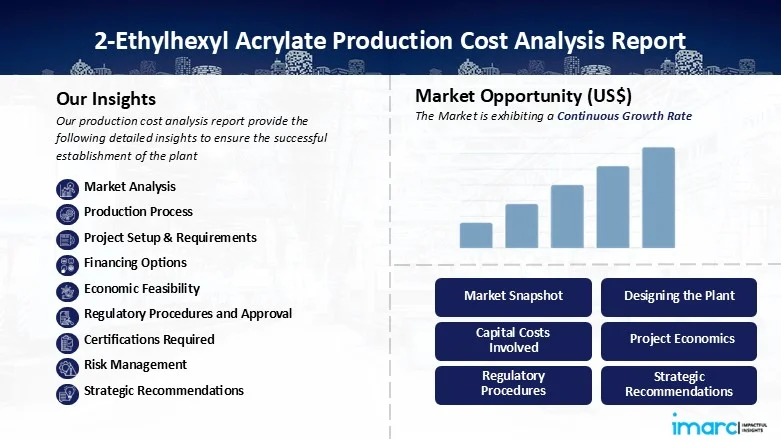

The global 2-ethylhexyl acrylate (2-EHA) market is experiencing steady growth, driven by rising demand in polymer and adhesive applications across industries such as coatings, construction, and automotive. According to Grand View Research, the global acrylate esters market—of which 2-EHA is a key derivative—is projected to expand at a CAGR of 4.5% from 2023 to 2030, fueled by increasing adoption of waterborne and radiation-curable coatings. Additionally, Mordor Intelligence forecasts a CAGR of approximately 4.8% for the acrylates market through 2028, underpinned by industrial expansion in Asia-Pacific and growing use in pressure-sensitive adhesives and plasticizers. As demand intensifies, a select group of manufacturers have emerged as leading producers of high-purity 2-ethylhexyl acrylate, combining scale, innovation, and regional reach to capture significant market share. Below are the top six 2-EHA manufacturers shaping the industry’s landscape.

Top 6 2 Ethylhexyl Acrylate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 2-Ethylhexyl Acrylate (2-EHA)

Domain Est. 1992

Website: dow.com

Key Highlights: Benefits · Toughness, flexibility, durability, elasticity, clarity · Weather resistance, moisture resistance, chemical resistance · Good low temperature properties ……

#2 2

Domain Est. 1998

Website: bamm.net

Key Highlights: 2-Ethylhexyl acrylate (2EHA) is used in the production of coatings and inks, adhesives, sealants, plastics and elastomers. For more information about 2 ……

#3 2-ETHYLHEXYL ACRYLATE

Domain Est. 1997

Website: osha.gov

Key Highlights: 2-Ethylhexyl acrylate chemical identification, physical properties, monitoring methods used by OSHA. All sampling instructions above are recommended guidelines….

#4 2

Domain Est. 1999

Website: chempoint.com

Key Highlights: 2-Ethylhexyl Acrylate is commonly used in to manufacture polymers for acrylic adhesives and to lower the Tg of acrylic polymers. Get a Quote Today!…

#5 2

Domain Est. 1999

Website: gjchemical.com

Key Highlights: GJ Chemical offers 2-Ethylhexyl Acrylate 10 PPM – 20 PPM, CAS# 103-11-7. Available in various grades, packaging and quantities from LTL to Bulk….

#6 2

Domain Est. 2020

Website: barentz-na.com

Key Highlights: 2-Ethylhexyl acrylate (HA) is the ester of acrylic acid and 2-ethyl hexanol. It is used as a raw material to make adhesives, coatings, construction materials….

