The global 12 VDC battery market is experiencing steady expansion, driven by rising demand across automotive, renewable energy, and backup power applications. According to Mordor Intelligence, the 12V battery market was valued at approximately USD 38.5 billion in 2023 and is projected to grow at a CAGR of over 5.2% through 2029. This growth is fueled by increasing vehicle production, the proliferation of off-grid solar systems, and the essential role of 12V lead-acid and lithium-ion batteries in uninterruptible power supply (UPS) systems. As industries prioritize reliable, compact, and efficient power solutions, manufacturers specializing in 12 VDC batteries are scaling innovation in energy density, cycle life, and sustainability. In this evolving landscape, nine key players have emerged as leaders, combining technological expertise, global reach, and strong R&D investment to dominate the market.

Top 9 12 Vdc Battery Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

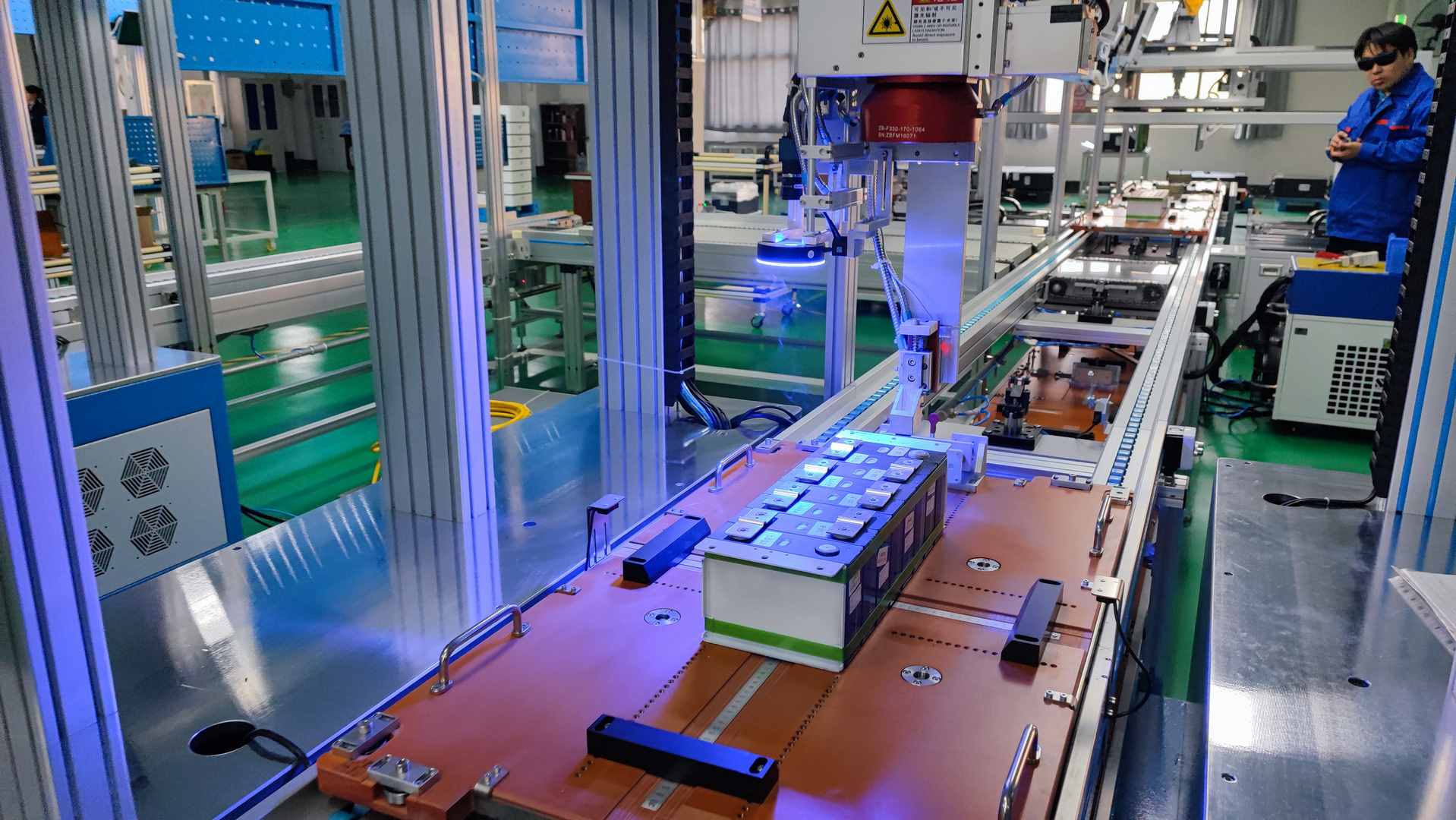

#1 Lithion Battery

Domain Est. 2020

Website: lithionbattery.com

Key Highlights: Our Brands Lithion Custom: Full-stack battery manufacturing from 12V to 1500V systems for mobile and industrial applications. Engineered with Lithion’s ……

