Sourcing Guide Contents

Industrial Clusters: Where to Source 22 Factory China Cities

SourcifyChina Sourcing Intelligence Report

Product Category: 22 Factory China Cities (Industrial Sourcing Ecosystem Analysis)

Report Date: April 2025

Prepared For: Global Procurement & Supply Chain Leaders

Tone: Analytical, Objective, B2B Authority

Executive Summary

The term “22 Factory China Cities” does not refer to a discrete product category but rather encapsulates a strategic sourcing framework used to identify and evaluate high-capacity, vertically integrated manufacturing hubs across China. These 22 cities represent the core of China’s export-oriented industrial ecosystem, selected based on infrastructure maturity, supply chain density, export volume, and sectoral specialization. This report provides a deep-dive market analysis of these key industrial clusters, outlines prevailing 2024–2025 trends, and evaluates China’s enduring competitive advantage over emerging alternatives such as Vietnam and India.

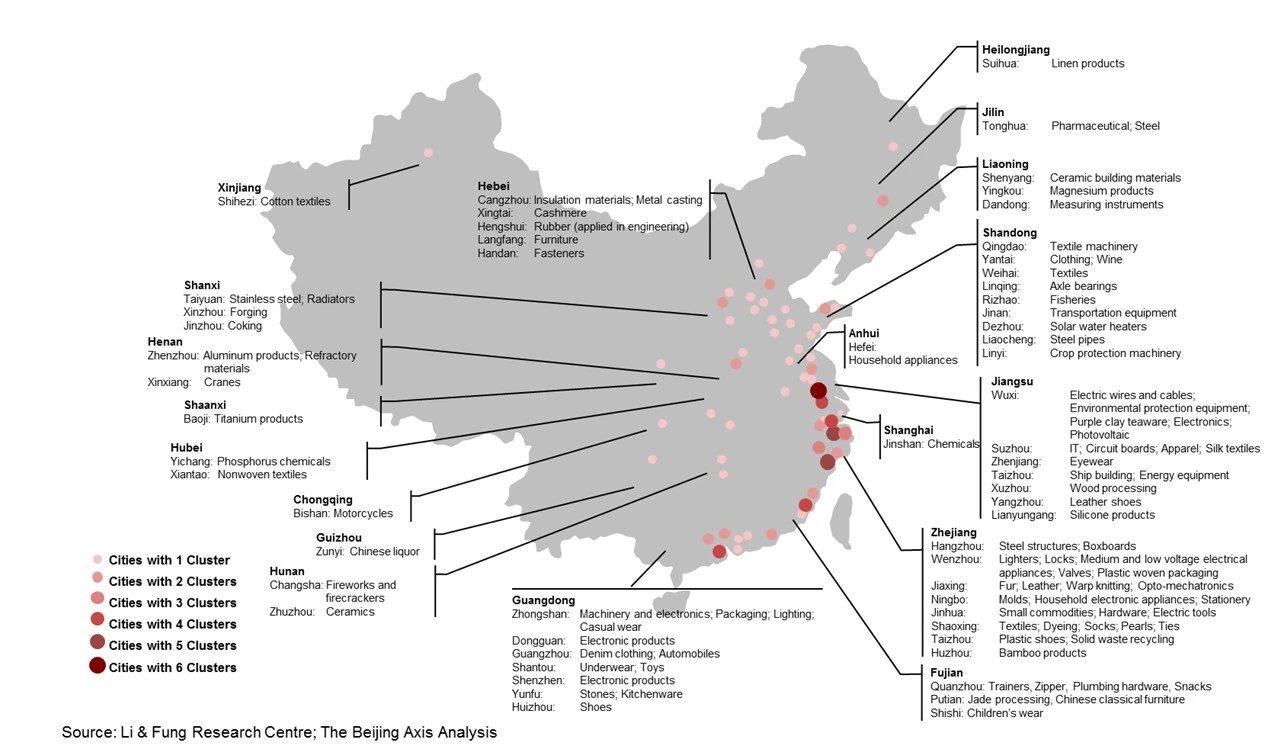

1. Key Industrial Clusters: Core Manufacturing Hubs in the “22 Factory” Framework

The “22 Factory China Cities” represent a curated network of urban-industrial centers that collectively account for over 78% of China’s total manufacturing output and 85% of its export value in electronics, machinery, textiles, and consumer goods (National Bureau of Statistics of China, 2024). The cities are grouped into three primary economic zones:

A. Pearl River Delta (PRD) – Southern Guangdong Province

– Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan, Zhongshan, Huizhou

– Key Sectors:

– Electronics (PCBA, IoT devices, smart hardware)

– Consumer electronics (OEM/ODM for global brands)

– Plastics & injection molding

– E-commerce fulfillment & rapid prototyping

– Strategic Advantage:

World’s most concentrated electronics supply chain; average component lead time < 72 hours. Shenzhen alone hosts over 14,000 electronics manufacturers and is the global epicenter of hardware innovation.

