The global wood veneer market is experiencing steady expansion, driven by rising demand in furniture, cabinetry, and architectural woodworking. According to Grand View Research, the global engineered wood market—of which veneer sheets are a key component—was valued at USD 163.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is largely fueled by increased construction activity, sustainability initiatives, and the aesthetic appeal of real wood finishes at competitive prices. As 4×8-foot wood veneer sheets have become a standard size for industrial and custom applications, manufacturers capable of delivering consistent quality, broad species variety, and scalable production are gaining prominence. In this evolving landscape, identifying the top performers in veneer manufacturing is essential for sourcing partners, designers, and fabricators aiming to balance cost, quality, and supply chain resilience.

Top 9 4X8 Wood Veneer Sheets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GL Veneer: Wood Veneer Sheets

Domain Est. 1999

Website: glveneer.com

Key Highlights: GL Veneer is a leading manufacturer of wood veneer sheets, architectural plywood, wood panel and live edge slabs in the United States….

#2 Precision Veneer

Domain Est. 2003

Website: precisionveneer.com

Key Highlights: Precison Veneer is one of North America’s leading manufacturers of wood veneer sheets and panels. We produce quality veneer for the most challenging ……

#3 Wood Veneer

Domain Est. 1997

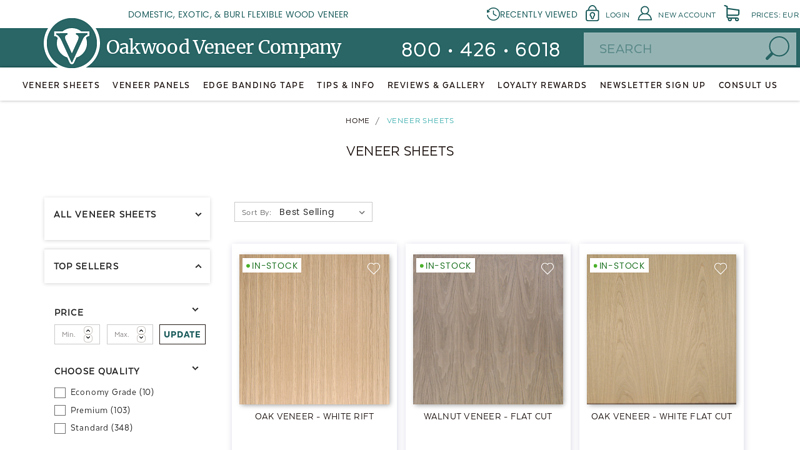

#4 Wood Veneer Sheets

Domain Est. 1998

Website: oakwoodveneer.com

Key Highlights: 1–3 day delivery 60-day returnsBrowse 300+ species of real wood veneer sheets. Better than standard hardwood plywood for custom projects. Available in 4×8 oak, walnut, and more….

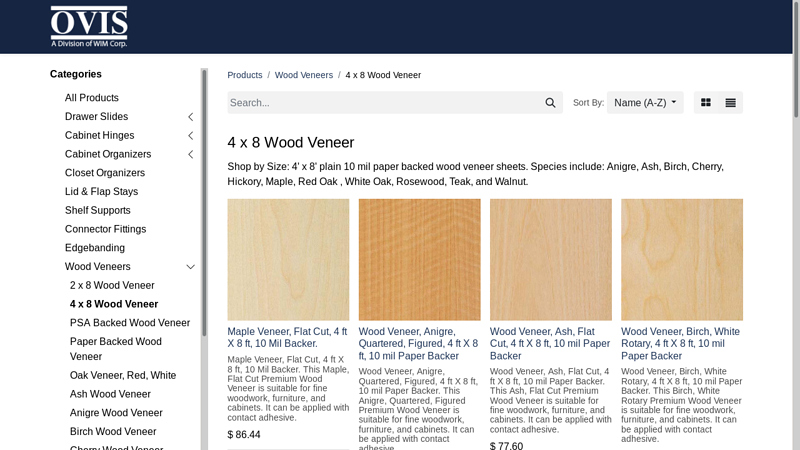

#5 4×8 Wood Veneer Sheets

Domain Est. 1999

Website: ovisonline.com

Key Highlights: 2–3 day delivery 30-day returnsShop by Size: 4′ x 8′ plain 10 mil paper backed wood veneer sheets. Species include: Anigre, Ash, Birch, Cherry, Hickory, Maple, Red Oak , White Oak,…

