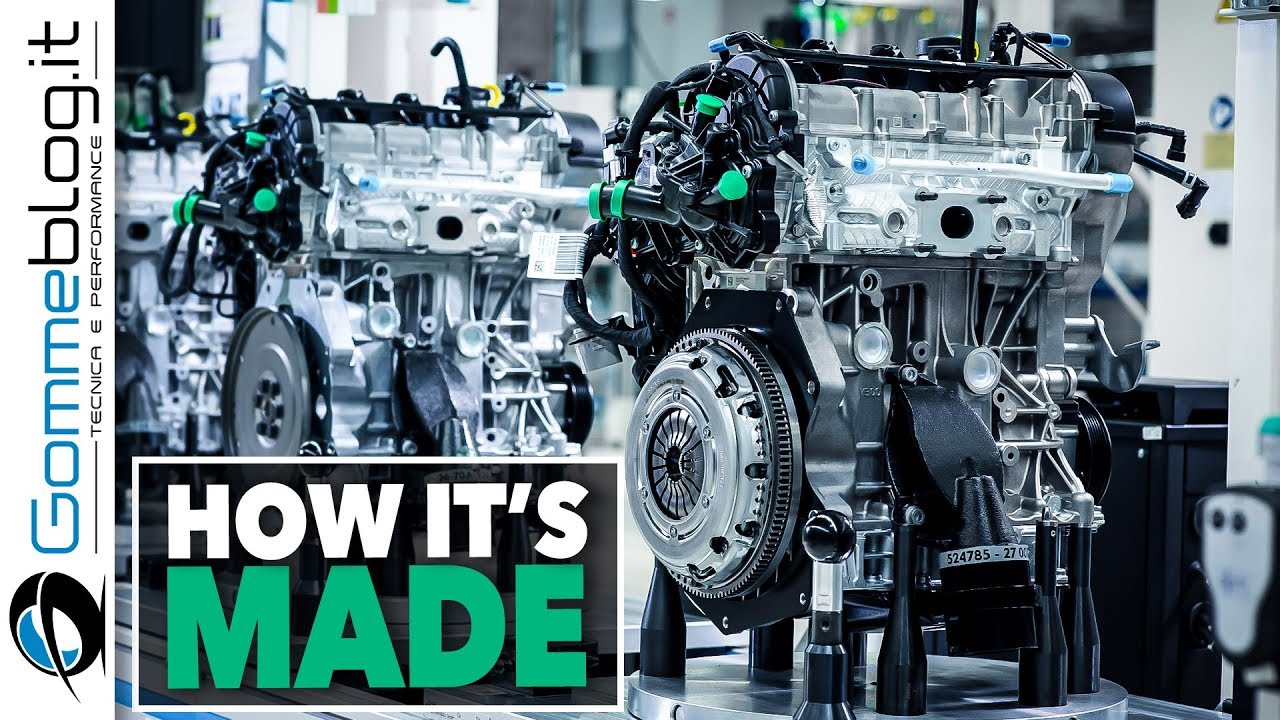

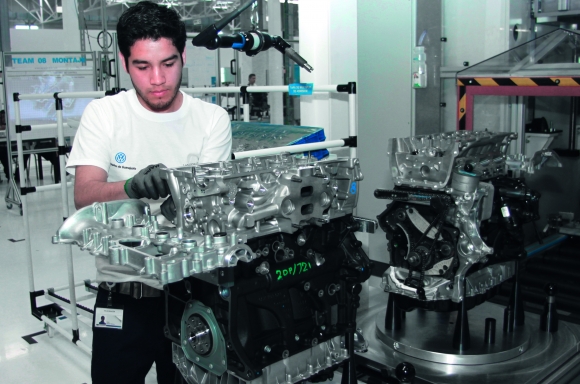

The global automotive engine market is experiencing steady transformation, driven by increasing demand for fuel-efficient, high-performance powertrains. According to Grand View Research, the global internal combustion engine (ICE) market size was valued at USD 98.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030, supported by ongoing advancements in engine technology and emissions compliance. Within this landscape, the 2.0 TSI (Turbocharged Stratified Injection) engine segment has emerged as a dominant force, particularly in premium and performance-oriented vehicle segments, due to its optimal balance of power output, fuel efficiency, and lower CO₂ emissions. As automakers continue to refine turbocharged gasoline direct injection systems, a select group of manufacturers has led innovation in 2.0 TSI engine design and production. Based on technological leadership, production volume, and OEM adoption, the following eight companies stand out as the top manufacturers of 2.0 TSI engines worldwide.

