The global lubricants market is experiencing steady expansion, driven by rising automotive production, increased industrial activity, and growing demand for high-performance engine oils. According to a report by Mordor Intelligence, the global engine oil market was valued at approximately USD 48.6 billion in 2023 and is projected to grow at a CAGR of over 3.8% from 2024 to 2029. This growth is bolstered by the expanding vehicle fleet, longer oil change intervals favoring synthetic and semi-synthetic formulations, and stricter emission regulations pushing for higher efficiency lubricants. As one of the most widely used viscosity grades, 15W-30 engine oil plays a critical role across passenger vehicles, commercial fleets, and industrial machinery. With performance, consistency, and formulation expertise becoming key differentiators, a select group of manufacturers has emerged as leaders in producing high-quality 15W-30 oils. Below is a data-informed overview of the top 8 15W30 oil manufacturers shaping the current market landscape.

Top 8 15W30 Oil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shell Rotella®

Domain Est. 1989

Website: rotella.shell.com

Key Highlights: For over 40 years, Shell Rotella® has delivered lubes, greases, and oils to provide unrivaled protection and performance for heavy duty vehicles and ……

#2 AGRI

Domain Est. 1997

Website: rockoil.co.uk

Key Highlights: AGRI-GUARD SUTO 15W-30 is a high-performance, multi-functional lubricant for most older off-highway equipment applications….

#3 Commercial Engine Oils

Domain Est. 2004

Website: granvilleoil.com

Key Highlights: Granville has the manufacturing capabilities to provide a variety of high-quality grade vehicle-specific lubricants all meeting the latest technical ……

#4 WOLF STOU 15W30

Domain Est. 2010

Website: wolflubes.com

Key Highlights: WOLF S.T.O.U. 15W30. Universal multigrade oil for engines, transmissions, wet brakes and hydraulic systems of agricultural tractors….

#5 champion stou farm 15w30

Domain Est. 2010

Website: championlubes.com

Key Highlights: CHAMPION S.T.O.U. FARM 15W30 · Description. Universal multigrade oil for engines, transmissions, wet brakes and hydraulic systems of agriculture tractors….

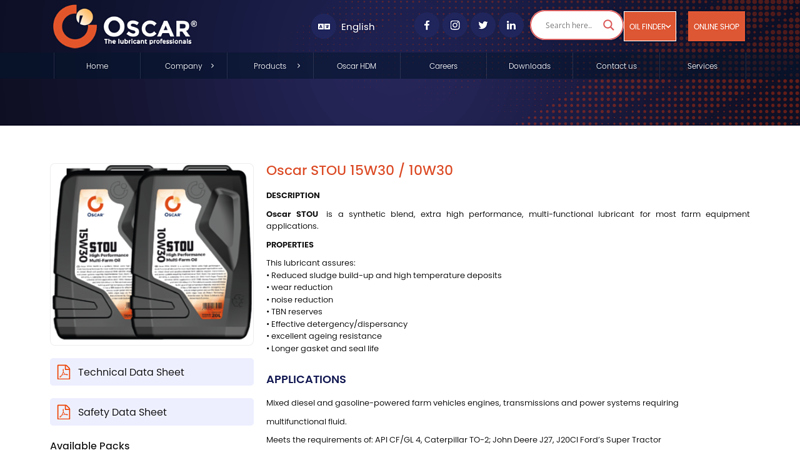

#6 Oscar STOU 15W30 / 10W30

Domain Est. 2014

Website: oscarlubricants.com

Key Highlights: Oscar STOU 15W30 / 10W30. DESCRIPTION. Oscar STOU is a synthetic blend, extra high performance, multi-functional lubricant for most farm equipment applications….

#7 Total Rubia Truck 7200 FE 15W30

Domain Est. 2021

Website: anadoluneft.com

Key Highlights: TOTAL RUBIA TIR 7200 FE 15W-30 is mineral engine oil for heavy diesel vehicles used in road transport. TOTAL RUBIA TIR 7200 FE 15W-30 is recommended for Euro 3 ……

#8 Buy 15W30 Engine Oil at the Best Price High Performance Lubricant

Domain Est. 2024

Website: mahabirchemical.com

Key Highlights: Discover the superior quality of our 15W30 Engine Oil, API CF-4/SG grade, designed for diesel and petrol engines. With a low pour point of -24°C, ……

