The global diesel engine market is experiencing steady growth, driven by rising demand across industrial, marine, and power generation sectors. According to Mordor Intelligence, the diesel engine market was valued at USD 208.9 billion in 2023 and is projected to grow at a CAGR of over 4.6% from 2024 to 2029. This expansion is fueled by continued reliance on diesel-powered equipment in off-grid energy solutions, construction, agriculture, and transportation—especially in emerging economies. Amid this growth, 1Hz (low-speed) diesel engines remain critical for heavy-duty applications, particularly in marine propulsion and large-scale power plants, where efficiency and durability are paramount. These engines, operating at approximately 60–100 RPM, offer superior fuel efficiency and longer operational lifespans compared to their medium- and high-speed counterparts. As industries prioritize reliability and lifecycle cost savings, leading manufacturers are investing in cleaner, more efficient 1Hz engine technologies to meet evolving emissions standards and energy demands. Below are the top seven manufacturers shaping the 1Hz diesel engine landscape through innovation, global reach, and engineering excellence.

Top 7 1Hz Diesel Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 1HZ Engine,New Toyota 1HZ Engine For Land Cruiser Coaster

Domain Est. 2017

Website: toyotapartsco.com

Key Highlights: 100% Brand new Japanese Toyota Genuine Engine Complete. Made in Japan. Manufacturer: Toyota Motor Corporation. When we have this 1hz engine assy in stock, ……

#2 This Bulletproof Toyota Engine Is The Oldest One In Production

Domain Est. 1996

Website: hotcars.com

Key Highlights: The 1HZ is old-school in the best way. It’s a naturally aspirated, overhead-cam diesel that makes around 129 horsepower and 210 lb-ft of torque….

#3 Toyota Engines

Domain Est. 2005

Website: henningersdiesel.com

Key Highlights: Toyota’s 1HZ is a re-manufactured engine that looks and runs like new. Our rebuilt engines are for purchasers who don’t subscribe to: Why pay less, if you can ……

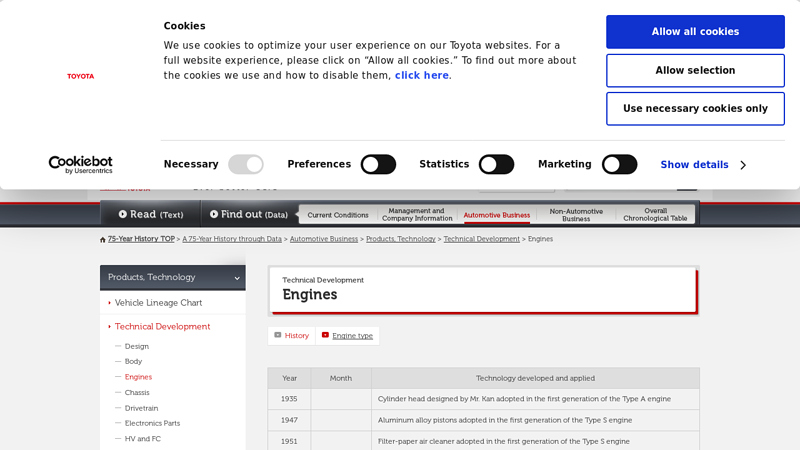

#4 75 Years of TOYOTA

Domain Est. 2006

Website: toyota-global.com

Key Highlights: 1HZ, in-line, 6-cylinder diesel engine developed. 1PZ, in-line, 5-cylinder diesel engine developed. 4A-FE, in-line, 4-cylinder lean-burn gasoline engine ……

