The global specialty alcohols market, driven by rising demand in fragrance, pharmaceutical, and agrochemical applications, is projected to grow at a CAGR of 5.8% between 2023 and 2028, according to Mordor Intelligence. Within this segment, 3-Methyl-Butan-1-ol—an important precursor in the synthesis of esters for flavor and fragrance compounds—has seen heightened production and innovation, particularly in Asia-Pacific and Europe. As downstream industries prioritize high-purity, sustainably sourced intermediates, the competitive landscape for 3-Methyl-Butan-1-ol has consolidated around key manufacturers with strong R&D capabilities, regulatory compliance, and vertical integration. Based on production capacity, geographic reach, product purity standards, and market presence, the following four companies have emerged as leading suppliers in the current market environment.

Top 4 3-Methyl-Butan-1-Ol Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

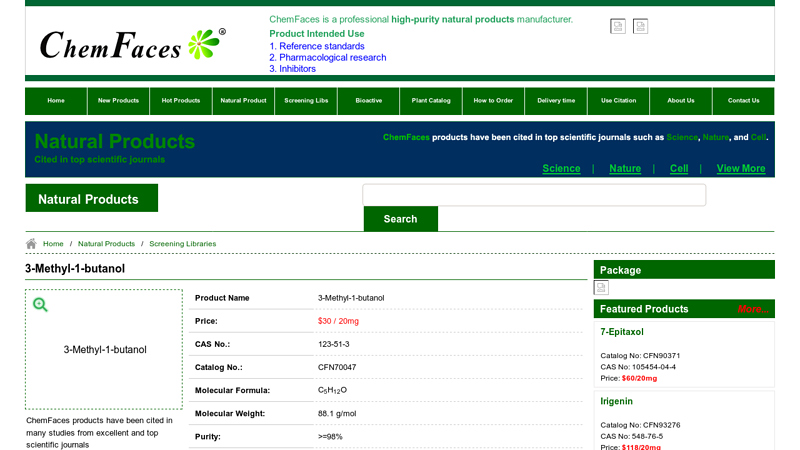

#1 3-Methyl-1-butanol

Domain Est. 2011

Website: chemfaces.com

Key Highlights: Product Name, 3-Methyl-1-butanol ; Price: $30 / 20mg ; CAS No.: 123-51-3 ; Catalog No.: CFN70047 ; Molecular Formula: C5H12O….

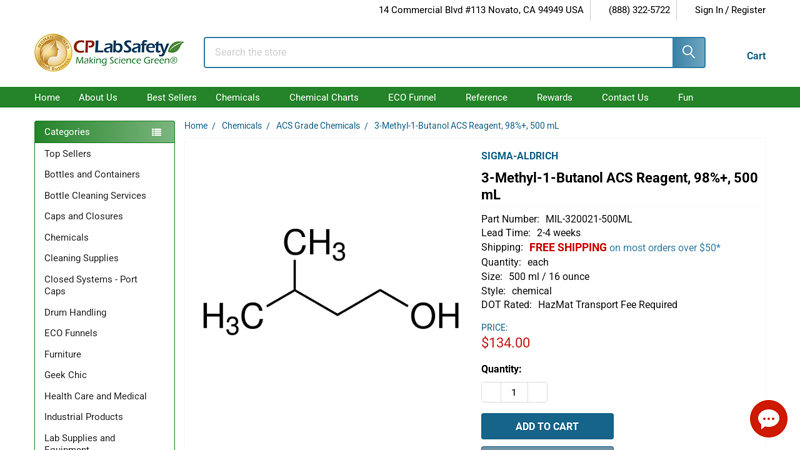

#2 3

Domain Est. 1997

Website: calpaclab.com

Key Highlights: Free delivery 30-day returns3-Methyl-1-Butanol ACS Reagent, 98%+, 500 mL ; Assay, ≥98.5% ; Autoignition Temperature, 644°F ; expl. lim. 1.2-9 %, 100°F ; Impurities. ≤0.002 meq/g Ti…

