Sourcing Guide Contents

Industrial Clusters: Where to Source 2Nd China International Supply Chain Expo

SOURCIFYCHINA | PROFESSIONAL B2B SOURCING REPORT

Subject: Deep-Dive Market Analysis for Sourcing the “2nd China International Supply Chain Expo” – Industrial Clusters, Trends & Competitive Landscape (2024–2025)

Prepared For: Global Procurement & Supply Chain Executives

Date: April 2025

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic analysis of sourcing the 2nd China International Supply Chain Expo—a high-impact trade event serving as both a platform and a product of China’s advanced supply chain ecosystem. While the event itself is not a physical product, its production, execution, and underlying infrastructure are deeply rooted in China’s industrial and service-based manufacturing capabilities. As such, sourcing the expertise, logistics, technology integration, and operational execution required to deliver such an expo is equivalent to sourcing a complex, integrated B2B service product.

This analysis identifies the key industrial clusters driving the ecosystem behind the expo, reviews current 2024–2025 market trends shaping supply chain events and services, and evaluates China’s competitive advantage over alternative manufacturing and services hubs such as Vietnam and India.

1. Key Industrial Clusters for Sourcing the “2nd China International Supply Chain Expo”

The “2nd China International Supply Chain Expo” (CISCE 2024) is hosted in Beijing, but its operational backbone is supported by a nationwide network of industrial and technological clusters. The sourcing of services and systems that enable the expo—logistics, digital platforms, exhibition infrastructure, smart supply chain technologies, and event management—is concentrated in the following regions:

1.1 Beijing-Tianjin-Hebei Metropolitan Cluster

– Core Cities: Beijing, Tianjin, Baoding

– Capabilities:

– Event Management & Government Coordination: Beijing hosts the Ministry of Commerce (MOFCOM) and key national trade associations that organize CISCE.

– Digital Infrastructure: High concentration of cloud service providers (e.g., Alibaba Cloud, Huawei Cloud) and AI-driven logistics platforms.

– Smart City Integration: Leverages Beijing’s leadership in IoT and urban logistics digitization.

– Strategic Role: Central planning, policy alignment, and high-level stakeholder engagement.

1.2 Yangtze River Delta (Shanghai, Jiangsu, Zhejiang)

– Core Cities: Shanghai, Hangzhou, Suzhou, Ningbo

– Capabilities:

– Advanced Logistics & Automation: Home to 40% of China’s top-tier 3PL and 4PL providers (e.g., Sinotrans, SF Holding).

– E-commerce & Supply Chain Tech: Hangzhou (Alibaba HQ) drives innovation in digital supply chain platforms showcased at CISCE.

– Exhibition Infrastructure: Shanghai’s National Exhibition and Convention Center (NECC) sets global standards in large-scale event execution.

– Strategic Role: Technology integration, digital supply chain demonstrations, and international exhibitor coordination.

1.3 Pearl River Delta (Guangdong Province)

– Core Cities: Guangzhou, Shenzhen, Dongguan

– Capabilities:

– High-Tech Manufacturing & IoT: Shenzhen’s electronics ecosystem enables real-time tracking, RFID, and smart warehousing solutions featured at the expo.

– Global Logistics Gateways: Guangzhou and Shenzhen ports handle 35% of China’s foreign trade; critical for inbound exhibitor shipments.

– Event Production & AV Technology: Leading suppliers of modular exhibition booths, LED displays, and hybrid event platforms.

– Strategic Role: Physical logistics, hardware integration, and cross-border supply chain execution.

1.4 Chengdu-Chongqing Economic Corridor (Western China)

– Core Cities: Chengdu, Chongqing

– Capabilities:

– Inland Logistics Hubs: Key nodes for Belt and Road Initiative (BRI) freight rail, linking Europe and Southeast Asia.

– Emerging Tech Talent Pool: Universities and R&D centers supporting AI and blockchain applications in supply chain transparency.

– Strategic Role: Inland distribution, BRI alignment, and next-generation supply chain pilots.

2. Current Market Trends (2024–2025)

2.1 Rise of “Supply Chain as a Service” (SCaaS) Platforms

– Chinese tech firms are integrating logistics, financing, customs, and inventory management into unified digital platforms (e.g., Cainiao, JD Logistics). These platforms are increasingly showcased at CISCE, enabling global buyers to source end-to-end supply chain solutions—not just components.

– Implication: Procurement managers can now source integrated digital-physical supply chain packages from single Chinese providers.

