The global market for electrical wires and cables, including 12-gauge wire, is experiencing steady expansion driven by rising investments in infrastructure, renewable energy, and industrial automation. According to a 2023 report by Mordor Intelligence, the global electrical wire and cable market was valued at USD 184.3 billion and is projected to grow at a CAGR of 5.1% from 2023 to 2028. A key contributor to this growth is the sustained demand for standard-gauge wiring, such as 12 AWG (American Wire Gauge), widely used in residential electrical systems, automotive applications, and commercial power distribution due to its balance of current-carrying capacity and flexibility. Grand View Research further supports this trend, noting that regional modernization of power grids and stricter building codes are accelerating product adoption across North America and Asia-Pacific. As demand rises, manufacturers are differentiating through material innovation, compliance with safety standards, and scalability—factors that shape the performance and reliability of the top 12 wire producers worldwide.

Top 10 12 Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rea Magnet Wire Company Inc.

Domain Est. 1995

Website: reawire.com

Key Highlights: At Rea Magnet Wire, we deliver reliable magnet wire solutions that power your business, from industrial applications to consumer products….

#2 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#3 Direct Wire

Domain Est. 2000

Website: directwire.com

Key Highlights: Leading manufacturer of best-in-class industrial wire and cable products and assemblies for demanding power applications. Made in USA….

#4 Service Wire Company

Domain Est. 1996 | Founded: 1968

Website: servicewire.com

Key Highlights: Since 1968, we’ve built a reputation for safely manufacturing high-quality wire and cable, delivering industry-leading service levels….

#5 Priority Wire & Cable

Domain Est. 1999

Website: prioritywire.com

Key Highlights: Priority Wire & Cable supplies wire & cable from the largest stock in the U.S. and offers same day shipping. This includes Industrial, Aluminum, and many ……

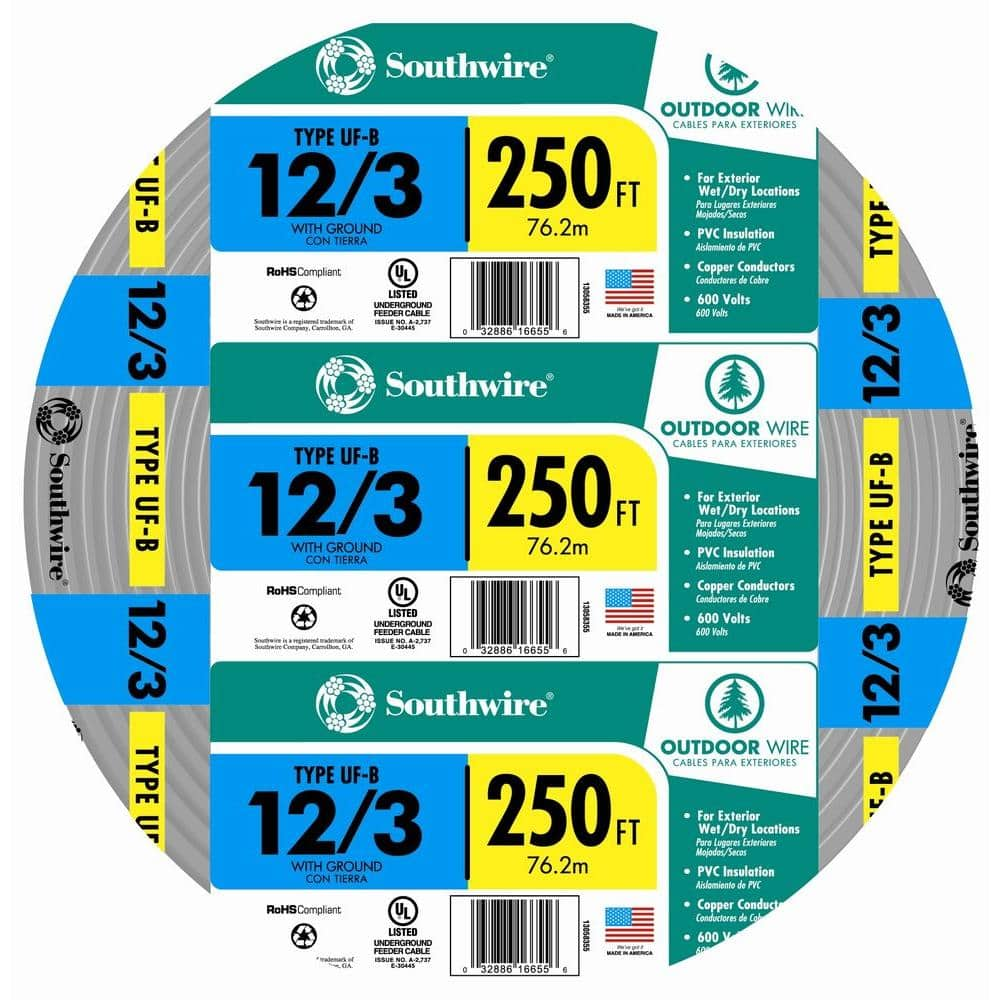

#6 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#7 Copper Wire Supplier

Domain Est. 1996

Website: cerrowire.com

Key Highlights: Cerrowire is a leading copper wire supplier offering MC cables, aluminum wire, and building cables for reliable electrical solutions….

