The global hard disk drive (HDD) market continues to evolve in response to rising data storage demands from cloud computing, enterprise data centers, and surveillance systems. According to Mordor Intelligence, the HDD market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, driven largely by increasing need for high-capacity storage solutions. As data generation accelerates—especially with the proliferation of AI, 4K/8K video, and IoT—the demand for high-density drives, including 40TB models, is gaining momentum. While 30TB+ HDDs are still emerging, manufacturers are pushing the boundaries of areal density through technologies like Heat-Assisted Magnetic Recording (HAMR) and Multi-Actuator Systems. The race to deliver reliable, energy-efficient 40TB drives has positioned a select group of leading manufacturers at the forefront of innovation. Below, we highlight the top six companies pioneering the development and commercialization of 40TB hard drives, based on technological advancement, market presence, and product readiness.

Top 6 40Tb Hard Drive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

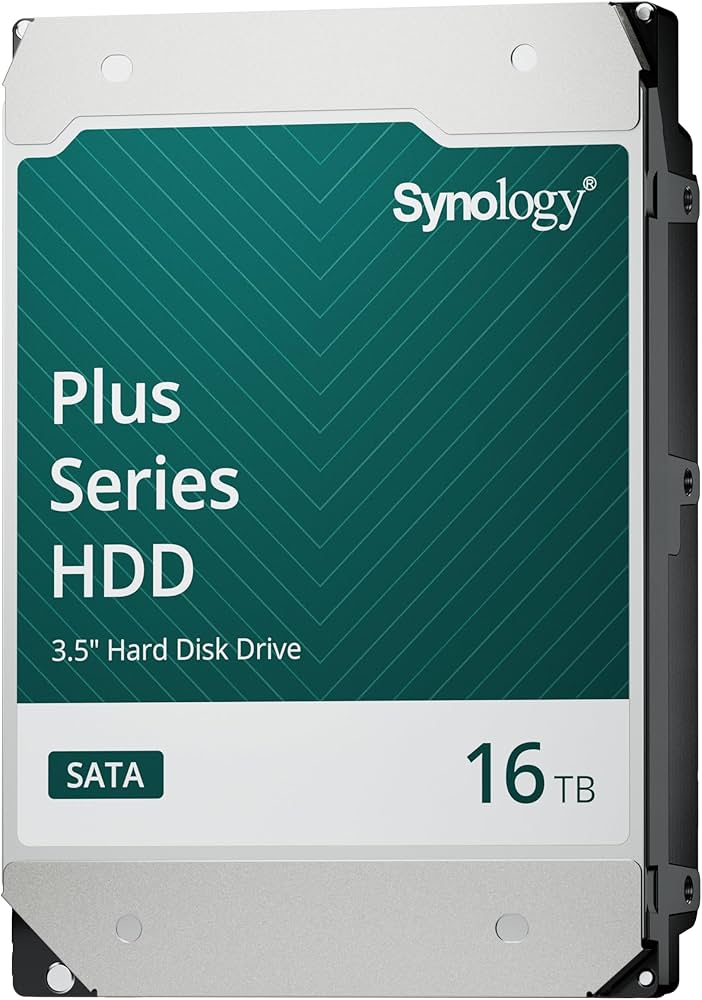

#1 Plus Series 3.5″ SATA HDD

Domain Est. 2000

Website: synology.com

Key Highlights: Plus Series 3.5″ SATA HDD. Reliable hard drives purpose-built for Synology systems in home and small office environments….

#2 Toshiba First in Industry to Verify 12

Domain Est. 2014

Website: toshiba.semicon-storage.com

Key Highlights: Toshiba First in Industry to Verify 12-Disk Stacking Technology for Hard Disk Drives. Targeting launch of next-generation 40TB-class HDDs in ……

#3 Internal Hard Drives

Domain Est. 1992

Website: seagate.com

Key Highlights: Free delivery 30-day returnsSeagate internal hard drives offer high-capacity options of up to 32TB, providing ample storage space for large files, multimedia content, and extensive…

