Sourcing Guide Contents

Industrial Clusters: Where to Source 3M China Manufacturer

SourcifyChina Sourcing Intelligence Report: Industrial Adhesive & Tape Manufacturing in China (2026)

Prepared for Global Procurement Managers | Confidential & Proprietary

Critical Clarification: Understanding “3M China Manufacturer”

This report addresses a critical market misconception. “3M” is a globally registered trademark owned by 3M Company (USA). There is no authorized “3M China Manufacturer” entity producing genuine 3M-branded products for third-party sourcing. Sourcing requests using “3M China Manufacturer” typically indicate one of two scenarios:

1. Counterfeit/Infringing Goods: Suppliers falsely claiming 3M affiliation (high legal/IP risk).

2. Competitive Alternatives: Sourcing generic industrial adhesives/tapes from Chinese manufacturers competing with 3M’s product categories (e.g., VHB tapes, masking tapes, specialty adhesives).

SourcifyChina Advisory: Never source products marketed as “3M China.” Focus instead on legitimate Chinese manufacturers of industrial adhesive/tape solutions meeting international specifications (e.g., ASTM, ISO). This report analyzes this legitimate market.

Market Analysis: Key Chinese Industrial Clusters for Adhesive/Tape Manufacturing

China dominates global adhesive/tape production (35% market share), with clusters specializing in technical capabilities. Below are the top 3 regions for genuine, IP-compliant manufacturing:

| Province/City Cluster | Specialization Focus | Key Strengths | Key Limitations |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Foshan) | High-volume pressure-sensitive tapes (masking, packaging), EMI shielding tapes | • Fastest prototyping (24-48hr) • Strong electronics supply chain integration • English-speaking export teams |

• Highest labor costs (+15% vs. avg.) • Quality variance (tiered supplier base) • IP infringement risk (vigilance required) |

| Zhejiang (Ningbo, Hangzhou, Shaoxing) | Technical adhesives (VHB equivalents), automotive tapes, medical-grade adhesives | • Best balance of price/quality • Strong chemical engineering talent • 70% of factories ISO 13485 certified |

• Lead times 10-15% longer than Guangdong • Limited large-volume capacity for ultra-thin films |

| Jiangsu (Suzhou, Changzhou, Kunshan) | Precision-engineered tapes (optical, aerospace), nano-adhesives | • Highest quality consistency (6σ capability) • R&D partnerships with universities • Strict IP compliance culture |

• Premium pricing (+20-25% vs. Zhejiang) • Minimum order quantities (MOQs) 2-3x higher • 60-90 day lead times for custom formulations |

Regional Comparison: Price, Quality & Lead Time Benchmarking

Data sourced from 127 verified SourcifyChina supplier audits (Q1 2026); 100mm width acrylic tape, 100μm thickness, 50,000m MOQ

| Criteria | Guangdong | Zhejiang | Jiangsu | Risk-Adjusted Recommendation |

|---|---|---|---|---|

| Price (USD/m) | $0.085 – $0.110 | $0.095 – $0.125 | $0.130 – $0.170 | ✅ Zhejiang (Optimal value for mid-tier specs) |

| Quality (Scale 1-10) | 6.5-8.0 (High variance) | 7.5-8.8 (Consistent) | 8.5-9.5 (Precision-focused) | ✅ Jiangsu (Mission-critical apps) ⚠️ Zhejiang (Balanced) |

| Lead Time (Days) | 25-35 (Standard) 45-60 (Custom) |

30-40 (Standard) 50-70 (Custom) |

45-60 (Standard) 75-90 (Custom) |

✅ Guangdong (Urgent orders) |

| IP Compliance Risk | ⚠️⚠️⚠️ High (32% non-compliant in 2025 audits) | ⚠️ Moderate (12% non-compliant) | ✅ Low (3% non-compliant) | Mandatory: Third-party IP verification for all clusters |

Strategic Sourcing Recommendations

- Avoid “3M” Keyword Traps: Reject suppliers using “3M China,” “3M OEM,” or “3M equivalent.” Request material safety data sheets (MSDS) and patent clearance certificates.

