The global fiber laser market is experiencing robust expansion, driven by increasing demand for high-power laser solutions across industrial, automotive, and aerospace sectors. According to a report by Mordor Intelligence, the fiber laser market was valued at USD 7.8 billion in 2022 and is projected to grow at a CAGR of over 7.5% through 2028, with high-power lasers—particularly 1000-watt and above systems—representing the fastest-growing segment. This surge is fueled by rising adoption of laser-based cutting, welding, and additive manufacturing technologies that prioritize precision, speed, and energy efficiency. As industries scale up production and embrace automation, the need for reliable, high-performance laser sources has intensified, positioning 1000-watt laser systems as a cornerstone of modern manufacturing. With key players advancing technological capabilities and reducing operational costs, the competitive landscape among manufacturers is rapidly evolving. Here are the top nine companies leading innovation and market share in the 1000-watt laser space.

Top 9 1000 Watt Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laser Technology

Website: luxinar.com

Key Highlights: We now provide a comprehensive CO2 laser portfolio, from 25 to 1000 Watts, including pulsed and CW systems and a combined short pulse laser product portfolio ……

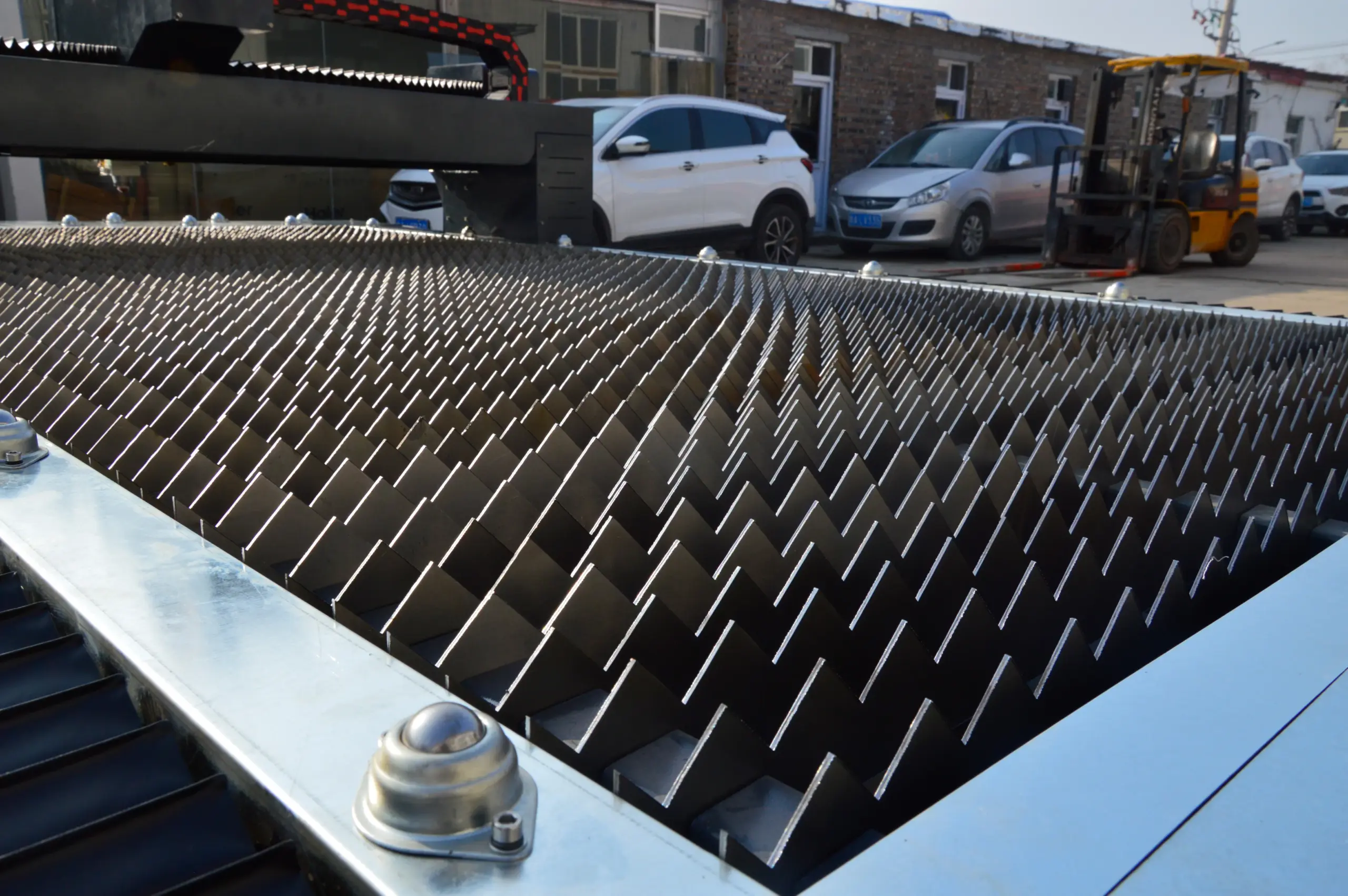

#2 SHARK P CL Industrial Laser Cleaning Machines (100

Website: pulsar-laser.com

Key Highlights: SHARK P CL is an industrial pulsed laser cleaning machine series by PULSAR Laser with outputs from 100 W to 1000 W, air-cooled up to 500 W….

#3 MOPA Fiber Lasers

Website: en.jptoe.com

Key Highlights: JPT is a leading laser manufacturer in the world, offering a full range of MOPA, CW, DPSS, and Diode lasers. Our products enable precise welding, cutting, micro ……

#4 1000W High

Website: en.raycuslaser.com

Key Highlights: Rating 4.9 (100) Raycus fiber laser 1000w high-power pulsed has high single pulse energy, uniform square or circular spot energy distribution, easy to use and maintain….

#5 Reci Laser

Website: reci-laser.com

Key Highlights: A series high-power single-mode continuous-wave fiber laser is developed and produced by Reci Laser. The average power exceeds 1000W….

#6 DIAMOND J

Website: coherent.com

Key Highlights: DIAMOND J-1000 offers the smallest footprint of any 1 kW, sealed, pulsed CO₂ laser available for converting, cutting, engraving, and drilling….

