The global plywood market is experiencing steady expansion, driven by rising construction activities, demand for sustainable building materials, and growth in furniture manufacturing. According to Mordor Intelligence, the global plywood market was valued at USD 45.6 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. This growth is further fueled by increased infrastructure development in emerging economies and a shift toward engineered wood products that offer better strength-to-weight ratios and dimensional stability compared to solid wood. Among the most widely used plywood formats, 2 x 4 ft sheets—commonly used in cabinetry, interior finishing, and DIY projects—are seeing heightened demand due to their convenience, reduced waste, and compatibility with modular construction techniques. As the industry evolves, several manufacturers have distinguished themselves through consistent quality, sustainable sourcing practices, and scalable production capabilities. Based on market presence, production volume, and product certification standards, we’ve identified the top 9 manufacturers leading the 2 x 4 plywood segment worldwide.

Top 9 2 X4 Plywood Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High

Domain Est. 2019

Website: lituo-plywood.com

Key Highlights: Looking for a reliable 2×4 Birch Plywood manufacturer? Linyi Lituo Imp & Exp Co., Ltd. offers high-quality plywood products for all your construction needs….

#2 Columbia Forest Products

Domain Est. 1996

Website: columbiaforestproducts.com

Key Highlights: Discover Columbia Forest Products, North America’s largest manufacturer of sustainable, decorative hardwood plywood and veneers for residential and commercial…

#3 Softwood Plywood

Domain Est. 1996

Website: roseburg.com

Key Highlights: As a leading producer of softwood plywood panels in North America, Roseburg manufactures a wide range of products for your building construction applications….

#4 2×4 3/4″ Birch Plywood

Domain Est. 1999

Website: exclusivelypet.com

Key Highlights: Rating 4.6 (125) Dec 19, 2025 · 2×4 3/4″ Birch Plywood ; Until the end. 07. 06. 07 ; New $35.51 (tax included) Number of stocks: 1 ; Number of stocks · 1 ; Used $17.76 (tax inclu…

#5 Atlantic Plywood

Domain Est. 1999

Website: atlanticplywood.com

Key Highlights: Wholesale Supplier of Hardwood Plywood, Panel Product and More! Since our inception in 1974, Atlantic Plywood Corporation has prided itself on delivering ……

#6 Chesapeake Plywood

Domain Est. 2000

Website: chesapeakeplywood.com

Key Highlights: Specialty wood distributor offering premium, hard-to-find products and custom solutions—delivered coast to coast with expert service.Missing: 2 x4…

#7 Swanson Group Forest Products

Domain Est. 2007

Website: swansongroup.biz

Key Highlights: Swanson Group primarily offers Kiln Dried and Green 2×4 and 2×6 studs, but also supplies 3” and 4”, available in lengths ranging 8-10’….

#8 Hardwood Plywood

Domain Est. 2012

Website: distributorserviceinc.com

Key Highlights: We are the best place to buy cabinet-grade decorative hardwood plywood panel sheets. Customers select from Domestic Plywood (birch, maple, cherry, hickory, and ……

#9 2×4 1/4″BC Pine Plywood

Domain Est. 2018

Website: solisdepot.com

Key Highlights: In stock Rating 4.9 (111) 2 days ago · 1/4″ 2′ x 4′ BC Sanded Pine Plywood. Ideal for a wide variety of home projects and repairs Smooth surface on one side makes custom finishin…

Expert Sourcing Insights for 2 X4 Plywood

H2: Projected Market Trends for 2×4 Plywood in 2026

As the construction and housing sectors evolve in response to economic, technological, and environmental factors, the market for 2×4 plywood—a structural material commonly used in framing, sheathing, and formwork—is expected to experience several key trends by 2026. Although “2×4 plywood” may be a misnomer (as 2×4 typically refers to dimensional lumber rather than plywood), this analysis assumes the focus is on plywood panels used in applications traditionally occupied by 2×4 lumber, such as structural sheathing and subflooring, or a hybrid product combining plywood with 2×4 framing components. With that context, the following trends are anticipated:

