper remains dominant in HVAC applications, alternative materials like aluminum and PEX (cross-linked polyethylene) are gaining traction in specific plumbing segments due to lower cost and easier installation. However, 5/8″ copper tubing retains advantages in high-temperature, high-pressure, and ultraviolet (UV)-exposed environments. Innovations such as coated copper for corrosion resistance may further entrench its position in aggressive water chemistry regions.

Conclusion

The 5/8″ copper tubing market in 2026 is poised for stable, if not high-growth, demand, anchored by its irreplaceable role in HVAC systems and resilient performance in plumbing. While cost and material substitution pose challenges, copper’s superior thermal properties, longevity, and recyclability support its continued relevance. Stakeholders should monitor copper commodity trends, regional construction cycles, and evolving energy efficiency standards to optimize market positioning.

Common Pitfalls When Sourcing 5/8-inch Copper Tubing (Quality, IP)

Sourcing 5/8-inch copper tubing—especially for instrumentation and process (IP) applications—requires careful attention to detail. Overlooking key factors can lead to system failures, safety hazards, and costly downtime. Below are the most common pitfalls to avoid:

Quality-Related Pitfalls

1. Confusing Tube with Pipe Dimensions

A frequent error is assuming nominal pipe sizes apply to tubing. Unlike pipe, copper tubing dimensions (like 5/8″) refer to the actual outside diameter (OD). Using pipe-sized fittings or misinterpreting specifications can result in improper connections, leaks, and system incompatibility.

2. Selecting Incorrect Material Grade

Using non-instrumentation-grade copper (e.g., Type K, L, or M plumbing tube) in sensitive IP systems risks contamination and reduced performance. For instrumentation, ASTM B88 Type A or ASTM B280 tubing is preferred due to tighter dimensional tolerances, cleaner interiors, and better consistency.

3. Ignoring Surface and Internal Cleanliness

Contaminants such as oils, oxides, or moisture inside tubing can compromise sensitive instrumentation and process systems. Failing to specify tubing with “clean and dry” or “degreased” certification can lead to sensor fouling, blockages, or corrosion, especially in high-purity or pneumatic applications.

4. Overlooking Wall Thickness and Pressure Ratings

Not verifying the required wall thickness (e.g., 0.049″ for standard 5/8″ tube) can result in tubing that cannot withstand system pressure. Always confirm compatibility with operating pressure and temperature, particularly in high-pressure instrumentation loops.

IP (Instrumentation & Process) Specific Pitfalls

5. Using Incompatible Fittings or Connection Methods

Instrumentation systems typically require flare, compression, or VCR fittings. Using standard plumbing fittings or improper installation techniques can cause micro-leaks or vibration failures. Ensure tubing is compatible with the specified fitting system (e.g., 37° flare per SAE J514).

6. Failing to Specify Required Certifications

In regulated or high-reliability industries (pharmaceuticals, semiconductor, oil & gas), tubing may require mill test reports (MTRs), ASTM compliance documentation, or traceability. Omitting these requirements can lead to rejection during audits or commissioning.

7. Neglecting Environmental and Corrosion Resistance

Copper is susceptible to corrosion in certain environments (e.g., ammonia, high-chloride, or acidic conditions). Failing to assess the operating environment may result in premature degradation. Consider alternative materials (e.g., stainless steel) if conditions warrant.

8. Poor Supply Chain and Lead Time Planning

5/8-inch copper tubing in instrumentation grades may not be stocked by general suppliers. Relying on non-specialized vendors can result in long lead times or substitution with inferior products. Source from reputable industrial or instrumentation supply chains with proven quality control.

By addressing these pitfalls during procurement, you ensure the reliability, safety, and longevity of your instrumentation and process systems. Always specify exact material standards, cleanliness requirements, and certifications to meet IP application demands.

Logistics & Compliance Guide for 5/8″ Copper Tubing

Overview

5/8″ copper tubing is a commonly used component in plumbing, HVAC (Heating, Ventilation, and Air Conditioning), refrigeration, and industrial applications. Due to its widespread use, proper logistics handling and adherence to compliance standards are essential to ensure product integrity, safety, and regulatory conformity throughout the supply chain.

1. Product Specifications and Identification

- Nominal Size: 5/8 inch (0.625″)

- Common Types: Type K, Type L, Type M (differing wall thicknesses)

- Standards: ASTM B88 (Standard Specification for Seamless Copper Water Tube), ASTM B280 (for AC&R applications)

- Common Alloys: C12200 (DHP – Deoxidized High Phosphorus Copper)

- Temper: Typically supplied in R290 (annealed/soft) or H55 (half-hard) conditions

- Packaging: Coiled (soft temper) or straight lengths (10 ft, 20 ft), bundled with protective end caps

2. Storage and Handling

Storage Conditions

- Environment: Dry, indoor, temperature-controlled area to prevent moisture exposure and condensation.

