The global 2D barcode scanner market is experiencing robust growth, driven by rising demand for efficient data capture across retail, healthcare, logistics, and manufacturing sectors. According to Grand View Research, the global barcode scanner market size was valued at USD 4.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.6% from 2023 to 2030. This expansion is fueled by the increasing adoption of mobile computing devices, the proliferation of automated checkout systems, and the need for real-time inventory tracking. Mordor Intelligence further supports this trend, projecting a CAGR of over 9% during the forecast period (2023–2028), with Asia-Pacific emerging as the fastest-growing region due to industrialization and digital transformation initiatives. As demand intensifies, a competitive landscape of innovative manufacturers has emerged, shaping advancements in imaging technology, wireless connectivity, and rugged design. Below are the top 10 2D barcode scanner manufacturers leading this evolution through technological excellence and global market presence.

Top 10 2D Barcode Scanner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 1D/2D Barcode Scanners & NFC Readers for Retail & Industrial …

Domain Est. 2006

Website: socketmobile.com

Key Highlights: Mobile data capture with native OS integration. Barcode scanners and contactless reader writers providing control, speed, and accuracy….

#2 General Purpose Handheld Scanners – Automation

Domain Est. 1988

Website: automation.honeywell.com

Key Highlights: Honeywell general purpose handheld scanners are the ideal tool for businesses looking to improve their day-to-day barcode reading applications….

#3 Products

Domain Est. 1994

Website: datalogic.com

Key Highlights: Our full range of barcode scanner products includes Fixed Retail Scanners, Hand Held Scanners, Mobile Computers, Sensors, Laser Marking Systems, Safety, Vision ……

#4 Barcode Scanners

Domain Est. 1995

Website: zebra.com

Key Highlights: Zebra’s 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or ……

#5 Barcode Scanners

Domain Est. 1995

Website: ute.com

Key Highlights: 2D Area imager – Barcode Scanner The MS842 is a 2D barcode scanner, it supports USB and RS232 interfaces for field service application….

#6 2D Barcode Scanner (Gen 1)

Domain Est. 1996

Website: elotouch.com

Key Highlights: Improve self-service and price-checker applications with Elo’s 2D Barcode scanner that easily attaches to a variety of Elo touchscreen displays. Learn more….

#7 ZEBEX

Domain Est. 1997

Website: zebex.com

Key Highlights: ZEBEX is the best 2D scanning solution provider. ZEBEX’s barcode scanners and readers to capture the data that matters most at the retail POS, ……

#8 Barcode & Software Readers & Scanning

Domain Est. 1998

Website: codecorp.com

Key Highlights: Scan all barcode types with 99.9995% accuracy to empower exceptional care. Healthcare Barcode Scanners, Printers, Software & ID. Streamline workflows with ……

#9 Barcode Scanner For 2D, Bluetooth Wireless, iPhone & Android

Domain Est. 1998

#10 LabelTac® Wireless 2D Barcode Scanner

Domain Est. 2010

Website: labeltac.com

Key Highlights: In stock Free 30-day returnsThe LabelTac Wireless 2D Barcode Scanner provides barcode scanning versatility that excels in various industry types, including busy retail stores….

Expert Sourcing Insights for 2D Barcode Scanner

2026 Market Trends for 2D Barcode Scanners

The global 2D barcode scanner market is poised for significant transformation by 2026, driven by technological advancements, evolving industry demands, and expanding applications across diverse sectors. Several key trends are expected to shape the market landscape, influencing product development, deployment strategies, and competitive dynamics.