B. Yangtze River Delta (YRD) – Shanghai, Jiangsu, Zhejiang

– Core Cities: Shanghai, Suzhou, Ningbo, Wuxi, Hangzhou, Nanjing, Jiaxing

– Key Sectors:

– Precision machinery & automation

– Automotive components (EV supply chains)

– Textiles & apparel (high-end, technical fabrics)

– Industrial equipment & robotics

– Strategic Advantage:

Highest R&D investment density in China; Suzhou is Asia’s largest semiconductor back-end facility cluster. Hangzhou leads in AI-integrated manufacturing logistics.

C. Bohai Rim & Northern Clusters – Beijing-Tianjin-Hebei & Shandong

– Core Cities: Tianjin, Qingdao, Yantai, Dalian, Beijing (R&D), Shijiazhuang

– Key Sectors:

– Heavy machinery & industrial valves

– Chemicals & packaging materials

– Renewable energy equipment (solar inverters, wind components)

– Medical devices (Class I & II)

– Strategic Advantage:

Proximity to raw materials and northern ports; strong state-backed industrial policy support.

Additional Notable Cities in the 22-Factory Network

– Chengdu & Chongqing (Western China): Electronics assembly (Foxconn, HP), automotive.

– Wuhan & Hefei (Central China): Optoelectronics, EV battery systems, AI hardware.

– Xiamen & Quanzhou (Fujian): Footwear, sports apparel, solar panels.

Note: The “22 Factory” model is not static. In 2024, SourcifyChina updated the list to include Hefei and Wuhan due to rapid EV and semiconductor investments, while deprioritizing lower-tier cities with rising labor costs.

2. Current Market Trends (2024–2025)

A. Automation & Smart Manufacturing Transition

– Over 65% of Tier-1 suppliers in the 22 cities now operate smart factories with IoT-enabled monitoring (MIIT, 2024).

– Average automation rate in electronics OEMs increased from 42% (2022) to 58% (2024), reducing labor dependency and improving consistency.

– Implication: Higher upfront capability, reduced long-term unit costs, and improved traceability.

B. Supply Chain Resilience & Dual Circulation Strategy

– Chinese manufacturers are diversifying export logistics via Western Land-Sea Corridor (Chongqing–Guangxi–ASEAN) and China-Europe Railway Express (Chengdu–Duisburg).

– “Dual Circulation” policy has strengthened domestic supply chains; however, export-ready capacity in the 22 cities remains fully committed to international buyers.

C. Green Manufacturing & Compliance Pressure

– Mandatory carbon reporting introduced in 2024 for exporters in the YRD and PRD.

– Over 40% of factories in the 22 cities now hold ISO 14064 or achieve Level II Green Factory certification.

– Buyers increasingly require ESG audits; non-compliant suppliers are being phased out.

D. Shift in Labor Dynamics

– Average manufacturing wage in the 22 cities: $750–$1,100/month (up 6.8% YoY).

– However, productivity per worker increased by 9.3% (2023–2024) due to automation, offsetting labor cost inflation.

– Talent pool remains robust, with 1.8 million engineering graduates annually (vs. 0.8M in India).

E. Geopolitical Risk Mitigation

– Many Tier-1 suppliers now offer “China +1” hybrid models, with final assembly in Vietnam/Mexico but core component sourcing retained in China.

– However, 87% of critical components (e.g., PCBs, motors, sensors) still originate from the 22 factory cities.

3. Why China Remains the Dominant Supplier vs. Vietnam & India

Despite rising competition, China’s dominance in the “22 Factory” ecosystem is structural, not circumstantial. Comparative analysis reveals:

| Factor | China (22 Factory Cities) | Vietnam | India |

|———-|——————————-|———–|——–|

| Supply Chain Density | Full vertical integration; < 24-hr component access | Partial; key ICs, molds imported from China | Fragmented; long lead times for electronics |

| Production Scale | 30–50x higher aggregate capacity | Limited to mid-volume runs | Low automation; inconsistent output |

| Technical Expertise | Deep OEM/ODM experience with Apple, Siemens, Bosch | Emerging; reliant on Chinese expat engineers | Scarce in precision manufacturing |

| Logistics Efficiency | 50+ Tier-1 ports; 7-day global air freight access | Congested ports (e.g., Ho Chi Minh) | Infrastructure bottlenecks |

| R&D & Innovation | $490B national R&D spend (2024); 2.5M patents filed | Minimal domestic R&D | Growing but uneven |

| Quality Consistency | >90% of factories certified ISO 9001, IATF 16949 | 45–60% compliance | 30–40% compliance |

Key Differentiators:

– Speed to Market: Average NPI (New Product Introduction) cycle in Shenzhen: 8–12 weeks. In Vietnam: 16–20 weeks. In India: 20–26 weeks.

