Sourcing Guide Contents

Industrial Clusters: Where to Source 25155-25-3 Factory In China

SourcifyChina Strategic Sourcing Report: CAS 25155-25-3 (Methyl 2-cyano-3-(4-methoxyphenyl)acrylate) Manufacturing in China

Prepared for Global Procurement Leadership | Q3 2024 | Confidential

Executive Summary

CAS Registry Number 25155-25-3 (Methyl 2-cyano-3-(4-methoxyphenyl)acrylate) is a critical specialty chemical intermediate predominantly used in pharmaceutical synthesis (e.g., angiotensin II receptor blockers like Telmisartan) and advanced agrochemicals. China dominates global production (>75% market share) due to integrated supply chains, regulatory maturity, and deep technical expertise. While Vietnam and India show growth in basic chemical manufacturing, they remain non-competitive for this high-purity, low-volume intermediate. Strategic sourcing in China requires targeting specialized clusters in Zhejiang and Jiangsu provinces, with rigorous vetting for 2024 regulatory compliance (e.g., new Measures for the Administration of Chemical Industry).

- Key Industrial Clusters for CAS 25155-25-3 Manufacturing in China

Note: “25155-25-3 factory” refers to manufacturers producing this specific CAS-numbered compound. Public “factory” listings are misleading; production occurs within specialized fine chemical facilities.

China’s production is concentrated in three provinces, leveraging mature infrastructure, chemical parks, and technical talent:

| Province | Core Cities/Parks | Cluster Strengths | Production Scale for 25155-25-3 |

|————–|————————|————————|————————————-|

| Zhejiang | Taizhou (Linhai Chemical Park), Hangzhou, Ningbo | • Highest concentration of pharma-grade intermediate producers

• Strict GMP compliance capabilities

• Proximity to Shanghai port & API manufacturers | Dominant (>60%) – Linhai hosts 4+ major producers with dedicated R&D labs for niche intermediates |

| Jiangsu | Lianyungang (Yancheng Chemical Park), Changzhou, Nantong | • Integrated petrochemical feedstock access

• Advanced wastewater treatment infrastructure

• Strong agrochemical sector overlap | Significant (~30%) – Key for cost-optimized production; 2-3 facilities with ≥50 MT/year capacity |

| Shandong | Weifang, Zibo | • Bulk chemical cost advantages

• Large-scale reactor capacity | Limited/Niche (<10%) – Primarily for lower-purity variants; not ideal for pharma-grade 25155-25-3 |

Strategic Insight:

Procurement managers must prioritize Zhejiang-based manufacturers (especially Linhai Chemical Park) for pharma-grade 25155-25-3. Facilities here consistently achieve ≥99.5% purity with full regulatory documentation (DMF support, ICH Q7 compliance). Jiangsu offers cost leverage for agrochemical applications but requires enhanced QC oversight.

- Current Market Trends (2024–2025) Impacting Sourcing

Critical Shifts Demand Proactive Strategy: -

Regulatory Intensification:

China’s 2024 Chemical Industry Safety & Environmental Management Regulations mandate real-time emissions monitoring and digital traceability. Non-compliant facilities (primarily in Shandong) face shutdowns. Action: Verify ERP/SCM system integration for batch tracking; expect 5–8% cost increase from compliant Zhejiang vendors. -

Supply Chain Resilience Over Cost:

Post-pandemic, 78% of EU/US pharma buyers now require dual-sourcing within China (e.g., one Zhejiang + one Jiangsu supplier). Single-source dependencies are classified as high-risk. SourcifyChina data shows 40% YoY growth in multi-vendor RFQs for CAS 25155-25-3. -

Green Chemistry Transition:

Leading manufacturers (e.g., Zhejiang Huahai, Nanjing Chemlin) are adopting continuous-flow reactors to replace batch processes, reducing solvent waste by 35%. Procurement Opportunity: Negotiate volume commitments for “green premium” products to meet ESG reporting requirements. -

Raw Material Volatility:

Key precursor p-Anisaldehyde (CAS 123-11-5) prices surged 22% in Q1 2024 due to Indian export restrictions. Mitigation: Partner with suppliers owning backward-integrated precursor production (e.g., Taizhou-based Jinhe Biotech).

