The global agricultural tire market is experiencing steady growth, driven by increasing demand for high-efficiency farming equipment and rising mechanization in emerging economies. According to Grand View Research, the global agricultural tires market size was valued at USD 11.2 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. A key segment within this market is the 16.9×28 tractor tire size, widely used in medium- to heavy-duty agricultural tractors due to its optimal balance of traction, load capacity, and compatibility with various soil conditions. With farmers prioritizing durability, fuel efficiency, and reduced soil compaction, manufacturers are investing heavily in advanced tread designs and rubber compounds. As demand for high-performance tires in precision agriculture grows, seven leading manufacturers have emerged at the forefront—combining innovation, global reach, and rigorous quality standards to dominate the 16.9×28 segment.

Top 7 16.9 X28 Tractor Tire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OTRUSA.COM

Domain Est. 2010

Website: otrusa.com

Key Highlights: 2–10 day deliveryWe stock all major tire brands and work with manufacturers to produce our lines of OTR, high-speed crane, and industrial tires in heavy duty, tough, and deutsch …..

#2 16.9

Website: goodyearfarmtires.eu

Key Highlights: Design, Sure Grip Industrial Tractor. Industry Classification, R-4. Tyre size, 16.9-28. LI/SS, 152A8. FR/DW. PR, 12. TL/TT, TL. Tyre Width (mm), 437….

#3 Tires Agriculture Tractor

Domain Est. 1997

Website: bkt-tires.com

Key Highlights: Discover the range of tires for vehicles Tractor . All the characteristics for the best performance on the road of your Agriculture vehicles….

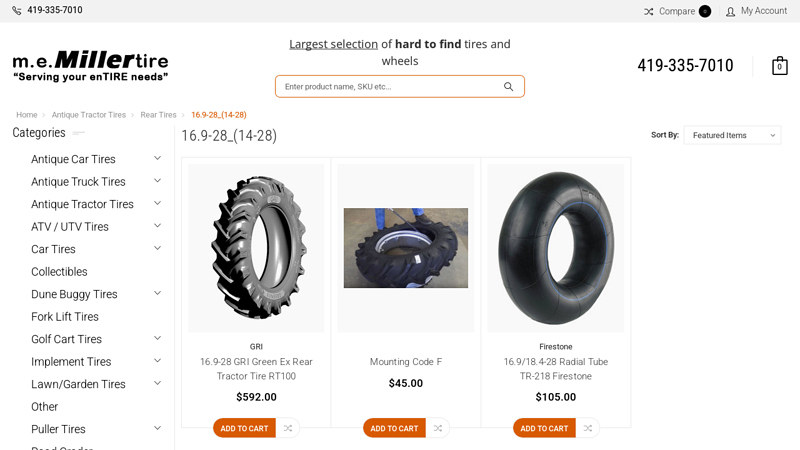

#4 Antique Tractor Tires

Domain Est. 1998

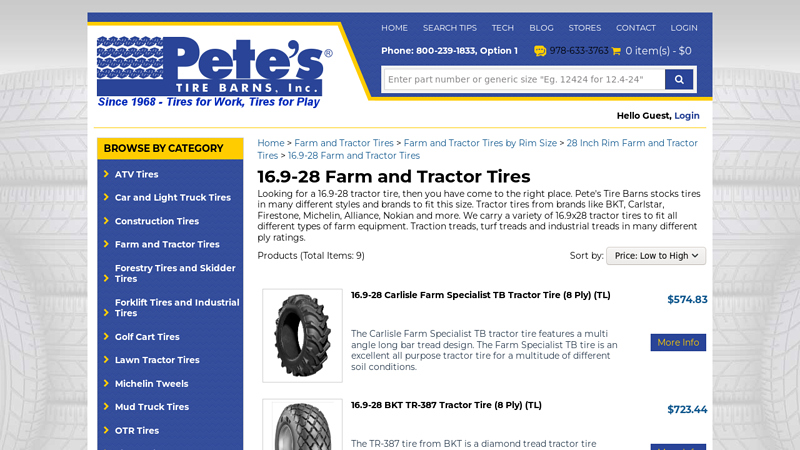

#5 Farm Tires, Tractor Tires & Ag Tires for Sale

Domain Est. 2000

Website: gallaghertire.com

Key Highlights: Free delivery 14-day returnsBuy top-quality farm tires, tractor tires, and AG tires from various brands at Gallagher Tire … 420/85R-28 (16.9R-28) 139D TIRE ONLY. Item #: ……