Expert Sourcing Insights for 15W30 Oil

H2: 2026 Market Trends for 15W-30 Motor Oil

The global 15W-30 motor oil market in 2026 is poised for moderate growth, shaped by evolving engine technologies, regulatory standards, and shifting consumer preferences. As a widely used multigrade lubricant suitable for a range of temperatures, 15W-30 continues to maintain relevance across various automotive and industrial applications. Key trends influencing the market in 2026 include:

-

Transition Toward Low-Viscosity Oils

Although 15W-30 remains popular, especially in older vehicles and certain commercial fleets, the broader automotive industry is trending toward lower-viscosity oils (e.g., 0W-20, 5W-30) to improve fuel efficiency and reduce emissions. This shift, driven by Original Equipment Manufacturers (OEMs) and tightening fuel economy regulations (e.g., CAFE standards in the U.S. and Euro 7 in Europe), may limit the expansion of 15W-30 in newer passenger vehicles. -

Strong Demand in Developing Markets

In emerging economies across Asia-Pacific, Africa, and Latin America, where aging vehicle fleets and high ambient temperatures favor the use of medium-viscosity oils, 15W-30 continues to see stable or growing demand. Countries like India, Nigeria, and Indonesia rely heavily on vehicles and machinery suited to 15W-30, supporting regional market resilience. -

Aftermarket Dominance and Brand Competition

The 15W-30 market is highly active in the aftermarket segment, where independent service centers and consumers prioritize cost-effective, widely available lubricants. Major players such as Shell, Castrol, Valvoline, and ExxonMobil are investing in product differentiation through synthetic blends and enhanced additive packages to retain market share. Synthetic and synthetic-blend 15W-30 formulations are gaining traction for their extended drain intervals and improved engine protection. -

Impact of Electrification

The rise of electric vehicles (EVs), which do not require engine oils, poses a long-term challenge to all conventional motor oil segments, including 15W-30. However, hybrid vehicles and internal combustion engine (ICE) fleets—especially in commercial transport and agriculture—will sustain demand through 2026. The gradual phaseout of ICE vehicles in some regions is expected to begin post-2030, allowing 15W-30 a transitional window. -

Sustainability and Circular Economy Initiatives

Environmental concerns are driving innovation in oil recycling and biodegradable formulations. In 2026, major lubricant producers are increasingly promoting closed-loop recycling programs and exploring bio-based base stocks. While 15W-30 is traditionally mineral or synthetic-based, eco-friendly variants may emerge to meet corporate sustainability goals and regulatory pressures. -

Supply Chain and Raw Material Volatility

Fluctuations in crude oil prices and base oil supply (especially Group II and III) continue to impact production costs. Geopolitical tensions and refining capacity constraints may lead to periodic price volatility for 15W-30, influencing procurement strategies among fleet operators and distributors.

Conclusion:

In 2026, the 15W-30 motor oil market is expected to experience steady but constrained growth. While technological and environmental trends favor lower-viscosity and alternative lubricants, 15W-30 will remain essential in legacy vehicle maintenance, heavy-duty applications, and high-temperature climates. Market success will depend on formulation innovation, regional targeting, and adaptation to sustainability demands.

Common Pitfalls Sourcing 15W30 Oil (Quality, IP)

Sourcing 15W30 engine oil, especially for industrial or high-performance applications, involves navigating several critical pitfalls related to both Quality Assurance and Intellectual Property (IP) protection. Overlooking these can lead to equipment damage, warranty voidance, operational inefficiencies, and legal complications.

Quality Pitfalls

1. Inadequate or Misleading Performance Specifications:

* The Pitfall: Suppliers may provide generic data sheets listing basic SAE viscosity (15W30) and common API categories (e.g., API SN, CK-4) without disclosing critical performance details relevant to your specific engine or operating conditions. They might omit essential tests like high-temperature high-shear (HTHS) viscosity, oxidation stability, or phosphorus/sulfur content limits crucial for after-treatment systems (DPF, SCR).

* The Risk: Oil may fail to meet the stringent requirements of modern engines (especially turbocharged, direct-injection, or those with emissions controls), leading to accelerated wear, sludge formation, or catalyst poisoning.