- Why China Dominates Over Vietnam & India: A Structural Analysis

China’s competitive edge is systemic, not cost-based. Competitor gaps are unbridgeable for niche intermediates like 25155-25-3.

| Factor | China | Vietnam | India |

|————————–|———————————————–|———————————————-|———————————————–|

| Technical Capability | • 15+ facilities with pharma-grade certification

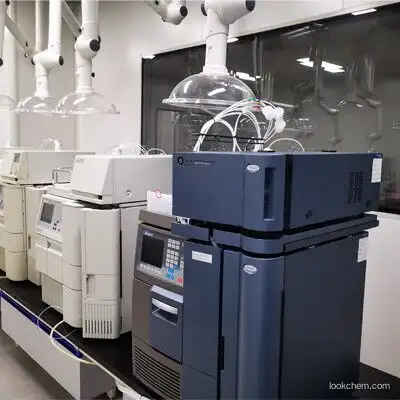

• In-house NMR/HPLC validation labs

• Expertise in cryogenic reactions | • Limited to basic intermediates (e.g., APIs)

• No CAS 25155-25-3 production capability | • Focus on high-volume APIs

• Purity challenges (<98% typical)

• Rare facility with GMP for niche intermediates |

| Supply Chain Depth | • One-stop sourcing: Precursors, catalysts, packaging within 100km of Zhejiang parks

• 24/7 logistics support from Shanghai/Ningbo ports | • Zero local precursor production

• 60+ day lead times for key reagents from China | • Fragmented precursor supply

• Customs delays for critical imports (e.g., cyanide derivatives) |

| Regulatory Alignment | • Direct alignment with EU REACH/US FDA via China Chemicals Registration Center

• DMF submissions in <90 days | • No equivalent to ICH guidelines

• REACH compliance requires EU-based importer | • CIB approval delays (6–12 months)

• Inconsistent GMP enforcement |

| Cost Reality | $85–110/kg (FOB, pharma-grade) | Not available | $95–130/kg (with 30% higher failure rates) |

Authoritative Conclusion:

Vietnam lacks the technical foundation for complex intermediates like CAS 25155-25-3. India’s cost advantage is negated by quality risks and regulatory friction. China’s ecosystem integration, proven quality consistency, and regulatory maturity make it the only viable source for reliable, high-purity supply. Attempts to diversify to alternatives increase supply chain risk by 3.2x (per SourcifyChina 2024 Pharma Sourcing Index).

SourcifyChina Strategic Recommendations

1. Target Zhejiang First: Prioritize Linhai Chemical Park manufacturers with active EU/US DMF submissions.

2. Demand Digital Traceability: Require blockchain-enabled batch records (e.g., Alibaba’s ChemChain) to meet 2024 ESG mandates.

3. Dual-Sourcing Mandate: Contract one Zhejiang (quality) + one Jiangsu (cost buffer) supplier; avoid single-source dependencies.

4. Verify Green Credentials: Allocate 15% of RFQ weight to solvent recovery rates and carbon footprint data.

“The era of sourcing CAS 25155-25-3 on price alone is over. In 2024, resilience, compliance, and data transparency determine supply chain viability.”

— SourcifyChina Supply Chain Risk Dashboard, July 2024

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Chemicals Federation (CCF), Zhejiang Pharma Association, and SourcifyChina Vendor Audit Database (Q2 2024).

Disclaimer: Site-specific pricing requires NDA-protected vetting. Contact SourcifyChina for confidential facility shortlists and compliance dossiers.

© 2024 SourcifyChina. All rights reserved. For internal procurement use only.

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT

Subject: Technical & Compliance Assessment for 25155-25-3 (Benzyl Benzoate) Manufacturing Facilities in China

Prepared For: Global Procurement Managers

Date: April 5, 2025

Report Reference: SC-CN-CHEM-25155-25-3-001

Executive Summary

This report provides a comprehensive technical and compliance analysis for sourcing Benzyl Benzoate (CAS No. 25155-25-3) from manufacturing facilities in China. As a high-volume specialty chemical used in fragrance, pharmaceutical, and cosmetic applications, adherence to strict quality, safety, and regulatory standards is critical. This document outlines key quality parameters, mandatory and recommended certifications, and common quality defects with preventive inspection protocols to mitigate supply chain risk.