#6 16.9

Domain Est. 2001

#7 16.9

Domain Est. 2010

Expert Sourcing Insights for 16.9 X28 Tractor Tire

H2: 2026 Market Trends for 16.9×28 Tractor Tires

The global market for 16.9×28 tractor tires is poised for notable transformation by 2026, driven by advancements in agricultural technology, shifting farming practices, and evolving supply chain dynamics. As a widely used tire size for mid-to-heavy-duty agricultural tractors, the 16.9×28 segment reflects broader trends within the agricultural machinery and tire manufacturing industries.

1. Increasing Demand from Mechanized Agriculture

The continued push toward mechanization in emerging economies—particularly across Asia-Pacific, Africa, and Latin America—is expected to bolster demand for durable, high-performance tractor tires like the 16.9×28. As small and medium-sized farms adopt larger equipment to improve efficiency, the need for reliable tires suited for heavy tillage, loader work, and transport applications will grow. This trend is supported by government subsidies and rural development programs promoting modern farming techniques.

2. Shift Toward Radial Tire Technology

By 2026, radial tires are projected to dominate the 16.9×28 segment due to their superior fuel efficiency, longer tread life, and improved soil compaction control compared to bias-ply alternatives. Leading manufacturers—including Titan, Goodyear, and Alliance—are investing in advanced radial compounds and tread designs tailored for versatility across field and road conditions, enhancing the attractiveness of radial 16.9×28 models.

3. Focus on Sustainability and Recyclability

Environmental regulations and consumer demand for sustainable products are pushing tire makers to incorporate more eco-friendly materials and improve end-of-life recyclability. By 2026, expect increased use of bio-based rubber, silica compounds, and retreadable casing designs in 16.9×28 tires. Some manufacturers are also launching take-back programs and exploring circular economy models, aligning with global ESG goals.

4. Supply Chain Resilience and Regional Manufacturing

Post-pandemic disruptions and geopolitical tensions have prompted tire producers to diversify manufacturing bases and strengthen regional supply chains. For the 16.9×28 tire, this means expanded production in India, Southeast Asia, and Eastern Europe to serve local and export markets more efficiently. Localization reduces logistics costs and import dependencies, supporting stable pricing and availability through 2026.

5. Integration with Precision Farming Equipment

As tractors become more integrated with GPS guidance, auto-steer systems, and variable rate technology, tire performance—including consistency, load rating, and sidewall stability—becomes increasingly critical. Tire manufacturers are collaborating with OEMs to ensure 16.9×28 models meet the demands of high-tech agricultural platforms, including compatibility with advanced inflation systems (e.g., Central Tire Inflation Systems – CTIS).

6. Price Volatility and Raw Material Costs

Natural rubber, synthetic rubber, and carbon black prices remain key cost drivers. Fluctuations in crude oil markets and climate-related rubber crop yields could lead to price volatility for 16.9×28 tires through 2026. However, long-term contracts, alternative materials, and improved manufacturing efficiency are helping manufacturers mitigate these risks.

7. Growth in Aftermarket and Replacement Demand

The replacement tire segment is expected to outpace original equipment (OE) demand by 2026, as aging tractor fleets in developed and developing regions require tire upgrades. The 16.9×28 size benefits from its widespread compatibility across multiple tractor models, making it a staple in farm supply stores and online agricultural marketplaces.

Conclusion

By 2026, the 16.9×28 tractor tire market will be shaped by technological innovation, sustainability initiatives, and growing global demand for agricultural productivity. Manufacturers that prioritize performance, durability, and environmental responsibility will be best positioned to lead in this competitive and evolving landscape.

