The global excavator market is experiencing robust expansion, driven by rising infrastructure development, urbanization, and government investments in construction across emerging economies. According to Mordor Intelligence, the construction equipment market—of which excavators are a key component—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. With compact and mid-sized models like the 349 category increasingly in demand for large-scale commercial and industrial projects, the segment has attracted significant manufacturing attention. In particular, the 349 class, known for its balance of power, efficiency, and operational versatility, has become a benchmark in heavy-duty excavation. As of 2023, Asia Pacific dominates global excavator demand, representing over 40% of market volume, further amplifying regional production capabilities. Drawing on industry data and equipment performance metrics, here are the top six manufacturers leading innovation and market share in the 349 Cat excavator and comparable high-tonnage hydraulic excavator space.

Top 6 349 Cat Excavator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Caterpillar

Domain Est. 1995

Website: caterpillar.com

Key Highlights: Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial turbines and ……

#2 [PDF] HYDRAULIC EXCAVATOR

Domain Est. 2005

Website: plmcat.com

Key Highlights: The CAT 349 gives you more operating efficiency with factory-installed Cat GRADE and PAYLOAD technologies, more fuel efficiency with a new electrohydraulic….

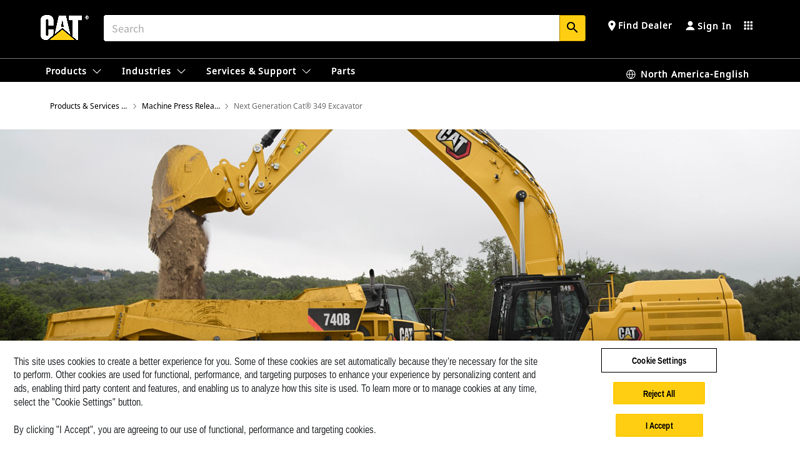

#3 Next Generation Cat® 349 Excavator Delivers Increased Efficiency …

Domain Est. 1993

Website: cat.com

Key Highlights: The Next Generation Cat 349 excavator offers contractors up to 45 percent more operating efficiency, up to 10 percent more fuel efficiency, and up to 15 ……

#4 Cat 349 Large Excavators

Domain Est. 1993

Website: h-cpc.cat.com

Key Highlights: The Cat 349 excavator brings premium performance with simple-to-use technologies like Cat GRADE with 2D, Grade Assist, and Payload….

#5 349 Hydraulic Excavator

Domain Est. 2004

Website: petersoncat.com

Key Highlights: The Cat 349 excavator brings premium performance with simple-to-use technologies like Cat GRADE with 2D, Grade Assist, and Payload – all standard equipment ……

#6 CAT Next generation CAT®349 Excavator

Domain Est. 2018

Website: product.global-ce.com

Key Highlights: CAT Next generation CAT®349 Excavator. Operating mass of complete machine (kg):. 48100. Rated bucket capacity (m ³):. 2.41….

Expert Sourcing Insights for 349 Cat Excavator

H2: 2026 Market Trends for the Caterpillar 349 Excavator

As the construction and mining sectors evolve by 2026, the market for large hydraulic excavators like the Caterpillar 349 will be shaped by technological advancements, regulatory shifts, and changing customer demands. Here’s an analysis of key trends expected to influence the 349’s position in the market:

1. Increased Demand for Fuel Efficiency & Lower Operating Costs

The Cat 349, particularly the 349 GC and 349 models with Cat® C15 engines and advanced hydraulics, is already engineered for optimal fuel efficiency. By 2026, escalating fuel prices and tighter operating budgets will make fuel economy a top purchasing criterion. Operators will prioritize excavators like the 349 that deliver high productivity with reduced fuel consumption—especially in long-duration projects such as infrastructure development and large-scale mining.

2. Electrification and Hybrid Technology Acceleration

While the 349 remains diesel-powered in 2025, 2026 could see early market testing of hybrid or near-zero-emission variants, especially in regions with strict emissions regulations (e.g., EU, California). Caterpillar is investing heavily in sustainable technology, and although a full electric 349 is unlikely by 2026, expect incremental improvements in emissions reduction (Tier 5/Stage V compliance), enhanced engine management systems, and potential hybrid pilot programs targeting high-cycle applications.

3. Growth in Infrastructure Spending Driving Demand

Global government initiatives—such as the U.S. Infrastructure Investment and Jobs Act, EU Green Deal investments, and emerging market urbanization—will fuel demand for heavy equipment. The 349’s 49-ton class makes it ideal for large earthmoving, demolition, and quarry operations. Increased public and private infrastructure projects in 2026 will sustain strong demand, particularly in North America, Asia-Pacific, and the Middle East.