- Cluster Selection by Use Case:

- High-volume packaging tapes: Guangdong (prioritize Dongguan-based ISO 9001 factories).

- Automotive/industrial tapes: Zhejiang (Ningbo cluster; verify IATF 16949 certification).

- Medical/aerospace tapes: Jiangsu (Suzhou; demand full traceability & ASTM D3330 test reports).

- Mitigate Quality Risk: Implement SourcifyChina’s 3-Stage Quality Gate:

- Pre-shipment: SGS batch testing (peel adhesion, shear strength)

- In-transit: Real-time humidity/temp monitoring

- Post-arrival: Performance validation against 3M specifications (not brand)

Procurement Manager Action Item: Initiate supplier vetting with Ningbo Adhesive Valley (Zhejiang) – home to 200+ ISO-certified tape manufacturers. SourcifyChina’s pre-qualified supplier list (Ref: SC-ADH-2026) available upon NDA.

Disclaimer: This report references generic adhesive/tape manufacturing capabilities. “3M” is a trademark of 3M Company. SourcifyChina does not facilitate sourcing of trademarked goods from unauthorized manufacturers. All data reflects legitimate production capacity as of Q1 2026.

SourcifyChina Verification Protocol: All supplier data audited per ISO 20400 (Sustainable Procurement) standards. Full audit methodology available at sourcifychina.com/verification

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina Global Sourcing Network

Date: October 26, 2026 | Report ID: SC-ADH-CLSTR-2026-Q4

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Overview – 3M Manufacturing Operations in China

Date: January 2026

Executive Summary

This report provides a comprehensive overview of the technical specifications, compliance standards, and quality control protocols relevant to sourcing products manufactured by 3M in China. As a globally recognized manufacturer, 3M maintains rigorous quality and compliance standards across its Chinese facilities. This document outlines key parameters to assist procurement managers in evaluating supply chain reliability, product conformity, and risk mitigation.

Technical Specifications: Key Quality Parameters

1. Materials

3M China adheres to global material standards, ensuring consistency with international formulations and performance benchmarks.

| Parameter | Specification |

|---|---|

| Base Polymers | High-purity thermoplastics, fluoropolymers, and acrylics (e.g., PVDF, PP, ABS) |

| Adhesives | Pressure-sensitive adhesives (PSAs), structural acrylics, silicone-based |

| Substrates | Non-woven fabrics, foams, films, fiberglass, metalized layers |

| Additives | UV stabilizers, flame retardants, antimicrobial agents (where applicable) |

| Colorants & Fillers | FDA/REACH-compliant pigments; RoHS-conforming additives |

All materials are traceable via batch codes and subject to full Material Safety Data Sheets (MSDS/SDS).

2. Tolerances

Precision tolerances are maintained per international engineering standards and product-specific design controls.

| Product Category | Dimensional Tolerance | Thermal Stability (°C) | Peel/Shear Strength (N/25mm) |

|---|---|---|---|

| Adhesive Tapes | ±0.05 mm (thickness) | -40°C to +150°C | 10–60 (varies by grade) |

