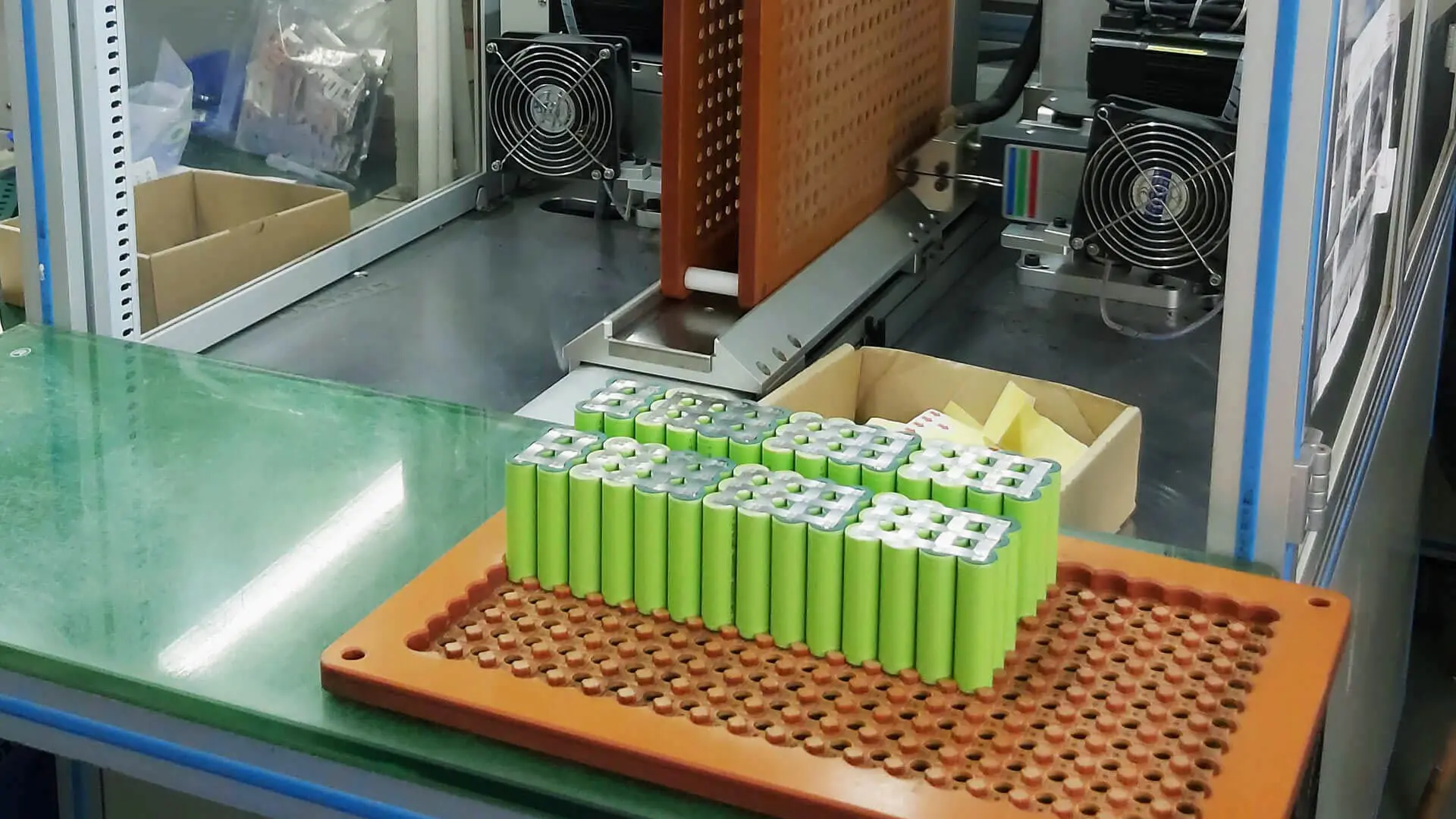

The global lithium-ion battery market is experiencing robust growth, driven by rising demand for portable electronics, electric vehicles (EVs), and energy storage systems. According to a report by Grand View Research, the global lithium-ion battery market size was valued at USD 73.7 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 14.6% from 2024 to 2030. A significant portion of this demand is attributed to the 18650 cylindrical cell format—renowned for its reliability, high energy density, and cost-efficiency—which remains a preferred choice across industries ranging from consumer electronics to industrial power tools and EVs. As bulk procurement becomes increasingly strategic for OEMs and energy solution providers, identifying reliable 18650 battery manufacturers capable of delivering consistent quality at scale has become critical. Based on production capacity, global market presence, and technological capabilities, here are the top 9 18650 battery bulk manufacturers shaping the industry landscape in 2024.

