The global off-highway tire market, which includes large-diameter tires such as the 33x1250R20 used in agricultural, construction, and industrial machinery, is experiencing steady growth driven by rising demand for high-performance equipment. According to Grand View Research, the global off-the-road (OTR) tire market size was valued at USD 27.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing mechanization in farming, infrastructure development, and mining activities, particularly in emerging economies. As demand for durable, load-bearing tires like the 33x1250R20 rises, a select group of manufacturers has emerged as leaders in innovation, quality, and market reach. Based on production capacity, geographical presence, product reliability, and market reputation, the following nine manufacturers have established themselves at the forefront of supplying this specialized tire segment.

Top 9 33X1250R20 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

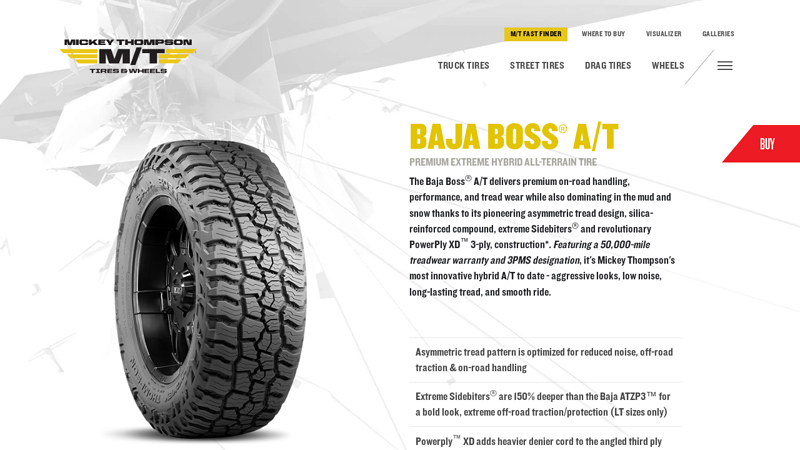

#1 Baja Boss® A/T

Domain Est. 1997

Website: mickeythompsontires.com

Key Highlights: The Baja Boss A/T delivers premium on-road handling, performance, and tread wear while also dominating in the mud and snow….

#2 BFGoodrich All

Domain Est. 1997

Website: bfgoodrichtires.com

Key Highlights: Rating 4.0 (191) The BFGoodrich All-Terrain T/A KO3 gives SUVs, CUVs & pickups proven off-road strength, severe snow traction, and a 50000-mile warranty….

#3 Ridge Grappler

Domain Est. 1998

Website: nittotire.com

Key Highlights: The Ridge Grappler features a revolutionary dynamic hybrid tread pattern and provides a quiet and comfortable with off-road performance capabilities….

#4 General Grabber A/TX Tire (33″

Domain Est. 1998

Website: americantrucks.com

Key Highlights: In stock Rating 5.0 (7) Product Details ; Tire Load Rating, E ; Tire Tread Depth, 16/32″ ; Tire Revs Per Mile, 615 ; Tire Speed Rating, (S) Up to 112mph ; Tire Weight, 66 ……

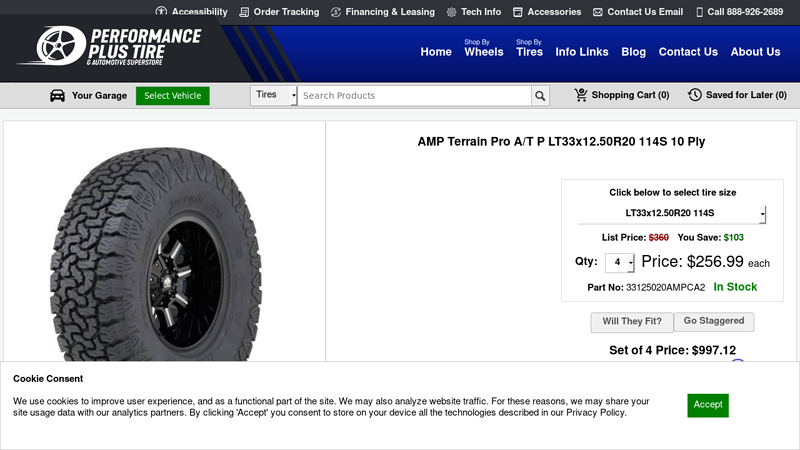

#5 AMP Terrain Pro A/T P LT 33×12.50R20

Domain Est. 1998

Website: performanceplustire.com

Key Highlights: Find the AMP Terrain Pro A/T P in size LT33x12.50R20 at the lowest price from Performance Plus Tire. With Free Shipping your choice is easy….