#8 Alpha Wire

Domain Est. 1997

Website: alphawire.com

Key Highlights: Help. Browse our FAQ or fill out a quick form to get support. Learn More ; Get a Sample. Request a free product sample. Get Sample ; Distributor. Find an Alpha ……

#9 American Wire Group

Domain Est. 2000

Website: buyawg.com

Key Highlights: American Wire Group specializing wire & cable products for renewable energy and electrical utilities. Learn more about our products here….

#10 International Wire

Domain Est. 2004

Website: internationalwire.com

Key Highlights: International Wire manufactures high-quality wire and cable products for diverse industries, delivering reliable performance and innovative solutions….

Expert Sourcing Insights for 12 Wire

2026 Market Trends for 12-Gauge Wire: A H2 Analysis

While “12 Wire” is a broad term, assuming it refers to 12-gauge electrical wire (a standard size for residential/commercial power circuits), analysis for 2026 points to significant growth and transformation, heavily influenced by macro trends. The dominant force shaping this market is the H2 (Hydrogen Economy) infrastructure build-out, alongside other key drivers.

1. H2 (Hydrogen) Infrastructure: The Primary Catalyst

* Electrolyzer Deployment: Large-scale green hydrogen production via electrolysis requires massive amounts of electrical power. 12-gauge wire is a fundamental component within the balance of plant (BOP) systems, control panels, and auxiliary power distribution for electrolyzer skids. As national and corporate H2 targets accelerate towards 2030/2040, 2026 will see a significant ramp-up in pilot and first commercial-scale electrolyzer installations, directly boosting demand for robust electrical wiring like 12 AWG.

* Hydrogen Refueling Stations (HRS): The expansion of the hydrogen refueling network for fuel cell electric vehicles (FCEVs – trucks, buses) is critical. HRS require substantial electrical infrastructure for compressors, dispensers, cooling systems, and controls. 12-gauge wire is essential for power feeds and control wiring within these stations. Government funding (e.g., US DOE’s Clean Hydrogen Hubs, EU Hydrogen Backbone) will drive HRS construction, creating new demand pockets.

* Grid Interconnection & Power Conversion: Connecting large H2 facilities to the grid necessitates complex substations and power conversion systems (rectifiers, inverters). 12-gauge wire is used extensively in control circuits, monitoring systems, and auxiliary power within these critical power electronics enclosures.

* Material & Safety Requirements: H2 environments demand specific material compatibility and safety standards. While the base copper conductor remains standard, there will be increased demand for 12-gauge wire with enhanced insulation (e.g., higher temperature ratings, improved chemical resistance) suitable for potentially corrosive or high-temperature zones near H2 equipment, and potentially halogen-free options for safety.

2. Broader Market Drivers Amplifying Demand (Synergistic with H2):

* Electrification & EV Charging: The continued rollout of Level 2 EV chargers (common in homes, workplaces, public lots) relies heavily on 12-gauge wire (often 12/2 or 12/3 NM-B) for the 240V circuits. Faster charging adoption (though requiring larger gauges) increases overall electrical load and infrastructure, supporting the broader wire market.

* Renewable Energy Integration: Solar PV installations (especially residential/commercial) use 12-gauge wire for inverter output circuits, combiner boxes, and critical control wiring. The push for decarbonization directly feeds demand.

* Grid Modernization & Resilience: Investments in smart grids, microgrids, and upgraded distribution networks involve extensive new wiring, including 12-gauge for control, monitoring, and auxiliary power in substations and switchgear.

* Industrial Automation & IoT: Factories adopting Industry 4.0 use vast networks of sensors, PLCs, and control systems, many powered and controlled via 12-gauge wiring for reliability and sufficient current capacity.

* Residential & Commercial Construction: Ongoing new construction and renovation projects provide steady baseline demand for standard 12-gauge NM (Romex) cable for branch circuits (outlets, lighting, appliances).

3. Key Trends & Implications for 2026:

* Shift Towards Premium/Enhanced Products: Driven by H2, renewables, and data centers, demand will grow for 12-gauge wire with features like:

* Higher Temperature Ratings (90°C+): Essential for dense installations and high-ambient environments (e.g., near H2 equipment, inverter rooms).

