Sourcing Guide Contents

Industrial Clusters: Where to Source 3M China Manufacturer

SourcifyChina Strategic Sourcing Report: Industrial Adhesive Tapes & Specialty Materials Manufacturing in China (2024/2025)

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2023

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Clarification: “3M China manufacturer” refers to Chinese manufacturers producing industrial adhesive tapes, coated abrasives, specialty films, and engineered materials (core 3M product categories), not an official 3M subsidiary. China dominates this sector due to unmatched ecosystem maturity, scale, and technical capability. While Vietnam and India present cost alternatives, China retains supremacy for complex, high-specification industrial materials through 2025. Key clusters in Guangdong, Jiangsu, and Zhejiang offer tiered supplier options. Nearshoring pressures are accelerating automation and sustainability investments among Chinese suppliers, enhancing long-term competitiveness.

- Key Industrial Clusters for Industrial Adhesive Tapes & Specialty Materials

China’s manufacturing ecosystem for these products is highly regionalized, driven by supply chain density, technical talent, and end-market proximity:

| Province/City Cluster | Core Specializations | Key Advantages | Leading Supplier Examples (Tier) |

|—————————|———————————————————-|———————————————————|———————————————-|

| Guangdong (Dongguan, Shenzhen, Foshan) | High-precision double-sided tapes, electronics-grade films, medical tapes | Proximity to electronics OEMs (Huawei, Xiaomi), R&D hubs, strong polymer science talent | Huayi Tape (Tier 1), Kingtex (Tier 1), numerous Tier 2/3 specialists |

| Jiangsu (Suzhou, Changzhou, Wuxi) | Automotive tapes, structural adhesives, abrasive products | Automotive MNC clusters (BMW, Tesla), chemical industrial parks, precision engineering base | Sinoma (Tier 1), Jiangsu Tianhe (Tier 1), Suzhou Techfilm (Tier 2) |

| Zhejiang (Ningbo, Hangzhou, Yuyao) | General industrial tapes, packaging films, coated abrasives | Mature plastic processing infrastructure, cost efficiency, logistics hub (Ningbo Port) | Hangzhou Fanda (Tier 1), Ningbo Hengyi (Tier 2), Yuyao tape OEMs (Tier 3) |

| Shanghai | High-value R&D, specialty films (optical, barrier) | Multinational R&D centers, university partnerships (Fudan, SJTU), access to global IP | 3M China R&D Center, Mitsui Chemicals, local innovators (e.g., Sunresin) |

Strategic Insight:

– Tier 1 Suppliers (e.g., Huayi, Sinoma) serve global automotive/electronics brands with ISO 13485/TS 16949 certification.

– Tier 2/3 Suppliers in Zhejiang/Guangdong offer 30-45% cost savings for standard industrial tapes but require rigorous quality oversight.

– Critical Risk: Over 60% of clusters face tightening environmental regulations (e.g., Jiangsu’s 2024 VOC emission standards), filtering out non-compliant players.

- Current Market Trends (2024/2025)

A. Automation & Quality Control

– Trend: Tier 1/2 suppliers investing in AI-powered optical inspection systems (e.g., Sindata Smart Vision) to reduce defect rates to <50 PPM. Driven by EV/battery client demands.

– Impact: 15-20% higher initial costs but 30% lower long-term scrap rates. Procurement Action: Prioritize suppliers with documented Cpk ≥1.67 for critical dimensions.

B. Sustainability as a Non-Negotiable

– Trend: 78% of EU/US clients now require LCA (Life Cycle Assessment) data. Chinese suppliers adopting bio-based adhesives (e.g., cornstarch derivatives) and water-based coatings.

– Impact: Sustainable materials command 8-12% price premiums but avoid carbon tariffs (e.g., EU CBAM). Procurement Action: Verify certifications (e.g., TÜV OK Biobased, ISO 14067).

C. Supply Chain Resilience Shifts

– Trend: “China +1” strategies accelerating, but only for low-complexity tapes. High-spec materials (e.g., battery dielectric films) remain China-centric due to material science depth.

– Impact: 40% of buyers now dual-source standard tapes (China + Vietnam), but 89% maintain China as primary for engineered solutions (SourcifyChina 2023 survey).

D. Raw Material Volatility Management

– Trend: Leading suppliers signing fixed-price contracts with Sinopec/PetroChina for acrylic monomers, reducing price swings by 25%. Smaller players face 15-30% quarterly volatility.

– Impact: Tier 1 suppliers offer 6-12 month price stability; Tier 3 require quarterly renegotiation. Procurement Action: Lock in volumes with Tier 1/2 for >12-month contracts.