#6 Hardwoods Specialty Products

Domain Est. 1999

Website: hardwoods-inc.com

Key Highlights: Our world-class products include highly engineered wood, synthetics, prefinished wood panels. High gloss and matte panels, decorative veneers, solid surfaces, ……

#7 Supporting Woodworkers for 22 Years!

Domain Est. 2003

Website: veneersupplies.com

Key Highlights: We make veneering easy and affordable with 280000 square feet of high-end burl, quilted, curly and birds eye exotic wood veneer sheets in stock and ready to ……

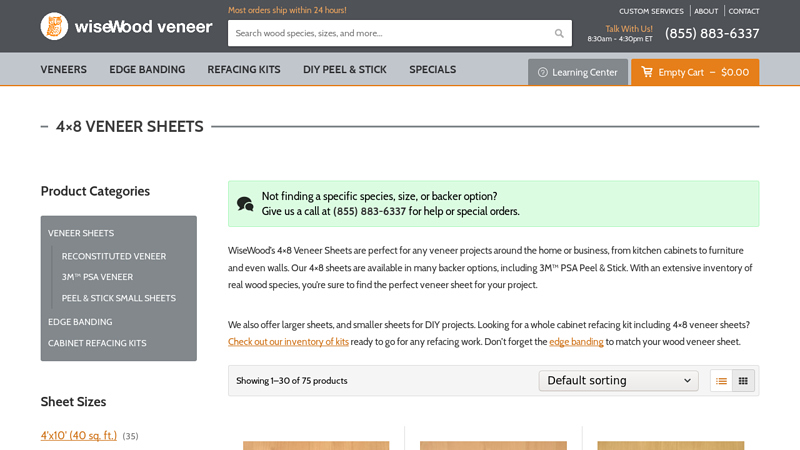

#8 4×8 Veneer Sheets

Domain Est. 2011

#9 Veneers Sheets

Domain Est. 2011

Website: wurthlac.com

Key Highlights: 3–7 day delivery 30-day returnsVeneer Sheets include options such as 48″ x 96″ Walnut veneer or 0.025″ thick Maple, designed for cabinetry and offering warp resistance….

Expert Sourcing Insights for 4X8 Wood Veneer Sheets

H2: 2026 Market Trends for 4X8 Wood Veneer Sheets

The global market for 4X8 wood veneer sheets is poised for steady growth and transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability demands. Here are the key trends shaping the 4X8 wood veneer sheet market in 2026:

-

Rising Demand in Furniture and Interior Design

The furniture and interior design sectors remain the largest consumers of 4X8 wood veneer sheets. With an increasing emphasis on aesthetic appeal and natural textures in residential and commercial spaces, designers are favoring veneers as a cost-effective and visually appealing alternative to solid wood. Urbanization and growth in the luxury housing and hospitality industries—especially in Asia-Pacific and North America—are amplifying demand. -

Sustainability and Eco-Friendly Materials

Environmental consciousness is reshaping material choices across industries. In 2026, manufacturers and consumers alike are prioritizing sustainably sourced wood veneers certified by bodies such as FSC (Forest Stewardship Council) or PEFC. The shift toward green building standards (e.g., LEED, BREEAM) is encouraging the use of veneers due to their efficient use of raw wood and lower environmental impact compared to solid timber. -

