The global 3D scanner market is experiencing robust expansion, driven by increasing demand for precision measurement and digital modeling across industries such as manufacturing, healthcare, automotive, and construction. According to Grand View Research, the market was valued at USD 6.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of approximately 7.8% during the forecast period of 2023–2028, underpinned by advancements in optical scanning technologies and rising adoption in quality control and reverse engineering applications. As industrial digitization accelerates, 3D scanning has become a cornerstone technology for enabling efficient product development and automation. This growth has spurred fierce innovation among manufacturers, with leading companies enhancing portability, accuracy, and software integration to meet evolving customer needs. In this competitive landscape, the following ten manufacturers stand out for their technological leadership, product diversity, and global market presence.

Top 10 3D Scanners Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SCANOLOGY

Domain Est. 2017

Website: 3d-scantech.com

Key Highlights: SCANOLOGY is a high-tech 3D laser scanner company that offers both industrial and professional 3D scanning solutions, like portable 3D scanners, ……

#2 ATOS Industrial 3D scanners

Domain Est. 1995

Website: zeiss.com

Key Highlights: Our systems deliver full-field 3D scans. Experience rapid, high-resolution data, enabling comprehensive process and quality control across diverse industries….

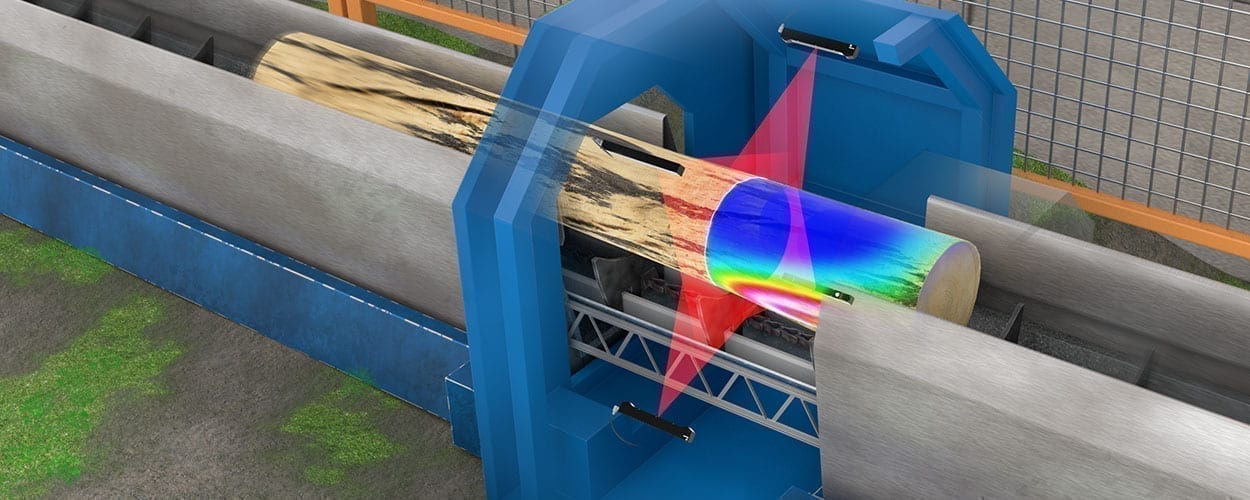

#3 LMI Technologies

Domain Est. 2009

Website: lmi3d.com

Key Highlights: Our smart 3D laser, snapshot, and line confocal sensors improve factory production by providing fast, accurate, reliable machine vision inspection ……

#4 SMARTTECH3D

Domain Est. 2011

Website: smarttech3d.com

Key Highlights: SMARTTECH3D company is a well-known expert in the 3D Measurement industry. Set up in 2000 we gained a leading position in the European region….

#5 Portable 3D Scanner

Domain Est. 2019

Website: revopoint3d.com

Key Highlights: Trackit is Revopoint’s latest high-accuracy 3D scanner and optical tracker for fine-detail industrial scanning. It enables highly efficient markerless 3D scans….

#6 3DMakerpro: Portable 3D Scanners

Domain Est. 2022

Website: store.3dmakerpro.com

Key Highlights: Explore high-precision portable 3D scanners for design, modeling, and industrial use. Ideal for engineers, creators, and professionals….