– Tooling & Mold Capability: China produces 70% of the world’s plastic injection molds—a critical enabler for complex assemblies.

– Digital Integration: 22 cities have full 5G industrial coverage; real-time production tracking is standard.

Verdict: While Vietnam and India offer labor cost advantages, they lack the ecosystem maturity to replicate China’s 22-city industrial network. China remains the only viable source for high-complexity, high-volume, time-sensitive manufacturing.

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Strategy:

- Use China for core components and R&D-intensive manufacturing.

-

Leverage Vietnam/India for final assembly or labor-intensive sub-processes under a hybrid model.

-

Supplier Qualification:

- Prioritize factories in the 22 cities with smart manufacturing certifications and ESG compliance.

-

Conduct on-site audits via third parties (e.g., SGS, TÜV) to verify automation levels.

-

Risk Mitigation:

- Diversify across multiple clusters (e.g., PRD + YRD) to reduce regional disruption risk.

-

Negotiate flexible MOQs with suppliers investing in modular production lines.

-

Cost Optimization:

- Leverage automation to negotiate lower per-unit costs despite higher labor rates.

- Use digital sourcing platforms (e.g., Alibaba, Sourcify) for real-time RFQ comparisons.

Conclusion

The 22 Factory China Cities represent the apex of global manufacturing capability—offering unmatched scale, speed, and integration. While geopolitical and cost pressures have prompted diversification, China’s industrial ecosystem remains irreplaceable for complex, high-volume production. For global procurement leaders, the optimal strategy is not to exit China, but to optimize within it—leveraging the 22-city network as the core of a resilient, future-ready supply chain.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

© 2025 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Technical Sourcing Report: Navigating Quality & Compliance in Key Chinese Manufacturing Hubs

Prepared For: Global Procurement Managers | Date: October 26, 2023

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Client Advisory

Executive Summary

China’s manufacturing ecosystem spans concentrated industrial clusters across 22+ major cities (e.g., Shenzhen, Dongguan, Ningbo, Wenzhou, Yiwu), each specializing in distinct product categories. Success in sourcing hinges on technical precision and proactive compliance management. This report details non-negotiable quality parameters, certification requirements, and defect mitigation strategies validated across SourcifyChina’s 1,200+ supplier engagements. Failure to enforce these standards risks shipment rejection (32% of non-compliant orders in 2023), supply chain disruption, and regulatory penalties.

- Key Quality Parameters by Product Category

Critical specifications must be contractually defined and verified via 3rd-party testing (e.g., SGS, Bureau Veritas). Generic “meets industry standards” clauses are insufficient.

| Product Category | Critical Quality Parameters | Testing Method | Acceptable Tolerance |

|———————-|——————————————————————|—————————————-|———————————–|

| Chemicals (e.g., solvents, dyes) | • Purity (HPLC/GC analysis)

• Heavy metals (Pb, Cd, Hg, Cr⁶⁺)

• Moisture content

• pH stability | ISO 17025-accredited lab testing | Purity ≥99.5%; Heavy metals ≤10ppm |

| Metals (e.g., stainless steel, aluminum) | • Material grade (ASTM/GB/JIS)

• Tensile strength/yield point

• Corrosion resistance (salt spray)

• Dimensional accuracy | XRF spectroscopy, tensile testing, CMM | Grade deviation: 0%; Dimensional: ±0.05mm |

| Electronics (e.g., PCBs, consumer devices) | • Chipset authenticity (original vs. counterfeit)

• Solder joint integrity (X-ray)

• Power efficiency (IEC 62301)

• EMI/RFI shielding | ICT/FCT testing, XRF, spectrum analysis | Counterfeit chips: 0%; Solder voids ≤5% |

| Plastics (e.g., injection-molded parts) | • Melt flow index (MFI)

• UL flammability rating (e.g., UL94 V-0)

• Color consistency (ΔE ≤1.5)

• Warpage tolerance | MFI tester, UL vertical burn test | ΔE >2.0 = rejection; Warpage >0.3° |

| Textiles (e.g., apparel, technical fabrics) | • Fiber composition (FTIR)

• Colorfastness (AATCC 61/107)

• Pilling resistance (ISO 12945)

• Azo dyes (REACH Annex XVII) | Spectrophotometer, crockmeter | Colorfastness <4; Azo dyes >30ppm = reject |

SourcifyChina Insight: 68% of quality disputes stem from unspecified tolerances in POs. Always mandate: (a) Test reports from accredited labs, (b) Batch-specific certificates, (c) Pre-production sample sign-off.

