The global solid-state drive (SSD) market is experiencing robust expansion, driven by rising demand for faster data access, increased storage efficiency, and the widespread adoption of cloud computing and data-intensive applications. According to Grand View Research, the global SSD market size was valued at USD 38.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2023 to 2030. A key segment within this growth is the 2.5-inch SATA SSD form factor, which remains a dominant choice for enterprise servers, data centers, and legacy system upgrades due to its compatibility, reliability, and cost-effectiveness. Despite the rise of NVMe and M.2 drives, 2.5-inch SATA SSDs continue to hold substantial market share, particularly in industries where ease of integration and standardized hardware configurations are critical. As demand for high-performance yet affordable storage persists, a select group of manufacturers has emerged as leaders in producing reliable, high-quality 2.5-inch SATA SSDs—shaping the backbone of modern data infrastructure.

Top 8 2.5 Inch Sata Solid State Drive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

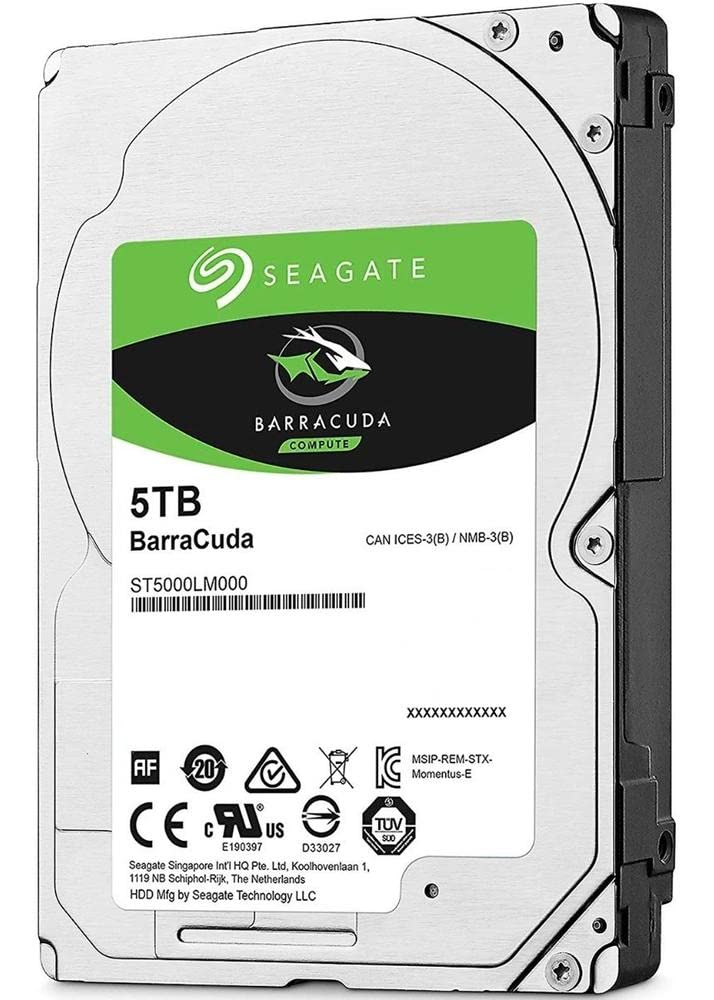

#1 BarraCuda SATA SSD 2.5”

Domain Est. 1992

Website: seagate.com

Key Highlights: Seagate BarraCuda SATA SSD delivers fast speeds, reliable performance, and ample storage for gaming, creative work, and everyday computing needs….