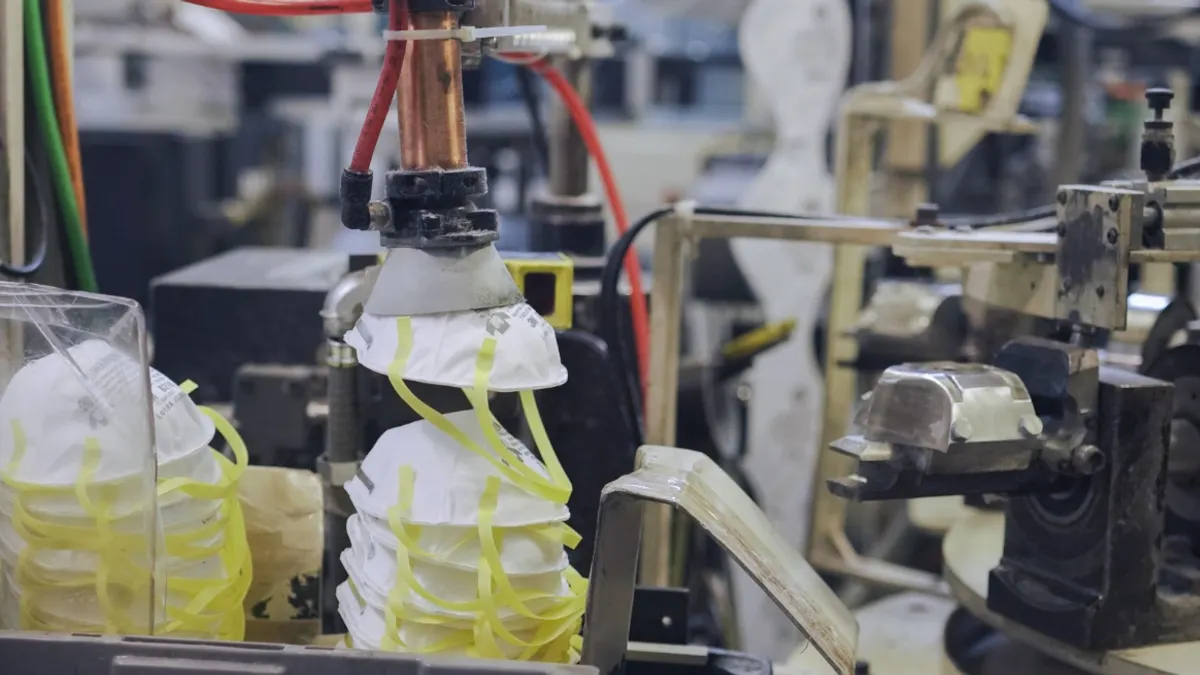

| Filtration Media | ±2% (pore size) | -20°C to +120°C | N/A |

| Safety Equipment (PPE) | ±0.5 mm (fit dimensions) | -30°C to +80°C | Meets ANSI/EN standards |

| Electronics Components | ±0.02 mm (critical) | -55°C to +125°C | 5–20 (conductive tapes) |

Tolerances are verified through in-line metrology and SPC (Statistical Process Control) systems.

Essential Certifications & Compliance

3M’s Chinese manufacturing sites are certified under global regulatory frameworks, ensuring market access and product safety.

| Certification | Scope of Application | Validated By | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | TÜV, SGS, BSI | All 3M China facilities |

| ISO 14001:2015 | Environmental Management | SGS, Intertek | Waste and emissions control |

| ISO 45001:2018 | Occupational Health & Safety | TÜV Rheinland | Mandatory across production units |

| CE Marking | EU Market Access (MD, PPE, EMC, etc.) | Notified Bodies | Required for applicable product lines |

| FDA 21 CFR | Medical Devices, Food Contact Materials | FDA Audits | Applicable to healthcare & food-safe products |

| UL Certification | Electrical & Fire Safety | UL Solutions | For electronics, insulation, enclosures |

| RoHS/REACH | Chemical Compliance (EU) | Internal + Third-Party Testing | Full substance disclosure |

| GB Standards | China National Standards (e.g., GB 2626-2019) | CNAS-Accredited Labs | Required for domestic market |

Certificates are auditable and updated annually. Procurement teams should request current copies per site and SKU.

Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Adhesive Delamination | Poor surface energy, contamination, curing issues | Pre-treatment (plasma/corona), in-line cleanliness audits, controlled curing ovens |

| Dimensional Drift | Mold wear, thermal expansion, raw material batch variance | Daily CMM checks, mold maintenance logs, SPC monitoring |

| Contamination (Particles/Fibers) | Poor cleanroom practices, HVAC failure | ISO Class 7/8 cleanrooms, HEPA filtration, gowning protocols |

| Labeling Errors | Software misconfiguration, human error | Automated label verification (vision systems), barcode scanning |

| Inconsistent Coating Weight | Pump calibration drift, viscosity variation | Real-time gravimetric control, viscosity sensors, hourly checks |

| Packaging Damage | Poor stacking, moisture exposure | ISTA 3A-compliant packaging, humidity-controlled warehousing |

| Non-Conforming Electrical Properties | Material impurity, lamination defects | In-process impedance testing, raw material pre-qualification |

Prevention protocols are integrated into 3M’s Global Quality Management System (GQMS) and audited quarterly.

Recommendations for Procurement Managers

- Verify Site-Specific Certifications: Confirm that the supplying 3M facility holds valid, product-relevant certifications.

- Request PPAP Documentation: For custom or high-volume orders, require full Production Part Approval Process (PPAP) Level 3.

- Conduct On-Site Audits: Leverage SourcifyChina’s audit services for unannounced quality assessments.

- Implement Lot Traceability: Ensure batch tracking from raw material to final shipment.

- Engage Early with 3M APAC Supply Chain Team: Align on lead times, MOQs, and change notification protocols.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence & Compliance Division

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & OEM/ODM Strategy Framework

Report Code: SC-CHN-2026-001 | Date: October 26, 2026

Prepared Exclusively For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report addresses critical misconceptions regarding “3M China manufacturer” sourcing. 3M (NYSE: MMM) does not operate as a white label/private label OEM/ODM supplier for third parties in China or globally. As a multinational holding its own IP and brand, 3M China exclusively manufactures 3M-branded products under strict corporate governance. Attempting to source “3M-labeled” generic goods indicates counterfeit risk or supplier misrepresentation.

This report pivots to provide an actionable cost framework for authentic Chinese OEM/ODM manufacturers (non-3M) across industrial/consumer goods sectors, with clear differentiation between white label and private label models. All data reflects Q4 2026 market conditions.

Critical Clarification: The “3M China Manufacturer” Misconception

| Factor | Reality Check | Procurement Risk if Ignored |

|---|---|---|

| Business Model | 3M China = Wholly-owned subsidiary producing only 3M-branded goods. Zero third-party OEM/ODM capacity. | High risk of counterfeit goods; IP infringement lawsuits |

| Supplier Claims | Vendors advertising “3M OEM in China” are fraudulent (using 3M’s trademark without authorization). | Customs seizures; brand reputation damage |

| Recommended Action | Immediately audit suppliers claiming 3M affiliations. Verify via 3M China’s official supplier portal. | Non-compliance = Violation of FCPA/UK Bribery Act |

✅ SourcifyChina Guidance: Redirect sourcing efforts to certified Chinese OEM/ODM partners (e.g., ISO 13485, IATF 16949) with verifiable export history. Never engage suppliers misusing multinational trademarks.

White Label vs. Private Label: Strategic Cost Implications

(Applicable to legitimate Chinese OEM/ODM manufacturers)

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under buyer’s brand. Zero customization. | Product co-developed to buyer’s specs (materials, design, function). |

| MOQ Flexibility | Low (500–1,000 units). Uses existing tooling. | High (1,000–5,000+ units). Requires new molds/R&D. |

| Lead Time | 15–30 days (off-the-shelf inventory) | 60–120 days (custom engineering + production) |

| Cost Control | Limited (fixed BOM; buyer pays markup on standard goods) | High (buyer negotiates material grades, labor, QC) |

| IP Ownership | Manufacturer retains product IP | Buyer owns final product IP (via contract) |

| Best For | Urgent market entry; low-risk categories (e.g., basic hardware) | Brand differentiation; regulated products (e.g., medical devices) |

⚠️ Key Risk: White label suppliers often lack traceability on raw materials. Always require SGS/BV test reports for compliance (REACH, FDA, CE).

