The global concrete cutting blade market is witnessing robust expansion, driven by rising construction activities, infrastructure development, and demand for precision cutting tools in both residential and industrial applications. According to a 2023 report by Mordor Intelligence, the global diamond blade market—of which concrete cutting blades are a major segment—was valued at USD 1.27 billion and is projected to grow at a CAGR of 5.8% from 2024 to 2029. This growth is further amplified by advancements in blade materials, such as enhanced diamond segments and laser-welded technologies, improving durability and cutting efficiency. With increasing urbanization and government investments in smart cities and transportation networks, especially across Asia-Pacific and North America, the demand for high-performance cutting solutions continues to surge. As a result, manufacturers are innovating rapidly to capture market share. In this dynamic landscape, we identify the top 9 manufacturers of 14-inch concrete cutting blades—leading suppliers recognized for product quality, technological innovation, global reach, and market influence.

Top 9 14 Concrete Cutting Blade Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tenryu Saw Mfg. Co., Ltd.

Domain Est. 2000

Website: tenryu-saw.com

Key Highlights: Tenryu Saw Mfg. Co., Ltd. Manufacturing, processing and sales of saws and blades, manufacturing, processing and sales of machinery and equipment for lumber, ……

#2 14in Super Premium Diamond Saw Blade

Domain Est. 1995

Website: globalgilson.com

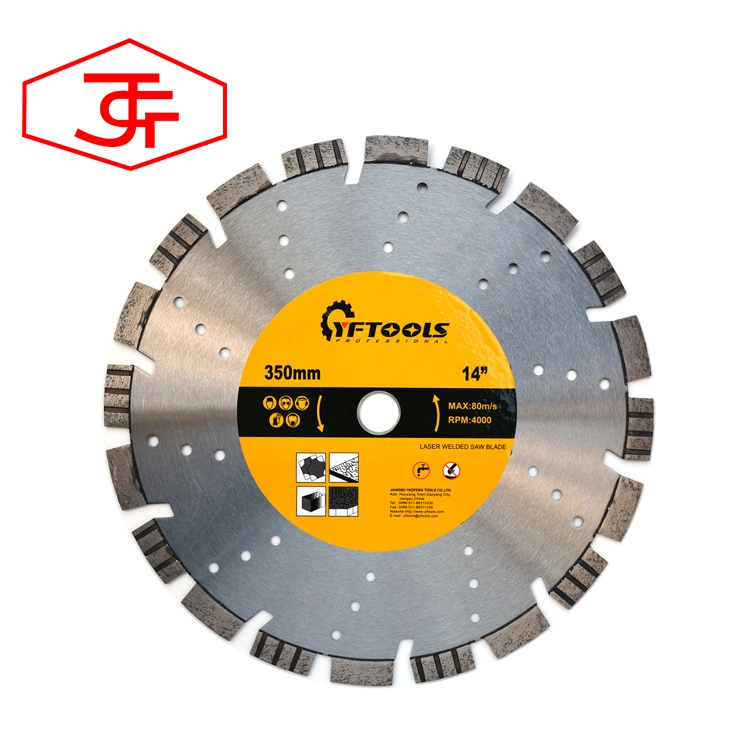

Key Highlights: 30-day returnsA universal blade ideal for concrete, asphalt, and masonry, with cuts of up to 5in (127mm) depth. The 14in (356mm) diameter high-quality metal-bonded diamond ……

#3 Cutter and Blade

Domain Est. 1996

Website: mikasas.com

Key Highlights: This is the product page for the Cutter & Blade that you can choose Wet or Dry according to your application, from Mikasa Sangyo Co.,Ltd., a comprehensive ……

#4 Diamond Products

Domain Est. 1996

Website: diamondproducts.com

Key Highlights: Diamond Products Limited Toll Free: 1-800-321-5336 Fax: 1-800-634-4035 333 Prospect St, Elyria, OH 44035…

#5 DMADST1400

Domain Est. 2004

Website: diablotools.com

Key Highlights: Diablo’s diamond segmented turbo rim masonry cut-off blades provide extreme durability, faster cuts and longer life in concrete, concrete with rebar, brick and ……

