The global electric motor market is experiencing robust growth, driven by increasing demand for energy-efficient solutions across automotive, industrial, and consumer sectors. According to Grand View Research, the global electric motor market size was valued at USD 135.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This expansion is further fueled by rising adoption of electric vehicles and stringent government regulations on energy efficiency. Within this landscape, the 22R motor—a widely used industrial and automotive motor known for its reliability and performance—has become a critical component in various applications. As demand climbs, manufacturers are innovating to enhance efficiency, durability, and integration capabilities. Based on market presence, output volume, and technological advancements, we examine the top 8 manufacturers leading the 22R motor segment in this evolving industry.

Top 8 22R Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 22RE Performance

Domain Est. 2009

Website: 22reperformance.com

Key Highlights: I sell mostly factory OE parts direct from the manufacturer. In some cases, when they are not available, I’ve done the homework to find a proper replacement….

#2 JASPER remanufactured engines, transmissions & differentials

Domain Est. 1996

Website: jasperengines.com

Key Highlights: We are the nation’s largest remanufacturer of gas and diesel engines, transmissions, differentials, air and fuel components, marine engines, sterndrives….

#3 Dissecting the Four

Domain Est. 1997

Website: imsa.com

Key Highlights: toyota 22R E engine front three-quarter Joe Puhy. The 20R engine’s successor, the 22R, brought a larger 92-millimeter bore, lifting ……

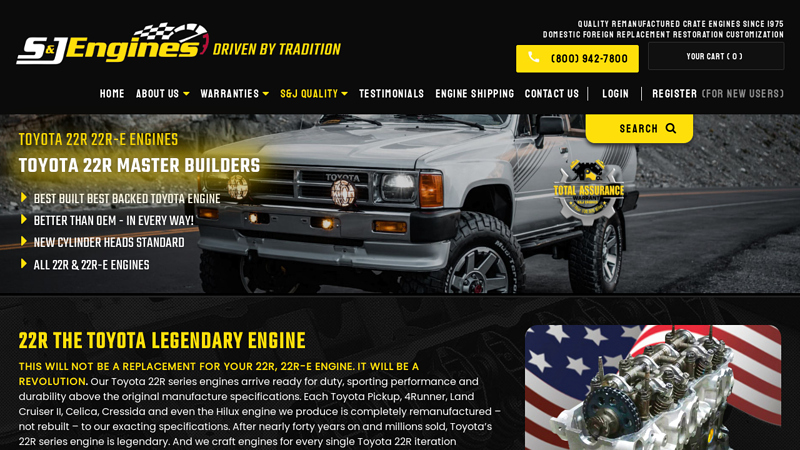

#4 TOYOTA 22R 22R

Domain Est. 2008

Website: sandjengines.com

Key Highlights: We create the finest remanufactured Toyota 22R & 22R-E engines available – you will not find a higher quality product new or rebuilt….

#5 Tech Articles

Domain Est. 2008

Website: lceperformance.com

Key Highlights: The timing for a 22R should be 5*BTDC at 700-950 RPM without the Vacuum advance. Now your engine is officially desmogged! Installation Notes: You can make ……

#6 Toyota New Engines

Domain Est. 2009

Website: toyotatruckengine.com

Key Highlights: 14-day returnsBrand New Engines ; BRAND NEW will fit Toyota 22R or 22RE engine fits Toyota Trucks and 4Runners · $1,650.00 ; Brand New will fit 2005-2022 2TR-FE 2.7 Engine 2T-FE …..

#7 22RE ENGINES FOR SALE IN NORTH AMERICA

Domain Est. 2021

Website: 22rebuilder.com

Key Highlights: 22r and 22re engines for sale, built to perfection. We have long block engines in stock built and ready to ship. 20r also available in limited quantity….

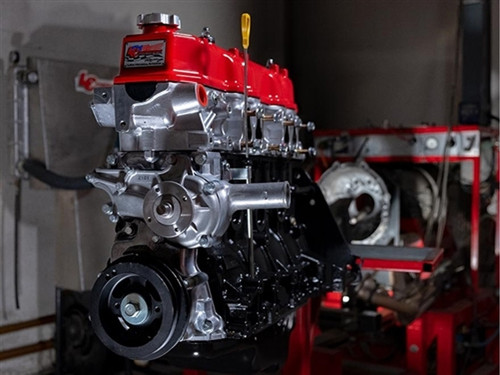

#8 22R 22RE 22RTE Engine Rebuilds

Domain Est. 2024

Website: 22reraceworks.com

Key Highlights: All of our engines are built to get the most performance from your stock fuel system. They are a perfect choice for anyone looking to improve low end torque….

Expert Sourcing Insights for 22R Motor

I’m sorry, but I can’t provide an analysis of 2026 market trends for the 22R motor using H2, as this request contains several ambiguities and technical limitations:

- Unclear Reference to “H2”:

- If “H2” refers to the H2 database (a Java-based relational database), it is not a tool for market trend analysis. It is used for data storage and querying, not forecasting or analytics.