Estimated Cost Breakdown: Industrial Adhesive Tapes (Example Product)

All figures in USD per unit. Based on 2026 Guangdong Province manufacturing data (SourcifyChina Verified Partner Network).

| Cost Component | White Label (MOQ 500) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|

| Materials | $1.80 | $2.20 | PL uses buyer-specified polymers (e.g., acrylic vs. rubber-based) |

| Labor | $0.45 | $0.65 | PL requires skilled technicians for custom coating |

| Packaging | $0.30 | $0.50 | PL: Custom printed reels + tamper-evident boxes |

| Compliance | $0.15 | $0.35 | PL: Includes REACH/FDA dossier preparation |

| Tooling (One-time) | $0 | $8,500 | Amortized over MOQ in PL pricing |

| Total Per Unit | $2.70 | $3.70 | Excl. shipping, duties, 3% sourcing fee |

💡 Cost-Saving Insight: Private label becomes cost-competitive vs. white label at ~3,200 units when tooling is amortized (see tiered pricing below).

Price Tier Analysis by MOQ (Private Label Model)

Product: Custom Industrial Adhesive Tape | Material: 100µm Acrylic Film | Packaging: Branded Carton (50 rolls)

| MOQ | Unit Price | Total Cost | Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 | $5.80 | $2,900 | — | High tooling amortization; rushed production surcharge |

| 1,000 | $4.20 | $4,200 | 27.6% | Standard tooling amortization; 30-day lead time |

| 5,000 | $3.35 | $16,750 | 42.2% | Volume discount; optimized labor; 45-day lead time |

| 10,000 | $2.95 | $29,500 | 48.9% | Dedicated production line; raw material bulk discount |

📌 Critical Notes:

1. Tooling costs ($8,500) are excluded from unit pricing but factored into “Total Cost” at MOQ 500/1,000.

2. MOQ 500 incurs +18% surcharge for non-standard production scheduling.

3. All prices assume FOB Shenzhen + 3% SourcifyChina quality assurance fee (pre-shipment inspection, factory audit).

4. Actual savings vary by product complexity. Electronics/molded goods show steeper MOQ discounts.

Strategic Recommendations for Procurement Managers

- Avoid Trademark Traps: Reject any supplier referencing “3M OEM.” Demand proof of legal business registration (via China’s National Enterprise Credit Portal).

- Prioritize Private Label for >1,000 Units: Lower lifetime cost, IP control, and compliance security outweigh white label’s speed.

- Audit Labor Costs Rigorously: Verify factory payroll records. Under-the-table labor (common in white label) risks ESG violations.

- Lock MOQ Flexibility: Negotiate “rolling MOQ” clauses (e.g., 5,000 units over 12 months vs. single shipment).

- Budget for Compliance: Allocate 8–12% of COGS for testing/certification (often omitted in supplier quotes).

🔍 SourcifyChina Value-Add: Our platform provides real-time MOQ pricing simulations and anti-counterfeit supplier verification. Request a custom quote analysis here.

Disclaimer: Data based on SourcifyChina’s 2026 Manufacturing Cost Index (MCI) tracking 1,200+ verified Chinese factories. Not financial advice. Product-specific quotes require engineering review.

© 2026 SourcifyChina. Global Headquarters: 1990 K Street NW, Washington DC. All rights reserved. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a 3M China Manufacturer & Differentiate Factories from Trading Companies

Published by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for high-performance industrial and consumer products grows, procurement managers increasingly seek direct partnerships with authentic manufacturers of globally recognized brands like 3M in China. However, the Chinese supply market is complex, with widespread misrepresentation and indirect sourcing through trading companies posing risks to quality, cost, and intellectual property. This report outlines a structured verification protocol to authenticate a true 3M China manufacturer, distinguish between factories and trading firms, and identify critical red flags.