Expert Sourcing Insights for 2 Ethylhexyl Acrylate

H2: Market Trends for 2-Ethylhexyl Acrylate (2-EHA) in 2026

As of 2026, the global market for 2-Ethylhexyl Acrylate (2-EHA) is experiencing steady growth, driven by increasing demand across key end-use industries, technological advancements in polymer production, and evolving regional dynamics. The following analysis outlines the primary market trends shaping the 2-EHA sector in 2026:

-

Rising Demand in Pressure-Sensitive Adhesives (PSAs)

The largest application segment for 2-EHA continues to be pressure-sensitive adhesives, particularly in packaging, labeling, medical tapes, and consumer electronics. The growth of e-commerce and the consequent surge in packaging needs have amplified demand for high-performance, flexible adhesives—properties that 2-EHA-based polymers excel at due to their low glass transition temperature (Tg) and excellent tack. -

Expansion in Coatings and Paints

Waterborne and UV-curable coatings are gaining traction due to stringent environmental regulations, especially in North America and Europe. 2-EHA is a key monomer in acrylic emulsions used in eco-friendly architectural and industrial coatings. In 2026, manufacturers are increasingly formulating low-VOC (volatile organic compound) coatings using 2-EHA, supporting sustainability goals while maintaining performance. -

Growth in Asia-Pacific, Particularly China and India

Asia-Pacific remains the fastest-growing regional market for 2-EHA. China dominates both production and consumption, supported by its robust chemical manufacturing infrastructure. India is emerging as a key growth market due to expanding infrastructure, urbanization, and government initiatives promoting domestic manufacturing in electronics and automotive sectors—both significant consumers of 2-EHA-based materials. -

Integration with Renewable and Bio-Based Feedstocks

Although 2-EHA is currently derived from petrochemical sources, research into bio-based alternatives is accelerating. In 2026, several chemical companies are piloting processes to produce acrylates from renewable feedstocks, which could influence future supply chains. While commercial-scale bio-based 2-EHA is not yet mainstream, it represents a long-term trend toward circular economy principles. -

Supply Chain Resilience and Regionalization

Post-pandemic and geopolitical tensions have led to a reevaluation of global supply chains. In 2026, there is a noticeable trend toward regionalization of 2-EHA production, with companies investing in localized manufacturing facilities to reduce dependency on single-source suppliers and mitigate logistics risks, especially in North America and Southeast Asia. -

Price Volatility and Raw Material Constraints

2-EHA production relies on propylene and acrylic acid, both of which are subject to price fluctuations due to crude oil volatility and refining capacity. In 2026, moderate price increases in 2-EHA are observed due to tighter acrylic acid supply and increased feedstock costs, prompting formulators to optimize formulations and explore cost-effective substitutes where feasible—though 2-EHA’s unique properties limit substitution in high-performance applications. -

Innovation in Specialty Polymers

There is growing R&D investment in functionalized acrylates and hybrid polymer systems incorporating 2-EHA for advanced applications such as flexible electronics, wearable sensors, and biomedical devices. These niche but high-value markets are expected to gradually increase 2-EHA’s relevance beyond traditional industrial uses. -

Environmental and Regulatory Pressures

Regulatory scrutiny on chemical safety and environmental impact continues to influence the 2-EHA market. REACH (EU), TSCA (US), and China’s new chemical regulations require thorough risk assessments. However, 2-EHA is generally considered safe when handled properly, and industry compliance programs have improved handling, storage, and emission controls across the value chain.

Conclusion:

The 2-Ethylhexyl Acrylate market in 2026 is characterized by solid demand growth, regional shifts in production and consumption, and innovation in sustainable and high-performance applications. While challenges related to feedstock pricing and environmental compliance persist, the versatility and performance advantages of 2-EHA ensure its strategic importance in the global acrylate market. Companies that invest in sustainable production, supply chain resilience, and application-specific innovation are best positioned to capitalize on emerging opportunities.

H2: Common Pitfalls in Sourcing 2-Ethylhexyl Acrylate – Quality and Intellectual Property Concerns

Sourcing 2-Ethylhexyl Acrylate (2-EHA), a key monomer used in adhesives, coatings, and polymer synthesis, involves several critical risks, particularly related to quality consistency and intellectual property (IP) compliance. Being aware of these pitfalls ensures reliable supply, regulatory adherence, and protection against legal and operational disruptions.

1. Quality Variability and Purity Issues

- Inconsistent Monomer Purity: Low-grade 2-EHA may contain impurities such as residual acrylate, alcohols, or inhibitors (e.g., hydroquinone), which can affect polymerization efficiency and final product performance.