Common Pitfalls When Sourcing 16.9 X 28 Tractor Tires: Quality and Intellectual Property Concerns

When sourcing 16.9 X 28 tractor tires—commonly used in agricultural and industrial applications—buyers often encounter challenges related to product quality and intellectual property (IP) risks. Being aware of these pitfalls can help avoid costly mistakes, supply chain disruptions, or legal complications.

Poor Quality Control and Inconsistent Manufacturing Standards

One of the most prevalent issues when sourcing 16.9 X 28 tractor tires is inconsistent quality, especially when dealing with manufacturers from regions with less stringent regulatory oversight. Some suppliers may cut corners by using inferior rubber compounds, substandard steel belts, or inadequate curing processes. This results in tires that wear out quickly, suffer from premature cracking, or fail under heavy loads. Buyers may receive shipments with visible defects such as uneven treads, misaligned beads, or air leaks, which compromise equipment performance and safety.

Misrepresentation of Branding and Specifications

A common red flag is the mislabeling or imitation of well-known tire brands. Some suppliers falsely advertise tires as OEM (Original Equipment Manufacturer) products or claim compatibility with brands like Goodyear, Firestone, or CEAT, without proper licensing. These counterfeit or replica tires often mimic logos, tread patterns, and packaging but lack the performance characteristics and durability of authentic products. This not only affects operational efficiency but also exposes buyers to intellectual property infringement liabilities.

Lack of Compliance with International Standards

Genuine 16.9 X 28 tractor tires should meet recognized industry standards such as ISO, ECE, or DOT certifications, which ensure safety, load capacity, and performance under various conditions. However, many low-cost suppliers provide tires that lack proper certification or submit falsified documentation. Without verified compliance, these tires may not perform reliably in real-world applications and could violate import regulations in certain countries.

Intellectual Property Infringement Risks

Sourcing tires that copy patented tread designs, sidewall markings, or brand names can lead to serious legal consequences. Intellectual property laws protect original designs and trademarks, and importing or distributing counterfeit tires—even unknowingly—can result in shipment seizures, fines, or lawsuits. Buyers should conduct due diligence by verifying supplier credentials, requesting proof of IP legitimacy, and avoiding deals that seem too good to be true.

Inadequate After-Sales Support and Warranty Coverage

Low-cost suppliers often provide little to no after-sales service or warranty protection. If a batch of tires fails prematurely, resolving the issue can be difficult due to poor communication, lack of accountability, or unenforceable agreements. This absence of support increases long-term costs and operational downtime.

Conclusion

To mitigate these risks, buyers should partner with reputable suppliers, request product samples and certifications, and use third-party inspection services before placing large orders. Ensuring transparent contracts and verifying IP rights can protect both business interests and end-user safety when sourcing 16.9 X 28 tractor tires.

Logistics & Compliance Guide for 16.9×28 Tractor Tire

Overview of the 16.9×28 Tractor Tire

The 16.9×28 tractor tire is a widely used agricultural and industrial tire designed for heavy-duty applications such as tractors, loaders, and other off-road machinery. Proper logistics handling and regulatory compliance are essential to ensure safe transportation, storage, and distribution. This guide outlines key considerations for supply chain professionals involved in managing this product.

Packaging and Handling Requirements

Due to the size and weight of the 16.9×28 tire (typically weighing between 80–110 lbs / 36–50 kg), proper packaging and handling protocols are crucial.

- Palletization: Tires should be stacked securely on standard 48″x40″ pallets. Limit stacking to 4–6 tires per pallet to prevent deformation and ensure stability.

- Strapping: Use durable polypropylene or steel strapping to secure tires on the pallet. Apply at least two straps per pallet, crisscrossed if possible.

- Labeling: Each pallet must include a shipping label with SKU, quantity, weight, and destination. Include handling symbols (e.g., “Do Not Stack,” “This Side Up” if applicable).

- Forklift Access: Ensure pallets are compatible with standard forklift operations. Avoid overhang beyond the pallet edges.

Transportation and Freight Classification

Proper freight classification determines shipping costs and regulatory requirements.

- Freight Class (NMFC): Tires generally fall under NMFC Class 85 or 92.5, depending on density and packaging. Confirm classification with the National Motor Freight Traffic Association (NMFTA) database.