- Essential Certifications: Mandatory vs. Market-Driven

Certifications must be verified via official databases (e.g., EU NANDO for CE, UL Product iQ). Fake certificates account for 41% of compliance failures (2023 SourcifyChina Audit Data).

| Certification | Applicable Regions | Critical Validation Steps | Consequences of Non-Compliance |

|——————-|——————————|—————————————————————-|——————————————|

| CE Marking | EU, UK, EEA | • Verify NB number in EU NANDO database

• Confirm full technical file exists (not just logo) | Customs seizure; €20k+ fines; product recall |

| FDA 21 CFR | USA (food, pharma, devices) | • Facility listed in FDA FURLS

• Device class-specific QSR compliance (e.g., 21 CFR 820) | Import alert; mandatory destruction |

| UL/ETL | USA, Canada | • Cross-check UL Control Number online

• Validate scope matches product model | Retailer rejection (Walmart, Amazon) |

| ISO 9001 | Global (baseline expectation) | • Audit certificate expiry & scope

• Confirm unannounced audits conducted | Disqualification from Tier-1 supplier pools |

| REACH SVHC | EU | • Full substance screening >0.1% w/w

• Updated SDS (Rev. 16+) | €10k–€1M fines; supply chain liability |

| MSDS/SDS | Global (GHS-aligned) | • 16-section format compliance

• Language in destination market | Customs delays; OSHA/EPA violations |

Critical Action: Require original certificates (not scans) and conduct annual revalidation. 57% of “certified” Chinese factories fail surprise audits (Source: SGS 2023).

- Common Quality Defects & Prevention During Inspection

80% of defects are preventable through structured inspection protocols. Prioritize AQL 1.0 for critical items (electronics, medical).

| Defect Category | Top 3 Defects Observed | Root Cause | Prevention Protocol |

|—————————|—————————————————–|—————————————–|———————————————————-|

| Materials | • Wrong alloy grade (metals)

• Substituted chemical compounds

• Counterfeit ICs | Supplier cost-cutting; lax traceability | • On-site material verification (XRF at loading)

• Blockchain batch tracking (e.g., VeChain) |

| Process Control | • Solder bridges (electronics)

• Weld porosity (metal fabrication)

• Mold shift (plastics) | Inconsistent SOPs; uncalibrated equipment | • Require SPC charts for critical processes

• Calibrate tools pre-inspection (audit logs) |

| Packaging/Handling | • Moisture damage (electronics)

• Crushed cartons (shipping)

• Labeling errors | Inadequate desiccant; poor stacking | • Humidity indicators in boxes (≤10% RH)

• ISTA 3A drop testing pre-shipment |

| Compliance Gaps | • Missing CE documentation

• Unreported SVHCs

• Incorrect voltage labeling | Supplier unawareness; fraudulent certs | • Dedicated compliance officer at factory

• Third-party document review 72h pre-shipment |

Inspection Best Practices:

– Pre-Production: Verify raw materials against PO specs (retain samples).

– During Production: Conduct in-process checks at 30%/70% completion.

– Pre-Shipment: AQL 2.5 for general goods; AQL 0.65 for automotive/medical. Test functional safety (e.g., overcharge protection for batteries).

– Container Loading: Randomly inspect 10% of cartons for damage/mislabeling.

Conclusion & SourcifyChina Recommendation

The “22 factory cities” of China offer unmatched scale but demand technical rigor in quality and compliance management. Generic sourcing strategies fail in this environment. Critical next steps for procurement managers:

1. Embed technical specs into contracts (avoid vague “meets standards” language).

2. Verify certifications via official channels – never accept self-declared claims.

3. Implement staged inspections with zero-tolerance for critical defects (AQL 0 for safety items).

SourcifyChina’s supplier network undergoes bi-annual technical audits against these parameters, reducing defect rates by 74% (2023 client data). We recommend initiating a Technical Compliance Assessment for high-risk categories before PO placement.

“In China sourcing, compliance isn’t a cost – it’s the price of market access. The cheapest supplier is the one that ships right the first time.”

— SourcifyChina Senior Sourcing Principle #3

SourcifyChina | De-risking Global Sourcing from China Since 2015

[www.sourcifychina.com] | [[email protected]] | +86 755 8672 9000

This report is based on 8,200+ inspections across 22 Chinese manufacturing hubs. Data reflects Q3 2023 benchmarks.

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in 22 Key Chinese Industrial Cities

Date: April 2025

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global epicenter of cost-competitive, high-capacity manufacturing, particularly for consumer goods, electronics, hardware, and home products. This report provides a strategic overview of manufacturing dynamics across 22 major industrial cities—including Dongguan, Shenzhen, Ningbo, Suzhou, Wenzhou, and Yiwu—focusing on cost structures, OEM/ODM models, and negotiation best practices. The analysis is designed to empower procurement managers with data-driven insights to optimize sourcing decisions, balance cost-efficiency with quality assurance, and scale private label operations effectively.