* Enhanced Insulation Materials: XLPE (cross-linked polyethylene), EPR (Ethylene Propylene Rubber), or specialized compounds offering better heat, moisture, and chemical resistance compared to standard PVC.

* Halogen-Free & Low-Smoke Zero-Halogen (LSZH): Critical for safety in confined spaces (control rooms, tunnels, refueling stations) to minimize toxic smoke in case of fire.

* Shielded Variants: Increased need for EMI/RFI protection in sensitive control systems within H2 facilities and industrial automation.

* Supply Chain Focus & Resilience: Geopolitical tensions and past disruptions emphasize the need for secure, diversified supply chains for copper and insulation materials. Local/nearshoring of production might gain traction.

* Sustainability & Recycling: Pressure will grow for manufacturers to use recycled copper, reduce production emissions, and design for recyclability. Transparency in material sourcing will be valued.

* Price Volatility: Copper prices will remain a key factor, influenced by global demand (especially from EVs, renewables, H2) and mining output. Efficiency and waste reduction in installation will be crucial.

Conclusion:

The 12-gauge wire market in 2026 will be significantly more dynamic than a commodity market. The H2 infrastructure build-out will be the single most transformative trend, creating substantial new demand and pushing the market towards higher-performance, specialized wire products with enhanced safety and durability features. This growth will be amplified by the ongoing electrification megatrends (EVs, renewables, grid modernization). Success for wire manufacturers and suppliers will depend on their ability to innovate with advanced materials, ensure supply chain resilience, meet stringent safety standards for emerging applications like H2, and navigate copper price volatility. 12-gauge wire will remain a foundational building block, but its applications will increasingly be found in the critical infrastructure powering the clean energy transition.

Common Pitfalls in Sourcing 12-Wire Components (Quality and IP)

Sourcing 12-wire components—commonly used in high-precision sensors, industrial automation, and medical devices—requires careful attention to both quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational failures, financial losses, and legal risks. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Specifications

Suppliers may provide 12-wire components that fail to meet required tolerances, shielding standards, or signal integrity benchmarks. Inconsistent batch quality, use of substandard materials (e.g., incorrect gauge or insulation), or poor manufacturing processes can result in signal crosstalk, electromagnetic interference (EMI), or premature failure in the field. Always verify supplier certifications (e.g., ISO 9001), request sample testing, and enforce rigorous incoming inspection protocols.

Lack of Traceability and Documentation

Many low-cost suppliers fail to provide full traceability for materials and production processes. Without proper documentation—such as RoHS compliance, material safety data sheets (MSDS), or test reports—it becomes difficult to ensure reliability or meet regulatory requirements, especially in regulated industries like aerospace or healthcare.

Counterfeit or Gray Market Components

The demand for high-performance 12-wire assemblies can attract counterfeit products or gray-market resellers. These may mimic genuine parts but lack proper testing, warranties, or compliance. Always source from authorized distributors or directly from OEMs, and verify component authenticity through lot tracking and third-party validation.

Intellectual Property Infringement Risks

Using or replicating 12-wire designs—especially proprietary connectors, pin configurations, or shielding techniques—can expose companies to IP violations. Some suppliers may offer “compatible” versions that infringe on patented technologies. Conduct due diligence on design rights, obtain proper licensing, and include IP indemnification clauses in procurement contracts.

Inadequate Supplier Vetting and Long-Term Support

Choosing suppliers based solely on price can lead to poor after-sales support, long lead times, or discontinuation of parts without notice. Ensure suppliers have a proven track record, scalable production capacity, and clear obsolescence management policies to support long-term product lifecycles.

Non-Compliance with Industry Standards

12-wire components must often meet specific standards (e.g., UL, CE, MIL-SPEC). Sourcing parts without verifying compliance can delay certifications, lead to product recalls, or result in safety hazards. Confirm that components meet all relevant regional and industry-specific requirements prior to integration.

By proactively addressing these pitfalls, organizations can ensure reliable performance, mitigate legal exposure, and maintain the integrity of their supply chain when sourcing 12-wire components.

Logistics & Compliance Guide for 12 Wire

This guide outlines the essential logistics and compliance considerations when handling, transporting, storing, and using 12-gauge wire. Adhering to these guidelines ensures safety, regulatory compliance, and operational efficiency across supply chain activities.

