The global pipe and tube market is experiencing robust growth, driven by rising infrastructure development, expanding oil and gas activities, and increased demand from industrial and municipal applications. According to Mordor Intelligence, the global pipes and tubes market was valued at USD 182.67 billion in 2023 and is projected to reach USD 256.73 billion by 2029, growing at a CAGR of 5.8% during the forecast period. This expansion underscores the critical role of high-strength piping solutions such as 2-inch Schedule 80 pipes, which are widely used in high-pressure and high-temperature environments across sectors including chemical processing, water treatment, and energy. With stringent regulatory standards and a growing emphasis on durability and corrosion resistance, demand for reliable Schedule 80 pipe manufacturers has intensified. As market dynamics shift toward sustainability and performance efficiency, identifying key manufacturers with proven production capabilities, material expertise, and global reach has become essential for procurement and project planning. The following list highlights the top 10 manufacturers leading the 2-inch Schedule 80 pipe segment, evaluated based on market presence, product quality, innovation, and adherence to international standards.

Top 10 2 Inch Schedule 80 Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Schedule 80 PVC Piping System

Domain Est. 2001

Website: gfps.com

Key Highlights: Easy to join. The Industrial Schedule 80 PVC system can be easily joined by way of the proven two-step solvent welding process….

#2 JM Eagle™

Domain Est. 2007

Website: jmeagle.com

Key Highlights: JM Eagle · Delivering life’s essentials through the most eco-friendly plastic pipe products on the market. · Express Service Trucks (ESTs) Deliver within 24 hours ……

#3 Cantex PVC Conduit

Domain Est. 1996

Website: cantexinc.com

Key Highlights: Our offerings include: PVC Electrical Conduit: Schedule 40 & 80 Pipe/Conduit, PVC Utility Duct, Telephone Conduit, Flexible Conduit, ENT Electrical Nonmetallic ……

#4 Schedule 80 PVC & CPVC

Domain Est. 1996

Website: parts.spearsmfg.com

Key Highlights: Spears Manufacturing Parts, Plastic Pipe Fittings, FlameGuard, Valves, Fire Sprinklers, PVC Pipes, Schedule 80, LabWaste….

#5 PVC Schedule 80 Thick Wall Pipe & Fittings

Domain Est. 1997

Website: charlottepipe.com

Key Highlights: PVC schedule 80 plastic pressure pipe has thicker walls than schedule 40 for heavy-duty pressure applications. Durable and easy to install. Learn more here….

#6

Domain Est. 1998

Website: consolidatedpipe.com

Key Highlights: A national leader in piping, fittings, valves, and all accessories for the energy, oil & gas, utility, construction, water and sewer industries….

#7 PVC PIPE N80 2″

Domain Est. 1999

#8 Schedule 40/80 PVC Pipe & Fitting Specifications

Domain Est. 2005

Website: harrisonplastic.com

Key Highlights: Schedule 40-80 PVC pipe specifications, sizes and pipe dimensions. Specifications for schedule 40-80 PVC fittings….

#9 PVC Schedule 80 Pressure Pipe

Domain Est. 2021

Website: westlakepipe.com

Key Highlights: Schedule 80 PVC pipes are designed to handle higher pressure requirements with ease, making them ideal for water processing, wastewater treatment, irrigation ……

#10 J

Domain Est. 2022

Website: ewingoutdoorsupply.com

Key Highlights: In stock 7-day delivery2 in Sch. 80 PVC Pipe. 2 SCH 80 PVC PE PIPE. SKU#: 07000560. MFG#: PVC 10020 0600. $794.26. $305.87. /per 100ft. Case Qty: 20. Login to see your price. In St…

Expert Sourcing Insights for 2 Inch Schedule 80 Pipe

2026 Market Trends for 2-Inch Schedule 80 Pipe: A Hydrogen (H2) Perspective

The global energy transition, particularly the accelerating development of a hydrogen (H2) economy, is poised to significantly reshape industrial material demand by 2026. The 2-inch Schedule 80 (Sch 80) steel pipe, a workhorse in high-pressure and high-temperature industrial applications, is strategically positioned to benefit from several key trends driven by H2 infrastructure deployment. Here’s an analysis of the expected market trends for this specific pipe size and rating through the lens of the hydrogen sector:

1. Surge in Demand from Hydrogen Production & Refueling Infrastructure:

* Electrolyzer Plants: Green hydrogen production via electrolysis operates under high pressure (often 30-50 bar, potentially higher). 2-inch Sch 80 pipe is a standard choice for internal process piping within electrolyzer skids and balance-of-plant systems for transporting high-purity hydrogen gas, process water, and cooling fluids. As global electrolyzer capacity scales dramatically by 2026 (driven by national strategies and cost reductions), demand for this reliable, code-compliant piping will increase proportionally.

* Hydrogen Refueling Stations (HRS): The expansion of HRS networks for fuel cell electric vehicles (FCEVs) is critical. 2-inch Sch 80 pipe is commonly used for:

* Internal High-Pressure Piping: Connecting compressors, storage tanks (buffering), and dispensers within the station, handling pressures up to 875 bar (12,000 psi) for dispensing. While final dispensing lines might use smaller, specialized tubing, Sch 80 is crucial for core station plumbing.

* Offloading Hoses & Connections: While the hose itself is flexible, the connections and manifolds often utilize Sch 80 fittings and short pipe spools.

* On-Site Production Integration: Stations with integrated electrolyzers will require Sch 80 for the production-to-compression/storage loop.

* Blue Hydrogen Facilities: Large-scale blue hydrogen plants (SMR with CCS) involve complex high-pressure gas processing. 2-inch Sch 80 is standard for numerous utility, instrument, and process lines handling hydrogen, syngas, CO2, and steam within the plant, contributing to steady demand.

2. Heightened Focus on Material Compatibility & Safety:

* Hydrogen Embrittlement (HE) Awareness: The H2 industry is acutely aware of the risk of HE in carbon steel, which Sch 80 is typically made from. By 2026:

* Specification Evolution: Standards (e.g., ASME B31.12, CGA G-5.5) will be more widely adopted, mandating specific material grades (e.g., low sulfur, controlled hardness like HRC < 22), heat treatment (tempering), and potentially non-destructive testing (NDT) for carbon steel piping in H2 service, even at lower pressures/temperatures where Sch 80 might be used. Demand will shift towards Sch 80 pipe explicitly certified for H2 service.

* Premium Materials: Increased demand for inherently HE-resistant materials like 316L stainless steel Sch 80 pipe, especially in critical, high-pressure, or high-purity applications within H2 facilities, despite the higher cost. This creates a market segment for premium 2-inch Sch 80 H2-grade piping.

* Supplier Qualification: Manufacturers and distributors specializing in H2-compatible piping (with proper material certs, traceability, and testing) will gain significant market share over generic suppliers.

3. Supply Chain Dynamics and Regional Shifts:

* Geographic Hotspots: Demand for 2-inch Sch 80 pipe will be concentrated in regions with aggressive H2 strategies: North America (US H2 Hubs, Canada), Europe (EU Hydrogen Backbone, Germany, Netherlands), Japan, South Korea, and Australia. Local manufacturing or distribution hubs for H2-compatible pipe will become critical.

* Supply Chain Resilience: The strategic importance of H2 infrastructure may lead to efforts to secure domestic or regional supply chains for critical components like piping, potentially boosting local manufacturing of H2-grade Sch 80 pipe and reducing reliance on global suppliers vulnerable to disruption.

* Inventory & Lead Times: Increased demand from multiple sectors (H2, traditional oil & gas, chemical) could strain supply chains for specific H2-grade materials, potentially leading to longer lead times and the need for better inventory planning by project developers.

4. Integration with Broader Industrial Trends:

* Beyond “Pure” H2: 2-inch Sch 80 pipe will also be used in infrastructure for H2-derived fuels like ammonia and synthetic methane (e-fuels), which often involve similar high-pressure conditions and material compatibility challenges.