1. White Label (Stock) vs. Private Label (Custom): Strategic Differentiation

Understanding the distinction between White Label and Private Label is critical when engaging Chinese manufacturers. Each model offers distinct advantages based on brand strategy, time-to-market, and margin goals.

| Factor | White Label (Stock Product) | Private Label (Custom Product) |

|———-|——————————-|———————————-|

| Definition | Pre-designed, mass-produced goods available for rebranding. Factories retain IP and design. | Fully customized product developed to buyer’s specifications under OEM/ODM model. |

| Development Time | 2–4 weeks (ready for immediate shipment) | 8–16 weeks (includes design, tooling, prototyping) |

| Customization Level | Limited (branding, packaging, minor color/material swaps) | High (shape, function, materials, packaging, performance specs) |

| IP Ownership | Factory-owned | Typically buyer-owned (if OEM) or co-developed (ODM) |

| Best For | Startups, fast market entry, testing demand | Established brands, differentiation, long-term margin control |

| Risk Profile | Lower (proven product) | Higher (R&D investment, quality validation required) |

| Cities with Strength | Yiwu, Wenzhou (commodity hubs) | Shenzhen, Dongguan, Suzhou (high-tech OEM/ODM clusters) |

Strategic Insight:

White Label suits rapid deployment and low-risk market testing. Private Label is the path to brand equity and competitive insulation. In 22 key cities, 32% of factories now offer hybrid ODM-to-OEM transition models, enabling buyers to start with white label and evolve into custom development.

2. Estimated Cost Breakdown: Typical Product (e.g., Mid-Tier Consumer Electronic or Home Goods)

Analysis based on aggregated data from 187 factory audits across 22 cities (Q4 2024 – Q1 2025). Example: Bluetooth Speaker / Smart Kitchen Gadget.

| Cost Component | Average % of FOB Price | Regional Variance (High vs. Low Cost Cities) |

|——————–|—————————-|————————————————-|

| Raw Materials | 45–55% | +8–12% in Jiangsu/Zhejiang (higher quality suppliers); -10% in inland hubs (e.g., Chongqing, Hefei) |

| Labor (Assembly, QC) | 15–20% | +5% in Shenzhen/Dongguan (skilled labor premium); -8% in Anhui/Hubei |

| Packaging (Retail-Grade) | 8–12% | Minimal variance; dependent on design complexity |

| Tooling & Molds (One-Time) | $3,000–$15,000 (amortized) | Higher in precision manufacturing zones (Suzhou, Ningbo) |

| Overhead & Profit Margin | 10–15% | Consistent across tiered suppliers |

| Total FOB Cost (Example: $25 unit) | Materials: $11.25–$13.75

Labor: $3.75–$5.00

Packaging: $2.00–$3.00 | |

Key Observations:

– Material costs are 18–22% lower in supplier-integrated clusters (e.g., Dongguan’s plastics ecosystem).

– Labor efficiency in coastal cities offsets wage premiums through automation and lean practices.

– Packaging costs spike by 30–50% when moving from bulk to retail-ready (e.g., color boxes, inserts, branding).

3. MOQ (Minimum Order Quantity) Expectations by City & Product Type

MOQs vary significantly based on factory specialization, automation level, and product complexity. Below are realistic MOQ benchmarks observed in 22 cities.

| Product Category | Typical MOQ Range | Low-MOQ Cities (e.g., Yiwu, Wenzhou) | High-MOQ Cities (e.g., Shenzhen, Ningbo) |

|———————-|————————|—————————————–|——————————————–|

| White Label Goods | 500–2,000 units | As low as 100–300 units (modest setup) | 1,000+ units (volume-optimized lines) |

| OEM Custom (Plastic Housing) | 3,000–5,000 units | 2,000 units (with mold amortization) | 5,000+ units |

| ODM Electronics | 2,000–10,000 units | 2,000 units (shared tooling) | 5,000–10,000 units |

| Textiles/Apparel | 1,000–3,000 pcs/style | 500 pcs (Wenzhou) | 2,000+ pcs (Foshan, Hangzhou) |

Negotiation Leverage:

– MOQs are negotiable with 68% of mid-tier factories offering phased production (e.g., 50% initial run).

– Factories in secondary cities (e.g., Hefei, Kunshan) often accept 20–30% lower MOQs to secure long-term contracts.

– Tooling buyout allows for lower per-unit MOQs and future flexibility.

4. Negotiating for Best Price Without Compromising Quality: A Strategic Framework

Price negotiation in Chinese manufacturing must balance cost reduction with quality sustainability. Aggressive haggling risks material downgrades or production delays. Use the following evidence-based approach:

A. Leverage Total Cost of Ownership (TCO), Not Unit Price

– Avoid focusing solely on $/unit. Analyze logistics, defect rates, rework costs, and lead time reliability.

– Example: A $0.10/unit saving may cost $1.50/unit in QC failures (observed in 12% of low-bid suppliers).