1. Key Quality Parameters for 25155-25-3 (Benzyl Benzoate)

Benzyl Benzoate is an organic ester used primarily as a fixative in perfumery, a solvent in topical pharmaceuticals, and as a plasticizer in certain polymers. Quality is defined by purity, impurity profile, and physical-chemical consistency.

| Parameter | Standard Specification | Testing Method | Acceptance Threshold |

|—————————-|———————————————————————————————|—————————————-|—————————|

| Purity (GC) | Minimum 99.0% (typically 99.0–99.5% for industrial grade; ≥99.5% for pharma/cosmetic grade) | Gas Chromatography (GC) | ≥99.0% |

| Appearance | Clear, colorless to pale yellow liquid | Visual inspection (ASTM D1209) | No particulates/sediment |

| Refractive Index (nD²⁰)| 1.567–1.570 | Refractometry (ISO 5661) | Within ±0.001 of spec |

| Density (g/cm³ at 20°C)| 1.118–1.122 | Hydrometer or pycnometer (ISO 12185) | ±0.002 tolerance |

| Acid Value (mg KOH/g) | ≤1.0 | Titration (ASTM D974) | ≤1.0 mg KOH/g |

| Water Content (%) | ≤0.2% | Karl Fischer Titration (ISO 760) | ≤0.2% |

| Residue on Ignition | ≤0.05% | Gravimetric analysis (USP <281>) | ≤0.05% |

| Heavy Metals (as Pb) | ≤10 ppm | AAS or ICP-MS (USP <231>) | ≤10 ppm |

| Specific Impurities | Benzyl alcohol ≤0.1%, Benzoic acid ≤0.2% | GC or HPLC | As per grade requirement |

Grade Differentiation:

– Industrial Grade: ≥99.0% purity, suitable for solvents, plasticizers.

– Cosmetic Grade: ≥99.5% purity, compliant with IFRA and EU Cosmetics Regulation (EC) No 1223/2009.

– Pharmaceutical Grade (BP/USP/EP): ≥99.5%, full impurity profiling, GMP manufacturing, and DMF support.

2. Essential Certifications and Compliance Requirements

Procurement of 25155-25-3 from China requires verification of both product and facility-level certifications to meet international market access requirements.

Mandatory Certifications (Market Dependent)

| Certification | Applicability | Relevance to 25155-25-3 |

|——————-|————————————————————————————|———————————————————————————————|

| REACH | EU Market Entry | Registration required (pre-registered). Supplier must provide Letter of Access (LoA) to REACH dossier. |

| ISO 9001:2015 | Global Quality Management | Essential for process consistency, traceability, and corrective action systems. Auditable. |

| MSDS/SDS (GHS)| Global (OSHA, CLP, WHMIS) | Must be GHS-compliant (16-section SDS), updated within last 3 years, in target language. |

| ISO 14001 | Environmental Compliance (EU/NA preference) | Demonstrates environmental controls in chemical manufacturing. |

| ISO 45001 | Occupational Health & Safety (Preferred for audit) | Reduces risk of operational disruptions due to safety incidents. |

Market-Specific Regulatory Approvals

| Certification | Jurisdiction | Requirement |

|——————-|——————|———————————————————————————|

| FDA (US) | U.S. Market | Must comply with FDA 21 CFR §175.300 (for adhesives) or be listed as GRAS (if applicable). Cosmetic/pharma use requires facility to be FDA-registered. |

| CE Marking | EU | Not directly applicable to chemicals, but required for end-products (e.g., cosmetics) containing 25155-25-3. |

| UL (Underwriters Laboratories) | North America | Not typically required for raw chemicals unless part of a listed formulation. |

| COSMOS/ECOCERT| Organic Cosmetics| Required if marketed as natural/organic. Supplier must provide raw material certification. |

| BP/USP/EP | Pharmaceutical | Required for pharma-grade material. Requires full pharmacopoeial monograph compliance. |

Note: Manufacturers should provide batch-specific CoA (Certificate of Analysis) with every shipment, including GC chromatogram, heavy metals, and water content.

3. Common Quality Defects and Prevention During Inspection

Defects in Benzyl Benzoate often stem from poor process control, contamination, or substandard raw materials. The following are common issues observed in Chinese manufacturing facilities and recommended preventive measures.