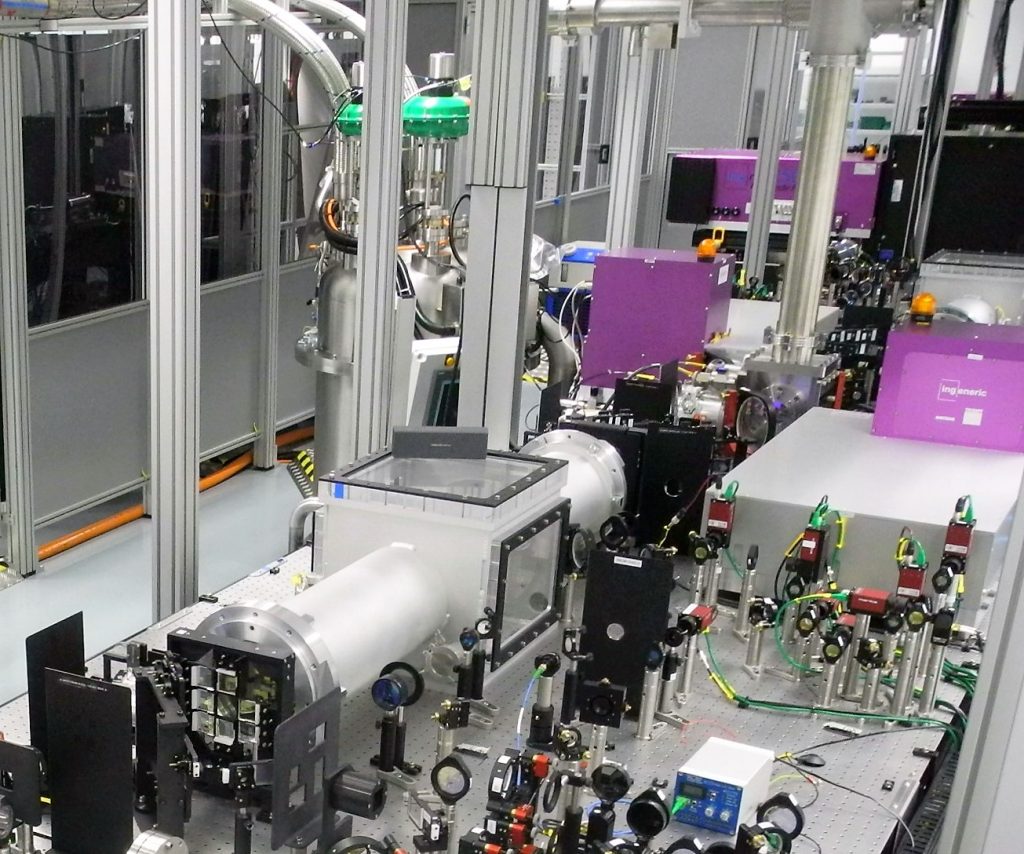

#7 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

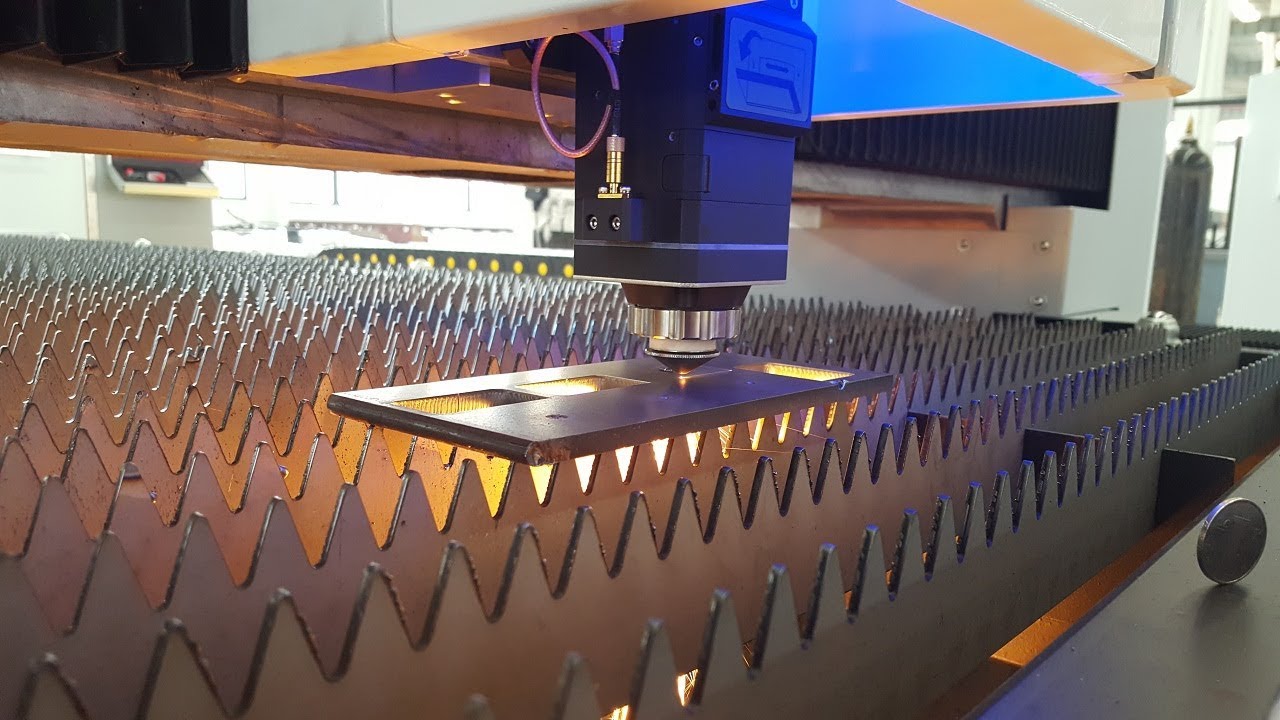

#8 1000 Watt Laser Cutting Machine

Website: pentalaser.com

Key Highlights: If you want to buy 1000 Watt Laser Cutting Machine,you can choose our company. Penta Laser can provide you with affordable laser machine….