#6 BFG All

Domain Est. 1999

Website: cokertire.com

Key Highlights: In stock $75.55 deliveryConquer any terrain with the BFGoodrich All Terrain T/A KO2! Exceptional mud, snow, and rock traction with a rugged design for on- and off-road performance….

#7 35 / 12.5 R20 – Car Tire Size & Dimension

Domain Est. 2001

Website: michelinman.com

Key Highlights: Browse Michelin car tires by size 35 / 12.5 R20. Find high-performance options designed for your vehicle, offering exceptional safety, durability, ……

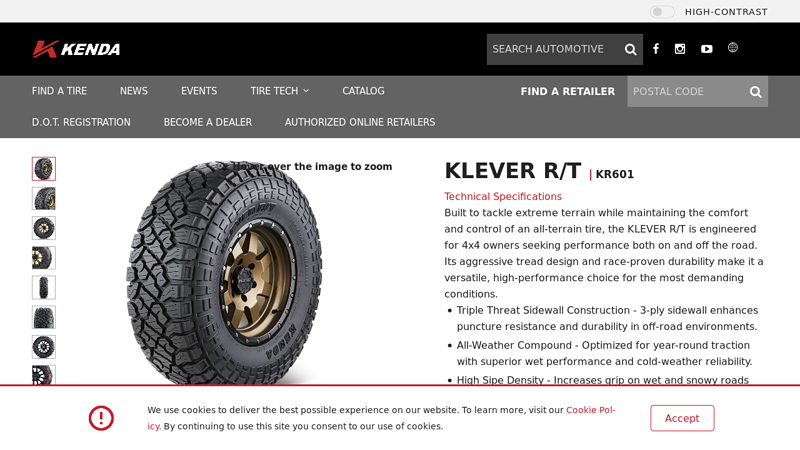

#8 klever r/t kr601

Domain Est. 2004

Website: automotive.kendatire.com

Key Highlights: Rating 4.6 (122) Built to tackle extreme terrain while maintaining the comfort and control of an all-terrain tire, the KLEVER R/T is engineered for 4×4 owners seeking ……

#9 Milestar Patagonia A/T R 33X12.50R20 E/10PLY BSW

Domain Est. 2015

Website: giga-tires.com

Key Highlights: In stock Rating 4.5 (14,694) The Patagonia A/T R tire is a rugged Light truck tire for pickups and SUVS. It is designed to balance long-haul on-road mannerisms with off-road toug…

Expert Sourcing Insights for 33X1250R20

As of now, there are no publicly available market forecasts specifically for the tire size 33X12.50R20 extending into 2026, and H2 (second half) of 2026 remains speculative. However, based on current automotive, tire industry, and consumer trends, we can project likely market dynamics for H2 2026 using available data and forward-looking analysis.

Market Trend Analysis: 33X12.50R20 Tires – H2 2026 Outlook

1. Overview of the 33X12.50R20 Tire Segment

- Application: This size is commonly used on full-size pickup trucks (e.g., Ford F-150, Chevrolet Silverado 1500, Ram 1500) and mid-to-large SUVs, typically as an aftermarket upgrade for lifted or off-road-oriented vehicles.

- Demand Drivers: Off-roading, overlanding, customization, and the popularity of truck culture in North America.

2. Key Market Trends Influencing H2 2026

A. Growth in Light-Duty Truck & SUV Sales

- Projection: By H2 2026, light-duty trucks and SUVs are expected to maintain over 70% market share in the U.S., supporting strong demand for larger tire sizes.

- Impact: Increased adoption of lifted trucks and off-road trims (e.g., Ford F-150 Raptor, Ram TRX, Chevrolet ZR2) will drive aftermarket tire demand, including 33X12.50R20.