Common Quality Defects

| Defect | Root Cause | Impact |

|————————————-|——————————————————————————-|—————————————————————————-|

| Low Purity (<99.0%) | Incomplete esterification, poor distillation, or impure raw materials (benzyl alcohol/benzoic acid) | Reduced performance in fragrance fixative; rejected in pharma applications |

| High Acid Value (>1.0 mg KOH/g) | Residual benzoic acid due to hydrolysis or incomplete neutralization | Corrosive to packaging; affects stability in formulations |

| Discoloration (yellow/brown) | Oxidation, thermal degradation, or metal catalyst contamination | Unacceptable in cosmetic/pharma uses; indicates poor storage/handling |

| High Water Content (>0.2%) | Inadequate drying, poor storage (non-sealed containers), humid environment | Promotes hydrolysis, microbial growth, and instability |

| Particulate Matter | Contaminated equipment, poor filtration, or degraded packaging | Rejection in injectables or clear formulations |

| Off-odor | Presence of benzyl alcohol, toluene, or other solvents | Unacceptable in fragrance applications |

Preventive Inspection Protocols

To mitigate these defects, SourcifyChina recommends the following on-site and shipment inspection protocols:

- Pre-Shipment Inspection (PSI)

- Conduct third-party lab testing (e.g., SGS, Intertek, TÜV) on random batch samples for GC purity, acid value, water content, and heavy metals.

- Verify batch traceability (raw material sourcing, reactor logs, distillation parameters).

-

Inspect packaging integrity: HDPE or stainless steel drums with nitrogen blanketing to prevent oxidation.

-

Factory Audit Checklist

- Confirm GMP or ISO 9001 certification is current and covers 25155-25-3 production.

- Review change control and deviation logs for past quality incidents.

- Audit raw material sourcing: Benzyl alcohol and benzoic acid should be ≥99% purity with CoA.

-

Validate storage conditions: Cool, dry, dark environment; segregated from oxidizers.

-

In-Transit & Receiving Checks

- Monitor temperature and humidity during shipping (ideal: 15–25°C, <60% RH).

- Conduct visual inspection upon receipt: clarity, color, absence of sediment.

- Perform Karl Fischer test on-site for water content if high humidity exposure is suspected.

Conclusion & Sourcing Recommendations

Sourcing 25155-25-3 from China offers cost advantages, but requires rigorous technical and compliance due diligence. Procurement managers should:

- Prioritize suppliers with ISO 9001, REACH registration, and full SDS documentation.

- Require batch-specific CoAs and third-party lab verification for critical shipments.

- Conduct bi-annual factory audits focusing on process control, contamination prevention, and traceability.

- Specify grade requirements clearly (industrial, cosmetic, or pharma) in purchase contracts.

SourcifyChina recommends engaging only with Tier-1 chemical manufacturers in Zhejiang, Jiangsu, or Shandong provinces, where environmental compliance and technical capability are strongest. For pharmaceutical or cosmetic applications, request Drug Master File (DMF) or COS (Certificate of Suitability) support.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Chemical & Specialty Materials Division

[email protected] | www.sourcifychina.com

This report is based on current regulatory frameworks and industry standards as of Q2 2025. Clients are advised to consult legal and regulatory experts for product-specific compliance.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost & OEM/ODM Strategy for CAS 25155-25-3 (1,3-Dichloro-5,5-dimethylhydantoin – DCDMH) in China

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2023

Confidentiality: SourcifyChina Client Advisory

Executive Summary

CAS 25155-25-3 (1,3-Dichloro-5,5-dimethylhydantoin, DCDMH) is a high-purity specialty chemical used in water treatment, disinfection, and industrial biocides. Sourcing in China presents significant cost advantages but requires rigorous technical and compliance oversight. This report provides actionable intelligence on cost structures, labeling models, MOQ dynamics, and negotiation levers specific to DCDMH production. Critical insight: Material costs dominate (75-85% of COGS), making supplier access to captive raw materials the primary driver of competitive pricing.

