The global medium-duty truck market, including 9.5-ton (9 1/2-ton) vehicles, is experiencing steady growth driven by rising demand for efficient intra-city and regional freight transportation. According to Mordor Intelligence, the Medium and Heavy Commercial Vehicle Market is projected to grow at a CAGR of over 5.8% from 2024 to 2029, with increasing urbanization and e-commerce logistics fueling demand for versatile trucks in the 7–12 ton range. Additionally, Grand View Research highlights that the global commercial vehicle market size was valued at USD 789.1 billion in 2023 and is expected to expand at a CAGR of 6.2% through 2030, supported by infrastructure development and supply chain modernization across emerging economies. As fleet operators prioritize fuel efficiency, payload capacity, and total cost of ownership, the competition among manufacturers to dominate the 9.5-ton truck segment has intensified. In this evolving landscape, nine key players have emerged as leaders in innovation, reliability, and market share—shaping the future of medium-duty transport worldwide.

Top 9 1 2 Ton Trucks Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

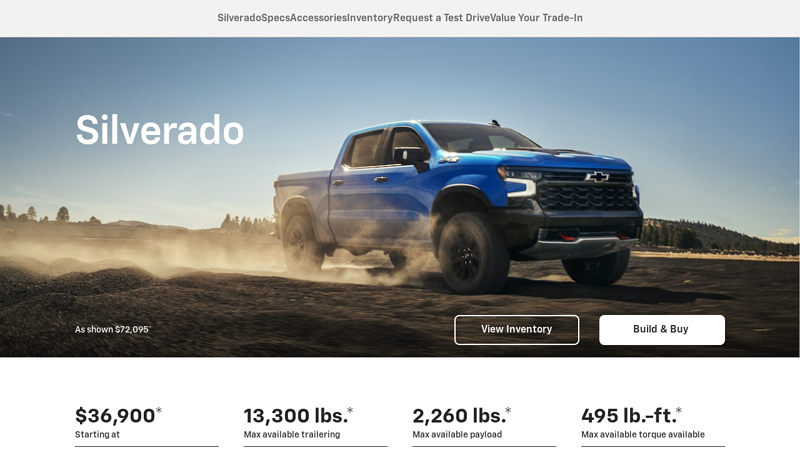

#1 2026 Chevy Silverado 1500

Domain Est. 1994

Website: chevrolet.com

Key Highlights: Experience the 2026 Chevy Silverado 1500 pickup truck available in 9 unique models and equipped with 13300 lbs. max towing and advanced technology features….

#2 2026 Ford Super Duty® Truck

Domain Est. 1988

Website: ford.com

Key Highlights: Check out the pinnacle of heavy-duty trucks with the Ford Super Duty®. Offering best-in-class towing and 15 different trims, this reliable truck is designed ……

#3 Toyota Trucks Family

Domain Est. 1994

Website: toyota.com

Key Highlights: Explore the Toyota Trucks Lineup to find a pickup truck that fits your lifestyle. The durable and powerful trucks from Toyota come with the performance and ……

#4 Mack Trucks

Domain Est. 1995

Website: macktrucks.com

Key Highlights: Mack creates durable, purpose-built trucks like the Mack Anthem® and Pioneer™, offering advanced uptime and driving progress for tough jobs worldwide.Missing: 2 ton…

#5 Peterbilt Work Trucks

Domain Est. 1996

Website: peterbilt.com

Key Highlights: Find the right Peterbilt truck model for on-highway, medium duty, vocational and electric applications. Every Peterbilt truck delivers unparalleled ……

#6 of Isuzu Commercial Vehicles. Low Cab Forward Trucks That …

Domain Est. 1996

Website: isuzucv.com

Key Highlights: Assembled in America. Isuzu N-Series gas-powered and F-Series diesel trucks are assembled in Charlotte, Michigan, by a highly skilled team of workers….