-

Increased Demand from Residential Construction

The U.S. and several global markets are projected to see a rebound or stabilization in single-family home construction by 2026. As housing starts recover from recent interest rate fluctuations, demand for structural plywood—used in wall sheathing, roof decking, and flooring—will grow alongside the need for 2×4 framing. This synergy drives integrated supply chains where plywood and dimensional lumber are procured together. -

Rise in Engineered Wood Alternatives

By 2026, engineered wood products such as cross-laminated timber (CLT) and laminated veneer lumber (LVL) may partially displace traditional 2×4 framing and plywood use in mid-rise construction. However, conventional plywood will retain dominance in cost-sensitive markets. Innovations in plywood bonding and moisture resistance will enhance its competitiveness. -

Sustainability and Certification Pressures

Environmental regulations and consumer preferences will push demand toward sustainably sourced and certified plywood (e.g., FSC or PEFC). Manufacturers producing plywood for 2×4-scale construction applications will need to demonstrate low carbon footprints and responsible forestry practices to remain competitive in green building markets. -

Price Volatility Linked to Softwood Supply Chains

Plywood prices are closely tied to softwood lumber markets, which are prone to geopolitical and trade fluctuations (e.g., U.S.-Canada lumber disputes). In 2026, supply chain resilience and regional production shifts—such as increased plywood output in the Southern U.S. and Southeast Asia—will influence pricing and availability for construction-grade panels used with 2×4 framing. -

Adoption of Prefabrication and Modular Construction

The growth of off-site construction methods will favor standardized, high-quality plywood panels that integrate seamlessly with 2×4 framing systems. Precision-cut plywood components for wall and floor cassettes will see increased demand, promoting tighter tolerances and higher consistency in product specifications. -

Technological Integration in Building Materials

Smart building initiatives may lead to the development of “intelligent” plywood panels embedded with sensors for moisture, structural stress, or thermal performance. While still niche in 2026, early adoption in high-end residential and commercial projects could signal long-term market transformation. -

Regional Market Divergence

In North America and Europe, labor costs and energy efficiency standards will support the use of advanced plywood products. In contrast, emerging markets in Africa and Southeast Asia may rely on lower-cost, locally produced plywood, creating a bifurcated global market.

Conclusion:

By 2026, the market for plywood used in conjunction with 2×4 framing systems will be shaped by housing demand, sustainability standards, and technological innovation. While traditional plywood will remain a staple in construction, its evolution into higher-performance, eco-friendly, and system-integrated products will define competitive advantage. Stakeholders—from manufacturers to contractors—must adapt to these trends to capture growth in a dynamic building materials landscape.

Common Pitfalls When Sourcing 2×4 Plywood (Quality, IP)

Sourcing 2×4 plywood—often referring to plywood sheets cut to approximate dimensions of 2 feet by 4 feet (typically 24″ x 48″)—can be cost-effective for small projects. However, several quality and intellectual property (IP) pitfalls can compromise both the performance and legality of your use. Here are the most common issues to avoid:

1. Inconsistent Thickness and Dimensional Accuracy

One of the biggest quality concerns with non-standard 2×4 plywood is inconsistent thickness. Unlike full 4×8-foot sheets that adhere to grading standards (e.g., 1/2″, 3/4″), smaller cuts may vary significantly. Suppliers might resaw larger sheets without precision, leading to warped, tapered, or uneven panels that are unsuitable for fine woodworking or structural applications.

Pitfall: Assuming all 2×4 plywood is uniform; using it in applications requiring precise tolerances.

Prevention: Always measure multiple samples before purchase and verify flatness. Request calibrated thickness data from the supplier.

2. Poor Core Quality and Veneer Defects

Smaller plywood cuts are often offcuts or remnants from larger sheets. These may originate from lower-grade sections—edges or ends—with core gaps, voids, delamination, or thin face veneers. Such defects reduce strength and make finishing difficult.