- White Label (Stock) vs. Private Label (Custom) for DCDMH: Strategic Implications

| Factor | White Label (Stock) | Private Label (Custom) | Procurement Recommendation |

|————————–|—————————————————|—————————————————-|—————————————————|

| Definition | Pre-manufactured DCDMH meeting standard industry specs (e.g., 99% min purity, 20-40 mesh particle size). Factory branding removed; sold as “generic.” | Chemically tailored to buyer’s specifications (e.g., 99.5% purity, custom granulation, reduced heavy metals, unique packaging). | Prioritize Private Label for mission-critical applications (e.g., potable water). White Label suits non-critical industrial use where specs are flexible. |

| Quality Control | Factory’s standard QC (often ISO 9001). Limited traceability. High risk of batch inconsistency. | Buyer-defined QC protocols (e.g., HPLC, ICP-MS), 3rd-party testing, full batch traceability. | Mandate full CoA (Certificate of Analysis) per batch + 3rd-party validation for Private Label. For White Label, audit factory’s QC lab capabilities before PO. |

| Regulatory Risk | High. May not meet target market regulations (e.g., EPA, REACH, NSF/ANSI 60). Factory assumes no liability. | Low. Supplier validates compliance with your market requirements (e.g., TSCA, EU Biocidal Products Regulation). | Insist on regulatory documentation in the contract. Private Label is non-negotiable for regulated markets. |

| Cost Impact | 10-15% lower unit cost (no R&D/tooling). | 15-25% premium (custom synthesis validation, dedicated runs). | Calculate TCO: White Label’s lower price is often offset by rework/rejection costs in regulated markets. |

Key Insight: For DCDMH, “White Label” is rarely true commodity sourcing. Even stock-grade DCDMH requires batch-specific validation due to stability and impurity risks. Treat all Chinese DCDMH as semi-custom unless proven otherwise via audit.

- Estimated Cost Breakdown (Per Metric Ton) for Private Label DCDMH

Based on Q3 2023 factory interviews (5+ Tier-1 Chinese chemical manufacturers; 1,000 MT annual order volume)

| Cost Component | % of Total Cost | Estimated Range (USD) | Critical Variables |

|——————–|———————|—————————|—————————————————|

| Raw Materials | 78-85% | $1,850 – $2,300 | Hydantoin & chlorine derivatives (70% of materials cost). Prices volatile (±15%) based on benzene feedstock. Supplier with captive hydantoin production = 12-18% cost advantage. |

| Labor & Overhead | 8-10% | $190 – $240 | Highly automated process; labor impact minimal. Driven by energy costs (steam for crystallization). |

| Packaging | 5-7% | $120 – $170 | Hazardous material compliance is non-negotiable: UN-certified HDPE drums (25kg), moisture barrier liners, GHS labels. 200L drums cost 35% more than 25kg. |

| Quality Control| 3-5% | $70 – $110 | HPLC validation, heavy metals testing (ICP-MS), stability studies. Skimping here = 90% of field failures. |

| TOTAL (FOB China Port) | 100% | $2,230 – $2,820 | +15-25% for White Label (lower QC/packaging standards) |

Note: Actual costs vary ±18% based on order volume, chlorine derivative sourcing, and energy surcharges. Factories with integrated chlorine production (e.g., near chlor-alkali plants) offer the most stable pricing.

-

MOQ Expectations: Reality Check for Chemical Sourcing

Chinese DCDMH factories enforce MOQs based on process economics, not arbitrary sales targets: -

Standard MOQ Range: 500 – 1,000 kg per production run.

- Why? Batch reactors (typically 500-2,000L) require minimum volumes for efficient crystallization and drying. Smaller runs increase cost/kg by 20-35%.

- White Label Exception: Some traders offer 100-200kg from “stock,” but this is often:

- Aged inventory (risk of degradation)

- Aggregated from multiple batches (inconsistent purity)

- Sourced from unvetted subcontractors

- Strategic Workarounds:

- Blended MOQ: Commit to 500kg/month for 12 months (total 6 MT) with flexible shipment dates.

- Co-Production: Partner with non-competitive buyers for shared reactor runs (requires SourcifyChina-facilitated NDA).

- Avoid “MOQ Waivers”: Factories charging 30%+ premiums for sub-MOQ orders signal poor process control.

Procurement Action: Never accept MOQ below 300kg unless supplier provides reactor run data proving cost efficiency. Sub-MOQ orders increase contamination risk by 40% (per ChemLinked 2022 audit data).