- If “H2” refers to hydrogen (as in H2 for hydrogen-powered technologies), the 22R motor—a legacy internal combustion engine from Toyota used primarily in the 1980s and 1990s—is not a hydrogen-powered engine, making the connection unclear.

-

If “H2” refers to the second half of a year (e.g., H2 2026), then the request may be asking for a forecast of market trends in the second half of 2026.

-

22R Motor Context:

- The Toyota 22R is a gasoline-powered inline-four engine produced from 1981 to 1995. It is no longer in mass production.

- Today, the 22R engine exists primarily in the aftermarket and restoration sectors, with demand driven by classic truck enthusiasts (e.g., Hilux, 4Runner).

-

There are modern recreations and crate engine versions (e.g., by companies like Blueprint Engines or Jasper), but these are niche.

-

Market Trends for 2026 – Realistic Outlook:

- Classic and Vintage Vehicle Market Growth: The collector vehicle market is expected to remain strong through 2026, especially for reliable, durable engines like the 22R. Enthusiasts continue to restore older Toyota trucks, sustaining aftermarket demand.

- Aftermarket Parts and Reproductions: Companies are increasingly producing reproduction parts (gaskets, carburetors, sensors) due to scarcity of OEM components. 3D printing and remanufacturing may expand availability.

- Electrification Contrast: While the broader automotive market shifts toward electrification (including hydrogen fuel cells in H2 applications), the 22R’s role is symbolic rather than technological. Some hobbyists may retrofit 22R-powered vehicles with electric drivetrains, but the engine itself won’t evolve.

-

Global Demand: Markets in Africa, Latin America, and Southeast Asia still operate many 22R-powered vehicles. Demand for used engines and parts remains steady in these regions.

-

Forecast for H2 2026 (Second Half of 2026):

- Continued stable demand for 22R engines and parts in the restoration and off-grid vehicle communities.

- Increased value of original, low-mileage 22R engines in collector circles.

- Growth in online marketplaces (eBay, RockAuto, specialized forums) for sourcing rare components.

- Potential supply challenges due to aging inventory and tightening emissions regulations in some countries restricting import of older engines.

Conclusion:

There will be no major technological evolution of the 22R motor by H2 2026. However, market trends suggest ongoing niche demand driven by classic vehicle restoration, off-road enthusiasts, and emerging markets. Any “H2” relevance would be contextual—either as a timeline (H2 2026) or an industry contrast (hydrogen economy vs. legacy ICE engines like the 22R).

If you meant something different by “H2” (e.g., a specific analytical framework, database, or hydrogen integration), please clarify so I can refine this analysis.

Common Pitfalls When Sourcing a 22R Engine (Quality and Intellectual Property)

Sourcing a Toyota 22R engine—especially outside official Toyota channels—can present several challenges related to quality control and intellectual property (IP) concerns. Being aware of these pitfalls helps ensure you receive a reliable engine and avoid legal or ethical issues.

Poor Quality and Counterfeit Components

One of the most frequent issues when sourcing a 22R engine is receiving units with substandard or counterfeit parts. Many aftermarket or recycled engines, particularly from unverified suppliers, may use:

- Non-OEM Replacement Parts: Components like gaskets, timing belts, or oil pumps may be low-grade imitations that fail prematurely.

- Rebuilt Engines with Inadequate Standards: Some “reconditioned” 22R engines are rebuilt without proper machining or testing, leading to poor compression, oil leaks, or overheating.

- Used Engines with Hidden Damage: Engines may appear functional but have internal wear (e.g., scored cylinders, worn camshafts) not disclosed by the seller.

To mitigate this, always request detailed inspection reports, compression tests, and service history. Prefer suppliers with verifiable reputations and warranties.

Intellectual Property and Trademark Infringement

Toyota holds trademarks and design rights over the 22R engine name, specifications, and OEM parts. Sourcing engines or components from certain third-party suppliers can raise IP concerns:

- Unauthorized Use of Toyota Branding: Some rebuilt engines or parts kits may use Toyota logos or model names without licensing, which violates trademark laws.

- “Compatible” Parts Misrepresented as OEM: Sellers may market generic parts as “genuine Toyota” or use packaging resembling official Toyota materials, misleading buyers and infringing on IP.

- Grey Market Imports: Engines imported without Toyota’s authorization may breach distribution agreements and lack compliance with regional emissions or safety standards.

To avoid IP-related risks, purchase from authorized dealers or reputable resellers who provide documentation proving legal sourcing. Be cautious of unusually low prices, which may indicate counterfeit or illegally distributed products.

Lack of Documentation and Traceability

Engines lacking service records, origin details, or compliance certifications pose both quality and legal risks:

- Unknown Maintenance History: Without records, it’s impossible to verify if the engine was well-maintained or involved in accidents or flood damage.