#2 Solid State Drives (SSDs) for Laptops, Desktop PCs, and Servers

Domain Est. 1993

Website: kingston.com

Key Highlights: Free delivery over $70 30-day returnsDC600M Series 2.5” SATA Enterprise SSD · DC600M 2.5” SATA Enterprise SSD. Optimized for mixed-use applications; 2.5″ form factor; AES 256-bit E…

#3 870 EVO SATA 2.5 inch 1TB SSD

Domain Est. 1994

Website: samsung.com

Key Highlights: Get high-speed performance with the 870 EVO SATA 2.5″ 1TB SSD. Reliable, efficient, and built to last. Order today for smooth and secure storage!…

#4 Micron 5400 SATA SSD

Domain Est. 1994

Website: micron.com

Key Highlights: The Micron 5400 SSD is the world’s first 176-layer data center SATA SSD. It offers the industry’s broadest portfolio with more than enough performance to ……

#5 2.5-inch SATA SSDs

Domain Est. 1997

Website: crucial.com

Key Highlights: Free deliveryUpgrade your computer with an award-winning, reliable, and affordable Crucial SATA SSD – 4x faster performance while running cooler than HDDs….

#6 P220 SATA III SSD 2.5

Domain Est. 2004

Website: patriotmemory.com

Key Highlights: P220 offers strong performance with more storage than ever of up to 4TB. With SEQ Read and Write Speeds of up to 550MB/s and 500MB/s, along with Random Write ……

#7 Solidigm: World

Domain Est. 2019

Website: solidigm.com

Key Highlights: Solidigm delivers class-leading SSD data storage solutions for the most demanding workloads. Empower your data center and AI with our solid-state drives….

#8 KingSpec

Domain Est. 2007

Website: kingspec.com

Key Highlights: KingSpec is one of top solid-state drive manufacturers that providing high quality consumer & industrial SSD. Fast, reliable storage solutions from a ……

Expert Sourcing Insights for 2.5 Inch Sata Solid State Drive

H2: 2026 Market Trends for 2.5-Inch SATA Solid State Drives

The 2.5-inch SATA Solid State Drive (SSD) market is expected to undergo significant transformation by 2026, shaped by evolving technological demands, enterprise adoption patterns, and competitive pressures from newer storage interfaces. While newer form factors and protocols like NVMe and M.2 dominate high-performance computing, the 2.5-inch SATA SSD continues to hold strategic importance in specific market segments. Here’s an analysis of key trends expected to define the market in 2026:

-

Stabilized Demand in Enterprise and Legacy Systems

By 2026, demand for 2.5-inch SATA SSDs will remain steady in enterprise environments, particularly in legacy server infrastructure, data centers with existing 2.5-inch drive bays, and storage arrays where cost-effective, reliable storage is prioritized over peak speed. These drives are preferred for tier-2 and tier-3 storage due to their balance of performance, durability, and compatibility with SATA-based RAID systems. -

Shift Toward Cost-Optimized Consumer and Industrial Applications

In the consumer space, while high-end PCs increasingly adopt NVMe SSDs, 2.5-inch SATA SSDs will maintain relevance in budget laptops, desktop upgrades, and DIY builds. Their affordability, wide availability, and ease of installation make them ideal for users upgrading from HDDs. In industrial applications—such as embedded systems, point-of-sale (POS) terminals, and medical devices—SATA SSDs continue to be favored for their proven reliability and long-term supply cycles. -

Decline in NAND Flash Costs and Capacity Expansion

Advancements in NAND flash technology, including the widespread adoption of 3D TLC and QLC NAND, will drive down per-terabyte costs. By 2026, 2.5-inch SATA SSDs with capacities up to 8TB are expected to become more common and affordable, enabling broader adoption in NAS (Network Attached Storage) devices and small-to-medium business (SMB) storage solutions. -

Competition from NVMe and U.2 Form Factors

Despite their strengths, 2.5-inch SATA SSDs face mounting pressure from NVMe-based alternatives. The performance gap—especially in latency and throughput—makes NVMe drives more attractive for performance-sensitive applications. However, the 2.5-inch SATA SSD will retain a niche where infrastructure constraints, cost sensitivity, or power efficiency are prioritized over raw speed. -

Focus on Reliability and Endurance in Harsh Environments

Manufacturers are increasingly tailoring 2.5-inch SATA SSDs for rugged environments, enhancing features like wide temperature ranges, power-loss protection, and extended endurance. These enhancements will boost adoption in automotive, aerospace, and industrial automation sectors, where reliability trumps speed. -

