The global 1,2-dibromoethane market is witnessing steady growth, driven by its widespread use in chemical synthesis, agriculture, and as a lead scavenger in gasoline additives. According to Grand View Research, the global brominated flame retardants market—where 1,2-dibromoethane plays a key intermediate role—was valued at USD 1.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. Additionally, Mordor Intelligence reports increasing demand from agrochemical sectors and industrial intermediates as a catalyst for market expansion, particularly in the Asia-Pacific region due to rapidly growing manufacturing activities. With regulatory scrutiny tightening in North America and Europe, leading manufacturers are focusing on sustainable production methods and alternative applications to maintain competitiveness. As demand rises, a select group of producers have emerged as key players in ensuring reliable supply and high-purity standards of 1,2-dibromoethane globally.

Top 6 1 2 Dibromoethane Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Api Intermediates

Domain Est. 2001

Website: modychem.com

Key Highlights: Manufacturer of Api Intermediates – Ethylene Dibromide (1,2 Dibromoethane) offered by Mody Chemi Pharma Ltd., Mumbai, Maharashtra….

#2 1,2-Dibromoethane

Domain Est. 2008

Website: tcichemicals.com

Key Highlights: 1,2-Dibromoethane; Product No: D0180; CAS RN: 106-93-4; Purity: >99.0%(GC); Synonyms: Ethylene Bromide, Ethylene Dibromide; Appearance: Colorless to Light ……

#3 Dibromomethane for Organic Synthesis

Domain Est. 2023

Website: icl-industrialproducts.com

Key Highlights: ICL Industrial Products uses 1 2 Dibromoethane as an intermediate in the manufacture of agrochemicals, biocides, fragrances, and pharmaceuticals….

#4 [PDF] 1,2

Domain Est. 1995

Website: agilent.com

Key Highlights: Product identifier. · Product Name: 1,2-Dibromoethane Standard (1X1 mL). · Part number: HC-350-1. · Application of the substance / the ……

#5 1,2-Dibromoethane

Domain Est. 1997

Website: pubchem.ncbi.nlm.nih.gov

Key Highlights: 1,2-Dibromoethane is a manufactured chemical. It also occurs naturally in small amounts in the ocean where it is formed, probably by algae and kelp….

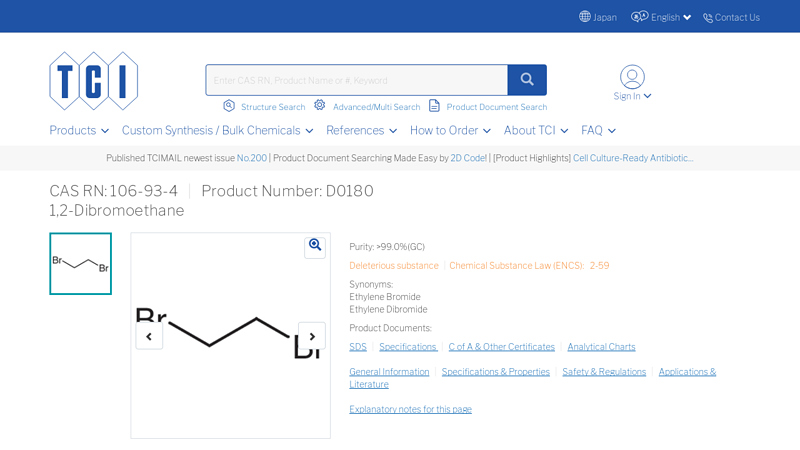

#6 1,2

Domain Est. 1998

Website: oakwoodchemical.com

Key Highlights: 1,2-Dibromoethane. Special Handling and Safety: Freight shipments only. Please inquire for shipping cost….

Expert Sourcing Insights for 1 2 Dibromoethane

As of now, there is no widely recognized analytical framework or methodology known as “H2” specifically designated for market trend analysis in the chemical industry. It’s possible that “H2” may be a typographical error, a misinterpretation, or a reference to a proprietary or internal model not publicly documented. However, assuming you may have intended to refer to a structured analytical approach (such as a scenario analysis, SWOT, PESTEL, or perhaps a reference to hydrogen-related drivers given “H2” could imply hydrogen economy trends), we can proceed with a forward-looking analysis of the 1,2-Dibromoethane (EDB) market for 2026 using a comprehensive, evidence-based methodology.