Top 9 18650 Battery Bulk Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 18650 Lithium

Domain Est. 2023

Website: sunpowernewenergy.com

Key Highlights: We not only supply and manufacture 18650 lithium-ion batteries but also support relevant OEM & ODM services. Additionally, our MOQ for 18650 cells is lower than ……

#2 Pkcell Battery

Domain Est. 2009 | Founded: 2006

Website: pkcell.com

Key Highlights: Shenzhen Pkcell Battery Co., Ltd, established in 2006, is a professional battery manufacturer over 18+ years. We has developed into a leading company in China’s ……

#3 18650 3.7V 2200mAh Lithium Ion Battery Cells

Domain Est. 2016

Website: szaspower.com

Key Highlights: An OEM rechargeable battery manufacturer in China for over 18 years. Specializing in Lithium Polymer Battery, LiFePO4 Battery and Li-ion Battery Pack. Our ……

#4 Batteries

Domain Est. 1994

Website: murata.com

Key Highlights: Murata provides various kinds of battery systems and battery products such as storage battery systems, lithium-ion secondary batteries, micro fuel cells, ……

#5 Molicel

Domain Est. 2001

Website: molicel.com

Key Highlights: A leading manufacturer of high-performance lithium-ion batteries designed for energy storage, electric vehicles, and advanced applications….

#6 18650 Li

Domain Est. 2010

Website: dnkpower.com

Key Highlights: Rating 4.5 (82) At DNK Power, we provide services for custom 18650 battery packs for all your industrial businesses and equipment applications….

#7 IMR Batteries

Domain Est. 2014

#8 Lithium Ion Battery Wholesale

Domain Est. 2015

Website: xtar.cc

Key Highlights: XTAR offers high-quality lithium-ion battery wholesale, including rechargeable cylindrical Li-ion 14500, 18650, 21700 & 1.5V AA lithium batteries….

#9 18650 Battery Bulk

Domain Est. 2021

Website: gobelpower.com

Key Highlights: Our 18650 battery bulk packs come in various configurations, including single cells, 2-pack, 4-pack, 6-pack, and 12-pack, to accommodate a wide range of ……

Expert Sourcing Insights for 18650 Battery Bulk

H2: Market Trends for 18650 Battery Bulk in 2026

As we approach 2026, the bulk market for 18650 lithium-ion batteries is undergoing significant transformation driven by evolving energy demands, technological advancements, and shifts in global supply chains. Once the dominant form factor in consumer electronics and early electric vehicles (EVs), the 18650 battery continues to hold a strategic position—albeit in a more specialized and competitive landscape.

-

Steady Demand in Niche Applications

Despite growing competition from larger-format cells like the 21700 and 4680, demand for bulk 18650 batteries remains strong in specific sectors. These include portable power tools, vaping devices, flashlights, e-bikes, and industrial backup systems. These applications benefit from the mature supply chain, standardized form factor, and proven reliability of 18650 cells. In 2026, bulk purchases are expected to be driven primarily by mid-tier manufacturers in emerging markets seeking cost-effective, readily available energy solutions. -

Price Stabilization Amid Raw Material Volatility

After the volatility in lithium, cobalt, and nickel prices seen in the early 2020s, the market for bulk 18650 batteries is expected to experience relative price stabilization by 2026. Improved recycling infrastructure, increased lithium production in countries like Argentina and Canada, and the adoption of high-nickel and cobalt-reduced chemistries (e.g., NMC 811) are helping to mitigate raw material cost swings. As a result, bulk pricing for 18650 cells is projected to hover between $0.07 and $0.12 per watt-hour, making them an attractive option for budget-conscious OEMs. -

Growth in Second-Life and Refurbished Markets

A notable trend in 2026 is the expanding use of retired 18650 cells from EVs and laptops in secondary applications. Companies are increasingly sourcing bulk used 18650 batteries, testing, reconditioning, and repackaging them for solar storage, DIY projects, and low-cost UPS systems. This circular economy model reduces waste and lowers entry barriers for energy storage in developing regions, further sustaining demand for bulk 18650 formats. -

