The global irrigation pumps market is experiencing robust growth, driven by rising agricultural productivity demands, increasing water scarcity, and the expansion of precision farming technologies. According to Mordor Intelligence, the irrigation pumps market was valued at USD 9.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% through 2029. This growth trajectory is further supported by government initiatives promoting efficient water management and the adoption of energy-efficient pumping systems across small and large-scale farms. Within this expanding landscape, 2 horsepower (HP) pumps have emerged as a preferred choice for mid-sized agricultural operations, balancing performance, energy efficiency, and cost-effectiveness. As demand intensifies, a select group of manufacturers have distinguished themselves through innovation, reliability, and scalable production. Based on market presence, product performance data, and technological advancement, the following analysis identifies the top 8 manufacturers leading the 2 HP irrigation pump segment globally.

Top 8 2 Horsepower Irrigation Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial, Irrigation, and Marine Pump Solutions

Domain Est. 1996 | Founded: 1957

Website: wilo.com

Key Highlights: Since 1957, Scot Pump has manufactured centrifugal pumps from our plant in Cedarburg, WI….

#2 Cornell Pump Company

Domain Est. 1997

Website: cornellpump.com

Key Highlights: Cornell Pump Company in Clackamas, Oregon, is a trusted manufacturer of high-quality pumps that have been designed in the USA, manufactured in the US with ……

#3 Pentair Simer 3420P 2 HP Thermoplastic Sprinkler System Pump

Domain Est. 1996

Website: pentair.com

Key Highlights: 2 HP Thermoplastic Sprinkler System Pump. With a combination of good flow and good pressure, these pumps are perfect for your in-ground sprinkler system….

#4 Zoeller Pump Company

Domain Est. 1999

Website: zoellerpumps.com

Key Highlights: Explore Zoeller Pumps for reliable and efficient pumping solutions. Find a wide range of quality pumps for residential and commercial applications….

#5 Flint & Walling

Domain Est. 2000

Website: flintandwalling.com

Key Highlights: Flint & Walling offers innovative water management solutions and high-quality pumps. Discover reliable products for residential and commercial applications….

#6 Franklin Water

Domain Est. 2009

Website: franklinwater.com

Key Highlights: Headquartered in Fort Wayne, Indiana, USA, Franklin Electric makes choosing the right products for your water system needs easy….

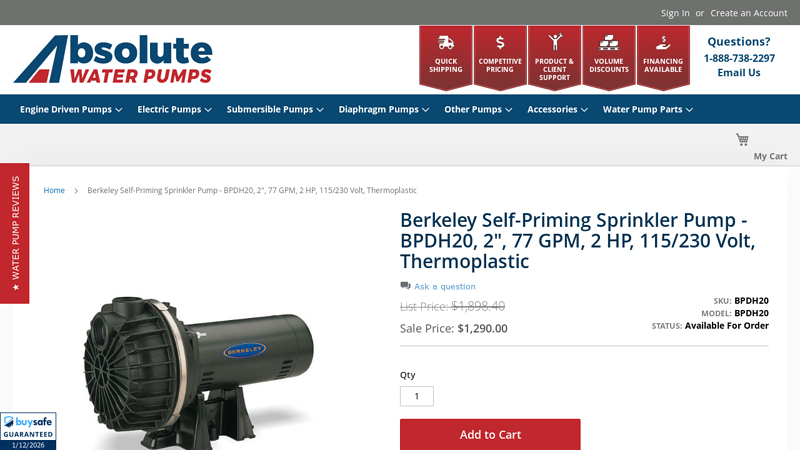

#7 Berkeley Self

Domain Est. 2012

Website: absolutewaterpumps.com

Key Highlights: Berkeley Self-Priming Sprinkler Pump – BPDH20, 2″, 77 GPM, 2 HP, 115/230 Volt, Thermoplastic ; Type. Self-Priming Pump ; GPM. 77.0 ; Power. Electric ; Compliance….