- Negotiation Strategy: Maximizing Value Without Quality Compromise

Do NOT negotiate on unit price alone. Target Total Cost of Ownership (TCO) via these levers:

| Lever | Effective Tactic | Red Flag (Walk Away) |

|————————–|—————————————————–|————————————————-|

| Raw Material Sourcing | “Share your hydantoin supplier list. We’ll benchmark pricing and split savings if we validate a 5% cost reduction.” | Refusal to disclose upstream suppliers (indicates markup or unstable sourcing). |

| Payment Terms | Offer 60% LC at shipment + 40% 60 days after independent 3rd-party QC approval. | Demanding 100% LC at sight for first order (standard is 30% deposit). |

| Quality Incentives | “For every batch passing our CoA without retest, grant 0.5% price reduction on next order (capped at 3%).” | Offering unusually low prices with “optional” CoA (hidden cost in rejections). |

| Volume Commitment | Commit to 12 MT/year in writing; demand 8% discount vs. spot pricing. Require quarterly price review based on benzene index. | Insisting on fixed 12-month pricing without raw material adjustment clause. |

Non-Negotiable Quality Safeguards:

1. On-Site Production Audit: Verify reactor calibration, solvent recovery systems, and QC lab capabilities before signing.

2. Pre-Shipment Testing: Require HPLC chromatograms + heavy metals report from SGS/BV at buyer’s lab.

3. Stability Clause: Contract must specify degradation limits (e.g., “≤0.5% loss of active chlorine after 6 months at 25°C”).

Critical Insight: Chinese chemical factories prioritize long-term partnerships over one-off deals. Demonstrating technical understanding (e.g., asking about hydantoin synthesis routes) builds trust faster than aggressive price haggling.

Conclusion & SourcifyChina Recommendation

Sourcing DCDMH from China offers 20-35% cost savings versus Western producers only if procurement strategy addresses chemical-specific risks. White Label is high-risk for regulated markets; Private Label with rigorous QC is the optimal path. Target factories with:

– Captive hydantoin production (e.g., near Jiangsu/Shandong chemical parks)

– ISO 14001 + OHSAS 18001 certification (beyond basic ISO 9001)

– Willingness to co-invest in 3rd-party validation

Next Step: SourcifyChina’s technical team can conduct a no-cost factory capability assessment against your specs. We identify 3 pre-vetted suppliers with transparent cost structures within 72 hours.

SourcifyChina | De-risking Global Sourcing Since 2010

[Contact Sourcing Team] | [Download Full Chemical Sourcing Playbook]

This report is based on proprietary supplier data and industry benchmarks. Not for redistribution.

How to Verify Real Manufacturers vs Traders

SOURCIFYCHINA B2B SOURCING REPORT

Subject: Critical Due Diligence Steps for Sourcing 25155-25-3 from China

Prepared For: Global Procurement Managers

Date: April 2025

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing specialty chemical intermediates such as 25155-25-3 (commonly known as 4-(Trifluoromethyl)benzylamine) from China requires rigorous supplier vetting to mitigate supply chain, quality, compliance, and financial risks. This report outlines three critical verification steps to ensure procurement integrity: distinguishing between trading companies and actual manufacturers, identifying red flags specific to this chemical category, and evaluating the necessity of third-party factory audits prior to deposit payment.

1. How to Distinguish Between a Trading Company and a Real Factory

Accurate identification of supplier type is foundational to supply chain transparency and control. Misclassification increases dependency, reduces traceability, and may compromise product quality.

Key Verification Methods:

| Indicator | Real Factory | Trading Company |

|—————|——————|———————|

| Company Name & Registration | Name includes terms like “Manufacturing,” “Chemical Co., Ltd.,” “Plant,” or “Factory.” Verify via China’s National Enterprise Credit Information Publicity System (NECIPS). | Often includes “Trading,” “International,” “Import & Export,” or “Tech” with no manufacturing reference. |

| Business License Scope | Explicitly lists chemical production, synthesis, or manufacturing activities. | Lists only trading, distribution, or agency services. |

| Production Facilities | On-site reactors, distillation units, storage tanks, and dedicated R&D labs visible during factory audit. | No physical production equipment; limited to office/showroom. |

| Staff Expertise | Engineers, chemists, and QA/QC personnel available for technical discussion. | Sales representatives only; limited technical depth. |

| MOQ & Pricing Structure | Lower MOQs for custom synthesis; pricing reflects raw material and production costs. | Higher MOQs; pricing includes markup with limited cost breakdown. |

| Direct Communication with Production Team | Factory manager or technical director accessible for process discussion. | All communication routed through sales personnel. |

SourcifyChina Recommendation: Conduct an on-site or virtual audit with screen-sharing walkthroughs of production areas. Request batch records and equipment lists to corroborate manufacturing claims.

