The global fertilizer market is experiencing steady expansion, driven by increasing agricultural productivity demands and rising food consumption. According to Grand View Research, the global fertilizer market size was valued at USD 218.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. Mordor Intelligence projects similar momentum, citing advancements in fertilizer formulations, growing adoption of precision farming, and government support for agriculture as key growth catalysts. Amid this upward trend, NPK compound fertilizers—particularly those with balanced ratios like 9-3-2-1—have gained prominence for their ability to deliver essential nutrients in optimal proportions for crop development. This performance-driven formulation supports improved yields, soil health, and nutrient uptake efficiency, making it a preferred choice across diverse farming systems. As demand surges, a select group of manufacturers has emerged as leaders in producing high-quality 9-3-2-1 fertilizers, combining innovation, scale, and sustainability to meet evolving agricultural needs.

Top 9 3 2 1 Fertilizer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ICL Group

Domain Est. 2002

Website: icl-group.com

Key Highlights: ICL is at the forefront of the global fight against hunger, playing a critical role in enhancing food security through its innovative agricultural solutions….

#2 EuroChem Group

Domain Est. 2014

Website: eurochemgroup.com

Key Highlights: A world leading fertilizer producer. Each year, we help farmers put food on tables for more than 350 million people around the world….

#3 Npk 3 2 1

Domain Est. 2023

Website: phosfertilizers.com

Key Highlights: We are based in Morocco. The company specializes in Phosphatic Fertilizers like Map, DAP, TSP and SSP in Powder as well as Granule….

#4 Pursell Fertilizer

Domain Est. 1995

Website: fertilizer.com

Key Highlights: Pursell controlled-release fertilizers minimize waste by controlling nutrient release, so they are available when, where and how your plants need them most….

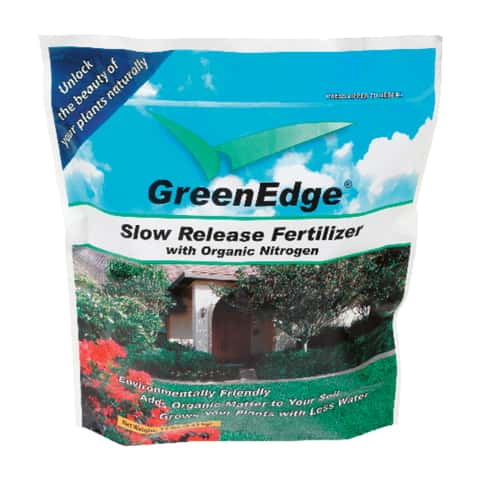

#5 GreenEdge® Fertilizer

Domain Est. 1999

Website: green-edge.com

Key Highlights: GreenEdge is the company’s patented line of enhanced-efficiency fertilizer. Each GreenEdge fertilizer recycles nutrients from local sources….

#6 Natural Fertilizers for Organic Gardening and Lawn Care

Domain Est. 2003

Website: arbico-organics.com

Key Highlights: $1,000 deliveryARBICO Organics sells organic and naturally based fertilizers designed to support healthy gardens, orchards, and farms….

#7 The Mosaic Company

Domain Est. 2004

Website: mosaicco.com

Key Highlights: The Mosaic Company mines and processes phosphate and potash minerals into crop nutrients to help feed the world….

#8 Nutrien

Domain Est. 2011

Website: nutrien.com

Key Highlights: Nutrien is a leading global provider of crop inputs and services. We operate a world-class network of production, distribution and ag retail facilities.Missing: 3 2 1…

#9

Domain Est. 2015

Website: nitro-phos.com

Key Highlights: Our fertilizer and agricultural products contain a balanced mix of nitrogen, phosphorus, and other essential nutrients that support healthy plant development….

Expert Sourcing Insights for 3 2 1 Fertilizer

H2: 2026 Market Trends for 3-2-1 Fertilizer

The 3-2-1 fertilizer, a balanced formulation containing 3% nitrogen (N), 2% phosphorus (P₂O₅), and 1% potassium (K₂O), is poised to experience notable shifts in demand and market dynamics by 2026. Driven by evolving agricultural practices, sustainability initiatives, and global food security concerns, several key trends are expected to shape the 3-2-1 fertilizer market in the coming years.

1. Growing Demand for Balanced Nutrition in Sustainable Farming

By 2026, there will be increased emphasis on balanced nutrient application to improve soil health and crop yields without causing nutrient imbalances or environmental degradation. The 3-2-1 formulation, though lower in concentration than many commercial fertilizers, is gaining relevance in precision agriculture and integrated nutrient management (INM) systems—especially in organic and regenerative farming. Its balanced N-P-K ratio supports gradual nutrient release, aligning with low-input farming models popular in Europe and parts of North America.