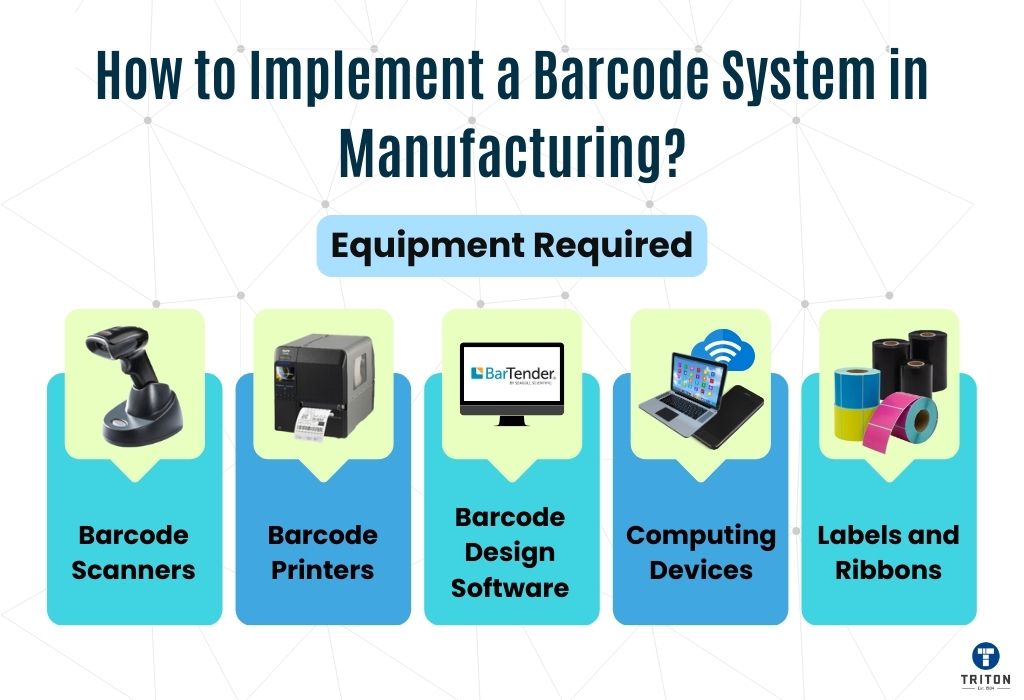

Increased Adoption Across Diverse Industries

By 2026, 2D barcode scanners will see accelerated adoption beyond traditional retail and logistics. Sectors such as healthcare, manufacturing, food and beverage, and field service will increasingly rely on 2D scanning for asset tracking, patient safety, inventory accuracy, and compliance. The ability of 2D scanners to read both linear and matrix codes (e.g., QR, Data Matrix) makes them ideal for complex data capture needs, particularly in regulated environments where traceability is critical.

Growth of Wireless and Mobile Solutions

Wireless 2D scanners—particularly Bluetooth-enabled and ruggedized mobile models—will dominate new deployments. The demand for mobility in warehouses, retail floors, and delivery operations will drive the shift from corded to wireless systems. Integration with smartphones and tablets via SDKs will further expand the use of mobile 2D scanning, especially in on-the-go applications like last-mile delivery, mobile point-of-sale (mPOS), and field inspections.

Integration with Cloud and IoT Platforms

2D scanners will increasingly function as edge devices within broader IoT ecosystems. Real-time data captured by scanners will be transmitted directly to cloud-based inventory, ERP, and supply chain management systems. This integration enables greater operational visibility, predictive analytics, and automated workflows. Manufacturers will focus on seamless API connectivity and compatibility with major enterprise platforms to enhance value propositions.

Advancements in Imaging and AI Technologies

Imaging technology in 2D scanners will continue to improve, with higher resolution sensors, better motion tolerance, and enhanced decoding algorithms. By 2026, AI-powered image recognition will allow scanners to read damaged, poorly printed, or obscured barcodes with greater accuracy. These intelligent scanners will also support multi-code reading and contextual data interpretation, reducing manual intervention and increasing throughput.

Focus on Ruggedness and Ergonomics

With expanding use in harsh industrial environments—such as manufacturing floors, cold storage, and outdoor logistics—the demand for rugged, IP-rated scanners will grow. Vendors will emphasize durability, drop resistance, and long battery life. Simultaneously, ergonomic design will remain a priority to reduce user fatigue in high-volume scanning scenarios, especially in e-commerce fulfillment centers.

Rise of Software-Defined Scanning

The line between hardware and software will blur as software development kits (SDKs) and configurable firmware become standard. End users and integrators will demand scanners that can be customized for specific workflows, including support for proprietary symbologies, data formatting rules, and security protocols. This shift will empower businesses to tailor scanning solutions without hardware replacement.

Sustainability and Lifecycle Management

Environmental concerns and corporate sustainability goals will influence procurement decisions. Vendors will respond with energy-efficient designs, longer product lifecycles, and take-back/recycling programs. Additionally, remote firmware updates and diagnostic capabilities will support better lifecycle management, reducing the need for hardware refreshes and minimizing e-waste.

In summary, the 2D barcode scanner market in 2026 will be characterized by smarter, more connected, and more versatile devices. As digital transformation continues across industries, 2D scanners will evolve from simple data capture tools into integral components of intelligent operational ecosystems. Companies that embrace innovation in connectivity, software integration, and user experience will lead the market in this pivotal year.

Common Pitfalls When Sourcing a 2D Barcode Scanner (Quality and IP)

Sourcing a 2D barcode scanner involves more than just comparing prices and specifications. Overlooking key quality and intellectual property (IP) considerations can lead to performance issues, compliance risks, and long-term costs. Below are common pitfalls to avoid:

Poor Optical and Decoding Quality

Many low-cost scanners use substandard image sensors or outdated decoding algorithms, resulting in slow or failed scans—especially with damaged, poorly printed, or reflective barcodes. Always verify real-world performance through sample testing under your specific operating conditions.

Inadequate Environmental Durability

Scanners marketed with high IP (Ingress Protection) ratings may not meet the claimed standards if sourced from unreliable manufacturers. A scanner advertised as IP65 might fail under dust or water exposure if the sealing or materials are compromised. Request independent test reports or conduct in-house durability trials.

Misleading IP Ratings and Certification Gaps

Some suppliers inflate or falsify IP ratings without third-party certification. Look for verifiable certifications from recognized bodies (e.g., TÜV, UL) and ensure the rating applies to the entire unit, not just components. Lack of certification can lead to equipment failure and safety hazards in industrial environments.