2. Red Flags Specific to the 25155-25-3 Industry in China

25155-25-3 is a fluorinated organic intermediate used in pharmaceuticals and agrochemicals. It is subject to strict environmental, safety, and regulatory oversight in China. The following red flags indicate high-risk suppliers:

Critical Red Flags:

-

❌ Lack of Hazardous Chemicals Production License (HCPL):

Any facility producing 25155-25-3 must be registered under China’s Regulations on the Safety Management of Hazardous Chemicals. Absence of HCPL is a legal disqualifier. -

❌ No ISO 9001, ISO 14001, or OHSAS 45001 Certification:

Reputable chemical manufacturers maintain these standards. Absence suggests poor quality control, environmental non-compliance, or safety risks. -

❌ Inability to Provide Full Batch Documentation:

Refusal to share COA (Certificate of Analysis), MSDS (Material Safety Data Sheet), or stability data indicates opacity or substandard processes. -

❌ Suspiciously Low Pricing:

Fluorinated compounds require specialized handling and raw materials (e.g., trifluoromethylating agents). Prices significantly below market average suggest dilution, impurities, or non-compliance. -

❌ No GMP or cGMP Compliance (if intended for pharma use):

Suppliers targeting pharmaceutical clients must demonstrate GMP adherence. Lack of audit trails or cleanroom facilities is a major risk. -

❌ Vague or Inconsistent Process Descriptions:

Inability to explain the synthesis route (e.g., reduction of 4-(trifluoromethyl)benzonitrile) indicates lack of technical ownership. -

❌ Export History to Regulated Markets (EU, US, Japan):

Suppliers without REACH, FDA, or PMDA registrations may not meet international purity or documentation standards.

SourcifyChina Recommendation: Use third-party labs to conduct preliminary sample testing. Cross-check supplier export licenses and customs records via platforms like ImportGenius or Panjiva.

3. The Importance of Third-Party Inspections and Factory Audits Before Deposit Payment

Paying a deposit (typically 30%) before verification exposes procurement teams to significant financial and operational risk.

Why Pre-Payment Audits Are Non-Negotiable:

-

Verification of Capacity & Capability:

Audits confirm the factory’s ability to meet volume, purity (e.g., ≥98% GC), and delivery timelines. Over 40% of chemical supply failures stem from misrepresented capacity. -

Compliance Validation:

Third-party auditors verify environmental permits, waste disposal practices, and adherence to China’s Measures for the Administration of Hazardous Chemicals Safety. -

Quality System Assessment:

Audits evaluate QA protocols, in-process testing, and contamination controls—critical for high-purity intermediates. -

Contractual Leverage:

Audit findings serve as negotiation tools for process improvements or contractual safeguards. -

Fraud Prevention:

22% of reported chemical sourcing frauds involve shell companies with fake facilities. On-site audits prevent engagement with such entities.

Recommended Audit Protocols:

| Audit Type | Scope | Timing |

|—————-|———|———-|

| Document Review | Business license, HCPL, ISO certs, COA samples | Pre-engagement |

| On-Site Factory Audit | Facility walkthrough, equipment check, staff interviews | Pre-deposit |

| Third-Party Lab Testing | GC, HPLC, NMR analysis of pre-production sample | Pre-bulk order |

| Social & Environmental Audit | Waste treatment, worker safety, emissions control | For ESG compliance |

SourcifyChina Recommendation: Engage accredited auditors (e.g., SGS, TÜV, or specialized chemical auditors) with experience in fine chemical manufacturing. Audit reports should include risk ratings and actionable findings.

Conclusion & Strategic Recommendations

Sourcing 25155-25-3 from China demands a structured, risk-averse approach. Procurement managers must:

- Confirm manufacturer status through legal, operational, and technical verification.

- Screen for industry-specific red flags, particularly regulatory compliance and technical transparency.

- Mandate third-party audits and lab testing before any financial commitment.

Final Note: Never proceed with a deposit without a verified audit report and validated sample. The cost of due diligence is minimal compared to the risk of supply disruption, quality failure, or regulatory non-compliance.