Pitfall: Overlooking visual inspection, leading to panels that splinter, crack, or fail under load.

Prevention: Inspect each panel for bubbles, gaps, knots, and edge chipping. Avoid pieces with visible glue lines or separation between plies.

3. Misrepresentation of Species and Grade

Suppliers may label plywood generically (e.g., “hardwood ply”) without specifying species (birch, maple, poplar) or compliance with standards like APA (Engineered Wood Association). This lack of transparency affects durability, workability, and appearance.

Pitfall: Assuming “plywood” means consistent quality, resulting in mismatched project components.

Prevention: Demand material certifications or mill stamps. Verify species and exposure rating (e.g., Exterior, Interior) before purchase.

4. Intellectual Property (IP) Infringement Risks with Decorative or Specialty Plywood

When sourcing plywood with decorative faces (e.g., printed wood grains, branded laminates, or patterned surfaces), unauthorized use can violate trademarks or design patents. For example, using plywood with a patented wood-grain pattern or a branded finish (like Wilsonart or Formica) in resale products without licensing may expose you to IP claims.

Pitfall: Assuming resale of finished goods made with branded plywood is permissible without checking usage rights.

Prevention: Review supplier terms regarding end-use restrictions. For commercial applications, confirm whether the decorative surface is licensed for resale use.

5. Lack of Traceability and Compliance Documentation

Smaller suppliers—especially online marketplaces or salvage yards—may not provide documentation proving compliance with environmental regulations (e.g., CARB Phase 2, Lacey Act) or formaldehyde emission standards. This is critical if the plywood is used in consumer goods or indoor environments.

Pitfall: Unknowingly using non-compliant material, leading to legal or safety issues.

Prevention: Source from reputable vendors who provide compliance paperwork. Ask for test reports or chain-of-custody documentation when needed.

6. Moisture Content and Storage Issues

Improperly stored 2×4 plywood, especially in humid or uncontrolled environments, can absorb moisture, leading to warping, mold, or glue failure. Offcuts are often stored loosely and may not be acclimated properly.

Pitfall: Using wood without checking moisture content, resulting in dimensional instability after installation.

Prevention: Use a moisture meter to verify readings (ideal: 6–8% for indoor use). Store panels flat and off the ground in a dry, climate-controlled area before use.

By recognizing these common pitfalls—ranging from physical defects to legal risks—you can make informed decisions when sourcing 2×4 plywood, ensuring both quality outcomes and compliance with IP and regulatory standards.