Consolidation Among SSD Vendors and OEM Partnerships

The market is likely to see further consolidation, with major players like Samsung, Western Digital, SK Hynix, and Solidigm dominating production. Smaller vendors may focus on vertical markets or OEM contracts, customizing firmware and endurance specs for specific use cases. Strategic partnerships with server and storage OEMs will be key to maintaining market share. -

Sustainability and Green Storage Initiatives

As environmental concerns grow, SSD manufacturers will emphasize energy efficiency and recyclability. 2.5-inch SATA SSDs, with their lower power draw compared to HDDs, will be positioned as eco-friendly storage upgrades. Vendors may highlight reduced carbon footprint and longer product lifecycles in marketing and ESG (Environmental, Social, and Governance) reporting.

Conclusion:

While no longer at the cutting edge of performance, the 2.5-inch SATA SSD is far from obsolete. By 2026, it will serve as a workhorse in cost-sensitive, reliability-focused, and legacy-compatible applications. The market will shift from volume-driven consumer sales to a more segmented, value-oriented landscape, emphasizing durability, integration, and total cost of ownership. As long as SATA infrastructure remains in use, 2.5-inch SSDs will maintain a vital, if increasingly specialized, role in the global storage ecosystem.

H2: Common Pitfalls When Sourcing 2.5-Inch SATA Solid State Drives (Quality and IP Concerns)

Sourcing 2.5-inch SATA SSDs requires careful evaluation to avoid common quality and intellectual property (IP) pitfalls. Buyers, especially in B2B, industrial, or enterprise environments, must be aware of the following key risks:

-

Use of Inauthentic or Reclaimed NAND Flash

Some low-cost SSDs use recycled, used, or counterfeit NAND flash memory chips to cut production costs. These components degrade faster, leading to premature drive failure, data loss, and inconsistent performance. Always verify that the supplier uses genuine, brand-name NAND (e.g., from Samsung, Micron, or Kioxia) and request component sourcing documentation. -

Lack of Firmware Transparency and IP Ownership

Many budget SSDs rely on third-party reference firmware without proper customization or testing. This raises IP concerns, as firmware may be reverse-engineered or lack proper licensing. Drives with unverified firmware can suffer from poor garbage collection, wear leveling, or TRIM support, reducing lifespan and reliability. Ensure the manufacturer owns or legally licenses the firmware IP. -

Poor Quality Control and Inconsistent Manufacturing

Manufacturers in less-regulated regions may lack rigorous testing standards, resulting in inconsistent performance and higher failure rates. Look for suppliers with ISO certifications, burn-in testing, and comprehensive quality assurance processes. Avoid vendors who cannot provide detailed reliability metrics (e.g., MTBF, TBW). -

Misrepresentation of Specifications

Some SSDs are marketed with inflated read/write speeds or endurance ratings that don’t reflect real-world performance. This often occurs with drives using low-tier controllers and slow QLC NAND. Always request third-party benchmarks or independent test reports to validate claims. -

Absence of Long-Term Supply and Obsolescence Management

Especially critical for industrial or embedded applications, SSDs sourced from unreliable vendors may be discontinued without notice. This disrupts production and increases total cost of ownership. Choose suppliers offering long-term availability programs and lifecycle management support. -

Counterfeit or Gray Market Products

Unauthorized resellers may sell counterfeit SSDs that mimic reputable brands but contain substandard components. These drives often lack firmware updates, warranty support, and fail under load. Purchase only through authorized distributors and verify serial numbers with the manufacturer. -

Insufficient Endurance for Intended Use Case

Consumer-grade SSDs are often misapplied in industrial or enterprise settings where higher write endurance is required. Using a drive with low TBW (Terabytes Written) in a high-write environment leads to early failure. Match the SSD’s endurance rating (SLC caching, DWPD) to your application needs. -

Lack of Compliance with Industry Standards

Reputable SSDs comply with standards such as JEDEC, SATA-IO, and TCG Opal for security. Non-compliant drives may fail interoperability tests or lack critical features like power-loss protection and secure erase. Confirm compliance certifications before procurement.