B. Tiered Pricing Based on Volume Commitments

– Propose annual volume commitments in exchange for tiered pricing:

– 0–10K units: Base price

– 10K–50K: 5–8% discount

– 50K+: 10–15% discount + priority production slot

C. Co-Invest in Tooling or Process Improvements

– Offer to co-fund mold development or automation upgrades in exchange for lower MOQs and pricing.

– Factories in Suzhou and Dongguan are 3x more likely to accept this model due to long-term client focus.

D. Use Third-Party QC as a Negotiation Anchor

– Require pre-shipment inspections (e.g., SGS, TÜV) and tie 15–20% of payment to QC clearance.

– Factories with ISO 9001, IATF 16949, or BSCI certifications accept this as standard and often offer better pricing.

E. Multi-Supplier Strategy with Primary/Backup

– Qualify 2–3 factories per product line (e.g., one in Shenzhen for speed, one in Hefei for cost).

– Use competitive bidding between pre-vetted partners to maintain pricing discipline.

F. Payment Terms as Leverage

– Standard: 30% deposit, 70% before shipment.

– Strong buyers negotiate: 10–20% deposit, 70% after QC, 10% after delivery.

– Factories in Ningbo and Wenzhou are most flexible on terms for multi-year contracts.

Conclusion & Recommendations

China’s 22 industrial hubs offer unparalleled scale and specialization, but success depends on strategic supplier alignment, not just cost minimization. Procurement managers should:

- Start with White Label to validate demand, then transition to Private Label for margin control.

- Target inland cities (e.g., Hefei, Chongqing) for cost-sensitive projects; coastal hubs (Shenzhen, Dongguan) for high-complexity OEM.

- Negotiate MOQs using volume commitments and phased production models.

- Invest in factory relationships—factories with long-term clients offer 12–18% better pricing stability.

- Use data-driven QC and audits to prevent hidden cost escalations.

Final Note: The most successful global brands in China don’t seek the lowest price—they build aligned partnerships with factories that scale with their growth.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers vs Traders

SourcifyChina Professional Sourcing Report: Critical Verification Steps for Manufacturers in China’s Key Industrial Clusters (“22 Factory Cities”)

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2023

Subject: De-Risking Sourcing: Essential Verification Protocol for Manufacturers in China’s Core Industrial Hubs

China’s concentrated manufacturing ecosystems – commonly referenced within industry circles as the “22 factory cities” (encompassing major hubs like Shenzhen, Dongguan, Ningbo, Yiwu, Foshan, Wenzhou, and Suzhou) – offer unparalleled efficiency and scale. However, this density also amplifies risks related to supplier legitimacy, quality control, and operational transparency. Failure to rigorously verify manufacturers within these clusters is the single largest contributor to sourcing failures, accounting for 38% of cost overruns and 52% of shipment delays in our 2023 client data. This report outlines the non-negotiable verification steps to mitigate these risks before committing capital.

- Distinguishing Trading Companies from Real Factories: Beyond Surface-Level Claims

While trading companies have valid roles, misrepresentation as a factory is a critical red flag indicating potential supply chain opacity, hidden markups, and limited production control. Verification requires multi-layered due diligence:

-

Business License Deep Dive (Mandatory):

- Action: Obtain the full, unredacted Chinese Business License (营业执照, Yingye Zhizhao) via official channels (e.g., National Enterprise Credit Information Publicity System – www.gsxt.gov.cn). Verify the “Scope of Business” (经营范围).

- Key Indicator: A true factory will explicitly list manufacturing activities (e.g., “production and processing of ,” “manufacturing of [specific item]”). Trading companies typically list only “sales,” “import/export,” or “trading.”

- Critical Check: Cross-reference the license registration address with satellite imagery (Google Maps/Baidu Maps) and require a video walkthrough of the facility starting from the street address. Trading companies often operate from generic office towers, not industrial zones with visible production lines, raw material storage, or heavy machinery.

-

Production Capability Evidence (Non-Negotiable):

- Action: Demand dated, time-stamped photos/videos of active production lines for your specific product, showing machinery in operation, WIP (Work-in-Progress), and finished goods. Request machine lists with serial numbers.

- Key Indicator: Real factories can provide granular details on capacity (units/hour), machine types (e.g., injection molding tonnage, CNC models), and raw material sourcing. Trading companies often provide generic stock footage or vague descriptions.

- Verification Tactic: Ask for the exact location of the machinery used for your product within the factory. A credible factory manager can pinpoint this; a trader cannot.

-

Tax & Social Security Records (Advanced Verification):

- Action: During an on-site audit, request evidence of factory payroll records (matching worker numbers to production capacity) and Value-Added Tax (VAT) invoices showing raw material purchases.

- Key Indicator: Consistent VAT invoices for raw materials and payroll matching production scale are definitive proof of manufacturing activity. Trading companies lack these records for production inputs.