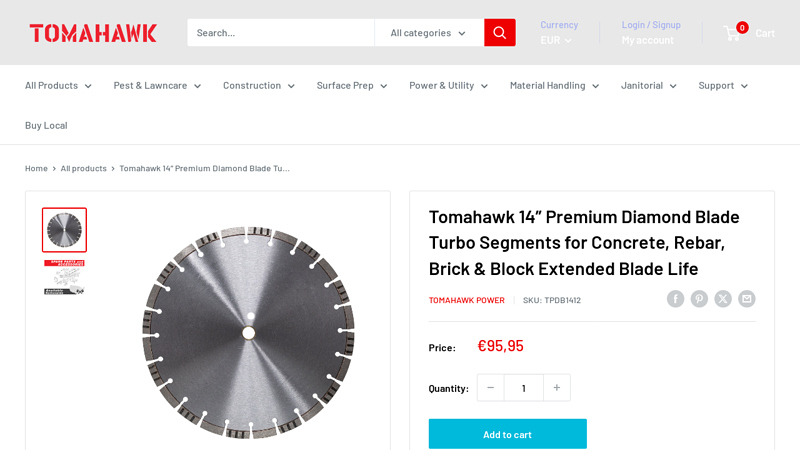

#6 Tomahawk 14” Premium Diamond Blade Turbo Segments for …

Domain Est. 2012

Website: tomahawk-power.com

Key Highlights: In stock Free delivery over $2,000Designed with laser-welded 12mm alternating turbo segments, this blade offers enhanced cutting speed, superior cooling, and long-lasting durabilit…

#7 Premium Diamond Blades for Concrete

Domain Est. 2019

Website: husqvarnaconstruction.com

Key Highlights: Explore our premium diamond blades designed for superior cutting performance on concrete surfaces … 12 / 14 / 16 in. Segment height inch. 0.6 in. Arbor diameter….

#8 MASTER BSE Concrete Diamond Blade

Domain Est. 2021

#9 Shop The Best Quality 14″ Diamond Concrete Cutting Blades

Domain Est. 2003

Website: ussaws.com

Key Highlights: $550 delivery 90-day returnsLooking for a durable 14″ diamond concrete cutting blade? Look no further than U.S. Saws! We offer the best quality blades in the market. Shop today!…

Expert Sourcing Insights for 14 Concrete Cutting Blade

H2: 2026 Market Trends for 14-Inch Concrete Cutting Blades

The global market for 14-inch concrete cutting blades is poised for significant transformation by 2026, driven by advancements in construction technologies, evolving safety standards, and growing infrastructure investments worldwide. This analysis explores key trends shaping the demand, innovation, and competitive landscape for 14-inch concrete cutting blades over the coming years.

-

Rising Infrastructure Development

Increased government and private-sector investments in infrastructure—particularly in emerging economies—will boost demand for efficient concrete cutting tools. Projects such as road expansions, bridge construction, and urban development require high-performance 14-inch blades, especially in regions like Asia-Pacific, Africa, and Latin America. -

Shift Toward Diamond-Infused Blades

By 2026, diamond-tipped and sintered diamond blades are expected to dominate the 14-inch segment due to their superior durability and cutting precision. Technological improvements in diamond bonding and segment design will enhance blade life and reduce downtime, making them more cost-effective over time despite higher initial costs. -

Growth in Cordless and Electric Power Tools

The surge in cordless angle grinders and electric-powered cutters is influencing blade design. Manufacturers are optimizing 14-inch blades for compatibility with high-torque, low-vibration electric systems, focusing on heat dissipation and reduced kickback to improve safety and performance. -

Emphasis on Safety and Dust Control

Regulatory bodies such as OSHA (U.S.) and similar agencies in Europe are tightening silica dust exposure limits. As a result, wet-cutting blades and designs compatible with dust-shroud systems will gain traction. By 2026, demand for low-dust and water-efficient 14-inch blades will rise significantly across commercial and residential construction. -

Sustainable Manufacturing Practices

Environmental concerns are pushing manufacturers to adopt eco-friendly production methods. Recyclable materials, reduced carbon footprints in manufacturing, and longer blade lifespan will become key selling points. Brands promoting sustainability are likely to gain competitive advantage in green-certified construction projects. -

Regional Market Diversification

While North America and Europe remain mature markets with steady demand, the Asia-Pacific region—led by China, India, and Southeast Asian nations—is expected to show the highest growth rate. Rapid urbanization and smart city initiatives will drive the need for precision cutting tools, including 14-inch blades. -

Smart Blade Technology Integration

Emerging trends include the integration of sensor technology into cutting blades for real-time performance monitoring. Though still in early stages, by 2026, smart blades with wear indicators or temperature sensors may begin entering premium market segments, especially in industrial applications. -

Price Competition and Brand Differentiation

As the market expands, competition among manufacturers will intensify. While low-cost alternatives from Asia will challenge established brands, differentiation through innovation, warranty, and performance data will be critical. OEM partnerships with power tool companies will also become more common.