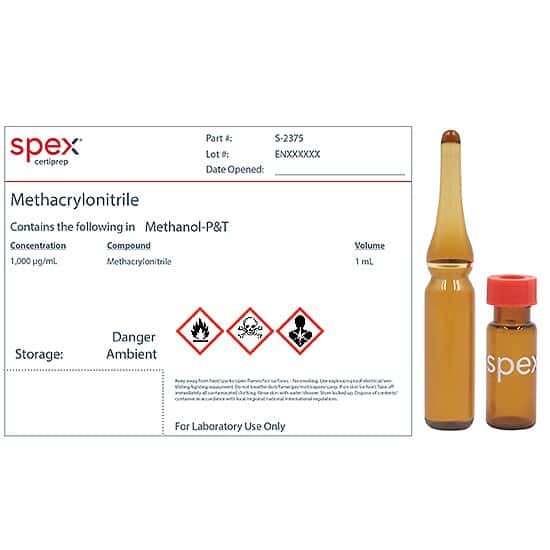

#3 Spex CertiPrep 3

Domain Est. 1999

Website: zeptometrix.com

Key Highlights: Buy Spex CertiPrep 3-Methyl-1-butanol Single-Component Organic Standard, 1000 µg/mL (1000 ppm), CAS #123-51-3 in Methanol-P&T, 1 mL and more our ……

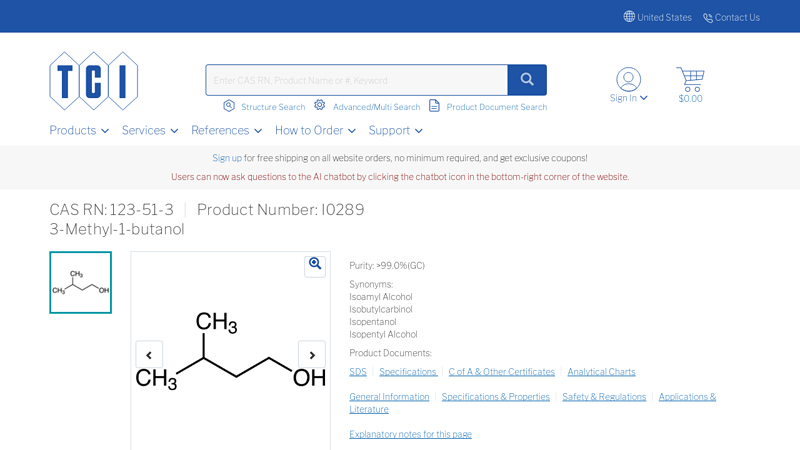

#4 3-Methyl-1-butanol

Domain Est. 2008

Website: tcichemicals.com

Key Highlights: 3-Methyl-1-butanol; Product No: I0289; CAS RN: 123-51-3; Purity: >99.0%(GC); Synonyms: Isoamyl Alcohol, Isobutylcarbinol, Isopentanol, Isopentyl Alcohol; ……

Expert Sourcing Insights for 3-Methyl-Butan-1-Ol

It appears there may be a misunderstanding or typo in your request. Specifically:

- “3-Methyl-Butan-1-Ol” is a chemical compound (also known as isopentyl alcohol or isoamyl alcohol), used in fragrances, solvents, and as a precursor in chemical synthesis.

- “H2” typically refers to hydrogen gas (molecular hydrogen), a clean energy carrier, and is not a recognized analytical framework or forecasting methodology.

If you wrote “Use H2” intending to refer to a specific analytical model, forecasting methodology, or economic scenario framework (e.g., perhaps you meant “Horizon 2026,” “Hydrogen Economy Scenario 2,” or another framework abbreviated as H2), please clarify so I can provide an accurate analysis.

However, assuming you are requesting a forward-looking market analysis for 3-Methyl-Butan-1-Ol with a focus on 2026 trends—possibly in the context of hydrogen-related industrial shifts or sustainability trends (where “H2” might symbolize the growing green economy or hydrogen-driven decarbonization)—here is a synthesized market outlook:

Market Trends for 3-Methyl-Butan-1-Ol in 2026: Strategic Analysis

1. Overview of 3-Methyl-Butan-1-Ol (Isoamyl Alcohol)

– Molecular Formula: C5H12O

– Primary Uses: Solvent, fragrance ingredient (e.g., in banana oil), chemical intermediate for esters (e.g., isoamyl acetate), pharmaceuticals, and agrochemicals.