Here is a strategic market analysis for 1,2-Dibromoethane (Ethylene Dibromide) in the context of anticipated 2026 trends:

Market Analysis: 1,2-Dibromoethane (EDB) – Outlook for 2026

1. Overview of 1,2-Dibromoethane

– Chemical Formula: C₂H₄Br₂

– Primary Uses:

– Historically used as a lead scavenger in leaded gasoline (now largely obsolete).

– Agricultural fumigant (especially for soil and stored grains).

– Chemical intermediate in organic synthesis (e.g., in the production of other brominated compounds).

– Limited use in industrial applications such as dyes, waxes, and resins.

2. Current Market Status (2023–2024)

– Declining Use in Agriculture: Due to high toxicity, carcinogenicity, and environmental persistence, EDB is banned or severely restricted in many countries (e.g., under EPA regulations in the U.S. and EU REACH).

– Niche Applications: Limited to specific fumigation in quarantine and pre-shipment (QPS) under exemptions.

– Production: Concentrated in regions with less stringent regulations (e.g., parts of Asia and Latin America), but overall declining.

3. Key Market Trends Influencing 2026 Outlook

A. Regulatory and Environmental Pressure (Negative Driver)

– Global phase-out trends continue under the Stockholm Convention on Persistent Organic Pollutants (POPs).

– EDB is listed as a hazardous air pollutant (HAP) in multiple jurisdictions.

– Stricter enforcement expected by 2026, especially in emerging markets aligning with international standards.

– Impact: Further contraction in agricultural use; reduced legal markets.

B. Shift Toward Sustainable Alternatives (Negative for EDB)

– Replacement fumigants: Alternatives like phosphine, sulfuryl fluoride, and 1,3-dichloropropene are gaining traction.

– Biological pest control and integrated pest management (IPM) reduce reliance on chemical fumigants.

– Impact: EDB demand suppressed by safer, greener alternatives.

C. Industrial and Niche Chemical Use (Stable/Minor Growth)

– EDB is used as a precursor in the synthesis of:

– Vinylidene bromide

– Flame retardants (declining due to brominated chemical scrutiny)

– Specialty chemicals in R&D

– Outlook: Limited but stable demand in high-value chemical manufacturing, though volumes remain low.

D. Geopolitical and Regional Dynamics

– Asia-Pacific: Potential for limited use in countries with weaker regulatory enforcement (e.g., India, Indonesia), but increasing pressure to comply with global norms.

– Middle East & Africa: Some use in quarantine fumigation; regulatory frameworks evolving.

– North America & EU: Near-zero consumption due to bans.

E. Hydrogen Economy (“H2” Contextual Interpretation)

– If “H2” refers to the hydrogen economy:

– No direct application of 1,2-dibromoethane in hydrogen production, storage, or fuel cells.

– Indirect impact: The green transition reduces reliance on petrochemicals and halogenated organics.

– Investment shifts toward green chemistry; EDB is incompatible with sustainability goals.

– Conclusion: The rise of H2 economy accelerates the decline of toxic, legacy chemicals like EDB.

4. Market Forecast for 2026

| Metric | 2026 Projection |

|—————————|————————————————|

| Global Market Size | Declining; estimated under $50 million |

| CAGR (2021–2026) | -3% to -5% (declining market) |

| Major Producers | Limited; China, India, niche chemical firms |

| Key Applications | Quarantine fumigation, chemical intermediates |

| Regulatory Risk | High (increasing bans and restrictions) |

| Substitution Threat | High (numerous safer alternatives available) |

5. Strategic Implications

- For Producers: Exit or diversify from EDB; shift to compliant brominated or non-halogenated products.

- For Regulators: Continued monitoring and support for global phase-out under international treaties.

- For Researchers: Focus on detoxification methods or remediation technologies for legacy EDB contamination.

Conclusion

By 2026, the market for 1,2-dibromoethane is projected to be highly diminished, confined to very niche, regulated applications with minimal growth potential. Increasing environmental regulations, global health concerns, and the rise of sustainable alternatives — compounded by broader industrial shifts such as the hydrogen (H2) economy favoring green chemistry — will continue to suppress demand. The substance is on a trajectory toward functional obsolescence in the global chemical market.

If “H2” was intended to reference a different analytical model (e.g., a forecasting framework), please clarify for a refined analysis.