2. Expansion in Specialty and Organic Agriculture

The global rise in organic and specialty crop production (e.g., fruits, vegetables, herbs) is expected to drive demand for mild, balanced fertilizers like 3-2-1. These crops often require careful nutrient management to avoid over-fertilization, which can impair quality or lead to nutrient runoff. As consumer demand for organic produce grows, especially in North America and Western Europe, the use of low-analysis, environmentally compatible fertilizers such as 3-2-1 will likely increase.

3. Increased Use in Urban and Home Gardening

Urban agriculture and home gardening are projected to remain strong growth areas through 2026, particularly in developed markets. The 3-2-1 fertilizer is well-suited for container gardening, lawns, and small-scale cultivation due to its gentle formulation and low risk of plant burn. Retail sales of such fertilizers through e-commerce platforms and home improvement stores are expected to rise, supported by educational outreach and DIY gardening trends.

4. Regional Market Shifts

- North America and Europe: These regions will lead in the adoption of 3-2-1 fertilizers, driven by regulatory support for reduced fertilizer runoff and consumer preference for sustainable products. Government subsidies for eco-friendly inputs may further boost market penetration.

- Asia-Pacific: While high-analysis fertilizers dominate large-scale farming in countries like India and China, niche applications in horticulture and urban farming could create new opportunities for 3-2-1 blends, particularly in Japan, South Korea, and urban centers.

- Latin America and Africa: Demand will remain limited due to cost sensitivity and preference for higher nutrient concentrations. However, pilot projects in agroecology and smallholder training programs may introduce 3-2-1 blends in select markets.

5. Innovation in Formulation and Delivery

By 2026, manufacturers are expected to enhance 3-2-1 fertilizers with bio-stimulants, humic acids, or microbial inoculants to improve nutrient uptake and soil microbiome health. Water-soluble and liquid versions of 3-2-1 formulations will become more common, catering to hydroponic systems and foliar application methods. These innovations will expand the product’s utility beyond traditional soil application.

6. Environmental and Regulatory Influences

Environmental regulations targeting nitrogen and phosphorus runoff—such as the EU’s Farm to Fork Strategy and U.S. EPA nutrient reduction initiatives—will encourage the use of lower-concentration, balanced fertilizers. The 3-2-1 ratio supports compliance with nutrient management plans, positioning it as a strategic tool for reducing agricultural pollution.

7. Pricing and Supply Chain Considerations

Global fertilizer prices, which have been volatile due to energy costs and geopolitical factors, are expected to stabilize by 2026. However, the production of low-analysis fertilizers like 3-2-1 may face challenges due to economies of scale favoring high-concentration products. Nonetheless, localized blending and on-farm mixing solutions could reduce transportation costs and improve accessibility.

Conclusion

By 2026, the 3-2-1 fertilizer market will be shaped by sustainability trends, technological innovation, and shifting consumer preferences. While it will remain a niche product compared to high-analysis fertilizers, its role in sustainable, urban, and specialty agriculture is expected to grow. Stakeholders should focus on product differentiation, education, and distribution channels targeting environmentally conscious farmers and gardeners to capitalize on emerging opportunities.

Common Pitfalls Sourcing 3-2-1 Fertilizer (Quality, Intellectual Property)

Sourcing a reliable 3-2-1 fertilizer (referring to a balanced N-P-K ratio of 3% Nitrogen, 2% Phosphorus, 1% Potassium) involves navigating several potential pitfalls related to both product quality and intellectual property (IP) considerations. Overlooking these can lead to subpar crop performance, regulatory issues, or legal disputes. Here are key pitfalls to avoid:

1. Inconsistent or Unverified Nutrient Content (Quality)

- Pitfall: Assuming the labeled 3-2-1 ratio accurately reflects the actual nutrient content in every batch. Poor manufacturing practices, inadequate quality control, or adulteration can lead to significant deviations.

- Risk: Under-application of key nutrients stunts growth, while over-application (especially nitrogen) can burn plants, cause environmental runoff, or waste money. Inconsistent results make crop planning difficult.

- Mitigation: Demand and verify third-party lab test reports (Certificate of Analysis – CoA) for each batch or shipment. Ensure testing is done by accredited labs using standardized methods (e.g., AOAC). Include nutrient content specifications in your contract.