#7 Mid-Size, Heavy Duty, and EV Trucks

Domain Est. 1996

Website: gmc.com

Key Highlights: 1–7 day deliveryGMC trucks are built with capability and craftsmanship. Find professional grade mid-size, heavy duty, and EV trucks to help you tackle any challenge….

#8 Freightliner Trucks

Domain Est. 1997

Website: freightliner.com

Key Highlights: Dedicated to providing superior trucks built to lower your real cost of ownership, Freightliner delivers innovation and reliability….

#9 Trucks

Domain Est. 1998

Website: international.com

Key Highlights: Discover the range of heavy-duty trucks from International®. Outstanding performance and endurance built for life on the road, whether long or short distances….

Expert Sourcing Insights for 1 2 Ton Trucks

H2: Market Trends for 1–2 Ton Trucks in 2026

The global market for 1–2 ton trucks is poised for significant transformation by 2026, driven by technological innovation, regulatory shifts, and changing consumer demands. These light-duty commercial vehicles, essential for urban logistics, last-mile delivery, and small-scale freight operations, are adapting to a rapidly evolving transportation landscape.

-

Electrification Acceleration

A dominant trend shaping the 2026 market is the accelerated adoption of electric 1–2 ton trucks. Governments worldwide are enforcing stricter emissions regulations, particularly in urban areas, pushing fleets toward zero-emission solutions. Major manufacturers such as Ford (E-Transit), Mercedes-Benz (eSprinter), and new EV-focused entrants like Rivian and BrightDrop are expanding their electric van and light-truck offerings. By 2026, electric variants are projected to capture 25–30% of new 1–2 ton truck sales in developed markets like North America, Western Europe, and parts of East Asia. -

Growth in Last-Mile Delivery Demand

The continued expansion of e-commerce is fueling demand for compact, maneuverable trucks ideal for urban environments. 1–2 ton trucks offer the optimal balance of payload capacity and agility for last-mile delivery operations. Logistics companies are investing heavily in fleet modernization, prioritizing vehicles with lower operating costs and higher uptime. This trend is especially strong in emerging markets such as India, Southeast Asia, and Latin America, where urban delivery networks are scaling rapidly. -

Advancements in Connectivity and Telematics

By 2026, connectivity is becoming a standard feature in 1–2 ton trucks. Integrated telematics systems enable real-time fleet tracking, predictive maintenance, route optimization, and driver behavior monitoring. These capabilities enhance operational efficiency and reduce total cost of ownership. Original Equipment Manufacturers (OEMs) are partnering with tech firms to offer bundled digital services, turning trucks into data-driven assets. -

Regional Market Diversification

Market dynamics vary significantly by region: - In Asia-Pacific, particularly China and India, cost-effective diesel and CNG-powered 1–2 ton trucks remain dominant, though EV adoption is gaining momentum with government incentives.

- In Europe, stringent Euro 7 emissions standards and urban clean air zones are pushing fleets toward electrification.

-

In North America, while pickup trucks dominate the light-duty segment, commercial van and chassis-cab models in the 1–2 ton range are seeing increased demand from service fleets and delivery providers.

-

Supply Chain Resilience and Localization

Post-pandemic supply chain challenges have prompted OEMs to localize production and secure battery supply chains for electric models. By 2026, regional manufacturing hubs for 1–2 ton trucks—especially electric variants—are expected to expand in North America, Eastern Europe, and Southeast Asia to reduce dependency on single-source suppliers and mitigate logistical risks. -

Sustainability and Total Cost of Ownership (TCO) Focus

Fleet operators are increasingly evaluating 1–2 ton trucks based on TCO rather than upfront price. Electric models, despite higher initial costs, offer lower fuel and maintenance expenses over time. Coupled with carbon reduction goals, this shift is making electrified and fuel-efficient models more attractive. Circular economy practices—such as remanufactured parts and battery recycling—are also gaining traction.