Conclusion

The 14-inch concrete cutting blade market in 2026 will be shaped by technological innovation, regulatory demands, and global construction trends. Companies that prioritize performance, safety, and sustainability are best positioned to capture market share. The convergence of smart technology and eco-conscious manufacturing will define the next generation of concrete cutting solutions.

Common Pitfalls When Sourcing 14-Inch Concrete Cutting Blades (Quality and Intellectual Property)

Sourcing 14-inch concrete cutting blades—especially from overseas suppliers—can be fraught with challenges related to both product quality and intellectual property (IP) risks. Being aware of these pitfalls is crucial for ensuring performance, safety, and legal compliance.

Inconsistent or Substandard Quality

One of the most frequent issues is receiving blades that fail to meet advertised performance standards. Low-cost suppliers may use inferior diamond grit, improper bonding matrices, or inconsistent manufacturing processes. This leads to rapid wear, reduced cutting efficiency, and potential safety hazards such as blade warping or fragmentation during use.

Misrepresentation of Blade Specifications

Suppliers may exaggerate key performance metrics like diamond concentration, bond hardness, or maximum RPM. For example, a blade advertised for reinforced concrete may lack the necessary core strength or diamond distribution for the task. Always verify specifications through independent lab testing or third-party certifications.

Lack of Safety and Compliance Certification

Many imported blades lack essential safety certifications such as ANSI, OSHA, or EN standards. Using non-compliant blades increases liability risks and may violate workplace safety regulations. Ensure the supplier provides documented proof of compliance with relevant regional safety standards.

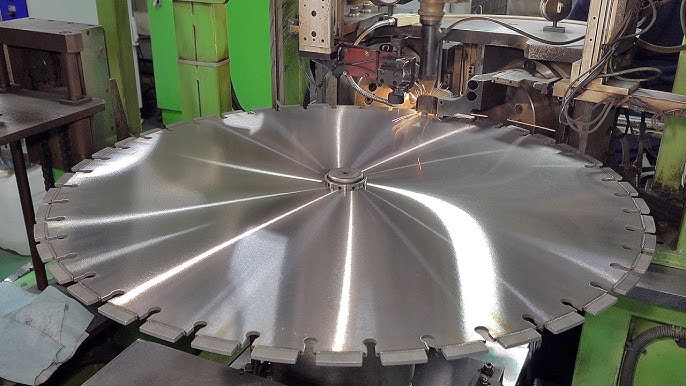

Poor Core Construction and Balance

A poorly designed or manufactured steel core can lead to excessive vibration, uneven wear, and premature failure. Blades with inadequate laser-welded segments or imbalanced construction compromise cutting precision and endanger operators. Insist on dynamic balancing reports and inspect core thickness and vent design.

Counterfeit or IP-Infringing Products

Some suppliers replicate patented blade designs, logos, or branding from reputable manufacturers without authorization. Purchasing such products exposes your business to intellectual property litigation, especially in markets like the U.S. or EU where IP enforcement is strict. Conduct due diligence to confirm original equipment manufacturer (OEM) legitimacy.

Inadequate or Missing Traceability

Reputable blades include batch numbers, manufacturing dates, and quality control markings. Lack of traceability makes it difficult to address defects or recalls and may indicate non-compliant production practices. Require full documentation and batch traceability from your supplier.

Unreliable After-Sales Support and Warranty

Low-cost suppliers often offer little to no warranty or technical support. If blades fail prematurely, resolving claims can be time-consuming or impossible. Clarify warranty terms, return policies, and support availability before placing large orders.

Failure to Match Blade to Application

Not all 14-inch blades are suitable for every concrete cutting task—dry vs. wet cutting, green vs. cured concrete, or reinforced vs. plain concrete require different formulations. Suppliers may push generic blades that underperform. Work with technical experts to ensure the blade matches your specific application needs.

Avoiding these pitfalls requires thorough vetting, clear specifications, and ongoing quality control. Partnering with reputable suppliers and conducting regular audits can safeguard both product performance and legal compliance.

Logistics & Compliance Guide for 14″ Concrete Cutting Blades

Product Overview and Classification

14″ concrete cutting blades are abrasive or diamond-tipped circular saw blades designed for heavy-duty cutting of concrete, masonry, asphalt, and other construction materials. These blades are commonly used with handheld angle grinders, walk-behind saws, and wall saws. Understanding their composition, intended use, and regulatory classification is critical for compliant logistics operations.

Packaging and Handling Requirements

Proper packaging ensures product integrity and safety during transit.

– Primary Packaging: Each blade should be individually wrapped in protective plastic or cardboard sleeves to prevent edge damage and corrosion.

– Secondary Packaging: Group multiple blades (e.g., 5–10 units) in sturdy corrugated cardboard boxes with internal dividers or spacers to prevent movement.