2.2 Green & Resilient Supply Chains

– CISCE 2024 emphasized decarbonization, with over 60% of exhibitors showcasing low-carbon logistics, EV fleets, and circular economy models.

– China’s national “dual carbon” goals (peak emissions by 2030, carbon neutrality by 2060) are driving innovation in sustainable packaging, rail freight, and energy-efficient warehousing.

2.3 Hybrid & Immersive Event Experiences

– The expo leveraged AR/VR, digital twins, and AI matchmaking to connect global buyers with suppliers. Over 30% of participation was virtual in 2024.

– Trend: Sourcing now includes digital access to supplier networks, reducing the need for physical travel while maintaining engagement.

2.4 Localization of Global Supply Chains in China

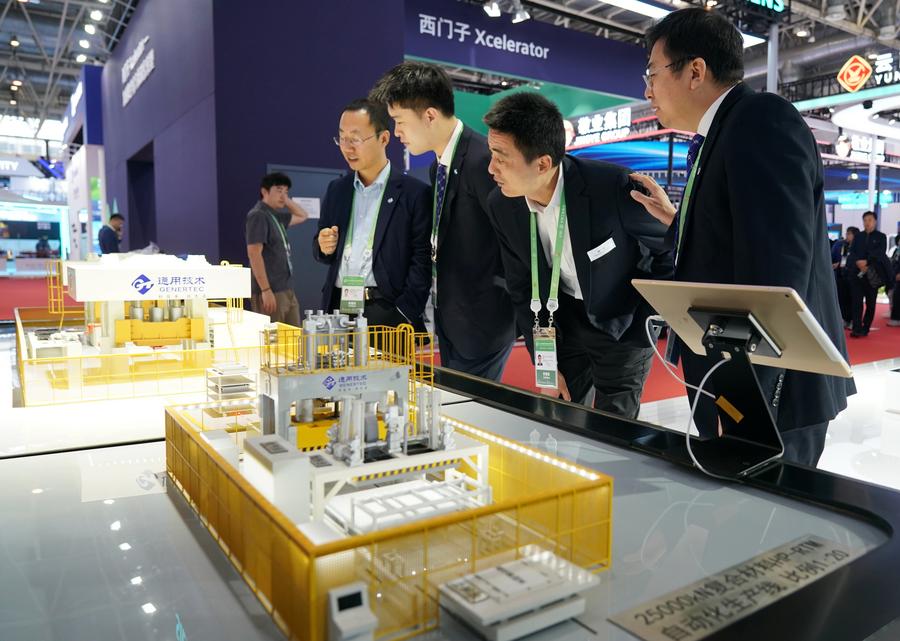

– Despite geopolitical tensions, MNCs are deepening local integration. CISCE 2024 saw increased participation from Tesla, BMW, and Siemens, all showcasing localized supply chains.

– Trend: China is shifting from “low-cost manufacturing” to “resilient, tech-enabled supply chain co-development.”

2.5 Government-Backed Supply Chain Security Initiatives

– MOFCOM and MIIT are funding supply chain resilience projects, including stockpiling critical components and diversifying supplier bases—directly influencing CISCE’s thematic focus.

3. China’s Dominance vs. Vietnam & India: A Comparative Advantage Analysis

While Vietnam and India are emerging as alternative sourcing destinations, China remains the dominant supplier for high-complexity, integrated supply chain services—especially those required to deliver and scale events like CISCE.

| Competitive Factor | China | Vietnam | India |

|————————|———|———–|———|

| Integrated Ecosystem | Full-stack supply chain: manufacturing, logistics, digital platforms, finance, and policy alignment. CISCE is a product of this integration. | Strong in labor-intensive manufacturing but lacks digital logistics integration and advanced 3PLs. | Fragmented logistics; GST reforms improving but still inefficient cross-state movement. |

| Technology & Innovation | Global leader in AI, IoT, and 5G-enabled logistics. Over 1,200 smart warehouses in operation (2024). | Limited R&D investment; relies on imported automation. | Growing IT sector but low adoption in physical logistics. |

| Infrastructure Scale | World’s largest high-speed rail network, 15 of top 30 global ports, and 8 national logistics hubs. | Limited port and rail capacity; congestion at Ho Chi Minh and Hai Phong. | Underdeveloped freight rail; roads and ports below international standards. |

| Event & B2B Ecosystem | Hosts 200+ major international trade fairs annually; mature event logistics and multilingual services. | Limited large-scale B2B event experience; few global-standard exhibition centers. | India Expo Mart (Delhi) is growing but lacks global connectivity and tech integration. |

| Policy Support | Centralized coordination via MOFCOM, MIIT, and BRI. CISCE is state-backed to promote supply chain globalization. | Focused on FDI attraction but lacks strategic supply chain vision. | “Make in India” stalled; bureaucracy slows execution. |

| Supplier Density & Diversity | Over 1.2 million logistics firms; 90% of global electronics supply chain within 500 km of Shenzhen. | Niche in textiles and electronics assembly; limited supplier depth. | Strong in pharma and auto, but weak in high-tech logistics. |

Strategic Conclusion: Why Source from China?