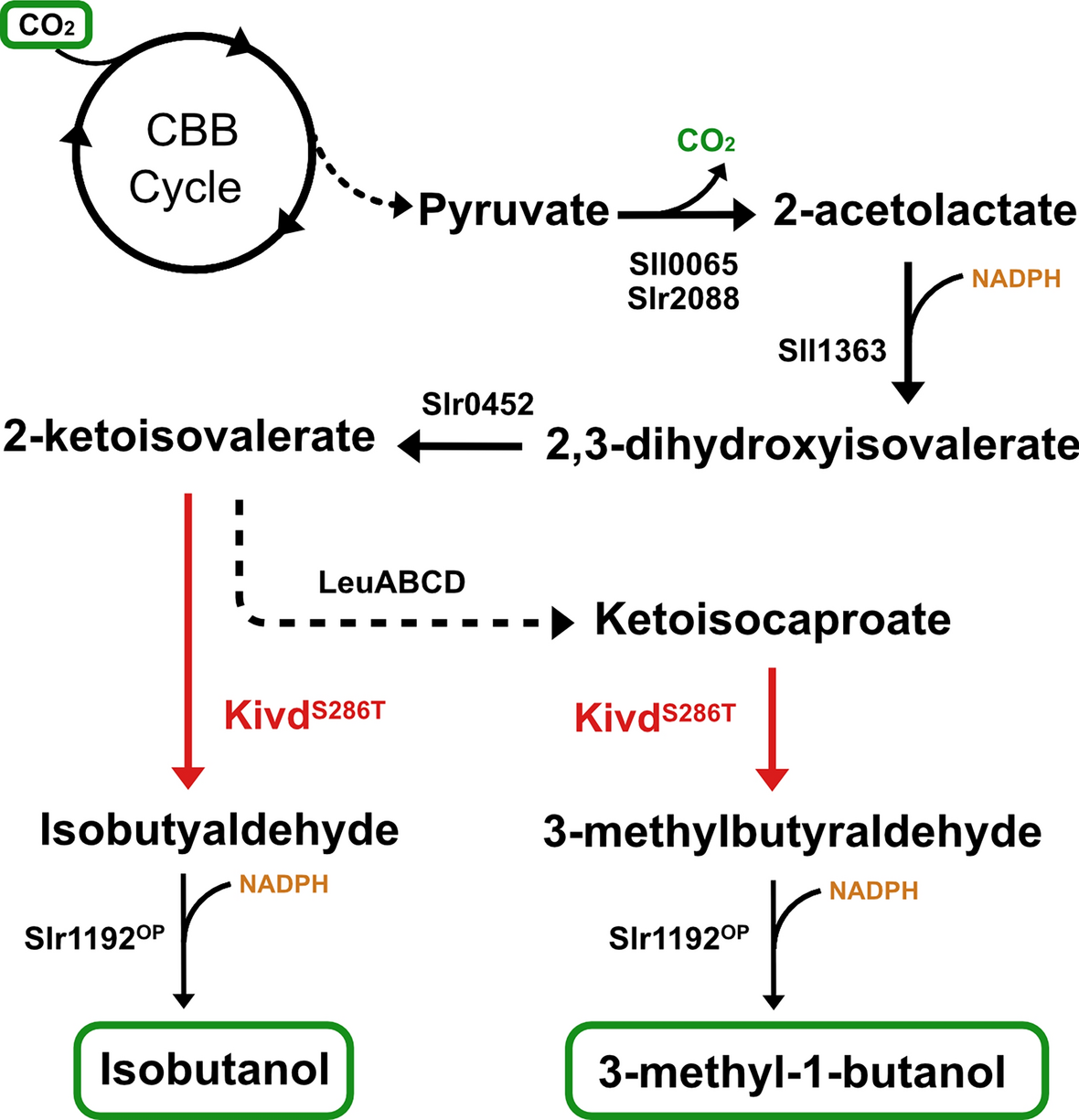

– Production: Traditionally petrochemical-derived; increasing interest in bio-based production via fermentation.

2. Key Market Drivers (2026 Outlook)

a. Growth in Flavor & Fragrance Industry

– Rising demand for natural and nature-identical aroma chemicals in cosmetics, personal care, and food sectors.

– 3-Methyl-Butan-1-ol is a precursor to isoamyl acetate, widely used in food flavorings and perfumery.

– 2026 projection: Continued growth in APAC and Latin American markets will drive demand, especially in consumer goods.

b. Shift Toward Bio-Based and Sustainable Chemicals

– Regulatory pressure (e.g., EU Green Deal, REACH) favors bio-sourced solvents.