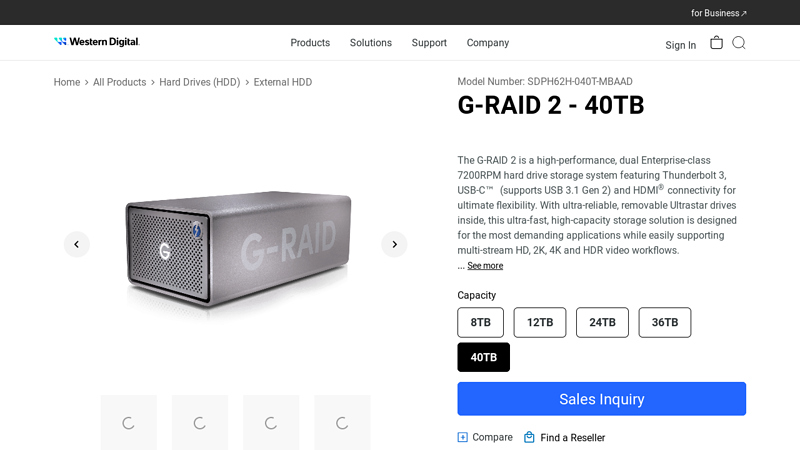

#4 SDPH62H

Domain Est. 1998

Website: westerndigital.com

Key Highlights: Rating 1.0 (1) · Free delivery over $299 · Free 30-day returnsThe G-RAID 2 is a high-performance, dual Enterprise-class 7200RPM hard drive storage system featuring Thunderbolt…

#5 40 TB Hard Drives

Domain Est. 2021

#6 Toshiba HDD Roadmap Reveals 40TB and 55TB Hard Drives Using …

Domain Est. 2024

Website: technetbooks.com

Key Highlights: Toshiba unveils its future hard disk drive roadmap, detailing plans for 40TB HDDs by 2027 and up to 55TB drives by 2029 using MAMR and HAMR tech ……

Expert Sourcing Insights for 40Tb Hard Drive

H2: Projected 2026 Market Trends for 40TB Hard Drives

By 2026, the market for 40TB hard disk drives (HDDs) is expected to be shaped by a confluence of technological advancements, evolving data demands, and competitive dynamics with solid-state storage. Here’s an analysis of the key trends:

1. Mainstream Availability and Price Stabilization:

* Widespread Commercialization: 40TB HDDs, currently in limited enterprise and hyperscale deployment (e.g., using HAMR or MAMR), will become more widely available across enterprise, cloud data center, and high-end NAS markets by 2026. Major vendors (Seagate, Western Digital, Toshiba) will have matured their HAMR/MAMR production.

* Falling $/TB Costs: Increased production yields and volume will drive down the cost per terabyte ($/TB) significantly. While still higher than lower-capacity drives, the $/TB for 40TB+ HDDs will become increasingly competitive, solidifying HDDs as the dominant solution for cold and warm data storage at scale. Expect prices to potentially fall below $0.02/GB for bulk enterprise purchases.

2. Dominance in Enterprise & Cloud Storage:

* Hyperscaler Adoption: Cloud giants (AWS, Azure, GCP, Meta) will be primary drivers, deploying 40TB drives extensively in their object storage and archival tiers to manage exponentially growing data (video, backups, AI training data, logs). The TCO advantage over SSDs for rarely accessed data is overwhelming.

* AI/ML Data Fueling Demand: The explosive growth of AI requires massive datasets for training and inference. 40TB HDDs will be crucial for storing these large, less-frequently-accessed datasets cost-effectively within data centers.

* Focus on Efficiency: Vendors will heavily market 40TB drives based on per-rack density and power/cooling efficiency. Replacing multiple lower-capacity drives with fewer 40TB units reduces footprint, power consumption, and management overhead – critical for large-scale operations.

3. Technological Maturity and Roadmap Pressure:

* HAMR/MAMR Maturation: Production yields for Heat-Assisted Magnetic Recording (HAMR – Seagate) and Microwave-Assisted Magnetic Recording (MAMR – WD) will improve dramatically, enabling reliable, high-volume manufacturing of 40TB+ drives. Reliability (MTBF) and areal density will meet or exceed enterprise standards.

* Beyond 40TB: 2026 will see the introduction of 48TB and potentially 50TB+ drives from leading vendors, leveraging further HAMR/MAMR advancements and multi-actuator technologies (e.g., Seagate’s Mach.2). This will push 40TB towards becoming a “standard” high-capacity option rather than the absolute cutting edge.

* Interface Evolution: While SATA and SAS will remain dominant for compatibility, E1.S and E3.S form factors (especially with NVMe interfaces) may start gaining traction in hyperscalers seeking higher performance and better power management, even for HDDs. However, standard 3.5″ form factors will still dominate volume.

4. Competition with SSDs and Niche Applications:

* Clear Market Segmentation: The market will be clearly segmented:

* SSDs: Dominate performance-critical applications (databases, transactional systems, OS boot, hot data).

* 40TB+ HDDs: Dominate capacity-critical, cost-sensitive applications (archival, backup, bulk object storage, cold/warm data lakes, media libraries).