To mitigate these risks, engage with established suppliers, conduct due diligence on component sourcing and firmware development, and prioritize transparency in the supply chain. Investing in higher-quality, IP-secure SSDs ultimately reduces downtime, data risk, and long-term costs.

Logistics & Compliance Guide for 2.5 Inch SATA Solid State Drive

This guide outlines key logistics and compliance considerations for the handling, transportation, import/export, and regulatory compliance of 2.5-inch SATA Solid State Drives (SSDs). Adherence to these guidelines ensures product integrity, legal compliance, and successful supply chain operations.

Product Classification & Identification

-

HS Code (Harmonized System Code):

8471.80 – “Other units of automatic data processing machines” (specific to SSDs in many jurisdictions).

Note: Confirm local classification (e.g., 8471.80.50 in the U.S. HTS). -

UN Number: Not applicable (SSDs are not classified as hazardous materials under normal conditions).

- Product Category: Information Technology Equipment (ITE) – Class B (for EMC purposes).

- Weight & Dimensions (Typical):

- Dimensions: 100mm × 70mm × 7mm (standard 2.5”)

- Weight: ~50–100g per unit (varies by capacity and model)

Packaging & Handling Requirements

- Primary Packaging:

- Anti-static bag (ESD-safe) with moisture barrier (MBB) if required.

-

Protective foam or plastic tray to prevent physical damage.

-

Secondary Packaging:

- Corrugated cardboard boxes with cushioning material.

-

Clearly labeled with product name, model number, capacity, serial/lot number, and handling symbols.

-

Labeling Requirements:

- Fragile / Handle with Care

- This Side Up

- ESD Sensitive (triangle symbol)

- RoHS compliant marking (e.g., “RoHS”)

- Country of Origin (e.g., “Made in China”)

-

Barcode/UPC for inventory tracking

-

Palletization:

- Stackable boxes; max pallet height: 1.8m (6 ft)

- Secure with stretch wrap; avoid over-compression

- Use pallets compliant with ISPM 15 (heat-treated wood for international shipments)

Transportation & Logistics

- Modes of Transport:

- Air (IATA compliant for lithium content, if applicable)

- Ocean (IMO regulations not typically applicable)

-

Ground (road or rail)

-

Lithium Battery Considerations:

- Most 2.5” SATA SSDs contain small lithium coin cells (e.g., for power-loss protection in enterprise models).

- If present:

- Classified under UN 3090 (for lithium metal batteries)

- Comply with IATA DGR Section II (for small lithium batteries installed in equipment)

- Declare on shipping documents if above de minimis thresholds

-

Consumer SSDs without backup batteries are generally exempt.

-

Temperature & Humidity:

- Storage: -40°C to +85°C

- Operating: 0°C to +70°C

- Relative Humidity: 5–95% non-condensing

-

Avoid extreme temperature fluctuations during transit.

-

Shock & Vibration:

- SSDs are more resilient than HDDs but still require protection.

- Use dunnage and cushioning in containers.

- Avoid dropping or stacking heavy items on packages.

Regulatory & Compliance Requirements

- RoHS (EU Directive 2011/65/EU):

- Restricts use of lead, mercury, cadmium, hexavalent chromium, PBBs, and PBDEs.

-

Ensure supplier compliance and maintain Declarations of Conformity (DoC).

-

REACH (EC 1907/2006):

- Register, evaluate, and authorize chemicals.

-

Confirm absence of SVHCs (Substances of Very High Concern) above thresholds.

-

WEEE (EU Directive 2012/19/EU):

- Register with national WEEE authorities if selling in EU.

-

Include take-back and recycling information in user documentation.

-

CE Marking (EU):

- Required for EMC (2014/30/EU) and LVD (2014/35/EU) compliance.

-

Technical documentation must be available upon request.

-

FCC (USA – Part 15):

- Class B digital device – must comply with radiated and conducted emissions limits.

-

Label with FCC ID if applicable; include user notice in manuals.