* Retrofitting vs. New Build: While new H2 infrastructure is the primary growth driver, retrofitting existing natural gas infrastructure for H2 blending (up to certain percentages) or conversion may utilize Sch 80 pipe, though compatibility assessments are paramount.

* Competition: While H2 is a major driver, demand will also be sustained by traditional sectors (chemical processing, power generation, oil & gas secondary systems, high-pressure water/air). Competition for production capacity and raw materials exists.

2026 Outlook Summary for 2-Inch Sch 80 Pipe:

- Positive Growth Trajectory: The H2 economy is a significant, identifiable driver for increased demand in 2-inch Sch 80 pipe by 2026.

- Market Segmentation: The market will bifurcate. Demand for standard carbon steel Sch 80 will grow, but increasingly tied to H2-specific material certifications and processing. Demand for stainless steel (316L) Sch 80 will see stronger growth due to inherent HE resistance.

- Quality & Certification Premium: “H2-ready” or “H2-compliant” certified 2-inch Sch 80 pipe (especially carbon steel meeting strict HE mitigation criteria) will command a premium and be essential for project acceptance.

- Supplier Specialization: Suppliers demonstrating expertise in H2 material science, certification, and supply chain reliability will capture disproportionate market share.

- Regional Focus: Manufacturing and distribution will align closely with major H2 project clusters globally.

Conclusion:

By 2026, the 2-inch Schedule 80 pipe market will be significantly influenced by the hydrogen economy. While a reliable staple in industrial piping, its role in H2 production, distribution (refueling), and related infrastructure will drive substantial demand. Success for manufacturers and distributors will depend on moving beyond generic supply to offering pipe with demonstrable H2 compatibility – through specific material grades, rigorous processing, comprehensive certification, and traceability – meeting the stringent safety and performance requirements of this emerging, high-growth sector. The pipe itself becomes a critical component in the foundation of the clean energy future.

Common Pitfalls When Sourcing 2 Inch Schedule 80 Pipe (Quality & Inspection Plan)

Sourcing 2-inch Schedule 80 pipe—commonly used in high-pressure and high-temperature applications—requires careful attention to both material quality and inspection processes. Overlooking key aspects can lead to project delays, safety hazards, and costly failures. Below are common pitfalls to avoid:

1. Inadequate Material Certification and Traceability

One of the most frequent issues is accepting pipe without proper mill test reports (MTRs) or certified material test reports (CMTRs). For critical applications, failing to verify that the pipe meets ASTM/ASME standards (e.g., ASTM A53, A106, or A312 for stainless) can result in non-compliance. Lack of full traceability back to the heat number increases the risk of counterfeit or substandard materials entering the system.

2. Ignoring Dimensional Tolerances

Schedule 80 pipe has specific wall thickness requirements. However, suppliers may deliver pipe that barely meets minimum tolerances or is out of spec. Not verifying outer diameter (OD), wall thickness, and straightness during inspection can compromise system integrity, especially in high-pressure environments where even minor deviations affect safety and performance.

3. Poor Surface Quality and Defects

Visual inspection is often overlooked. Pipes may arrive with surface defects such as seams, laps, pits, or scratches exceeding allowable limits per standards. Corrosion or mill scale left unaddressed can accelerate degradation, particularly in corrosive service environments. Without a defined acceptance criteria in the inspection plan, these defects may go unnoticed until installation or failure.

4. Incomplete or Missing Non-Destructive Testing (NDT)

For critical services, NDT such as ultrasonic testing (UT) or hydrostatic testing is essential. A common pitfall is assuming all Schedule 80 pipe is automatically tested. Unless explicitly required in the purchase order and inspection plan, suppliers may skip or perform minimal testing. Always specify NDT requirements (e.g., 100% UT for seamless pipe in hydrocarbon service) and verify test records.

5. Lack of Clear Inspection and Hold Points

Failing to define inspection and hold points in the Inspection and Test Plan (ITP) can result in unchecked deliveries. Key milestones—such as pre-shipment inspection, dimensional checks, and document review—should be contractually mandated. Without clear ITPs, buyers lose control over quality verification and may accept non-conforming materials.