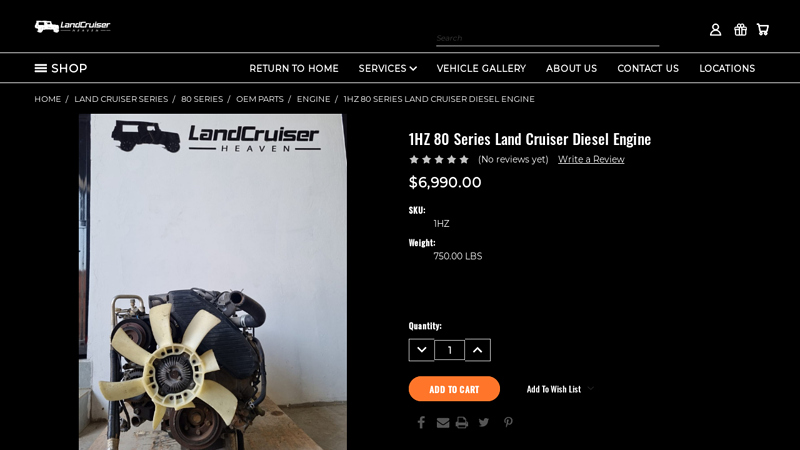

#5 1HZ 80 Series Land Cruiser Diesel Engine

Domain Est. 2015

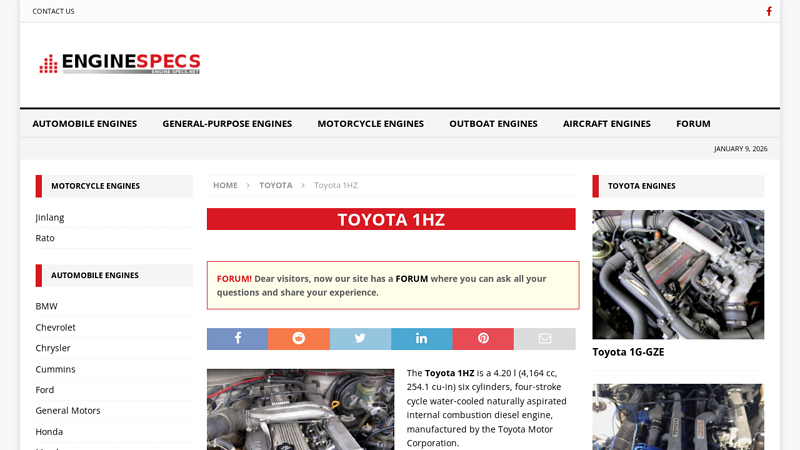

#6 Toyota 1HZ

Domain Est. 2015

Website: engine-specs.net

Key Highlights: The Toyota 1HZ is a 4.20 l (4,164 cc, 254.1 cu-in) six cylinders, four-stroke cycle water-cooled naturally aspirated internal combustion diesel engine, ……

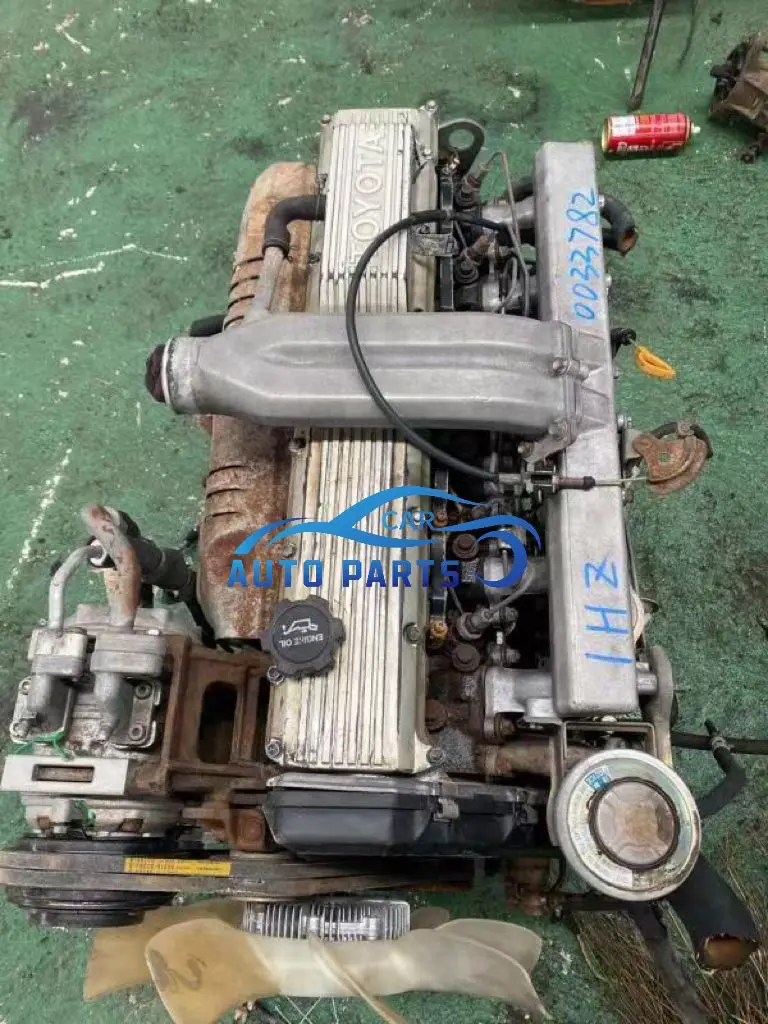

#7 Genuine Toyota 1HZ Diesel Engines For LandCruiser & More

Website: nunawadingtoyotaparts.com.au

Key Highlights: The 1HZ is a legendary 4.2-liter inline-six naturally aspirated diesel engine produced by Toyota. Renowned for its incredible durability and longevity….