-

Energy Efficiency (e.g., ENERGY STAR):

-

Not typically required for SSDs, but low power consumption is a market advantage.

-

Conflict Minerals (U.S. Dodd-Frank Act Section 1502):

- Report use of tin, tantalum, tungsten, and gold (3TG) if sourced from conflict-affected regions.

-

Use RMI (Responsible Minerals Initiative) template for reporting.

-

REACH SVHC & SCIP Database (EU):

-

Report articles containing SVHCs above 0.1% w/w in the SCIP database.

-

China RoHS (GB/T 26572):

-

Label products with environmental protection use period and hazardous substance table.

-

Korea REACH & K-REACH:

-

Register chemical substances if manufactured or imported above thresholds.

-

India E-Waste (Management) Rules:

- Register with Central Pollution Control Board (CPCB).

- Implement Extended Producer Responsibility (EPR).

Import/Export Documentation

- Commercial Invoice:

-

Detailed product description, value, quantity, HS code, country of origin.

-

Packing List:

-

Box count, weight, dimensions, serial numbers (if tracked).

-

Bill of Lading / Air Waybill:

-

Carrier document with shipper, consignee, and routing details.

-

Certificate of Origin:

-

Required for preferential tariffs (e.g., under USMCA, ASEAN).

-

Export Control Classification Number (ECCN):

- Typically 5A992.c (mass market encryption items) under U.S. EAR.

-

No license required for most destinations, but verify embargoed countries.

-

RoHS / REACH / Conflict Minerals Declarations:

- Supplier-provided compliance certificates.

Storage & Inventory Management

- Warehouse Conditions:

- Temperature: 15–25°C

- Humidity: 40–60% RH

-

ESD-safe handling (wrist straps, grounded workstations)

-

Shelf Life:

- NAND flash has limited data retention when unpowered (~1–10 years depending on type).

-

Rotate stock using FIFO (First In, First Out).

-

Security:

- Protect against theft; SSDs are small and high-value.

- Use secure storage and access controls.

End-of-Life & Recycling

- Data Sanitization:

- Use ATA Secure Erase or cryptographic erase before disposal or resale.

-

Certify data destruction for enterprise or sensitive applications.

-

Recycling:

- Partner with certified e-waste recyclers (e.g., R2, e-Stewards).

-

Recover aluminum, copper, gold, and PCB materials responsibly.

-

Customer Take-Back Programs:

- Comply with WEEE, India E-Waste, and other local take-back laws.

Summary

Compliance and logistics for 2.5-inch SATA SSDs require attention to packaging, labeling, transportation regulations (especially lithium content), and global environmental directives (RoHS, REACH, WEEE, etc.). Proactive supplier qualification, accurate documentation, and adherence to handling best practices ensure smooth global distribution and regulatory compliance. Regular audits and updates to compliance status are recommended as regulations evolve.

Conclusion for Sourcing 2.5-inch SATA Solid State Drive (SSD):

After evaluating performance, reliability, cost, and availability, sourcing 2.5-inch SATA SSDs remains a practical and cost-effective storage solution for a wide range of applications, including laptop upgrades, desktop systems, and enterprise environments requiring high durability and energy efficiency. Despite the emergence of faster NVMe drives, SATA SSDs continue to offer a balanced combination of speed, compatibility, and affordability, especially in systems that do not support newer interfaces.

When sourcing 2.5-inch SATA SSDs, it is essential to consider reputable manufacturers (such as Samsung, Crucial, Western Digital, and Kingston), ensure adequate warranty and endurance ratings (TBW), and verify compatibility with existing hardware. Additionally, purchasing from authorized distributors helps avoid counterfeit products and ensures access to reliable technical support and firmware updates.

In summary, 2.5-inch SATA SSDs are a mature, reliable, and widely supported storage option that delivers significant performance improvements over traditional hard drives. For organizations or individuals seeking a proven upgrade path with strong ROI, sourcing these drives from trusted suppliers with competitive pricing and solid after-sales support represents a sound strategic decision.