* Mitigation: Demand original, supplier-specific technical data sheets (TDS) and safety data sheets (SDS). Verify the oil meets the exact OEM specifications required (e.g., ACEA C3, MB 229.51, Volvo VDS-4.5, Cummins CES 20082) – not just the minimum API standard. Request independent test reports (e.g., from a recognized lab) for critical parameters if sourcing from a new or unfamiliar supplier.

2. Counterfeit or Adulterated Products:

* The Pitfall: The market is vulnerable to counterfeit oils (fake branding) or adulterated oils (diluted with lower-grade base stocks or re-refined oil without proper certification). This is common with popular brands or in regions with weak regulatory enforcement.

* The Risk: Severely compromised lubrication, rapid engine wear, catastrophic engine failure, voided OEM warranties. Adulterated oil may contain harmful contaminants or lack necessary additives.

* Mitigation: Source exclusively from authorized distributors or directly from the manufacturer/brand owner. Verify distributor credentials. Inspect packaging meticulously (packaging quality, batch numbers, security features, fill levels). Be wary of prices significantly below market average. Consider using authentication services if available.

3. Inconsistent Base Oil and Additive Package Quality:

* The Pitfall: Suppliers, especially smaller blenders or those using multiple base oil sources, may have inconsistent base oil quality (varying Group I, II, II+, III content) or inconsistent additive package blending. This leads to batch-to-batch variability.

* The Risk: Unpredictable performance, potential incompatibility issues when mixing batches, failure to meet long-term performance expectations (e.g., extended drain intervals).

* Mitigation: Prioritize suppliers with robust quality control (QC) systems (e.g., ISO 9001 certified). Request certificates of analysis (CoA) for each batch received. Establish long-term relationships with reputable, consistent blenders or major oil companies known for quality control.

4. Lack of Traceability and Documentation:

* The Pitfall: Inadequate record-keeping from supplier to end-user, missing batch numbers, or unclear origin of base oils/additives.

* The Risk: Impossible to trace the source of a problem (e.g., engine failure, contamination), difficult to manage recalls, challenges in proving compliance during audits, inability to verify genuine product origin.

* Mitigation: Insist on full traceability documentation (batch numbers, manufacturing dates, origin of key components) with every shipment. Maintain meticulous internal records linking batches to equipment usage.

Intellectual Property (IP) Pitfalls

1. Sourcing “Private Label” or “OEM Equivalent” Oil with Unclear IP Status:

* The Pitfall: Suppliers offer oil branded as “equivalent to Brand X” or as a “private label” solution. The formulation might be a direct copy of a patented additive package or a well-known branded oil, infringing on the original manufacturer’s IP.

* The Risk: Your organization could become embroiled in IP infringement lawsuits initiated by the rights holder. Reputation damage, legal costs, potential damages, and forced discontinuation of supply are significant risks. The supplier may not have the resources or willingness to defend you.

* Mitigation: Demand transparency on formulation origin. Require the supplier to warrant that the formulation is either:

* Licensed: They hold a valid license from the IP holder to use the specific additive technology.

* Independently Developed & Non-Infringing: They provide evidence (e.g., formulation documents, legal opinion) that the oil uses a unique, proprietary additive package that does not infringe on third-party patents (especially key additive patents held by major additive companies like Lubrizol, Afton, Infineum, Oronite).

* Generic/Non-Proprietary: The formulation relies solely on non-patented, generic additive chemistries. Be aware this might limit performance to basic standards.

2. Misuse of Trademarks and Branding:

* The Pitfall: Suppliers use logos, brand names, or trade dress (packaging design) that are confusingly similar to major brands, even if not identical. This creates brand confusion and implies unauthorized endorsement.

* The Risk: Trademark infringement claims, consumer confusion, dilution of your own brand reputation if you distribute such oil, potential seizure of goods by customs.

* Mitigation: Scrutinize all branding and packaging. Ensure the product clearly identifies the actual manufacturer and uses only its legitimate trademarks. Avoid any packaging that mimics the look and feel of established brands. Conduct trademark searches if launching a private label.

3. Lack of Clear Contractual IP Indemnification:

* The Pitfall: Supply contracts fail to include strong clauses where the supplier indemnifies the buyer (you) against any third-party claims of IP infringement related to the supplied oil.

* The Risk: If an IP lawsuit arises, your organization bears the full cost of defense and any damages, even if the infringement originated solely from the supplier’s actions.