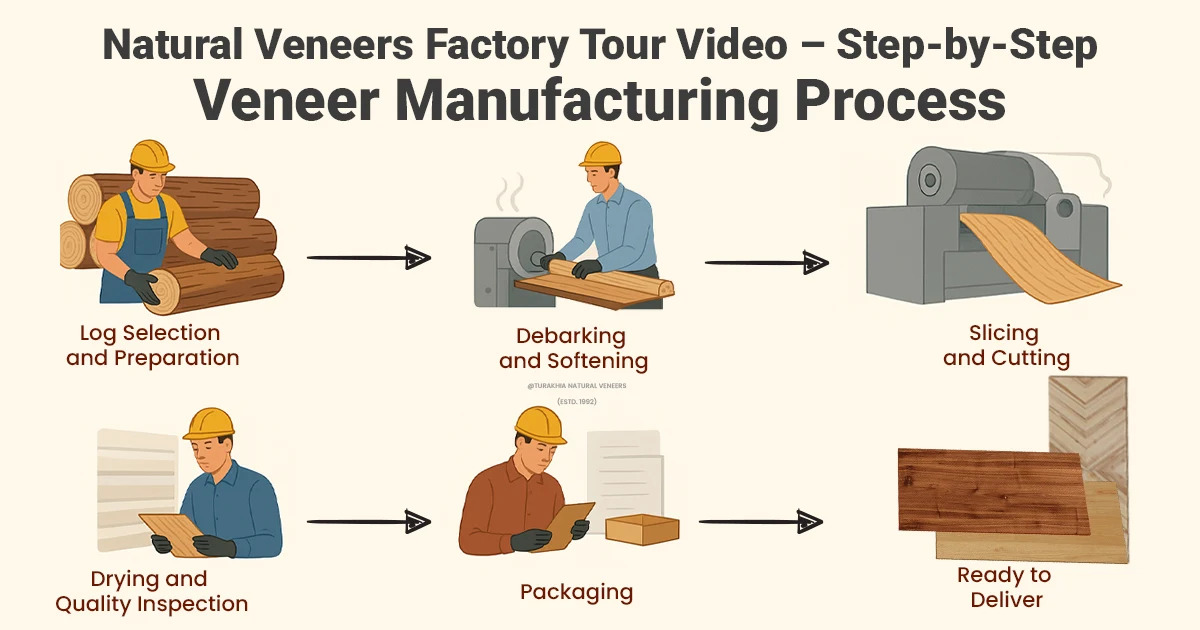

Technological Advancements in Veneer Production

Innovations in slicing, rotary cutting, and adhesive technologies are enhancing the quality, consistency, and durability of 4X8 wood veneer sheets. Digital printing and embossing techniques are enabling custom wood grain patterns and exotic finishes on veneers, expanding design possibilities. Automation in manufacturing is also reducing production costs and improving scalability. -

Growth in Engineered Wood and Composite Panels

The integration of wood veneers with substrates like MDF, plywood, and particleboard continues to grow. These engineered solutions offer stability, reduced warping, and improved performance in varying climates—making them ideal for cabinetry, wall paneling, and doors. The popularity of ready-to-assemble (RTA) furniture further supports veneer demand. -

Regional Market Dynamics

- North America and Europe: Mature markets with steady demand driven by renovation projects and high-end architectural interiors. Emphasis on reclaimed and exotic wood veneers persists.

- Asia-Pacific: Fastest-growing region due to rapid urbanization, rising disposable incomes, and expanding construction activities in countries like China, India, and Vietnam.

-

Latin America and Africa: Emerging markets with increasing interest in modern design and imported veneer products, though infrastructure and supply chain challenges remain.

-

Impact of Supply Chain and Raw Material Availability

Fluctuations in hardwood supply, trade policies, and transportation costs are influencing pricing and availability. In response, manufacturers are diversifying sourcing strategies and investing in plantation forests to ensure long-term supply stability. -

E-Commerce and Digital Showrooms

Online platforms are transforming how veneers are marketed and sold. Virtual sample libraries, augmented reality (AR) tools, and B2B e-commerce portals allow designers and contractors to visualize and order 4X8 veneer sheets remotely—accelerating procurement and reducing lead times.

