The global aluminum cable market is experiencing robust growth, driven by rising demand for lightweight, cost-effective, and energy-efficient electrical solutions across power transmission, construction, and renewable energy sectors. According to a report by Mordor Intelligence, the aluminum conductor market is projected to grow at a CAGR of over 6.2% from 2023 to 2028, fueled by infrastructure development and expanding transmission networks in emerging economies. Similarly, Grand View Research estimates that the global aluminum wire and cable market size was valued at over USD 35 billion in 2022 and is expected to expand at a CAGR of 5.8% through 2030. This growth trajectory reflects a strategic industry shift toward aluminum as a preferred conductor material due to its favorable conductivity-to-weight ratio and corrosion resistance. As demand intensifies, a select group of manufacturers has emerged at the forefront of innovation, production scale, and product reliability—setting the standard in the 1/0 aluminum cable segment. Below are eight leading companies shaping the future of power distribution with high-performance aluminum cable solutions.

Top 8 1 0 Aluminum Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AFC Cable Systems

Domain Est. 2010

Website: atkore.com

Key Highlights: AFC Cable Systems, Inc., a part of Atkore International, is a leading designer, manufacturer and supplier of electrical distribution products….

#2 Page

Domain Est. 1996

Website: alanwire.com

Key Highlights: Based in Sikeston, Missouri, AW offers copper and aluminum 600-volt wire and cable products for commercial, industrial, and utility markets.Missing: 1 0…

#3 Service Entrance Cable, Stranded, 1/0 AWG, 4 wire, Aluminum, Gray …

Domain Est. 1996

Website: stateelectric.com

Key Highlights: In stock $12 deliveryService Entrance Cable, Stranded, 1/0 AWG, 4 wire, Aluminum, Gray, 600 Volts. SKU: WALSER1/04AL. Manufacturer Part Number: SER1/04AL. $3.54/foot….

#4 Electrical Wire & Cable Distributors

Domain Est. 1997 | Founded: 1975

Website: houwire.com

Key Highlights: Founded in 1975, Houston Wire and Cable is a master distributor of industrial wire and cable, supplying electrical distributors throughout the USA….

#5 Bare Aluminum Overhead Transmission & Distribution

Domain Est. 1994

Website: southwire.com

Key Highlights: Upgrade your transmission and distribution system with the best bare aluminum cables from Southwire….

#6 Aluminum

Domain Est. 1998

Website: omnicable.com

Key Highlights: We’re proud to be the leading master supplier of aluminum building wire and cable products, providing our customers with the highest quality options available….

#7 1/0 AWG RAVEN (6/1) ACSR Reinforced Aluminum Wire

Domain Est. 2014

Website: prowireandcable.com

Key Highlights: In stock Free delivery over $750Made of 1350 aluminum alloy, this 6 strand 1/0 AWG steel-reinforced bare wire, is a strong, cost-effective option for overhead power….

#8 1/0

Domain Est. 2015

Website: wireandcableyourway.com

Key Highlights: In stock Free delivery over $1,0001/0-1/0-1/0-4 MC Cable w/ G, alum. armored stranded aluminum conductors. Sold in 50ft, 100ft, 200ft, 250ft, 500ft or 1000ft spools with same-day s…

Expert Sourcing Insights for 1 0 Aluminum Cable

H2: Market Trends for 1/0 Aluminum Cable in 2026

The global market for 1/0 aluminum cable is projected to experience steady growth in 2026, driven by increasing demand for cost-effective and lightweight electrical infrastructure solutions across residential, commercial, and industrial sectors. Several key trends are shaping the trajectory of this market:

1. Rising Adoption in Renewable Energy Projects

The expansion of solar and wind energy installations is a major driver for 1/0 aluminum cable demand. As renewable energy systems require extensive cabling for grid interconnection and power distribution, the cost advantage and sufficient conductivity of aluminum make 1/0 AWG aluminum cable a preferred choice. In 2026, governments and private investors are expected to continue prioritizing green energy, bolstering long-term demand.