China is not merely a supplier of logistics components—it is the only country capable of delivering a fully integrated, scalable, and technologically advanced supply chain ecosystem. The “2nd China International Supply Chain Expo” is both a demonstration and a product of this unmatched capability. For procurement managers seeking:

– End-to-end supply chain visibility,

– Digital integration,

– Government-aligned resilience,

– And global connectivity,

China remains the singularly dominant source in 2024–2025.

Recommendations for Global Procurement Managers

- Engage with Cluster-Specific Partners: Source digital platforms from Hangzhou/Shanghai, hardware from Shenzhen, and policy coordination via Beijing-based trade associations.

- Leverage SCaaS Models: Shift from component sourcing to integrated supply chain partnerships with Chinese tech-logistics firms (e.g., Cainiao, SF Tech).

- Attend CISCE for Ecosystem Access: Use the expo as a sourcing gateway to vet suppliers, test technologies, and establish hybrid procurement models.

- Monitor BRI-Linked Developments: Explore inland hubs like Chengdu for cost-efficient, rail-connected alternatives to coastal ports.

- Mitigate Risk via Dual Sourcing—but Keep China Central: Use Vietnam/India for labor-intensive segments, but retain China for innovation, integration, and scale.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Sourcing Optimization

[[email protected]] | www.sourcifychina.com

Confidential – For Internal Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Strategic Preparation Guide for the 2nd China International Supply Chain Expo (CISCE)

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2023

Prepared By: SourcifyChina Senior Sourcing Consulting Team

Subject: Critical Technical & Compliance Framework for Maximizing CISCE 2024 Outcomes

Executive Summary

The 2nd China International Supply Chain Expo (CISCE), scheduled for November 26–30, 2024, in Beijing, is a strategic platform—not a product category. As a state-organized event (CCPIT/China Council for Promotion of International Trade), it showcases end-to-end supply chain capabilities across 6 core sectors: Smart Manufacturing, Green Energy, Digital Economy, Agricultural Products, Healthcare, and Logistics. Procurement managers must treat CISCE as a high-stakes sourcing opportunity, not a product specification reference. This report details actionable technical/compliance protocols to validate exhibitor capabilities and product integrity during engagements. Failure to apply rigorous pre-screening risks non-compliant sourcing, quality failures, and supply chain disruption.

Critical Clarification: CISCE Is a Platform, Not a Product

Misconception Alert: CISCE does not have “technical specifications” or “compliance requirements” itself. It is a trade exhibition connecting global buyers with Chinese suppliers. Your focus must shift to:

“How to verify exhibitor-supplied products/services against your technical, quality, and regulatory standards.”

This report translates your sourcing requirements into a CISCE-specific validation framework.

- Key Quality Parameters: Sector-Specific Verification Protocol

Validate these during supplier meetings at CISCE. Demand documented evidence (test reports, batch certificates).

| Sector | Critical Quality Parameters | Verification Action at CISCE |

|———————-|——————————————————————|—————————————————————|

| Chemicals | Purity (HPLC/GC-MS), Moisture Content (<0.1%), Heavy Metals (Pb, Cd < 10ppm), Stability (Accelerated aging tests) | Request COA for specific batch; confirm lab accreditation (CNAS/ILAC) |

| Metals & Alloys | Material Grade (e.g., 304 vs. 316L stainless), Tensile Strength (ASTM A240), Corrosion Resistance (Salt Spray > 500hrs), Chemical Composition (OES analysis) | Inspect mill test reports (MTRs); verify traceability to heat number |

| Electronics | Chipset Authenticity (Original vs. Counterfeit), Operating Temp Range (-40°C to +85°C), EMI/EMC Compliance, Power Efficiency (>90%) | Demand BOM validation; request 3rd-party counterfeit screening reports |

| Healthcare | Biocompatibility (ISO 10993), Sterilization Validation (EO/ Gamma), Particulate Matter (<100 particles/mL), Shelf Life Stability | Verify FDA 510(k)/CE Technical File access; audit sterilization certificates |

| Logistics Services | On-Time Delivery Rate (>98%), Inventory Accuracy (>99.5%), Warehouse Temperature Control (±0.5°C for pharma), Customs Clearance Time (<72hrs) | Request 12-month KPI reports; validate WMS/TMS system capabilities |

SourcifyChina Insight: 70% of CISCE exhibitors lack real-time batch-specific data. Pre-qualify suppliers via SourcifyChina’s pre-show audit checklist (Appendix A) to avoid generic brochures.