Top 8 2.0 Tsi Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Volkswagen’s latest turbocharged TSI engine debuts in the Jetta and …

Domain Est. 1994

Website: media.vw.com

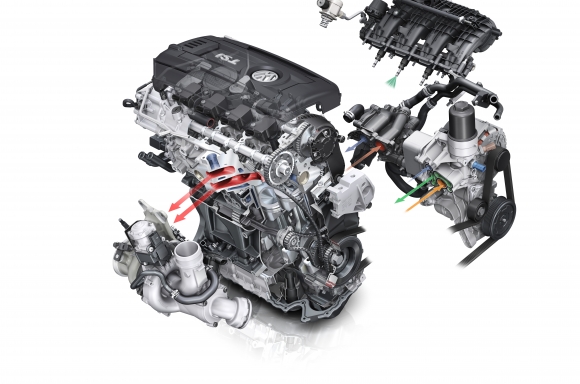

Key Highlights: Designed to be lighter and more efficient, the new EA888 Gen 3 turbocharged and direct-injection four-cylinder powerplant features a number of refinements….

#2 2026 VW Golf GTI

Domain Est. 1994

Website: vw.com

Key Highlights: 2.0L TSI® engine w/ 241 hp and 273 lb-ft of torque; Get Superior HandlingAvailable DCC Adaptive Chassis Control; See the Big ScreenStandard 12.9” touchscreen ……

#3 Petrol engines

Domain Est. 1996

Website: volkswagen.co.uk

Key Highlights: TSI engines offer an enjoyable and involving drive, while cutting fuel consumption and CO2 emissions. Because TSI engines are cleaner, you’ll also save on car ……

#4 VOLKSWAGEN ARTEON 2.0 TSI 272 PS NOW AVAILABLE

Domain Est. 2000

Website: vwpress.co.uk

Key Highlights: Volkswagen’s Arteon five-seat fastback is gaining a new range-topping engine: a 2.0-litre four-cylinder turbocharged TSI petrol unit developing 272 PS from ……

#5 Unitronic Presents Performance Software for 2.0 TSI® Gen3 MQB®

Domain Est. 2011

Website: getunitronic.com

Key Highlights: Unitronic is pleased to announce the official worldwide release of its Performance Software for the 3rd generation of Volkswagen’s 210- and 220-horsepower 2.0 ……

#6 High

Domain Est. 2016

Website: volkswagen-newsroom.com

Key Highlights: The new Polo GTI has front-wheel drive. The turbocharged direct petrol injection engine delivers 152 kW (207 PS) and permits a top speed of 240 km/h….

#7 2.0 TSI 190PS DSG now available for the SEAT Leon

Domain Est. 2023

Website: seat-cupra-mediacenter.com

Key Highlights: The Leon adds a new engine, the 2.0 TSI 190PS DSG powertrain, available in both 5-door and Sportstourer bodies….

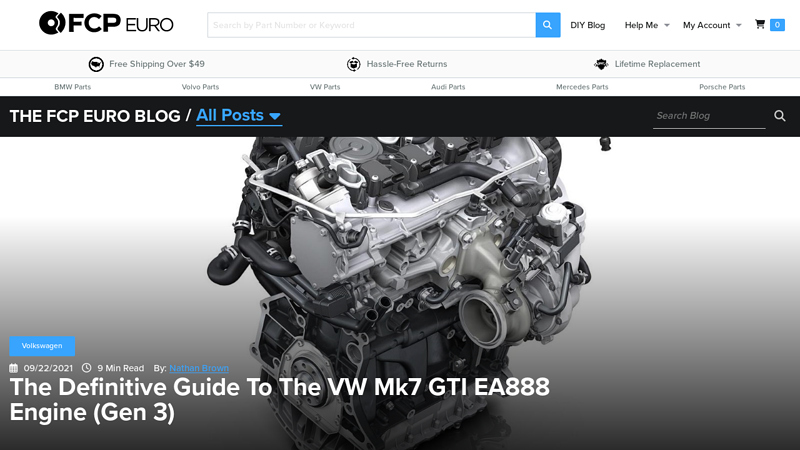

#8 The Definitive Guide To The VW Mk7 GTI EA888 Engine (Gen 3)

Domain Est. 2010

Website: fcpeuro.com

Key Highlights: The Mk7 GTI is equipped with an evolution of the 2.0t turbocharged Volkswagen ‘TSI’ EA888 generation of engines….