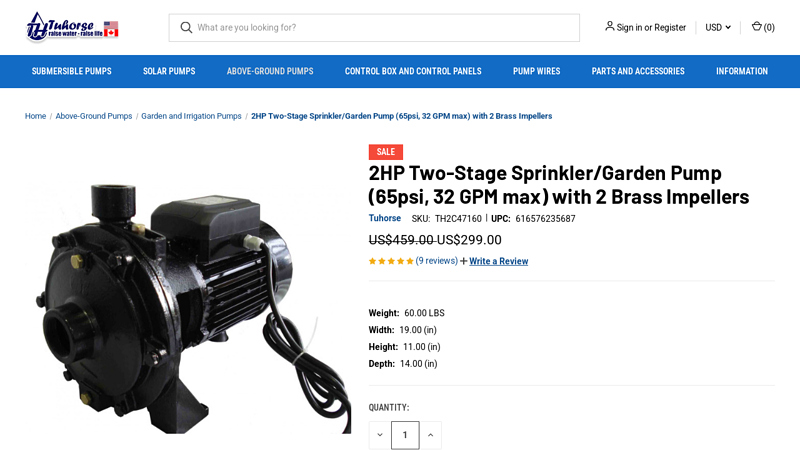

#8 Sprinkler Pumps

Domain Est. 2012

Expert Sourcing Insights for 2 Horsepower Irrigation Pump

Market Analysis: 2 Horsepower Irrigation Pumps (2026 Outlook)

H2: Key 2026 Market Drivers Shaping the 2 HP Irrigation Pump Landscape

The market for 2 horsepower (HP) irrigation pumps in 2026 is poised for significant transformation, driven by a confluence of technological, environmental, economic, and policy factors. While remaining a staple for small to medium-scale farms and specific applications, its future is defined by adaptation to global challenges. Here are the primary drivers shaping the 2026 outlook:

-

Intensifying Focus on Water Scarcity & Efficiency:

- Driver: Climate change impacts (droughts, erratic rainfall) and growing water stress in key agricultural regions (e.g., parts of India, China, Middle East, Western US, Mediterranean) will make efficient water use paramount.

- Impact on 2 HP Pumps: Demand will shift decisively towards pumps integrated into high-efficiency irrigation systems (drip, micro-sprinkler). The 2 HP pump itself must be highly efficient (IE3/IE4 motors, optimized hydraulics). Smart controls enabling precise scheduling and monitoring (soil moisture sensors, weather data integration) will become standard expectations, even at this power level. Pumps solely for flood irrigation will lose favor.

-

Accelerating Adoption of Smart Farming & IoT:

- Driver: The broader AgTech revolution is making inroads into smaller operations. Farmers seek data-driven insights for optimization and cost reduction.

- Impact on 2 HP Pumps: “Dumb” pumps will become less competitive. The 2 HP segment will see a surge in IoT-enabled pumps offering:

- Remote monitoring (pump status, pressure, flow, energy consumption).

- Remote control/start-stop via smartphones/apps.

- Predictive maintenance alerts (vibration, temperature).

- Integration with farm management software (FMS).

- This enables better resource management and reduces labor costs.

-

Energy Cost Volatility & Sustainability Pressures:

- Driver: High and fluctuating electricity/fuel prices, coupled with corporate ESG (Environmental, Social, Governance) goals and government emissions targets, push for lower energy consumption and renewable integration.

- Impact on 2 HP Pumps:

- Solar Dominance: Solar-powered 2 HP pumps will experience explosive growth, especially in off-grid or grid-unreliable areas (Africa, South Asia, remote farms globally). Falling PV panel costs and improved pump controller efficiency make this highly attractive. Hybrid systems (solar + grid/generator) will also gain traction.

- Energy Efficiency: High-efficiency electric motors (IE4, PM motors) and variable speed drives (VSDs), allowing pumps to match output precisely to demand, will become premium features, reducing operational costs significantly.

- Diesel Phase-down: Diesel-powered 2 HP pumps will face increasing restrictions and higher operating costs (fuel, carbon taxes), leading to market contraction, especially in regions with strong environmental regulations.