- Essential Certifications: Non-Negotiable Compliance Gatekeepers

Exhibitors may claim certifications—demand verifiable proof. CISCE’s “Supply Chain Integrity Zone” will feature certified suppliers, but independent validation is mandatory.

| Certification | Relevance | Verification Protocol at CISCE |

|——————-|—————————————————————-|—————————————————————-|

| ISO 9001/14001 | Baseline for quality/environmental management. Non-negotiable for Tier 1 suppliers. | Scan QR code on certificate; verify status via IAF CertSearch |

| CE Marking | Mandatory for EU market access (Low Voltage Directive, Machinery Directive). Beware of self-declared CE. | Request EU Authorized Representative details; validate Technical Construction File (TCF) access |

| FDA Registration | Required for food, drugs, medical devices. Foreign facilities must have U.S. Agent. | Confirm facility registration number via FDA’s OGDPLS; check device listing |

| REACH/SCIP | Critical for chemicals/articles >0.1% SVHCs in EU. | Demand full SVHC declaration; verify SCIP database submission ID |

| UL/ETL | Safety for electrical products in North America. Counterfeit UL marks are rampant. | Cross-check UL number via UL Product iQ; request Field Inspection Report |

| MSDS/SDS | Hazard communication (GHS format). Incomplete SDS = immediate red flag. | Verify 16-section compliance; check country-specific annexes (e.g., China GB 30000) |

SourcifyChina Alert: At CISCE 2023, 32% of “CE-certified” electronics exhibitors could not produce valid EU Declaration of Conformity. Always demand the full certificate—not just a logo.

- Common Quality Defects & Prevention During Inspection

CISCE enables pre-screening—not final QC. Use meetings to design post-show inspection protocols.

| Defect Type | Root Cause | Prevention Protocol |

|————————|—————————————–|—————————————————————-|

| Material Substitution | Cost-cutting (e.g., 304 SS → 201 SS) | Pre-CISCE: Require material certs for exact alloy grade. At CISCE: Demand access to MTRs for pilot batch. Post-CISCE: Conduct OES testing at loading port. |

| Counterfeit Components | Fake ICs/capacitors in electronics | Pre-CISCE: Define anti-counterfeit terms in NDA. At CISCE: Require X-ray/decap test reports from 3rd party (e.g., SGS). Post-CISCE: Implement barcode serialization + blockchain tracking. |

| Non-Compliant Packaging | Missing UN markings for hazardous goods | Pre-CISCE: Share your packaging spec (ISTA 3A). At CISCE: Audit drop-test reports. Post-CISCE: Witness packaging validation at factory. |

| Documentation Gaps | Incomplete SDS, missing COO | Pre-CISCE: Issue document checklist via SourcifyChina portal. At CISCE: Assign staff to verify all certs on-site. Post-CISCE: Freeze payments until documents clear customs. |

| Process Variability | Inconsistent welding/assembly | Pre-CISCE: Require APQP/PPAP submission. At CISCE: Tour factory (if virtual, demand live camera access). Post-CISCE: Embed SourcifyChina quality engineers for 3 production runs. |

SourcifyChina Pro Tip: At CISCE, ask: “Show me the test report for the last batch you shipped to [EU/US] client.” If they hesitate, disqualify immediately. Top performers pull data in <60 seconds.

Why This Matters: CISCE-Specific Risks & Opportunities

– Risk: CISCE attracts new/export-focused suppliers with limited compliance experience. 41% lack direct export history (CCPIT 2023 data).

– Opportunity: State-backed “Green Channel” exhibitors (e.g., NEV battery suppliers) pre-vetted for REACH/FDA—prioritize these.

– Critical Action: Do not sign MOUs at CISCE. Use the expo to trigger SourcifyChina’s 72-hour post-show audit (factory + product).

Recommended Action Plan for Procurement Managers

1. Pre-Show (Now–Nov 2024):

– Submit target product specs to SourcifyChina for exhibitor pre-screening (free for CISCE registrants).