#7 3D Measurement, Imaging & Realization Solutions

Domain Est. 1995

Website: faro.com

Key Highlights: FARO provides the most precise 3D measurement, imaging and realization technologies for manufacturing, construction and public safety analytics industries….

#8 3D Systems

Domain Est. 1996

Website: 3dsystems.com

Key Highlights: 3D Systems provides comprehensive products and services, including 3D printers, print materials, software, on-demand manufacturing services, and healthcare ……

#9 SHINING 3D

Domain Est. 2008

Website: shining3d.com

Key Highlights: SHINING 3D develops high-accuracy 3D scanners for a wide range of applications. Our solutions are ideal for use in high-precision metrology, digital dentistry, ……

#10 Handheld 3D Scanners

Domain Est. 2009

Website: artec3d.com

Key Highlights: Artec`s handheld 3D scanners are professional solutions for 3D digitizing real-world objects with complex geometry and rich texture in high resolution….

Expert Sourcing Insights for 3D Scanners

2026 Market Trends for 3D Scanners

The global 3D scanning market is poised for significant transformation by 2026, driven by technological advancements, expanding applications, and evolving industry demands. As industries increasingly adopt digital workflows, 3D scanners are transitioning from niche tools to essential components across a wide range of sectors. Here are the key trends expected to shape the 3D scanner market in 2026:

1. Accelerated Adoption in Industrial Manufacturing and Quality Control

By 2026, industrial metrology and quality assurance will remain dominant drivers of 3D scanner adoption. With the rise of Industry 4.0 and smart factories, manufacturers will increasingly rely on high-precision scanners for real-time inspection, reverse engineering, and first-article inspection. Portable and automated scanning systems integrated into production lines will enhance efficiency, reduce downtime, and ensure tighter tolerances in sectors such as automotive, aerospace, and heavy machinery.

2. Expansion in Healthcare and Personalized Medicine

The healthcare sector will witness substantial growth in 3D scanning applications, particularly in prosthetics, orthodontics, surgical planning, and custom implants. By 2026, intraoral scanners and full-body 3D imaging systems will become standard in clinics and hospitals. Advances in speed, accuracy, and patient comfort will enable rapid digital capture, supporting the trend toward personalized treatment plans and on-demand medical device manufacturing.