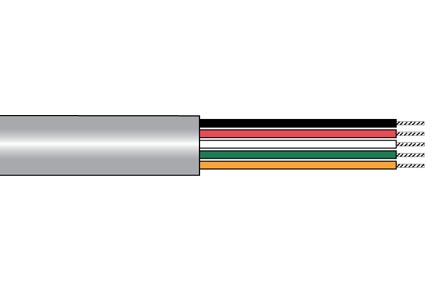

Product Specifications and Identification

12-gauge wire refers to a standardized wire size defined by the American Wire Gauge (AWG) system. It typically has a diameter of approximately 0.0808 inches (2.05 mm) and is commonly used in electrical, fencing, crafting, and industrial applications. Accurate identification is crucial to prevent substitution errors and ensure compatibility with end-use requirements.

Regulatory Compliance Requirements

Compliance with national and international standards is mandatory. Key regulations include:

- National Electrical Code (NEC): If used for electrical purposes, 12-gauge wire must meet NEC standards for insulation, ampacity, and installation.

- RoHS (Restriction of Hazardous Substances): Ensures wire materials do not contain restricted substances such as lead, mercury, or cadmium, particularly for electronics applications.

- REACH (EU Regulation): Applies to wire shipped to or used in the European Union; mandates declaration of Substances of Very High Concern (SVHC).

- OSHA Standards: Workplace handling and storage must comply with Occupational Safety and Health Administration guidelines to prevent injury.

Packaging and Labeling Standards

Proper packaging protects the wire during transit and ensures traceability:

- Wire must be wound on reels, spools, or coiled and secured to prevent unraveling.

- Packaging materials should be moisture-resistant and durable to prevent corrosion or mechanical damage.

- Labels must include:

- AWG size (12 gauge)

- Material type (e.g., copper, aluminum, galvanized steel)

- Length and weight

- Manufacturer information

- Compliance markings (e.g., UL, CSA, CE)

- Hazard symbols if applicable (e.g., sharp ends)

Storage and Handling Procedures

Safe storage and handling prevent degradation and workplace incidents:

- Store in a dry, temperature-controlled environment to prevent oxidation or insulation breakdown.

- Keep coils upright on pallets; avoid stacking heavy items on top.

- Use appropriate lifting equipment (e.g., drum handlers, forklifts) when moving heavy spools.

- Provide protective gear (gloves, eye protection) for personnel due to sharp wire ends.

Transportation Guidelines

Transporting 12-gauge wire requires adherence to shipping regulations:

- Secure loads to prevent shifting during transit; use straps or bracing as needed.

- Follow DOT (Department of Transportation) regulations for domestic U.S. shipments.

- For international shipping, comply with IMDG (maritime), IATA (air), or ADR (road in Europe) as applicable.

- Declare wire contents accurately on shipping manifests; classify based on material (e.g., non-hazardous unless coated with flammable substances).

Import/Export Documentation

Cross-border movement requires proper documentation:

- Commercial invoice with product description, value, and origin.

- Packing list detailing weight, dimensions, and quantity.

- Certificate of Compliance or Conformity (COC) for regulated applications.

- Harmonized System (HS) Code: Typically 7408.10 (copper wire) or 7217.20 (iron or steel wire), depending on material.

Quality Assurance and Traceability

Maintain full traceability from manufacturer to end-user:

- Implement lot or batch numbering on packaging.

- Conduct regular quality audits and retain test reports for conductivity, tensile strength, and insulation integrity (if applicable).

- Keep records of supplier certifications and compliance documentation for at least 5 years.

Environmental and Disposal Compliance

Dispose of scrap or defective wire responsibly:

- Recycle through certified metal recyclers; copper and steel have high recyclability.

- Follow EPA guidelines for handling wire with hazardous coatings or insulation.

- Document waste disposal to meet environmental reporting requirements.

Training and Documentation

Ensure staff are trained on:

- Safe handling and emergency procedures

- Regulatory compliance requirements

- Use of personal protective equipment (PPE)

- Recordkeeping protocols

Maintain up-to-date training logs and compliance checklists as part of your logistics management system.

Conclusion

Adhering to this Logistics & Compliance Guide for 12-gauge wire ensures operational safety, legal compliance, and supply chain reliability. Regular audits, staff training, and documentation are key to sustaining compliance across all stages of the product lifecycle.

Conclusion for Sourcing 12-Gauge Wire:

After evaluating suppliers, quality standards, cost considerations, and logistical requirements, sourcing 12-gauge wire should prioritize reliability, compliance with electrical safety standards (such as NEC and UL certification), and long-term performance. Based on the comparative analysis, a balanced approach involving vetted suppliers offering competitive pricing, consistent material quality (e.g., copper conductivity, insulation type), and timely delivery is recommended. Additionally, ensuring that the wire meets local regulatory requirements and application-specific needs—such as ampacity for residential, commercial, or industrial use—will mitigate risks and support project efficiency. Ongoing supplier relationships and periodic quality audits are advised to maintain supply chain integrity and project success.