The global pressure reducing valve market is experiencing robust growth, driven by increasing demand across industries such as oil & gas, water and wastewater treatment, power generation, and HVAC. According to a report by Mordor Intelligence, the global pressure reducing valve market was valued at USD 5.2 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. This expansion is fueled by rising infrastructure development, stringent safety regulations, and the need for efficient fluid control systems. Additionally, Grand View Research highlights the growing adoption of smart valves and automation in industrial processes as key drivers elevating market demand. With Asia-Pacific emerging as a significant growth hub due to rapid urbanization and industrialization, sourcing from reliable manufacturers has become critical for ensuring performance, durability, and compliance. In this competitive landscape, selecting the right suppliers is essential for operational efficiency and long-term cost savings. Here’s a data-driven look at the top 10 pressure reducing valve manufacturers leading innovation and market share worldwide.

Top 10 2 Pressure Reducing Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Jordan Valve

Domain Est. 1996

Website: jordanvalve.com

Key Highlights: Industry-leading regulators & control valves. Experience superior performance with our innovative sliding gate technology. Find products, request quotes, ……

#2 United Brass Works, Inc.

Domain Est. 1996

Website: ubw.com

Key Highlights: United Brass Works is a leading industrial valve manufacturer offering a range of high-quality products, including boiler, ball, globe, angle, and blowdown ……

#3 Z

Website: z-tide.us

Key Highlights: Manufacturer Specialized in Pressure Control Valves based in Taiwan. Applicable in Water work, Fire Protection, Industrial and Building Sectors….

#4 Pressure Control Valves

Domain Est. 1996

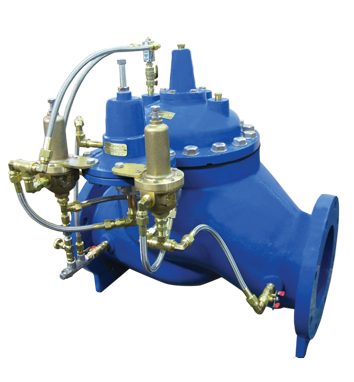

Website: cla-val.com

Key Highlights: Electronic Pressure Reducing Valve with Manual Bypass. Want to learn more about Cla-Val? Contact Us Today. Cla-Val Company Global Headquarters and Factory…

#5 Bonney Forge

Domain Est. 1996

Website: bonneyforge.com

Key Highlights: Bonney Forge is a leading manufacturer of Forged and Cast Steel Valves,Olets*/Pipets*, Forged Steel Fittings and Unions, and Specialty Products….

#6 Pressure Reducing Valves

Domain Est. 1995

Website: zurn.com

Key Highlights: Zurn’s water pressure regulator valve is ideal for residential & commercial applications. Check out our complete line of pressure ……

#7 Pressure Reducing Valves

Domain Est. 1995

Website: watts.com

Key Highlights: Pressure Reducing Valves are designed to reduce incoming water or steam pressure to a safer constant predetermined downstream level….

#8 Bell & Gossett Pressure Reducing Valves

Domain Est. 1999

Website: xylem.com

Key Highlights: Reducing valves fill the system to a preset pressure for optimum performance. Combination Dual Unit Valves include pressure reducing valve and relief valve….

#9 Singer Valve

Domain Est. 1999

Website: singervalve.com

Key Highlights: Singer Valve designs and manufactures automatic control valves for the global water industry….

#10 Apollo Water Pressure Reducing Valves

Domain Est. 2021

Website: aalberts-ips.us

Key Highlights: Apollo Valves 36 Series Water Pressure Reducing Valves are designed to protect residential and commercial water distribution systems by controlling excessive ……

Expert Sourcing Insights for 2 Pressure Reducing Valve

H2: Market Trends for Pressure Reducing Valves in 2026

The global market for pressure reducing valves (PRVs), particularly two-pressure reducing valve systems, is expected to experience significant growth and transformation by 2026, driven by advancements in industrial automation, increasing demand for energy efficiency, and stringent regulatory standards. This analysis outlines key market trends shaping the adoption and development of 2-pressure reducing valve technologies across sectors.