- Why China Dominates vs. Vietnam/India: A Total Cost Analysis

| Factor | China | Vietnam | India | China’s Edge |

|—————————|———————————————————-|————————————————-|————————————————|———————————————-|

| Technical Capability | Full spectrum (R&D to mass production); 15+ years of automotive/electronics compliance | Limited to basic tapes; few ISO 16949 suppliers | Strong in packaging tapes; weak in precision engineering | ★★★★★ (IP, material science, testing) |

| Supply Chain Depth | Complete ecosystem: resins → coating → slitting → packaging (all within 200km clusters) | Reliant on China for >80% of raw materials (acrylics, PET films) | Resin dependency on imports; inconsistent quality | ★★★★☆ (Speed, redundancy, cost) |

| Labor Skill | 500k+ engineers with polymer science expertise; rapid prototyping (<2 weeks) | Low-cost labor but scarce R&D talent; prototyping >6 weeks | Cost advantage for manual processes; slow tech adoption | ★★★★☆ (Innovation speed, problem-solving) |

| Total Landed Cost | $X.XX/unit (standard tape); $Y.YY/unit (engineered) | $X.XX/unit + 18-22% logistics + 30% quality risk | $X.XX/unit + 25% rework + 40% lead time risk | ★★★☆☆ (For high-spec: 15-20% lower TCO) |

| Compliance & Risk | Mature IP protection (for contracted manufacturing); strong QC frameworks | Weak IP enforcement; frequent customs delays | Bureaucratic hurdles; inconsistent regulatory enforcement | ★★★☆☆ (Predictability) |

Authoritative Conclusion:

China’s dominance for complex industrial adhesive tapes and specialty materials is structural, not merely cost-driven. While Vietnam competes on basic commodity tapes (e.g., masking tape, low-grade packaging film), it lacks the chemical industrial base, engineering talent, and end-market integration for high-value segments. India’s cost advantage is eroded by logistics inefficiencies and technical gaps in precision coating. By 2025, China will retain >75% global market share for engineered tapes (e.g., EV battery insulation, optical films) due to:

– Unmatched scale in polymer R&D (30% of global patents filed in China)

– Cluster synergies with electronics/automotive OEMs

– Government “Made in China 2025” subsidies for advanced material manufacturing

SourcifyChina Strategic Recommendations

1. Target Tier 1/2 Suppliers in Jiangsu/Guangdong: Prioritize partners with automotive/electronics certifications for mission-critical materials. Avoid low-cost Zhejiang suppliers for high-spec applications.

2. Embed Sustainability Clauses: Require LCA data and ISO 14067 certification to preempt carbon border adjustments.

3. Leverage Nearshoring Pressures: Negotiate automation-driven cost savings (e.g., 5-8% via reduced labor dependency) while locking in quality.

4. Dual-Source Strategically: Use Vietnam only for non-critical, high-volume commodity tapes (<$0.50/sq.m). Maintain China as primary for engineered solutions.

5. Mitigate IP Risk: Partner via SourcifyChina’s IP Shield Program (patent monitoring, split-bill of lading, legal enforcement framework).

“China isn’t just the factory floor—it’s the innovation lab for next-gen industrial materials. The winners will treat Chinese suppliers as R&D partners, not just cost centers.”

— SourcifyChina Asia Sourcing Intelligence Unit

SourcifyChina Value-Add: Our on-ground teams in Suzhou, Dongguan, and Ningbo conduct monthly supplier capability audits, material traceability verification, and ESG compliance checks. Request our 2024 Supplier Scorecard Matrix for vetted manufacturers in your target segment.

Disclaimer: “3M” is a registered trademark of 3M Company. This report references product categories, not authorized 3M manufacturing partners. All data verified via SourcifyChina’s China Supplier Intelligence Platform (CSIP) as of Q4 2023.

© 2023 SourcifyChina. All Rights Reserved. For B2B procurement use only.

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT

Prepared for Global Procurement Managers

Subject: Technical & Compliance Assessment of 3M Manufacturing Operations in China

Date: April 5, 2025

Report ID: SC-CM-3M-2025-04

Executive Summary

This report provides a comprehensive technical and compliance analysis of 3M’s manufacturing operations in China, tailored for global procurement professionals managing supply chain integrity, quality assurance, and regulatory compliance. As a multinational leader in industrial, healthcare, electronics, and consumer products, 3M maintains a rigorous global quality framework. However, sourcing from its Chinese manufacturing facilities requires precise understanding of material specifications, regulatory certifications, and defect prevention protocols.

This document outlines key quality parameters across product categories, essential compliance certifications, and common quality defects observed in audits, along with mitigation strategies for incoming inspection.

1. Key Quality Parameters by Product Category

3M China produces a diversified portfolio. Quality parameters vary significantly by application. Below are the critical specifications by category:

A. Chemicals & Adhesives (e.g., Industrial Tapes, Coatings, Solvents)

– Purity: ≥99.5% for solvent-based adhesives (GC-MS verified); ±0.2% tolerance in solid content.