Expert Sourcing Insights for 2.0 Tsi Engine

2026 Market Trends for 2.0 TSI Engine

The 2.0 TSI (Turbocharged Stratified Injection) engine, a mainstay in the global automotive industry for over a decade, faces a transformative period leading into 2026. While remaining a popular powertrain choice, its market trajectory is shaped by accelerating electrification, tightening emissions regulations, and evolving consumer preferences. Here’s an analysis of key trends expected to define the 2026 landscape for the 2.0 TSI engine:

1. Declining Market Share Amid Electrification Surge

By 2026, the 2.0 TSI will experience a measurable decline in market share, particularly in key regions like Europe and China. This is driven by aggressive government mandates (e.g., Euro 7, China 6b, ZEV programs in California and Canada) and automakers’ commitments to electrify their lineups. Many manufacturers are shifting production capacity toward hybrid and fully electric vehicles (EVs). The 2.0 TSI will increasingly be reserved for performance trims (e.g., GTI, R models) or vehicles where electrification is less practical (e.g., large SUVs, performance sedans), rather than mainstream applications.

2. Integration into Hybrid and Mild-Hybrid Systems

Rather than disappearing, the 2.0 TSI is evolving through integration with electrified drivetrains. By 2026, PHEV (Plug-in Hybrid Electric Vehicle) and MHEV (Mild Hybrid Electric Vehicle) variants of the 2.0 TSI will become more common. These systems use the TSI engine as a range extender or primary power source, augmented by electric motors to improve fuel efficiency, reduce emissions, and enhance performance. Examples include Volkswagen’s GTE models and various luxury brands (Audi, BMW) using electrified 2.0L turbo engines to meet regulatory targets without sacrificing driving dynamics.

3. Technological Refinements for Efficiency and Compliance

To extend its viability, manufacturers will continue refining the 2.0 TSI platform. Expected advancements by 2026 include:

– Advanced Thermal Management: Faster warm-up systems to reduce cold-start emissions.

– Enhanced Turbocharging: Twin-scroll or electric turbos to minimize lag and improve low-end torque.

– Lean-Burn and Miller Cycle Adaptations: For improved fuel economy in specific operating conditions.

– Integration with 48V MHEV Systems: Enabling start-stop functionality, torque assist, and regenerative braking.

These refinements aim to meet increasingly stringent emissions standards (especially NOx and CO2) while maintaining performance appeal.

4. Regional Divergence in Adoption

The 2.0 TSI’s relevance will vary significantly by region:

– Europe: Strongest pressure to phase out ICE; 2.0 TSI will be largely confined to performance and hybrid models.

– North America: Slower transition allows broader use, especially in SUVs and trucks. However, CAFE standards and state-level ZEV rules will limit growth.

– China: Rapid EV adoption and local NEV mandates will sharply reduce 2.0 TSI volume in mainstream models, though premium and performance segments may retain it.

– Emerging Markets (e.g., Latin America, Middle East): Longer lifecycles for ICE engines mean the 2.0 TSI may remain relevant in premium and performance segments due to fuel availability and infrastructure gaps for EVs.

5. Shift Toward Niche and Performance Applications

By 2026, the 2.0 TSI is expected to transition from a volume engine to a performance and enthusiast-focused powerplant. Its strong torque curve, tuning potential, and reliability make it ideal for hot hatches, sports sedans, and performance SUVs. Automakers may emphasize its emotional appeal—sound, responsiveness, driver engagement—in contrast to the smooth but less tactile EV experience. This repositioning helps preserve brand identity in an electrifying world.

6. Aftermarket and Tuning Community Resilience

The 2.0 TSI will continue to thrive in the aftermarket and tuning sectors. Its modular design, widespread availability, and proven durability ensure strong support from performance parts manufacturers. Enthusiasts will seek out 2.0 TSI-powered vehicles as “last of the breed” internal combustion performance cars, driving demand in the used car market and fueling a robust ecosystem of tuning shops and online communities.

Conclusion

By 2026, the 2.0 TSI engine will no longer dominate the mainstream automotive market as it once did. However, it will persist as a critical component in performance vehicles, hybrid systems, and select regional markets. Its future lies not in ubiquity, but in specialization—serving as a high-efficiency, high-performance engine adapted to an electrified world. While the era of the standalone 2.0 TSI as a mass-market solution is waning, its legacy and engineering excellence will ensure continued relevance in a more diverse and complex powertrain landscape.

