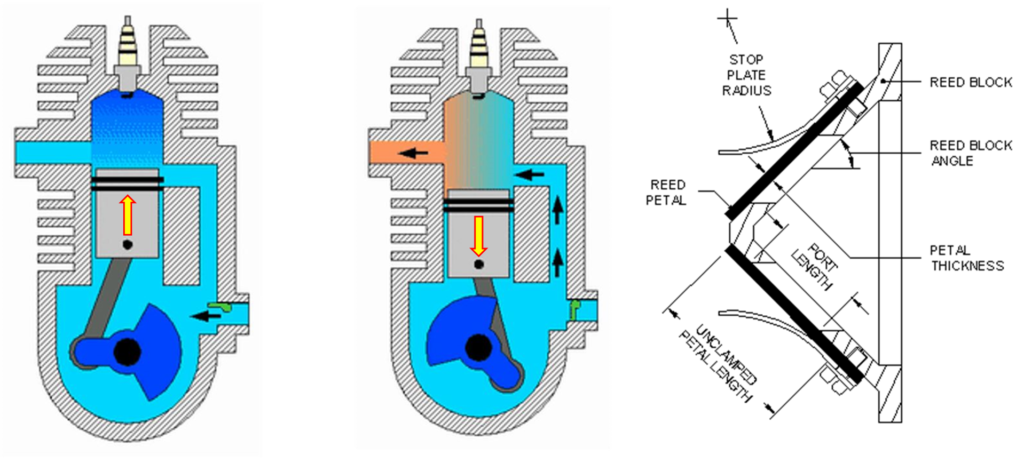

The global small engine components market, driven by increasing demand in outdoor power equipment, two-wheelers, and marine applications, is experiencing steady growth, with the 2-cycle engine segment maintaining a strong presence in developing economies and niche industrial applications. According to a 2023 report by Mordor Intelligence, the global small engine market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, fueled by rising demand for handheld power tools, agricultural machinery, and recreational vehicles—many of which rely on efficient 2-cycle engine systems. A critical component influencing the performance and reliability of these engines is the reed valve, responsible for regulating air-fuel intake and optimizing power output. As manufacturers prioritize efficiency, durability, and emission compliance, the demand for high-performance reed valves has intensified. This growing market landscape underscores the importance of identifying leading reed valve manufacturers that combine innovative design, precision manufacturing, and material science expertise. Below, we spotlight the top six manufacturers shaping the 2-cycle engine reed valve industry through technological advancement and global supply chain integration.

Top 6 2 Cycle Engine Reed Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Boyesen Factory Racing Dirt Bike Parts

Domain Est. 1995

Website: boyesen.com

Key Highlights: OEM REPLACMENT REEDS FOR YOUR 2 STROKE GOLD KART. Boyesen’s line of OEM Replacement Reeds feature our Superstock Fiber which adds performance and overall ……

#2 Moto Tassinari

Domain Est. 1999

Website: mototassinari.com

Key Highlights: The unique design of the Moto Tassinari VForce reed valve system features twice the reed-tip surface of a conventional reed valve….

#3 100cc Reed Valve for V2 80/100cc Engine

Domain Est. 2007

Website: bikeberry.com

Key Highlights: In stock $12.95 deliveryThe Reed Valve is designed to optimize the performance of your 80/100cc engine. Installation is simple: just replace your existing intake manifold with the …

#4 3D printed reed valve for racing motorbike two

Domain Est. 2015

Website: crp-group.com

Key Highlights: The reed valve function is to regulate the fresh gas intake in the crankcase and/or combustion chamber of a 2 stroke engine. The reed valve is therefore a ……

#5 ADIGE® reed valves

Website: adige.eu

Key Highlights: ADIGE® reed valves are available for the most common 2-stroke engines in a standard version or in the following racing versions: “Air Bag” and “Power-Reed Valve ……

#6 Reed valves for two

Website: highpowermedia.com

Key Highlights: The reed valve – sometimes called a leaf valve – is a profiled flat component that sits across an aperture in its closed position….

Expert Sourcing Insights for 2 Cycle Engine Reed Valve

2026 Market Trends for 2-Cycle Engine Reed Valves

The 2-cycle engine reed valve market, while operating within a mature and gradually declining broader engine segment, is poised for nuanced evolution by 2026. Driven by specific high-performance, niche applications, and technological refinement, the market will likely experience modest shifts rather than explosive growth. Key trends shaping the landscape include:

1. Persistent Demand in High-Performance & Niche Applications: Despite the overall decline of 2-cycle engines in mainstream transportation due to emissions regulations, demand for reed valves will remain robust in specific sectors. High-performance applications like motocross, enduro, and off-road motorcycles, as well as specialized uses in chainsaws, leaf blowers, string trimmers, marine outboards (particularly in developing regions), and auxiliary power units (APUs) for racing/drones, will continue to rely on advanced 2-cycle engines. These segments prioritize power-to-weight ratio and simplicity, where reed valves play a critical role in efficiency and throttle response. This sustained demand in performance niches will underpin the market.