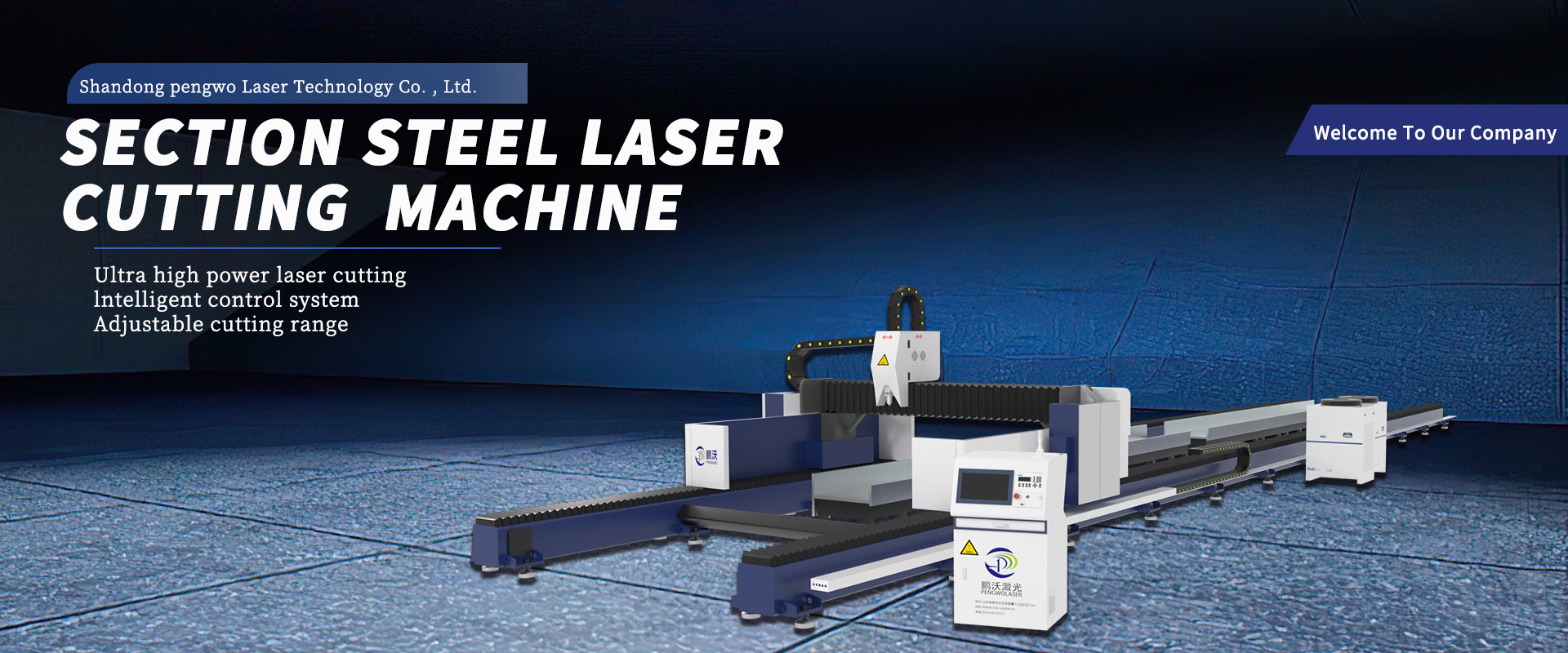

#9 Laser Equipment Supplier

Website: radianlaser.com

Key Highlights: Radian Laser Systems is a laser equipment supplier specializing in high-speed, customizable laser machinery, including fiber, CO2, and galvo lasers….

Expert Sourcing Insights for 1000 Watt Laser

H2: 2026 Market Trends for 1000 Watt Lasers

The global market for 1000-watt lasers is poised for significant evolution by 2026, driven by technological advancements, expanding industrial applications, and shifting manufacturing demands. These high-power fiber lasers, widely used in cutting, welding, additive manufacturing, and surface treatment, are expected to experience both increased adoption and intensified competition across key sectors.

H2: Rising Industrial Automation and Demand for Precision Manufacturing

One of the primary drivers of the 1000-watt laser market in 2026 is the ongoing industrial shift toward automation and smart manufacturing. As industries—particularly automotive, aerospace, and electronics—adopt Industry 4.0 principles, demand for high-precision, high-speed laser systems continues to grow. Lasers with 1000-watt output offer an optimal balance between cutting speed and thickness capacity (up to 10–12 mm in mild steel), making them ideal for automated production lines. By 2026, integration with robotics and IoT-enabled monitoring systems will further enhance efficiency, driving demand for compact and energy-efficient 1000-watt laser sources.