6. Overlooking Coating and Protection Requirements

Even if the pipe material is sound, inadequate protection during transit or storage can lead to damage. Pipes stored outdoors without end caps or proper coating are prone to internal contamination and external corrosion. Specify preservation requirements (e.g., VCI caps, wax coating) in the procurement documents to maintain quality from mill to site.

7. Supplier Qualification and Past Performance

Procuring from unqualified or low-tier suppliers increases quality risks. A supplier without a proven track record in pressure piping may lack robust quality management systems. Always evaluate supplier certifications (e.g., ISO 9001, API 5L) and audit history before awarding contracts.

By addressing these common pitfalls through rigorous specifications, detailed inspection plans, and supplier oversight, organizations can ensure the reliable and safe performance of 2-inch Schedule 80 pipe in demanding applications.

H2 Logistics & Compliance Guide for 2-Inch Schedule 80 Pipe

H2: Overview and Key Characteristics

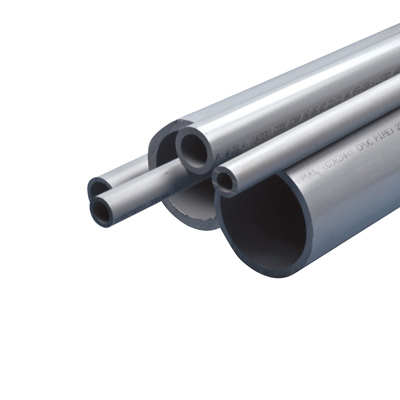

2-inch Schedule 80 pipe is a heavy-wall steel or stainless steel pipe commonly used in high-pressure, high-temperature, or corrosive environments across industries such as oil & gas, chemical processing, power generation, and water treatment. The “Schedule 80” designation indicates a specific wall thickness standardized by ANSI/ASME B36.10M (for carbon/alloy steel) and B36.19M (for stainless steel), providing greater strength and durability than Schedule 40 pipe of the same nominal size.

- Nominal Pipe Size (NPS): 2 inches

- Outside Diameter (OD): 2.375 inches (60.3 mm)

- Wall Thickness (Schedule 80): 0.218 inches (5.54 mm)

- Common Materials:

- Carbon Steel (e.g., ASTM A53, A106)

- Stainless Steel (e.g., ASTM A312, A790 – Grades 304/304L, 316/316L)

- Other Alloys (e.g., duplex, nickel alloys – upon specification)

- Common Lengths: 20 ft (6.1 m), 21 ft (6.4 m), 40 ft (12.2 m), or cut-to-length per order

Understanding the physical and chemical properties of the pipe is essential for ensuring safe handling, transportation, and regulatory compliance.

H2: Packaging and Handling Requirements

Proper packaging and handling are critical to preventing damage, ensuring safety, and maintaining material integrity during logistics.

- Bundling and Securing:

- Pipes are typically bundled in hexagonal or square configurations using steel strapping or banding.

- Bundles should be secured with dunnage (wood or plastic spacers) to prevent internal pipe-to-pipe contact.

-

End caps or protective rings must be installed to prevent damage to pipe ends and threads (if applicable).

-

Handling Equipment:

- Use cranes, forklifts with pipe clamps, or lifting beams—never lift by slings wrapped around individual pipes.

-

Avoid dragging or dropping pipes to prevent dents, scratches, or ovalization.

-

Storage:

- Store pipes indoors or under cover to avoid moisture, corrosion, and UV degradation (especially for coated pipes).

- Elevate bundles off the ground using wooden skids to prevent contact with standing water.

- Keep stainless steel separate from carbon steel to avoid chloride contamination and galvanic corrosion.

H2: Transportation Logistics

Transporting 2-inch Schedule 80 pipe requires attention to weight, length, and route planning.