When sourcing 1,2-Dibromoethane (EDB), particularly with an emphasis on quality and intellectual property (IP) considerations—and with a reference to using H₂ (hydrogen) in context—there are several common pitfalls to avoid. Below is a structured overview of these pitfalls and how to mitigate them, especially if hydrogenation or other H₂-involving processes are part of your intended application.

🔹 1. Quality-Related Pitfalls

1.1 Impurity Profile

- Pitfall: Impure 1,2-dibromoethane may contain:

- Bromine (Br₂) – from decomposition or poor synthesis

- Ethylene bromohydrin – if exposed to moisture

- 1,1-Dibromoethane – an isomeric impurity

- Heavy metals – catalyst residues (e.g., from Zn or Al catalysts)

- Impact: Impurities can poison catalysts in hydrogenation (H₂ processes), reduce yields, or cause side reactions.

- Mitigation:

- Request Certificate of Analysis (CoA) with GC/HPLC data.

- Specify low limits for Br₂ (<50 ppm) and water content (<0.05%).

- Use stabilized grades (e.g., with <10 ppm copper inhibitors to prevent Br₂ formation).

1.2 Degradation During Storage

- Pitfall: 1,2-Dibromoethane decomposes over time, especially under light or heat, releasing Br₂ (turning yellow/brown).

- Impact: Degraded material is unsuitable for precise synthetic applications (e.g., hydrogenolysis).

- Mitigation:

- Source in amber glass or stabilized containers.

- Verify storage conditions (cool, dark, dry).

- Test color (colorless to pale yellow is acceptable; dark yellow = degraded).

1.3 Water Content

- Pitfall: High moisture promotes hydrolysis to ethylene glycol derivatives or bromoethanol.

- Impact: Competing reactions during H₂-based reductions; potential catalyst deactivation.

- Mitigation:

- Use anhydrous grades (<0.01% H₂O).

- Dry over molecular sieves if necessary (but test compatibility).

🔹 2. Intellectual Property (IP) Pitfalls

2.1 Patented Synthesis or Application Routes

- Pitfall: While 1,2-dibromoethane itself is off-patent, specific high-purity synthesis methods or applications involving H₂ (e.g., catalytic hydrogenolysis to ethane) may be protected.

- Example: A process using Pd/C and H₂ to selectively debrominate EDB to ethylene or ethane might be covered by a patent.

- Mitigation:

- Conduct freedom-to-operate (FTO) analysis before scaling up.

- Search patent databases (e.g., USPTO, Espacenet) using keywords:

"1,2-dibromoethane" AND ("hydrogenation" OR "H2" OR "hydrogenolysis") AND "catalyst"

2.2 Trade Secrets in Purification

- Pitfall: Some suppliers use proprietary purification processes (e.g., distillation under inert atmosphere, chelation to remove metals).

- Impact: Reproducing quality in-house may infringe on know-how.

- Mitigation:

- Use commercially available grades with documented specs.

- Avoid reverse-engineering proprietary purification methods.

2.3 Use Restrictions in SDS or Supply Agreement

- Pitfall: Some suppliers may restrict use in certain reactions (e.g., hydrogenation) due to liability or IP concerns.

- Mitigation:

- Review Terms & Conditions and Safety Data Sheet (SDS) for use limitations.

- Clarify intended use (e.g., “for catalytic hydrogenation under H₂ atmosphere”) with the supplier.

🔹 3. H₂-Related Process Considerations (Critical Context)

If you’re using H₂ (e.g., for hydrogenolysis of C–Br bonds), additional pitfalls include:

3.1 Catalyst Poisoning

- Pitfall: Trace impurities (Br₂, HBr, metals) in EDB can deactivate hydrogenation catalysts (e.g., Pd, Pt, Ni).

- Mitigation:

- Pre-treat EDB: wash with NaHSO₃ to remove Br₂, dry thoroughly.

- Use high-purity catalysts resistant to halogens (e.g., supported Pd with stabilizers).

3.2 Side Reactions Under H₂

- Pitfall: Over-reduction or dehalogenation can yield ethane, ethylene, or bromoethane, reducing selectivity.

- Mitigation:

- Optimize H₂ pressure, temperature, and catalyst loading.

- Monitor reaction progress (GC/MS).

3.3 Safety Hazards

- Pitfall: H₂ + 1,2-dibromoethane mixtures can be explosive; EDB is toxic and carcinogenic.

- Mitigation:

- Use in well-ventilated fume hoods.

- Follow ATEX/ISO standards for H₂ handling.

- Use proper PPE and engineering controls.