2. Infrastructure Modernization and Grid Upgrades

Ongoing investments in smart grid technologies and aging electrical infrastructure upgrades—particularly in North America and Europe—are increasing the need for reliable, high-performance aluminum conductors. Utilities are increasingly opting for 1/0 aluminum cable in medium-voltage distribution networks due to its favorable ampacity-to-cost ratio, especially in retrofitting projects.

3. Growth in Construction and Real Estate

The residential and commercial construction sectors are rebounding in many regions, fueling demand for electrical wiring. Aluminum cables, including the 1/0 size, are commonly used in service entrance and feeder applications due to their lighter weight and lower cost compared to copper. With urbanization continuing in emerging markets, this trend is expected to persist through 2026.

4. Technological Improvements and Safety Standards

Advancements in aluminum alloy formulations (e.g., AA-8000 series) have improved the mechanical and electrical performance of aluminum cables, addressing past concerns about creep and thermal expansion. Enhanced termination techniques and revised electrical codes (such as NEC allowances for aluminum in branch circuits) are increasing confidence among electricians and engineers, further supporting market growth.

5. Supply Chain and Raw Material Dynamics

Aluminum prices are expected to remain relatively stable in 2026 compared to the volatility seen in copper markets. This price stability, combined with global efforts to improve recycling rates and reduce carbon emissions in metal production, is making aluminum an even more attractive material for sustainable electrical systems.

6. Regional Market Variations

North America remains the largest consumer of 1/0 aluminum cable, driven by NEC-compliant electrical installations and widespread use in residential power feeds. Asia-Pacific is witnessing rapid growth due to industrialization and grid development in countries like India and Indonesia. Meanwhile, Europe is gradually adopting aluminum cables as part of energy efficiency and decarbonization strategies.

In conclusion, the 2026 market for 1/0 aluminum cable is characterized by robust demand from energy, construction, and infrastructure sectors, supported by favorable economics, technological improvements, and sustainability trends. Manufacturers and suppliers who focus on quality, compliance, and innovation are well-positioned to capitalize on this expanding market.

Common Pitfalls When Sourcing 1.0 mm² Aluminum Cable (Quality and IP Considerations)

Sourcing 1.0 mm² aluminum cables can be cost-effective for electrical installations, but several pitfalls—particularly relating to quality and Ingress Protection (IP) ratings—can compromise performance, safety, and compliance. Being aware of these common issues helps ensure reliable and code-compliant installations.

Poor Material Quality and Purity

One of the most frequent issues is substandard aluminum used in cable conductors. Low-grade aluminum may contain impurities or inconsistent alloy composition, leading to higher electrical resistance, overheating, and increased risk of failure. Ensure suppliers provide cables made from high-purity (typically 1350-O or EC-grade) aluminum and request material certification.

Inadequate Insulation Material and Thickness

Some suppliers cut costs by using thin or low-quality insulation (e.g., PVC that degrades under heat or UV exposure). For 1.0 mm² cables, insufficient insulation compromises dielectric strength and mechanical protection. Always verify that insulation thickness meets relevant standards (e.g., IEC 60227 or NEC requirements) and is suitable for the intended environment (indoor, outdoor, direct burial).

Misrepresentation of Ingress Protection (IP) Ratings

The IP rating indicates protection against solids and liquids, but some suppliers falsely claim high IP ratings without proper testing. For example, a cable marketed as IP67 may lack proper sealing or jacketing to withstand water immersion. Verify IP claims with test reports and ensure the cable’s construction (e.g., sheathing, sealing methods) supports the stated rating.

Lack of Compliance and Certification

Many low-cost aluminum cables lack certifications from recognized bodies (e.g., UL, CE, RoHS). Without proper certification, cables may not meet national or international safety standards. Always require documentation such as test reports, conformity certificates, and compliance with local electrical codes (e.g., NEC Article 310 for aluminum conductors).

Incompatible Terminations and Connectors

Aluminum is prone to oxidation and galvanic corrosion when improperly terminated. Using connectors not rated for aluminum can lead to loose connections, arcing, and fire hazards. Ensure compatibility with AL/CU-rated lugs and anti-oxidant compound application during installation. Mismatched hardware is a common oversight during sourcing.