Expert Sourcing Insights for 1Hz Diesel Engine

H2: 2026 Market Trends for 1Hz Diesel Engines – Niche Demand Amid Energy Transition

As of 2026, the market for diesel engines operating at 1Hz (equivalent to 60 RPM, a very low rotational speed) remains highly specialized and confined to specific industrial and marine applications. These engines are typically large, slow-speed two-stroke diesel engines used primarily in maritime propulsion and some stationary power generation systems. The trend in 2026 reflects a complex interplay between long-term infrastructure reliance, tightening environmental regulations, and the global shift toward decarbonization.

- Marine Sector Dominance with Regulatory Pressure

The primary application of 1Hz diesel engines is in large container ships, bulk carriers, and tankers, where slow-speed two-stroke engines provide high fuel efficiency and reliability over long voyages. In 2026, despite growing interest in alternative fuels (e.g., LNG, methanol, and ammonia), conventional heavy fuel oil (HFO) and marine diesel oil (MDO) engines—many operating at or near 1Hz—still dominate the global shipping fleet due to their proven durability and cost-effectiveness.

However, International Maritime Organization (IMO) 2030 and 2050 emissions targets are accelerating retrofitting initiatives and dual-fuel engine adoption. Many 1Hz engine manufacturers (e.g., MAN Energy Solutions, WinGD) have shifted focus to offering engines capable of running on green fuels while maintaining similar low-speed performance.

-

Declining Demand in Stationary Power Applications

Once used in remote or off-grid power generation, the deployment of 1Hz diesel engines in stationary applications has declined sharply by 2026. This is due to competition from renewable energy hybrids (solar + battery storage) and medium-speed engine alternatives that offer better scalability and lower maintenance. Diesel engines at this low frequency are less practical for grid support or load-following roles, limiting their relevance in modern energy systems. -

Technological Evolution: Efficiency and Emissions Control

OEMs have enhanced 1Hz diesel engines with advanced turbocharging, exhaust gas recirculation (EGR), and selective catalytic reduction (SCR) to meet Tier III NOx standards. Additionally, digital twin technology and predictive maintenance platforms are increasingly integrated to extend engine life and optimize fuel use—critical in an era of rising carbon pricing. -

Supply Chain and Manufacturing Shifts

Production of 1Hz engines remains concentrated in Europe and East Asia. However, rising steel and component costs—due to inflation and supply chain reconfigurations—have increased engine prices. Some shipbuilders are opting for slightly higher-speed engines with gearboxes to reduce capital expenditure, signaling a potential long-term decline in demand for ultra-slow-speed designs. -

Future Outlook

The 1Hz diesel engine market is expected to contract slowly through 2030 as the maritime industry adopts zero-carbon propulsion technologies. However, the long operational lifespan of existing vessels (30+ years) ensures continued demand for maintenance, spare parts, and retrofits. By 2026, the market is transitioning from growth to sustainability and compliance, with innovation focused on fuel flexibility rather than expansion of diesel-only platforms.

Conclusion:

In 2026, the 1Hz diesel engine occupies a shrinking but still vital niche in global shipping. While environmental and economic pressures are driving the sector toward decarbonization, the technical advantages of slow-speed operation ensure these engines remain relevant—especially in retrofitted, dual-fuel configurations. The future of the 1Hz diesel engine lies not in proliferation, but in adaptation to a low-carbon maritime economy.

H2: Common Pitfalls When Sourcing a 1Hz Diesel Engine (Quality and Intellectual Property Concerns)

Sourcing a 1Hz diesel engine—typically referring to low-frequency or specialized low-RPM diesel engines used in niche industrial, marine, or power generation applications—presents unique challenges. Buyers must be vigilant about both quality assurance and intellectual property (IP) risks, particularly when dealing with emerging markets or unverified suppliers. Below are the most common pitfalls:

1. Poor Build Quality and Substandard Materials

- Issue: Many low-cost suppliers, especially in regions with lax manufacturing oversight, use inferior materials (e.g., low-grade cast iron, subpar bearings) that compromise engine durability and efficiency.

- Risk: Premature wear, frequent breakdowns, and higher total cost of ownership.

- Mitigation: Require detailed material certifications (e.g., ISO 9001), conduct third-party factory audits, and insist on performance testing under load.