#2 Power-Sonic

Domain Est. 1995

Website: power-sonic.com

Key Highlights: Power-Sonic delivers innovative battery solutions with sealed lead acid and lithium batteries, energy storage systems, and EV chargers….

#3 Quality Deep Cycle Batteries

Domain Est. 1997

Website: usbattery.com

Key Highlights: Reliable, deep cycle batteries from U.S. Battery Mfg Co. High-quality 6V, 8V, 12V, 24V, and 48V batteries deliver power you can depend on!…

#4 BATTERIES

Domain Est. 1997

Website: enersys.com

Key Highlights: Explore our application-specific batteries designed to meet the specific energy storage challenges unique to your industry and all the ……

#5 Sterling Power USA, Marine Grade AC Battery Chargers, Marine …

Domain Est. 2009

Website: sterling-power-usa.com

Key Highlights: Sterling Power Battery to Battery Charger 12V input to 12V output 40amp DC powered charger. Part # BB1240 Now Available. Our Newest DC to DC charger in a 12v ……

#6 Battle Born Batteries

Domain Est. 2016

Website: battlebornbatteries.com

Key Highlights: Free delivery · 30-day returnsShop premium LiFePO4 lithium batteries from Battle Born for unmatched power, reliability, and a 10-year warranty. Get started today!…

#7 Ionic Lithium Deep Cycle Batteries

Domain Est. 2017

#8 The Best Solutions in Lithium & Sodium 12V Batteries for EVs …

Domain Est. 2017

Website: ohmmu.com

Key Highlights: The best 12V replacement batteries for EVs, Off-Road, Overland, RVs, Boats and Solar. Get longer life, lighter weight, and better performance with Ohmmu ……

#9 Redodo Official Store

Domain Est. 2021

Website: redodopower.com

Key Highlights: Free delivery 30-day returns Redodo Official Store – Best Lithium Batteries for RV, Marine, Solar · 【New】12V 320Ah mini Bluetooth Battery, Best for Long RV Trips Shop Now · Save Mo…

Expert Sourcing Insights for 12 Vdc Battery

H2: 2026 Market Trends for 12 Vdc Batteries

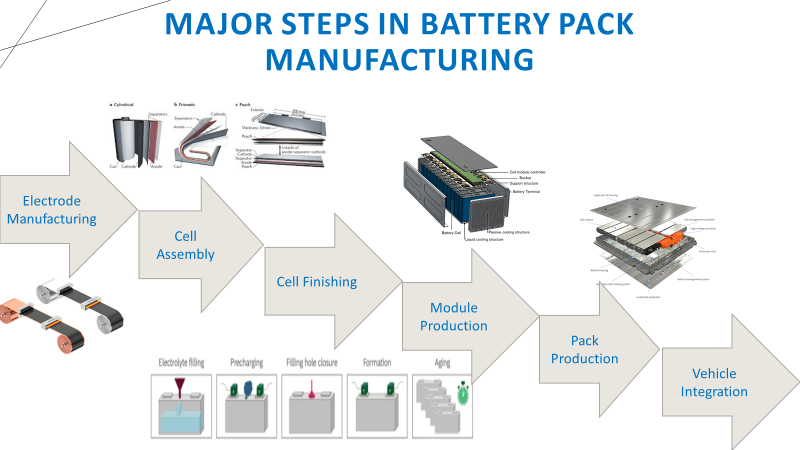

The 12-volt direct current (12 Vdc) battery market is poised for significant transformation by 2026, driven by shifts in energy demand, technological advancements, and expanding applications across industries. While traditional lead-acid batteries remain prevalent, emerging trends indicate a growing transition toward lithium-ion (Li-ion) and other advanced chemistries. Below are the key market trends expected to shape the 12 Vdc battery landscape in 2026:

1. Accelerated Shift from Lead-Acid to Lithium-Ion

By 2026, lithium iron phosphate (LiFePO₄) batteries are expected to capture a larger share of the 12 Vdc market, particularly in automotive, marine, and renewable energy storage applications. Their higher energy density, longer cycle life (2,000–5,000 cycles vs. 300–500 for lead-acid), and lower maintenance requirements make them increasingly cost-competitive despite higher initial prices. Falling lithium-ion production costs and improved manufacturing scale are accelerating this transition.