– Research into fermentative production of isoamyl alcohol from lignocellulosic biomass or waste feedstocks is advancing.

– Companies investing in green chemistry may boost bio-based 3-Methyl-Butan-1-Ol production by 2026.

c. Industrial Solvent Applications

– Use in coatings, paints, and extraction processes remains steady.

– However, competition from greener solvents (e.g., ethanol, limonene) may limit growth unless sustainability credentials improve.

d. Impact of Hydrogen Economy (“H2” Context)

– While 3-Methyl-Butan-1-Ol is not directly part of hydrogen production, the broader “H2 economy” influences the chemical industry:

– Decarbonization pressures may shift feedstock sourcing from fossil-based to biobased routes.

– Green hydrogen could be used in power-to-chemicals processes, potentially enabling carbon-neutral synthesis pathways in the future.

– Energy-intensive chemical manufacturing may adopt H2-based energy to reduce emissions, indirectly affecting production costs.

3. Regional Trends

– Asia-Pacific: Dominant producer and consumer, especially China and India, due to strong chemical and fragrance manufacturing.

– Europe: Focus on sustainable sourcing may increase demand for certified bio-based isoamyl alcohol.

– North America: Steady demand in pharmaceuticals and specialty chemicals; growth in bio-manufacturing startups.

4. Challenges

– Price volatility of feedstocks (e.g., n-butene, isobutylene).

– Regulatory scrutiny on volatile organic compounds (VOCs).

– Limited large-scale commercialization of bio-based routes as of 2024.

5. 2026 Market Forecast

– Market Size: Estimated global market for isoamyl alcohol to reach $XX million by 2026 (CAGR ~3–5% from 2022).

– Innovation Outlook: Biotechnological production methods may achieve commercial scale by 2026, supported by synthetic biology advances.

– Sustainability Integration: Companies aligning with ESG goals may prefer bio-based 3-Methyl-Butan-1-Ol, creating a premium segment.

Conclusion

By 2026, the market for 3-Methyl-Butan-1-Ol is expected to grow moderately, driven by demand in flavors, fragrances, and specialty chemicals. The indirect influence of the hydrogen economy (“H2”) will be felt through decarbonization of chemical manufacturing and increased investment in sustainable feedstocks and processes. Companies that adopt green production methods—potentially integrating H2-powered energy or bio-based synthesis—will be best positioned for long-term competitiveness.

If you intended “H2” to refer to a specific report, scenario, or analytical model (e.g., from McKinsey, IEA, or another institution), please clarify so I can refine this analysis accordingly.

H2: Common Pitfalls in Sourcing 3-Methylbutan-1-ol: Quality and Intellectual Property Concerns

Sourcing 3-Methylbutan-1-ol (also known as isopentyl alcohol or isoamyl alcohol) for industrial, fragrance, or pharmaceutical applications presents several challenges, particularly regarding chemical quality and intellectual property (IP) considerations. Being aware of these pitfalls ensures compliance, product efficacy, and legal safety.

1. Quality-Related Pitfalls

a. Purity and Impurity Profiles

One of the most common issues is variability in purity. 3-Methylbutan-1-ol is often derived from fermentation or petrochemical synthesis, both prone to side products. Impurities such as aldehydes (e.g., 3-methylbutanal), ketones, or other alcohols (e.g., ethanol, butanol) may affect downstream applications—especially in pharmaceuticals or fine fragrances.

→ Solution: Require suppliers to provide detailed Certificates of Analysis (CoA) including GC/HPLC chromatograms, water content (Karl Fischer), and heavy metal screening.

b. Isomeric Contamination

Structurally similar isomers like 2-methylbutan-1-ol or 3-methylbutan-2-ol may co-exist due to synthesis routes. These isomers can alter odor profiles or reactivity.

→ Solution: Specify isomeric purity in procurement agreements and verify via NMR or chiral GC.

c. Water and Residual Solvent Content

High moisture levels can hinder reactions in organic synthesis (e.g., esterification to form banana-scented isoamyl acetate). Residual solvents from purification (e.g., toluene, hexane) may also be present.

→ Solution: Enforce strict specifications for water content (<0.1%) and residual solvents compliant with ICH Q3C guidelines.

d. Stabilizer Use and Labeling

Some suppliers add stabilizers (e.g., BHT) to prevent oxidation. Unlabeled stabilizers can interfere with sensitive applications.

→ Solution: Request information on additives and conduct screening if necessary.