2. Misrepresentation of Technical Specifications

- Issue: Some suppliers falsify engine specs such as power output, fuel efficiency, emissions compliance, or actual operating frequency (e.g., claiming true 1Hz capability when the engine operates at higher RPM with gearing).

- Risk: Operational inefficiencies, non-compliance with project requirements, and integration failures.

- Mitigation: Request independent test reports, verify with OEM documentation, and conduct on-site performance validation.

3. Counterfeit or Clone Engines (IP Infringement)

- Issue: Certain manufacturers produce unlicensed clones of well-known engine designs (e.g., mimicking Caterpillar, MTU, or Cummins), violating patents and trademarks.

- Risk: Legal exposure, lack of warranty support, spare parts incompatibility, and potential seizure by customs authorities.

- Mitigation: Verify OEM authorization, conduct IP due diligence, and avoid suppliers offering “exact copies” at suspiciously low prices.

4. Lack of Traceability and Certification

- Issue: Engines may lack proper documentation (e.g., CE, EPA, IMO Tier certifications), making them unsuitable for regulated environments.

- Risk: Project delays, regulatory fines, or inability to commission the engine.

- Mitigation: Insist on full technical dossiers, certification copies, and serial number traceability.

5. Inadequate After-Sales Support and Spare Parts Access

- Issue: Cloned or non-OEM engines often have no established spare parts supply chain.

- Risk: Extended downtime and costly custom fabrication of components.

- Mitigation: Prioritize suppliers with global service networks or partnerships with recognized brands.

6. Hidden Design Limitations in “1Hz” Claim

- Issue: True 1Hz (60 RPM) diesel engines are rare. Many “1Hz” engines are standard engines with gearboxes, which introduce inefficiencies and failure points.

- Risk: Misalignment with application needs (e.g., direct-drive systems requiring true low-RPM torque).

- Mitigation: Clarify whether the engine is naturally low-RPM or gear-reduced; request torque-speed curves and mechanical schematics.

Conclusion

Sourcing a 1Hz diesel engine requires careful vetting to avoid quality defects and IP violations. Buyers should prioritize transparency, demand verifiable certifications, and consider partnering with established OEMs or authorized distributors—even at higher initial cost—to ensure reliability, compliance, and long-term operational success.

H2: Logistics & Compliance Guide for 1Hz Diesel Engine

The 1Hz Diesel Engine is a specialized low-frequency industrial power unit designed for continuous-duty applications such as marine propulsion, power generation, and heavy machinery. Due to its operational characteristics, size, and environmental impact, strict logistics and compliance protocols must be followed during import, export, transportation, installation, and operation. This guide outlines key regulatory requirements, shipping considerations, and compliance standards applicable globally and regionally.

1. Regulatory Compliance Overview

1.1 Emissions Standards

– The 1Hz Diesel Engine must comply with international emissions regulations:

– IMO Tier III (for marine applications): Required for engines operating in Emission Control Areas (ECAs). May necessitate Selective Catalytic Reduction (SCR) or Exhaust Gas Recirculation (EGR) systems.

– EPA Tier 4 Final (U.S.): Applies to non-road diesel engines. Requires ultra-low NOx and particulate matter (PM) emissions.

– EU Stage V (European Union): Applicable to engines used in non-road mobile machinery (NRMM).

– Documentation: Obtain and retain Engine International Air Pollution Prevention (EIAPP) Certificate and/or EPA Certificate of Conformity.

1.2 Noise Regulations

– Comply with ISO 3046-5 (Noise Measurement) and local noise ordinances.

– Marine: SOLAS Chapter II-1/Regulation 3-12 requires noise level certification.

– Land-based: Adhere to EU Directive 2000/14/EC or national equivalents.

1.3 Safety & Certification

– CE Marking (EU): Required for placement on the European market. Involves conformity with Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU.

– UL/CSA Certification (North America): For electrical systems and control panels.

– ATEX/IECEx (if used in explosive atmospheres): Required in oil & gas or mining environments.

2. Logistics & Transportation

2.1 Packaging & Handling

– Engine must be crated using ISPM 15-certified wooden materials or metal containers to prevent pest infestation.

– Desiccants and anti-corrosion VCI (Vapor Corrosion Inhibitor) papers must be used inside packaging.

– Secure lifting points must be clearly marked; use only certified slings and overhead cranes.

2.2 Mode of Transport

– Marine Freight:

– Use flat-rack or open-top containers if oversized.

– Declare engine weight and dimensions (LxWxH) for stowage planning.