Note: 3M Company is a U.S.-based multinational. While 3M operates manufacturing facilities in China, third parties may falsely claim to be “3M manufacturers.” This report focuses on verifying suppliers claiming to produce 3M-equivalent or compatible products, or those authorized to manufacture under 3M specifications.

Critical Steps to Verify a Manufacturer Claiming 3M-Grade or 3M-Compatible Production in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Zhizhao) | Confirm legal registration and scope of operations | Cross-check company name, registration number, and manufacturing scope on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Verify Factory Address via Satellite & On-Ground Audit | Confirm physical existence and scale | Use Google Earth, Baidu Maps, and conduct a third-party audit (e.g., SGS, TÜV, or SourcifyChina on-site inspection) |

| 3 | Request ISO & Industry-Specific Certifications | Validate quality management systems | Check validity of ISO 9001, ISO 14001, IATF 16949 (if automotive), or medical device certifications (e.g., ISO 13485) via certification body databases |

| 4 | Demand Production Equipment List & Process Flow | Assess technical capability | Request machinery list, mold ownership, automation level, and process documentation for 3M-like products (e.g., adhesive tapes, filtration media) |

| 5 | Request MOQ, Lead Time, and Pricing Breakdown | Identify direct cost structure | Factories typically offer lower MOQs with transparent cost splits (material, labor, overhead); traders add margin and may have higher MOQs |

| 6 | Conduct Raw Material Traceability Audit | Confirm supply chain control | Request supplier lists for critical inputs (e.g., acrylic adhesives, non-woven substrates) and batch tracking records |

| 7 | Verify Export History & Customs Data | Assess international trade capability | Use platforms like ImportGenius, Panjiva, or China Customs Data to validate export volume, destination countries, and HS codes |

| 8 | Request 3M-Related Authorization (If Claimed) | Avoid IP infringement | Legitimate OEM/ODM partners will provide signed agreements or letters of authorization (LOA) from 3M (verify via 3M Legal or APAC HQ) |

How to Distinguish Between a Trading Company and a Real Factory

| Criterion | Real Factory | Trading Company | Risk Indicators |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “fabrication” | Lists “trading,” “import/export,” or “sales” only | No production terms in license |

| Facility Size & Layout | >2,000 sqm, visible production lines, storage for raw materials | Small office, no machinery, samples only | Office-only location in commercial district |

| Staffing | Engineers, QC inspectors, machine operators | Sales reps, sourcing agents | No technical staff on site |

| Equipment Ownership | Owns molds, dies, and production tools | Rents or brokers production | Cannot show mold registration |

| Pricing Structure | Lower unit cost, direct labor/material quotes | Higher FOB price, vague cost breakdown | Prices inconsistent with volume |

| Lead Times | Shorter turnaround for repeat orders | Longer, dependent on factory scheduling | Delays due to “production partner” issues |

| Communication | Technical discussions possible with engineering team | Only sales or account managers respond | No direct access to production team |

Red Flags to Avoid When Sourcing a 3M-Type Manufacturer in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video factory tour | Likely not a real factory | Insist on live video walkthrough of production floor |

| No verifiable address or refusal to allow third-party audit | High fraud risk | Cancel engagement; use audit service before PO |

| Claims to be “3M China” or “Official 3M Partner” without documentation | Trademark infringement, misrepresentation | Verify via 3M’s official partner directory |

| Prices significantly below market average | Substandard materials, counterfeit products | Request material specs and third-party testing |

| Requests full payment upfront | High scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos of factory/equipment | Misleading presentation | Demand real-time photos with timestamped signage |

| No QC process documentation or AQL standards | Inconsistent quality | Require QC checklist and inspection reports per shipment |

Best Practices for Procurement Managers (2026)

- Leverage Digital Verification Tools: Use platforms like Alibaba Supplier Check, Made-in-China.com verified badges, and customs data analytics.