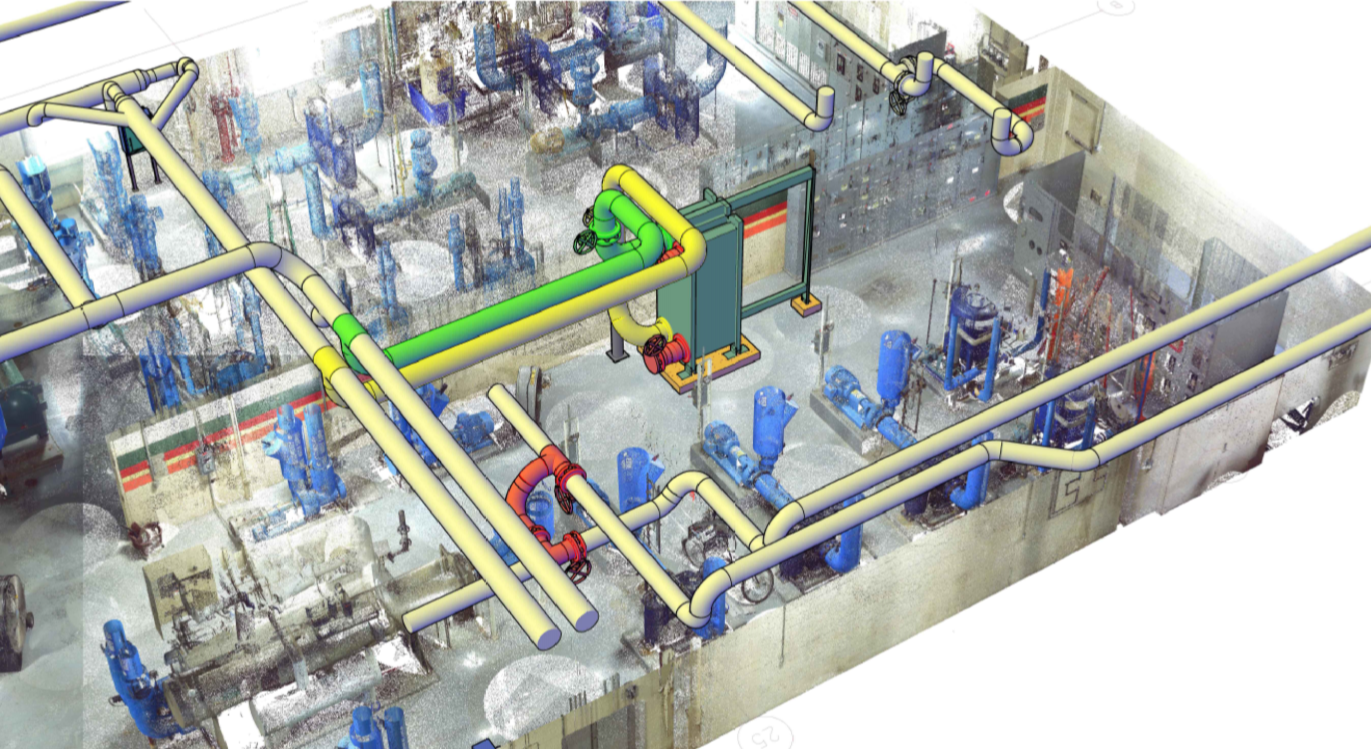

3. Growth in Construction and Architecture (AEC)

In the Architecture, Engineering, and Construction (AEC) industry, 3D scanners will play a pivotal role in building information modeling (BIM), facility management, and as-built documentation. By 2026, drone-mounted and terrestrial laser scanning will be widely adopted for site surveys, progress monitoring, and renovation projects. The integration of scan data with cloud-based platforms will streamline collaboration and improve project accuracy.

4. Rising Demand for Portable and Handheld Scanners

User-friendly, portable, and handheld 3D scanners will dominate market growth due to their versatility and ease of use. These devices will be increasingly adopted by small and medium enterprises (SMEs), artists, educators, and field technicians. Improvements in battery life, wireless connectivity, and real-time processing will enhance mobility and on-site scanning capabilities.

5. Integration with AI and Machine Learning

Artificial intelligence will transform how 3D scanning data is processed and interpreted. By 2026, AI-powered software will automate scan alignment, defect detection, and data segmentation, reducing post-processing time and minimizing human error. Predictive analytics based on scan data will enable proactive maintenance in industrial settings and improve decision-making across applications.

6. Advancements in Sensor Technology and Accuracy

Ongoing innovations in sensor technology—such as structured light, laser triangulation, and photogrammetry—will lead to higher accuracy, faster capture speeds, and better performance on challenging surfaces (e.g., reflective or dark materials). Time-of-flight (ToF) and phase-shift scanners will also gain traction in large-scale applications like urban planning and autonomous vehicle development.

7. Democratization of 3D Scanning through Software and Cloud Platforms

User-centric software and cloud-based platforms will lower barriers to entry. By 2026, subscription-based SaaS models will make advanced scanning and processing tools accessible to non-specialists. Real-time collaboration, remote access to scan data, and seamless integration with CAD/CAM and AR/VR tools will enhance workflow efficiency.

8. Sustainability and Digital Twin Applications

As sustainability becomes a global priority, 3D scanning will support circular economy initiatives by enabling precise asset tracking, remanufacturing, and life-cycle analysis. The creation and maintenance of digital twins—virtual replicas of physical assets—will rely heavily on continuous 3D scanning for monitoring, simulation, and optimization in energy, transportation, and urban infrastructure.

In conclusion, the 3D scanner market in 2026 will be defined by broader accessibility, deeper integration with digital ecosystems, and expansion into new verticals. Companies that focus on innovation, usability, and cross-industry applications will be well-positioned to lead this dynamic and rapidly evolving market.