H2: Expansion in Metal Fabrication and Small-to-Medium Enterprises (SMEs)

Metal fabrication remains the largest end-use segment for 1000-watt lasers. The affordability and declining cost of ownership—due to reductions in fiber laser diode prices and improved system reliability—have made 1000-watt systems accessible to SMEs. In 2026, these businesses are expected to invest heavily in mid-power lasers to remain competitive. The compact footprint and lower operational costs (compared to higher-wattage systems) position the 1000-watt laser as a sweet spot for shops balancing throughput and budget.

H2: Technological Innovations and Efficiency Improvements

By 2026, technological advancements will continue to enhance the performance of 1000-watt lasers. Key trends include:

– Improved beam quality (M² < 1.1): Enables finer cuts and better edge quality.

– Higher wall-plug efficiency (up to 45%): Reduces energy consumption and operational costs.

– Smart software integration: AI-powered predictive maintenance and real-time process optimization.

– Modular and hybrid designs: Allowing quick upgrades or integration into multi-process workcells.

Innovations in cooling systems and diode longevity will also contribute to lower total cost of ownership, making 1000-watt lasers more attractive in competitive markets.

H2: Regional Market Dynamics and Competitive Landscape

Asia-Pacific, led by China, Japan, and India, will remain the dominant region for 1000-watt laser demand in 2026 due to rapid industrialization and government support for advanced manufacturing. Chinese manufacturers such as Raycus, Max Photonics, and JPT have significantly reduced prices, intensifying global competition. In contrast, North America and Europe will focus on high-value applications—such as medical device manufacturing and aerospace—where precision and reliability are prioritized over cost.

Established players like IPG Photonics, TRUMPF, and Coherent will continue to emphasize innovation and service ecosystems, while new entrants leverage cost advantages to gain market share.

H2: Sustainability and Energy Efficiency as Market Differentiators

Sustainability is becoming a key consideration in industrial procurement. By 2026, manufacturers will increasingly favor 1000-watt lasers with low energy consumption, recyclable components, and reduced emissions. Regulatory pressures and corporate ESG (Environmental, Social, Governance) goals will push laser producers to offer greener solutions. Energy-efficient 1000-watt systems will be positioned not only as cost-effective but also as environmentally responsible choices.

H2: Challenges and Future Outlook

Despite strong growth, the 1000-watt laser market faces challenges:

– Market saturation in price-sensitive regions

– Competition from higher-power lasers (e.g., 1500W–3000W) that are becoming more affordable

– Supply chain volatility for key components like pump diodes and optical fibers

However, the versatility and cost-performance ratio of 1000-watt lasers will ensure continued relevance. The global 1000-watt fiber laser market is projected to grow at a CAGR of 8–10% from 2023 to 2026, reaching an estimated value of USD 1.8–2.2 billion by 2026.

In conclusion, the 1000-watt laser will remain a cornerstone of industrial laser applications in 2026, supported by technological innovation, expanding adoption in SMEs, and strategic positioning within the broader laser power spectrum.

Common Pitfalls When Sourcing a 1000 Watt Laser: Quality and Intellectual Property (IP) Concerns

Sourcing a 1000-watt laser—commonly used in industrial cutting, welding, and additive manufacturing—requires careful evaluation beyond just power output. Two of the most critical areas where buyers encounter problems are quality inconsistencies and intellectual property (IP) risks, particularly when dealing with low-cost suppliers or emerging manufacturers. Overlooking these pitfalls can lead to equipment failure, safety hazards, legal disputes, and significant financial loss.

Quality Pitfalls

-

Inaccurate or Misrepresented Power Output

- Pitfall: Suppliers may advertise “1000W” based on peak or theoretical output under ideal conditions, not sustained, real-world performance. Actual delivered power might be significantly lower (e.g., 800–900W), impacting cutting speed and material compatibility.

- Risk: Reduced productivity, inability to process thicker materials, and failure to meet production targets.

- Mitigation: Insist on third-party power meter calibration reports (e.g., Ophir or Coherent meters) demonstrating average power output over a sustained period under standard operating conditions. Include performance verification in the contract.

-

Poor Beam Quality (High M² Value)

- Pitfall: Beam quality, measured by the M² factor (closer to 1 is better), determines focusability. Low-cost lasers often have high M² values (>1.2–1.3) due to substandard optics or diode quality.