Common Pitfalls When Sourcing a 2.0 TSI Engine (Quality & Intellectual Property)

Sourcing a 2.0 TSI engine—whether for replacement, restoration, or performance modification—can be fraught with challenges, particularly concerning quality assurance and intellectual property (IP) issues. Being aware of these pitfalls helps avoid costly mistakes, legal complications, and reliability problems.

Poor Quality Control in Aftermarket or Used Engines

One of the most significant risks is acquiring an engine with hidden defects or inconsistent quality. Many suppliers, especially in the used or remanufactured market, may not adhere to stringent testing protocols. Engines might have internal wear, timing chain issues (common in earlier 2.0 TSI models), or turbocharger degradation that isn’t immediately visible. Without proper documentation or a reliable rebuild history, buyers risk installing an engine prone to early failure.

Counterfeit or Replica Components

The popularity of the 2.0 TSI platform has led to a proliferation of counterfeit parts and even full engine clones. These replicas often mimic genuine Volkswagen Group (VAG) components but use inferior materials and manufacturing processes. They may bear fake part numbers or logos, misleading buyers into thinking they’re acquiring OEM-quality products. This not only affects performance and longevity but also raises serious IP concerns.

Intellectual Property Infringement

Sourcing engines or parts from unauthorized manufacturers may involve the use of patented technologies, designs, or software owned by Volkswagen AG. Reproducing or selling engines that incorporate protected engine management systems (e.g., Bosch ECU firmware), turbocharger designs, or direct injection components without licensing constitutes IP infringement. Buyers—even unknowingly—can become complicit in these violations, potentially facing legal action or import restrictions, especially in regions with strong IP enforcement.

Lack of Authenticity Verification

Many suppliers, particularly in international or online marketplaces, offer “OEM” or “genuine” 2.0 TSI engines without verifiable proof. Serial numbers may be altered or missing, and documentation such as service history or import records can be forged. Without access to Volkswagen’s database or a trusted verification process, confirming authenticity is difficult, increasing the risk of receiving a stolen, salvaged, or non-compliant engine.

Software and Calibration Locks

Modern 2.0 TSI engines rely heavily on proprietary software and immobilizer systems. Sourcing an engine without the proper ECU, keys, or coding tools can lead to integration issues. Unauthorized reflashing or bypassing of security features may violate software licensing agreements and void warranties. Additionally, using cloned ECUs or pirated tuning software infringes on Volkswagen’s intellectual property and can result in unstable engine performance.

Inadequate Warranty and Support

Engines sourced from non-authorized channels often come with limited or no warranty. If quality issues arise, recourse is minimal. Reputable suppliers provide warranties backed by testing and quality assurances, but many budget vendors offer disclaimers that absolve them of responsibility. This lack of support increases long-term risk and total cost of ownership.

Regulatory and Compliance Risks

Engines imported without proper certification may not meet local emissions or safety standards (e.g., EPA in the U.S. or Euro 6 in Europe). Using such engines can lead to registration issues, fines, or failure during inspections. Furthermore, circumventing emissions controls—sometimes done with modified or cloned engine management systems—violates environmental regulations and IP laws alike.

Conclusion

To mitigate these pitfalls, always source 2.0 TSI engines through authorized dealers, certified rebuilders, or reputable suppliers with transparent histories. Verify authenticity, insist on proper documentation, and ensure compliance with IP and regulatory standards. Investing time in due diligence protects both the integrity of your vehicle and your legal standing.

Logistics & Compliance Guide for 2.0 TSI Engine

This guide outlines the key logistics and compliance considerations for the handling, transportation, import/export, and servicing of the 2.0 TSI (Turbocharged Stratified Injection) engine, commonly used in Volkswagen Group vehicles. Adherence to these guidelines ensures regulatory compliance, operational efficiency, and product integrity.

Regulatory Compliance

- Emissions Standards: The 2.0 TSI engine must comply with regional emissions regulations such as Euro 6d (EU), Tier 3 (USA), or China 6. Ensure all engines are certified for the destination market and are accompanied by valid Certificate of Conformity (CoC) or equivalent documentation.

- Type Approval: Confirm engine type approval (e.g., EC Type Approval, EPA/CARB certification) is valid for the target country. Unauthorized modifications may void compliance.

- REACH & RoHS Compliance: Verify that engine components adhere to EU REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives regarding restricted substances.