Logistics & Compliance Guide for 2 x 4 Plywood

Overview

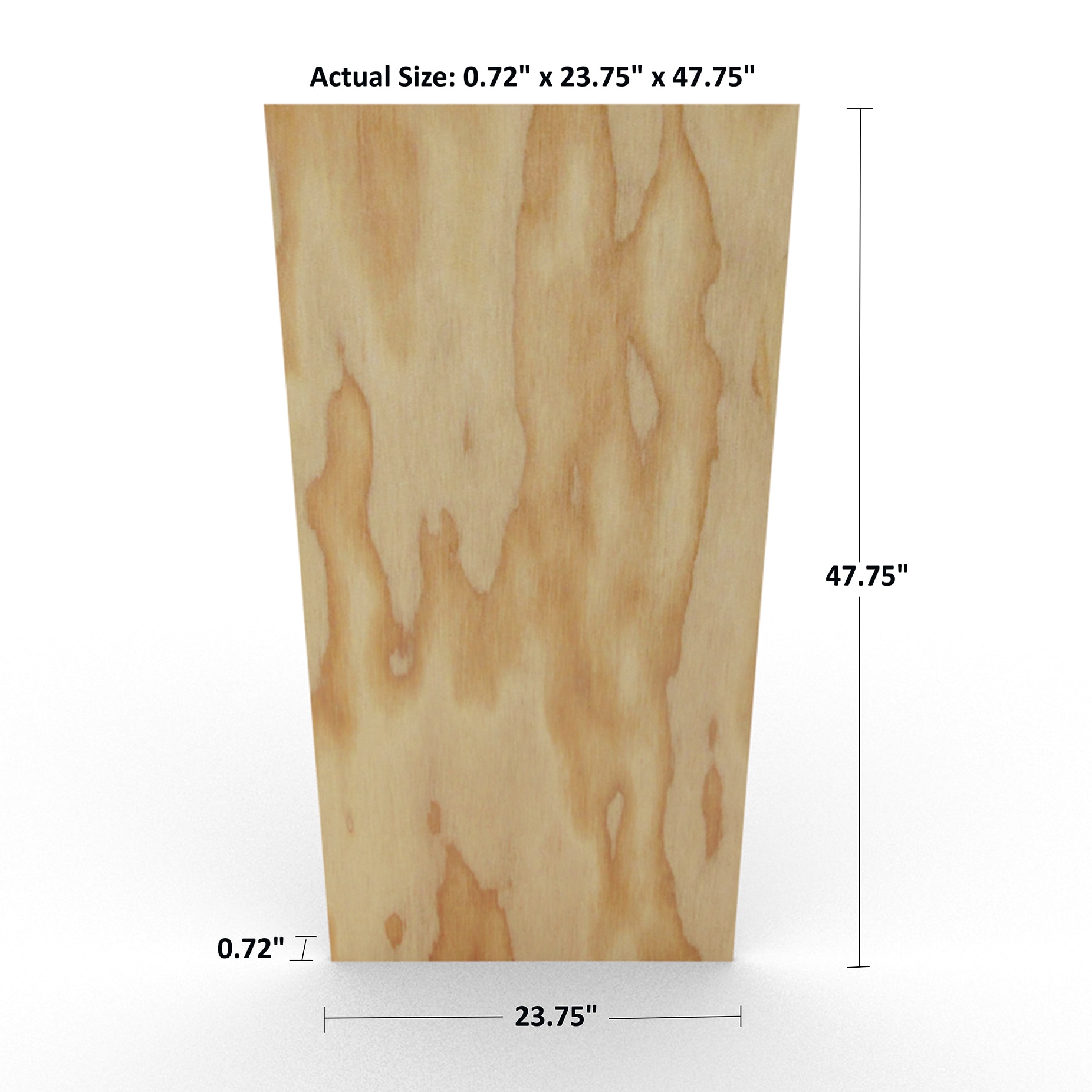

2 x 4 plywood refers to engineered wood panels typically measuring 2 feet by 4 feet (24″ x 48″) with a thickness of approximately 4-ply construction (commonly around 11–12 mm or 7/16″). This guide outlines key logistics and compliance considerations for handling, transporting, and using this product in construction, packaging, or industrial applications.

Dimensions & Specifications

- Nominal Size: 2 ft x 4 ft (24″ x 48″)

- Thickness: ~7/16″ to 1/2″ (11–12 mm), depending on ply count and manufacturer

- Core Material: Typically softwood veneers (e.g., birch, poplar, or pine)

- Common Grades: Exposure 1, Exterior, or Industrial Use (check manufacturer specs)

- Weight per Sheet: ~25–35 lbs (11–16 kg), varies by density and moisture content

Packaging & Handling

- Stacking: Bundle sheets with steel or nylon strapping; use edge protectors to prevent damage.

- Palletization: Secure on standard 48″ x 40″ pallets; max stack height 60″–72″ for stability.

- Moisture Protection: Wrap bundles in waterproof plastic or use pallet covers if stored or shipped outdoors.

- Handling Equipment: Use forklifts or pallet jacks; avoid dragging to prevent edge chipping.

Transportation Requirements

- Load Securing: Use straps or load bars to prevent shifting during transit.

- Vehicle Type: Box trucks, flatbeds (with tarps), or dry van trailers.