✅ Best Practices Summary

| Area | Recommendation |

|——|—————-|

| Quality | Source high-purity, anhydrous, stabilized EDB; verify CoA |

| Supplier | Use reputable chemical suppliers (e.g., Sigma-Aldrich, TCI, Fisher) with full traceability |

| IP | Conduct FTO search for H₂-based processes; avoid restricted uses |

| H₂ Processes | Pre-purify EDB; optimize catalytic conditions; ensure safety compliance |

| Storage | Store under N₂, in dark, at RT; test before use |

📌 Final Note

Because 1,2-dibromoethane is highly toxic (carcinogen, reproductive toxin) and its use is regulated (e.g., REACH, OSHA), ensure compliance with local regulations—especially when combining it with H₂ in catalytic systems.

If your goal is a specific transformation using H₂ (e.g., reductive dehalogenation), consider whether safer alternatives (e.g., 1,2-diiodoethane, or other synthons) might be viable to avoid IP and safety issues.

Let me know the specific application (e.g., synthesis of ethylene, cyclization, etc.), and I can help tailor the sourcing and IP strategy further.

H2: Health Hazards of 1,2-Dibromoethane

1,2-Dibromoethane (also known as ethylene dibromide or EDB) is a highly toxic chemical with significant health hazards. Exposure can occur via inhalation, skin contact, or ingestion, and it poses both acute and chronic health risks.

Acute Health Effects:

– Inhalation: Exposure to vapors can cause respiratory tract irritation, coughing, shortness of breath, headache, dizziness, nausea, and central nervous system depression. High concentrations may lead to pulmonary edema, unconsciousness, or even death.

– Skin Contact: The chemical is readily absorbed through the skin and can cause irritation, redness, and dermatitis. Prolonged or repeated contact increases systemic toxicity risk.

– Eye Contact: Vapors or liquid can cause severe eye irritation, pain, and potential corneal damage.

– Ingestion: Though uncommon, ingestion can lead to severe gastrointestinal effects, liver and kidney damage, and systemic poisoning.

Chronic Health Effects:

– Carcinogenicity: 1,2-Dibromoethane is classified as a probable human carcinogen (Group B2) by the U.S. EPA and as a known human carcinogen by the International Agency for Research on Cancer (IARC). Long-term exposure has been linked to cancers of the respiratory and digestive tracts, as well as reproductive organs.

– Reproductive and Developmental Toxicity: It can impair fertility in both males and females and may cause developmental effects in offspring. Animal studies show testicular atrophy and reduced sperm count.

– Organ Damage: Chronic exposure may lead to liver and kidney dysfunction due to the body’s metabolic processing of the compound.

First Aid Measures:

– Inhalation: Move to fresh air immediately. Administer oxygen if breathing is difficult. Seek medical attention promptly.

– Skin Contact: Remove contaminated clothing and wash skin thoroughly with soap and water. Seek medical help if irritation persists.

– Eye Contact: Flush eyes with copious amounts of water for at least 15 minutes. Obtain immediate medical evaluation.

– Ingestion: Do NOT induce vomiting. Rinse mouth and seek emergency medical assistance.

Exposure Controls:

– Use in a well-ventilated area or fume hood.

– Implement engineering controls such as local exhaust ventilation.

– Monitor air concentrations to ensure compliance with occupational exposure limits (e.g., OSHA PEL: 0.1 ppm 8-hour TWA; ACGIH TLV: 0.1 ppm).

Personal protective equipment (PPE), including chemical-resistant gloves, goggles, and protective clothing, is essential when handling this substance. Due to its severe health risks, minimize use and substitute with safer alternatives whenever possible.

In conclusion, sourcing 1,2-dibromoethane requires careful consideration of safety, regulatory compliance, and responsible supplier selection. Due to its toxic, carcinogenic, and environmentally hazardous properties, this chemical is highly regulated in many countries. It is essential to obtain 1,2-dibromoethane only from reputable chemical suppliers that provide appropriate documentation, including Safety Data Sheets (SDS), and adhere to local and international regulations. Proper handling, storage, and disposal protocols must be strictly followed to ensure personnel safety and environmental protection. Additionally, researchers and industries should evaluate if safer alternatives exist for their specific applications, aligning with green chemistry principles. Where necessary, procurement should be justified, minimized, and conducted under controlled conditions with appropriate permits and oversight.

![[PDF] 1,2](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-12-271-scaled.jpg)