Impact of Manufacturing Shifts and Geopolitics

China remains the largest producer of 18650 batteries, but geopolitical tensions and supply chain diversification efforts are prompting companies in North America and Europe to source from alternative suppliers in South Korea, Japan, and Southeast Asia. By 2026, trade policies, local content requirements, and incentives under initiatives like the U.S. Inflation Reduction Act (IRA) are influencing procurement strategies. Bulk buyers are prioritizing suppliers with transparent sourcing and ESG compliance, even if it means slightly higher costs. -

Technological Stagnation vs. Cost Efficiency

While innovation in 18650 technology has slowed compared to next-gen formats, manufacturers are focusing on incremental improvements—such as enhanced thermal management, longer cycle life (up to 1,500 cycles), and higher discharge rates. These refinements maintain the cell’s relevance, particularly in high-drain applications. For bulk buyers, the 18650 offers a compelling balance of performance, availability, and cost, especially where size and energy density are less critical. -

Rise of Private Label and Grey Market Concerns

The bulk 18650 market in 2026 faces challenges from counterfeit and mislabeled cells, particularly on e-commerce platforms. Unbranded or falsely branded cells (e.g., fake Sony or Panasonic) pose safety risks and undermine trust. As a result, reputable bulk buyers are increasingly demanding certifications (e.g., UN38.3, CE, RoHS) and traceability, pushing suppliers to improve transparency.

Conclusion

In 2026, the bulk 18650 battery market is characterized by resilience rather than rapid growth. While overshadowed by newer cell formats in high-performance applications, the 18650 remains a workhorse in cost-sensitive and legacy-compatible systems. Market trends point toward sustained demand in industrial, consumer, and second-life applications, supported by price stability, recycling advances, and global supply diversification. For bulk purchasers, the key to success will lie in balancing cost, quality, and supply chain security in an increasingly regulated and transparent marketplace.

Common Pitfalls When Sourcing 18650 Batteries in Bulk

Sourcing 18650 lithium-ion batteries in bulk can offer significant cost savings, but it comes with serious risks related to quality, safety, and intellectual property (IP). Avoiding these pitfalls is critical for product reliability, user safety, and legal compliance.

Quality-Related Pitfalls

Counterfeit or Recycled Cells

One of the most widespread issues is receiving counterfeit batteries falsely labeled as genuine cells from reputable manufacturers (e.g., Samsung, Panasonic, LG). Some suppliers rewrap used or degraded cells from laptop batteries or power tools, passing them off as new. These cells often have reduced capacity, unstable voltage, and higher internal resistance, increasing the risk of overheating, fire, or explosion.

Inconsistent Performance and Capacity

Bulk purchases often lack proper binning or grading, resulting in significant variation in capacity (mAh), internal resistance, and cycle life across cells. Poorly matched cells in a battery pack lead to imbalance, reduced efficiency, shortened lifespan, and potential safety hazards during charging/discharging.

Lack of Safety Certifications

Many low-cost suppliers provide cells without proper safety certifications such as UL, IEC 62133, UN38.3, or CE. Without these, the cells may not have undergone rigorous testing for overcharge, short circuit, crush, or thermal stability—critical factors for commercial and consumer applications.

Poor Quality Control and Traceability

Inferior suppliers often lack documented quality control processes. There may be no batch traceability, making it difficult to identify or recall faulty cells. This increases liability risk, especially in regulated industries like medical devices or electric vehicles.

Intellectual Property (IP) and Legal Pitfalls

Unauthorized Use of Brand Logos and Specifications

Suppliers may illegally use logos, model numbers, or datasheets from established brands (e.g., Samsung INR18650-35E) to misrepresent generic or inferior cells. This constitutes trademark and copyright infringement and exposes buyers to IP litigation, especially if the end product is sold under a brand name.

Misrepresentation of Technical Specifications

False claims about capacity, discharge rate (C-rating), or cycle life are common. For example, a seller may advertise a 3500mAh cell that actually delivers only 2500mAh. This misrepresentation can lead to product failure, customer dissatisfaction, and potential breach of contract claims.

Lack of Licensing for Protected Technologies

Some 18650 cells incorporate patented technologies (e.g., advanced cathode materials, safety coatings). Sourcing unlicensed clones may expose your company to IP infringement claims, especially when importing into regions with strong IP enforcement (e.g., the U.S. or EU).