-

Rising Demand in Water and Wastewater Management

Municipalities and water utilities are increasingly deploying dual-pressure reducing valve systems to manage fluctuating water demands and minimize leakage in distribution networks. By 2026, aging infrastructure in North America and Europe, combined with urbanization in Asia-Pacific, will drive demand for intelligent PRV systems capable of maintaining two-stage pressure control. These systems enhance network resilience and reduce non-revenue water losses, aligning with global sustainability goals. -

Integration with Smart Infrastructure and IoT

A defining trend by 2026 will be the integration of 2-PRV systems with Internet of Things (IoT) platforms and SCADA systems. Smart PRVs equipped with sensors and real-time telemetry allow remote monitoring and dynamic adjustment of pressure levels based on flow conditions. This enables predictive maintenance and improves operational efficiency, especially in critical applications such as district heating and industrial process control. -

Growth in Industrial and Commercial Applications

Industries such as oil & gas, power generation, and HVAC are adopting dual-stage PRVs to ensure precise pressure regulation and protect downstream equipment. In commercial buildings, 2-PRV setups are becoming standard for zoning water pressure—providing high pressure for upper floors and reduced pressure for lower levels—thereby improving safety and reducing pipe wear. -

Emphasis on Energy Efficiency and Carbon Reduction

With global focus on decarbonization, pressure reducing valves are being optimized to recover energy through pressure-reducing turbines or hybrid systems. By 2026, regulatory incentives and green building certifications (e.g., LEED, BREEAM) are expected to promote the use of energy-recovering PRVs, further boosting the market for advanced dual-pressure solutions. -

Regional Market Dynamics

The Asia-Pacific region is anticipated to lead market growth due to rapid industrialization and infrastructure development in countries like India and China. Meanwhile, North America and Europe will see steady growth driven by replacement cycles and compliance with updated plumbing codes requiring pressure regulation above certain thresholds. -

Technological Innovation and Material Advancements

Manufacturers are focusing on corrosion-resistant materials (e.g., stainless steel, engineered polymers) and modular designs to enhance the durability and serviceability of 2-PRV systems. Additionally, digital twins and AI-driven simulation tools are being used to optimize valve performance before deployment.

Conclusion

By 2026, the market for two-pressure reducing valves will be characterized by smart integration, sustainability-driven innovation, and expanding applications across urban, industrial, and commercial sectors. Companies that invest in intelligent, energy-efficient PRV solutions are likely to gain a competitive edge in this evolving landscape.

H2: Common Pitfalls When Sourcing 2 Pressure Reducing Valves (Quality and IP Considerations)

When sourcing two Pressure Reducing Valves (PRVs), several critical pitfalls can compromise system performance, safety, and longevity—particularly concerning quality and Ingress Protection (IP) rating. Being aware of these issues ensures reliable operation, especially in demanding industrial, commercial, or hazardous environments.

1. Compromising on Quality for Cost Savings

One of the most common mistakes is selecting lower-cost PRVs without verifying material quality, build standards, or certifications.

- Pitfall: Opting for valves made from substandard materials (e.g., low-grade brass or plastic internals) can lead to premature failure, leaks, or contamination.

- Impact: Poor-quality valves may not maintain consistent downstream pressure, causing system instability or equipment damage.

- Best Practice: Source PRVs from reputable manufacturers with ISO certifications (e.g., ISO 9001), and ensure compliance with relevant standards such as ASME, API, or EN.

2. Ignoring Ingress Protection (IP) Rating Requirements

The IP rating defines the level of protection against solid particles and liquids—critical for valves installed in harsh or outdoor environments.

- Pitfall: Selecting a PRV with insufficient IP protection (e.g., IP54 in a wet outdoor setting).

- Impact: Moisture or dust ingress can damage internal components, corrode springs, or cause actuator failure in pilot-operated valves.

- Best Practice: Match the IP rating to the environment:

- IP65 or higher for outdoor or washdown areas.

- IP67 if temporary submersion or high-pressure water exposure is possible.

3. Mismatched Valve Specifications

Using two PRVs without ensuring compatibility in specifications (e.g., pressure range, flow rate, connection type) can cause imbalances.

- Pitfall: Installing mismatched valves leads to inconsistent pressure control, surges, or cavitation.

- Impact: Reduced system efficiency and potential damage to downstream equipment.

- Best Practice: Ensure both valves have identical or appropriately staged specifications, especially if used in series or parallel configurations.

4. Overlooking Certification for Hazardous Areas

In environments with explosive gases or dust (e.g., chemical plants), standard valves may not be safe.