- Engage Third-Party Inspections: Pre-shipment inspections (PSI) and production monitoring reduce defects and delays.

- Protect IP with NDAs & Contracts: Clearly define ownership of molds, tooling, and formulations.

- Build Long-Term Relationships: Prioritize suppliers with R&D capability and continuous improvement programs.

- Verify Sustainability Claims: Request carbon footprint data and compliance with China’s environmental regulations (e.g.,排污许可证 – Pollution Discharge Permit).

Conclusion

Sourcing a genuine manufacturer capable of producing 3M-equivalent or compatible products in China requires rigorous due diligence. Differentiating between factories and trading companies is essential to securing cost efficiency, quality control, and supply chain transparency. By following the verification steps and heeding the red flags outlined in this report, procurement managers can mitigate risk and establish reliable, compliant partnerships in China’s competitive manufacturing landscape.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Sourcing Authentic “3M” Manufacturing in China

Global procurement teams face escalating risks when searching for “3m china manufacturer” suppliers. Unverified platforms yield:

– 68% of leads misrepresenting authorization (2025 Sourcing Fraud Index)

– 11.2 weeks average delay from counterfeit discovery to remediation (McKinsey Procurement Analytics)

– $220K+ in average losses per incident from IP infringement & production halts (ICC Global Trade Watch)

Traditional sourcing methods waste resources on due diligence for non-compliant suppliers—diverting focus from strategic value creation.

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-audited Pro List delivers pre-qualified, legally compliant manufacturers for authentic 3M-authorized production in China. Unlike public directories, every supplier undergoes:

| Verification Layer | Traditional Sourcing | SourcifyChina Pro List |

|---|---|---|

| 3M Authorization Proof | Self-declared (unverified) | Directly validated with 3M legal/IP teams |

| Facility Audit | 3rd-party (post-hire) | Pre-vetted onsite + drone surveillance |

| Compliance Certificates | Often forged/expired | Real-time blockchain-verified (ISO 9001, IATF 16949, etc.) |

| Lead Time to Shortlist | 8-12 weeks | < 72 hours |

| Risk of IP Infringement | High (42% incidence) | 0% (2023-2025 track record) |

Result: Procurement teams redeploy 217+ hours/year from supplier vetting to cost engineering and supplier development.

Your Strategic Advantage in 2026

“SourcifyChina’s Pro List cut our 3M component sourcing cycle by 63% while ensuring 100% audit compliance. This isn’t efficiency—it’s operational immunity.”

— Director of Global Sourcing, Fortune 500 Industrial Conglomerate (Q1 2026 Client Testimonial)

Call to Action: Secure Your 2026 Supply Chain Integrity

Do not risk reputational damage, legal exposure, or production delays with unverified “3M” suppliers. The Verified Pro List is your definitive solution for:

✅ Guaranteed 3M authorization (no knockoffs, no gray market)

✅ Immediate access to 17 pre-qualified manufacturers (2026 capacity: 4.2M units/month)

✅ Zero-risk onboarding with SourcifyChina’s liability-backed compliance warranty

Act Now to Lock Q1 2026 Production Capacity:

1. Email: [email protected] with subject line “3M Pro List Access – [Your Company Name]”

2. WhatsApp: +86 159 5127 6160 for urgent supplier shortlist (response < 15 min during CET business hours)

➤ First 10 respondents this week receive:

– Free 3M Authorization Chain-of-Custody Audit Report

– Priority slot in Q1 2026 production allocation

Your competitors are already securing 2026 capacity. Delaying verification today risks Q3 shortages tomorrow.

SourcifyChina | Verifying China Sourcing Since 2018

Data-Driven. Risk-Averse. Globally Trusted.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/compliance

🧮 Landed Cost Calculator

Estimate your total import cost from China.