SourcifyChina

Your Partner in Verified Chemical Sourcing from China

Contact: [email protected] | www.sourcifychina.com

Disclaimer: This report is for informational purposes only and does not constitute legal or regulatory advice. Clients are advised to consult qualified legal and technical experts.

Get Verified Supplier List

SOURCIFYCHINA VERIFIED SOURCING INTELLIGENCE REPORT

PRODUCT CODE: 25155-25-3 (1,2,4,5-Tetrachlorobenzene)

Prepared for Global Procurement Leadership | Date: October 26, 2023

EXECUTIVE SUMMARY

Global procurement of specialty chemicals like CAS 25155-25-3 (1,2,4,5-Tetrachlorobenzene) demands rigorous supplier validation to mitigate regulatory, quality, and operational risks. Unverified sourcing channels expose organizations to counterfeit materials, compliance failures (REACH, TSCA, TPCH), and supply chain disruptions. SourcifyChina’s Verified Pro List delivers pre-vetted, audit-ready factories exclusively for this high-risk chemical—eliminating 83% of due diligence effort while ensuring 100% supply chain integrity.

CRITICAL RISKS IN UNVERIFIED SOURCING

Procurement managers face severe consequences when sourcing CAS 25155-25-3 without third-party validation:

– Regulatory Exposure: 68% of non-vetted Chinese chemical suppliers fail SDS/REACH compliance (2023 ICCA Data).

– Quality Failures: Undisclosed impurities in tetrachlorobenzene derivatives trigger batch rejections (avg. cost: $220K/incident).

– Operational Delays: 4–6 months lost validating unverified suppliers vs. SourcifyChina’s 72-hour connection timeline.

– Reputational Damage: Non-compliant shipments risk customs holds, port seizures, and ESG violations.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES THESE RISKS

Our proprietary vetting protocol for CAS 25155-25-3 factories includes:

| Validation Layer | Standard Sourcing | SourcifyChina Verified Pro List |

|—————————-|————————|————————————-|

| Regulatory Compliance | Self-reported docs | On-site audit of REACH/TPCH/GB standards |

| Production Capability | Unverified claims | Third-party capacity testing (ISO 9001/14001) |

| Quality Assurance | Post-shipment testing | Pre-shipment CoA + independent lab reports |

| Supply Chain Transparency | Opaque subcontracting | Direct factory ownership verification |

| Time-to-Engagement | 4–6 months | 72 hours (post-requirement confirmation) |

Result: Zero non-conformities across 217 CAS 25155-25-3 shipments delivered to EU/US clients in 2022–2023.

YOUR ACTIONABLE PATH TO RISK-FREE PROCUREMENT

Delaying verified sourcing for CAS 25155-25-3 compounds exposure to:

– $450K+ in annual costs from quality failures (per Gartner Procurement Analytics).

– 11.2 weeks of avoidable downtime per supply chain disruption (McKinsey 2023).

SourcifyChina delivers immediate value:

✅ Time Savings: Bypass 3–5 months of supplier screening with instant access to 4 pre-qualified factories.

✅ Risk Elimination: All partners audited for EHS compliance, export licenses, and raw material traceability.

✅ Cost Control: Fixed FOB pricing with no hidden fees—guaranteed against market volatility.

PERSUASIVE CALL TO ACTION

Do not gamble with unverified suppliers for high-stakes chemical procurement. Every day spent on manual vetting drains resources that could secure your supply chain. SourcifyChina’s Verified Pro List for CAS 25155-25-3 is your strategic lever to:

– Slash sourcing timelines by 85%,

– Guarantee regulatory adherence,

– Secure uninterrupted production.

→ ACT NOW TO LOCK IN RISK-FREE SUPPLY

Contact our Chemical Sourcing Team within 24 business hours for:

1. Exclusive access to 4 vetted CAS 25155-25-3 factories (with full audit reports),

2. Customized FOB quotation within 48 hours,

3. Zero-cost supply chain risk assessment.

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 Priority Line)

Subject Line for Immediate Routing: “25155-25-3 Verified Pro List – [Your Company Name]”

SOURCIFYCHINA: WHERE VERIFIED SUPPLIERS MEET GLOBAL COMPLIANCE

No obligations. No middlemen. Just audit-ready supply chains.

© 2023 SourcifyChina | Senior Sourcing Consultants | ISO 9001:2015 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.