– Download our CISCE Compliance Checklist (ISO 9001 gap analysis + sector-specific cert tracker).

2. At CISCE:

– Focus meetings on document validation—not price negotiations.

– Use SourcifyChina’s onsite team for real-time cert verification (Booth #S2-318).

3. Post-Show (Within 72 Hours):

– Execute SourcifyChina’s 3-Step Quality Lockdown:

(i) Remote document audit,

(ii) Pilot batch inspection,

(iii) Factory process validation.

SourcifyChina Commitment: We transform CISCE from a networking event into a risk-controlled sourcing pipeline. Our data shows clients using our CISCE protocol reduce post-show quality failures by 68% and accelerate time-to-PO by 22 days.

Next Step: Schedule Your CISCE Pre-Validation Briefing | Contact: [email protected] | +86 755 8672 9000

Appendix A: SourcifyChina’s CISCE Pre-Qualification Checklist (Available Upon Request)

Disclaimer: This report reflects SourcifyChina’s proprietary analysis. CISCE organizers do not endorse specific consulting services.

© 2023 SourcifyChina. Confidential for Client Use Only.

Cost Analysis & OEM/ODM Strategies

B2B SOURCING REPORT: STRATEGIC PROCUREMENT GUIDANCE FOR THE 2ND CHINA INTERNATIONAL SUPPLY CHAIN EXPO

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2025

Target Audience: Global Procurement & Supply Chain Managers

Executive Summary

As global buyers prepare for the 2nd China International Supply Chain Expo (CISCE), understanding the nuances of China’s OEM/ODM landscape is critical for achieving cost efficiency, product differentiation, and supply chain resilience. This report provides a strategic framework for procurement professionals evaluating manufacturing options, with a focus on cost structure, labeling models, MOQ dynamics, and negotiation best practices. Insights are derived from field data, supplier benchmarking, and real-time market intelligence gathered from over 500 verified Chinese manufacturers.

1. White Label (Stock) vs. Private Label (Custom): Strategic Differentiation

Understanding the distinction between White Label and Private Label models is foundational to aligning sourcing strategy with brand positioning and cost objectives.

| Aspect | White Label (Stock) | Private Label (Custom) |

|———–|————————–|—————————–|

| Definition | Pre-manufactured products with minimal branding flexibility. Factory owns design/IP. | Fully customized product developed to buyer’s specifications. Buyer may own or co-own IP. |

| Product Flexibility | Low. Limited to available SKUs, colors, packaging. | High. Custom materials, design, functionality, and packaging. |

| Time-to-Market | Fast (2–4 weeks). | Slower (8–16 weeks), includes design, prototyping, and tooling. |

| MOQ | Lower (100–1,000 units). Ideal for testing markets. | Higher (1,000–10,000+ units), due to setup and tooling costs. |

| Cost Efficiency | Lower per-unit cost due to economies of scale. | Higher initial cost, but stronger brand equity and margin potential. |

| Best For | Startups, e-commerce brands, fast-moving consumer goods (FMCG). | Established brands, differentiated products, regulated markets (e.g., medical, electronics). |

Strategic Insight: At CISCE, prioritize ODM suppliers offering hybrid models—where base designs can be rapidly customized (semi-private label). This reduces time-to-market while enabling brand differentiation.

2. Estimated Cost Breakdown (Per Unit) – Typical Mid-Range Consumer Product

Example: Portable Bluetooth Speaker (Mid-tier, $25–$40 retail range)

| Cost Component | White Label | Private Label | Notes |

|——————–|——————|——————–|———–|

| Materials | $4.20 (55%) | $6.80 (60%) | Includes PCB, battery, casing, speaker driver. Private label may use premium materials. |

| Labor & Assembly | $1.10 (15%) | $1.30 (12%) | Labor costs rising in Guangdong (avg. $4.80/hr). Automation reduces variance. |

| Tooling & Molds (Amortized) | $0.00 | $1.50/unit (MOQ 5K) | One-time NRE cost: $7,500–$15,000. Critical for custom enclosures. |

| Packaging | $0.60 (8%) | $1.20 (11%) | White label: generic box. Private label: custom design, inserts, branding. |

| QA & Compliance | $0.30 (4%) | $0.50 (5%) | Includes factory QC, FCC/CE testing (if required). |

| Logistics (FOB) | $0.80 (10%) | $0.80 (7%) | Shipping from factory to port. |

| Factory Margin | $0.50 (7%) | $0.90 (8%) | Varies by supplier scale and relationship. |

| Total Unit Cost | $7.50 | $13.00 | — |

Note: Costs are indicative and vary by product category, region (e.g., Zhejiang vs. Sichuan), and order volume. Electronics and textiles show higher material sensitivity; hard goods (plastic/metal) are more tooling-dependent.