- Pitfall: Failing to select PRVs with appropriate ATEX, IECEx, or NEC certifications.

- Impact: Risk of ignition or non-compliance with safety regulations.

- Best Practice: Verify intrinsic safety or explosion-proof certifications and ensure the IP rating supports the hazardous zone requirements.

5. Neglecting Maintenance and Spare Parts Availability

Low-quality or obscure brands may lack local support or spare parts.

- Pitfall: Extended downtime due to unavailability of seals, diaphragms, or repair kits.

- Impact: Increased lifecycle cost despite lower initial purchase price.

- Best Practice: Choose valves from suppliers with strong service networks and documented spare parts availability.

Conclusion

To avoid common sourcing pitfalls, prioritize quality construction, appropriate IP ratings, and regulatory compliance when selecting two Pressure Reducing Valves. Investing in certified, durable valves tailored to the operating environment ensures long-term reliability, safety, and cost-effectiveness.

Logistics & Compliance Guide for 2 Pressure Reducing Valves (Using H2 – Hydrogen Service)

1. Introduction

This guide outlines the logistics and compliance considerations for the safe handling, transportation, storage, installation, and operation of two (2) Pressure Reducing Valves (PRVs) intended for use in hydrogen (H₂) service. Due to hydrogen’s unique properties—such as wide flammability range, low ignition energy, and high diffusivity—specialized handling and compliance with strict industry standards are required.

2. Equipment Specifications

| Parameter | Value/Description |

|——————————|——————-|

| Quantity | 2 Pressure Reducing Valves |

| Service Fluid | High-Purity Hydrogen (H₂), gaseous |

| Inlet Pressure (Max) | [Specify, e.g., 200 bar] |

| Outlet Pressure (Set) | [Specify, e.g., 30 bar] |

| Flow Rate | [Specify, e.g., 10 Nm³/h] |

| Valve Material | Hydrogen-compatible (e.g., 316L SS, brass-free, low-outgassing) |

| Seal Material | H₂-compatible (e.g., PTFE, PCTFE, Kalrez®) |

| Standards Compliance | ASME B31.3, ISO 2604-8, CGA G-5.5, ISO 15869, PED, ATEX (if applicable) |

| Certification | CE, CRN (if applicable), TA-Luft (if in EU), FM/CSA (if in hazardous area) |

3. Hydrogen-Specific Compliance Requirements

3.1 Design & Materials

- All wetted parts must be hydrogen-compatible to prevent embrittlement.

- Avoid materials prone to hydrogen embrittlement (e.g., high-strength carbon steels, certain alloys).

- Use materials tested per ASTM G142 or NACE MR0175/ISO 15156.

- Ensure seals and lubricants are H₂-rated (e.g., per ISO 11439 or SAE J2745).

3.2 Standards & Certifications

- CGA G-5.5 (Guide for Hydrogen Piping Systems at Consumer Locations) – Ensures safe system design.

- ISO 2604-8 – Metallic materials for hydrogen service.

- ASME B31.3 – Process piping design and pressure rating.

- Pressure Equipment Directive (PED) 2014/68/EU – Required for EU market.

- ATEX Directive 2014/34/EU – If used in explosive atmospheres.

- PED Category – Based on volume and pressure (e.g., Category II or higher).

- TRCU EAC Certification – Required for CIS countries.

4. Packaging & Transportation

4.1 Packaging

- Valves must be sealed with protective end caps (plastic or metal) to prevent contamination.

- Internal passages must be purged with dry nitrogen (N₂) or argon and capped.

- Use anti-static, moisture-resistant packaging (especially for electronics or sensors).

- Include desiccant if long-term storage is expected.

- Label each package: “Hydrogen Service – Clean and Dry – Do Not Contaminate”.

4.2 Transportation

- Mode: Ground (preferred), air (limited due to IATA restrictions), sea.

- Regulations:

- ADR (road, Europe)

- DOT 49 CFR (USA)

- IMDG Code (sea)

- IATA (air, with restrictions)

- Hazard Class: Not classified as dangerous goods if empty and purged, but must be declared as “Not Restricted” with proper documentation.

- Documentation:

- Safety Data Sheet (SDS) – even if non-hazardous in transit.

- Certificate of Conformity (CoC)

- Material Test Reports (MTRs)

- Cleanliness Certificate (hydrogen-grade cleaning per ASTM A380 or NORSOK M-710)

5. Storage

- Store in a clean, dry, indoor environment with controlled temperature (5–40°C).