- Pitfall: Suppliers may not provide detailed Certificates of Analysis (CoA) or may use inconsistent testing methods.

-

Mitigation: Require standardized analytical reports (e.g., GC, NMR, inhibitor content) and conduct batch testing.

-

Inadequate Stabilization: 2-EHA is prone to premature polymerization if not properly inhibited.

- Pitfall: Some suppliers under-dose or omit stabilizers to cut costs, leading to gelation during storage or transport.

-

Mitigation: Verify stabilizer type and concentration (e.g., MEHQ at 200–400 ppm) and ensure temperature-controlled logistics.

-

Water and Moisture Content: High moisture levels can interfere with sensitive reactions (e.g., in UV-curable systems).

- Pitfall: Poor packaging or handling can introduce moisture, especially in humid climates.

- Mitigation: Specify moisture limits (<0.1%) and use sealed, nitrogen-blanketed containers.

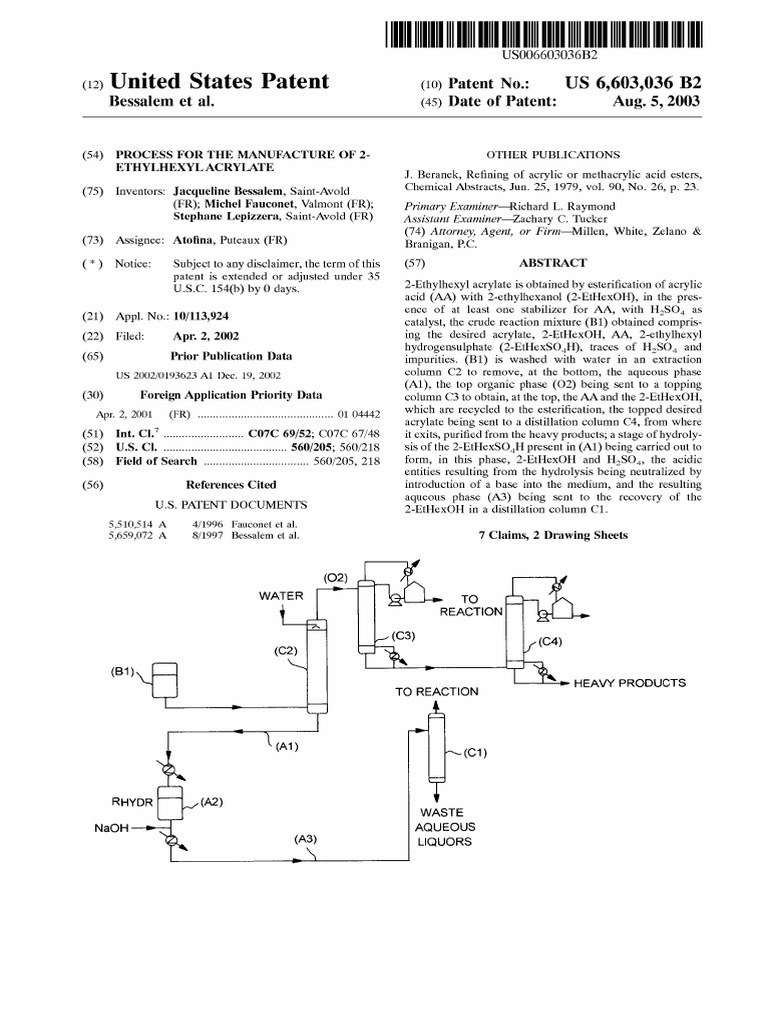

2. Intellectual Property (IP) Risks

- Patented Manufacturing Processes: Some 2-EHA production methods (e.g., catalytic esterification or novel purification techniques) are protected by patents.

- Pitfall: Sourcing from a supplier using an infringing process may expose the buyer to indirect liability or supply chain disruption if the supplier is sued.

-

Mitigation: Conduct due diligence on suppliers’ manufacturing claims and request assurances of IP compliance.

-

Formulation IP Infringement: If 2-EHA is used in a proprietary formulation (e.g., pressure-sensitive adhesives), sourcing from unauthorized or gray-market channels might violate licensing agreements.