Supply Chain Compliance Risks

Using unauthorized or counterfeit cells can violate industry standards and regulations (e.g., FCC, RoHS, REACH). This may result in product recalls, customs seizures, or fines, particularly for electronics sold in regulated markets.

How to Mitigate These Risks

- Source from Authorized Distributors or directly from OEMs.

- Demand Certifications and test reports (e.g., third-party lab reports for capacity and safety).

- Verify Supplier Credentials through business licenses, customer references, and factory audits.

- Conduct Sample Testing before bulk orders, including capacity, internal resistance, and cycle testing.

- Include IP Warranty Clauses in contracts to shift liability to the supplier.

- Use Legal Datasheets and Branding Only with Permission—avoid using manufacturer names unless officially licensed.

Avoiding these pitfalls ensures not only product performance and safety but also protects your brand and legal standing in competitive markets.

H2: Logistics & Compliance Guide for 18650 Battery Bulk Shipments

Shipping bulk quantities of 18650 lithium-ion batteries involves strict international regulations due to their classification as dangerous goods. Non-compliance risks safety hazards, shipment rejection, fines, and legal liability. This guide outlines key requirements for safe and compliant logistics.

H2: Classification & Regulatory Framework

18650 batteries are classified as Dangerous Goods under:

* UN Number: UN 3480 (Lithium ion batteries, contained in equipment), UN 3090 (Lithium metal batteries, installed in equipment), or most commonly for bulk: UN 3480 (Lithium ion batteries alone).

* Class: Class 9 – Miscellaneous Dangerous Goods.

* Packing Group: Usually PG II (Medium danger).

* Primary Regulations:

* IATA DGR (International Air Transport Association – Dangerous Goods Regulations): Mandatory for air freight. Updated annually. Most restrictive and commonly used standard.

* IMDG Code (International Maritime Dangerous Goods Code): Mandatory for ocean freight.

* ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road): Mandatory for road transport in Europe.

* 49 CFR (Code of Federal Regulations, Title 49): Mandatory for domestic US transport (road, rail, air, vessel).

* Key Principle: If shipping by multiple modes, the most stringent regulations (usually IATA DGR for air) govern the entire shipment.

H2: Packaging Requirements (Critical for Safety & Compliance)

Packaging must prevent short circuits, damage, and accidental activation. Requirements vary by mode and whether batteries are “contained in equipment” or “batteries alone” (bulk).

- For Bulk 18650s (UN 3480 – Batteries Alone):

- Rigid Outer Packaging: Strong, durable boxes (e.g., double-wall corrugated cardboard, wood, or plastic) capable of passing drop and stacking tests.

- Internal Separation & Protection:

- Batteries must be individually protected against short circuits (e.g., placed in non-conductive inner packaging like plastic clamshells, individual plastic bags, or separated by insulating material).

- Prevent movement within the outer packaging (use cushioning like bubble wrap or foam).

- Terminals must be insulated (e.g., caps, tape, or housing).

- State of Charge (SoC): Mandatory limitation! Batteries shipped by air must generally have a State of Charge not exceeding 30% of their rated capacity (IATA DGR Special Provision A154). Check specific carrier & regulation details. Ocean/road may allow higher SoC (e.g., 100% for some ocean shipments, but 30% is often safest).

- Packing Instruction: Must comply with specific IATA DGR Packing Instructions (e.g., PI 965, Section IB for bulk air shipments). IMDG has equivalent instructions.

H2: Marking, Labeling & Documentation

Accurate and visible markings are essential for handling and emergency response.

- Marking the Outer Package:

- Proper Shipping Name: “LITHIUM ION BATTERIES” or “UN 3480, LITHIUM ION BATTERIES”.

- UN Number: “UN 3480”.

- Shipper’s Name & Address.

- Consignee’s Name & Address.

- Net Quantity: Total weight of batteries.

- “Lithium Battery Handling Label” (IATA/IMDG): Diamond-shaped label with “LITHIUM BATTERIES”, a battery symbol, and “CLASS 9”. Mandatory for air.

- “Cargo Aircraft Only” Label (if applicable): Required if the shipment cannot go on passenger aircraft (often the case for bulk UN 3480 Section IB). Must be displayed if applicable.

- Orientation Arrows: If required by packaging test standards.

- “This Way Up” Markings: If applicable.

- Documentation:

- Dangerous Goods Declaration (DGD): Essential legal document. Must be completed by a certified person, detailing UN number, proper shipping name, class, packing group, quantity, packaging type, emergency contact, and certification statement. Submitted to the carrier.