-

Policy Support & Subsidies:

- Driver: Governments worldwide (e.g., India’s PM-KUSUM, various EU CAP measures, US initiatives) are actively subsidizing solar pumps and efficient irrigation technologies to promote water and energy conservation.

- Impact on 2 HP Pumps: These subsidies are a major catalyst, particularly for the solar 2 HP segment. They lower the upfront cost barrier, making advanced, efficient, and renewable-powered pumps accessible to small and marginal farmers who constitute a large portion of the 2 HP user base. Policy stability will be crucial for sustained growth.

-

Consolidation in Agriculture & Rising Input Costs:

- Driver: Farm consolidation (larger operations) and persistently high input costs (fuel, fertilizer, labor) pressure farmers to maximize yields and minimize waste.

- Impact on 2 HP Pumps: While larger farms might use bigger pumps, the 2 HP segment remains vital for orchards, vineyards, greenhouses, and specialized crops within larger farms, or for smaller independent farmers who survive by optimizing efficiency. The pump’s role evolves from simple water lifting to a precision input delivery tool, requiring higher reliability and data capabilities to justify its cost.

-

Supply Chain Resilience & Localization:

- Driver: Recent global disruptions highlight the need for resilient supply chains. Geopolitical tensions and “friendshoring” trends encourage regional manufacturing.

- Impact on 2 HP Pumps: Expect increased regional manufacturing hubs (e.g., India, Southeast Asia, potentially Africa) for components and assembly, reducing lead times and import dependencies. This could benefit local brands but also put pressure on global brands to establish local production or partnerships.

H2: Emerging Challenges and Competitive Dynamics

While opportunities abound, the 2026 market presents hurdles:

- Higher Upfront Costs: Solar, IoT, and VSD-equipped 2 HP pumps have significantly higher initial costs than basic models, despite long-term savings. Financing solutions will be critical.

- Technology Complexity & Support: Smart and solar pumps require more technical knowledge for installation, operation, and maintenance. A shortage of skilled technicians, especially in rural areas, is a barrier. Robust after-sales service and training are essential.

- Battery Cost & Lifespan (for Solar): For off-grid solar systems requiring batteries, battery cost and limited lifespan (3-7 years) remain a significant cost factor and maintenance burden. Direct-drive (pump only when sun shines) systems are simpler but less flexible.

- Intense Competition & Price Pressure: The market, especially for standard electric pumps, will be highly competitive. Low-cost manufacturers (particularly from Asia) will pressure margins, forcing innovation and differentiation (e.g., superior efficiency, durability, smart features, solar integration) to command premium prices.

- Data Security & Interoperability: As IoT adoption grows, concerns about data privacy, security, and the lack of standardization between different brands’ systems will emerge as challenges.

Conclusion for 2026:

The 2 HP irrigation pump market in 2026 will be far more sophisticated and sustainable than today. Survival and success will hinge on embracing key trends: transitioning to solar power, integrating IoT and smart controls, achieving ultra-high efficiency, and supporting precision irrigation. While basic models will persist, the growth and value will be concentrated in the efficient, smart, and renewable-powered segments, driven by environmental necessity, economic pressures, and supportive government policies. Manufacturers who innovate in these areas and address the challenges of cost, complexity, and service will lead the market.

H2: Common Pitfalls When Sourcing a 2 Horsepower Irrigation Pump (Quality and Intellectual Property)

Sourcing a 2 horsepower (HP) irrigation pump, especially from international or non-branded suppliers, can expose buyers to several critical pitfalls related to quality assurance and intellectual property (IP) concerns. Understanding these risks is essential for ensuring long-term performance, reliability, and legal compliance.

1. Compromised Quality Due to Substandard Components

- Use of Inferior Materials: Many low-cost pumps use subpar materials such as low-grade cast iron, plastic impellers, or thin motor windings, leading to premature failure under continuous agricultural use.

- Inaccurate Power Ratings: Some suppliers falsely advertise pumps as “2 HP” when the actual motor output is significantly lower (e.g., 1.5 HP or less). This results in reduced water flow and pressure, undermining irrigation efficiency.