- Risk: Larger focal spot size, reduced power density, poor cut edge quality, inability to cut thin materials cleanly, and higher operating costs due to slower speeds.

- Mitigation: Require a certified M² measurement report. Understand the required M² for your application (e.g., fine cutting demands M² < 1.1).

-

Unreliable Components and Materials

- Pitfall: Use of low-grade diodes, cooling systems, optical fibers, or power supplies to cut costs. This leads to frequent failures, downtime, and short lifespans.

- Risk: High maintenance costs, production interruptions, and total cost of ownership far exceeding the initial purchase price.

- Mitigation: Request detailed BOMs (Bill of Materials) and specifications for critical components (e.g., pump diode brand/lifespan, fiber type). Prioritize suppliers with proven reliability and strong warranties.

-

Inadequate or Non-Standard Cooling Systems

- Pitfall: 1000W lasers generate substantial heat. Under-spec’d chillers or inefficient thermal design cause overheating, power fluctuations, and premature component degradation.

- Risk: System instability, reduced laser lifetime, and potential safety hazards.

- Mitigation: Verify the chiller specifications (capacity, flow rate, temperature stability) match the laser’s requirements. Ensure integration is seamless and meets industry standards.

-

Lack of Compliance and Safety Certification

- Pitfall: Lasers may lack essential safety certifications (e.g., FDA/CDRH in the US, CE in Europe, IEC 60825) or fail to meet EMC/EMI standards.

- Risk: Legal non-compliance, inability to operate legally, safety incidents, and voided insurance.

- Mitigation: Demand valid, up-to-date certificates for all relevant regions. Verify certifications directly with issuing bodies if possible.

Intellectual Property (IP) Pitfalls

-

Sourcing Counterfeit or Clone Lasers

- Pitfall: Some suppliers, particularly in certain regions, produce illegal copies of established brands (e.g., IPG, nLIGHT, Coherent) with stolen designs or reverse-engineered components. These may carry fake logos or misleading model numbers.

- Risk: Direct legal liability for purchasing infringing goods, seizure of equipment, reputational damage, and complete lack of support or warranty.

- Mitigation: Source only from authorized distributors or the OEM directly. Perform due diligence on the supplier’s legitimacy. Be wary of prices significantly below market value.

-

Using Unlicensed Core Technology

- Pitfall: The laser may incorporate patented technology (e.g., specific fiber designs, diode pumping methods, cooling architectures, control software) without proper licensing.

- Risk: Your company could be drawn into IP infringement lawsuits as the end-user, even unknowingly. Equipment may be subject to injunctions or seizures.

- Mitigation: Require the supplier to provide written assurance of IP ownership or valid licensing for all core technologies. Include IP indemnification clauses in the contract.

-

Unclear or Ambiguous IP Ownership in Customization

- Pitfall: If you request modifications or integrations, the contract may not clearly state who owns the IP for the new design or software.

- Risk: Loss of control over proprietary processes, inability to use the solution with other equipment, or disputes over future improvements.

- Mitigation: Define IP ownership explicitly in the contract before development begins. Specify that custom modifications or software developed for your use remain your property or are licensed exclusively to you.

-

Weak or Unenforceable Warranty and Support

- Pitfall: Suppliers with questionable IP practices often offer limited or non-existent technical support, spare parts availability, or warranty coverage. If the laser contains stolen tech, the supplier may disappear.

- Risk: Downtime with no recourse, inability to repair the system, and stranded investment.

- Mitigation: Prioritize suppliers with strong, verifiable service networks and comprehensive support contracts. Avoid suppliers with no physical presence or poor customer references.

Conclusion: Sourcing a 1000W laser demands rigorous due diligence. Prioritize verified quality metrics (power, beam quality, component specs, certifications) over price alone. Equally critical is protecting against IP risks by sourcing from reputable, legitimate suppliers with clear IP ownership and robust support. Investing time in vetting both quality and IP integrity upfront prevents costly failures, legal exposure, and operational disruptions down the line.

Logistics & Compliance Guide for a 1000-Watt Laser – Hydrogen (H₂) Powered or Assisted Systems

Version 1.0 – Focus on H₂ Integration

⚠️ Important Note:

This guide assumes the 1000-watt laser either uses hydrogen (H₂) as a power source (e.g., via a hydrogen fuel cell) or operates in an environment where hydrogen is used as an assist gas (e.g., in laser cutting). Both scenarios present unique logistics and compliance challenges. This document addresses safety, transportation, regulatory, and operational considerations.