Inconsistent Cable Dimensions and Gauge

Some suppliers provide cables with actual cross-sectional areas smaller than the labeled 1.0 mm², affecting current-carrying capacity. This undersizing can cause overheating under load. Perform random physical inspections or third-party testing to confirm dimensional accuracy and conductivity.

Insufficient UV and Environmental Resistance

If used outdoors, 1.0 mm² aluminum cables must resist UV radiation, moisture, and temperature fluctuations. Non-UV-stabilized jackets degrade quickly, leading to insulation failure. Confirm that the outer sheath is rated for outdoor use (e.g., UV-resistant PE or XLPE) and suitable for the deployment environment.

Poor Supply Chain Traceability and IP Risks

Sourcing from unreliable suppliers may lead to counterfeit or duplicated products, including intellectual property (IP) infringement on branded cable designs. This poses legal and safety risks. Work with reputable vendors, conduct supplier audits, and ensure clear documentation for traceability and authenticity.

By addressing these pitfalls proactively, buyers can ensure that 1.0 mm² aluminum cables meet required safety, performance, and regulatory standards.

Logistics & Compliance Guide for 1/0 Aluminum Cable

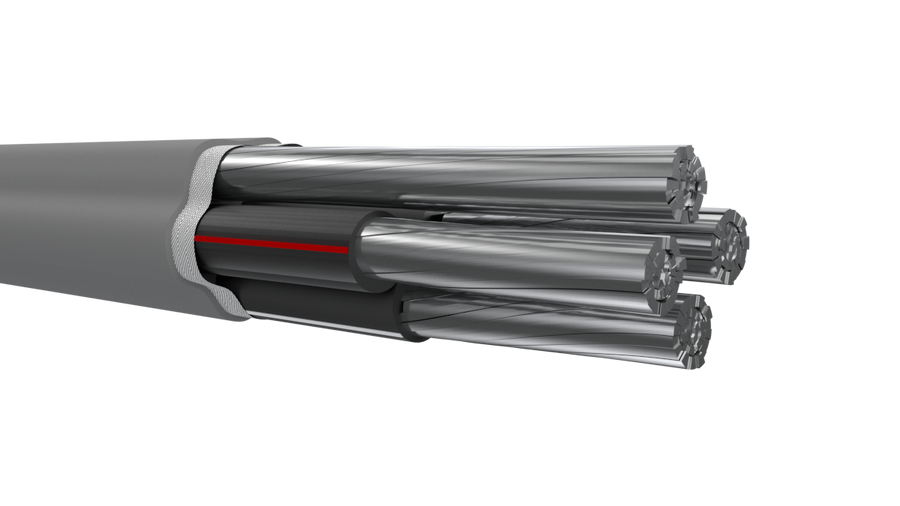

Overview of 1/0 Aluminum Cable

1/0 aluminum cable (also known as 1/0 AWG or 53.49 mm²) is a widely used conductor in electrical power distribution systems. It is commonly employed in service entrance, feeder circuits, and underground installations due to its balance of conductivity, weight, and cost. Proper logistics and compliance are essential to ensure safety, performance, and adherence to regulatory standards throughout the supply chain.

Regulatory Standards and Compliance

All 1/0 aluminum cable must meet specific national and international standards to ensure safety and performance. Key compliance requirements include:

- National Electrical Code (NEC) – NFPA 70: Mandates installation practices, ampacity ratings, and approved cable types for use in the United States. 1/0 aluminum cable is typically rated for 125–150 amps depending on insulation type and temperature rating (e.g., 75°C or 90°C).

- ASTM B881 or ASTM B800: Specifies mechanical and electrical properties for concentric-lay-stranded aluminum conductors.

- UL 44 / UL 83 / UL 1277: Covers insulation types such as XHHW, RHH/RHW, and USE for different environmental conditions.

- RoHS and REACH Compliance: Required for shipments to the European Union, ensuring restricted substances are not present in cable materials.

- Country-Specific Approvals: Canada (CSA C22.2), Australia (AS/NZS 3008), and other regions may have additional certification needs.