* Limited Consumer/NAS Penetration: While high-end NAS (e.g., Synology, QNAP) might support 40TB drives, high cost and limited need for such capacity in typical home/small business use will keep them primarily an enterprise/cloud product. Consumer HDDs will likely max out at 20-22TB using conventional PMR/CMR.

5. Sustainability and Supply Chain Focus:

* Environmental Scrutiny: The energy efficiency and material usage of high-capacity drives will be under greater scrutiny. Vendors will emphasize the lower carbon footprint per terabyte stored compared to using more drives.

* Supply Chain Resilience: Geopolitical factors and the need for stable helium supplies (critical for HAMR/MAMR manufacturing) will remain a focus. Diversification and potential technological shifts (e.g., air-based HAMR) may be explored.

Conclusion:

By 2026, the 40TB HDD will be a mature, mainstream workhorse in the enterprise and cloud storage ecosystem. Driven by HAMR/MAMR technology, plummeting $/TB, and insatiable data growth (especially from AI), these drives will be the cornerstone for cost-effective, high-density storage of cold and warm data. While SSDs continue their performance march, 40TB HDDs will maintain a dominant and essential role in the data storage hierarchy, with vendors already pushing towards 48TB+ capacities. Their success hinges on continued reliability improvements, cost reduction, and demonstrating unmatched TCO for bulk storage needs.

H2: Common Pitfalls When Sourcing 40TB Hard Drives

Sourcing 40TB hard drives—especially as they represent cutting-edge or emerging storage capacity—comes with several potential pitfalls related to quality assurance and intellectual property (IP) concerns. Being aware of these risks is essential for enterprises, data centers, and procurement teams to avoid operational disruptions, financial loss, or legal exposure.

1. Quality and Reliability Risks

-

Limited Availability and Unproven Technology: True 40TB hard drives are at the forefront of storage technology (as of 2023–2024), often utilizing heat-assisted magnetic recording (HAMR) or microwave-assisted magnetic recording (MAMR). These technologies are still maturing, leading to potential reliability issues, shorter lifespans, or higher failure rates compared to established drives.

-

Counterfeit or Refurbished Units Misrepresented as New: Due to high demand and limited supply, the market may see counterfeit drives or refurbished units relabeled as new. These often fail prematurely and lack warranty support.

-

Inconsistent Performance Across Batches: Early adopters may experience performance variability due to firmware issues, inconsistent manufacturing yields, or immature drive controllers.

-

Insufficient Vendor Support and Warranty: Some suppliers, especially third-party or gray-market vendors, may offer inadequate technical support or limited warranty coverage, leaving buyers exposed if drives fail.

2. Intellectual Property (IP) and Legal Concerns

-

Use of Proprietary Technologies Without Licensing: High-capacity drives rely on patented technologies such as HAMR (developed by Seagate) or MAMR (by Western Digital). Sourcing drives from unauthorized or non-OEM manufacturers may involve IP infringement, exposing the buyer to legal risk—especially if used in commercial or enterprise environments.

-

Grey Market and Unauthorized Resellers: Purchasing from unauthorized distributors increases the risk of acquiring drives that violate IP agreements or import/export regulations. These drives may lack proper certification or compliance (e.g., CE, FCC), leading to compliance issues.

-

Firmware and Software IP Violations: Some third-party drives may include modified or reverse-engineered firmware, potentially infringing on the original manufacturer’s software IP. This can lead to instability and legal liability.

3. Supply Chain and Sourcing Challenges

-

Overreliance on a Single Vendor: The 40TB drive market is dominated by a few key players (e.g., Seagate, Western Digital). Relying solely on one supplier increases vulnerability to shortages, price volatility, and delivery delays.

-

Lack of Standardization: With multiple technologies competing (HAMR vs. MAMR), interoperability and long-term compatibility may be uncertain, creating future migration challenges.

Mitigation Strategies

- Purchase only from authorized distributors or directly from OEMs.

- Verify authenticity through serial number checks and manufacturer validation tools.

- Ensure compliance with regional regulations and IP laws.

- Evaluate vendor reputation, warranty terms, and return policies.

- Stay informed on technology maturity and real-world performance benchmarks.

By addressing these quality and IP-related pitfalls proactively, organizations can make more secure, reliable, and legally sound decisions when adopting next-generation 40TB storage solutions.

Logistics & Compliance Guide for 40TB Hard Drive

Overview

The shipment of a 40TB hard drive—whether as a standalone storage device, part of server equipment, or a data transfer medium—requires careful consideration of logistics and regulatory compliance due to its high data capacity, potential inclusion of sensitive information, and physical handling requirements. This guide outlines critical steps to ensure secure, legal, and efficient transport.