Common Pitfalls When Sourcing 3D Scanners: Quality and Intellectual Property Concerns

Sourcing 3D scanners for industrial, engineering, or creative applications involves more than just comparing price and resolution. Overlooking critical quality and intellectual property (IP) aspects can lead to project delays, compromised data integrity, legal exposure, and financial loss. Below are key pitfalls to avoid.

Poor Data Accuracy and Repeatability

One of the most frequent quality-related pitfalls is assuming manufacturer specifications reflect real-world performance. Some scanners may advertise high resolution but deliver inconsistent or inaccurate results under varying environmental conditions (e.g., lighting, temperature, surface reflectivity). Buyers often fail to validate scanner performance with test scans of representative objects, leading to costly rework or flawed digital models.

Inadequate Build Quality and Durability

Low-cost or unproven scanners may use substandard components that degrade quickly or fail under routine use. This is especially problematic in industrial environments where scanners are subject to vibrations, dust, or frequent handling. Sourcing without assessing the device’s robustness can result in downtime, increased maintenance costs, and unreliable data over time.

Insufficient Software Integration and Support

Many 3D scanners come with proprietary software that may not integrate well with existing CAD, reverse engineering, or data analysis tools. Poor software support, lack of API access, or limited file export options can hinder workflow efficiency. Buyers should evaluate software compatibility and ongoing support before procurement.

Hidden Costs and Licensing Restrictions

Some vendors embed hidden costs through mandatory software subscriptions, limited licensing models, or per-scan fees. Additionally, certain scanners lock users into closed ecosystems, making it difficult or expensive to extract raw data. These restrictions can reduce flexibility and inflate long-term costs.

Intellectual Property Risks from Data Ownership Ambiguity

A critical but often overlooked pitfall is unclear ownership of scanned data. Vendor terms of service may claim partial rights or usage licenses over the 3D models generated using their hardware or software. This poses significant IP risks, especially when scanning proprietary designs, medical data, or culturally sensitive artifacts. Always review licensing agreements to ensure full ownership and control of output data.

Use of Non-Compliant or Reverse-Engineered Technology

Some low-cost scanners, particularly from unverified suppliers, may incorporate reverse-engineered or patented technologies without proper licensing. Using such devices exposes the buyer to potential legal liability for contributory infringement. Sourcing from reputable vendors with verifiable technology origins mitigates this risk.

Lack of Calibration and Certification Documentation

For regulated industries (e.g., aerospace, medical devices), traceable calibration and compliance with standards (such as ISO 17025) are essential. Scanners lacking proper certification or calibration logs may invalidate inspection data, leading to audit failures or rejection of parts.

Inadequate Vendor Support and Long-Term Viability

Choosing a scanner from a vendor with poor technical support or uncertain market longevity can jeopardize long-term project sustainability. If the vendor goes out of business or discontinues software updates, users may lose access to critical patches, drivers, or compatibility upgrades.

To avoid these pitfalls, conduct thorough due diligence: request test scans, audit software and licensing terms, verify IP clauses, and prioritize vendors with proven track records and transparent support policies.

Logistics & Compliance Guide for 3D Scanners

Import and Export Regulations

3D scanners may be subject to international trade controls depending on their technical specifications. Key regulatory frameworks include the Wassenaar Arrangement, which governs dual-use technologies. Exporters must determine whether their 3D scanner meets controlled parameters (e.g., accuracy, scanning speed, or intended use). Always verify the Export Control Classification Number (ECCN) and consult your country’s export administration (e.g., Bureau of Industry and Security in the U.S.) before shipping internationally. Some models may be classified under ECCN 3A999 or similar categories.

Customs Documentation

Accurate customs documentation is essential for smooth international shipments. Required documents typically include a commercial invoice, packing list, bill of lading or air waybill, and, when applicable, a certificate of origin and export license. Clearly describe the item as “3D Optical Scanner” or “Laser Scanning Device” and include technical specifications such as resolution, accuracy, and wavelength. Misclassification or incomplete documentation may result in delays, fines, or seizure of goods.