- Racking: Store on flat, level racks to prevent bending or kinking; avoid stacking heavy materials on top.

- Humidity Control: Maintain relative humidity below 60% to minimize oxidation and corrosion.

- Separation: Keep away from corrosive chemicals, acids, ammonia, and sulfur-containing materials.

Handling Precautions

- End Protection: Use plastic or rubber end caps to prevent contamination and damage to tube interiors.

- Lifting: Use soft slings or padded forklift attachments; avoid direct metal-to-copper contact.

- Coil Handling: Use proper coil cradles; do not drag coils across surfaces.

- Labeling: Ensure clear identification of alloy type, size, temper, and compliance certifications.

3. Transportation

Domestic (U.S.) Transport

- Mode: Truck (flatbed, dry van), rail

- Securing Loads: Use straps with edge protectors to prevent crushing or scuffing; avoid over-tightening.

- Weather Protection: Cover loads with waterproof tarps if transported on open trailers.

- Documentation: Bill of Lading (BOL), packing list, and material certifications must accompany shipment.

International Transport

- Containerization: Use dry, ventilated containers; avoid mixed loads with moisture-emitting goods.

- Export Compliance: Comply with U.S. Department of Commerce (BIS) regulations; copper is generally not ITAR-controlled but may require ECCN classification.

- Customs Documentation: Provide commercial invoice, packing list, and Certificate of Origin (e.g., NAFTA/USMCA if applicable).

- HS Code: 7411.10.0000 (Copper pipes and tubes, seamless) – verify with local customs.

4. Regulatory and Compliance Requirements

Environmental & Safety Regulations

- REACH (EU): Ensure compliance with SVHC (Substances of Very High Concern) declarations; copper itself is not restricted but check for any coatings or lubricants.

- RoHS (EU): Not typically applicable to raw copper tubing, but verify if used in electrical/electronic assemblies.

- OSHA (U.S.): Follow safe handling practices to prevent inhalation of copper dust during cutting or brazing; provide proper PPE.

- TSCA (U.S.): Copper is listed under TSCA; no significant restrictions but maintain SDS (Safety Data Sheet).

Industry Standards

- ASTM B88: Mandatory for water distribution applications.

- ASME B31.9: Building Services Piping – governs installation in commercial buildings.

- ASHRAE Standards: Relevant for HVAC/R applications (e.g., refrigerant line sets).

- Local Plumbing Codes: Compliance with IPC (International Plumbing Code) or UPC (Uniform Plumbing Code) required for installation.

Certifications & Traceability

- Mill Test Reports (MTRs): Required for most industrial and construction projects; include chemical composition and mechanical properties.

- Traceability: Tubes should be marked with manufacturer, alloy, size, ASTM standard, and lot number.

- Certifications: Look for ISO 9001 (quality management) and NIST-traceable test results where applicable.

5. Import/Export Considerations

- Tariffs: Subject to standard import duties; check current HTS rates based on destination country.

- Anti-Dumping/Countervailing Duties: Monitor for any trade actions on copper products from specific countries.

- Sanctions: Screen end users and destinations against OFAC and other sanction lists.

6. Sustainability & Recycling

- Recyclability: Copper is 100% recyclable; encourage return of scrap or offcuts.

- Environmental Impact: Promote use of recycled-content copper where available (up to 85% post-consumer content possible).

- Waste Management: Follow EPA guidelines for disposal of contaminated tubing or cutting oils.

Conclusion

Proper logistics and compliance management for 5/8″ copper tubing ensures product performance, regulatory compliance, and operational safety. Adherence to ASTM standards, safe handling procedures, and accurate documentation throughout the supply chain minimizes risk and supports sustainable practices. Always consult local, national, and international regulations based on the final application and destination.

In conclusion, sourcing 5/8-inch copper tubing requires careful consideration of factors such as intended application (e.g., plumbing, HVAC, refrigeration), required length, type of copper (Type K, L, or M), and compliance with local building codes and industry standards. It is essential to evaluate suppliers based on reliability, pricing, availability, and delivery timelines. Purchasing from reputable suppliers or distributors ensures material quality and proper certification. Additionally, comparing both local and online vendors may lead to cost savings and faster lead times. By thoroughly assessing these elements, one can efficiently source high-quality 5/8-inch copper tubing that meets project specifications and performance requirements.