Physical Handling & Packaging

- Shock Protection: Use anti-static, crush-resistant packaging with ample cushioning (e.g., foam inserts) to prevent physical damage during transit.

- Environmental Controls: Avoid extreme temperatures (below 0°C or above 60°C) and high humidity (above 80% RH) to prevent condensation or mechanical failure.

- Orientation: Ship the drive upright (label side up) to minimize internal stress on components.

- Labeling: Clearly mark as “Fragile,” “This Side Up,” and “Electronic Equipment” to guide handlers.

Data Security & Encryption

- Encryption: Ensure all data on the drive is encrypted using AES-256 or equivalent standard. For drives at rest, use full-disk encryption (e.g., BitLocker, LUKS).

- Access Control: Protect encryption keys separately—never store them on the same device or in the same shipment.

- Data Sanitization: If reusing or disposing of a drive, use certified data wiping tools (e.g., DoD 5220.22-M, NIST 800-88) or physical destruction.

Export Controls & Regulatory Compliance

- ITAR/EAR (U.S.): Determine if the drive or its technology falls under the Export Administration Regulations (EAR). High-capacity storage may be subject to licensing requirements if exported to embargoed countries.

- Encryption Regulations: Many countries regulate the import/export of encrypted devices. Check local laws (e.g., Wassenaar Arrangement signatories may require declarations).

- Customs Documentation: Provide accurate HS codes (e.g., 8471.70 for magnetic storage units), commercial invoices, and, if required, export licenses or encryption registration forms.

Import & Customs Clearance

- Duties & Tariffs: Research applicable import duties based on destination country and product classification.

- Prohibited Data: Ensure the drive does not contain data restricted in the destination country (e.g., classified information, pirated content).

- Local Compliance: Adhere to regional standards such as CE (EU), FCC (USA), or KC (South Korea) for electronic equipment.

Carrier & Transit Considerations

- Carrier Selection: Use reputable carriers with experience in high-value electronics (e.g., FedEx, DHL, UPS). Opt for services with tracking, insurance, and chain-of-custody documentation.

- Insurance: Insure the shipment for full replacement value, including data recovery costs if applicable.

- Tracking & Chain of Custody: Enable real-time tracking and maintain a signed handover log to verify accountability at every stage.

Data Sovereignty & Privacy Laws

- GDPR (EU): If personal data is stored, ensure compliance with GDPR, including lawful transfer mechanisms if crossing borders.

- CCPA (California): For data involving California residents, adhere to disclosure and protection requirements.

- Other Jurisdictions: Evaluate local privacy laws (e.g., Brazil’s LGPD, Canada’s PIPEDA) if data residency is a concern.

Incident Response Plan

- Loss or Theft: Establish a protocol to remotely wipe data (if enabled) and report breaches per legal requirements (e.g., within 72 hours under GDPR).

- Damage: Have a data recovery plan in place with certified labs to minimize data loss.

Best Practices Summary

- Encrypt all data before shipment.

- Use tamper-evident packaging.

- Verify export/import compliance based on route and content.

- Maintain detailed documentation for audits.

- Train personnel on handling procedures and data security policies.

By following this guide, organizations can mitigate risks associated with transporting high-capacity storage devices while remaining compliant with international and local regulations.

Conclusion for Sourcing a 40TB Hard Drive:

As of now, a consumer or enterprise-grade 40TB hard drive is not commercially available. The highest capacity hard drives currently on the market (as of 2024) max out around 22TB to 26TB, primarily utilizing technologies such as HAMR (Heat-Assisted Magnetic Recording) or SMR/CMR. While HAMR and other emerging technologies show promise for achieving higher capacities in the future—potentially reaching 30TB to 40TB in the coming years—these drives are still in development or limited production phases.

Therefore, sourcing a single 40TB hard drive is not feasible at this time. Organizations or individuals requiring such storage capacity should consider alternative solutions, such as:

- Deploying multi-drive RAID arrays or storage enclosures to achieve aggregate capacity.

- Utilizing high-capacity enterprise SSDs or NVMe drives in scalable storage systems.

- Exploring cloud storage or hybrid models for flexible, high-volume data storage.

- Monitoring advancements from major manufacturers like Seagate, Western Digital, and Toshiba, who are expected to introduce higher-density drives in the next few years.

In summary, while the demand for 40TB hard drives is growing, especially in data centers and AI applications, the technology is not yet mainstream. A strategic approach using existing high-capacity drives combined with scalable storage architectures is currently the most viable solution.