Counterfeit or Clone Devices

Unscrupulous suppliers may offer counterfeit versions of reputable brands that mimic appearance but lack the original’s quality, firmware, and support. These clones often infringe on IP and can introduce security vulnerabilities or compatibility issues. Purchase only through authorized distributors.

Firmware and Software IP Risks

Cloned scanners may use pirated or reverse-engineered firmware, exposing buyers to legal liability for IP infringement. Additionally, such firmware may lack updates, security patches, or SDK support, limiting integration and scalability.

Inconsistent Build Quality and Component Sourcing

Low-cost suppliers may use inconsistent component batches—such as varying lens quality or battery types—leading to unreliable performance across units. This variability undermines automation and support in large deployments.

Lack of Technical Support and Documentation

Scanners from unknown vendors often come with poor or missing technical documentation, SDKs, or firmware update tools. This hampers integration and troubleshooting, increasing downtime and development costs.

Hidden Total Cost of Ownership

While initial pricing may be attractive, poor quality leads to higher failure rates, increased maintenance, and operational delays. Factor in expected lifespan, warranty terms, and availability of spare parts when evaluating total cost.

Avoiding these pitfalls requires due diligence: verify certifications, test samples, audit supplier credibility, and ensure compliance with IP and regulatory standards before finalizing procurement.

Logistics & Compliance Guide for 2D Barcode Scanner

This guide outlines the essential logistics considerations and compliance requirements for the deployment, operation, and maintenance of 2D barcode scanners in enterprise environments.

Regulatory and Safety Compliance

Ensure all 2D barcode scanners comply with relevant regional and international regulations. This includes adherence to FCC, CE, and RoHS standards for electromagnetic compatibility, safety, and environmental protection. Devices used in hazardous or specialized environments (e.g., healthcare, food processing, or explosive atmospheres) must meet additional certifications such as IP ratings for dust and water resistance, or FDA 21 CFR Part 11 for electronic records in regulated industries.

Data Security and Privacy

Protect scanned data in accordance with data privacy laws such as GDPR, HIPAA, or CCPA. Implement encryption for data at rest and in transit, especially when barcode scanners transmit sensitive information (e.g., patient IDs, personal identification, or financial data). Ensure scanners do not store personal data unless necessary, and apply secure configuration protocols to prevent unauthorized access or data leakage.

Device Certification and Standards

Verify that all 2D barcode scanners are certified to industry standards such as ISO/IEC 15415 (for barcode print quality verification) and ISO/IEC 18000 (for RFID interoperability, if applicable). Use only models tested and approved by recognized bodies (e.g., UL, TÜV) to guarantee performance, reliability, and safety in your operating environment.

Supply Chain and Inventory Logistics

Integrate 2D barcode scanners into your supply chain management systems to enable accurate tracking of goods from receipt to shipment. Ensure compatibility with existing Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) platforms. Standardize scanner models across locations to streamline spare parts inventory, reduce training complexity, and simplify maintenance logistics.

Transportation and Handling

When shipping or relocating 2D barcode scanners, use anti-static packaging and shock-resistant containers to prevent damage. Follow manufacturer guidelines for temperature and humidity exposure during transport. Maintain a chain of custody for devices used in regulated environments to ensure audit compliance.

Installation and Configuration

Deploy scanners using standardized configuration templates to ensure consistent settings across devices. Enable only necessary features (e.g., Bluetooth, Wi-Fi) to minimize security risks. Apply firmware updates promptly and maintain version control logs to support compliance audits and troubleshooting.

Maintenance and Calibration

Establish a routine maintenance schedule to clean scanner lenses, verify decode accuracy, and inspect for physical damage. Perform periodic calibration checks using certified test barcodes to ensure scanning reliability. Document all maintenance activities for compliance and warranty purposes.

End-of-Life and Disposal

Decommission scanners securely by wiping all stored data using manufacturer-recommended procedures. Dispose of devices in compliance with local e-waste regulations and environmental standards (e.g., WEEE Directive). Maintain disposal records to demonstrate responsible asset management and regulatory adherence.

Conclusion for Sourcing a 2D Barcode Scanner

After evaluating various options, it is clear that sourcing a 2D barcode scanner significantly enhances operational efficiency, accuracy, and data capture capabilities across inventory management, point-of-sale systems, logistics, and customer service applications. 2D scanners offer superior performance compared to traditional 1D scanners by reading both linear barcodes and complex 2D codes (such as QR codes and DataMatrix), enabling broader functionality and future-proofing business operations.

Key considerations in the sourcing decision include scan speed, durability, compatibility with existing systems, ease of integration, and total cost of ownership. Scanners from reputable manufacturers provide reliable performance, extended warranties, and technical support, contributing to long-term value.

Ultimately, investing in a high-quality 2D barcode scanner aligns with digital transformation goals, improves workflow accuracy, reduces manual errors, and supports scalability. Based on the assessment, sourcing a versatile, durable, and cost-effective 2D barcode scanner that meets specific operational needs is a strategic move that delivers measurable returns across the organization.