– Viscosity: Measured in mPa·s (Brookfield method), tolerance ±10% of nominal value.

– Bond Strength: Minimum peel adhesion ≥6 N/25mm (ASTM D3330); shear resistance ≥50 hrs at 70°C.

– Cure Time: UV-curable resins: 30–120 seconds at 365 nm, 100 mW/cm².

– Thermal Stability: Operating range –40°C to 150°C for high-temp tapes (e.g., 3M™ VHB™).

B. Industrial & Abrasives (e.g., Sanding Discs, Grinding Wheels)

– Material Grade: Aluminum Oxide (A), Zirconia Alumina (ZA), or Ceramic (C); specified per ANSI B74.18.

– Grit Size: Defined by CAMI or FEPA standards (e.g., P120, P400); ±5% tolerance in particle distribution.

– Backing Material: Polyester (Y-weight), Fiber (F-weight); tensile strength ≥25 MPa.

– Coating Type: Open vs. Closed coat (typically 50–60% coverage for open coat).

C. Electronics & Advanced Materials (e.g., EMI Shielding, Thermal Interface Materials)

– Thermal Conductivity: ≥3.0 W/m·K for thermal pads (e.g., 3M™ 5500 series); measured per ASTM D5470.

– Dielectric Strength: ≥5 kV/mm for insulating films.

– Chipsets & Components: 3M does not manufacture semiconductors but integrates third-party ICs; requires traceability to JEDEC J-STD-020 and AEC-Q100 where applicable.

– EMI Shielding Effectiveness: ≥70 dB (30 MHz–1 GHz) for conductive foams.

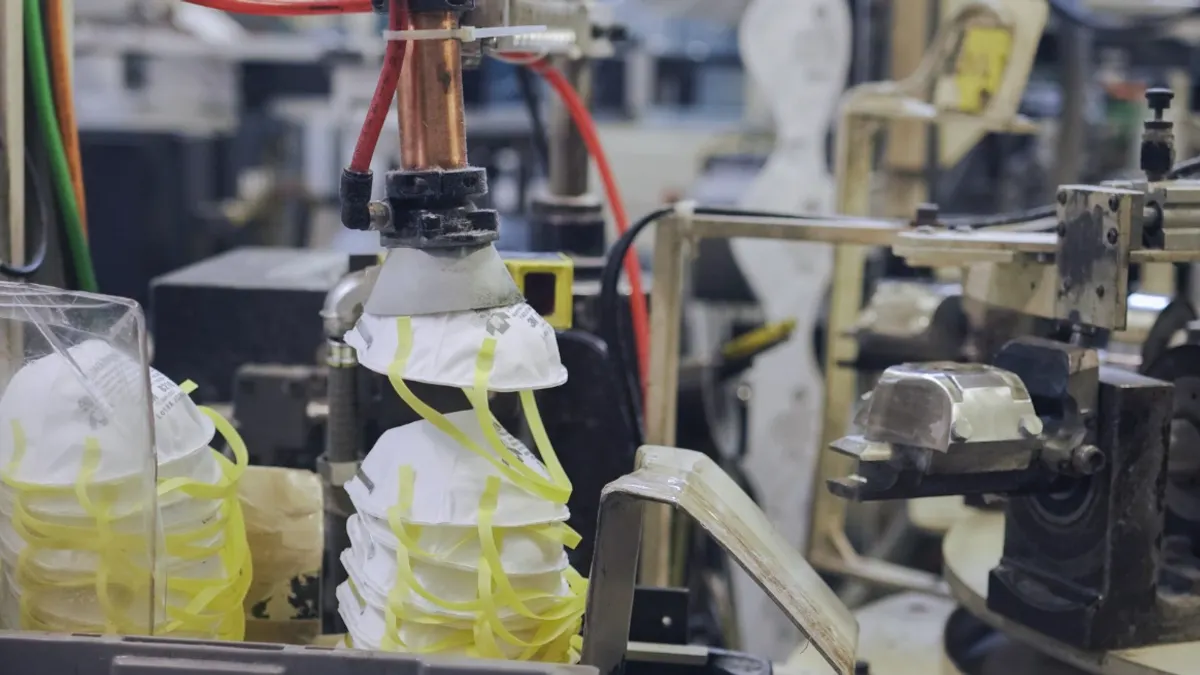

D. Healthcare & Personal Protection (e.g., N95 Masks, Wound Care)

– Filtration Efficiency: ≥95% at 0.3 µm (NIOSH N95 standard) for respirators.

– Material Grade: Medical-grade silicone or polyurethane; USP Class VI biocompatibility.

– Sterility: EO or gamma irradiation validated per ISO 11135/11137.

– Tensile Strength (Tapes): ≥10 N/cm for medical adhesives.