- Pitfall: Offshore or unbranded suppliers may not respect regional distribution rights or end-use restrictions.

-

Mitigation: Source through authorized distributors and include IP warranties in supply contracts.

-

Trade Secret Exposure: Working with multiple or unfamiliar suppliers increases the risk of unintentional disclosure of downstream application details.

- Pitfall: Suppliers may reverse-engineer formulations based on volume, purity demands, or technical queries.

- Mitigation: Limit technical disclosure and use non-disclosure agreements (NDAs).

3. Supply Chain Transparency and Regulatory Compliance

- Lack of Traceability: Some suppliers, especially in less-regulated regions, may not provide full material traceability.

- Pitfall: Risk of sourcing materials produced with banned catalysts or under unsafe conditions.

-

Mitigation: Require ISO 9001/14001 certification and audit rights.

-

REACH, TSCA, and Other Regulatory Gaps: Non-compliant 2-EHA may lack proper registration or contain restricted substances.

- Pitfall: Import delays or product recalls due to non-compliance.

- Mitigation: Confirm regulatory status in target markets and request full compliance documentation.

Conclusion

To avoid quality and IP pitfalls when sourcing 2-Ethylhexyl Acrylate, prioritize transparency, technical specifications, and legal safeguards. Engage only with reputable suppliers who provide full analytical data, adhere to international standards, and respect intellectual property rights. Implementing rigorous qualification and monitoring processes reduces risk and ensures consistent performance in end applications.

Logistics & Compliance Guide for 2-Ethylhexyl Acrylate (CAS No. 103-11-7)

Classification: Hazard Class 2 (H2) — Flammable Liquids

1. Product Overview

- Chemical Name: 2-Ethylhexyl Acrylate (2-EHA)

- CAS Number: 103-11-7

- UN Number: UN 3082

- Hazard Class: 3 (Flammable Liquid), PG II

(Note: H2 typically refers to hazard statement codes in GHS; however, under transportation regulations, Class 3 is the correct classification. If “H2” was intended as a reference to flammability, it aligns with Class 3 in transport.) - GHS Hazard Statements (H-Statements):

- H225: Highly flammable liquid and vapor.

- H315: Causes skin irritation.

- H317: May cause an allergic skin reaction.

- H319: Causes serious eye irritation.

- H335: May cause respiratory irritation.

- H361: Suspected of damaging fertility or the unborn child.

- H410: Very toxic to aquatic life with long-lasting effects.

2. Transportation Classification

- UN Number: UN 3082

- Proper Shipping Name: 2-Ethylhexyl acrylate

- Transport Hazard Class: 3 (Flammable Liquid)

- Packing Group: II (Medium hazard)

- Labels Required:

- Flammable Liquid (Class 3)

- Environmentally Hazardous Substance (Aquatic Pollutant – Class 9 mark may also be required depending on formulation)

3. Packaging Requirements

- Must be packaged in UN-approved containers rated for Packing Group II.

- Drums, jerricans, or intermediate bulk containers (IBCs) must meet:

- Leak-proof

- Pressure-resistant

- Compatible with acrylates (e.g., HDPE, stainless steel)

- Inhibitor (e.g., Hydroquinone Monomethyl Ether – MEHQ) must be present to prevent polymerization during transport.

- Packaging must be tightly closed and secured against vapor leakage.

4. Storage Guidelines

- Storage Temperature: Store below 25°C (77°F), away from heat, sparks, and open flames.

- Ventilation: Store in a cool, well-ventilated area.

- Segregation: Keep away from oxidizers, strong bases, amines, and other reactive chemicals.

- Containers: Keep container tightly closed and grounded to prevent static discharge.

- Inhibitor Check: Confirm inhibitor levels before storage and periodically during long-term storage.

5. Handling Precautions

- Use only in well-ventilated areas or under fume hoods.

- Avoid contact with skin, eyes, and clothing.

- Prohibit eating, drinking, or smoking in handling areas.

- Use explosion-proof equipment and grounding/bonding during transfer.

- Prevent release to the environment.

6. Personal Protective Equipment (PPE)

- Eye Protection: Chemical splash goggles or face shield.