B. Aftermarket Tire Expansion

- Trend: The global automotive aftermarket is projected to grow at a CAGR of 5.2% (2023–2027).

- Implication: Consumers are increasingly investing in vehicle personalization and performance upgrades post-purchase.

- 33X12.50R20 Relevance: As a popular “plus-sizing” option, this tire fits well within the trend of larger, aggressive all-terrain or mud-terrain tires.

C. Rise in Overlanding & Outdoor Recreation

- Consumer Behavior: Post-pandemic interest in outdoor recreation continues to grow.

- H2 2026 Outlook: Overlanding communities and off-road adventure travel are expected to expand, especially in North America and parts of Europe.

- Tire Demand: 33-inch tires like the 33X12.50R20 are ideal for rugged terrain and moderate off-road use, positioning them as a preferred choice.

D. EV Pickup Trucks Entering the Market

- Key Players: Ford F-150 Lightning, Rivian R1T, Tesla Cybertruck, and upcoming GM Electric Silverado.

- Consideration: These EVs often support large tire sizes and come with off-road packages.

- Forecast for H2 2026: EV truck sales are expected to reach 15–20% of total truck sales in the U.S.

- Opportunity: EV owners may seek performance and all-terrain tires, but efficiency concerns could limit oversized tire adoption. However, 33X12.50R20 offers a balance between size and range impact.

E. Sustainability & Tire Innovation

- Industry Shift: Tire manufacturers (e.g., BFGoodrich, Toyo, Nitto, Falken) are investing in sustainable materials, longer tread life, and lower rolling resistance.

- H2 2026 Expectation: New models of 33X12.50R20 tires may feature:

- Silica-enhanced compounds

- Noise-reducing tread designs

- Improved fuel efficiency (for ICE vehicles) and range optimization (for EVs)

- Recycled or bio-based materials

F. Supply Chain & Pricing Trends

- Post-Pandemic Normalization: By H2 2026, global tire supply chains are expected to stabilize.

- Inflationary Pressures: Raw material costs (rubber, oil derivatives) could fluctuate due to geopolitical factors.

- Price Outlook: Expect modest 2–4% annual price increases for premium all-terrain tires, including the 33X12.50R20.

3. Regional Market Focus – North America

- Dominant Market: North America accounts for over 60% of global demand for 33-inch tires.

- Retail Channels: Growth in e-commerce (e.g., Discount Tire, Tire Rack, SimpleTire) and installation networks will support accessibility.

- H2 2026 Retail Strategy: Bundled offers (tire + installation + TPMS) and subscription models may gain traction.

4. Competitive Landscape

- Key Brands: BFGoodrich All-Terrain T/A KO2, Toyo Open Country AT3, Nitto Ridge Grappler, Falken Wildpeak A/T4W.

- Innovation Focus:

- Hybrid terrain performance (on-road comfort + off-road grip)

- Load range E (10-ply) variants for towing and hauling

- UTQG (treadwear) improvements for longer life

5. Risks & Challenges

- Regulatory Pressure: Potential emissions and efficiency standards may discourage oversized tire use, especially on EVs.

- Tire Wear & Warranty Issues: Larger tires can affect speedometer accuracy, fuel economy, and OEM warranties.

- Competition from Slightly Smaller Sizes: 285/65R20 (≈33.5″) may remain more OEM-aligned and fuel-efficient.

Conclusion: H2 2026 Outlook for 33X12.50R20 Tires

| Factor | Outlook |

|——-|———|

| Demand | ⬆️ Strong growth due to truck/SUV popularity and off-road trends |

| Innovation | ⬆️ Increased focus on longevity, noise reduction, and sustainability |

| Pricing | ⬆️ Slight inflation (2–4% annually) |

| EV Compatibility | ➕ Growing niche, especially with performance variants |

| Market Competition | 🔁 Intensifying, with premium brands leading |

Summary: The 33X12.50R20 tire is expected to remain a high-demand segment in H2 2026, especially in North America. Driven by truck culture, off-road recreation, and aftermarket customization, the market will likely see enhanced product offerings, moderate price increases, and growing relevance in the EV truck space—provided efficiency trade-offs are managed.

Manufacturers and retailers should focus on performance differentiation, sustainability messaging, and omnichannel sales strategies to capture this growing market.