- Air Waybill (AWB) / Bill of Lading (B/L): Must include full dangerous goods description matching the DGD.

- Material Safety Data Sheet (MSDS/SDS): Often required by carriers or destination authorities.

- Export/Import Licenses: May be required depending on destination country (e.g., ECCN 3A994 under US EAR).

- Commercial Invoice & Packing List: Clearly stating battery content and quantities.

H2: Carrier Selection & Handling Procedures

- Carrier Authorization: Not all carriers accept lithium batteries. Confirm in advance that your chosen carrier (airline, freight forwarder, trucking company) is authorized and accepts your specific shipment type (bulk, UN 3480, Section IB, SoC limit).

- Pre-Notification: Mandatory. Notify the carrier well in advance of shipment details (UN number, quantity, SoC, packaging) to obtain acceptance and ensure proper handling.

- Training: All personnel involved in packing, marking, offering, or transporting must have valid dangerous goods training (IATA/IMDG/ADR/49 CFR as applicable) within the last 24 months. Certification records must be maintained.

- Handling: Handle packages with care. Avoid dropping, crushing, or exposing to extreme temperatures. Store away from flammable materials and other dangerous goods.

H2: Key Compliance & Safety Considerations

- State of Charge (SoC): The single biggest compliance point for air freight. Verify and document SoC ≤ 30% for air shipments (UN 3480 IB). Use calibrated equipment.

- Battery Condition: Ship only new, undamaged, non-defective batteries. Damaged or recalled batteries are often prohibited or require special provisions.

- Mixed Shipments: Avoid mixing different battery chemistries or UN numbers in the same package unless specifically allowed by regulations.

- Quantity Limits: IATA DGR has limits on the number of batteries per package and per aircraft (especially passenger). Bulk shipments often exceed passenger aircraft limits, requiring “Cargo Aircraft Only” labeling and routing.

- Recycling/Returns: Sending used/damaged batteries for recycling involves different, often stricter, regulations (e.g., UN 3091 for scrap lithium metal, potentially UN 3481 for damaged/defective lithium-ion). Seek specific guidance.

- Destination Requirements: Research specific import regulations, labeling requirements, and potential bans in the destination country (e.g., some countries restrict large lithium battery imports, require local agent registration).

- Insurance: Ensure adequate cargo insurance covering dangerous goods.

H2: Summary & Best Practices

- Classify Correctly: UN 3480, Class 9, PG II for bulk 18650s.

- Use IATA DGR: Follow it meticulously for air freight; it’s the benchmark.

- Limit SoC: Ensure ≤ 30% SoC for air shipments; document it.

- Package Securely: Prevent short circuits and movement. Use certified packaging.

- Mark & Label Fully: Include UN 3480, Proper Shipping Name, Class 9 Label, and Cargo Aircraft Only label if needed.

- Prepare Documents: Complete a valid DGD, AWB/B/L, SDS, and commercial paperwork.

- Choose Authorized Carrier: Get pre-approval.

- Train Personnel: Ensure all staff have valid DG training.

- Verify Destination Rules: Check country-specific import regulations.

- Prioritize Safety: Handle gently, store properly, avoid damage.

Disclaimer: Regulations change frequently. Always consult the latest official regulations (IATA DGR, IMDG Code, ADR, 49 CFR) and your freight forwarder/carrier for the most current and specific requirements before shipping. This guide provides an overview, not exhaustive legal advice.

Conclusion for Sourcing 18650 Batteries in Bulk:

Sourcing 18650 batteries in bulk requires a careful balance between cost-efficiency, quality assurance, and supplier reliability. While competitive pricing is essential, prioritizing certified, high-quality cells from reputable manufacturers—such as Samsung, LG, Panasonic, or Sony—is critical to ensure safety, performance, and longevity. Counterfeit or substandard batteries pose significant risks, including overheating, reduced lifespan, and potential safety hazards.

Key considerations include verifying authentic cell origins, checking for necessary safety certifications (e.g., UN38.3, CE, RoHS), and assessing supplier track record through audits or third-party testing. Additionally, evaluating logistical factors such as shipping regulations for lithium-ion batteries, import duties, and warranty/support terms can further optimize the sourcing process.

In conclusion, a strategic and diligent approach—emphasizing quality control, supply chain transparency, and long-term reliability—will ensure a successful bulk procurement of 18650 batteries that meets both performance standards and safety requirements.