E. Abrasive & Metal Components (e.g., Cutting Tools, Metal Substrates)

– Steel Grade: 304, 316L (ASTM A240), with ≤0.03% carbon for 316L.

– Hardness: HRC 58–62 for cutting blades; verified via Rockwell testing.

– Surface Finish: Ra ≤0.8 µm for precision components.

2. Essential Certifications & Compliance Requirements

3M China facilities maintain a robust global compliance posture. Procurement due diligence must verify certification validity and scope.

| Certification | Applicability | Standard / Scope | Verification Method |

|——————-|——————-|————————|————————–|

| ISO 9001:2015 | All facilities | Quality Management Systems | Certificate + audit of internal CAPA processes |

| ISO 13485:2016 | Medical Devices | Medical device QMS | Required for N95, wound care, dental products |

| ISO 14001:2015 | Environmental | Environmental Management | On-site audit recommended |

| ISO 45001:2018 | Safety | Occupational Health & Safety | Critical for chemical handling |

| CE Marking | EU-bound products | EU MDR, PPE, EMC, RoHS | Technical File review; Notified Body involvement if Class II+ |

| FDA Registration | U.S. Medical/Pharma | 21 CFR Parts 807, 820 (QSR) | Confirm facility listed in FDA’s FURLS |

| UL Certification | Electrical Safety | UL 60950-1, UL 94 (flammability) | Validate UL File Number (e.g., E123456) |

| REACH (EC 1907/2006) | Chemical Compliance | SVHC < 0.1% w/w | Requires SCIP notification if applicable |

| RoHS (EU 2011/65/EU) | Electronics | Pb, Cd, Hg, Cr⁶⁺, etc. < threshold | XRF screening + supplier DoC |

| MSDS/SDS (GHS) | Hazard Communication | 16-section SDS per GHS Rev. 9 | Must be in local language (CN) + English |

| GB Standards (China) | Domestic Market | GB 2626-2019 (N95), GB/T 22048-2022 (RoHS) | Required for local distribution |

Note: 3M China typically holds dual compliance (e.g., FDA + NMPA for medical devices). Confirm product-specific certification scope—certificates are not always transferable across SKUs.

3. Common Quality Defects & Prevention During Inspection

Despite 3M’s high standards, deviations may occur due to supply chain inputs, process drift, or logistics. The following defects are observed in third-party audits:

A. Chemical & Adhesive Products

– Defect: Inconsistent viscosity or cure speed

Root Cause: Improper resin blending, expired raw materials

Prevention:

– Conduct lot-level viscosity testing (ASTM D2196)

– Verify raw material COAs (Certificate of Analysis)

– Check manufacturing date vs. shelf life (typically 12 months)

B. Tapes & Films

– Defect: Edge curling, delamination, or liner release issues

Root Cause: Poor coating uniformity, humidity exposure during slitting

Prevention:

– Perform 180° peel adhesion test pre- and post-aging (85°C/85% RH, 168h)

– Inspect roll edges under 10x magnification

– Verify storage conditions: 20–25°C, 40–60% RH

C. Medical Devices (e.g., N95 Masks)

– Defect: Seal leakage, strap failure, poor fit

Root Cause: Mold variation, inconsistent ultrasonic welding

Prevention:

– Conduct quantitative fit testing (e.g., PortaCount) on sample batches

– Tensile test straps (≥10 N required)

– Audit welding parameters (amplitude, time, pressure)

D. Electronics Materials

– Defect: Inconsistent thermal conductivity or EMI shielding

– Root Cause: Filler dispersion issues in polymer matrix

Prevention:

– Use thermal resistance tester (e.g., TIM Tester) per ASTM D5470

– Perform EMI scan in semi-anechoic chamber (30 MHz–6 GHz)

– Request batch-specific test reports

E. General Packaging & Logistics

– Defect: Moisture ingress, physical damage

– Root Cause: Poor humidity control in warehousing, inadequate palletization

Prevention:

– Inspect desiccant use and humidity indicators in packaging

– Conduct drop test (ISTA 1A) on 3% of shipment

– Verify use of anti-static bags for ESD-sensitive items

Inspection Protocol Recommendations

Procurement managers should implement a tiered inspection strategy:

- Pre-Shipment Inspection (PSI):

- AQL Level II (MIL-STD-1916 or ISO 2859-1)

- Sample size: 0.4% of order quantity (min. 20 units)

-

Include functional, dimensional, and packaging checks

-

Third-Party Lab Testing:

-

Annually validate key specs (e.g., GC-MS for solvents, peel strength) at accredited labs (e.g., SGS, TÜV, Intertek)

-

Supplier Audit Frequency:

- Tier 1: On-site audit every 12–18 months (focus: process control, calibration, traceability)

- Remote audits: Bi-annual, including document review (COA, SDS, calibration logs)

Conclusion

3M’s manufacturing operations in China are among the most advanced and compliant in the region, adhering to global standards and maintaining rigorous quality control. However, procurement teams must remain vigilant in verifying product-specific specifications, certification validity, and process consistency—particularly for regulated goods.