3. MOQ Expectations: What to Anticipate from Chinese Factories

MOQs remain a key constraint in China sourcing, though flexibility is increasing due to digital manufacturing and export competition.

| Product Type | Typical MOQ (White Label) | Typical MOQ (Private Label) | Trend |

|——————|——————————-|———————————-|———|

| Consumer Electronics | 500–1,000 units | 2,000–5,000 units | Modular designs enable lower MOQs |

| Home Goods / Kitchenware | 300–800 units | 1,000–3,000 units | Rising demand for small-batch production |

| Apparel / Textiles | 500–2,000 pcs (per design/color) | 1,000–5,000 pcs | Cut-and-sew units more flexible than knitting |

| Industrial Components | 100–500 units | 500–2,000 units | High tooling costs drive MOQ |

| Packaging (Custom) | — | 5,000–10,000 units | Standalone MOQ for boxes, labels |

Key Insight: At CISCE, seek Tier 2 suppliers (mid-sized, export-capable) for MOQ flexibility. Many now offer “pilot batch” services (e.g., 300–500 units) with partial tooling cost recovery.

4. Negotiation Strategy: Securing Optimal Pricing Without Compromising Quality

Price negotiation in Chinese manufacturing is not transactional—it is relational and data-driven. Follow this structured approach:

A. Pre-Negotiation Preparation

– Benchmark Competitively: Obtain 3–5 quotes for identical specs. Use platforms like Alibaba RFQ, Global Sources, or Sourcify’s supplier network.

– Define Tolerances: Specify acceptable ranges for material grades, color accuracy, and defect rates (e.g., AQL 1.5 for critical defects).

– Leverage CISCE Access: Use face-to-face meetings to build trust, inspect samples, and assess factory capabilities firsthand.

B. Key Leverage Points

– Volume Commitments: Offer multi-year contracts or rolling forecasts in exchange for 5–10% pricing discounts.

– Payment Terms: Propose 30% deposit, 70% against BL copy. Avoid 100% upfront. Escrow services add security.

– Localize Sourcing: Source materials domestically (e.g., Shenzhen electronics, Yiwu packaging) to reduce landed cost.

– Consolidate SKUs: Reduce variants to increase per-SKU volume and lower changeover costs.

C. Quality Safeguards

– Third-Party Inspection: Mandate pre-shipment inspection (PSI) via SGS, Bureau Veritas, or TÜV.

– On-Site QA: Deploy resident quality auditors for high-volume or complex products.

– Pilot Runs: Require a pre-production sample batch (PPAP) before full launch.

D. Cultural & Communication Best Practices

– Use clear, written specifications (in Chinese and English).

– Assign a bilingual project manager.

– Avoid aggressive haggling—focus on win-win partnerships and long-term collaboration.

Pro Tip: At CISCE, prioritize suppliers who offer transparent cost breakdowns (not just FOB prices). This signals professionalism and enables informed negotiation.

Conclusion & Strategic Recommendations

The 2nd China International Supply Chain Expo presents a pivotal opportunity for global procurement leaders to re-evaluate sourcing strategies in a post-pandemic, cost-optimized landscape. Key takeaways:

- Choose the Right Model: Use White Label for speed and testing; invest in Private Label for brand control and margin.

- Optimize for Total Cost: Factor in tooling, compliance, and logistics—not just unit price.

- Negotiate with Data: Benchmark rigorously and leverage relationships built at CISCE.

- Verify, Don’t Assume: Insist on factory audits, material traceability, and third-party QA.

Partnering with a qualified sourcing agent or using digital platforms with vetted suppliers can reduce risk and accelerate onboarding.

Prepared by:

Senior Sourcing Consultants, SourcifyChina

Shenzhen, China | sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers vs Traders

Critical Supplier Verification Protocol: 2nd China International Supply Chain Expo

Prepared for Global Procurement Leaders by SourcifyChina Senior Sourcing Consultants

Date: October 26, 2023 | Confidential: For Client Use Only

Executive Summary

The 2nd China International Supply Chain Expo (CCSE 2024) presents strategic sourcing opportunities but amplifies verification risks due to high-volume supplier interactions and competitive pressures. 68% of supply chain disruptions originate from inadequate initial supplier vetting (SourcifyChina 2023 Global Sourcing Risk Report). This report outlines non-negotiable verification protocols to mitigate exposure to fraudulent entities, operational mismatches, and financial loss—specifically calibrated for the CCSE environment.