In conclusion, the 4X8 wood veneer sheet market in 2026 will be defined by innovation, sustainability, and expanding global reach. As construction and design industries embrace both aesthetics and environmental responsibility, wood veneers are well-positioned to maintain their relevance and growth trajectory.

Common Pitfalls When Sourcing 4×8 Wood Veneer Sheets: Quality and Intellectual Property Issues

Sourcing 4×8 wood veneer sheets can be a cost-effective way to achieve a high-end wood appearance, but buyers often encounter significant challenges related to quality inconsistencies and intellectual property concerns. Being aware of these pitfalls helps ensure a successful procurement process.

Inconsistent Veneer Quality and Appearance

One of the most frequent issues when sourcing large-format veneer sheets is variability in quality and visual characteristics. Natural wood veneer is subject to grain pattern, color tone, and structural variations due to the organic nature of wood. Buyers may receive sheets from different logs or batches that don’t match in color or grain, leading to visible inconsistencies once installed. This is especially problematic in large installations where seamless appearance is expected. Additionally, defects such as splits, checks, insect damage, or mineral streaks might not be disclosed, affecting both aesthetics and usability.

Poor Backing Material and Adhesion Issues

The backing material (often paper, phenolic, or wood core) plays a crucial role in the veneer’s durability and application. Low-quality backing can lead to warping, bubbling, or delamination after installation, especially in environments with fluctuating humidity. Some suppliers use substandard adhesives or uneven lamination processes, which compromise the veneer’s integrity. This becomes a significant problem in cabinetry, wall paneling, or furniture, where long-term performance is expected.

Misrepresentation of Veneer Thickness and Grade

Suppliers may advertise veneer sheets using ambiguous or misleading thickness standards. For example, “standard cut” or “commercial grade” can vary significantly between vendors. Some may sell thinner-than-advertised veneers (e.g., less than 1/42” or 0.6mm), which are more prone to sanding through during fabrication. Additionally, grading systems (such as AA, A, B, C) are not universally standardized, increasing the risk of receiving lower-grade material than expected.

Intellectual Property Violations in Specialty Veneers

When sourcing exotic, rare, or designer-patterned veneers (e.g., book-matched, rotary-cut, or digitally printed wood looks), there is a risk of intellectual property (IP) infringement. Some suppliers may replicate patented or trademarked veneer patterns, especially in digitally enhanced or engineered veneers. Using such materials in commercial projects can expose designers, fabricators, or end clients to legal liability. Always verify that the supplier has proper licensing for proprietary veneer designs or finishes.

Lack of Traceability and Sustainable Sourcing Claims

Many suppliers claim their veneers are “sustainably sourced” or FSC-certified, but without proper documentation or chain-of-custody certification, these claims may be misleading. Sourcing from regions with lax forestry regulations increases the risk of illegal logging or deforestation. Using non-compliant materials can lead to reputational damage, project delays, or disqualification from green building certifications like LEED.

Inadequate Technical Support and Sample Accuracy

Suppliers may provide small samples that do not accurately represent the full sheet in color, grain, or texture. Without access to full sheets or digital mockups, buyers risk ordering large quantities that don’t meet project expectations. Additionally, lack of technical guidance on finishing, sanding, or substrate compatibility can result in installation failures or unsatisfactory end results.

Hidden Costs and Minimum Order Constraints

While 4×8 sheets may appear competitively priced, additional costs for shipping, customs (for imported veneers), or special handling (due to fragility) can significantly increase the total expense. Some suppliers impose high minimum order quantities or charge premium fees for custom cuts or packaging, reducing flexibility for smaller projects.

Avoiding these pitfalls requires due diligence: request full-sheet samples, verify certifications, review supplier reputations, and clarify IP rights—especially for high-design or commercial applications.

Logistics & Compliance Guide for 4×8 Wood Veneer Sheets

Product Overview

4×8 wood veneer sheets are thin slices of wood typically bonded to substrates like plywood or MDF. Due to their large surface area, lightweight nature, and organic material composition, special attention is required during handling, transport, and customs clearance.