- Weight and Dimensions: Confirm individual tire dimensions (approx. 48″ diameter, 16.9″ width) and total pallet weight for accurate freight quoting.

- Carrier Requirements: Notify carriers in advance of heavy or oversized shipments. Use flatbed, dry van, or LTL carriers experienced in handling industrial tires.

- Hazardous Materials: Standard tractor tires are not classified as hazardous. However, tires containing certain chemical treatments or recycled materials may require documentation—verify with manufacturer.

Storage and Warehouse Guidelines

Improper storage can lead to cracking, deformation, or safety hazards.

- Environment: Store in a cool, dry, and well-ventilated area. Avoid direct sunlight, ozone sources (motors, transformers), and extreme temperatures.

- Racking: If not on pallets, tires should be stored vertically. Do not stack tires more than 8 high if stored standing, and avoid horizontal stacking for long periods.

- Shelf Life: Tires have a shelf life of approximately 6 years from manufacturing date. Rotate stock using FIFO (First In, First Out) inventory practices.

- Fire Safety: Tires are combustible. Store away from ignition sources and comply with local fire codes. Maintain appropriate sprinkler systems and fire extinguishers.

Regulatory Compliance

Adherence to domestic and international regulations is critical for legal distribution.

- DOT Compliance (U.S.): All tires sold in the U.S. must comply with Department of Transportation (DOT) standards, including proper sidewall markings (DOT code, size, load index, speed rating).

- EPA and TSCA: Ensure materials used in tire manufacturing comply with Toxic Substances Control Act (TSCA) regulations, particularly regarding chemical ingredients.

- REACH and RoHS (EU): For export to the European Union, verify that tire components meet REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives.

- Tire Labeling Regulations: Comply with EU tire labeling rules if exporting—providing fuel efficiency, wet grip, and noise ratings (though primarily for passenger tires, some industrial variants may require documentation).

Import and Export Considerations

Cross-border shipment of tires involves specific documentation and duties.

- HS Code: The Harmonized System (HS) code for tractor tires is typically 4011.20 (Pneumatic tires for agricultural machinery). Confirm with local customs authority.

- Import Duties: Duty rates vary by country. For example, the U.S. applies a duty rate of 4.5% on agricultural tires under HTSUS 4011.20.35.

- Documentation: Required documents include commercial invoice, bill of lading, packing list, and certificate of origin. Include tire specifications and compliance statements.

- ISPM 15: Wooden pallets must be treated and marked according to ISPM 15 standards for international shipments.

Environmental and Disposal Regulations

End-of-life handling is governed by environmental laws.

- Used Tire Management: Many jurisdictions regulate the storage and disposal of used tires due to fire and pest risks. Partner with certified tire recyclers.

- Extended Producer Responsibility (EPR): In regions like the EU and Canada, tire producers may be responsible for recycling costs. Verify obligations based on sales location.

- Waste Tire Bans: Several states and countries prohibit landfilling whole tires. Ensure proper downstream handling plans.

Conclusion

The logistics and compliance framework for 16.9×28 tractor tires encompasses safe handling, proper classification, regulatory adherence, and environmental responsibility. By following this guide, distributors and logistics providers can ensure efficient, legal, and sustainable movement of these essential agricultural components across supply chains. Always consult local regulations and work with certified partners to maintain full compliance.

In conclusion, sourcing 16.9×28 tractor tires requires careful consideration of factors such as application needs, quality, durability, supplier reliability, and cost-effectiveness. These oversized tires are commonly used in agricultural and heavy-duty industrial settings, where performance under load and traction on varied terrain are critical. It is essential to verify tire specifications—such as tread pattern, ply rating, load capacity, and compatibility with existing rims and equipment—to ensure optimal performance and safety.

Engaging with reputable suppliers or manufacturers, comparing pricing from multiple vendors, and reviewing customer feedback can help secure a reliable and cost-efficient supply. Additionally, evaluating availability, lead times, and after-sales support contributes to a sustainable sourcing strategy. By prioritizing quality and compatibility, sourcing the 16.9×28 tractor tire can lead to improved operational efficiency, reduced downtime, and long-term value for agricultural or industrial machinery operations.