Note: This analysis is based on current trends and projections as of 2024. Actual 2026 market conditions may vary due to unforeseen economic, technological, or regulatory changes.

Common Pitfalls When Sourcing 33X1250R20 Tires (Quality and IP)

When sourcing specialty tires like the 33X1250R20, particularly for industrial or off-road applications, buyers often encounter significant challenges related to quality consistency and intellectual property (IP) protection. Being aware of these pitfalls is critical to ensuring performance, safety, and legal compliance.

Inconsistent Quality and Performance

One of the most prevalent issues is variability in tire quality, especially when sourcing from less-regulated manufacturers or regions. The 33X1250R20 size is commonly used in demanding environments such as agriculture, construction, and mining. Substandard materials or poor manufacturing processes can lead to premature wear, blowouts, or reduced traction. Buyers may receive batches that fail to meet load, speed, or durability ratings, resulting in equipment downtime and safety risks.

Counterfeit or Misrepresented Products

The industrial tire market is susceptible to counterfeit goods and misleading labeling. Some suppliers may falsely claim compliance with international standards (e.g., ISO, DOT, or ECE) or misrepresent the tire’s origin or manufacturing date. Buyers assuming they are purchasing a reputable brand may unknowingly receive rebranded or recycled tires, undermining both performance and warranty validity.

Lack of Traceability and Certification

Reliable sourcing requires full traceability—batch numbers, manufacturing dates, and quality control documentation. Many lower-tier suppliers fail to provide verifiable certifications or test reports. Without this, it becomes difficult to prove compliance during audits or in the event of a product failure, exposing businesses to liability and reputational damage.

Intellectual Property Infringement

Reputable tire manufacturers invest heavily in R&D to develop proprietary tread patterns, rubber compounds, and structural designs. Sourcing from unauthorized suppliers increases the risk of purchasing IP-infringing products. These knockoffs not only violate patents and trademarks but also often underperform due to inferior engineering. Companies using such tires may face legal exposure, especially in regulated industries or international markets with strict IP enforcement.

Inadequate After-Sales Support and Warranty Enforcement

Even when initial quality appears acceptable, many low-cost suppliers offer limited or unenforceable warranties. Poor customer service, lack of technical support, and refusal to honor claims make it difficult to resolve issues post-purchase. This absence of support can be particularly damaging in mission-critical operations where tire failure leads to costly delays.

Supply Chain Transparency Gaps

Without due diligence, buyers may inadvertently source from manufacturers using unethical labor practices or environmentally harmful processes. This lack of supply chain transparency can conflict with corporate sustainability goals and expose companies to reputational and regulatory risks, especially under increasing ESG (Environmental, Social, and Governance) scrutiny.

To mitigate these risks, buyers should prioritize suppliers with proven track records, request comprehensive documentation, verify certifications, and conduct factory audits when possible. Engaging directly with authorized distributors or original equipment manufacturers (OEMs) further reduces exposure to quality and IP-related pitfalls.

Logistics & Compliance Guide for 33X1250R20 Tires

Overview

This guide provides essential logistics and compliance information for handling, transporting, storing, and certifying the 33X1250R20 tire size—a large off-road or specialty tire commonly used in agricultural, industrial, or heavy-duty applications. Adherence to these guidelines ensures safety, regulatory compliance, and product integrity.

Packaging & Handling

- Unit Packaging: Tires should be stored vertically on pallets or racks to prevent deformation. Use stretch-wrapping or banding to secure stacked tires.

- Pallet Configuration: Standard pallet size: 48″ x 40″. Max stack height: 3 tires per pallet (approx. 4–5 ft high) to prevent tipping.

- Lifting & Moving: Use forklifts with wide forks or specialized tire handlers. Never lift by the bead or sidewall.

- Manual Handling: Not recommended due to weight (typically 120–160 lbs per tire). Use mechanical aids when possible.

Transportation

- Load Securing:

- Use load bars, straps, or dunnage to prevent shifting during transit.

- Secure pallets to trailer floor with minimum 2 straps per pallet (tiedowns rated ≥ 5,000 lbs WLL).

- Trailer Type: Dry van or flatbed with side rails. Avoid open trailers in inclement weather.