2. Material Science Advancements Driving Performance & Durability: The primary technological trend will be the continued development and adoption of advanced composite materials beyond traditional fiberglass-impregnated plastics. By 2026, expect wider use of:

* High-Performance Polymers (e.g., PEEK, PI): Offering superior heat resistance, fatigue life, and dimensional stability, crucial for high-RPM engines.

* Advanced Composites (e.g., Carbon Fiber Reinforced Polymers): Providing exceptional stiffness-to-weight ratios, enabling thinner, faster-reacting reeds for improved high-end power.

* Nanocomposites: Potential integration for enhanced wear resistance and thermal management.

These materials will allow for lighter, more responsive, and longer-lasting reed valves, catering to the performance demands of the core market segments.

3. Precision Engineering and Customization for Optimization: As competition intensifies in performance markets, engine tuners and OEMs will increasingly demand highly customized reed valve configurations. Trends include:

* Laser-Cut Precision: Ensuring exact reed petal profiles and thickness gradients for optimal airflow and flutter characteristics.

* Tunable Reed Stacks: Offering kits with varying reed thicknesses, materials, and petal geometries allowing fine-tuning for specific engine setups, fuel types (including bio-fuels), and riding/operating conditions.

* Integrated Reed Block Designs: Optimizing port shapes, reed cage rigidity, and airflow paths within the manifold to maximize the efficiency gains from advanced reeds.

This shift towards bespoke solutions will differentiate suppliers and add value beyond commodity components.

4. Sustainability Pressures and Regulatory Influence: While less direct than for the engine itself, sustainability will influence the reed valve sector:

* Material Sourcing: Increased focus on recyclable polymers and sustainable manufacturing processes for reed valve production.

* End-of-Life: Potential for take-back schemes or improved recyclability of composite reed assemblies.

* Regulatory Indirect Impact: Stricter emissions standards (like EU Stage V, US EPA Tier 4) continue to shrink the overall 2-cycle market, particularly in non-road equipment, limiting the total available market size for reed valves. However, within the remaining compliant engines, reed valve efficiency becomes even more critical for meeting emissions targets.

5. Consolidation and Specialization Among Suppliers: The market is likely to see further consolidation among manufacturers. Larger players with R&D capabilities in advanced materials and precision manufacturing will gain share. Simultaneously, specialized boutique manufacturers focusing exclusively on high-end performance reed valves for racing and tuning will maintain a strong presence, leveraging expertise and direct relationships with performance enthusiasts and OEMs. Global supply chains will remain important, with significant manufacturing in Asia (notably China, Taiwan, Japan), but with increasing emphasis on quality control and IP protection.

6. Digitalization and Data-Driven Development: Leading manufacturers will increasingly utilize:

* Computational Fluid Dynamics (CFD): To simulate and optimize reed valve and reed block airflow dynamics virtually.

* Finite Element Analysis (FEA): For stress and fatigue life prediction of new reed materials and designs.

* Real-World Data: Gathering performance data from engine dynos and field testing to refine product offerings.

This data-driven approach accelerates innovation and reduces development time.

Conclusion for 2026: The 2-cycle engine reed valve market in 2026 will be characterized by stability within defined niches, driven by technological refinement rather than volume growth. Success will hinge on suppliers’ ability to innovate with advanced materials, offer precise customization for performance applications, navigate regulatory pressures, and leverage digital tools for development. While the total addressable market may be constrained by the broader shift away from 2-cycle engines, the demand for high-quality, high-performance reed valves in motocross, off-road, marine, and specialized equipment will ensure the segment remains relevant and technologically dynamic.

Common Pitfalls When Sourcing 2-Cycle Engine Reed Valves (Quality & IP)

Sourcing 2-cycle engine reed valves—critical components for efficient engine performance—can be fraught with challenges, especially concerning quality inconsistencies and intellectual property (IP) risks. Avoiding these pitfalls is essential for maintaining engine reliability, avoiding legal complications, and protecting brand reputation.

Poor Material Quality and Durability

One of the most frequent issues is receiving reed valves made from substandard materials. Low-quality reeds may use inferior fiberglass or carbon fiber composites that lack the necessary flexibility, tensile strength, or fatigue resistance. Such materials degrade quickly under high-frequency operation, leading to premature cracking, delamination, or failure. This results in reduced engine performance, increased fuel consumption, and potential engine damage.