– Ensure compliance with IMDG Code (for fuel residues or lubricants shipped with unit).

– Air Freight: Rare due to size/weight; only for emergency spare parts.

– Land Transport:

– Oversize load permits required if dimensions exceed local regulations (e.g., >8.5 ft width, >13.5 ft height in U.S.).

– Escort vehicles may be required.

2.3 Documentation

– Commercial Invoice

– Packing List

– Bill of Lading / Air Waybill

– Certificate of Origin

– EIAPP Certificate or EPA Certificate

– CE Declaration of Conformity

– Test Reports (Performance, Noise, Vibration)

– Risk Assessment and Safety Data Sheet (SDS) for residual fuels/lubricants

3. Import & Export Controls

3.1 Export Licenses

– Check if the 1Hz Diesel Engine is subject to export controls under:

– EAR (Export Administration Regulations, U.S.): Check ECCN (Export Control Classification Number). Likely under 8A001 (Marine propulsion systems) or 8805 (dual-use).

– Wassenaar Arrangement: Applies to dual-use engines with potential military applications.

– Non-U.S. equivalents: EU Dual-Use Regulation (Regulation (EU) 2021/821).

3.2 Import Requirements

– Customs Tariff Classification (HS Code):

– Typically under 8408.10 (Diesel engines for marine use) or 8408.90 (other compression-ignition engines).

– Duties & Taxes: Vary by country; check local tariff schedules.

– Local Type Approval: Required in countries like China (CCC), India (BIS), and Russia (EAC TR CU).

4. On-Site Installation & Commissioning

4.1 Site Preparation

– Ensure foundation meets vibration and load-bearing requirements per ISO 8528-9.

– Provide adequate ventilation and exhaust routing.

– Comply with NFPA 30 (flammable liquids) and OSHA 1910 (workplace safety).

4.2 Commissioning Compliance

– Conduct performance testing per ISO 3046-1.

– Verify emissions using calibrated analyzers; document results.

– Submit compliance reports to local environmental agencies if required (e.g., CARB in California).

5. Maintenance & Ongoing Compliance

- Maintain engine logbooks recording:

- Operating hours

- Emissions test results

- Maintenance activities

- SCR fluid (AdBlue) usage (if applicable)

- Schedule periodic inspections per manufacturer recommendations and regulatory mandates.

- Retain records for minimum 5 years (10 years for marine applications under MARPOL).

6. Environmental & Sustainability Considerations

- Biodiesel Compatibility: Confirm engine certification for B100 or blended fuels (e.g., EN 14214, ASTM D6751).

- End-of-Life Management: Follow WEEE Directive (EU) or RCRA (U.S.) for proper disposal/recycling.

- Carbon Reporting: Include engine emissions in corporate GHG inventories (Scope 1) under ISO 14064 or GHG Protocol.

Conclusion

The 1Hz Diesel Engine requires meticulous attention to international and local compliance frameworks throughout its lifecycle. Proactive engagement with regulatory bodies, accurate documentation, and adherence to best practices in logistics are essential to ensure legal operation and avoid penalties. Always consult with local authorities and certified compliance officers before shipment or installation.

Note: This guide is for general informational purposes. Specific requirements may vary by jurisdiction and application. Always verify with up-to-date regulatory sources.

Conclusion for Sourcing a 1Hz Diesel Engine

After a comprehensive evaluation of technical requirements, market availability, supply chain reliability, and cost considerations, sourcing a 1Hz diesel engine presents significant challenges due to the non-standard nature of the frequency specification. Standard diesel generator sets are typically designed to operate at common frequencies such as 50Hz or 60Hz, and engines specifically rated for 1Hz operation are not commercially available off-the-shelf.

Instead, achieving a 1Hz output would require either a custom-engineered solution involving significant modifications to a standard diesel engine and generator system—such as incorporating a specialized gearbox or variable frequency drive—or the use of a frequency conversion system to step down the standard output to 1Hz. Both approaches entail higher capital and operational costs, longer lead times, and increased maintenance complexity.

Therefore, it is recommended to re-evaluate the technical necessity of a 1Hz power supply. If this requirement is critical, collaboration with specialized engineering firms or OEMs capable of designing and certifying custom low-frequency systems is essential. Alternatively, exploring simulation or testing methods using frequency converters with standard generator sets may provide a more practical and cost-effective solution.

In summary, while sourcing a dedicated 1Hz diesel engine is not feasible through conventional means, the requirement can potentially be met through customized engineering or frequency conversion technologies—subject to further technical validation and cost-benefit analysis.