- Weight Considerations: Confirm axle weight limits; 33X1250R20 tires contribute significantly to cargo weight.

- Temperature Control: Avoid prolonged exposure to extreme heat or cold (>120°F or < -20°F) during transit.

Storage Conditions

- Environment: Store indoors in a cool, dry, well-ventilated area away from direct sunlight, ozone sources (e.g., motors), and chemicals.

- Temperature Range: 40°F to 85°F (4°C to 29°C).

- Humidity: Below 65% RH to prevent mold and degradation.

- Shelf Life: Rotate stock (FIFO); maximum recommended storage: 5 years from manufacture date.

Regulatory Compliance

- DOT Certification:

- Each tire must display a Department of Transportation (DOT) code indicating compliance with FMVSS No. 109/119.

- Verify DOT marking: “DOT” followed by plant code, tire size, brand/line, and date code (e.g., 33X1250R20 XXXX 2323 = week 23, 2023).

- EPA & TSCA:

- Comply with Toxic Substances Control Act (TSCA) regulations on chemical content (e.g., PCBs, phthalates).

- Report if containing restricted substances under EPA guidelines.

- DOT Hazardous Materials (Non-Applicable):

- Tires are not classified as hazardous under 49 CFR when new and non-recycled.

- Exception: Used or damaged tires may be regulated in some states—check local rules.

Import/Export Requirements

- HS Code: Typically 4011.20 (pneumatic tires for off-highway vehicles).

- Country-Specific Certifications:

- EU: ECE R30 approval required; display E-mark.

- Canada: CMVSS 109/119 compliance; confirm with Transport Canada.

- Other Markets: Verify local standards (e.g., INMETRO in Brazil, CCC in China).

- Documentation:

- Commercial invoice

- Bill of Lading

- Certificate of Origin

- DOT/ECE Compliance Certificate (if required)

Safety & Environmental

- Fire Risk: Tires are flammable; store away from ignition sources. Maintain fire suppression systems in warehouse.

- Spill & Leak Response: No liquid content; clean dust/debris with HEPA vacuum if powder coating is present.

- End-of-Life: Dispose per local regulations. Used tires may require recycling through certified facilities (e.g., under U.S. EPA or EU ELT directives).

Labeling & Traceability

- Required Markings:

- Size: 33X1250R20

- Load Range (e.g., Load Range D, E)

- Ply Rating

- DOT Code

- Manufacturer Name/Brand

- UTQG (if applicable)

- Batch Tracking: Maintain records of production date, DOT code, and shipment details for recall readiness.

Quality Assurance

- Incoming Inspection: Verify correct size, no visible damage (cuts, bulges), and legible markings.

- Documentation Retention: Keep compliance certificates, test reports, and shipping logs for minimum 5 years.

Emergency Procedures

- Spill/Breach: Isolate area; inspect for structural damage. Report to supervisor.

- Fire: Use water spray or foam extinguishers. Evacuate and call emergency services—tire fires release toxic smoke.

- Exposure: No significant health risk from handling new tires. Use gloves to prevent abrasion.

Contacts

- Compliance Officer: [Name, Email, Phone]

- Logistics Manager: [Name, Email, Phone]

- Manufacturer Support: [Tire Brand Hotline]

Note: Always consult the tire manufacturer’s technical data sheet (TDS) and regional regulations for updates.

Conclusion for Sourcing 33x1250R20 Tires:

After evaluating available suppliers, pricing, quality certifications, delivery timelines, and market availability, sourcing 33x1250R20 tires is feasible but requires careful vendor selection due to their specialized size and limited availability in certain regions. Key suppliers from manufacturing hubs in Asia and Europe offer competitive pricing and compliance with international standards (e.g., ISO, DOT), though lead times may vary significantly based on order volume and shipping logistics.

Prioritizing suppliers with proven track records in off-road or agricultural/commercial tire segments ensures durability and performance alignment with intended applications. Additionally, establishing long-term contracts can mitigate price volatility and supply chain disruptions.

Ultimately, a balanced approach focusing on quality, reliability, and cost-effectiveness—supported by due diligence in supplier verification—will ensure successful sourcing of 33x1250R20 tires to meet operational demands.