2. Poor Ingredient Quality and Solubility

- Pitfall: Focusing solely on the N-P-K ratio while ignoring the source and quality of the raw materials. Low-grade or impure ingredients (e.g., crude phosphates, contaminated nitrogen sources) can contain harmful heavy metals (arsenic, cadmium, lead) or have poor solubility.

- Risk: Toxic elements accumulate in soil and crops, posing health risks and potentially violating food safety regulations. Insoluble nutrients are unavailable to plants, reducing efficacy and potentially clogging irrigation systems (especially in fertigation).

- Mitigation: Specify acceptable ingredient sources and purity standards in the sourcing agreement. Require CoAs that include heavy metal testing and solubility data. Prefer fertilizers made from high-purity, fully water-soluble raw materials for consistent performance.

3. Lack of Traceability and Supply Chain Transparency

- Pitfall: Sourcing from suppliers or manufacturers who cannot provide clear traceability of raw materials back to their origins.

- Risk: Difficulty in verifying claims about ingredient quality, sustainability practices, or regulatory compliance. Increased vulnerability to counterfeit products or supply chain disruptions. Limits ability to conduct audits or respond to food safety incidents.

- Mitigation: Require suppliers to provide detailed supply chain documentation. Prioritize suppliers with robust traceability systems and certifications (e.g., ISO, GMP). Conduct supplier audits when feasible.

4. Misunderstanding or Infringing on Intellectual Property (IP)

- Pitfall: Assuming a 3-2-1 blend is generic and freely copyable, potentially infringing on patents, trademarks, or trade secrets associated with a specific formulation, manufacturing process, or branded product.

- Risk: Legal action (injunctions, damages) from the IP holder. Forced reformulation, supply disruption, and reputational damage. Paying royalties or licensing fees unexpectedly.

- Mitigation: Conduct thorough IP due diligence:

- Patents: Search patent databases (e.g., USPTO, WIPO) for active patents covering specific 3-2-1 formulations, delivery mechanisms (e.g., coatings), or unique manufacturing processes. A simple NPK ratio itself is rarely patentable, but the specific method or enhanced formulation might be.

- Trademarks: Ensure the product name, branding, or specific packaging design you plan to use doesn’t infringe on existing trademarks for similar fertilizers.

- Trade Secrets: Avoid sourcing from suppliers who might be using proprietary, undisclosed processes or additives protected as trade secrets without proper licensing. Ensure confidentiality agreements are in place if sharing your own formulations.

- Licensing: If a desired formulation or technology is patented, explore obtaining a license from the IP holder.

5. Inadequate Regulatory Compliance Documentation

- Pitfall: Failing to obtain or verify all necessary regulatory documentation required for the fertilizer in your target market(s).

- Risk: Product seizure, fines, import/export bans, or inability to sell. Regulations cover nutrient labeling accuracy, heavy metal limits, registration requirements, and environmental impact assessments.

- Mitigation: Ensure the supplier provides all required documentation (e.g., product registration certificates, heavy metal compliance statements, safety data sheets – SDS) specific to your country/region. Verify the fertilizer is legally registered for sale and use in your jurisdiction.

6. Overlooking Physical Properties and Form

- Pitfall: Not specifying required physical characteristics like granule size, hardness, moisture content, or dust level.

- Risk: Poor flowability leading to uneven application with spreaders. Excessive dust creates health hazards for handlers and environmental concerns. Granules that are too soft can break down, causing caking during storage.

- Mitigation: Clearly define required physical specifications (e.g., granule size distribution, hardness, moisture content) in your purchase agreement and verify them upon receipt.

By proactively addressing these quality and IP pitfalls through rigorous supplier vetting, clear contractual specifications, independent verification (lab testing), and thorough IP research, you can source a reliable, effective, and legally compliant 3-2-1 fertilizer.

H2: Logistics & Compliance Guide for 3-2-1 Fertilizer

H2: Overview of 3-2-1 Fertilizer

3-2-1 fertilizer refers to a balanced nutrient formulation containing 3% nitrogen (N), 2% phosphorus (P₂O₅), and 1% potassium (K₂O). This NPK ratio supports healthy plant growth, particularly in maintenance or slow-release feeding programs for lawns, gardens, and certain agricultural crops. Due to its relatively low concentration, 3-2-1 fertilizer is often considered safe for general use but still requires adherence to logistics and regulatory compliance standards.

H2: Regulatory Compliance

- Labeling Requirements

- The fertilizer label must clearly display the guaranteed analysis: “3-2-1” or “3% Nitrogen – 2% Available Phosphate – 1% Soluble Potash.”