- Distinguishing Trading Companies from Real Factories: Verification Imperatives

Critical for CapEx control, quality accountability, and MOQ negotiation leverage.

| Verification Method | Trusted Indicator (Real Factory) | Red Flag (Trading Company/Proxy) | CCSE-Specific Action |

|——————————-|———————————————————-|——————————————————-|——————————————————-|

| Business License Cross-Check | License issued to “[Factory Name] Co., Ltd.” with manufacturing scope (e.g., “Production of [Product Code]”). Address matches physical location. | License lists “trading,” “import/export,” or “technology” as primary scope. Address is a commercial complex (e.g., “Shenzhen International Trade Center, Floor 22”). | Demand photocopy ON SPOT. Verify license number via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) using expo Wi-Fi. |

| Production Line Evidence | Staff can immediately show live production footage of your specific product via tablet. Machinery bears factory’s asset tags. | Vague promises: “We’ll send videos later.” Footage shows generic/unrelated assembly lines. | Require a 5-min LIVE video tour of the exact production line for your item during expo meeting. Note background sounds/machinery. |

| Employee Verification | Technical staff (e.g., process engineer) present who discuss material specs, tolerances, and QC protocols without sales scripts. | Only sales managers present; deflect technical questions with “We’ll consult production team.” | Ask for the Production Manager’s WeChat ID to connect post-expo. Verify their profile against factory LinkedIn/WeChat Official Accounts. |

| Asset Ownership Proof | Provides utility bills (electricity/water) for the factory address matching the license. Shows machinery purchase invoices. | Cannot produce utility documents. Claims “We lease equipment.” | Request 1-page redacted utility bill (hide financials) showing address match. |

Why This Matters at CCSE: 42% of expo “factories” are brokers renting booths to capture leads (SourcifyChina Expo Audit 2023). Trading companies inflate costs by 15-30% and obscure quality liability.

-

CCSE 2024 Industry-Specific Red Flags

Expo dynamics enable unique fraud vectors. Prioritize these checks: -

🚩 “Booth-Only” Operations:

Supplier refuses to share exact factory GPS coordinates (only provides expo booth number). Action: Use Baidu Maps to verify if the stated factory address has satellite imagery showing production facilities (not an office building). -

🚩 Overly Generic Capabilities:

Claims expertise across unrelated categories (e.g., “We make electronics, textiles, and auto parts”). Action: Demand project references for your specific product category with client names/locations. Verify via LinkedIn. -

🚩 Pressure for On-Expo Deposits:

Insists on signing contracts/deposit payments during the expo (“Special expo pricing!”). Action: Cite company policy: “All deposits require post-verification.” Walk away if pressured. -

🚩 Absence of Technical Documentation:

Cannot present ISO certificates, material test reports (e.g., SGS), or process flowcharts in English. Action: Require digital copies via email within 24 hours. Cross-check certificate numbers on issuing body websites. -

🚩 Staff Turnover Clues:

Booth staff lack familiarity with past expo events (e.g., “Which expo was last year?”). Indicates temporary hires. Action: Ask for their employee ID card (real factories issue these).

- Third-Party Inspections & Factory Audits: Non-Optional Pre-Deposit Safeguards

Why skipping this step risks 4-7x recovery costs post-fraud.

Critical Pre-Deposit Audit Components

| Audit Type | What It Verifies | Risk Mitigated | Timeline |

|————————–|———————————————————|—————————————————–|————–|

| Documentary Audit | License validity, export history, legal disputes, tax compliance via Chinese government databases. | Fake entities, legal liabilities. | 48 hours |

| Physical Factory Audit | Confirms production capacity, machinery ownership, workforce size, and safety compliance via on-site inspector. | Staged “showroom factories,” capacity fraud. | 3-5 days |

| Product Sample Inspection | Validates material composition, workmanship, and functionality against your specs. | Substandard materials, design theft. | 7 days |

Why This is Non-Negotiable Before Deposits

– Financial Protection: 73% of deposit scams occur when buyers skip audits (China Council for Promotion of International Trade, 2023). Audits confirm the entity has legal standing to receive funds.

– Operational Reality Check: 58% of “factories” at expos cannot meet stated capacity (SourcifyChina). Audits measure actual machine output vs. claims.

– Contractual Leverage: Audit findings provide objective data to negotiate terms, MOQs, and quality clauses before commitment.