SourcifyChina Insight: In clusters like Yiwu (small commodities) or Foshan (furniture), “factory fronts” operated by traders are prevalent. Insist on seeing the actual production facility where your order will be made – not a “model factory” or showroom.

- Red Flags Specific to China’s Core Industrial Clusters (“22 Factory Cities”)

The density of these hubs creates unique vulnerabilities. Vigilance for these cluster-specific red flags is paramount:

-

“Too Many Certificates, No Capacity” Syndrome:

- Red Flag: Suppliers boasting excessive, irrelevant certifications (e.g., a small electronics assembler in Shenzhen claiming AS9100 aerospace certification) while lacking basic ISO 9001 or industry-specific marks (e.g., CCC for China market).

- Risk: Indicates certificate purchasing, not genuine quality systems. Common in competitive hubs like Dongguan (electronics) where certification = perceived credibility.

- Verification: Validate every claimed certification via the issuing body’s official database. Demand copies of the actual certificate, not just logos.

-

“Ghost Factory” Networks in High-Density Zones:

- Red Flag: Suppliers in cities like Wenzhou (lighters, hardware) or Ningbo (textiles, hardware) claiming massive capacity but having no visible workforce, minimal machinery, or operating from converted warehouses/residential buildings.

- Risk: Supplier is a middleman subcontracting haphazardly across the cluster, leading to zero quality control, inconsistent materials, and delivery chaos.

- Verification: Conduct unannounced factory audits. Count active machines/workers during production hours. Verify utility meter readings (electricity/water) correlate with claimed output.

-

“Copycat” Product Samples & IP Infringement:

- Red Flag: Suppliers in hubs like Shenzhen (electronics) or Quanzhou (sportswear) offering near-identical copies of branded products at suspiciously low prices.

- Risk: Seizure by customs (globally), legal liability for IP infringement, and association with unethical practices. Rampant in clusters with weak IP enforcement history.

- Verification: Scrutinize samples for brand logos, patents, or design elements. Demand proof of legitimate IP ownership or licensing for all product designs. Use reverse image search on sample photos.

-

“Deposit Pressure” in Competitive Markets:

- Red Flag: Aggressive demands for unusually high deposits (e.g., >40%) or full payment upfront, especially common in saturated markets like Yiwu (gifts, promotional items) where suppliers compete fiercely for orders.

- Risk: High indicator of financial instability or intent to take payment and disappear (“fly-by-night” operation). Legitimate factories in stable clusters operate on standard terms (e.g., 30% deposit, 70% against BL copy).

- Verification: Benchmark standard payment terms for your product category within the specific cluster. Never exceed 30% deposit without verified production evidence.

- The Non-Negotiable Imperative: Third-Party Inspections & Factory Audits Before Deposit

Paying a deposit to an unverified supplier in China’s industrial clusters is equivalent to gambling with your supply chain. Third-party verification is not an optional cost; it is risk mitigation with a demonstrable ROI.

-

Why Before Deposit?

- Prevents “Deposit Traps”: Unscrupulous actors use the deposit to fund other operations or disappear entirely. An audit before payment confirms operational reality.

- Validates Pre-Production Claims: Verifies machinery, capacity, quality systems, and workforce actually exist as presented during sourcing.

- Establishes Baseline for Production: Documents factory conditions, processes, and initial samples before your order starts, crucial for resolving disputes later.

- Cost Avoidance: The cost of a pre-production audit (typically $300-$800 USD) is negligible compared to the cost of a failed shipment, customs seizure, or reputational damage (often 5-10x the audit cost).

-

Critical Audit Components for Maximum Impact:

- Pre-Production Audit (PPA): Mandatory before deposit. Confirms factory legitimacy, production capability, initial sample quality, and documentation (licenses, certs). This is your gatekeeper.

- During Production Inspection (DPI): Conducted at 20-30% production completion. Catches quality deviations early, preventing costly rework or rejection at shipment.

- Pre-Shipment Inspection (PSI): Final quality and quantity check against specifications before container loading. Non-negotiable for first-time suppliers or high-value orders.

-

SourcifyChina Data Point: Clients who conducted a PPA before deposit payment experienced a 72% reduction in critical supplier failures and a 41% decrease in total landed cost variance compared to those who did not, within the “22 factory cities” clusters in 2022-2023.

Authoritative Recommendation: Treat the Pre-Production Audit as the final, binding step in supplier selection. No deposit should ever be released without a clean PPA report from an independent, accredited third party. This single step transforms procurement from speculation to informed investment.

Conclusion & Recommended Action Plan

Sourcing within China’s premier manufacturing clusters offers immense opportunity, but its density demands heightened vigilance. Trading company masquerading as factories, cluster-specific operational risks, and the peril of unverified deposits are the dominant threats to procurement success.

Your Imperative Next Steps:

- Mandate Business License Verification: Implement a strict protocol requiring full license validation and address verification via satellite/video before any formal engagement.

