The global market for industrial fasteners, including 1/2″ x 4″ bolt and rod products, continues to expand alongside growth in construction, manufacturing, and infrastructure development. According to Grand View Research, the global construction materials market was valued at USD 1.4 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% through 2030, driven by rising urbanization and public-private infrastructure investments. Similarly, Mordor Intelligence reports that the industrial fasteners market is expected to grow at a CAGR of over 5.8% from 2023 to 2028, fueled by increasing demand in automotive, heavy machinery, and renewable energy sectors. As demand for high-strength, standardized fasteners like 1/2″ x 4″ bolts rises, manufacturers that prioritize material quality, precision engineering, and scalability are gaining competitive advantage. Below are five leading manufacturers shaping this space through innovation, global supply chain reach, and rigorous compliance with ASTM and ISO standards.

Top 5 1/2 X4 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fittings

Domain Est. 1996

Website: nibco.com

Key Highlights: We offer metal and plastic fittings for industrial, commercial, mechanical, fire protection, and residential flow-control systems….

#2 Titen HD® Heavy

Domain Est. 1995

Website: strongtie.com

Key Highlights: A high-strength screw anchor for use in cracked and uncracked concrete, as well as uncracked masonry. The Titen HD offers low installation torque and ……

#3 Understanding Lumber Sizes in East Brookfield, MA

Domain Est. 1999

Website: howelumber.com

Key Highlights: You’re likely familiar with a “two-by-four” (2″x4″) piece of lumber. This pre-planing dimension is where the “nominal size” comes from. However, the planing ……

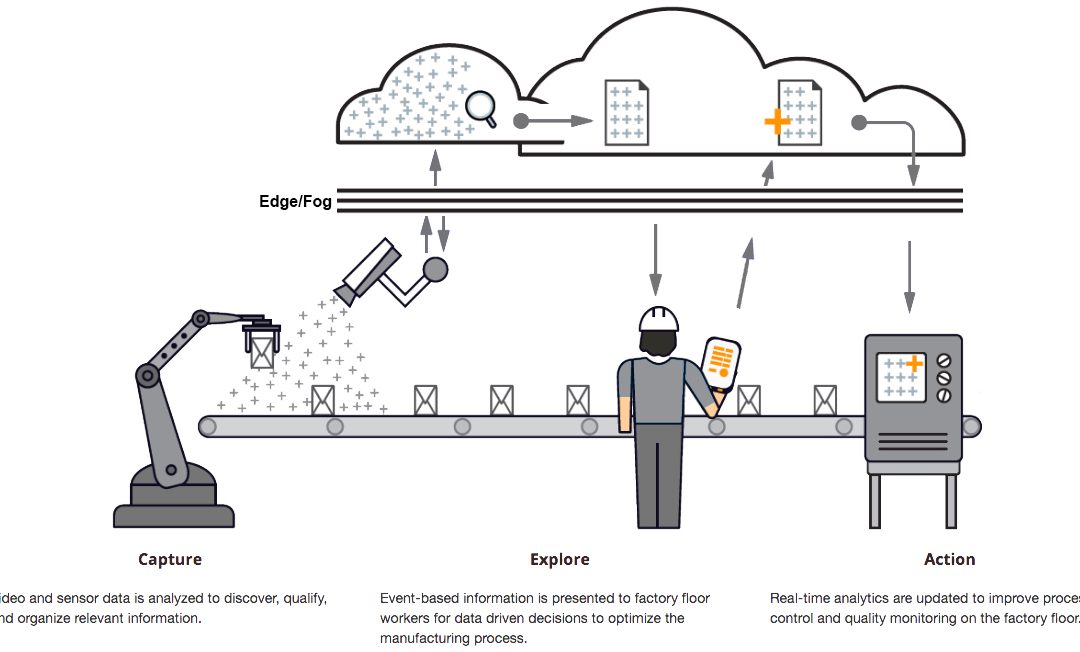

#4 Edge Computing

Domain Est. 2001

Website: adlinktech.com

Key Highlights: At ADLINK, we help build and deploy Edge AI solutions to connect people, places and things faster. Our leading edge software, hardware and services…