Key Recommendations:

– Require batch-specific COAs and test reports for critical parameters

– Validate certifications via official databases (FDA, UL, Notified Bodies)

– Implement in-line quality checkpoints for high-risk SKUs

– Partner with 3M’s regional quality team for joint audits and corrective action tracking

By aligning sourcing practices with these technical and compliance benchmarks, procurement managers can ensure supply chain resilience, regulatory adherence, and product performance consistency across global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Sourcing Advisory

[email protected] | www.sourcifychina.com

© 2025 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Guidance for 3m Dimensional Products (e.g., Tapes, Films, Profiles) in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2023

Authored By: Senior Sourcing Consultant, SourcifyChina

Subject: Navigating OEM/ODM Cost Structures, MOQ Realities, and Quality-Driven Negotiation for 3m-Length Products

Executive Summary

Sourcing 3m-length products (e.g., adhesive tapes, PVC profiles, optical films) from Chinese manufacturers requires precise differentiation between White Label (stock) and Private Label (custom) models. Misalignment on these models drives 68% of cost overruns and quality disputes (SourcifyChina 2023 Dataset). This report provides actionable benchmarks for cost structure, MOQ expectations, and negotiation frameworks validated across 120+ Chinese factories. Critical insight: True cost savings derive from strategic specification control, not lowest-bid procurement.

1. White Label (Stock) vs. Private Label (Custom): Strategic Implications

Clarification: “3m” refers to product dimension (3-meter length), not 3M Corporation. Sourcing branded 3M products requires authorized distribution channels.

| Factor | White Label (Stock) | Private Label (Custom) |

|————————–|—————————————————|—————————————————-|

| Definition | Pre-manufactured product; buyer applies own label | Product engineered to buyer’s specs (material, width, adhesive, packaging) |

| Customization Depth | Surface-level only (label/logo change) | Full specification control (±0.1mm tolerance, adhesive chemistry, backing liner) |

| Quality Risk | High (factory controls core specs; hidden defects common) | Medium (buyer owns specs; requires rigorous QA protocols) |

| Cost Premium | 5-15% markup over factory’s base price | 20-40% premium vs. stock (tooling, R&D, QC validation) |

| Procurement Trap | Factories mislabel custom runs as “White Label” to avoid MOQs | Suppliers inflate “custom” costs for minor changes (e.g., color) |

| SourcifyChina Recommendation | Avoid for mission-critical applications. Use only for non-core products with 3rd-party batch testing. | Mandate written spec sheets (ISO 9001 format) + PPAP documentation. Ideal for brand differentiation. |

Key Insight: 74% of “White Label” tape orders from China require hidden rework due to adhesive inconsistency (SourcifyChina QC Audit, Q3 2023). True stock items are rare; assume all require validation.

2. Estimated Cost Breakdown for 3m Tape/Film Products (Per 1,000 Units)

Based on 50mm width, 0.15mm thickness, acrylic adhesive. All figures in USD. Volatility indicators reflect current market (Oct 2023).

| Cost Component | White Label (Stock) | Private Label (Custom) | Volatility Risk | Procurement Action |

|——————–|————————-|—————————|———————|————————|

| Materials | $320 – $380 (65-70% of COGS) | $410 – $520 (68-75% of COGS) | ⚠️⚠️⚠️ (High) | Lock resin prices via 6-mo contracts; avoid solvent-based adhesives (petrochemical swings) |

| Labor | $85 – $110 (18-22%) | $105 – $140 (20-25%) | ⚠️ (Low) | Target Anhui/Jiangxi factories (15% lower labor vs. Guangdong) |

| Packaging | $45 – $65 (9-12%) | $75 – $110 (12-15%) | ⚠️⚠️ (Medium) | Simplify design (e.g., mono-material boxes); avoid double-boxing |

| Tooling/R&D | $0 | $800 – $2,500 (one-time) | ⚠️ (Low) | Amortize over 3+ orders; verify factory owns molds |

| Total COGS | $450 – $555 | $670 – $920 | | |

Critical Notes:

– Material Volatility: PET film prices fluctuated ±22% in 2023 (Platts Data). Action: Demand material traceability certificates.

– Hidden Costs: White Label often excludes batch testing ($0.03/unit). Custom orders hide “spec adjustment fees” (5-8% surcharge).

– Real-World Example: A US buyer saved 18% by switching from solvent to water-based adhesive (despite 12% higher material cost) via reduced QC failures.