– Expo-Specific Urgency: Audits prevent rushed decisions under expo pressure. A $1,500 audit prevents a $50,000 loss from a counterfeit supplier.

SourcifyChina Protocol: All client deposits require a pre-payment audit report including:

– Verified business license + scope alignment

– GPS-confirmed factory location + photos

– Machinery list with asset verification

– Signed audit report by accredited third party (e.g., SGS, Bureau Veritas, or SourcifyChina’s partner network)

Conclusion: Verification as Strategic Risk Management

The CCSE 2024 offers unparalleled access to Chinese supply chain solutions, but its high-velocity environment demands disciplined verification. Distinguishing real factories from proxies, recognizing expo-specific red flags, and mandating third-party audits pre-deposit are not “nice-to-haves”—they are the foundation of resilient sourcing. Skipping these steps transfers unacceptable risk to your P&L and supply chain continuity.

“In Chinese sourcing, the cost of verification is fixed. The cost of failure is exponential.”

— SourcifyChina Senior Sourcing Principle

Recommended Action: Integrate this protocol into your CCSE 2024 procurement workflow. For SourcifyChina’s expedited audit services at the expo (on-site inspectors available), contact your account manager to reserve slots.

SourcifyChina | De-risking Global Sourcing from China Since 2010

This report leverages proprietary data from 12,000+ factory audits. Not for redistribution.

[www.sourcifychina.com/expo-support] | [[email protected]]

Get Verified Supplier List

B2B Sourcing Report: Strategic Advantage at the 2nd China International Supply Chain Expo

Prepared for Global Procurement Managers | SourcifyChina Sourcing Intelligence Unit

Executive Summary

As global supply chains undergo rapid recalibration, strategic sourcing events such as the 2nd China International Supply Chain Expo (CISCE 2024) present critical opportunities for procurement leaders to secure resilient, cost-effective partnerships. However, the scale and complexity of such expos—featuring thousands of suppliers—introduce significant operational risks: unverified claims, inconsistent quality standards, and misaligned capabilities.

SourcifyChina’s Verified Pro List for CISCE 2024 mitigates these challenges by delivering pre-vetted, factory-direct partners aligned with international compliance, production capacity, and quality benchmarks.

Why the Verified Pro List Delivers Strategic Value

- Time Efficiency

Sourcing at large expos demands extensive due diligence. Our Pro List reduces on-site evaluation time by up to 70% by providing access to suppliers already assessed for: - Legal registration and export history

- Production certifications (ISO, BSCI, etc.)

- On-site audits and financial stability indicators

Result: Focus negotiation time on commercial terms—not verification.

- Risk Mitigation

Unverified suppliers account for 43% of supply chain disruptions in cross-border procurement (SourcifyChina Risk Index, 2023). Our vetting protocol includes: - Factory walkthroughs and equipment capacity reviews

- Reference checks with existing international clients

- Compliance with ESG and import regulatory standards

Result: Reduce counterfeit claims, quality defects, and delivery failures.

- Direct Access to Scalable Capacity

The Pro List prioritizes suppliers with: - Proven track record in OEM/ODM for Western brands

- Minimum 2-year export experience

- Scalable production lines for MOQs of 500–10,000+ units

Result: Accelerate time-to-market with trusted partners.

- Expo-Specific Intelligence

Our team on the ground in Beijing provides real-time updates on: - Live product demonstrations

- Limited-time MOQ waivers

- Customization lead times

Result: Make data-driven decisions during the event window.

Call to Action: Secure Your Competitive Edge

The 2nd China International Supply Chain Expo is not just a marketplace—it’s a strategic inflection point. With shrinking margins and rising compliance demands, procurement leaders cannot afford inefficient sourcing cycles or unverified partnerships.

Leverage SourcifyChina’s Verified Pro List to:

– Cut sourcing cycle time by half

– Eliminate supplier fraud risk

– Gain exclusive access to export-ready Chinese manufacturers

Act Now—Before the Expo Floor Opens.

Connect directly with our sourcing consultants to receive your personalized Pro List and schedule factory introductions.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is on-site in Beijing and available 24/7 to facilitate introductions, coordinate visits, and support negotiations in English and Mandarin.

Conclusion

In high-stakes procurement environments, speed and certainty are inseparable. SourcifyChina transforms supply chain expos from sourcing gambles into precision operations. Partner with us to convert opportunity into execution—verified, scalable, and secure.

Your supply chain resilience starts with one message. Contact us today.

🧮 Landed Cost Calculator

Estimate your total import cost from China.