* Mitigation: Include robust IP indemnification clauses in all supply agreements. The clause should require the supplier to defend, indemnify, and hold harmless your organization against any claims of IP infringement arising from the oil’s formulation, branding, or manufacture. Verify the supplier has adequate insurance coverage.

4. Unlicensed Use of Performance Claims:

* The Pitfall: Suppliers claim their oil is “Approved for” or “Meets the requirements of” a specific OEM specification (e.g., “FORD WSS-M2C949-A Approved”) without holding the official license from the OEM to make that claim.

* The Risk: False advertising claims, potential trademark infringement, loss of OEM warranty for end-users, reputational damage. OEMs typically require formal licensing and rigorous testing for such approvals.

* Mitigation: Verify OEM approvals directly with the OEM or through their official online portals. Do not rely solely on the supplier’s claim. Only use marketing claims that are verifiably licensed and authorized.

By proactively addressing these quality and IP pitfalls through rigorous supplier vetting, demanding transparency, securing proper documentation, and implementing strong contractual protections, organizations can significantly mitigate the risks associated with sourcing 15W30 oil and ensure they receive a product that is both effective and legally sound.

H2: Logistics & Compliance Guide for 15W30 Engine Oil

Purpose: This guide outlines the critical logistics handling, transportation, storage, and regulatory compliance requirements for 15W30 engine oil to ensure safety, product integrity, and legal adherence throughout the supply chain.

1. Product Identification & Classification

* Product: 15W30 Engine Oil (Multi-grade motor oil).

* Primary Components: Base oils (typically Group I, II, II+, or III) and performance additive packages (detergents, dispersants, anti-wear agents, viscosity index improvers, etc.).

* Regulatory Classification (Typical – Verify SDS):

* GHS/CLP: Usually Not Classified for acute toxicity, flammability (flash point typically > 200°C / 392°F), or environmental hazards under normal handling. However, always consult the specific Safety Data Sheet (SDS).

* Transportation (e.g., ADR/RID, IMDG, IATA): Often Not Restricted (UN 3462, “ENVIRONMENTALLY HAZARDOUS SUBSTANCE, LIQUID, N.O.S.” may apply if meeting ecotoxicity criteria, but many 15W30 oils do not). Crucially, classification depends on the specific formulation and test data.

* EPA (US): Generally Not a “Hazardous Waste” under RCRA when unused. Spent oil is hazardous waste.

* Mandatory: ALWAYS consult the current Safety Data Sheet (SDS) for the specific 15W30 product before any logistics or compliance decision. SDS Section 2 (Hazard Identification) and Section 14 (Transport Information) are critical.

2. Storage Requirements

* Location: Dry, well-ventilated, cool, and secure indoor area. Protect from direct sunlight, extreme temperatures (avoid prolonged exposure >40°C/104°F or freezing), and weather. Secondary containment (bunded area) is mandatory for bulk storage (drums, IBCs, tanks) to contain spills (e.g., 110% of largest container volume).

* Containers:

* Small Quantities (Drums, Pails, Bottles): Store upright on pallets. Use original, tightly sealed containers. Prevent contamination.

* Bulk (Tanks, IBCs): Use dedicated, compatible tanks (e.g., carbon steel, specific plastics). Ensure tanks are clearly labeled. Implement leak detection for underground storage tanks (USTs – subject to strict EPA regulations in the US).

* Segregation: Store away from food, beverages, animal feed, and incompatible materials (e.g., strong oxidizers, acids, bases). Maintain separation from combustible materials (though not flammable, oil can fuel fires).

* First In, First Out (FIFO): Implement strict FIFO inventory management to prevent degradation of older stock. Monitor shelf life (typically 5+ years unopened, but verify with manufacturer).

* Labeling: Ensure all containers are clearly labeled with product name (“15W30 Engine Oil”), supplier, batch number, and relevant hazard pictograms (if applicable per SDS).

3. Handling & Transportation

* Personal Protective Equipment (PPE): Minimum: Safety glasses, chemical-resistant gloves (e.g., nitrile), and protective clothing (coveralls/apron) to prevent skin contact and contamination. Respiratory protection usually not required for normal handling, but may be needed in confined spaces with significant vapor/mist generation (consult SDS).

* Transfer Operations: Use dedicated, clean pumps and hoses. Prevent spills using drip trays and funnels. Ground and bond containers during transfer of large quantities to prevent static discharge (though low risk, good practice).