Inconsistent Manufacturing Tolerances

Many suppliers—especially low-cost manufacturers—fail to maintain tight tolerances during production. Variations in reed petal thickness, curvature, or valve seat flatness can cause improper sealing or uneven airflow. These inconsistencies disrupt the engine’s intake cycle, reducing power output and increasing emissions. Without rigorous quality control, even seemingly identical reed valves can perform differently across batches.

Lack of Performance Testing and Validation

Reputable OEMs and performance engine builders rely on validated reed designs tested under real-world conditions. However, many third-party suppliers offer reed valves without any documented testing data. Sourcing untested components means assuming performance risk, as the reeds may not match the engine’s RPM range, airflow requirements, or durability expectations.

Counterfeit or IP-Infringing Components

A significant IP-related pitfall is the proliferation of counterfeit or reverse-engineered reed valves that copy patented designs from leading manufacturers (e.g., Boyesen, Moto Tassinari). These knock-offs often mimic branding, packaging, and design features without licensing. Purchasing such components exposes buyers to legal liability, especially in commercial applications or markets with strict IP enforcement. Furthermore, counterfeit valves often combine IP infringement with poor quality, compounding the risks.

Inadequate Documentation and Traceability

Many suppliers fail to provide material certifications, compliance statements, or traceable batch information. This lack of documentation makes it difficult to conduct root cause analysis in failure scenarios or meet regulatory requirements in certain industries (e.g., marine, professional racing). It also raises concerns about supply chain transparency and compliance with environmental or safety standards.

Overlooking Application-Specific Design Needs

Reed valves are highly application-specific, varying by engine displacement, RPM range, and intended use (e.g., racing vs. utility). A common mistake is sourcing generic “universal fit” reeds that compromise performance. These one-size-fits-all solutions often fail to optimize airflow dynamics, leading to inefficient combustion and reduced engine life.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source from reputable suppliers with verifiable quality certifications (ISO 9001, etc.).

– Request material specifications and performance test reports.

– Conduct sample testing before large-scale procurement.

– Perform IP due diligence to ensure components do not infringe on existing patents.

– Establish long-term partnerships with transparent, traceable manufacturers.

By proactively addressing quality and IP concerns, organizations can ensure reliable engine performance and protect themselves from legal and operational risks.

H2: Logistics & Compliance Guide for 2-Cycle Engine Reed Valves

This guide outlines the key logistics and compliance considerations for the international transportation, import, and export of 2-cycle engine reed valves.

H2: Classification & Regulatory Framework

- HS Code (Harmonized System): The most accurate classification is typically 8409.91.95 (Other parts suitable for use solely or principally with internal combustion piston engines, of the kind used for spark-ignition engines). Crucially, verify this with a licensed customs broker for your specific product configuration and destination country, as sub-codes can vary.

- ECCN (Export Control Classification Number – US): Generally falls under EAR99 (Items not specifically listed on the Commerce Control List). This indicates low-level export controls for most destinations. Always confirm via the BIS website or a qualified export compliance officer, especially if valves contain specific materials (e.g., certain alloys) or are destined for embargoed countries (e.g., Cuba, Iran, North Korea, Syria, Crimea region of Ukraine).

- ITAR (International Traffic in Arms Regulations): Reed valves are NOT controlled under ITAR (22 CFR Parts 120-130) as they are not specifically designed or modified for military aircraft, missiles, or weapons systems.

H2: Material & Environmental Compliance

- REACH (EU): Comply with Regulation (EC) No 1272/2008 (CLP) and Regulation (EC) No 1907/2006. Ensure:

- Registration of any substances manufactured/imported >1 tonne/year per legal entity in the EU (though reed valves themselves are articles, components might trigger obligations).

- Notification of Substances of Very High Concern (SVHCs) in articles if present above 0.1% weight by weight (w/w) and quantities exceed 1 tonne/year.

- Provide Safety Data Sheets (SDS) if requested by downstream users and the article contains an SVHC above the threshold.

- RoHS (EU & Similar Jurisdictions): Directive 2011/65/EU restricts specific hazardous substances (Lead, Mercury, Cadmium, Hexavalent Chromium, PBB, PBDE, and 4 Phthalates – DEHP, BBP, DBP, DIBP). Ensure reed valve materials (e.g., composite fibers, adhesives, metal components, coatings) comply. Obtain RoHS compliance certificates from suppliers.

- Proposition 65 (California, USA): If selling in California, evaluate if the reed valve contains any chemicals listed under Prop 65 (e.g., certain forms of lead, chromium) above safe harbor levels. If so, provide a “clear and reasonable” warning on the product or packaging.

- Conflict Minerals (Dodd-Frank Act Section 1502): If the reed valve contains Tin (Sn), Tantalum (Ta), Tungsten (W), or Gold (Au) (common in some metal components or platings), determine if these originate from the Democratic Republic of the Congo (DRC) or adjoining countries. File a Form SD with the SEC if necessary, detailing due diligence efforts.