2. Growth in Off-Grid and Renewable Energy Storage

The global push for energy independence and decentralized power systems is boosting demand for 12 Vdc batteries in solar power systems, especially in residential and rural off-grid installations. 12 Vdc remains a standard voltage for small-scale solar kits due to compatibility with common inverters and charge controllers. By 2026, integration with smart energy management systems and IoT-enabled monitoring will enhance the functionality and appeal of 12 Vdc battery banks in microgrids.

3. Expansion in Automotive and Recreational Vehicle (RV) Sectors

While 12 Vdc starter batteries in conventional internal combustion engine (ICE) vehicles face long-term decline due to electrification, demand remains robust in hybrid vehicles, RVs, and specialty automotive applications. The RV and overlanding trends are driving demand for reliable, deep-cycle 12 Vdc batteries, favoring lithium solutions for their lightweight and fast-charging capabilities. Dual-purpose 12 Vdc batteries (starting + deep cycling) will see innovation to meet these hybrid needs.

4. Increased Focus on Sustainability and Recycling

Environmental regulations and consumer demand for sustainable products are pushing manufacturers to improve battery recyclability and reduce reliance on hazardous materials. By 2026, closed-loop recycling programs for both lead-acid and lithium-based 12 Vdc batteries are expected to become standard in major markets like the EU and North America. Innovations in lead recycling and second-life applications for Li-ion batteries will support circular economy goals.

5. Smart and Connected Battery Solutions

The integration of battery management systems (BMS) in 12 Vdc batteries will become more widespread, enabling real-time monitoring of state of charge (SoC), health, and temperature via smartphone apps or cloud platforms. This trend is particularly strong in marine, telecom backup, and solar applications, where reliability and predictive maintenance are critical.

6. Regional Market Diversification

Emerging markets in Africa, Southeast Asia, and Latin America will drive demand for affordable 12 Vdc battery solutions, especially for solar lighting and mobile power. While lead-acid will dominate due to cost and availability, localized manufacturing of LiFePO₄ batteries is expected to grow, supported by international development initiatives and declining lithium prices.

7. Impact of Supply Chain and Raw Material Dynamics

By 2026, supply chain resilience will influence battery chemistry choices. Volatility in lithium, cobalt, and nickel prices may temporarily slow Li-ion adoption, benefiting alternative technologies like sodium-ion, which could begin to appear in low-cost 12 Vdc applications by the end of the decade. However, for 2026, lithium remains dominant in the premium segment.

Conclusion:

By 2026, the 12 Vdc battery market will be characterized by a dual-track evolution: continued use of lead-acid in cost-sensitive and legacy applications, and rapid adoption of lithium-based solutions in high-performance and renewable energy sectors. Innovation in smart features, sustainability, and integration with digital ecosystems will differentiate leading brands. As electrification and energy resilience become global priorities, the 12 Vdc battery—though seemingly modest in voltage—will remain a critical enabler of decentralized and mobile power solutions.

Common Pitfalls When Sourcing a 12 Vdc Battery (Quality, IP)

Sourcing a reliable 12 Vdc battery requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these factors can lead to performance failures, safety hazards, legal exposure, and long-term cost overruns.

Quality-Related Pitfalls

1. Choosing Batteries Based Solely on Price

Opting for the cheapest available 12 Vdc battery often results in substandard components, reduced cycle life, poor charge retention, and inconsistent voltage output. Low-cost batteries may use recycled or inferior-grade cells, increasing the risk of premature failure or thermal runaway.

2. Ignoring Battery Chemistry and Specifications

Not all 12 Vdc batteries are created equal. Confusing lead-acid, AGM, gel, and lithium-ion (LiFePO₄) types can lead to improper selection. Each chemistry has distinct performance characteristics—such as depth of discharge, charging requirements, and temperature tolerance—that must align with the application. Misalignment can cause inefficiency or safety risks.

3. Overlooking Real-World Capacity and Discharge Rates

Manufacturers may advertise ideal laboratory capacities that don’t reflect real-world performance under load or at higher discharge rates. Failing to verify C-rate specifications and actual usable capacity can result in underpowered systems or unexpected downtime.

4. Neglecting Certifications and Safety Standards

Batteries lacking certifications such as UL, CE, IEC, or UN38.3 may not meet minimum safety, performance, or transport requirements. This poses fire, explosion, or regulatory compliance risks—especially in commercial or industrial applications.