- Poor Sealing and Motor Insulation: Inadequate IP (Ingress Protection) ratings—often not clearly disclosed—can lead to water or dust ingress, causing motor burnout, especially in wet or dusty farm environments.

2. Misleading or Missing IP (Ingress Protection) Ratings

- False IP Claims: Suppliers may claim an IP68 rating (dust-tight and submersible) without certification. In reality, many pumps fail at IP54 (splash-resistant), making them unsuitable for harsh outdoor conditions.

- Lack of Standard Compliance: Reputable irrigation pumps should comply with international standards like IEC 60034 or ISO 2858. Counterfeit or unbranded units often lack third-party testing or certification, increasing the risk of electrical hazards or mechanical failure.

3. Intellectual Property (IP) Infringement

- Counterfeit or Copycat Designs: Many low-cost pumps mimic the appearance and branding of well-known manufacturers (e.g., Grundfos, KSB, or Shakti). These knockoffs infringe on patents, trademarks, and design rights, exposing buyers to legal risks—especially in regulated markets.

- Voided Warranties and Limited Support: Purchasing IP-infringing products often means no access to genuine spare parts, technical support, or manufacturer warranties. This leads to higher total cost of ownership due to downtime and replacement costs.

- Customs Seizures: In regions with strict IP enforcement (e.g., EU, USA), importing counterfeit pumps can result in shipment seizures, fines, or legal action against the importer.

4. Inadequate Documentation and Traceability

- Missing Technical Data: Poor-quality suppliers often provide incomplete or falsified performance curves, efficiency ratings, or material specifications, making it difficult to verify suitability for specific irrigation needs.

- No Serial Numbers or Authenticity Verification: Legitimate equipment includes traceable serial numbers and anti-counterfeit features. Their absence is a red flag for IP issues and quality control lapses.

5. Short-Term Savings, Long-Term Costs

- While low-cost 2 HP pumps may appear economical upfront, frequent breakdowns, high energy consumption (due to inefficiency), and replacement costs often outweigh initial savings.

- Downtime during peak irrigation periods can lead to crop loss, further amplifying financial impact.

Recommendations to Avoid Pitfalls:

– Source from authorized distributors or OEMs with verifiable quality certifications (ISO, CE, IP ratings tested by accredited labs).

– Request performance test reports and validate HP and flow rate claims.

– Verify brand authenticity and ensure no IP violations through trademark and patent checks.

– Insist on clear documentation, warranty terms, and after-sales support.

By prioritizing quality and IP integrity, buyers ensure reliable, efficient, and legally compliant irrigation systems that support sustainable agricultural operations.

H2: Logistics & Compliance Guide for 2 Horsepower Irrigation Pump

Product Overview

A 2 horsepower (HP) irrigation pump is a mechanical device used in agricultural and landscaping applications to transfer water from a source (such as a well, river, or reservoir) to fields or irrigation systems. These pumps are typically powered by electricity, diesel, or gasoline and are designed for durability and efficient water delivery.

H2: Logistics Planning

1. Packaging Requirements

- Standard Packaging: Pumps should be shipped in robust, moisture-resistant cardboard or wooden crates to prevent damage during transit.

- Internal Protection: Use foam inserts, bubble wrap, or palletized strapping to secure the pump and prevent internal movement.

- Labeling: Clearly label each package with:

- Product name: “2 HP Irrigation Pump”

- Weight and dimensions

- Handling symbols (e.g., “This Side Up”, “Fragile”)

- SKU or model number

2. Weight & Dimensions

- Typical weight: 25–40 kg (55–88 lbs), depending on motor type and construction material (cast iron, stainless steel, etc.)

- Approximate dimensions: 40 cm x 30 cm x 30 cm (L x W x H)

- Confirm exact specs with manufacturer datasheet for accurate freight calculation.

3. Transportation Modes

- Road Freight (Primary): Ideal for domestic or regional distribution. Use enclosed trucks to protect from weather.