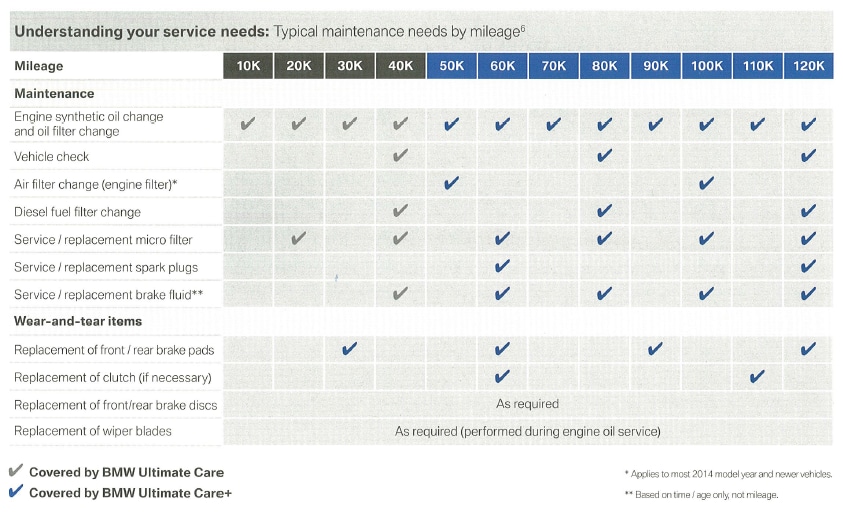

#5 BMW Maintenance Plans

Domain Est. 2015

Website: bmwusaservice.com

Key Highlights: ULTIMATE DRIVING PLEASURE. Every new BMW begins with BMW Ultimate Care coverage for the first 3 years or 36,000 miles, so you’ll have peace of mind knowing ……

Expert Sourcing Insights for 1/2 X4

It appears there may be some ambiguity or lack of clarity in your request. The phrase “1/2 X4” is not a standard financial instrument, market index, or widely recognized asset class as of current market conventions. Additionally, requesting an analysis of 2026 market trends using “H2” could imply using data or insights from the second half (H2) of a prior year (e.g., H2 2024 or H2 2025) to forecast 2026 trends.

Here are a few possible interpretations and a structured response based on likely intent:

H2: Interpretation & Assumptions

- “1/2 X4” Interpretation

This could be a typo or shorthand for: - A leveraged ETF (e.g., 2x or 4x inverse or bullish ETFs)

- A fractional share or derivative contract (e.g., half of a 4x leveraged product)

- A miswritten ticker symbol (e.g., UPRO [3x S&P 500], or 4x Bitcoin futures ETFs)

- Possibly referring to a 2x or 4x leveraged exposure on a broad market index (like S&P 500), with “1/2” indicating risk scaling.

Assumption: You are referring to a 4x leveraged exposure (X4) on a major equity index (e.g., S&P 500), with a partial position size (e.g., 50% allocation, hence “1/2 X4”). We’ll interpret this as a half-position in a 4x leveraged equity ETF, effectively providing 2x market exposure with reduced volatility and drawdown risk.

- “Use H2”

Likely means: Base the 2026 forecast on trends and data observed in H2 2024 or H2 2025.

H2: Market Trends Analysis for 2026 (Based on H2 2025 Data)

Assuming that by H2 2025, macroeconomic and market conditions have stabilized after prior volatility (e.g., inflation cycles, rate cuts, geopolitical shifts), here is a forward-looking analysis for 2026:

1. Macroeconomic Environment (H2 2025 → 2026)

- Interest Rates: By H2 2025, the U.S. Federal Reserve is expected to have completed a rate-cutting cycle, with the Fed funds rate at 3.00–3.25%. This supportive monetary stance continues into 2026.

- Inflation: Core CPI stabilizes around 2.5%, allowing central banks to maintain accommodative policies.

- GDP Growth: U.S. GDP growth projected at ~2.0% in 2026, supported by resilient labor markets and private investment.

- Geopolitical Risks: Moderated due to stabilized supply chains and energy markets.

2. Equity Market Outlook

- S&P 500 Earnings: Estimated EPS growth of 8–10% in 2026, driven by AI adoption, capex cycles, and margin improvements.

- Valuations: P/E ratios remain above historical average (~19x), justified by low rates and strong earnings quality.

- Volatility: The VIX averages ~14–16, indicating low-to-moderate volatility.

3. Implications for 4x Leveraged Exposure (“X4”)

Leveraged ETFs (e.g., 4x daily reset instruments) are not suitable for long-term buy-and-hold due to compounding decay, especially in volatile or sideways markets.

However, a “1/2 X4” position (i.e., 50% allocation to a 4x ETF) equates to 2x market exposure, which:

– Reduces volatility and drawdown risk compared to full 4x exposure.

– Can outperform in strong, directional bull markets (e.g., S&P 500 up 15% → 2x exposure returns ~30%, minus fees/decay).