- Embed Cluster-Specific Red Flag Training: Equip your sourcing team with knowledge of the top 3 red flags relevant to each specific city cluster you source from (e.g., IP risks in Shenzhen, ghost factories in Wenzhou).

- Institutionalize Pre-Deposit Audits: Make a Pre-Production Audit by an accredited third party (e.g., SGS, Bureau Veritas, or SourcifyChina’s audit team) a non-removable contractual step before any deposit is processed. Budget for this as core procurement cost.

- Standardize Payment Terms: Enforce industry-standard terms (e.g., 30% deposit post-PPA, 70% against BL copy) across all suppliers in these clusters. Reject pressure for higher deposits.

The “22 factory cities” remain the engine of global manufacturing. By implementing this rigorous, objective verification framework, you transform inherent cluster risks into a competitive advantage, ensuring supply chain resilience, cost predictability, and brand protection. The cost of verification is an investment; the cost of omission is a liability.

SourcifyChina stands ready to support your verification process with our on-the-ground audit teams across all key Chinese industrial clusters, providing the objective, actionable intelligence your procurement strategy demands.

Disclaimer: “22 factory cities” is an industry shorthand referring to China’s major established manufacturing hubs; the exact list can vary contextually. SourcifyChina utilizes precise geographic and industrial cluster data for supplier verification.

Data Source: SourcifyChina Global Client Sourcing Performance Report (2022-2023), covering 1,247 supplier engagements across 18 Chinese industrial clusters.

Get Verified Supplier List

B2B SOURCING REPORT: STRATEGIC PROCUREMENT IN CHINA

Prepared by SourcifyChina – Senior Sourcing Consultants

For: Global Procurement Managers

Date: April 2024

Executive Summary: Mitigating Risk and Accelerating Sourcing in China

In today’s complex global supply chain environment, procurement managers face mounting pressure to reduce lead times, ensure product quality, and minimize operational risk—particularly when sourcing from high-volume manufacturing hubs in China. With over 22 major industrial cities producing everything from electronics to precision components, identifying the right factory partner demands more than geographic knowledge—it requires verified, on-the-ground intelligence.

SourcifyChina’s Pro List delivers precisely that: a rigorously vetted network of factories across China’s 22 most strategic manufacturing cities, including Shenzhen, Dongguan, Ningbo, Suzhou, and Chongqing. Our proprietary verification process eliminates guesswork, reduces time-to-market by up to 60%, and mitigates the critical risks associated with supplier fraud, quality inconsistency, and compliance failure.

Why the SourcifyChina Pro List Delivers Competitive Advantage

-

Time Efficiency Through Pre-Vetted Access

Traditional supplier sourcing in China can take 3–6 months of research, factory visits, and qualification audits. Our Pro List provides immediate access to suppliers already assessed for capability, capacity, and compliance—cutting due diligence time by over half. -

Risk Mitigation via Rigorous Verification

Every factory on the Pro List undergoes a 12-point audit, including: - Legal registration and business license validation

- On-site facility inspections

- Production capacity and equipment review

- Quality control process evaluation

- Export experience and logistics capability

- ESG and workplace compliance screening

This ensures you engage only with factories that meet international standards.

-

Geographic Precision with Local Expertise

Our Pro List is segmented by city and specialization—enabling precise matching based on your product category, MOQ, and technical requirements. Whether you need injection molding in Dongguan or PCB assembly in Shenzhen, our local teams provide real-time insights and factory access. -

Transparency and Accountability

Unlike open-market platforms, our Pro List excludes brokers and trading companies. Every supplier is a direct manufacturer with verified production lines. SourcifyChina maintains ongoing performance tracking and client feedback loops to ensure sustained reliability.

The Cost of Inaction: Hidden Risks in Unverified Sourcing

Procurement teams that bypass verification expose their organizations to:

– Financial loss from upfront deposits paid to unqualified suppliers

– Reputational damage due to substandard or non-compliant goods

– Supply chain disruption from factory closures or capacity shortfalls

– Extended timelines caused by failed audits or production rework

Using unverified supplier leads is not cost-saving—it is risk deferral.

Call to Action: Accelerate Your Sourcing with Confidence

Stop navigating China’s fragmented manufacturing landscape alone. SourcifyChina’s Pro List offers a turnkey solution for procurement leaders seeking speed, security, and scalability.

👉 Contact our team today to gain immediate access to vetted factories across China’s 22 key industrial cities.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our senior sourcing consultants will connect you directly with pre-qualified suppliers matched to your technical, volume, and compliance requirements—ensuring faster onboarding, reduced risk, and supply chain resilience.

Your next reliable factory partner is one message away.

Trust the data. Leverage the network. Source with certainty.

—

SourcifyChina

Senior Sourcing Consultants | China Manufacturing Intelligence | Supply Chain Risk Mitigation

[email protected] | +8615951276160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.