- Sea Freight (International): Containerized shipping (FCL or LCL). Ensure compliance with maritime hazardous materials regulations if shipping fuel-powered units.

- Air Freight: Suitable for urgent deliveries; higher cost, best for lightweight electric models.

4. Storage Conditions

- Store in dry, ventilated, indoor areas.

- Avoid direct exposure to rain, humidity, or extreme temperatures.

- Elevate pallets off the floor to prevent moisture absorption.

5. Inventory Management

- Track stock using a barcode/QR code system.

- Implement FIFO (First In, First Out) rotation, especially for units with rubber seals or hoses that may degrade over time.

H2: Compliance & Regulatory Requirements

1. International Trade Compliance

- HS Code: Typically 8413.70 (Pumps for liquids, centrifugal) – confirm with local customs authority.

- Import Duties & Taxes: Varies by country; consult local tariff schedules.

- Documentation:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Product Compliance Certificates (e.g., CE, UL, ISO)

2. Product Safety & Certification

- Electric Models:

- Must comply with electrical safety standards (e.g., IEC 60335, UL 507).

- CE marking (for EU), UKCA (UK), or ETL listing (North America) required.

- Fuel-Powered Models:

- EPA and CARB compliance (U.S. emissions standards).

- Noise emission standards (EU Directive 2000/14/EC).

- General:

- ISO 9001 (Quality Management) recommended for manufacturing.

- ISO 14001 (Environmental Management) for sustainable operations.

3. Environmental & Disposal Regulations

- Oil & Fuel Handling: Fuel-powered pumps must include instructions for proper maintenance and disposal of engine oil.

- End-of-Life Management: Comply with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- RoHS Compliance: Restriction of Hazardous Substances (Pb, Hg, Cd, etc.) in electrical components.

4. Labeling & User Documentation

- Include multilingual instruction manuals.

- Safety warnings (e.g., electrical shock, moving parts, hot surfaces).

- Energy efficiency ratings where applicable (e.g., EU Energy Label for electric pumps).

5. Country-Specific Requirements

- United States: NEMA standards for motors; EPA certification for fuel engines.

- European Union: CE marking, EMC Directive, Low Voltage Directive.

- India: BIS (Bureau of Indian Standards) certification may be required.

- Australia/NZ: Complies with AS/NZS 60335.2.41 for water pumps.

H2: Best Practices

- Pre-Shipment Inspection: Conduct quality and compliance checks before dispatch.

- Carrier Vetting: Use logistics partners experienced in handling industrial equipment.

- Insurance: Obtain freight insurance covering damage, loss, and delays.

- Customer Training: Provide installation and maintenance guidance to ensure safe and compliant use.

By adhering to this logistics and compliance guide, suppliers and distributors can ensure the safe, timely, and legal delivery of 2 HP irrigation pumps across domestic and international markets.

Conclusion for Sourcing a 2 Horsepower Irrigation Pump

After careful evaluation of technical specifications, performance requirements, cost considerations, and supplier reliability, sourcing a 2 horsepower irrigation pump is a practical and efficient solution for medium to large-scale agricultural applications. This pump size offers an optimal balance between water delivery capacity and energy consumption, ensuring adequate flow rates and pressure for most field irrigation systems, including drip, sprinkler, and sprinkler-gun setups.

Key factors considered—such as pump type (centrifugal vs. submersible), material durability, energy efficiency, and compatibility with local water sources (e.g., wells, rivers, or reservoirs)—confirm that a 2 HP pump meets the operational demands of most farming setups. Additionally, availability of both electric and diesel-powered models allows flexibility depending on power source accessibility in remote areas.

Sourcing from reputable suppliers with established service networks ensures long-term reliability, warranty support, and access to spare parts. Prioritizing energy-efficient models can also lead to lower operational costs and environmental impact over time.

In conclusion, a 2 horsepower irrigation pump represents a cost-effective, reliable, and scalable investment that enhances agricultural productivity and water management. With proper installation and maintenance, it will serve as a vital component in ensuring consistent crop yields and efficient water use.