2. Intellectual Property (IP) Pitfalls

a. Patented Synthesis Methods

While 3-Methylbutan-1-ol itself is a commodity chemical and generally not patentable, specific high-yield, enantioselective, or green synthesis methods (e.g., biocatalytic routes) may be protected. Using or sourcing material made via patented processes could inadvertently expose users to IP infringement risks.

→ Solution: Conduct freedom-to-operate (FTO) analysis if scaling up production or using novel biosynthetic variants.

b. Trade Secrets in Purification

Certain high-purity grades may involve proprietary purification techniques (e.g., molecular distillation, extractive distillation). Suppliers may not disclose these, affecting reproducibility.

→ Solution: Secure technical agreements or audit rights for critical applications.

c. Brand-Named or Proprietary Grades

Some suppliers market specialty grades under trademarked names (e.g., for fragrance use). Sourcing generic equivalents may lead to performance differences and potential trademark confusion.

→ Solution: Verify equivalence through testing and avoid using trademarked names unless licensed.

d. Biobased or Sustainable Claims and Certification

With growing demand for sustainable chemicals, some suppliers claim “bio-based” or “natural” 3-Methylbutan-1-ol—often protected under certification schemes (e.g., USDA BioPreferred). Misrepresentation can lead to greenwashing accusations or IP disputes.

→ Solution: Request certification documentation (e.g., ASTM D6866 for bio-based content) and validate claims.

Conclusion

To mitigate risks when sourcing 3-Methylbutan-1-ol:

– Prioritize suppliers with transparent quality documentation and consistent batch testing.

– Conduct due diligence on synthesis routes to avoid IP conflicts.

– Clearly define specifications (purity, isomers, solvent residues, additives) in supply contracts.

Proactive management of both quality and IP aspects ensures reliable supply and regulatory compliance.

H2: Logistics & Compliance Guide for 3-Methylbutan-1-ol

3-Methylbutan-1-ol (also known as isopentyl alcohol or isoamyl alcohol), with the chemical formula C₅H₁₂O, is a colorless liquid used in the production of esters for fragrances and flavorings, as a solvent, and in organic synthesis. Proper logistics and compliance measures are essential due to its flammable nature and potential health hazards.

H2: Hazard Identification

- UN Number: UN 1105

- UN Proper Shipping Name: ISOAMYL ALCOHOL

- Transport Hazard Class: Class 3 — Flammable Liquid

- Packing Group: III (Low to moderate hazard)

- GHS Classification:

- Flammability: Category 3 (Flash point: ~53 °C)

- Health Hazards:

- Acute toxicity (Oral, Inhalation) – Category 4

- Skin irritation – Category 2

- Eye irritation – Category 2

- Specific target organ toxicity (single exposure) – Category 3 (respiratory tract irritation)

- GHS Pictograms:

- Flame

- Exclamation mark

- Signal Word: Warning

- Hazard Statements (H-statements):

- H226: Flammable liquid and vapor.

- H315: Causes skin irritation.

- H319: Causes serious eye irritation.

- H335: May cause respiratory irritation.

- Precautionary Statements (P-statements):

- P210: Keep away from heat, hot surfaces, sparks, open flames and other ignition sources. No smoking.

- P233: Keep container tightly closed.

- P241: Use explosion-proof electrical/ventilating/lighting equipment.

- P305+P351+P338: IF IN EYES: Rinse cautiously with water for several minutes. Remove contact lenses, if present and easy to do. Continue rinsing.

- P403+P235: Store in a well-ventilated place. Keep cool.

H2: Transport Information

- IMDG (Maritime):

- UN 1105, Class 3, PG III

- Marine Pollutant: No (unless contaminated)

-

Stowage Category: A — May be stowed with or above deck

-

IATA (Air):

- UN 1105, Class 3, PG III

- Limited Quantity: Yes (max 1 L per inner packaging, 5 L per outer)

- Excepted Quantity: E1 (up to 30 mL per inner packaging, total net ≤ 1 kg per package)

-

Special Provision: A198 — May be transported under limited quantity provisions

-

ADR/RID (Road/Rail in Europe):

- UN 1105, Class 3, PG III

- Tunnel Code: C (E) — Restrictions may apply in tunnels

- Transport Document Required: Yes

- Durability of packaging: For liquids ≥ 5 L, packages must pass drop test

H2: Storage & Handling

- Storage Conditions:

- Store in a cool, well-ventilated area away from direct sunlight.