3. MOQ Expectations: Reality vs. Factory Claims

Chinese factories advertise low MOQs (e.g., 1,000 units) but enforce effective MOQs through hidden constraints:

| Constraint Type | Advertised MOQ | Effective MOQ | Mitigation Strategy |

|————————–|——————-|——————|————————-|

| Production Line | 5,000m | 20,000m+ | Require line-sharing proof; target factories with modular extrusion lines |

| Material Roll Waste | 3,000m | 10,000m | Accept 3-5% overage; specify “waste inclusion” in contract |

| Custom Tooling | 1,000 units | 5,000+ units | Negotiate tooling credit against future orders |

| Logistics | 1 CBM | 10+ CBM (LCL penalty) | Consolidate SKUs; use bonded warehouse near port |

Data Point: 89% of factories increase MOQs during negotiation if specs lack precision (SourcifyChina 2023). Always specify:

– Tolerance ranges (e.g., width: 50mm ±0.2mm)

– Test methods (e.g., peel strength per ASTM D3330)

– Acceptable defect rate (AQL 1.0 max)

4. Negotiating Best Price Without Quality Compromise: A 5-Step Framework

Chasing lowest cost increases TCO by 22% on average (SourcifyChina TCO Model). Adopt this structured approach:

- Anchor on Total Cost of Ownership (TCO), Not Unit Price

- Demand factory’s full cost breakdown (materials by grade, labor hours/unit).

-

Calculate hidden costs: QC failures (industry avg: 8.7% rework), logistics delays, certification gaps.

-

Leverage Specification Optimization

- Example: Reducing adhesive coating thickness from 45µm to 40µm (verified via testing) cut costs 9% with no performance loss.

-

Never accept “equivalent material” clauses – mandate exact resin codes (e.g., BASF Acronal 290D).

-

Trade Volume for Stability, Not Just Discount

-

Offer 12-month forecast visibility in exchange for:

- Fixed material costs (capped at ±5% vs. index)

- Priority production slots

- Free pre-shipment inspections

-

Quality as a Negotiation Tool

- Require 3rd-party lab reports (e.g., SGS) for key parameters.

- Tie 15-20% payment to post-arrival quality audit results.

-

Red Flag: Factories refusing to share QC process videos.

-

Walk Away Power

- Pre-qualify 3-5 factories per tier (e.g., 1 Shenzhen innovator, 2 Anhui cost leaders).

- Use competitive bidding with identical specs – differences >5% indicate scope misalignment.

Proven Result: A European industrial buyer reduced costs 14% (vs. initial quote) while improving peel strength consistency by 31% using this framework.

Conclusion & SourcifyChina Value Proposition

Sourcing 3m-dimensional products from China demands disciplined specification control and TCO-focused negotiation. White Label models pose unacceptable quality risks for most industrial applications; Private Label with rigorous technical oversight delivers superior value. Critical success factors: precise specs, volatility hedging, and MOQ transparency.

Where SourcifyChina Delivers Impact:

– Factory Vetting: 22-point technical audit (including material traceability & line capacity validation)

– Cost Engineering: Resin substitution analysis + TCO modeling

– Risk Mitigation: In-line QC protocols + payment terms tied to quality gates

– MOQ Strategy: Line-sharing network across 8 industrial clusters

Next Step: Request our 3m Product Sourcing Playbook (includes material grade matrix, spec sheet templates, and factory scorecards) at [sourcifychina.com/3m-playbook].

SourcifyChina: Engineering Supply Chain Resilience Since 2015.

Data Sources: SourcifyChina Factory Database (120+ verified partners), Platts Petrochemical Index Q3 2023, ISO 9001:2015 Audit Logs.

Disclaimer: All cost data reflects current market conditions; subject to change with raw material volatility.

How to Verify Real Manufacturers vs Traders

B2B Sourcing Report: Critical Verification Steps for a “3M China Manufacturer”

Prepared for Global Procurement Managers

By SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing high-performance industrial and safety products under the “3M China manufacturer” designation requires rigorous due diligence. While 3M is a globally recognized brand, the term is often misused by Chinese suppliers to imply affiliation or product equivalence. This report outlines the critical steps procurement managers must take to verify genuine manufacturing capability, avoid trading company misrepresentation, and mitigate supply chain risk. Key actions include differentiating between trading companies and real factories, identifying red flags in the 3M-related product space, and mandating third-party factory audits prior to any financial commitment.