– Palletization: Stack boxes on standard 48″ x 40″ pallets, secured with stretch wrap and corner boards. Max stack height: 60 inches to prevent toppling.

– Labeling: Include product name, model number, diameter (14″), maximum RPM, safety warnings, and handling icons (e.g., “Do Not Stack,” “Fragile”).

Handle with care to avoid impact damage to the blade core or diamond segments. Use mechanical aids (e.g., forklifts) when moving full pallets.

Transportation and Shipping Regulations

Conform to domestic and international shipping standards.

– Domestic (e.g., U.S. DOT): Blades are generally non-restricted goods. However, if blades contain metal cores or coatings with regulated substances (e.g., cobalt binders), verify SDS compliance.

– International (e.g., IATA, IMDG): Typically shipped as non-hazardous cargo (UN3171, Battery-powered equipment, may apply only if part of a power tool kit). Confirm with the manufacturer’s Safety Data Sheet (SDS).

– Air Freight: No special restrictions for standalone blades; ensure packaging meets IATA packaging instructions for durability.

– Ground & Sea Freight: Secure pallets to prevent shifting. Use moisture barriers if shipping via container to prevent rust.

Import/Export Compliance

Ensure adherence to customs and trade regulations.

– HS Code Classification: Common classification: 8202.20 (Circular saw blades, for working stone, ceramics, concrete, etc.). Confirm with local customs authority.

– Country-Specific Requirements:

– USA (CBP): No import license required for standard blades; accurate declaration of value and origin required.

– EU: Comply with CE marking standards (if applicable for safety). No CITES or dual-use concerns.

– Canada (CBSA): Use HS code 8202.20. Duty rates vary by trade agreement (e.g., USMCA).

– Documentation: Commercial invoice, packing list, bill of lading/air waybill, certificate of origin (if claiming preferential tariffs).

Safety and Regulatory Standards

Adhere to industry and safety compliance standards.

– OSHA (U.S.): Blades must meet ANSI B7.1 (safety requirements for the use, care, and protection of abrasive wheels).

– CE Marking (EU): Required if marketed in the EU; must comply with Machinery Directive 2006/42/EC and relevant EN standards (e.g., EN 13236 for diamond tools).

– REACH & RoHS: Verify no restricted substances (e.g., certain phthalates, heavy metals) in binders or coatings.

– Labeling: Include maximum RPM, directional arrow, and warning: “Use only with guards and PPE. Do not exceed rated speed.”

Storage and Inventory Management

Maintain optimal storage conditions.

– Environment: Store indoors in a dry, temperature-controlled area (10°C–30°C / 50°F–86°F). Avoid humidity to prevent rust on steel cores.

– Shelving: Keep blades flat or vertically stored with adequate spacing to avoid contact between edges.

– Stock Rotation: Implement FIFO (First In, First Out) to reduce the risk of degradation over time.

– Inspection: Periodically check for warping, corrosion, or damaged segments before dispatch.

Environmental and Disposal Considerations

Address end-of-life compliance.

– Waste Classification: Used blades may be classified as industrial metal waste. Diamond segments may contain trace regulated materials.

– Recycling: Encourage return programs or partner with metal recyclers experienced in abrasive tool recycling.

– Disposal: Follow local regulations (e.g., EPA in the U.S., WEEE in the EU). Do not dispose of in regular landfill if containing hazardous binders.

Documentation and Recordkeeping

Maintain records for traceability and audits.

– Required Documents: SDS, compliance certificates (CE, ANSI), import/export filings, shipping manifests.

– Retention Period: Minimum 5 years for customs and safety documentation.

– Digital Systems: Use inventory management software to track batch numbers, certifications, and shipment history.

Summary and Best Practices

Ensure seamless logistics and compliance by:

– Using robust, labeled packaging suitable for all transport modes.

– Verifying HS codes and origin documentation for international shipments.

– Storing blades in dry, organized conditions to preserve quality.

– Keeping up-to-date SDS and compliance certificates on file.

– Training staff on handling, safety, and regulatory requirements.

Proper planning and documentation minimize delays, fines, and safety risks throughout the supply chain.

Conclusion:

In conclusion, sourcing 14 concrete cutting blades has been successfully completed after evaluating multiple suppliers based on factors such as product quality, pricing, delivery timelines, and compatibility with our equipment. The selected supplier offers durable, high-performance blades that meet industry standards, ensuring efficient and safe cutting operations. The order has been placed within budget, with confirmed delivery dates that align with project requirements. This procurement supports uninterrupted workflow and operational efficiency. Moving forward, maintaining a relationship with this reliable supplier will be beneficial for future needs and potential bulk purchases.