1. Overview

A 1000-watt laser system is classified as a Class 4 laser under international safety standards (IEC 60825-1), meaning it poses significant fire, skin, and eye hazards. When hydrogen (H₂) is involved—either as an energy source or process gas—additional risks related to flammability, storage, and handling must be addressed.

This guide covers:

– Regulatory compliance (laser & hydrogen)

– Safe handling and storage

– Transportation logistics

– Facility requirements

– Emergency response

2. Regulatory Compliance Framework

A. Laser Safety (IEC / FDA / OSHA)

- IEC 60825-1: International standard for laser product safety. Class 4 lasers require:

- Interlocks

- Emergency stop

- Beam enclosures

- Warning labels and indicators

- FDA (21 CFR 1040.10 & 1040.11) – U.S. compliance for laser products:

- Registration with FDA (Manufacturer/Distributor)

- Performance standard compliance

- Certification and labeling

- OSHA 29 CFR 1910.97 / ANSI Z136.1:

- Workplace laser safety program

- Designated Laser Controlled Area

- Personal Protective Equipment (PPE)

B. Hydrogen Safety & Compliance

- NFPA 2: Hydrogen Technologies Code (2023 Edition)

- Covers production, storage, use, and handling of hydrogen

- Ventilation, separation distances, fire protection

- OSHA 29 CFR 1910.103 – Hydrogen

- Flammable gas handling standards

- Storage in well-ventilated, fire-resistant areas

- DOT 49 CFR Parts 171–180 – Hazardous Materials Regulations

- Transportation of compressed hydrogen gas

- ISO 16111:2021 – Transportable gas storage devices (hydrogen)

- Local Fire Codes & Authorities Having Jurisdiction (AHJ):

- Permitting for H₂ storage and use

- Inspection requirements

3. Logistics: Handling & Transportation

A. Laser Equipment Transport

- Packing:

- Secure optical components; use anti-static, shock-absorbent packaging

- Disconnect power and remove consumables

- Clearly label as “LASER – CLASS 4 – DO NOT EXPOSE TO LIGHT”

- Shipping Classification:

- Not typically hazardous unless batteries or gas cylinders included

- If lithium batteries are used (e.g., for control systems), classify under UN 3480 (lithium-ion) or UN 3090 (lithium metal)

- Carrier Requirements:

- Notify carrier of laser classification

- Include technical documents (IEC/FDA compliance)

B. Hydrogen Transport (if applicable)

- Form of H₂:

- Compressed gas in cylinders (typically 200 bar or 350 bar)

- OR liquid hydrogen (cryogenic, -253°C) – rare for industrial lasers

- Classification:

- UN 1049 – Hydrogen, compressed – Hazard Class 2.1 (Flammable Gas)

- Packaging & Labeling:

- DOT/UN-approved cylinders

- Flame-resistant transport containers

- Proper hazard labels: “FLAMMABLE GAS” (2.1), “NON-TOXIC”

- Documentation:

- Safety Data Sheet (SDS) – Section 14: Transport Information

- Shipper’s Declaration for Dangerous Goods (if air freight)

- Transport Modes:

- Ground: Most common; follow DOT 49 CFR

- Air: Restricted; requires special approval (IATA DGR – Section 2.4)

- Marine: IMDG Code compliant packaging

4. On-Site Storage & Facility Requirements

A. Laser System Installation

- Location:

- Stable, level surface; away from moisture and vibration

- Enclosed Laser Controlled Area with interlocked access

- Ventilation:

- Fume extraction for laser plume (especially when cutting metals)

- Avoid shared ventilation with H₂ storage

- Electrical:

- Dedicated 208–240V circuit with proper grounding

- Surge protection

B. Hydrogen Storage (if used)

- Storage Type:

- High-pressure cylinders (CGA 350 or 356 fittings)

- Max 300 kg H₂ per indoor storage room (per NFPA 2)

- Location:

- Outdoors preferred; if indoor, in a dedicated, ventilated room

- Minimum 15 ft (5 m) from oxidizers, ignition sources

- Non-combustible construction; explosion relief vents

- Ventilation:

- Natural or mechanical ventilation at ceiling (H₂ rises)

-

1 ft³/min per ft² of floor area (NFPA 2)

- Monitoring:

- Install H₂ gas detectors with alarms (set at 1–2% LEL)

- Automatic shutoff valves

5. Operational Safety & Procedures

A. Laser Operation

- Training: ANSI Z136.1-compliant laser safety officer (LSO) required

- PPE:

- Laser safety goggles (OD 5+ at 1064 nm or relevant wavelength)

- Flame-resistant lab coat

- Face shield (for cutting operations)

- Procedures:

- Never bypass interlocks

- Use beam blocks and enclosures

- Perform alignment at lowest possible power

B. Hydrogen Use (as assist gas or fuel)

- Leak Checks:

- Use soap solution or H₂ leak detector before each use

- Never use open flame for detection

- Piping:

- Use stainless steel or approved H₂-compatible materials

- Avoid threaded connections; prefer welded or flare fittings

- Purge Procedures:

- Purge lines with inert gas (N₂) before H₂ introduction

- Flame Prevention:

- No smoking, sparks, or hot work within 25 ft (8 m)

6. Emergency Response Plan

A. Laser Incident (fire, exposure)

- Eye/Skin Exposure: Flush with water; seek immediate medical attention

- Laser Fire: Use CO₂ or dry chemical extinguisher; do not use water on electrical fires

- Evacuate and isolate area

B. Hydrogen Leak or Fire

- Leak:

- Shut off source if safe

- Evacuate area; ventilate

- Do not operate electrical switches (risk of spark)

- Fire:

- Use Class B extinguishers (dry chemical, CO₂)

- Do NOT extinguish flame unless gas flow can be stopped (risk of re-ignition)

- Call emergency services immediately

- Emergency Contacts Posted:

- Fire department (note: “Hydrogen fire – invisible flame”)

7. Documentation & Recordkeeping

- Laser:

- FDA registration (if applicable)

- IEC/ANSI compliance certificate

- LSO designation and training records

- Hydrogen:

- SDS on file

- Cylinder inspection logs (DOT 4B/4BA)

- Leak test records

- Training logs for H₂ handling

- Inspections:

- Annual review by AHJ or safety officer

- Third-party audits recommended

8. Best Practices Summary

| Area | Best Practice |

|——|—————-|

| Transport | Use UN-certified containers for H₂; label clearly |

| Storage | Store H₂ cylinders upright, secured, outdoors if possible |

| Ventilation | Ensure high-point ventilation for H₂; separate from laser fumes |

| Training | Train all users on laser AND hydrogen hazards |

| Monitoring | Install H₂ sensors and beam interlocks |

| Compliance | Coordinate with local fire marshal for permits |

9. Resources

- ANSI Z136.1: Safe Use of Lasers

- NFPA 2: Hydrogen Technologies Code

- OSHA Technical Manual (Section III, Chapter 6): Laser Hazards

- IATA Dangerous Goods Regulations – for air transport

- DOE Hydrogen Safety, Codes, and Standards Portal (hydrogen.energy.gov)

Prepared by: [Your Safety Officer / Compliance Team] Last Reviewed: [Date] Next Review: [Date + 12 months]

⚠️ Disclaimer: This guide is for informational purposes only. Always consult local authorities, AHJs, and certified safety professionals before deploying high-power lasers or hydrogen systems. Regulations vary by jurisdiction.

In conclusion, sourcing a 1000-watt laser requires careful consideration of several key factors to ensure performance, safety, and value for money. It is essential to identify the primary application—such as cutting, welding, engraving, or research—as this will influence the type of laser (fiber, CO₂, or diode) and the necessary beam quality, cooling system, and integration requirements. Evaluating reputable suppliers with strong technical support, warranty options, and compliance with international safety and regulatory standards is crucial for long-term reliability.

Additionally, total cost of ownership should be assessed beyond the initial purchase price, including maintenance, power consumption, consumables, and training. Safety measures, including protective enclosures, interlocks, and proper ventilation, must not be overlooked due to the high power output. Finally, staying informed about technological advancements and industry trends can help in making a future-proof investment. With thorough research and due diligence, sourcing a 1000-watt laser can significantly enhance productivity and precision in industrial or research applications.