* Transportation Modes:

* Road (Truck/Van): Secure loads to prevent shifting. Use vehicles with spill containment capability (e.g., lined beds, containment trays). Ensure proper vehicle maintenance. Drivers require appropriate licenses. Documentation: Transport documents must include accurate product description based on SDS/transport classification (e.g., “Lubricating Oil, N.O.S.” if UN 3462 applies, or “Not Restricted” if applicable). Emergency contact information is mandatory.

* Sea (Container Ship): Pack securely in containers using dunnage to prevent movement. Declare accurately per IMDG Code based on SDS classification. UN number, proper shipping name, and class (if any) are required on shipping documents.

* Air (Cargo): Subject to strict IATA DGR regulations. Most 15W30 oils are Forbidden on passenger aircraft and may be Forbidden or Limited Quantity Excepted on cargo aircraft depending on flash point and packaging. Extreme caution required – verify SDS and IATA DGR thoroughly. Often shipped via surface transport instead.

* Spill Kits: Mandatory on all transport vehicles and at storage/handling locations. Kits must contain absorbents (pads, socks, granular), containment booms, PPE, disposal bags, and instructions.

4. Regulatory Compliance

* Safety Data Sheets (SDS): Maintain readily accessible, up-to-date SDS (GHS-compliant) for every 15W30 product on site. Required by OSHA (US), WHMIS (Canada), CLP (EU), etc.

* Spill Reporting: Report significant spills to relevant authorities immediately (e.g., National Response Center (NRC) in the US for reportable quantities, local environmental agencies). Follow facility Spill Response Plan.

* Waste Management: SPENT 15W30 OIL IS HAZARDOUS WASTE. Collect used oil separately in labeled, compatible, leak-proof containers. Store in designated, secondary-contained area. Dispose of only through licensed hazardous waste contractors with proper manifests. Never mix with other wastes or pour down drains. Compliance with RCRA (US), WEEE (if applicable), local hazardous waste regulations is critical.

* Environmental Regulations: Prevent releases to soil, water, or storm drains. Comply with Clean Water Act (US), Water Framework Directive (EU), and local environmental protection laws. Implement Spill Prevention, Control, and Countermeasure (SPCC) plans if above threshold quantities are stored (US EPA).

* Labeling & Marking: Ensure all containers (storage & transport) are correctly labeled per local regulations (GHS, transport codes).

* Training: Provide mandatory training for all personnel involved in handling, storage, and transport on:

* Hazards of the product (per SDS)

* Safe handling procedures

* Emergency response (spill control, first aid)

* Proper use of PPE

* Waste disposal procedures

* Relevant regulatory requirements

5. Key Considerations & Best Practices

* SDS is Paramount: Never assume classification or handling requirements. The specific SDS governs everything.

* Prevent Contamination: Use dedicated equipment. Keep containers closed. Contaminated oil loses performance and becomes hazardous waste.

* Temperature Control: Avoid prolonged exposure to high heat (accelerates oxidation) or freezing (can affect pour point temporarily, potential for condensation).

* Security: Secure storage areas against theft and unauthorized access.

* Record Keeping: Maintain logs for inventory, SDS, training, spill incidents, waste disposal manifests, and inspections.

* Supplier Coordination: Ensure suppliers provide compliant packaging, labeling, and accurate SDS. Verify transport classification alignment.

Disclaimer: This guide provides general information. Regulations vary significantly by country, region, and specific formulation. Always consult the product’s Safety Data Sheet (SDS) and relevant local, national, and international regulations (e.g., OSHA, EPA, DOT, ADR, IMDG, IATA, REACH, CLP) for definitive requirements. Engage qualified environmental, health, and safety professionals for specific compliance advice.

In conclusion, sourcing 15W-30 motor oil requires careful consideration of several key factors to ensure optimal engine performance and longevity. It is essential to select an oil that meets the manufacturer’s specifications, including the appropriate API service rating and viscosity grade suitable for your engine type and operating conditions. Whether opting for conventional, synthetic blend, or full synthetic 15W-30 oil, prioritizing quality brands and certifications helps ensure reliability and protection. Additionally, evaluating cost-effectiveness, availability, and supplier reputation will support consistent supply and operational efficiency. Proper sourcing not only enhances engine performance but also contributes to reduced maintenance costs and extended equipment life.