5. Poor Quality Control from Unverified Suppliers

Sourcing from suppliers without a proven track record or manufacturing oversight increases the likelihood of receiving counterfeit, reconditioned, or inconsistently assembled batteries. These units often fail prematurely or exhibit unpredictable behavior.

IP-Related Pitfalls

1. Inadvertent Use of Proprietary Battery Management Systems (BMS)

Many advanced 12 Vdc batteries, especially lithium-based ones, include integrated BMS electronics protected by patents or copyrighted firmware. Reverse engineering or replicating these systems without authorization can lead to intellectual property infringement.

2. Sourcing Counterfeit or Clone Batteries

Some suppliers offer low-cost “compatible” batteries that mimic branded designs or packaging. These clones often infringe on trademarks, design patents, or trade dress. Using them exposes the buyer to legal liability and reputational damage.

3. Lack of IP Due Diligence in the Supply Chain

Failing to request documentation—such as IP indemnification clauses, freedom-to-operate opinions, or design ownership confirmation—can leave buyers vulnerable if a third party asserts IP rights against the battery or its use in a product.

4. Unlicensed Use of Firmware or Software Interfaces

Smart batteries may include communication protocols (e.g., CAN bus, Bluetooth) with proprietary software. Unauthorized integration or modification of these interfaces can violate software copyrights or licensing agreements.

5. Overlooking Design Patent Infringement

The physical form factor, terminal layout, or enclosure design of a battery may be protected by design patents. Copying these aesthetic or functional elements, even unintentionally, can result in infringement claims.

Mitigation Strategies

To avoid these pitfalls, always:

– Source from reputable, certified suppliers with verifiable quality control processes.

– Request full technical specifications, test reports, and compliance documentation.

– Conduct independent testing or third-party validation of sample units.

– Perform IP due diligence, including supplier warranties and IP ownership verification.

– Consult legal counsel when integrating batteries with proprietary electronics or software.

By addressing both quality and IP concerns proactively, organizations can ensure reliable performance, regulatory compliance, and freedom from legal risk in their 12 Vdc battery deployments.

H2: Logistics & Compliance Guide for 12 Vdc Battery

Overview

This guide outlines the critical logistics and compliance considerations for the safe handling, transportation, storage, and disposal of 12 Vdc (12-volt direct current) batteries. These batteries are commonly used in automotive, marine, renewable energy systems, and backup power applications. Depending on chemistry (e.g., lead-acid, lithium-ion, AGM, or gel), specific regulatory and safety protocols must be followed.

H2: Regulatory Classifications and Transport Requirements

1. Battery Chemistry and Classification

Identify the battery type to determine applicable regulations:

– Lead-Acid (Flooded, AGM, Gel): Typically non-spillable if sealed; regulated under specific provisions.

– Lithium-Ion (Li-ion): Classified as dangerous goods due to fire risk; stricter regulations apply.

2. International Regulations

- IATA (Air Transport):

- Lead-acid: Permitted if non-spillable and properly protected (IATA DGR Section II).

- Lithium-ion: Must comply with Packing Instruction 965 (for batteries alone). Requires:

- State of Charge (SoC) ≤ 30% for shipping.

- Proper packaging, marking, and documentation.

- UN3480 classification.

- IMDG Code (Sea Transport):

- Lithium batteries: UN3480 or UN3090; require dangerous goods declaration, labeling, and stowage requirements.

- Lead-acid: Classified under UN2794 or UN2800; must be non-spillable and securely packaged.

- DOT (U.S. Ground Transport – 49 CFR):

- Lead-acid: Generally exempt if non-spillable and properly secured (§173.159a).

- Lithium-ion: Regulated as hazardous materials; requires HAZMAT training, labeling, and shipping papers.

3. Packaging and Labeling

- Packaging:

- Use UN-rated packaging where required.

- Prevent short circuits (e.g., terminal protection with caps or tape).

- Secure batteries to prevent movement.

- Labeling:

- Lithium batteries: “Lithium Ion Batteries – Forbidden for transport by aircraft unless packed with equipment” or “Class 9 Miscellaneous Dangerous Goods” label.

- Lead-acid: “Battery, Wet, Non-Spillable” or “Corrosive” label if applicable.

4. Documentation

- Safety Data Sheet (SDS) must be current and available.

- Air/sea shipments: Shipper’s Declaration for Dangerous Goods (if applicable).

- Domestic ground: Bill of lading with proper HAZMAT notation (if required).