- Environmental Exposure: Avoid prolonged exposure to rain or direct sunlight during transport.

- Hazard Class: Non-hazardous; no special DOT or ADR classification required.

Storage Conditions

- Location: Dry, well-ventilated indoor area.

- Elevation: Store on level skids or pallets, minimum 6″ off the ground.

- Moisture Control: Maintain relative humidity between 35–65%; avoid condensation.

- Duration: Limit outdoor storage to 30 days unless protected; rotate stock (FIFO).

Regulatory & Compliance Standards

1. Lumber Grading (U.S./Canada)

- Must comply with APA – The Engineered Wood Association standards (e.g., PS 1-19 for structural plywood).

- Grading stamps must be visible on each sheet (grade, exposure rating, mill number).

2. Formaldehyde Emissions (CARB & EPA)

- Must meet CARB Phase 2 or TSCA Title VI regulations for formaldehyde emissions if sold in the U.S.

- Look for certification labels (e.g., EPA TSCA Title VI Compliant).

3. Import/Export Compliance

- Lacey Act (U.S.): Requires proof of legal harvest and chain-of-custody documentation.

- ISPM 15: Wooden packaging (pallets) must be heat-treated and marked if shipping internationally.

- Customs Documentation: Include commercial invoice, packing list, and certificate of origin.

4. Sustainability & Certification

- FSC® (Forest Stewardship Council) or SFI (Sustainable Forestry Initiative) certification may be required for green building projects (e.g., LEED).

- Verify chain-of-custody documentation if specified by the buyer.

Safety & Handling Precautions

- PPE: Wear gloves, safety glasses, and dust masks when cutting or sanding.

- Dust Control: Use HEPA-filter vacuums or wet-cutting methods to minimize wood dust exposure (IARC Group 1 carcinogen for hardwood dust).

- Fire Safety: Store away from open flames; keep fire extinguishers accessible.

Quality Assurance

- Incoming Inspection: Check for warping, delamination, surface defects, and correct labeling.

- Moisture Content: Ideal range: 6–12%; use a moisture meter if used in precision applications.

- Documentation: Retain mill test reports, compliance certificates, and delivery receipts.

Disposal & Recycling

- Landfill Disposal: Permitted but discouraged; check local regulations.

- Recycling: Separate from treated wood; recyclable at wood processing facilities.

- Treated Wood: If coated with fire retardants or preservatives, dispose of as hazardous waste per local rules.

Summary Checklist

- [ ] Confirm product meets APA/PS-1 standards

- [ ] Verify TSCA Title VI or CARB compliance

- [ ] Ensure FSC/SFI certification if required

- [ ] Secure loads properly during transit

- [ ] Store indoors on elevated, dry surfaces

- [ ] Maintain handling and safety protocols

- [ ] Retain all compliance documentation

By adhering to this guide, businesses can ensure safe, legal, and efficient handling of 2 x 4 plywood across the supply chain. Always consult manufacturer data sheets and local regulations for project-specific requirements.

Conclusion for Sourcing 2×4 and Plywood:

After evaluating various suppliers, pricing, availability, and quality, sourcing 2×4 lumber and plywood can be efficiently accomplished through a combination of local lumberyards and home improvement retailers. Local suppliers often provide higher quality materials, personalized service, and faster availability, which is ideal for time-sensitive projects. National chains such as Home Depot or Lowe’s offer competitive pricing, consistent stock, and delivery options, adding convenience and reliability.

For cost-effectiveness and bulk purchases, contacting wholesale distributors or placing a direct order with a mill may yield better pricing and material consistency. Additionally, considering alternative materials—such as engineered wood or sustainably sourced options—can enhance project durability and align with environmental goals.

Ultimately, the best sourcing strategy depends on project scale, timeline, and budget. Establishing relationships with reliable suppliers, comparing quotes, and factoring in delivery and handling will ensure a smooth and economical procurement process for both 2x4s and plywood.