Packaging and Handling Requirements

Proper packaging and handling are critical to prevent damage and maintain cable integrity during transit and storage.

- Reel Specifications: 1/0 aluminum cable is typically supplied on wooden or steel reels. Reels must meet minimum bend radius requirements (usually 8–12 times the cable diameter).

- Moisture Protection: Use sealed plastic wrapping or caps on reel flanges to prevent moisture ingress, especially for underground or wet-location cables.

- Labeling: Each reel must include legible labels listing:

- Manufacturer name

- Cable type (e.g., XHHW-2, USE-2)

- AWG size (1/0)

- Voltage rating

- Standards met (e.g., UL, CSA)

- Lot or serial number

- Handling Equipment: Use forklifts or reel dollies to move reels; never roll reels on their side unless designed for it.

Storage Conditions

Improper storage can degrade insulation and compromise performance.

- Environment: Store in a dry, temperature-controlled area away from direct sunlight, heat sources, and corrosive substances.

- Orientation: Reels should be stored vertically on end to prevent deformation.

- Stacking: Avoid stacking reels unless specifically designed for such use. If stacking, use protective spacers and do not exceed manufacturer limits.

- Duration: Limit long-term outdoor storage. If unavoidable, cover reels with UV-resistant tarps and elevate off the ground.

Transportation and Shipping

Shipping must comply with carrier regulations and protect cable from physical and environmental damage.

- Domestic (USA/Canada): Follow DOT and TDG regulations for hazardous materials if applicable (usually not required for standard aluminum cable).

- International: Comply with IMDG Code (sea), IATA (air), or ADR (road in Europe). While aluminum cable is generally non-hazardous, proper documentation is required.

- Securement: Reels must be firmly strapped to pallets or within containers to prevent movement during transit.

- Documentation: Include packing lists, commercial invoices, certificates of compliance (e.g., UL, CSA), and any required customs forms.

Import and Customs Compliance

For cross-border shipments, ensure all documentation supports product legitimacy and regulatory compliance.

- HS Code: Typically classified under 7605.10 (aluminum wire, not electrically insulated) or 8544.49 (insulated aluminum wire). Confirm with local customs authority.

- Country of Origin Labeling: Required on packaging and shipping documents.

- Duties and Tariffs: Check bilateral trade agreements (e.g., USMCA) that may affect duty rates.

- Inspection Readiness: Be prepared for customs inspections; maintain test reports and certification documents.

Quality Assurance and Traceability

Maintain a traceable supply chain to support compliance and warranty claims.

- Lot Traceability: Each reel should be traceable to production batch, with associated mill test reports.

- Incoming Inspection: Verify cable markings, reel condition, and insulation integrity upon receipt.

- Third-Party Testing: Periodic testing by accredited labs (e.g., UL, Intertek) may be required for large projects or government contracts.

Disposal and Environmental Considerations

End-of-life cable must be managed responsibly.

- Recycling: Aluminum is highly recyclable. Partner with certified e-waste or metal recyclers.

- Hazardous Waste: Insulation materials (e.g., PVC) may require special handling in some jurisdictions. Check local regulations.

Summary

Adhering to logistics and compliance guidelines for 1/0 aluminum cable ensures product integrity, regulatory approval, and project safety. Always verify local codes, maintain proper documentation, and use certified suppliers to minimize risk across the supply chain.

In conclusion, sourcing 1/0 aluminum cable requires careful consideration of several key factors to ensure safety, performance, and compliance with electrical codes. It is essential to verify the cable’s specifications, including gauge size, insulation type, temperature rating, and compliance with standards such as the NEC (National Electrical Code) and ASTM B231 for aluminum conductors. Additionally, proper installation practices—such as using compatible connectors, torque specifications, and anti-oxidant compounds—are critical due to aluminum’s unique properties.

Sourcing from reputable suppliers or manufacturers ensures material quality and traceability. Cost-effectiveness, availability, and suitability for the intended application (e.g., service entrance, feeder circuits, or underground installations) should also guide purchasing decisions. Ultimately, selecting the right 1/0 aluminum cable and installing it correctly balances performance, safety, and economic efficiency in electrical projects.