4. Rising Importance of Telematics and Machine Connectivity

Cat Connect technologies, including Grade with Assist, Payload, and VisionLink®, are standard differentiators. By 2026, fleet managers will demand seamless integration with construction management software. Real-time data on machine health, fuel usage, and utilization will be critical for optimizing ROI. The 349’s compatibility with advanced telematics will enhance its appeal among large contractors focused on predictive maintenance and job site efficiency.

5. Labor Shortages Driving Automation and Ease of Operation

With persistent labor shortages in skilled equipment operation, contractors will favor machines that reduce operator fatigue and improve productivity. The 349’s intelligent hydraulic system, intuitive controls, and automation features (e.g., swing deceleration control, auto-idle) will be key selling points. Expect increased adoption of operator-assist technologies that allow less-experienced operators to achieve near-expert performance.

6. Strong Secondary Market and Resale Value

The Cat 349 has historically retained strong residual value due to durability and widespread service support. In 2026, high demand for reliable used equipment—driven by cost-conscious buyers and supply chain constraints—will bolster the resale market. Certified pre-owned Cat 349s will remain attractive, especially in developing regions and among rental fleets.

7. Regional Market Divergence

- North America & Europe: Focus on emissions compliance, technology integration, and productivity. Demand driven by infrastructure and energy transition projects.

- Asia-Pacific: Robust growth in mining and construction, particularly in India and Southeast Asia. Preference for high-durability machines suited to harsh conditions.

- Latin America & Africa: Demand for cost-effective, reliable heavy equipment. Refurbished or older-spec 349 models may see strong uptake.

Conclusion

By 2026, the Caterpillar 349 excavator will remain a competitive leader in the 45–50 ton class, supported by its reputation for durability, fuel efficiency, and technological integration. While full electrification may still be on the horizon, incremental innovations in connectivity, automation, and emissions control will sustain its market relevance. Contractors seeking a balance of power, precision, and total cost of ownership will continue to favor the 349—especially in infrastructure and resource sectors poised for growth.

Common Pitfalls When Sourcing a 349 Cat Excavator (Quality and Intellectual Property)

Sourcing a used or aftermarket 349 Cat Excavator—especially from third-party suppliers or international markets—can present significant challenges related to equipment quality and intellectual property (IP) concerns. Avoiding these pitfalls is critical for ensuring performance, longevity, and legal compliance.

Poor Quality Due to Lack of Genuine Parts

One of the most frequent issues when sourcing a 349 Cat Excavator is the use of counterfeit or non-genuine replacement parts. These parts often fail to meet Caterpillar’s engineering standards, leading to reduced machine life, frequent breakdowns, and higher maintenance costs. Buyers may unknowingly acquire excavators rebuilt with substandard components, especially when purchasing from unauthorized dealers or gray-market suppliers.

Inadequate Maintenance History and Odometer Fraud

Many used 349 Cat Excavators available in secondary markets lack transparent service records. Tampered hour meters or falsified maintenance logs can mislead buyers about the machine’s true condition. Without verified documentation, assessing wear on critical components like the hydraulic system, undercarriage, and engine becomes highly speculative.

Risk of IP Infringement with Replica or Clone Machines

In some regions, particularly in emerging markets, manufacturers produce replica excavators that closely mimic the Caterpillar 349 model in appearance and branding. These machines may unlawfully use Caterpillar’s trademarks, logos, and design elements, raising serious intellectual property concerns. Purchasing such equipment—even unknowingly—can expose buyers to legal risks, especially in regulated industries or cross-border operations.

Non-Compliant Aftermarket Modifications

Some sourced 349 Cat Excavators come with unapproved modifications to the engine, hydraulics, or control systems. These alterations may void warranties, compromise safety certifications, and violate emissions regulations (e.g., EPA or EU Stage V standards). Additionally, modified machines may infringe on Caterpillar’s proprietary software and technology rights.

Lack of OEM Support and Software Access

Genuine Cat machines come with access to Caterpillar’s proprietary monitoring systems (e.g., Cat Connect, Product Link). Counterfeit or heavily modified units often lack compatibility with these platforms, limiting remote diagnostics, fleet management, and predictive maintenance capabilities. This disconnection can hinder operational efficiency and increase downtime.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Purchase only through authorized Caterpillar dealers or certified resellers.

– Request complete service records and verify machine hours via Cat ET or similar diagnostic tools.

– Inspect for genuine Cat parts and serial number authenticity.

– Conduct third-party inspections before finalizing purchases.

– Confirm compliance with regional emissions and safety standards.

– Ensure software and telematics systems are original and functional.

By focusing on authenticity, documentation, and compliance, stakeholders can reduce risks related to both equipment quality and IP violations when sourcing a 349 Cat Excavator.

Logistics & Compliance Guide for 349 Cat Excavator

This guide provides essential information for the safe, legal, and efficient transport and operation of the Caterpillar 349 Excavator. Adherence to these guidelines ensures regulatory compliance, minimizes risks, and supports project success.