Conclusion

By 2026, the 1–2 ton truck market will be defined by electrification, digitalization, and sustainability. While internal combustion engine (ICE) models will still hold a significant share—especially in developing regions—the trajectory is clearly toward cleaner, smarter, and more connected fleets. Companies that invest in EV infrastructure, data integration, and flexible logistics solutions will be best positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing 1–2 Ton Trucks (Quality, IP)

Sourcing 1–2 ton trucks—especially for commercial or industrial use—can present several challenges, particularly when assessing quality and managing intellectual property (IP) concerns. Buyers must navigate issues ranging from inconsistent manufacturing standards to unauthorized use of proprietary designs. Below are the most common pitfalls to avoid.

Quality-Related Pitfalls

Inconsistent Build Quality Across Manufacturers

Many suppliers of 1–2 ton trucks, especially in emerging markets, may lack standardized production processes. This often results in inconsistent build quality, where trucks from the same model line exhibit differences in welding integrity, material thickness, or component durability. Buyers may receive units that fail prematurely under normal operating conditions due to subpar steel alloys or poor assembly practices.

Use of Substandard Components

Critical components such as engines, transmissions, suspension systems, and braking mechanisms may be sourced from low-tier suppliers. For example, some trucks may use remanufactured or counterfeit parts that compromise safety and longevity. Without thorough vetting and third-party inspections, buyers risk purchasing vehicles with higher maintenance demands and reduced operational lifespans.

Lack of Compliance with Safety and Emission Standards

Some 1–2 ton trucks—particularly those from less regulated regions—may not comply with international safety or emission standards (e.g., Euro 4/5, EPA Tier 4). This can lead to legal and logistical issues when importing or operating the vehicles in regulated markets. Non-compliant trucks may also face restrictions or higher operating costs due to fuel inefficiency or environmental regulations.

Inadequate Testing and Certification

Many suppliers do not subject their trucks to rigorous performance or stress testing. As a result, load capacity claims (e.g., “2-ton payload”) may be exaggerated. Without certified third-party validation (e.g., ISO, TÜV), performance data should be treated with caution. Buyers should request test reports and conduct on-site load trials before bulk procurement.

Intellectual Property (IP) Pitfalls

Copycat Designs and Brand Infringement

It is common in some manufacturing regions to encounter trucks that closely mimic the design of established OEM brands (e.g., Toyota, Isuzu, or Ford). These “clone” models may infringe on registered trademarks, patented chassis designs, or proprietary engine technologies. Sourcing such vehicles exposes buyers to legal liability, customs seizures, and reputational damage.

Unauthorized Use of Proprietary Technology

Some suppliers integrate branded components—such as engines or transmissions—without proper licensing. For example, a truck advertised with a “Cummins-style” engine might use an unlicensed copy that voids warranty and support. Buyers may unknowingly contribute to IP theft, which can lead to supply chain audits, import denials, or legal action from IP holders.

Misrepresentation of OEM Affiliations

Suppliers may falsely claim partnerships, certifications, or endorsements from well-known automotive brands to enhance credibility. For instance, a manufacturer might imply they are an “authorized licensee” of a global brand when no such agreement exists. These misrepresentations undermine trust and can result in procurement of non-genuine products.

Weak Contractual IP Protection

Purchase agreements often lack clear clauses addressing IP ownership, liability for infringement, and warranty enforcement. Without strong legal safeguards, buyers may have limited recourse if they receive trucks involved in IP disputes. Contracts should explicitly state that all designs and components are legally licensed and indemnify the buyer against third-party IP claims.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough due diligence, including factory audits, sample testing, and IP verification. Engaging legal and technical experts during procurement helps ensure compliance, quality, and protection against intellectual property risks when sourcing 1–2 ton trucks.

Logistics & Compliance Guide for 1-2 Ton Trucks

Vehicle Classification and Permits

1-2 ton trucks are typically categorized as light-duty commercial vehicles. Operators must ensure proper vehicle registration and obtain necessary permits based on jurisdiction. In many regions, these trucks require a standard commercial driver’s license (CDL) or equivalent non-CDL license depending on gross vehicle weight rating (GVWR). Check local transportation authority guidelines to confirm licensing requirements and ensure all documentation—registration, insurance, and operating authority—is up to date.