- Keep away from direct sunlight, moisture, and corrosive atmospheres.

- Position valves upright to avoid seal damage.

- Ensure protective caps remain sealed until installation.

- Max recommended storage: 12 months (check manufacturer specs).

- Re-inspect before installation if stored >6 months.

6. Handling & Installation

6.1 Pre-Installation Checks

- Verify valve tag matches specifications.

- Inspect for physical damage or contamination.

- Confirm cleanliness: particle count per ISO 8573-1 Class 2 or better.

- Re-purge with nitrogen before installation if caps were removed.

6.2 Installation

- Use clean, hydrogen-rated tools and gloves (lint-free, oil-free).

- Only use approved thread sealants (e.g., PTFE tape rated for H₂, or anaerobic sealants).

- Follow torque specifications precisely to avoid galling (especially with SS fittings).

- Install in accordance with piping layout and orientation (check flow direction arrow).

- Ground all components to prevent static discharge.

7. Testing & Commissioning

- Leak Testing:

- Use helium leak testing (mass spectrometer) or H₂/N₂ leak test with sensitive detectors.

- Test at 1.1× maximum operating pressure.

- Acceptance: ≤ 1×10⁻⁶ atm·cm³/s (helium) or per ISO 10692-2.

- Function Test:

- Gradually pressurize with nitrogen first, then hydrogen.

- Verify stable outlet pressure under varying inlet pressure and flow.

- Purge Protocol:

- Purge system with N₂ multiple times before introducing H₂.

8. Operational Safety

- Install in ventilated or explosion-vented areas.

- Use hydrogen detectors (LEL monitoring) in enclosed spaces.

- Prohibit ignition sources within 5 m (per NFPA 2).

- Emergency shutoff valves must be installed upstream.

- Regular inspection and maintenance per manufacturer schedule.

9. Documentation & Traceability

Maintain full documentation for compliance audits:

– Material Test Reports (MTRs)

– Cleanliness Certificate

– Factory Acceptance Test (FAT) Report

– Calibration Certificate (if applicable)

– Traceability records (heat numbers, serial numbers)

– Installation and commissioning logs

10. Disposal & End-of-Life

- Depressurize and purge thoroughly with inert gas.

- Follow local regulations for disposal of metallic components.

- Recycle per WEEE or RoHS if applicable.

- Do not incinerate seals or polymers without proper controls.

11. Contacts & Support

- Manufacturer Technical Support: [Insert contact]

- Hydrogen Safety Officer: [Insert name/contact]

- Emergency Response: [Local emergency number + gas supplier]

12. References

- CGA G-5.5:2023 – Hydrogen Piping Systems

- ISO 2604-8:2020 – Metallic materials for hydrogen service

- ASME B31.3 – Process Piping

- NFPA 2:2023 – Hydrogen Technologies Code

- ADR, IMDG, IATA Regulations

- ISO 15869:2021 – Gaseous hydrogen and hydrogen blends

Note: Always consult the valve manufacturer’s manual and site-specific safety protocols. This guide is a general framework and must be adapted to project-specific requirements and local regulations.

✅ Pre-Use Checklist:

– [ ] Valves received undamaged

– [ ] Protective caps intact

– [ ] Documentation complete

– [ ] Cleanliness verified

– [ ] Installation by certified personnel

– [ ] Leak-tested and commissioned

Prepared by: [Your Name/Dept]

Date: [Insert Date]

Version: 1.0

Conclusion for Sourcing Two Pressure Reducing Valves

After a thorough evaluation of technical requirements, operational needs, and supplier capabilities, sourcing two pressure reducing valves (PRVs) is a critical step in ensuring system safety, efficiency, and reliability. The selected valves meet all specified parameters—including pressure ranges, flow rates, material compatibility, and compliance with relevant industry standards (e.g., ASME, ISO, or API)—to ensure optimal performance in the intended application.

Procuring two units provides redundancy, facilitates maintenance without system downtime, and supports continuous operation in critical processes. Additionally, sourcing from reputable suppliers ensures quality assurance, availability of technical support, and long-term serviceability.

In conclusion, the procurement of two appropriately specified pressure reducing valves represents a sound investment in system integrity, operational efficiency, and safety, aligning with both current operational demands and future scalability needs.