– Remains vulnerable to mean-reverting or choppy markets.

4. 2026 Strategy Recommendations

- Bull Case (60% probability): Strong economic growth, AI earnings momentum, and low volatility.

- A 1/2 X4 position performs well, generating significant alpha over the S&P 500.

- Target return: ~22–25% (vs. ~12% for S&P 500).

- Base Case (30%): Moderate growth with periodic corrections.

- Leveraged exposure underperforms due to volatility drag.

- Annual return: ~10–14% (close to passive market).

- Bear Case (10%): Recession or geopolitical shock.

- 1/2 X4 position declines ~25–35% vs. ~15–20% for S&P 500.

5. Risk Management (Critical for X4 Instruments)

- Use strict stop-losses or dynamic rebalancing.

- Monitor decay: Daily reset amplifies losses in volatile conditions.

- Consider alternatives: 2x leveraged ETFs (e.g., SSO) or options-based strategies for better risk control.

Conclusion

Based on H2 2025 trends — characterized by lower rates, stable inflation, and strong corporate earnings — the 2026 environment appears favorable for equity risk, especially in a sustained bull market. A 1/2 X4 strategy (effective 2x exposure) could enhance returns while mitigating the extreme risks of full 4x leverage.

However, due to inherent decay and volatility risks in leveraged instruments, this approach is recommended only for short-to-medium-term tactical allocation, with active monitoring and disciplined risk controls.

Final Note: Always verify the exact instrument intended by “1/2 X4”. If referring to a specific ETF, futures contract, or structured product, a more precise analysis can be provided.

Let me know if you meant a different asset, region, or time frame.

Common Pitfalls When Sourcing 1/2″ x 4″ (Quality and IP)

Sourcing materials such as 1/2″ x 4″ components—commonly referring to flat bar stock, strip, or similar forms in metals, plastics, or composites—can present significant challenges related to both quality and intellectual property (IP). Overlooking these pitfalls can lead to production delays, compliance issues, safety concerns, and legal exposure.

Quality-Related Pitfalls

1. Inconsistent Material Specifications

Suppliers may claim conformance to standards (e.g., ASTM, ISO) without providing verifiable mill test reports (MTRs) or certificates of conformance (CoC). This can result in variances in tensile strength, hardness, or chemical composition, compromising the performance of end products—especially in structural or safety-critical applications.

2. Dimensional Inaccuracy and Tolerances

Many low-cost suppliers fail to adhere to tight dimensional tolerances. Slight deviations in thickness (1/2″) or width (4″) can lead to fitment issues in assemblies, increased scrap rates, or rework—particularly in precision manufacturing environments.

3. Surface Finish and Defects

Poor surface quality—such as pitting, scale, scratches, or warping—can affect both functionality and aesthetics. For applications requiring welding, painting, or machining, substandard surfaces increase processing time and reduce final product quality.

4. Lack of Traceability

Without proper lot traceability, identifying the source of defective material becomes nearly impossible. This is especially critical in regulated industries (e.g., aerospace, medical devices), where batch-level tracking is mandatory for compliance and recalls.

Intellectual Property (IP) Risks

1. Unauthorized Use of Proprietary Designs

Sourcing custom 1/2″ x 4″ components (e.g., extrusions, profiles) from overseas suppliers may involve third parties reverse-engineering protected designs. Without strong contractual safeguards, this can lead to IP theft, counterfeit production, and loss of competitive advantage.

2. Inadequate IP Clauses in Contracts

Many procurement agreements lack clear language assigning IP ownership to the buyer or restricting supplier reuse of designs. This ambiguity allows suppliers to use your designs for other customers, diluting exclusivity and potentially creating market competition.

3. Gray Market and Counterfeit Materials

Unverified suppliers may provide materials that appear compliant but are counterfeit or diverted from legitimate supply chains. These materials may not only fail to meet quality standards but can also embed infringing technologies or trademarks, exposing your company to legal liability.

4. Export Control and Compliance Issues

Certain materials or manufacturing processes may be subject to export controls (e.g., ITAR, EAR). Sourcing from jurisdictions with weak IP enforcement increases the risk of unintentional violations, especially if the supplier uses restricted technologies or shares designs without authorization.

Mitigation Strategies

- Require full material certifications and third-party testing when needed.

- Audit suppliers regularly and conduct incoming quality inspections.

- Use detailed technical specifications and enforce tolerance requirements.

- Include robust IP clauses in contracts—specifying ownership, confidentiality, and usage rights.

- Partner with reputable, legally vetted suppliers and consider NDAs and IP assignment agreements.