Packaging Requirements

- Protective Wrapping: Each sheet must be wrapped in kraft paper or moisture-resistant film to prevent scratches, moisture damage, and edge chipping.

- Edge Protection: Use cardboard or plastic edge protectors on all four sides to minimize damage during stacking and handling.

- Palletization: Sheets should be stacked evenly on standard 48″x40″ pallets. Secure with stretch wrap or strapping to prevent shifting.

- Labeling: Clearly label each bundle with product details, batch number, species, dimensions (4’x8’), and handling instructions (e.g., “This Side Up”, “Protect from Moisture”).

Handling & Storage

- Flat Storage: Always store sheets flat to prevent warping or curling. Avoid leaning against walls.

- Climate Control: Store in a dry, temperature-controlled environment (ideally 35–50% humidity, 60–80°F). Excess moisture can cause swelling; dryness may lead to cracking.

- Ventilation: Allow airflow between stacks to reduce moisture buildup. Do not place directly on concrete floors—use pallets or spacers.

- Handling Tools: Use suction lifters or panel carts to move sheets. Avoid dragging or bending.

Transportation Guidelines

- Domestic (US/Canada):

- Secure loads with straps or cargo nets to prevent shifting.

- Use enclosed trailers to protect from weather and debris.

- Stack no higher than 60 inches on pallets for stability.

- International Shipping:

- Use ISPM 15-compliant wooden pallets (heat-treated and stamped).

- Consider containerized shipping with desiccant packs to control humidity.

- Provide detailed packing list and commercial invoice.

Regulatory Compliance

- Lacey Act (USA):

- Ensure veneer is sourced from legal and sustainable forests.

- Maintain documentation of species, country of harvest, and supplier chain of custody.

- Declare accurate species name (e.g., Quercus alba for White Oak) on import forms.

- CITES (if applicable):

- Check if the wood species is listed (e.g., certain rosewoods). Permits may be required.

- EPA & Formaldehyde Regulations (TSCA Title VI):

- If veneer is pre-laminated to composite panels, ensure compliance with formaldehyde emission standards.

- Customs Documentation:

- Provide HS Code (typically 4408.31 or 4408.39 for wood veneer).

- Include commercial invoice, packing list, bill of lading, and certificate of origin.

Import/Export Considerations

- Country-Specific Rules: Verify destination country regulations (e.g., EU Timber Regulation, Australia’s Biosecurity Act).

- Phytosanitary Certificates: May be required to prove freedom from pests and diseases, especially for raw veneer.

- Duties & Tariffs: Research applicable tariffs based on species, processing level, and trade agreements.

Best Practices Summary

- Use proper packaging and handling to maintain veneer integrity.

- Comply with environmental and trade laws (Lacey Act, CITES, TSCA).

- Maintain detailed sourcing and shipping documentation.

- Store under controlled conditions to prevent defects.

- Partner with experienced freight forwarders familiar with wood products.

Adhering to this guide ensures efficient logistics and full regulatory compliance for the shipment and use of 4×8 wood veneer sheets globally.

In conclusion, sourcing 4×8 wood veneer sheets requires careful consideration of several key factors to ensure quality, consistency, and value. It is essential to evaluate the type of wood species, veneer cut, grade, and substrate depending on the intended application—whether for cabinetry, furniture, or architectural paneling. Sourcing from reputable suppliers who provide consistent thickness, glue compatibility, and sustainable sourcing practices can significantly impact the success of your project. Additionally, comparing pricing, lead times, and minimum order requirements will help balance cost efficiency with availability. By conducting thorough research and possibly ordering samples beforehand, buyers can make informed decisions that align with both aesthetic goals and functional requirements. Ultimately, reliable sourcing of 4×8 wood veneer sheets ensures a high-quality finish and smooth fabrication process, contributing to a professional and durable end product.