- End-of-Life Vehicle (ELV) Directive: Comply with ELV requirements for recyclability and use of hazardous materials. Proper documentation must be maintained for tracking and reporting.

Packaging & Handling

- Original Equipment Packaging: Use manufacturer-approved packaging to prevent damage during transit. Include protective caps on fuel lines, intake/exhaust ports, and electrical connectors.

- Moisture & Corrosion Protection: Apply rust-preventative coatings (e.g., VCI – Vapor Corrosion Inhibitor) and ensure engines are stored in dry, climate-controlled environments.

- Lifting & Handling: Use appropriate lifting equipment (e.g., engine hoists with soft slings) to avoid damage to mounting points or components. Never lift by oil pan, turbocharger, or ancillary parts.

Transportation & Shipping

- Domestic & International Shipping: Classify the engine correctly under Harmonized System (HS) Code (e.g., 8407.34 for spark-ignition piston engines). Declare accurate weight, dimensions, and value.

- Hazardous Materials: While the engine itself is not hazardous, residual oils or fluids may require special handling. Drain all fluids per manufacturer specifications before shipping.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DAP) in shipping contracts to allocate risks and costs.

- Temperature & Climate Control: Avoid exposure to extreme temperatures or humidity during transit, especially for engines with sensitive electronic components (e.g., ECU, sensors).

Import & Export Documentation

- Commercial Invoice: Must detail engine model, serial number, HS code, country of origin (e.g., Germany, Mexico), and transaction value.

- Packing List: Include itemized contents, packaging type, gross/net weight, and dimensions.

- Certificate of Origin: Required for tariff determination and trade agreement eligibility (e.g., USMCA, EU free trade agreements).

- Bill of Lading / Air Waybill: Ensure accurate consignee, notify party, and routing information.

- Customs Clearance: Work with licensed customs brokers to ensure timely clearance. Be prepared for inspection and provide technical specifications if requested.

Inventory & Storage

- Shelf Life Management: Monitor storage duration; follow OEM guidelines for maximum storage time before reconditioning or re-certification.

- First-In, First-Out (FIFO): Implement FIFO inventory rotation to prevent obsolescence or degradation.

- Security & Tracking: Use barcode/RFID systems to track engine serial numbers, location, and service history.

Aftermarket & Service Compliance

- Software & Calibration: Ensure engine control unit (ECU) software is up to date and complies with anti-tampering laws (e.g., no unauthorized remapping that affects emissions).

- Warranty & Recalls: Register engines sold aftermarket and monitor for manufacturer recalls or technical service bulletins (TSBs).

- Used Engine Regulations: If handling used or remanufactured engines, comply with local regulations on emissions, labeling, and warranty disclosures.

Environmental & Safety Considerations

- Waste Oil & Fluid Disposal: Follow EPA or local environmental agency protocols for disposal of residual lubricants and coolants.

- Worker Safety: Provide proper training for handling heavy engines and high-pressure components (e.g., fuel system).

- Fire Safety: Store away from ignition sources; have appropriate fire suppression systems in place.

Adhering to this logistics and compliance guide ensures that the 2.0 TSI engine is handled safely, legally, and efficiently throughout its supply chain lifecycle—from manufacturing to installation. Always consult the latest OEM technical service bulletins and local regulatory authorities for updates.

Conclusion for Sourcing a 2.0 TSI Engine:

Sourcing a 2.0 TSI engine requires careful consideration of compatibility, condition, cost, and reliability. These engines, known for their balance of performance and efficiency, are widely used across Volkswagen Group vehicles (including Volkswagen, Audi, Seat, and Škoda), offering broad availability in both new, used, and remanufactured options. However, potential buyers should be mindful of common issues associated with certain model years, such as carbon buildup, timing chain wear, and oil consumption, particularly in earlier versions.

To ensure a successful sourcing process, it is recommended to:

- Verify engine compatibility with the intended vehicle (model, year, ECU mapping, and emissions standards).

- Source from reputable suppliers or salvage yards with clear history and warranty options.

- Prioritize low-mileage, well-maintained engines with documented service history.

- Consider a remanufactured or crate engine for enhanced reliability and longer-term value.

- Perform a thorough inspection or compression test if purchasing a used unit.

Ultimately, diligent research, accurate matching, and professional consultation will lead to a reliable and cost-effective solution when sourcing a 2.0 TSI engine, ensuring optimal performance and longevity for the vehicle.