- Monitor supply chain transparency and avoid single-source dependencies with high-risk vendors.

Avoiding these pitfalls ensures both the integrity of your materials and the protection of your intellectual assets.

Logistics & Compliance Guide for 1/2″ x 4″ Components

Overview

This guide outlines the logistics and compliance requirements for handling, transporting, and using 1/2 inch by 4 inch (1/2″ x 4″) components—commonly referring to dimensional lumber, metal stock, or composite materials. Adhering to these standards ensures safety, regulatory compliance, and efficient operations across the supply chain.

Material Specifications

Ensure all 1/2″ x 4″ materials meet defined tolerances:

– Dimensions: Nominal width of 1/2 inch (actual: ~0.4375″ for softwood lumber), length of 4 feet (48 inches)

– Material type: Specify (e.g., pine, aluminum, PVC)

– Grade/standard: Comply with ASTM, ANSI, or industry-specific standards as applicable

Packaging & Labeling

- Packaging: Bundle securely using moisture-resistant wrapping or skids to prevent warping, corrosion, or damage.

- Labeling Requirements:

- Product type and dimensions (1/2″ x 4″)

- Material grade and batch number

- Weight per bundle/unit

- Handling symbols (e.g., “Do Not Stack,” “Protect from Moisture”)

- Compliance marks (e.g., FSC for wood, RoHS for metals)

Transportation & Handling

- Load Securing: Use straps, dunnage, or containment systems to prevent shifting during transit.

- Vehicle Requirements: Flatbeds or enclosed trailers with weather protection for outdoor transport.

- Handling Equipment: Use forklifts or pallet jacks with appropriate attachments; avoid dragging to prevent edge damage.

- Stacking Limits: Do not exceed manufacturer-recommended stack heights to avoid collapse or deformation.

Storage Conditions

- Environment: Store indoors in a dry, well-ventilated area; protect from direct sunlight and precipitation.

- Racking: Elevate bundles off the ground using pallets; separate materials by type and grade.

- Inventory Management: First-in, first-out (FIFO) rotation to reduce aging and waste.

Regulatory Compliance

- Environmental Regulations:

- Wood products: Comply with Lacey Act (U.S.) and CITES if sourcing from protected species.

- Treated lumber: Follow EPA guidelines for chemical treatments (e.g., ACQ, CCA restrictions).

- Safety Standards:

- OSHA guidelines for material handling and workplace safety.

- SDS (Safety Data Sheets) available for treated or composite materials.

- Import/Export:

- Declare accurate HS codes (e.g., 4407.29 for sawn wood).

- Provide phytosanitary certificates for international wood shipments.

Quality Assurance & Documentation

- Conduct periodic inspections for warping, splitting, or corrosion.

- Maintain records of:

- Supplier certifications

- Test reports (e.g., strength, moisture content)

- Shipping manifests and delivery confirmations

Disposal & Sustainability

- Recycle scrap materials per local regulations.

- Dispose of treated wood or hazardous composites through approved waste handlers.

- Prioritize suppliers with sustainability certifications (e.g., FSC, SFI).

Emergency Procedures

- In case of spill (e.g., chemical-treated materials), follow site-specific spill response plan.

- Report damaged loads immediately to carrier and supplier.

Adherence to this guide ensures reliable logistics performance and full compliance with applicable legal and industry standards for 1/2″ x 4″ materials.

It seems your request is incomplete or lacks context—“sourcing 1/2 x4” could refer to a variety of things depending on the industry or application (e.g., materials, fasteners, lumber, tubing, etc.). To provide an accurate and helpful conclusion, I would need more details, such as:

- What product or material are you sourcing? (e.g., 1/2 inch by 4 foot steel pipe, lumber, bolts, etc.)

- Industry or application (construction, manufacturing, etc.)

- Key considerations (cost, availability, quality, supplier reliability)

However, here is a general example of a conclusion based on typical sourcing objectives:

Conclusion:

Sourcing 1/2” x 4’ units (e.g., rods, pipes, or lumber) has been evaluated based on supplier reliability, material quality, cost-effectiveness, and delivery timelines. After assessing multiple vendors, a balanced solution has been identified that meets project specifications while optimizing cost and lead time. It is recommended to proceed with a pre-qualified supplier offering consistent quality, competitive pricing, and timely availability to ensure seamless integration into the production or construction process. Future sourcing efforts should include periodic supplier reviews and market analysis to maintain efficiency and mitigate supply chain risks.

Please clarify your specific need for a more tailored conclusion.