- Weight Considerations:

- Carbon steel (ASTM A53): ~5.79 lb/ft (8.64 kg/m)

- Stainless steel (304): ~6.56 lb/ft (9.78 kg/m)

-

A 40-ft bundle (~230 ft total length) may weigh over 1,300 lbs (590 kg) — confirm load limits.

-

Transport Modes:

- Truck (Flatbed/Step Deck): Most common; ensure proper blocking, bracing, and load securement per FMCSA regulations (49 CFR Part 393).

- Rail: Suitable for large bulk shipments; use gondola or flatcars with side stakes.

-

Ocean Freight: Use containerized or break-bulk shipping; protect against saltwater exposure and condensation.

-

Routing and Permits:

- Over-length or overweight shipments may require special permits, especially for 40-ft lengths.

- Avoid low bridges, sharp turns, and restricted zones.

H2: Regulatory and Compliance Considerations

Compliance with international, national, and industry-specific regulations is mandatory.

- Material Certification (MTRs):

- Mill Test Reports (per ASTM or ASME standards) must accompany shipments.

-

Required for ASME B31.1 (Power Piping), B31.3 (Process Piping), and API standards.

-

Pressure Equipment Directive (PED) – EU:

- Applies if pipe is used in pressure systems. Schedule 80 may fall under Module A (internal production control) or higher modules depending on fluid group and pressure.

-

CE marking and EU Declaration of Conformity required.

-

ASME Code Compliance (USA):

- Piping systems in nuclear, power, or chemical plants must comply with ASME B31 codes.

-

Materials must be traceable and certified (e.g., ASME Section II, ASTM).

-

DOT Hazardous Materials (if applicable):

- Not typically classified as hazardous unless lined or coated with hazardous substances.

-

Empty pipes previously used for hazardous materials may require cleaning and certification per 49 CFR.

-

Customs and Import/Export:

- HS Code Example: 7306.30 (Iron or steel pipe, of circular cross-section, seamless, >406.4 mm) – varies by material and manufacturing method.

- Provide accurate COO (Country of Origin), material specs, and HTS codes.

-

Anti-dumping or countervailing duties may apply (e.g., on Chinese steel products).

-

Environmental and Safety (OSHA/WHMIS):

- Handling hazards: sharp edges, heavy lifting, pinch points.

- Provide SDS (Safety Data Sheet) if the pipe has protective coatings (e.g., epoxy, zinc).

H2: Quality Assurance and Traceability

- Traceability: Each pipe or bundle should have legible heat/lot numbers for full material traceability.

- Inspection: Perform visual inspection upon receipt for dents, corrosion, or damage.

- Documentation: Retain MTRs, packing lists, certificates of compliance, and shipping records for audit purposes.

H2: Best Practices Summary

- Verify pipe specifications (material, schedule, length, end finish) against purchase order.

- Use certified carriers with experience in metal freight.

- Ensure proper packaging and end protection.

- Maintain separation of carbon and stainless steel during storage and transport.

- Retain and organize compliance documentation.

- Train personnel on safe lifting and handling procedures.

Adhering to this guide ensures efficient, safe, and compliant logistics for 2-inch Schedule 80 pipe across global supply chains.

Conclusion for Sourcing 2-Inch Schedule 80 Pipe:

After evaluating various suppliers, material options, pricing, lead times, and quality certifications, the most viable option for sourcing 2-inch Schedule 80 pipe is through a reputable domestic steel distributor with ISO 9001 certification and ready inventory of ASTM A53/A106 seamless or ERW carbon steel pipe. This ensures compliance with industry standards for high-pressure applications, timely delivery, and material traceability.

Procuring from a supplier offering bulk pricing and reliable logistics reduces overall project costs and minimizes downtime. Additionally, confirming all pipes meet mill test reporting (MTR) requirements will ensure quality assurance and regulatory compliance. Alternative materials (e.g., stainless steel or PVC) should be considered only if specific corrosion resistance or operational conditions require them.

In summary, a balanced approach prioritizing quality, availability, and cost-effectiveness points to sourcing carbon steel Schedule 80 pipe from a prequalified vendor, ensuring project efficiency and long-term system integrity.