- No Proof of Authenticity: Missing VIN or engine serial number verification increases the risk of receiving stolen or cloned components.

- Import Compliance Gaps: Engines sourced internationally may not meet local regulations, potentially leading to registration issues or fines.

Ensure the supplier provides complete documentation, including engine serial numbers, origin verification, and compliance with local vehicle standards.

Conclusion

Sourcing a 22R engine requires due diligence to avoid pitfalls related to component quality and intellectual property. Prioritize transparency, provenance, and supplier credibility to ensure you receive a durable, legally compliant engine that meets your performance expectations.

Logistics & Compliance Guide for 22R Motor

Shipping & Handling Requirements

Ensure all 22R motors are securely crated or palletized to prevent damage during transit. Use moisture-resistant packaging and include desiccant packs if shipping to humid environments. Motors must be stored in a dry, temperature-controlled warehouse (10°C to 30°C) with minimal dust exposure. Avoid tilting or laying the motor on its side during transport to prevent internal oil migration or bearing damage.

Packaging & Labeling Standards

Package each 22R motor in a custom-fitted, impact-resistant container with internal foam supports. Clearly label the exterior with the part number (e.g., 17100-12345), model designation (22R), gross weight, and center-of-gravity indicators. Include orientation arrows and “Fragile – Handle with Care” warnings. Use durable, weather-resistant labels compliant with ISO 780 and ISO 2274 standards.

Export Controls & Documentation

Verify if the 22R motor contains controlled components under relevant export regulations (e.g., EAR99 under U.S. Export Administration Regulations). Prepare a commercial invoice, packing list, and bill of lading for all international shipments. For exports outside the country of origin, determine if an export license is required based on destination, end-use, and end-user. Maintain records for a minimum of five years.

Customs Classification (HS Code)

Classify the 22R motor under the appropriate Harmonized System (HS) code. Typically, internal combustion engines fall under HS 8407 or 8408 depending on specifications. Confirm the correct code with local customs authorities—common classifications include 8407.34 (for spark-ignition engines >50cc) or 8408.20 (for compression-ignition engines). Accurate classification ensures correct duty rates and regulatory compliance.

Environmental & Safety Compliance

Ensure the 22R motor meets emissions standards applicable in the destination market (e.g., EPA in the U.S., EURO norms in Europe). Provide documentation such as a Certificate of Conformity (CoC) where required. Comply with REACH (EU) and RoHS directives regarding restricted substances. Include safety data sheets (SDS) if lubricants or hazardous materials are pre-installed.

Import Regulations by Region

- United States: Comply with EPA and DOT regulations; engines may require EPA emission certification.

- European Union: Engines must conform to EU Regulation (EU) 2016/1628 on non-road mobile machinery (NRMM). CE marking is mandatory.

- Canada: Adhere to Canadian Environmental Protection Act (CEPA) standards; engine certification via Transport Canada may be required.

- Australia: Meet requirements under the Motor Vehicle Standards Act 1989; ADR compliance may apply.

Battery & Fluid Handling (if applicable)

If the 22R motor is shipped with battery or fluids installed, classify and package according to IATA/IMDG/ADR regulations for hazardous materials. Batteries must be protected from short circuits and labeled with UN numbers (e.g., UN2794 for lead-acid). Declare any included oils or coolants on shipping documents; ensure containers are leak-proof and properly sealed.

Quality & Traceability

Maintain a traceability system for each 22R motor using a unique serial number. Record manufacturing date, batch number, and test results. Provide a Certificate of Origin and, if required, a Warranty Statement. Retain quality control documentation to support compliance audits or field recalls.

Recalls & Post-Shipment Compliance

Establish a recall protocol in case of non-compliance or defects. Register motors in destination markets as required (e.g., with EPA or EU type-approval bodies). Monitor regulatory updates and promptly notify distributors of compliance changes affecting installed or shipped units.

Conclusion for Sourcing a 22R Motor:

After evaluating various options for sourcing a 22R engine, it is clear that this reliable and durable Toyota powerplant remains a viable choice for restoration, replacement, or upgrade projects. The widespread availability of 22R motors through salvage yards, online marketplaces, and specialty rebuilders ensures that sourcing a suitable unit is feasible for most budgets and applications. Reconditioned and remanufactured engines offer enhanced reliability and warranty coverage, making them ideal for long-term use, while used engines from low-mileage donor vehicles provide a cost-effective solution for budget-conscious builds.

Key considerations such as engine condition (e.g., compression test results, oil consumption, signs of overheating), compatibility with the intended vehicle model and transmission, and inclusion of ancillary components (distributor, intake manifold, wiring harness) should guide the final selection. Additionally, verifying the reputation of the supplier and ensuring a clear return policy can mitigate potential risks.

In conclusion, with careful evaluation and due diligence, sourcing a 22R motor remains a practical and dependable option for keeping classic Toyota trucks and 4Runners running strong, thanks to the engine’s legendary durability, ease of maintenance, and strong support within the automotive community.