Transportation Planning

Proper planning is critical for moving the 349 Cat Excavator safely and in accordance with legal requirements.

- Route Survey: Conduct a detailed route analysis to identify bridges, low-clearance structures, weight-restricted roads, and turning radius constraints. Use GPS and local transportation authority maps.

- Permits and Documentation: Obtain oversized/overweight transport permits from relevant state/provincial authorities where required. Maintain up-to-date equipment registration, insurance, and operator credentials.

- Trailer Selection: Use a lowboy or step-deck trailer rated for a minimum of 110,000 lbs. Ensure trailer brakes, lights, and securing points are in working order.

- Weight Distribution: Confirm the excavator’s operating weight (~110,000 lbs) and ensure load is evenly distributed across axles to comply with axle weight limits.

- Timing and Scheduling: Plan transport during off-peak hours to reduce traffic impact and avoid rush-hour restrictions in urban areas.

Loading and Securing Procedures

Safe loading and securement prevent accidents during transit.

- Pre-Load Inspection: Verify excavator is in transport mode (blade down, bucket closed, boom and arm stowed, cab locked).

- Ramp Safety: Use rated loading ramps with non-slip surfaces. Ensure ground is level and stable. Spotters must guide operator during loading.

- Tie-Down Requirements: Secure the excavator with a minimum of four (4) tiedowns—two from the front and two from the rear. Use Grade 70 transport chains or equivalent rated straps connected to reinforced undercarriage points.

- Tension and Inspection: Tighten all tiedowns to eliminate slack. Recheck tension after initial movement and at regular intervals during transport.

Regulatory Compliance

Ensure adherence to national and local regulations governing heavy equipment transport and operation.

- DOT/FMCSA Regulations (U.S.): Comply with Federal Motor Carrier Safety Regulations, including hours-of-service for drivers, vehicle maintenance standards (49 CFR Part 396), and proper load securement (49 CFR §393.110).

- Provincial Rules (Canada): Follow provincial transportation guidelines such as Ontario HTA or BC Motor Vehicle Act, including seasonal weight restrictions and permit requirements.

- Environmental Compliance: Ensure excavator meets Tier 4 Final emissions standards. Confirm there are no fuel or hydraulic leaks that could violate environmental protection laws.

- Cross-Border Requirements (if applicable): For international moves, ensure customs documentation, import permits, and EPA/CARB compliance are in order.

On-Site Handling and Setup

Proper handling at the destination supports safety and operational readiness.

- Unloading Site Prep: Ensure unloading area is level, stable, and free of overhead obstructions. Use ground protection mats if needed.

- Operator Qualifications: Only certified and trained operators should load, unload, or operate the 349 Cat. Maintain training records per OSHA (U.S.) or provincial standards.

- Post-Transport Inspection: Check for transport-related damage, loose bolts, hydraulic leaks, or tire/track wear before operation.

Documentation and Recordkeeping

Maintain thorough records to demonstrate compliance and support logistics tracking.

- Transport Logs: Record route, permits, inspection dates, driver details, and transport times.

- Maintenance Records: Keep logs of all maintenance, inspections, and repairs, including transport-related checks.

- Compliance Files: Store copies of permits, safety certifications, operator licenses, and insurance documents for audit purposes.

Emergency Procedures

Prepare for unexpected situations during transport or setup.

- Spill Response: Carry spill kits for fuel, oil, or hydraulic fluid. Know reporting procedures per local environmental regulations.

- Breakdown Protocol: Have roadside assistance contacts and a recovery plan for mechanical failure during transit.

- Incident Reporting: Document any accidents, near misses, or compliance violations immediately and report as required by law.

Adhering to this guide ensures the safe and compliant movement and operation of the 349 Cat Excavator, protecting personnel, equipment, and the environment.

Conclusion for Sourcing a Caterpillar 349 Excavator

After a thorough evaluation of technical specifications, market availability, cost considerations, and operational requirements, sourcing a Caterpillar 349 excavator presents a strategic and reliable investment for heavy-duty construction, mining, or large-scale excavation projects. The Cat 349 excels in performance, fuel efficiency, operator comfort, and durability, supported by Caterpillar’s global service network and advanced technology such as Grade Control and telematics (Cat Connect).

Sourcing options—whether through new purchases, certified pre-owned units, or leasing—offer flexibility depending on budget and project duration. Purchasing from authorized Cat dealers ensures authenticity, warranty coverage, and access to maintenance support, while pre-owned units from reputable sources can deliver significant cost savings without compromising reliability.

Ultimately, the Caterpillar 349 stands out as a high-productivity machine that aligns well with long-term operational goals. Proper due diligence in supplier selection, service agreements, and lifecycle cost analysis will ensure optimal return on investment and sustained project efficiency. Therefore, proceeding with the sourcing of a Cat 349 excavator is a justified and advantageous decision for heavy equipment fleets.

![[PDF] HYDRAULIC EXCAVATOR](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-hydraulic-excavator-174.jpg)