- Skin Protection: Nitrile or neoprene gloves, chemical-resistant apron, and clothing.

- Respiratory Protection: Use NIOSH-approved respirator with organic vapor cartridge if vapor concentration exceeds exposure limits.

- Footwear: Chemical-resistant boots.

7. Regulatory Compliance (Globally Aligned)

- GHS: Fully classified under GHS Rev. 9+ (ensure SDS reflects current version).

- OSHA (USA): Compliant with HCS 2012; listed under permissible exposure limits (PELs) — monitor acrylate exposure.

- REACH (EU): Registered substance; SVHC candidate listing due to reproductive toxicity.

- TSCA (USA): Listed and regulated.

- EPCRA (USA): Reportable under SARA Title III if stored above threshold quantities.

- IMO/IMDG Code: Compliant for maritime shipping (Class 3, PG II).

- IATA/ICAO: Allowed for air transport with restrictions (Class 3, PG II, inhibitor required).

- ADR/RID (Europe): Permitted for road/rail under Class 3 regulations.

8. Environmental & Emergency Response

- Spill Response:

- Eliminate ignition sources.

- Contain spill with inert absorbents (vermiculite, sand).

- Do not allow entry into drains or waterways.

- Collect spillage and dispose of as hazardous waste.

- Fire Fighting:

- Use alcohol-resistant foam, dry chemical, or CO₂.

- Water may be ineffective but can be used to cool containers.

- Wear full protective gear and SCBA.

- Environmental Precautions:

- H410: Very toxic to aquatic life — avoid release.

- Report spills to local environmental authorities if >1 kg released.

9. Waste Disposal

- Dispose of in accordance with local, national, and international regulations.

- Treat as hazardous waste due to flammability and toxicity.

- Incineration in approved facilities with emission controls.

10. Documentation Requirements

- Safety Data Sheet (SDS): Must be provided (GHS-compliant, Section 14 updated for transport details).

- Transport Documents: Include:

- Proper shipping name

- UN number

- Class and packing group

- Tunnel code (D/E)

- Emergency contact

- Labels and Markings:

- Class 3 Flammable Liquid label

- Environmentally Hazardous Substance mark (fish and tree symbol)

- Orientation arrows on packages >4L

11. Special Notes

- Polymerization Risk: 2-EHA can self-polymerize if inhibitor degrades or is absent. Monitor inhibitor levels, especially after prolonged storage.

- In Transit: Temperature control advised; avoid direct sunlight.

- Training: Personnel must be trained in hazardous material handling, emergency procedures, and regulatory compliance (e.g., DOT, ADR, IATA).

Disclaimer: Always consult the most current SDS, local regulations, and competent authorities before transport, storage, or use. Regulations may vary by country and mode of transport.

Prepared by: [Your Company Name] – EHS & Logistics Team

Revision Date: April 2025

Reference Standards: GHS, UN Recommendations, IMDG Code, ADR, IATA DGR, OSHA, REACH

Conclusion for Sourcing 2-Ethylhexyl Acrylate:

Sourcing 2-ethylhexyl acrylate (2-EHA) requires a strategic approach that balances quality, cost, supply chain reliability, and regulatory compliance. As a key monomer used in adhesives, coatings, sealants, and specialty polymers, ensuring a consistent supply of high-purity 2-EHA is critical for maintaining product performance and production efficiency.

After evaluating potential suppliers, key considerations include production capacity, adherence to international quality standards (such as ISO certifications), logistical capabilities, and technical support. Additionally, engaging with suppliers who demonstrate strong environmental, health, and safety practices is essential due to the chemical’s classification as a hazardous and potentially sensitizing substance.

Establishing long-term agreements with reputable suppliers—preferably those with global reach and proven track records—can mitigate supply disruptions and provide stability in pricing. Furthermore, diversifying the supplier base may reduce dependency risks and enhance negotiation leverage.

In conclusion, successful sourcing of 2-ethylhexyl acrylate hinges on a comprehensive supplier evaluation process, proactive risk management, and ongoing collaboration to ensure a secure, safe, and cost-effective supply chain. Regular market monitoring and relationship management will further support resilience and adaptability in a dynamic chemical market landscape.