- Packaging Waste: Comply with regulations like the EU Packaging Waste Directive (94/62/EC) or similar national schemes (e.g., Germany’s VerpackG). Minimize packaging, use recyclable materials, and potentially join a producer responsibility organization (PRO).

H2: Logistics & Transportation

- Packaging:

- Use robust packaging (corrugated cardboard, plastic clamshells) to prevent physical damage (bending, chipping) during transit.

- Employ anti-static packaging if components are sensitive.

- Clearly label packages with product description, quantity, HS code, country of origin, and handling instructions (e.g., “Fragile,” “Do Not Stack,” “This Side Up”).

- Documentation:

- Commercial Invoice: Detailed description (e.g., “Reed Valve Assembly for 2-Cycle Engine Model XYZ”), quantity, unit/total price, currency, Incoterms® 2020 (e.g., FOB, EXW, DDP), seller/buyer details, country of origin.

- Packing List: Itemizes contents per package, weights, dimensions, marks & numbers.

- Certificate of Origin: Required by many countries for tariff assessment and trade agreements. Can be a simple declaration or require a Chamber of Commerce stamp.

- Bill of Lading (B/L) or Air Waybill (AWB): Contract of carriage. Ensure correct details (HS code, description, weight, volume).

- Incoterms® 2020: Clearly define responsibilities (cost, risk, customs clearance) between buyer and seller (e.g., EXW – buyer handles all; FCA – seller delivers to carrier; DDP – seller handles all to destination).

- Transport Mode:

- Air Freight: Fastest, highest cost. Ideal for urgent shipments or high-value/low-weight orders. Subject to stricter weight/volume limits and handling.

- Ocean Freight (FCL/LCL): Most cost-effective for bulk shipments. FCL (Full Container Load) for large volumes; LCL (Less than Container Load) for smaller volumes. Longer transit times.

- Ground Freight: Used domestically or regionally (e.g., within North America, EU). Cost and speed vary significantly by distance and service level.

H2: Import/Export Procedures & Duties

- Importer of Record (IOR): Designate a legal entity responsible for ensuring compliance with customs regulations, paying duties/taxes, and providing necessary documentation in the destination country.

- Customs Clearance:

- Submit accurate documentation (Invoice, Packing List, B/L/AWB, CoO) to customs authorities.

- Pay applicable Import Duties (ad valorem or specific rates based on HS code and origin) and Value-Added Tax (VAT) or Goods and Services Tax (GST) (based on landed cost: product value + insurance + freight + duties).

- Potential Customs Bonds may be required.

- Free Trade Agreements (FTAs): If applicable (e.g., USMCA, EU-South Korea), provide a Certificate of Origin meeting FTA rules of origin to claim preferential (often 0%) duty rates. Verify product-specific rules.

- Import Restrictions/Permits: Generally, reed valves are not subject to specific import licenses or permits in most countries. Always verify with the destination country’s customs authority.

H2: Key Compliance & Risk Mitigation

- Accurate Classification: HS code and ECCN errors are primary risks. Invest in expert classification services.

- Supply Chain Due Diligence: Audit suppliers for RoHS, REACH SVHC, and Conflict Minerals compliance. Obtain valid certificates.

- Record Keeping: Maintain detailed records (invoices, CoOs, compliance certs, shipping docs) for the statutory period (often 5-7 years).

- Staying Updated: Regulations (REACH, RoHS, sanctions) change. Subscribe to updates from relevant authorities (e.g., BIS, ECHA, EU Commission, destination country customs).

- Partner with Experts: Utilize experienced freight forwarders, customs brokers, and legal/compliance consultants specializing in your target markets.

Disclaimer: This guide provides general information and does not constitute legal, tax, or customs advice. Regulations vary significantly by country and change frequently. Always consult with qualified professionals (customs brokers, export compliance officers, legal counsel) for specific transactions and jurisdictions.

In conclusion, sourcing a reed valve for a 2-cycle engine requires careful consideration of compatibility, quality, and reliability. It is essential to identify the specific engine make, model, and year to ensure the reed valve fits correctly and functions optimally. High-quality materials such as carbon fiber or fiberglass-reinforced polymers contribute to improved engine performance, durability, and responsiveness. Whether purchasing from OEM suppliers, reputable aftermarket brands, or specialized performance shops, verifying specifications and customer reviews helps minimize the risk of incorrect or substandard parts. Additionally, considering factors like cost, availability, and lead time ensures timely maintenance or repairs. Ultimately, investing time in sourcing the right reed valve enhances engine efficiency, prolongs component life, and supports consistent performance in demanding operating conditions.