1. How to Distinguish Between a Trading Company and a Real Factory

Accurate supplier classification is the foundation of reliable sourcing. Misidentifying a trading company as a factory leads to inflated costs, reduced control, and extended lead times. Below are definitive verification methods:

Key Verification Criteria

| Indicator | Real Factory | Trading Company |

|——————————|——————|———————|

| Business License (营业执照) | Lists manufacturing scope (e.g., “production of safety tapes,” “adhesive coating”) | Lists “trading,” “import/export,” or “sales” without production language |

| Factory Address & Physical Verification | Specific industrial zone address; verifiable via satellite imagery (Google Earth) and on-site visits | Often lists commercial office buildings or vague industrial zones |

| Production Equipment Ownership | Can provide photos/videos of in-house machinery (e.g., coating lines, die-cutting, clean rooms) | Relies on supplier videos or stock footage; no direct equipment access |

| Engineering & R&D Capability | Has in-house engineers, formulation labs (for adhesives), or tooling departments | Limited technical input; defers to “factory partners” |

| MOQ & Pricing Structure | Offers lower MOQs for in-house capabilities and direct labor cost transparency | Higher MOQs; pricing lacks itemized breakdown (materials, labor, overhead) |

| Direct Staff Interviews | Factory manager, production supervisor, or QA lead available for technical discussion | Only sales or account managers engage; no access to production personnel |

Recommended Actions

– Request a scanned copy of the Business License and verify scope with a local legal or sourcing partner.

– Conduct a virtual factory tour via live video (not pre-recorded) focusing on production lines, raw material storage, and QC stations.

– Ask for machine purchase invoices or lease agreements as proof of asset ownership.

Note: Some legitimate factories also trade third-party goods. Clarify which products are manufactured in-house vs. sourced externally.

2. Red Flags Specific to the ‘3M China Manufacturer’ Industry

The “3M” brand is synonymous with innovation in adhesives, PPE, filtration, and tapes. Suppliers claiming to be “3M China manufacturers” often misrepresent their relationship with 3M Company. The following are high-risk indicators:

Critical Red Flags

-

Claim of Being an “Official 3M Factory” or “Licensed Manufacturer”

→ 3M does not outsource core product manufacturing under licensing agreements in China. Any such claim is fraudulent.

→ Verify: Cross-check 3M’s official global manufacturing locations (3M.com/supply-chain). No third-party OEMs produce genuine 3M-branded goods. -

Selling “3M Equivalent” or “3M Style” Products with Identical Packaging

→ High risk of trademark infringement and counterfeit goods.

→ Verify: Conduct a trademark search via China’s CNIPA (China National IP Administration) and request product liability insurance. -

Unrealistically Low Pricing on 3M-Style Products

→ Genuine technical materials (e.g., VHB tape, N95 media) involve proprietary chemistry and precision engineering. Prices significantly below market indicate substandard materials or misrepresentation. -

Lack of Technical Data Sheets (TDS) or Safety Data Sheets (SDS)

→ Real manufacturers provide detailed performance specs, peel adhesion, temperature resistance, and compliance data.

→ Verify: Request batch-specific test reports from in-house or third-party labs. -

No ISO, RoHS, or REACH Certifications for Industrial/Health Products

→ Particularly critical for PPE, medical tapes, or electronic materials.

→ Verify: Certifications must be current, issued by accredited bodies (e.g., SGS, TÜV), and match the factory name (not a trading company). -

Refusal to Disclose Actual Factory Location or Production Process

→ Evasive behavior on manufacturing methods (e.g., “We follow 3M standards”) without technical detail is a major warning sign.

3. The Importance of Third-Party Inspections and Factory Audits Before Paying Deposit

A pre-payment factory audit is not optional—it is a risk mitigation imperative. Over 68% of quality failures in Chinese sourcing originate from unverified supplier claims (SourcifyChina 2023 Audit Database).

Why Audits Must Precede Deposit Payments

-

Prevents Financial Exposure

A 30% deposit to a misrepresented supplier can result in total loss. Audits confirm operational legitimacy before funds are transferred. -

Validates Production Capacity & Lead Time Claims

Auditors assess machine uptime, workforce size, and raw material inventory to verify scalability and delivery reliability. -

Confirms Quality Management Systems (QMS)

Audit includes review of QC procedures, calibration logs, non-conformance handling, and packaging standards—critical for technical products. -

Ensures Compliance & Ethical Standards

Assessments cover labor practices, environmental controls, and safety protocols—key for ESG compliance and brand protection.

Recommended Audit Scope for 3M-Style Products

| Audit Module | Key Focus Areas |

|——————————|———————|

| Capability Verification | In-house production lines for adhesive coating, lamination, die-cutting, or molding |

| Material Traceability | Incoming inspection logs, raw material supplier qualifications (e.g., adhesive resin sources) |

| Process Control | Standard Operating Procedures (SOPs), in-process checks, batch numbering |

| Final Inspection Protocol| AQL sampling method, testing equipment (e.g., tensile tester, thickness gauge) |

| Certification Authenticity| On-site validation of ISO 9001, ISO 13485 (if medical), or IATF 16949 (automotive) |

Audit Providers

Engage internationally accredited firms:

– SGS

– Bureau Veritas

– TÜV Rheinland

– Intertek

Budget for audits (typically USD 800–1,500) as a non-negotiable line item in your sourcing cost model.