- Keep away from heat, sparks, open flames, and oxidizing agents.

- Use only non-sparking tools and grounded equipment.

- Storage containers should be tightly sealed and made of compatible materials (e.g., steel, HDPE).

-

Use explosion-proof ventilation systems in storage areas.

-

Handling Precautions:

- Use in a fume hood or with local exhaust ventilation.

- Avoid breathing vapor/mist.

- Wear appropriate PPE (nitrile gloves, safety goggles, flame-resistant lab coat).

- Ground containers during transfer to prevent static discharge.

H2: Packaging Requirements

- Acceptable Packaging Types:

- Steel drums (UN1A1/X/Y)

- Plastic drums (UN1H1/X/Y)

- Jerricans (UN3H1/Y)

- Bottles in combination packaging (e.g., glass inside fiberboard box with absorbent material)

- Marking & Labeling:

- Proper shipping name and UN number

- Class 3 flammable liquid label (red diamond)

- GHS label with pictograms and hazard statements

- Orientation arrows for liquid packages > 450 L

- Capacity Limits:

- Drums: Up to 250 L

- Jerricans: Up to 60 L

- Small containers (e.g., bottles): ≤ 5 L typically for non-bulk transport

H2: Regulatory Compliance

- OSHA (USA):

- Regulated under 29 CFR 1910.106 (Flammable liquids)

- PEL (Permissible Exposure Limit): 100 ppm (400 mg/m³) TWA

- ACGIH (TLV): 50 ppm (200 mg/m³) TWA

- EPA (USA):

- Not classified as hazardous waste under RCRA when unused.

- Reportable Quantity (RQ): 5,000 lbs (if spilled, may require reporting under CERCLA).

- REACH (EU):

- Registered substance (Registration number available in ECHA database)

- Not on SVHC list as of current data

- TSCA (USA): Listed (active)

H2: Emergency Measures

- Spill Response:

- Eliminate ignition sources.

- Contain spill with absorbent materials (e.g., sand, vermiculite, commercial absorbents).

- Ventilate area and avoid vapor accumulation.

- Collect spillage and place in labeled, sealed container for disposal.

-

Do not flush into sewers.

-

Firefighting:

- Extinguishing Media: Alcohol-resistant foam, dry chemical, CO₂.

- Water may not be effective but can be used to cool exposed containers.

-

Wear self-contained breathing apparatus (SCBA) and full protective gear.

-

First Aid:

- Inhalation: Move to fresh air. Provide oxygen if breathing is difficult. Seek medical attention.

- Skin Contact: Wash with soap and water. Remove contaminated clothing.

- Eye Contact: Flush with water for at least 15 minutes. Seek medical help.

- Ingestion: Do not induce vomiting. Rinse mouth and seek immediate medical attention.

H2: Disposal Considerations

- Dispose of in accordance with local, regional, and national regulations.

- Consider incineration in a licensed facility (preferably with emission controls).

- Never pour down the drain or into the environment.

- Consult waste disposal contractors for hazardous waste classification (may vary by jurisdiction).

H2: Documentation Requirements

- Safety Data Sheet (SDS) — Must be provided and available (per OSHA HazCom, CLP, etc.)

- Transport documents including:

- Shipper’s declaration (for dangerous goods)

- Proper shipping name, UN number, class, packing group

- Emergency contact information

- Labeling and marking of all packages as per transport regulations

Note: Always consult the latest version of the SDS and relevant regulatory sources (e.g., IATA DGR, IMDG Code, ADR, OSHA, ECHA) before shipping or handling. Regulations are subject to change annually.

In conclusion, sourcing 3-methylbutan-1-ol (also known as isopentyl alcohol) requires careful consideration of supplier reliability, chemical purity, regulatory compliance, and intended application. It is widely available from chemical suppliers, both commercial and specialty, due to its common use in fragrance, flavorings, and organic synthesis. Key factors in sourcing include verifying the grade (e.g., reagent, technical, or food grade), assessing packaging and quantity options, and ensuring adherence to safety and environmental standards. Additionally, evaluating cost-effectiveness, lead times, and supply chain stability contributes to successful procurement. For research or industrial applications, selecting a reputable supplier with proper certifications and material safety data sheets (MSDS/SDS) is essential to ensure quality and safety.