Restricted Destinations and End-Use Controls

Be aware of sanctions and embargoes on certain countries, regions, or entities. The use of 3D scanners in military or surveillance applications may trigger additional scrutiny. Ensure compliance with end-use and end-user certification requirements, particularly when shipping to high-risk jurisdictions. Screen all parties against government restricted entity lists (e.g., OFAC, BIS Denied Persons List) prior to shipment.

Packaging and Handling Requirements

3D scanners are precision instruments sensitive to shock, moisture, and temperature extremes. Use anti-static, cushioned packaging with rigid outer cases. Include desiccants if transporting through humid environments. Clearly label packages as “Fragile,” “This Side Up,” and “Protect from Moisture.” For air freight, ensure compliance with IATA requirements for lithium batteries if the scanner includes rechargeable power sources.

Battery Regulations

If the 3D scanner contains lithium-ion or lithium-metal batteries (common in portable models), shipping regulations apply. Batteries must meet UN 38.3 testing requirements. For air transport, packages must comply with IATA Dangerous Goods Regulations (DGR), including proper marking, labeling, and documentation (e.g., Shipper’s Declaration for Dangerous Goods, if required). In most cases, batteries installed in equipment are permitted under special provision A45 or A194.

Data Privacy and Cybersecurity Compliance

3D scanners may capture sensitive or personal data, especially in applications involving human scanning (e.g., medical, security, or biometrics). Ensure compliance with data protection laws such as GDPR (EU), CCPA (California), or HIPAA (for medical use in the U.S.). Implement secure data storage, encryption, and access controls. Inform users when data is being collected and obtain consent where required.

Product Certification and Standards

3D scanners must meet regional safety and electromagnetic compatibility standards. Common certifications include:

– CE Marking (EU): Required for compliance with the EU’s EMC, RoHS, and RED directives.

– FCC Certification (USA): Mandatory for devices emitting radio frequency energy.

– IC Certification (Canada): Similar to FCC, governed by Innovation, Science and Economic Development Canada.

– PSE Mark (Japan): Required for electrical safety under the DENAN Law.

Verify that your device holds the appropriate certifications for the destination market.

Warranty and After-Sales Support Logistics

Plan for cross-border warranty claims, repairs, and technical support. Maintain authorized service centers or partner with local distributors to reduce turnaround time. Clearly communicate warranty terms, including what constitutes valid use and exclusions. Track serial numbers and sales locations to manage compliance with regional consumer protection laws.

Environmental and Disposal Regulations

Comply with environmental regulations such as the EU’s WEEE (Waste Electrical and Electronic Equipment) Directive, which mandates proper recycling and disposal of electronic equipment. Provide end-of-life take-back programs where required. Ensure packaging materials are recyclable and comply with local restrictions on hazardous substances (e.g., RoHS, REACH).

Recordkeeping and Audit Preparedness

Maintain detailed records of all shipments, compliance checks, export licenses, and end-user documentation for a minimum of five years (or as required by local law). These records are essential for internal audits and potential government inquiries. Implement a compliance management system to track regulatory changes and ensure ongoing adherence.

Conclusion for Sourcing 3D Scanners

After a thorough evaluation of available 3D scanning technologies, vendors, and market offerings, it is evident that selecting the right 3D scanner depends heavily on the specific application requirements, including accuracy, speed, portability, object size, surface complexity, and budget constraints. A variety of scanner types—such as structured light, laser, photogrammetry, and contact-based systems—each offer distinct advantages and limitations that must be carefully aligned with operational needs.

Key considerations for sourcing include not only the scanner’s technical specifications, but also software compatibility, ease of integration into existing workflows, vendor support, training availability, and total cost of ownership. Additionally, emerging trends such as handheld portability, real-time scanning, AI-enhanced processing, and cloud-based data management are shaping the future landscape of 3D scanning solutions.

Ultimately, sourcing the optimal 3D scanner requires a balanced approach that prioritizes performance, scalability, and long-term value. It is recommended to engage in pilot testing with shortlisted vendors, solicit demonstrations on real-world use cases, and obtain user feedback before final procurement. By doing so, organizations can ensure a successful implementation that enhances productivity, improves data accuracy, and supports innovation across design, manufacturing, quality control, and other critical functions.