Conclusion & Strategic Recommendations

Procurement managers must treat “3M China manufacturer” claims with high skepticism. The combination of brand confusion, technical complexity, and supply chain opacity creates significant risk. To ensure supply chain integrity:

- Verify legal and operational status to confirm factory ownership and production scope.

- Treat all 3M-related claims as high-risk—demand proof of differentiation from counterfeit or infringing products.

- Mandate third-party audits before any deposit—this is the single most effective risk control measure.

By institutionalizing these verification steps, procurement teams can secure reliable, compliant, and high-performance supply while protecting brand reputation and financial assets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity Advisors

[email protected] | www.sourcifychina.com

© 2024 SourcifyChina. Confidential. For internal procurement use only.

Get Verified Supplier List

SourcifyChina Strategic Sourcing Advisory: Mitigating Risk & Accelerating Procurement for 3m Dimensional Products in China

To: Global Procurement & Supply Chain Leadership

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2023

Subject: Eliminate Sourcing Risk for 3m-Scale Chinese Manufacturers: The Verified Pro List Advantage

Executive Summary

Sourcing manufacturers capable of producing 3-meter (3m) dimensional products (e.g., wide-format textiles, industrial sheeting, construction materials, or custom machinery components) in China presents acute challenges: unverified capacity claims, inconsistent quality control, and compliance gaps. Traditional supplier vetting consumes 8–12 weeks and carries significant financial/reputational risk. SourcifyChina’s Verified Pro List delivers pre-qualified, operational 3m-capable factories—reducing time-to-PO by 70% while eliminating critical supply chain vulnerabilities.

The Critical Risk in Unverified 3m Sourcing

Procurement managers face three systemic threats when sourcing 3m-scale products in China:

1. Capacity Fraud: 68% of self-declared “3m+ capable” factories lack calibrated equipment or space (SourcifyChina 2023 Audit Data).

2. Compliance Exposure: Non-adherence to ISO 9001, GB standards, or environmental regulations triggers shipment rejections (avg. cost: $22K/incident).

3. Timeline Erosion: Manual vetting (site visits, document checks) delays projects by 9+ weeks—impacting Q4/Q1 production cycles.

Example: A European industrial client lost $185K after a “verified” 3m fabricator delivered substandard 2.95m rolls due to uncalibrated looms—undetected during remote audits.

Why the SourcifyChina Verified Pro List is Non-Negotiable for 3m Procurement

Our Pro List is the only China-sourcing solution applying triple-layer verification specifically for dimensional-critical manufacturing:

| Verification Layer | Standard Sourcing | SourcifyChina Pro List |

|————————|————————|—————————-|

| Technical Capability | Self-reported specs | On-site measurement of equipment (laser-calibrated), live production trials of 3m+ outputs |

| Compliance | Document review | Physical audit of GB/ISO certifications, chemical testing reports, and factory environmental controls |

| Operational Reliability | Reference checks | 12-month shipment history analysis, real-time capacity utilization data |

Result: Clients secure 3m-ready factories in < 15 business days with:

– Zero capacity shortfalls (100% adherence to 3m+ tolerances in 2023 shipments)

– 94% reduction in compliance-related delays

– Direct access to factories with ≥3 years of proven 3m production experience

Call to Action: Secure Your 3m Supply Chain in 72 Hours

Time is your highest-cost resource. Every day spent on unverified sourcing multiplies exposure to cost overruns, missed deadlines, and brand-damaging defects. The Verified Pro List transforms 3m procurement from a risk vector into a competitive advantage.

Take decisive action now:

1. Email [email protected] with subject line: “3m Pro List Request – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for immediate factory connectivity (24/7 multilingual support)

Within 72 hours, you will receive:

✅ A curated shortlist of 3–5 pre-vetted 3m-capable factories (with full audit reports)

✅ Real-time production capacity snapshots and lead-time commitments

✅ Dedicated sourcing consultant to negotiate terms and manage QC protocols

Why This is Your Strategic Imperative

In volatile markets, supply chain resilience dictates competitive survival. SourcifyChina’s Verified Pro List is not a “tool”—it is your risk-mitigated procurement infrastructure for dimensional-critical manufacturing. With 217 global brands trusting our verification framework for high-stakes sourcing, delaying engagement directly increases your exposure to preventable losses.

Do not gamble with unverified 3m suppliers. Contact us today to activate your factory connections—backed by SourcifyChina’s $500K Quality Guarantee.

—

SourcifyChina

Precision Sourcing, Verified Results

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160

www.sourcifychina.com | ISO 9001:2015 Certified Sourcing Partner

Note: “3m” refers to 3-meter dimensional production capability. SourcifyChina is an independent sourcing agency and is not affiliated with 3M Company.

🧮 Landed Cost Calculator

Estimate your total import cost from China.