- Include the net weight, manufacturer name and address, and any special handling instructions.

-

If sold commercially, comply with state-specific fertilizer laws (e.g., under the Association of American Plant Food Control Officials – AAPFCO guidelines).

-

Registration

- Fertilizer products must be registered with the appropriate state departments of agriculture in the U.S. (or equivalent bodies in other countries).

-

Registration typically requires submission of product formulation, labeling, and sometimes laboratory testing data.

-

Environmental Regulations

- Comply with nutrient management regulations to prevent runoff and contamination of water sources.

-

Follow guidelines from the Environmental Protection Agency (EPA) or local environmental authorities regarding storage, application, and disposal.

-

Organic Certification (if applicable)

- If marketed as organic, ensure compliance with the USDA National Organic Program (NOP) or other certifying bodies. The 3-2-1 formulation must derive nutrients from approved organic sources.

H2: Storage & Handling

- Storage Conditions

- Store in a dry, well-ventilated, and covered area to prevent moisture absorption and caking.

- Keep away from direct sunlight and extreme temperatures.

-

Use non-corrosive containers or bags with inner liners to maintain product integrity.

-

Segregation

- Store separately from pesticides, herbicides, and food-grade products to avoid cross-contamination.

-

Clearly label storage areas to prevent misidentification.

-

Safety Precautions

- Provide Material Safety Data Sheets (MSDS/SDS) for all formulations.

- Use PPE (gloves, masks, eye protection) during handling to prevent skin or respiratory irritation.

H2: Transportation & Logistics

- Packaging

- Use durable, sealed bags or containers appropriate for the mode of transport (e.g., 25 kg or 50 lb bags for retail; bulk super sacks for commercial distribution).

-

Ensure packaging meets UN/DOT standards if transported internationally or classified as hazardous (rare for low-analysis fertilizers like 3-2-1).

-

Domestic Shipping

- Comply with Department of Transportation (DOT) regulations if shipped in large quantities.

-

Most 3-2-1 fertilizers are classified as non-hazardous, simplifying transport via truck, rail, or parcel services.

-

International Shipping

- Check import regulations in destination countries. Some nations restrict certain fertilizer components or require phytosanitary certificates.

-

Provide accurate Harmonized System (HS) codes (e.g., 3105.90 for mixed mineral or chemical fertilizers).

-

Cold Chain & Environmental Exposure

- Not required for dry 3-2-1 fertilizers, but avoid exposure to excessive humidity or freezing conditions during transit.

H2: Recordkeeping & Traceability

- Maintain batch records, including production date, ingredient sources, test results, and distribution logs.

- Implement a traceability system to support recalls or audits.

- Retain compliance documentation for a minimum of 3–5 years, depending on jurisdiction.

H2: Disposal & Environmental Responsibility

- Unused or expired fertilizer should not be dumped into waterways or storm drains.

- Follow local waste management guidelines; some areas allow safe land application at reduced rates, while others require disposal as industrial waste.

- Consider take-back programs or recycling options for packaging materials (e.g., poly woven bags).

H2: Conclusion

Proper logistics and compliance practices ensure the safe, legal, and environmentally responsible distribution and use of 3-2-1 fertilizer. Adhering to labeling, storage, transportation, and regulatory requirements protects consumers, the environment, and your business from liability. Always consult local authorities and stay updated on evolving regulations in your region.

Conclusion on Sourcing 3-2-1 Fertilizer:

Sourcing a 3-2-1 fertilizer (referring to the N-P-K ratio of 3% Nitrogen, 2% Phosphorus, and 1% Potassium) can be an effective solution for promoting balanced plant growth, particularly for maintenance applications or in situations where a mild, all-purpose nutrient supply is desired. After evaluating availability, cost, and applicability, it is evident that while a commercially labeled “3-2-1” fertilizer may not be widely standardized, similar formulations can be achieved through blending custom mixes or selecting close commercial alternatives (such as 6-4-2, which can be diluted accordingly).

Organic sources such as composted manure, blended bone meal, blood meal, and kelp can also be combined to approximate a 3-2-1 ratio, offering sustainable and slow-release benefits. The key to successful sourcing lies in understanding the specific nutritional needs of the crops or plants, soil test results, and whether synthetic or organic inputs are preferred.

In conclusion, while a precisely labeled 3-2-1 fertilizer may require formulation or dilution of stronger blends, achieving this nutrient ratio is both practical and beneficial. Careful sourcing—whether through commercial products or custom organic mixes—ensures optimal plant health, efficient nutrient use, and long-term soil fertility.