Weight Limits and Load Securement

Adherence to weight regulations is critical. The combined weight of cargo and vehicle must not exceed the manufacturer’s specified GVWR or local legal limits. Overloading can result in fines, vehicle damage, and safety risks. Use certified scales when loading, and secure cargo with appropriate tie-downs, straps, or load bars. The load must be evenly distributed and fully contained to prevent shifting during transit, in compliance with standards such as the U.S. DOT’s Load Securement Rules (49 CFR Part 393, Subpart I) or equivalent regional regulations.

Route Planning and Access Restrictions

Plan delivery routes considering road weight limits, low bridges, and urban access restrictions. Some cities impose curfews or require special permits for commercial vehicles, even light-duty ones. Use GPS systems designed for commercial fleets to avoid prohibited zones. Be mindful of residential areas, schools, and environmental zones (e.g., low-emission zones in European cities) that may restrict truck access during certain hours.

Safety and Maintenance Compliance

Conduct daily pre-trip and post-trip vehicle inspections (DVIR – Driver Vehicle Inspection Report) to check brakes, lights, tires, mirrors, and fluid levels. Maintain a regular servicing schedule based on manufacturer recommendations. Ensure all safety equipment—including fire extinguishers, warning triangles, and reflective vests—is present and functional. Document all maintenance activities for audit purposes.

Cargo Documentation and Recordkeeping

Carry accurate shipping documents, including bills of lading, delivery receipts, and hazardous materials manifests (if applicable). For non-hazardous goods, ensure inventory lists match dispatched items. Electronic logging devices (ELDs) may be required depending on usage and jurisdiction—verify if your operation falls under ELD mandates based on vehicle weight and service type.

Environmental and Fuel Regulations

Follow local emissions standards and fuel usage guidelines. Many urban areas require compliance with anti-idling laws to reduce pollution. Consider using fuel-efficient driving techniques and explore cleaner fuel alternatives (e.g., CNG, electric models) where available. Stay informed about upcoming regulations, such as zero-emission vehicle mandates in certain metropolitan zones.

Driver Training and Hours of Service

Ensure drivers are trained in defensive driving, cargo handling, and emergency procedures. While 1-2 ton trucks may be exempt from strict Hours of Service (HOS) rules in some jurisdictions, promoting responsible work schedules helps prevent fatigue-related incidents. Document training sessions and maintain records for compliance audits.

Insurance Requirements

Maintain commercial auto insurance with coverage limits that meet or exceed legal minimums. Policies should include liability, cargo, and physical damage protection. Additional coverage may be needed for specialized cargo (e.g., refrigerated goods, high-value items). Review policies annually and notify insurers of route or operational changes.

By following this guide, operators of 1-2 ton trucks can ensure safe, efficient, and legally compliant logistics operations across diverse environments.

Conclusion for Sourcing 1–2 Ton Trucks

Sourcing 1–2 ton trucks is a strategic decision that balances payload capacity, fuel efficiency, maneuverability, and operational cost-effectiveness, making these vehicles ideal for urban logistics, last-mile delivery, and small to medium freight operations. After evaluating market options, total cost of ownership (including acquisition, maintenance, fuel, and insurance), reliability, brand reputation, and after-sales support, it is evident that selecting the right model depends on specific operational needs.

Key considerations include engine performance, fuel type (diesel, CNG, or electric), payload consistency, cabin comfort, safety features, and compliance with emission standards. Additionally, the growing availability of electric 1–2 ton trucks presents a sustainable and cost-effective alternative for businesses aiming to reduce their carbon footprint and benefit from lower running costs and government incentives.

In conclusion, a thorough supplier evaluation, fleet requirement analysis, and total lifecycle cost assessment are essential to make an informed sourcing decision. Prioritizing reliability, service network, and future-ready technologies will ensure long-term operational efficiency and scalability. With the right strategy, sourcing 1–2 ton trucks can significantly enhance logistics productivity and support sustainable business growth.