H2: Storage and Handling

1. Storage Conditions

- Store in a dry, well-ventilated, temperature-controlled area (15–25°C recommended).

- Avoid direct sunlight and heat sources.

- Separate from incompatible materials (e.g., oxidizers, flammables).

- Lead-acid batteries: Store upright; do not stack unless designed for it.

- Lithium batteries: Store at ~50% charge for long-term stability.

2. Handling Precautions

- Use appropriate PPE: gloves, eye protection.

- Prevent short circuits: Insulate terminals during handling.

- Use non-conductive tools.

- Do not drop or crush batteries.

H2: Compliance and Certification

1. Safety Standards

- UL 1973 / UL 1989: For batteries used in stationary and backup power.

- IEC 60095 (Lead-Acid): Automotive battery safety.

- UN 38.3 (Lithium Batteries): Mandatory testing (vibration, shock, thermal, etc.) for air transport.

2. Environmental Regulations

- REACH (EU): Declaration of Substances of Very High Concern (SVHC).

- RoHS (EU): Restriction of hazardous substances (Pb, Cd, Hg).

- Battery Directive 2006/66/EC (EU): Mandates recycling and labeling (e.g., “crossed-out wheeled bin” symbol).

- EPA (U.S.): Lead-acid batteries are regulated under RCRA; recyclable but not classified as hazardous if recycled properly.

3. Recycling and Disposal

- Lead-Acid:

- Highly recyclable (>99% in many regions).

- Must be recycled via authorized facilities.

- Follow local hazardous waste rules if damaged/leaking.

- Lithium-Ion:

- Recycle through certified e-waste or battery recyclers.

- Never dispose in regular trash.

- Use programs like Call2Recycle (U.S./Canada).

H2: Training and Documentation

1. Personnel Training

- HAZMAT training required for those shipping lithium batteries (DOT/IATA/IMDG).

- Internal training on safe handling, emergency response, and spill procedures.

2. Record Keeping

- Maintain records of:

- SDS and compliance certifications.

- Dangerous goods training.

- Shipping manifests and recycling documentation.

- Incident reports (leaks, fires, damage).

H2: Emergency Response

1. Spills and Leaks

- Lead-Acid:

- Neutralize acid spills with baking soda or commercial neutralizer.

- Wear PPE; ventilate area.

- Collect residue and dispose as hazardous waste.

- Lithium-Ion:

- No aqueous spill; risk is thermal runaway.

- Isolate battery; use Class D fire extinguisher or sand.

- Do not use water on lithium fires.

2. Fire

- Evacuate and call emergency services.

- Use appropriate extinguishers: CO₂ or dry chemical for small fires; large lithium fires may require specialized agents.

Summary Checklist

| Task | Lead-Acid | Lithium-Ion |

|——|———–|————-|

| UN Classification | UN2794 / UN2800 | UN3480 |

| Air Transport Allowed | Yes, if non-spillable | Yes, with restrictions |

| HAZMAT Training Required | Usually no (non-spillable) | Yes |

| Recycling Required | Yes | Yes |

| Labeling | Corrosive / Non-spillable | Class 9 / Lithium Battery Mark |

| Max SoC for Shipping | Not applicable | ≤30% |

Always consult current regulatory texts and local authorities for updates. Regulations are subject to change annually (e.g., IATA updates each January).

Conclusion for Sourcing 12V DC Battery

After evaluating various options, specifications, and supplier capabilities, sourcing a 12V DC battery requires a balanced approach that considers application requirements, performance, reliability, cost, and lifecycle sustainability. Key factors such as battery chemistry (e.g., lead-acid, AGM, gel, or lithium-ion), capacity (Ah rating), charge/discharge cycles, maintenance needs, and operational environment must align with the intended use—whether for backup power, automotive applications, solar energy storage, or portable electronics.

Lithium-ion batteries offer high energy density, longer lifespan, and lighter weight, making them ideal for performance-critical or space-constrained applications, despite higher initial costs. In contrast, AGM and sealed lead-acid batteries remain cost-effective and reliable choices for less demanding or budget-sensitive projects.

It is recommended to partner with reputable suppliers offering certified products, warranty support, and consistent quality control. Additionally, attention to logistics, lead times, and local regulatory compliance (such as shipping classifications and environmental standards) will ensure efficient integration into the supply chain.

In conclusion, the optimal 12V DC battery sourcing strategy depends on a clear understanding of technical needs and total cost of ownership. A deliberate selection process will ensure reliable power supply, long-term operational efficiency, and value for investment.